Interactive Brokers Trading Notice

26 June 2024 - 10:36PM

Business Wire

Interactive Brokers (Nasdaq: IBKR), On the morning of Monday,

June 3, 2024, at approximately 9:50 am EDT, the price of Berkshire

Hathaway Class A shares (“BRK A”) suddenly plummeted in the space

of a few seconds from approximately $622,000 per share to

approximately $185 per share. This occurred as part of an

unspecified technical issue at the New York Stock Exchange

(“NYSE”). This technical issue and dramatic price event led NYSE to

promptly halt BRK A from trading.

News of BRK A’s anomalous price drop quickly spread across

social media. Some of the clients of the various brokerage

subsidiaries of Interactive Brokers Group, Inc. (together with its

subsidiaries, the “Company”), in an apparent attempt to take

advantage of this “opportunity,” submitted market buy orders during

the trading halt, presumably expecting those orders to be filled at

approximately $185/share when trading resumed.

Without any further notice and without addressing a substantial

order imbalance that developed during the halt, NYSE resumed

trading of BRK A at approximately 11:35:54 am EDT at a price of

$648,000. Over the next 98 seconds, the price of BRK A rose to as

high as $741,971.39 per share. Many of the Company’s clients that

had placed market buy orders during the trading halt were filled at

various prices during this run-up, including some who were filled

at the peak price.

The Company promptly filed a clearly erroneous execution (“CEE”)

petition with NYSE and certain other U.S. exchanges, seeking to

bust the trades that had occurred at anomalously high prices during

the disorderly market that followed the resumption of trading. NYSE

did not respond to that petition until several hours later, after

the close of regular trading hours. At approximately 6:30 pm EDT,

NYSE informed the Company that it had determined, together with the

other US stock exchanges, that it would decline to act with respect

to IBLLC’s CEE petition.

That evening, the Company determined to take over a substantial

portion of these trades as a customer accommodation. The Company

also promptly filed claims for compensation with NYSE. On June 25,

2024, NYSE notified the Company that it had denied those claims in

full. As a result, the Company has realized losses (including

losses on certain hedge transactions) in the amount of

approximately $48 million.

The Company is continuing to consider its options with respect

to recovery of these amounts, including any claims at law it could

assert against NYSE or related entities. The Company does not

believe that these losses will have a material effect on its

financial condition.

About Interactive Brokers Group, Inc.:

Interactive Brokers Group affiliates provide automated trade

execution and custody of securities, commodities, and foreign

exchange around the clock on over 150 markets in numerous countries

and currencies, from a single unified platform to clients

worldwide. We serve individual investors, hedge funds, proprietary

trading groups, financial advisors and introducing brokers. Our

four decades of focus on technology and automation has enabled us

to equip our clients with a uniquely sophisticated platform to

manage their investment portfolios. We strive to provide our

clients with advantageous execution prices and trading, risk and

portfolio management tools, research facilities and investment

products, all at low or no cost, positioning them to achieve

superior returns on investments. Interactive Brokers has

consistently earned recognition as a top broker, garnering multiple

awards and accolades from respected industry sources such as

Barron’s, Investopedia, Stockbrokers.com, and many others.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240626609524/en/

Contact for Interactive Brokers Group, Inc. Media: Katherine

Ewert, media@ibkr.com

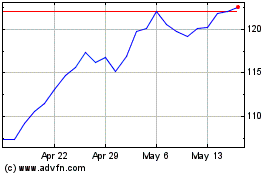

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From May 2024 to Jun 2024

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Jun 2023 to Jun 2024