false

0001289419

0001289419

2024-02-05

2024-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 5, 2024

MORNINGSTAR,

INC.

(Exact

name of registrant as specified in its charter)

| Illinois |

000-51280 |

36-3297908 |

(State

or other

jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer

Identification

No.) |

|

|

|

| 22

West Washington Street |

|

| Chicago,

Illinois |

60602 |

| (Address

of principal executive offices) |

(Zip

Code) |

(312)

696-6000

(Registrant’s

telephone number,

including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

Trading

Symbol |

Name

of Each Exchange on Which

Registered |

| Common

stock, no par value |

MORN |

The

Nasdaq Stock Market LLC |

Item 7.01. Regulation FD Disclosure.

The following information is included in this Current Report on Form 8-K

as a result of Morningstar, Inc.’s policy regarding public disclosure of corporate information.

Caution Concerning Forward-Looking Statements

This current report on Form 8-K contains forward-looking statements

as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about

future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees,

uncertain, and often contain words such as “may,” “could,” “expect,” “intend,” “plan,”

“seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“prospects,” or “continue.” These statements involve known and unknown risks and uncertainties that may cause

the events we discuss not to occur or to differ significantly from what we expect. For us, these risks and uncertainties include, among

others,

| · | failing to maintain and protect our brand, independence, and reputation; |

| · | liability related to cybersecurity and the protection of confidential information, including personal information about individuals; |

| · | compliance failures, regulatory action, or changes in laws applicable to our credit ratings operations, investment advisory, ESG and

index businesses; |

| · | failing to innovate our product and service offerings or anticipate our clients’ changing needs; |

| · | prolonged volatility or downturns affecting the financial sector, global financial markets, and the global economy and its effect

on our revenue from asset-based fees and credit ratings business; |

| · | failing to recruit, develop, and retain qualified employees; |

| · | liability for any losses that result from errors in our automated advisory tools; |

| · | inadequacy of our operational risk management and business continuity programs in the event of a material disruptive event; |

| · | failing to efficiently integrate and leverage acquisitions and other investments to produce the results we anticipate; |

| · | failing to scale our operations and increase productivity and its effect on our ability to implement our business plan; |

| · | artificial intelligence and related new technologies that may present business, compliance and reputational risks; |

| · | failing to maintain growth across our businesses in today's fragmented geopolitical, regulatory and cultural world; |

| · | liability relating to the information and data we collect, store, use, create, and distribute or the reports that we publish or are

produced by our software products; |

| · | the potential adverse effect of our indebtedness on our cash flows and financial flexibility; |

| · | challenges in accounting for complexities in taxes in the global jurisdictions in which we operate could materially affect our tax

obligations and tax rate; and |

| · | failing to protect our intellectual property rights or claims of intellectual property infringement against us. |

Investor Questions and Answers: February 5, 2024

We encourage current shareholders, potential shareholders, and other

interested parties to send questions to us in writing and we make written responses available on a regular basis. The following answers

respond to selected questions primarily received through December 31, 2023. We retain the discretion to combine answers for duplicate

or similar questions into one comprehensive response.

If you would like to submit a question,

please send an e-mail to investors@morningstar.com or write to us at the following address:

Morningstar, Inc.

Investor Relations

22 W. Washington St.

Chicago, IL 60602

Competitive Landscape

| 1. | Although MORN was historically a one segment company, MORN appears to have at least 20 distinct lines of business. We appreciate

the TAM estimates at your recent Annual General Meeting and your new segment level disclosures. Can you go through each of your lines

of business and discuss your market share, how many players are in the market and their market shares? What are the areas that you believe

you are #1 or #2 in terms of dollar share? For areas that you are not #1 or #2, can you help us understand a path to #1 or #2 or your

philosophy to stay in those lines of business as a lower share competitor? |

We are competitive in the areas that we’re active in and aim

for market-leading positions. For example, PitchBook is a clear leader in the market for private market data, and Morningstar Sustainalytics

is one of the leading providers of ESG data. In other product areas, we may have smaller market share globally, but a leading position

in certain geographies or market segments. For example, Morningstar DBRS has a market-leading position for corporate, structured, covered

bond, financial institution, and sovereign credit ratings in Canada and Morningstar Retirement is one of the leading providers of managed

accounts for defined contribution plans in the US.

Overall, we look to participate in markets that are large and growing

and where our products can gain competitive advantages over time. We provide detailed market share metrics for these areas when there’s

a clear third-party source. Recent responses to investor questions have addressed Morningstar DBRS’ market position (see responses

dated July 6, 2023) and Morningstar Sustainalytics second-party opinion (SPO) product’s market position (see response dated

December 19, 2023).

We provided an estimate of the potential

market for our largest products at our Annual Shareholder Meeting in May 2023 and will update that analysis at our Annual Shareholder

Meeting in May 2024. Please see slide 17 of our 2023 Annual Shareholder Meeting presentation. It is available at https://shareholders.morningstar.com/investor-relations/events-and-presentations/default.aspx.

For more detail on the PitchBook total addressable market, please see a related response filed in August 2023.

Our year-end 2022 10-K provides detailed descriptions of many of our

largest product areas, including a discussion of our key competitors in different parts of the business.

Segment Reporting

| 2. | Is transaction-based revenue in the Data and Analytics segment primarily

Sustainalytics’ SPO? Could you please clarify transaction-based revenue in the Data and Analytics segment and license- and

transaction-based revenue in the Asset and Index Solutions Segment? |

Transaction-based revenue in the Data and Analytics segment includes

second-party opinions and Morningstar investment conference revenue. License-based revenue in the Asset and Index Solutions segment includes

revenue from subscription-based products including Morningstar Office, Advisor Logic, and Morningstar Investor; transaction-based revenue

in this segment is related to ad sales for Morningstar.com and related international web properties.

Compensation

| 3. | Recent earnings reports and management commentary in 8-Ks have described increased focus on controlling expenses and expanding

margins. Can you share the variables and drivers of management incentive compensation and how they align with margin expansion and opex

control? Do you anticipate any changes or tweaks in incentive compensation drivers for 2024? |

In 2023, our company-level annual incentive structure equally weighted

adjusted revenue and adjusted EBITDA, a structure that was designed to incentivize profitable growth. This represented an increased emphasis

on profitability in the incentive structure compared to 2022 when the financial measures were weighted 67% to adjusted revenue and 33%

to adjusted EBITDA. We expect that the equal weighting of revenue and profitability will continue in 2024.

We’d also note that stock ownership is the cornerstone of our

executive compensation program. In particular, a significant portion of our CEO’s stock-based compensation and the compensation

for the other named executive officers is driven by Total Shareholder Return, which motivates value creation and aligns their compensation

with shareholders.

Morningstar DBRS

| 4. | What are the expected amounts of DBRS’s SEC settlement fees and non-China surveillance costs for 4QFY23 and FY24? |

As

disclosed in Morningstar’s most recent 10-Q, in September 2023 Morningstar DBRS entered into two settlements with

the SEC. These related to Morningstar DBRS’s compliance with recordkeeping requirements for certain credit ratings-related

communications sent over unapproved electronic messaging channels and disclosure and non-financial internal controls requirements

related to former commercial mortgage-backed securities (CMBS) ratings methodologies Morningstar DBRS used during the period from

July 2019 through November 2022. Under the terms of the settlements, Morningstar DBRS agreed to ongoing compliance-related

obligations to resolve the investigation related to record-keeping, which will extend through 2024. In early October 2023, it

paid a $6.0 million civil monetary penalty to the SEC for this matter, and a $2.0 million civil monetary penalty to the SEC to

resolve the investigation related to CMBS ratings methodologies. The costs related to the ongoing monitoring associated with

the record-keeping matter are not material.

Morningstar

DBRS does not have any operations in China and the order does not reference China.

PitchBook

| 5. | To what extent have credit and private credit related use cases contributed to incremental sales and licenses for PitchBook in

FY23? |

We’ve seen significant

client expansion opportunities arise from the extension of our private credit data and news coverage, particularly as market trends have

favored private credit. For example, we recently renewed and meaningfully expanded our relationship with a large asset manager who was

a client of LCD and PitchBook, supported by our ability to offer PitchBook private credit coverage and LCD private credit news. We’ve

also seen opportunities where the strength of our combined offering has helped us deliver better value and expand client relationships. For

example, we were able to secure an expansion of PitchBook licenses and displace a competitor with a different asset manager, who was attracted

by the breadth of the platform’s capabilities, specifically private equity and private credit fund data, underlying holdings, and

precedent transactions. Finally, the addition of syndicated loan and high-yield bond coverage not previously available on the PitchBook

platform has driven new sales with clients including a mid-sized bank in Europe who needed loan data.

| 6. | Long term, can PitchBook Manager Scores represent a similar mix of

PitchBook revenues that Morningstar Essentials and Morningstar Ratings make up of Morningstar Data today? |

PitchBook’s Manager Scores provide insight into fund performance

and cash flow timing at the fund family level. Manager Scores are used by asset allocators to discover new managers with similar strategies,

to make informed comparisons across different vintages, and to optimize capital deployment. Investors use Manager Scores to support

their fundraising efforts, provide market intelligence on the competitor peer group, and inform portfolio management strategies.

PitchBook pricing is all-inclusive for the platform and includes Manager

Scores. PitchBook does not have a ratings license for managers comparable to Morningstar Essentials and we do not expect that to change

for the foreseeable future.

| 7. | What is the revenue CAGR of PitchBook over the last 10, 5, and 3 years? |

PitchBook’s revenue CAGRs for the trailing three- and

five-year periods ended September 30, 2023 were 36.2% and 39.7% respectively. PitchBook’s revenue CAGR for the six-year

period ended September 30, 2023 was 45.9%. Morningstar acquired PitchBook in late 2016.

PitchBook and Morningstar Sustainalytics

| 8. | Sustainalytics has already released the climate suites (physical risk and transition risk), and PitchBook will complete the integration

of LCD in 1HF24. After those investments, what are the high priority investment areas for PitchBook and Sustainalytics in the medium term? |

Continued development of our climate suite remains an important priority

for Morningstar Sustainalytics. In the short-to-intermediate term, we are working on the development of additional tools to help institutional

clients evaluate the climate risks of portfolio companies and to support their decision making as they seek to meet net zero objectives.

As we discussed in a related question in December 2023, we are also focused on enhancements to our reporting tools to help clients

respond to mandated climate disclosure regulations in key markets including the UK and the EU. These require financial institutions to

report on how they are integrating climate risks into investment decision making and taking steps to mitigate these risks. Specific areas

of focus include the introduction of a low carbon transition and physical climate risk value at risk signal to help investors evaluate

and report on the value degradation of portfolio companies resulting from exposure to climate risks, and the enhancement of our carbon

emissions data (an important input to our Low Carbon Transition Ratings) to help clients understand the full value chain of carbon impacts

from their investments and to meet disclosure reporting requirements. We also expect to expand our climate index capabilities, with continued

close alignment between Morningstar Indexes and Morningstar Sustainalytics. Finally, we are bolstering our other offerings to support

evolving regulatory requirements with a particular focus on supporting improved EU taxonomy alignment and reporting across asset classes.

For PitchBook, in 2024, we plan

to further expand our data and research assets and product capabilities. Data plans include enhancing private credit coverage, building

out our coverage of non-PE- or VC-backed companies, and further strengthening our public equity datasets. Our research team is building

more proprietary tools and analytics like the VC Exit Predictor and Manager Scores that were introduced in 2023. Product initiatives

are focused on building features that leverage new data and research and launching improvements to workflows such as a new advanced screening

experience. In a collaboration between PitchBook and Morningstar Indexes, we also plan to continue our build out of the PitchBook Global

Unicorn indexes, a global series of indexes tracking privately held late-stage venture capital companies initially launched in 2022.

Morningstar Data

| 9. | Can you provide an updated revenue mix for Morningstar Data? Ideally, with the mix today vs. ~5 years ago? In November 2011,

you all commented that Morningstar Essentials represented 20% of total Licensed Data revenue. In September 2009, it was about 25%

(one-fourth). We would be interested in the sales mix of Morningstar Essentials, Morningstar Ratings, and sales related to redistributor

agreements. We would also be interested in the mix of Morningstar Data by delivery method and that mix over time. This could include the

mix of real-time data, mix of API calls, or distribution through cloud data warehouse marketplaces. We are not sure what kind of cuts

you would have available to disclose but we are interested in a quantification of the key underlying growth drivers and detractors within

Morningstar Data. |

Overall, we are focused on delivering our data to meet different investor

needs. Data is a key component of our offering across our product suite, including PitchBook, Morningstar Direct, Morningstar Advisor

Workstation, and Morningstar Investor.

The Morningstar Data product area includes managed investment data

(such as mutual funds, ETFs, separate accounts, collective investment trusts, and model portfolios), Morningstar Essentials, equity data,

and real time data. The mix remained relatively stable between 2018 and the first nine months of 2023. Morningstar managed investment

data continued to account for the largest share of Morningstar Data revenue, a percentage that grew from roughly 60% of revenue in 2018

to slightly less than two-thirds of Morningstar Data revenue for the year-to-date period through September 2023. Morningstar Essentials,

a product that allows clients to license Morningstar ratings, rankings, reports, and other metrics accounted for a little under a fifth

of total Morningstar Data revenue for the year-to-date period through September 2023. Real-time data and equity data together accounted

for the remaining roughly fifth of Morningstar Data revenue through the period.

Morningstar Data’s clients include asset and wealth managers

and redistributors. Data sold to redistributors powers third-party applications and platforms and accounted for roughly one-fifth of Morningstar

Data annual contract value as of September 2023. From a geographic perspective, North America accounted for roughly 60% of Morningstar

revenue for the year-to-date period through September 2023, with another third coming from EMEA and the remaining share coming from

Asia Pacific. That mix was substantially the same as the mix in 2019, with a slight increase in the percent of revenue from North America,

and a slight decrease in the percent from EMEA.

The Morningstar Data product area includes data delivered through direct

data feeds, direct shares, streaming capabilities, and APIs. Data feeds are typically delivered through flat files via FTP / SFTP. APIs

are generally consumed on demand to power websites and Morningstar’s client applications. The recently announced Direct Web Services

API platform enables broad consumption of Morningstar data by Morningstar’s clients and partners. Morningstar Data is not listed

on any data marketplaces but can be delivered directly via platforms like snowflake and AWS data marketplace via direct data shares or

through partners such as CRUX. Finally, real time market data is delivered via both API and streaming webservices.

India Operations

| 10. | In a prior answer, Morningstar managed to decrease adjusted operating expense per average employee in 2023 due in part to the increased

proportion of the employee base being located within India. In light of the growing tensions between India and the United States, is Morningstar

prepared to ensure its continued operations if there is a scenario where the US restricts or blocks US financial data processing within

India? Can you provide insights into the company's contingency plans or measures in place to mitigate potential disruptions and maintain

business continuity in such a geopolitical context? |

Our data collection, technology, and operational center in Mumbai, India,

is our largest location measured by number of employees and we also engage third-party vendors in India. Morningstar maintains a robust

business continuity strategy that is focused on ensuring that our teams, offices, and the business processes they support are protected

and able to quickly recover in the event of a business disruption. This ongoing process includes risk assessments, a business impact analysis,

business continuity plans, business continuity exercises, and evaluations to assess the effectiveness of these plans. That process covers

key locations, including our operations in India.

Capital Allocation

| 11. | What are the guardrails for M&A other than IRR hurdle rates? Are there natural adjacencies that MORN is unwilling to expand

into? Please provide examples if possible. |

As we consider potential acquisitions, we focus on transactions that

align with our mission of empowering investor success; build our investment databases, research capabilities, technical expertise, or

customer groups faster or more cost effectively than we could if we built them ourselves; and offer a good cultural fit with our entrepreneurial

spirit and brand leadership. We prefer areas that have natural adjacencies to our portfolio as they

generally provide greater opportunities for financial success. Recent examples include our acquisitions of Leveraged Commentary &

Data, Praemium’s UK and international business, and Moorgate Benchmarks.

While we are active in looking at M&A opportunities, we generally

favor organic investments and maintain a high hurdle for completing transactions with a focus on evaluating long-term returns relative

to other potential uses of cash. We assess overall cash-on-cash and internal rates of return based

on the price we are paying and the value we expect to realize over time.

Corporate Sustainability

| 12. | Do you have employee training programs or hiring ratio targets that align with ESG outcome reporting? |

Morningstar models industry-leading ESG disclosures through our annual

disclosures of racial diversity data for the U.S. and Canada, diverse representation data by functional area globally, and turnover by

gender and race in the U.S. market. We were one of the first firms to publish both our adjusted and unadjusted pay gap in markets where

data is available, including the dollar amount required to close the pay gap and the number of employees affected. By quantifying and

addressing this challenge, we are aiming to attract and retain talent, enable equitable business practices, and build trust with colleagues.

We do not have specific hiring targets, but we do report on our demographics annually in our Corporate Sustainability Report (CSR). We

provide training to hiring managers to promote the use of an equitable hiring and recruitment process to generate candidate pools that

are reflective of the communities where we operate. We continue to be committed to increasing diversity in locations where we may

not match industry or regional demographics.

| 13. | What are your key sustainability objectives and how do they align with ESG ratings? What is the long-term vision? Which ESG metrics

or indicators do you consider most relevant for your company, and how are they measured? How do you handle the monitoring and ongoing

evaluation of your progress towards ESG goals and how does this impact your corporate strategy? |

Our 2022 Corporate Sustainability Report (available at www.morningstar.com/company/corporate-sustainability),

provides a summary of Morningstar’s approach to corporate sustainability and our related material issues. Please refer to pages 6

and 7 for an explanation of Morningstar’s commitment to sustainability. At Morningstar, it’s our mission to empower investor

success. Enabling sustainable investing and creating sustainable business practices is an integral part of this effort.

On pages 11 and 12 of the Corporate Sustainability Report, we

detail Morningstar’s materiality framework, which prioritizes the environmental, social, and governance issues that have the potential

to impact our business over the long-term as well as those that we believe are the most important to our stakeholders. To determine our

firm’s most material issues, which are detailed in this section of the report, Morningstar combined a data-driven approach with

the expertise of our own research teams.

Morningstar has a dedicated Enterprise Sustainability team that supports

Morningstar in our overall identification and management of corporate sustainability risk and opportunities. We regularly conduct benchmarking

analyses to assess Morningstar's performance in this regard relative to global and industry best practices and identify areas of focus

or improvement. We use this information as inputs to evaluate our sustainability objectives and continue to evolve our practices over

time. We plan to publish our 2023 Corporate Sustainability Report in spring 2024.

| 14. | What have been your recent ESG ratings and how are you working to improve them over time? How do you integrate ESG ratings into

your business decisions and future investments? How do you engage internal and external stakeholders in your ESG strategy and the enhancement

of your ratings? |

Morningstar participates in ESG ratings

evaluations from external providers including MSCI, ISSB, Equileap, and EcoVadis. We welcome the feedback provided by these

ratings. They contribute to our understanding of the ESG issues that are material to Morningstar and to our ability to prioritize the

management of these issues across the firm. In addition, we partner with researchers across Morningstar to examine the firm’s strengths

and opportunities to improve performance. We don’t publicly disclose our ratings; these ratings are available to subscribers to

the various rating providers’ platforms.

Morningstar’s executive leadership

team and board provide oversight relating to key aspects of our sustainability strategy. Our business units and central functions

across the firm are aligned with our strategy and our corporate goals. Externally, we regularly disclose our sustainability progress and

data to keep stakeholders informed.

ESG

| 15. | Would it be possible for you to tell us the percentage of ESG/Social data/indexes in your revenue contribution? In case you cannot

provide us with an exact percentage, would it be possible to confirm or deny that the percentage would be higher than 30%? |

The majority of our ESG revenue is generated by Morningstar Sustainalytics,

which accounted for a little over 5% of total Morningstar revenue for the trailing 12 months ended September 2023. We also leverage

Morningstar Sustainalytics data, research, and ratings across multiple other products, including Morningstar Indexes’ Morningstar

Sustainability and Morningstar EU Climate Indexes, and in other products in the Data and Analytics segment, such as Morningstar Direct,

whose users can access ESG data, ratings, and reporting capabilities. Morningstar Wealth offers ESG-focused investment options including

a suite of ESG model portfolios, while its direct indexing solution allows advisors to customize portfolios across a number of different

inputs including ESG preferences for those who value ESG factors in their investment decisions. While we don’t disclose total revenue

attributable to ESG, it is substantially less than 30%.

Shareholder Engagement

| 16. | MORN is now a $12B market cap company but remains unfollowed by the sell-side (no analyst coverage), does not hold conference calls

for earnings, nor attend investor conferences. Do you anticipate interacting more with investors outside of your annual shareholder meeting

and 8-K communications? |

Consistent with our approach to shareholder engagement since we went

public, our goal is to communicate equally with all shareholders, without special treatment for large shareholders or research analysts.

Our management team and board engage with investors at our Annual Shareholder Meeting which includes a dedicated time for Q&A, and

we regularly answer questions in written form in 8-K filings. We have evolved our investor communications over time in response to the

questions we receive and shareholder feedback. In 2023, we continued to enhance our quarterly shareholder presentation and introduced

a letter from our CEO to our quarterly reporting package.

We welcome sell-side coverage and questions submitted by sell-side

analysts for response through our regular 8-K process.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MORNINGSTAR, INC. |

| |

|

| Date: February 5, 2024 |

By: |

/s/ Jason

Dubinsky |

| |

|

Jason Dubinsky |

| |

|

Chief Financial Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

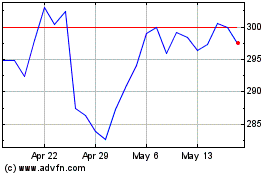

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Apr 2024 to May 2024

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From May 2023 to May 2024