UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File No. 001-39621

OPTHEA LIMITED

(Translation of registrant’s name into English)

Level 4

650 Chapel Street

South Yarra, Victoria, 3141

Australia

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

OPTHEA LIMITED |

|

(Registrant) |

|

|

|

|

By: |

/s/ Frederic Guerard |

|

Name: |

Frederic Guerard |

|

Title: |

Chief Executive Officer |

Date: 06/12/2024

Equity Raising Presentation�Institutional Placement and Accelerated Non-Renounceable Entitlement Offer (“ANREO”) June 2024 NASDAQ (OPT); ASX (OPT.AX) Exhibit 99.1

Important Notice and Disclaimer IMPORTANT: You must read the following before continuing or making use of the information contained in this presentation. By attending an investor presentation, or accepting or viewing this presentation you represent and warrant that you are entitled to receive or access the presentation in accordance with the restrictions below and agree to be bound by the limitations contained within it. This presentation is dated 12 June 2024 and has been prepared by Opthea Limited (ABN32 006 340 567) (“Company” or “Opthea”) in relation to: a placement of new fully paid ordinary shares in the Company (“New Shares”) to certain eligible institutional investors (“Placement”); and an accelerated non-renounceable entitlement offer of New Shares to be made to existing eligible shareholders of Opthea (“Entitlement Offer”), the Placement and Entitlement Offer together, the “Offer”. For every 3 New Shares issued under the Offer, 1 option will be issued. The option will have an exercise price of A$1.00 and an expiry date of 30 June 2026 (“New Options”). Application will be made for the New Options to be quoted on ASX (subject to satisfying spread requirements set out in ASX Listing Rule 2.5, condition 6). The Company reserves the right to withdraw, or vary the timetable for, the Offer without notice. Summary information This presentation contains summary information about the Company and its activities and is current as at the date of this presentation. The information in this presentation is of a general nature and does not purport to be complete nor does it provide or contain all the information that would be required in a prospectus or other disclosure document prepared in accordance with the requirements of the Corporations Act 2001 (Cth) (“Corporations Act”), or that an investor should consider when making an investment decision. No representation or warranty, express or implied, is provided in relation to the accuracy or completeness of the information. Statements in this presentation are made only as of the date of this presentation unless otherwise stated and the information in this presentation remains subject to change without notice. The Company is not responsible for updating, nor undertakes to update, this presentation. It should be read in conjunction with the Company’s other periodic and continuous disclosure announcements lodged with the Australian Securities Exchange (“ASX”), which are available at www.asx.com.au, and with the U.S. Securities and Exchange Commission (the “SEC”), which are available at www.sec.gov. The Company has also prepared a target market determination in respect of the New Options which is available on the Company’s website at https://opthea.com/. This presentation may also include information derived from public or third-party sources, including public filings, research, surveys or studies conducted by third parties, including industry or general publications and other publicly available information, that has not been independently verified. Neither Opthea nor any of its subsidiaries or any of the respective directors, officers, employees, representatives, agents or advisers of Opthea or its subsidiaries (“Opthea Related Persons”) makes any representation or warranty with respect to the fairness, accuracy, completeness or adequacy of such information. Not financial product advice This presentation is for information purposes only and is not a prospectus, product disclosure statement or other offer document under Australian law or the law of any other jurisdiction. This presentation has not been, nor will it be, lodged with the Australian Securities and Investments Commission (“ASIC”). This presentation is not a financial product or investment advice, a recommendation to acquire New Shares, New Options or accounting, legal or tax advice. It has been prepared without taking into account the objectives, financial or tax situation or needs of individuals. Any references to, or explanations of, legislation, regulatory issues or any other legal commentary (if any) are indicative only, do not summarize all relevant issues and are not intended to be a full explanation of a particular matter. You are solely responsible for forming your own opinions and conclusions on such matters and the market, and for making your own independent assessment of the information in this presentation. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial and tax situation and needs, and seek legal, taxation and other professional advice appropriate to their circumstances. The Company is not licensed to provide financial product advice in respect of its securities. Cooling off rights do not apply to the acquisition of New Shares or New Options. Effect of rounding A number of figures, amounts, percentages, estimates, calculations of value and fractions in this presentation are subject to the effect of rounding. Accordingly, the actual calculation of these figures may differ from the figures set out in this presentation. Past performance Information relating to past performance and activities included in this presentation is given for illustrative purposes only and should not be relied upon as (and is not) an indication of the Company’s views on its future performance or condition. Investors should note that past performance, including the past share price performance of Opthea, cannot be relied upon as an indicator of (and provides no guidance as to) future performance, including future share price performance. The historical information included in this presentation is, or is based on, information that has previously been released to the market and is not represented as being indicative of Opthea’s views on its future financial condition and/or performance. Trademarks and trade names This presentation may contain trademarks and trade names of third parties, which are the property of their respective owners. Third party trademarks and trade names used in this presentation belong to the relevant owners and use is not intended to represent sponsorship, approval or association by or with any of Opthea or the Extended Parties (defined below).

Important Notice and Disclaimer Financial data All dollar values are in United States dollars ($ or US$) unless stated otherwise. This presentation includes pro forma financial information which is provided for illustrative purposes only and is not represented as being indicative of the Company’s (or anyone else's) views on the Company’s future financial position or performance. The pro-forma financial information included in this presentation is for illustrative purposes and does not purport to be in compliance with Article 11 of Regulation S-X of the rules and regulations of the SEC. Any conversion of amounts in US$ to amounts in A$ has been conducted at the exchange rate of 0.66. Financial Information Throughout this presentation, we have presented certain summary condensed unaudited financial and other data as of December 31, 2023 and March 31, 2024, including pro forma condensed unaudited capitalization data as of March 31, 2024. We have derived the summary condensed unaudited financial and other data as of December 31, 2023 from our unaudited consolidated financial statements and the related notes for the six months ended December 31, 2023. Our unaudited consolidated financial statements for the six months ended December 31, 2023 were prepared on a basis consistent with our audited consolidated financial statements and include, in our opinion, all adjustments of a normal and recurring nature that are necessary for the fair statement of the financial information set forth in this presentation. We have derived the summary condensed unaudited financial and other data as of March 31, 2024, with the exception of the pro forma amounts, from our unaudited consolidated statement of cash flows for the three and nine months ended March 31, 2024. However, we have not prepared full consolidated financial statements and related notes for the three and nine months ended March 31, 2024. Accordingly, the summary condensed unaudited financial and other data as of March 31, 2024 as presented herein are not complete. Our historical results are not necessarily indicative of results that may be expected in the future and our interim results are not necessary indictive of the results that may be expected for the full fiscal year. The summary condensed unaudited financial and other data included in this presentation are not intended to replace our consolidated financial statements and the related notes and are qualified in their entirety by our consolidated financial statements and the related notes included elsewhere in our public filings with the Australian Securities Exchange Limited (the “ASX”) and the Australian Securities and Investments Commission (the “ASIC”). The estimated pro forma data as included in this presentation is illustrative only, subject to adjustments. You should read the summary condensed unaudited financial and other data with our unaudited consolidated financial statements and related notes, as available, and not to give undue weight to any estimates. The summary condensed unaudited financial and other data contained in this presentation have been prepared in good faith by, and are the responsibility of management based upon our internal reporting as of March 31, 2024. Deloitte Touche Tohmatsu, our independent registered public accounting firm, has not audited such summary condensed financial and other data. Accordingly, Deloitte Touche Tohmatsu does not express an opinion or any other form of assurance with respect thereto. Future performance / forward-looking statements This presentation contains certain forward-looking statements. The words "expect", "anticipate", "estimate", "intend", "believe", "guidance", "should", "could", "may", "will", "predict", "plan" and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future financial position and performance including the unaudited financial information and pro forma data and projected use of cash in operations for FY 2024, are also forward-looking statements. Forward-looking statements in this presentation include statements regarding the timetable, conduct and outcome of the Offer and the use of the proceeds thereof, the therapeutic and commercial potential and size of estimated market opportunity of the Company’s product in development, the viability of future opportunities, future market supply and demand, the expected cash runway, the timing of top-line data, expectations about topline data based on masked pooled or unpooled data, the financial condition, results of operations and businesses of Opthea, certain plans, objectives and strategies of the management of Opthea, including with respect to the current and planned clinical trials of its product candidate, and the future performance of Opthea. Forward-looking statements, opinions and estimates provided in this presentation are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current conditions. Forward-looking statements, including projections, guidance on the future financial position of the Company including the pro forma data, are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. They involve known and unknown risks and uncertainties and other factors, many of which are beyond the control of Opthea and its directors and management and may involve significant elements of subjective judgment and assumptions as to future events that may or may not be correct. These statements may be affected by a range of variables which could cause actual results or trends to differ materially, including but not limited to the risks described in this presentation under “Key Risks” and the risk factors set forth in Opthea’s Annual Report on Form 20-F filed with the SEC on September 28, 2023, Opthea’s 2024 Half Year Report included as an exhibit to the Form 6-K filed with the SEC on February 29, 2024, and other future filings with the SEC, including risks associated with: the availability of funding, future capital requirements, the ability of Opthea to continue as a going concern, the development, testing, production, marketing and sale of drug treatments, regulatory risk and potential loss of regulatory approvals, ongoing clinical studies to demonstrate sozinibercept (OPT-302) safety, tolerability and therapeutic efficacy, additional analysis of data from Opthea’s Phase 3 clinical trials once unmasked, CRO, contract manufacturer, BLA preparation, corporate and labor costs, intellectual property protections, the successful completion of the Offer, and other factors that are of a general nature which may affect the future operating and financial performance of the Company. No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including the Company and Opthea Related Persons). In particular, no representation, warranty or assurance (express or implied) is given that the occurrence of the events expressed or implied in any forward-looking statements in this presentation will actually occur. Actual results, performance or achievement may vary materially from any projections and forward-looking statements and the assumptions on which those statements are based. The forward-looking statements in this presentation speak only as of the date of this presentation. Subject to any continuing obligations under applicable law or any relevant ASX listing rules, the Company and Opthea Related Persons disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statements in this presentation to reflect any change in expectations in relation to any forward-looking statements or any change in events, conditions or circumstances on which any such statement is based. Nothing in this presentation will create an implication that there has been no change in the affairs of Opthea since the date of this presentation.

Important Notice and Disclaimer Diagram, charts, graphs and tables Any diagrams, charts, graphs and tables appearing in this presentation are illustrative only and may not be drawn to scale. Investment risk An investment in New Shares and New Options is subject to investment and other known and unknown risks, many of which are beyond the control of Opthea. Opthea does not guarantee any particular rate of return on the New Shares, New Options or their respective performance, nor does it guarantee any particular tax treatment. In considering an investment in New Shares and New Options, investors should have regard to (among other things) the risks and disclosures outlined in this presentation, including the “Key Risks” section of this presentation, before making an investment decision, and should consult their professional adviser(s) if they are in any doubt about what to do. Not an offer This presentation is not a disclosure document and should not be considered as investment advice. This presentation is for information purposes only and should not be considered an offer or an invitation to acquire, or a solicitation or recommendation in relation to the subscription, purchase or sale of Company securities (including the New Shares and New Options to be offered and sold in the Offer) or any other financial products and does not and will not form any part of any contract for the acquisition of New Shares or New Options. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal or impermissible. The New Shares and New Options (including the shares underlying the New Options) to be issued in the Offer have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or the securities laws of any state or other jurisdiction of the United States. The New Shares and New Options (including the shares underlying the New Options) to be issued in the Offer may not be offered and sold to, directly or indirectly, any person in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. The release, publication or distribution of this presentation (including an electronic copy) in other jurisdictions outside Australia may also be restricted by law and any such restrictions should be observed. If you come into possession of this presentation, you should observe such restrictions and should seek your own advice on such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities laws. Refer to the “Foreign Selling Restrictions” section of this presentation for more information. By accepting this presentation you represent and warrant that you are entitled to receive such presentation in accordance with the above restrictions and agree to be bound by the limitations contained herein. Disclaimer Neither BofA Securities, Inc. and Leerink Partners LLC, as advisers to the Company in connection with the transactions (“Advisers”), MST Financial Services Pty Ltd, as placement agent (in respect of the Placement), lead manager and bookrunner (in respect of the Entitlement Offer) and underwriter (in respect of part of the Entitlement Offer) ("Lead Manager"), nor any of the Company’s other advisers or any of their respective affiliates, related bodies corporate, directors, officers, partners, employees, agents and associates, have authorised, permitted or caused the issue, submission, dispatch or provision of this presentation and, except to the extent referred to in this presentation, none of them makes or purports to make any statement in this presentation and there is no statement in this presentation which is based on any statement by any of them. To the maximum extent permitted by law, the Company, the Advisers, the Lead Manager, and their respective affiliates, related bodies corporate, directors, officers, partners, employees, agents and advisers (the “Extended Parties”): (i) exclude and disclaim all liability, for any expenses, losses, damages or costs incurred by you as a result of your participation in any offer of the New Shares and New Options and the information in this presentation being inaccurate or incomplete in any way for any reason, whether by negligence or otherwise; and (ii) make no representation or warranty, express or implied, as to the currency, accuracy, reliability, timeliness or completeness of information in this presentation, or likelihood of fulfilment of any forward-looking statement or any event or results expressed or implied in any forward-looking statement. Pursuant to ASX Listing Rule 7.2, the directors of the Company give notice that they reserve the right to issue any New Shares (and New Options) not issued in the Entitlement Offer (“Shortfall Shares”) to new investors or existing shareholders within 3 months of the close of the offer at a price no less than the Offer Price. The allocation of Shortfall Shares will be within the complete discretion of the Company, having regard to factors such as the Company’s desire for an informed and active trading market, its desire to establish a wide spread of shareholders, the size and type of funds under management of particular investors, the likelihood that particular investors will be long-term shareholders, and any other factors the Company considers appropriate. You acknowledge and agree that determination of eligibility of investors for the purposes of the Offer is determined by reference to a number of matters, including legal requirements and the discretion of the Company, the Advisers and the Lead Manager and each of the Company, the Advisers and the Lead Manager (and their respective Extended Parties) disclaim any duty or liability (including for negligence) in respect of the exercise or otherwise of that discretion, to the maximum extent permitted by law. Further, you acknowledge and agree that any allocation of New Shares (and New Options) (other than pursuant to an entitlement under the Entitlement Offer) is at the sole discretion of the Company, the Advisers and the Lead Manager and each of the Company, the Advisers and the Lead Manager (and their respective Extended Parties) disclaim any duty or liability (including for negligence) in respect of the exercise or otherwise of that discretion, to the maximum extent permitted by law. The Company and the Lead Manager reserve the right to change the timetable in their absolute discretion including by closing the Offer early, withdrawing the Offer entirely or extending the Offer closing time (generally or for particular investor(s)) in their absolute discretion (but have no obligation to do so), without recourse to them or notice to you. Acceptance By attending a presentation or briefing, or accepting, accessing or reviewing this presentation, you acknowledge and agree to the terms set out in this important notice and disclaimer, including any modifications to them.

Table of Contents Content Page Opthea Business Snapshot 6 Opthea Update 7 Equity Raising Overview 8 Sources & Uses of Funds 9 Pro Forma Unaudited Condensed Capitalization 10 Equity Raising Timetable 11 Sozinibercept Overview 12 Wet AMD Unmet Medical Needs and Market Opportunity 13 Opthea Development Pipeline 24 Phase 2b Wet AMD Trial Data 26 Phase 3 Pivotal Program 38 Financial Snapshot and Corporate Focus 43 Key Risks 45 Summary of Underwriting Agreement 56 Foreign Selling Restrictions 59

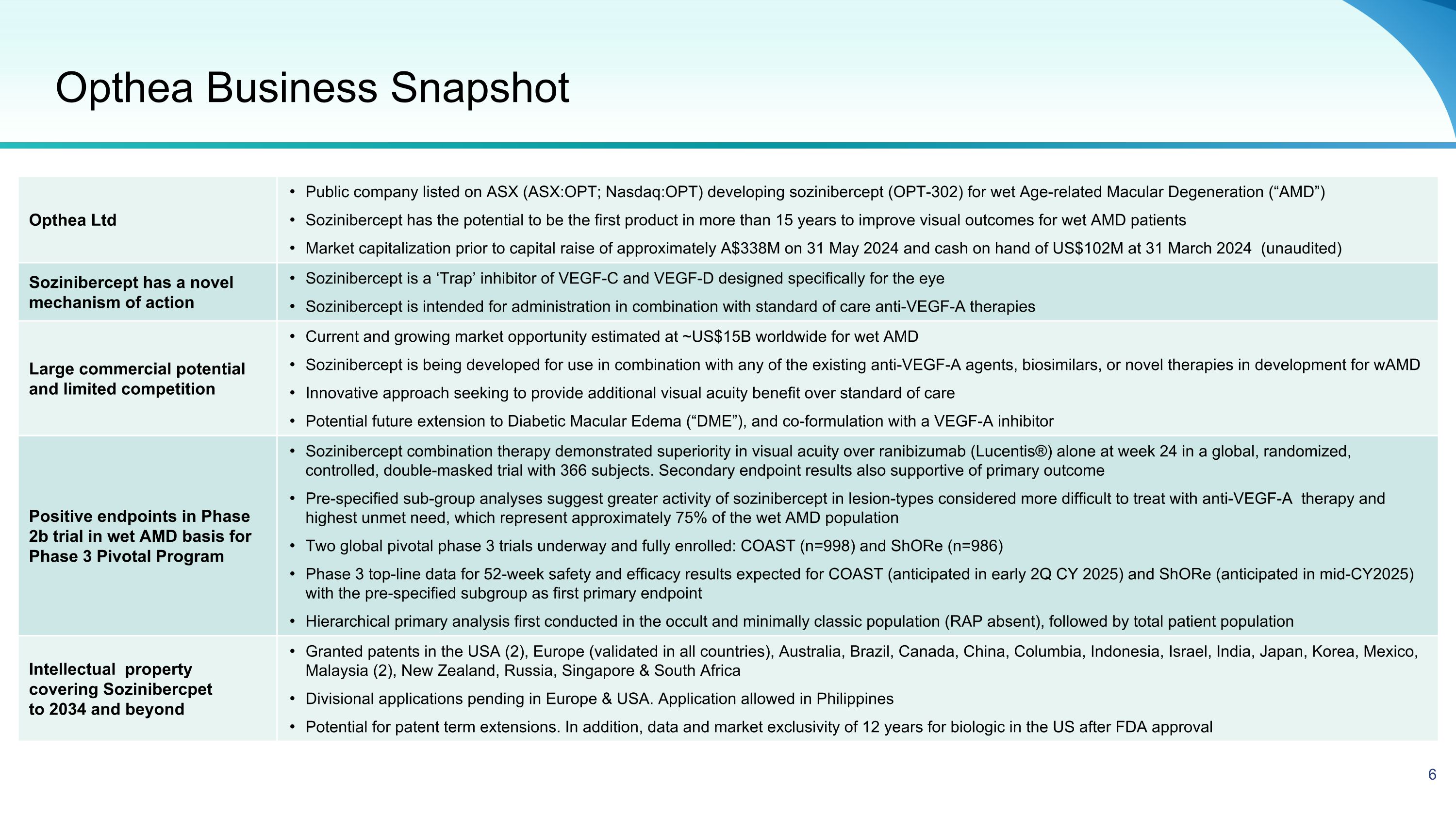

Opthea Business Snapshot Opthea Ltd Public company listed on ASX (ASX:OPT; Nasdaq:OPT) developing sozinibercept (OPT-302) for wet Age-related Macular Degeneration (“AMD”) Sozinibercept has the potential to be the first product in more than 15 years to improve visual outcomes for wet AMD patients Market capitalization prior to capital raise of approximately A$338M on 31 May 2024 and cash on hand of US$102M at 31 March 2024 (unaudited) Sozinibercept has a novel mechanism of action Sozinibercept is a ‘Trap’ inhibitor of VEGF-C and VEGF-D designed specifically for the eye Sozinibercept is intended for administration in combination with standard of care anti-VEGF-A therapies Large commercial potential and limited competition Current and growing market opportunity estimated at ~US$15B worldwide for wet AMD Sozinibercept is being developed for use in combination with any of the existing anti-VEGF-A agents, biosimilars, or novel therapies in development for wAMD Innovative approach seeking to provide additional visual acuity benefit over standard of care Potential future extension to Diabetic Macular Edema (“DME”), and co-formulation with a VEGF-A inhibitor Positive endpoints in Phase 2b trial in wet AMD basis for Phase 3 Pivotal Program Sozinibercept combination therapy demonstrated superiority in visual acuity over ranibizumab (Lucentis®) alone at week 24 in a global, randomized, controlled, double-masked trial with 366 subjects. Secondary endpoint results also supportive of primary outcome Pre-specified sub-group analyses suggest greater activity of sozinibercept in lesion-types considered more difficult to treat with anti-VEGF-A therapy and highest unmet need, which represent approximately 75% of the wet AMD population Two global pivotal phase 3 trials underway and fully enrolled: COAST (n=998) and ShORe (n=986) Phase 3 top-line data for 52-week safety and efficacy results expected for COAST (anticipated in early 2Q CY 2025) and ShORe (anticipated in mid-CY2025) with the pre-specified subgroup as first primary endpoint Hierarchical primary analysis first conducted in the occult and minimally classic population (RAP absent), followed by total patient population Intellectual property �covering Sozinibercpet to 2034 and beyond Granted patents in the USA (2), Europe (validated in all countries), Australia, Brazil, Canada, China, Columbia, Indonesia, Israel, India, Japan, Korea, Mexico, Malaysia (2), New Zealand, Russia, Singapore & South Africa Divisional applications pending in Europe & USA. Application allowed in Philippines Potential for patent term extensions. In addition, data and market exclusivity of 12 years for biologic in the US after FDA approval 6

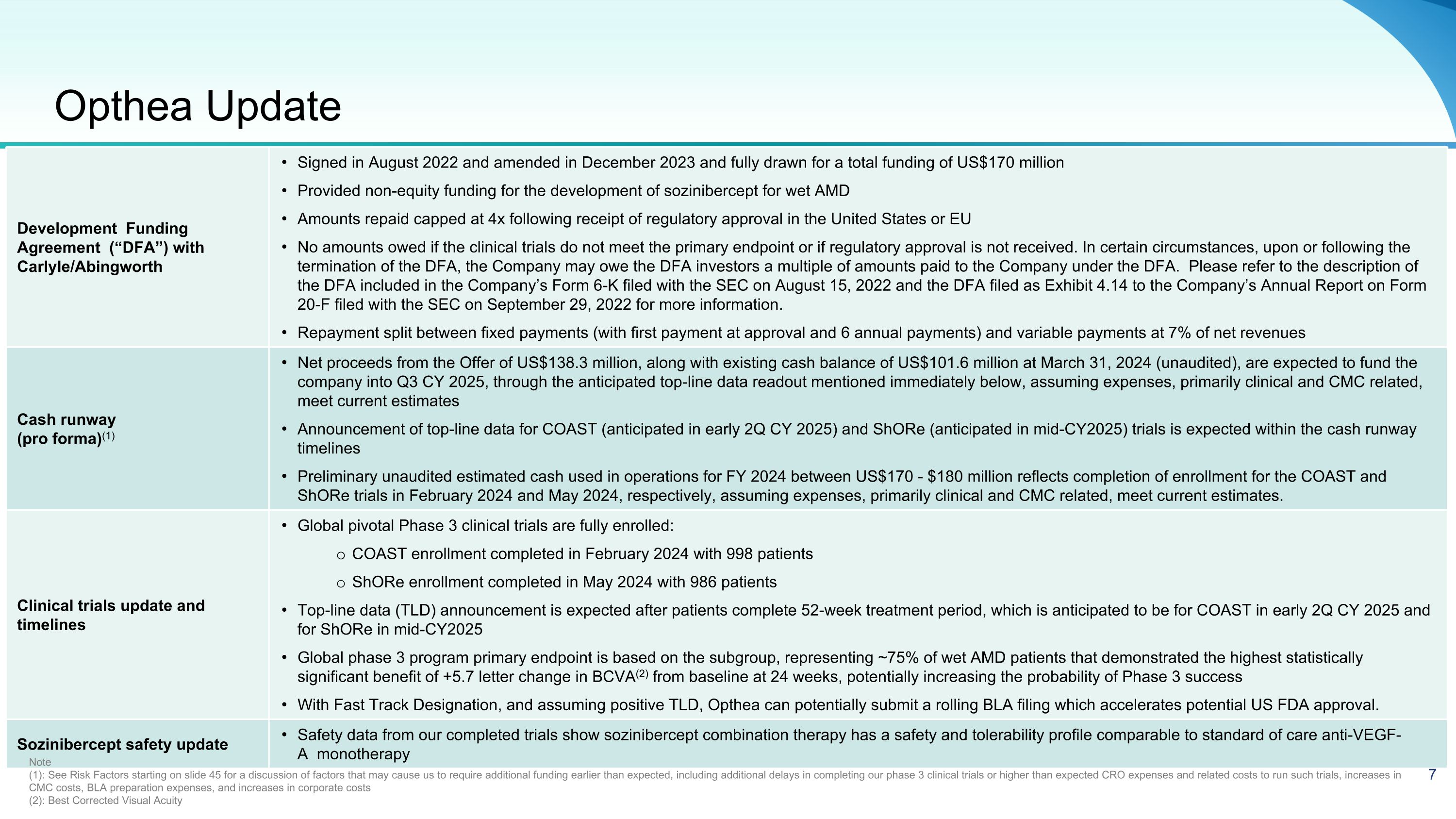

Opthea Update Development Funding Agreement (“DFA”) with �Carlyle/Abingworth Signed in August 2022 and amended in December 2023 and fully drawn for a total funding of US$170 million Provided non-equity funding for the development of sozinibercept for wet AMD Amounts repaid capped at 4x following receipt of regulatory approval in the United States or EU No amounts owed if the clinical trials do not meet the primary endpoint or if regulatory approval is not received. In certain circumstances, upon or following the termination of the DFA, the Company may owe the DFA investors a multiple of amounts paid to the Company under the DFA. Please refer to the description of the DFA included in the Company’s Form 6-K filed with the SEC on August 15, 2022 and the DFA filed as Exhibit 4.14 to the Company’s Annual Report on Form 20-F filed with the SEC on September 29, 2022 for more information. Repayment split between fixed payments (with first payment at approval and 6 annual payments) and variable payments at 7% of net revenues Cash runway (pro forma)(1) Net proceeds from the Offer of US$138.3 million, along with existing cash balance of US$101.6 million at March 31, 2024 (unaudited), are expected to fund the company into Q3 CY 2025, through the anticipated top-line data readout mentioned immediately below, assuming expenses, primarily clinical and CMC related, meet current estimates Announcement of top-line data for COAST (anticipated in early 2Q CY 2025) and ShORe (anticipated in mid-CY2025) trials is expected within the cash runway timelines Preliminary unaudited estimated cash used in operations for FY 2024 between US$170 - $180 million reflects completion of enrollment for the COAST and ShORe trials in February 2024 and May 2024, respectively, assuming expenses, primarily clinical and CMC related, meet current estimates. Clinical trials update and timelines Global pivotal Phase 3 clinical trials are fully enrolled: COAST enrollment completed in February 2024 with 998 patients ShORe enrollment completed in May 2024 with 986 patients Top-line data (TLD) announcement is expected after patients complete 52-week treatment period, which is anticipated to be for COAST in early 2Q CY 2025 and for ShORe in mid-CY2025 Global phase 3 program primary endpoint is based on the subgroup, representing ~75% of wet AMD patients that demonstrated the highest statistically significant benefit of +5.7 letter change in BCVA(2) from baseline at 24 weeks, potentially increasing the probability of Phase 3 success With Fast Track Designation, and assuming positive TLD, Opthea can potentially submit a rolling BLA filing which accelerates potential US FDA approval. Sozinibercept safety update Safety data from our completed trials show sozinibercept combination therapy has a safety and tolerability profile comparable to standard of care anti-VEGF-A monotherapy Note (1): See Risk Factors starting on slide 45 for a discussion of factors that may cause us to require additional funding earlier than expected, including additional delays in completing our phase 3 clinical trials or higher than expected CRO expenses and related costs to run such trials, increases in CMC costs, BLA preparation expenses, and increases in corporate costs (2): Best Corrected Visual Acuity 7

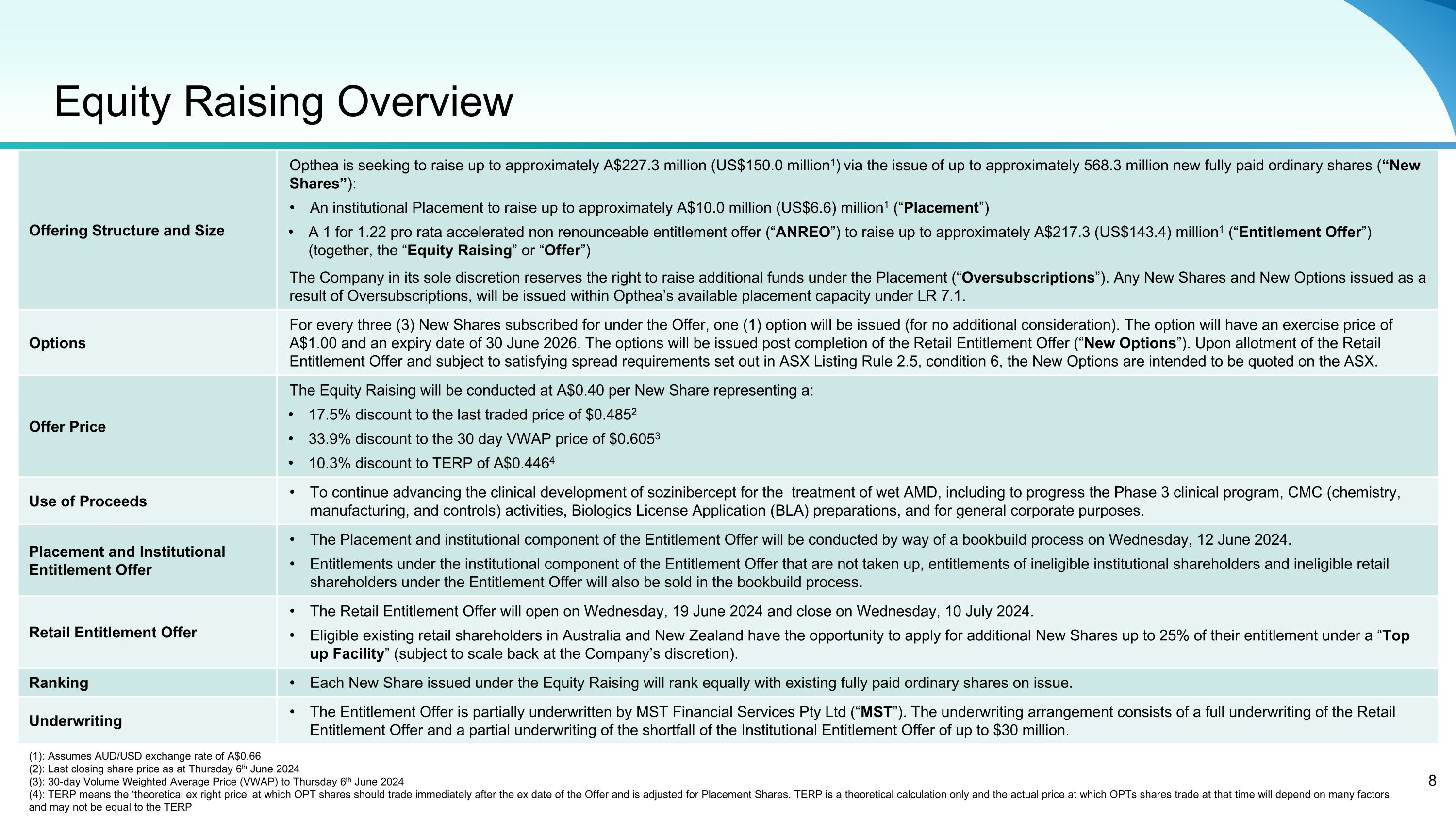

Equity Raising Overview Offering Structure and Size Opthea is seeking to raise up to approximately A$227.3 million (US$150.0 million1) via the issue of up to approximately 568.3 million new fully paid ordinary shares (“New Shares”): An institutional Placement to raise up to approximately A$10.0 million (US$6.6) million1 (“Placement”) A 1 for 1.22 pro rata accelerated non renounceable entitlement offer (“ANREO”) to raise up to approximately A$217.3 (US$143.4) million1 (“Entitlement Offer”) (together, the “Equity Raising” or “Offer”) The Company in its sole discretion reserves the right to raise additional funds under the Placement (“Oversubscriptions”). Any New Shares and New Options issued as a result of Oversubscriptions, will be issued within Opthea’s available placement capacity under LR 7.1. Options For every three (3) New Shares subscribed for under the Offer, one (1) option will be issued (for no additional consideration). The option will have an exercise price of A$1.00 and an expiry date of 30 June 2026. The options will be issued post completion of the Retail Entitlement Offer (“New Options”). Upon allotment of the Retail Entitlement Offer and subject to satisfying spread requirements set out in ASX Listing Rule 2.5, condition 6, the New Options are intended to be quoted on the ASX. Offer Price The Equity Raising will be conducted at A$0.40 per New Share representing a: 17.5% discount to the last traded price of $0.4852 33.9% discount to the 30 day VWAP price of $0.6053 10.3% discount to TERP of A$0.4464 Use of Proceeds To continue advancing the clinical development of sozinibercept for the treatment of wet AMD, including to progress the Phase 3 clinical program, CMC (chemistry, manufacturing, and controls) activities, Biologics License Application (BLA) preparations, and for general corporate purposes. Placement and Institutional Entitlement Offer The Placement and institutional component of the Entitlement Offer will be conducted by way of a bookbuild process on Wednesday, 12 June 2024. Entitlements under the institutional component of the Entitlement Offer that are not taken up, entitlements of ineligible institutional shareholders and ineligible retail shareholders under the Entitlement Offer will also be sold in the bookbuild process. Retail Entitlement Offer The Retail Entitlement Offer will open on Wednesday, 19 June 2024 and close on Wednesday, 10 July 2024. Eligible existing retail shareholders in Australia and New Zealand have the opportunity to apply for additional New Shares up to 25% of their entitlement under a “Top up Facility” (subject to scale back at the Company’s discretion). Ranking Each New Share issued under the Equity Raising will rank equally with existing fully paid ordinary shares on issue. Underwriting The Entitlement Offer is partially underwritten by MST Financial Services Pty Ltd (“MST”). The underwriting arrangement consists of a full underwriting of the Retail Entitlement Offer and a partial underwriting of the shortfall of the Institutional Entitlement Offer of up to $30 million. (1): Assumes AUD/USD exchange rate of A$0.66 (2): Last closing share price as at Thursday 6th June 2024 (3): 30-day Volume Weighted Average Price (VWAP) to Thursday 6th June 2024 (4): TERP means the ‘theoretical ex right price’ at which OPT shares should trade immediately after the ex date of the Offer and is adjusted for Placement Shares. TERP is a theoretical calculation only and the actual price at which OPTs shares trade at that time will depend on many factors and may not be equal to the TERP

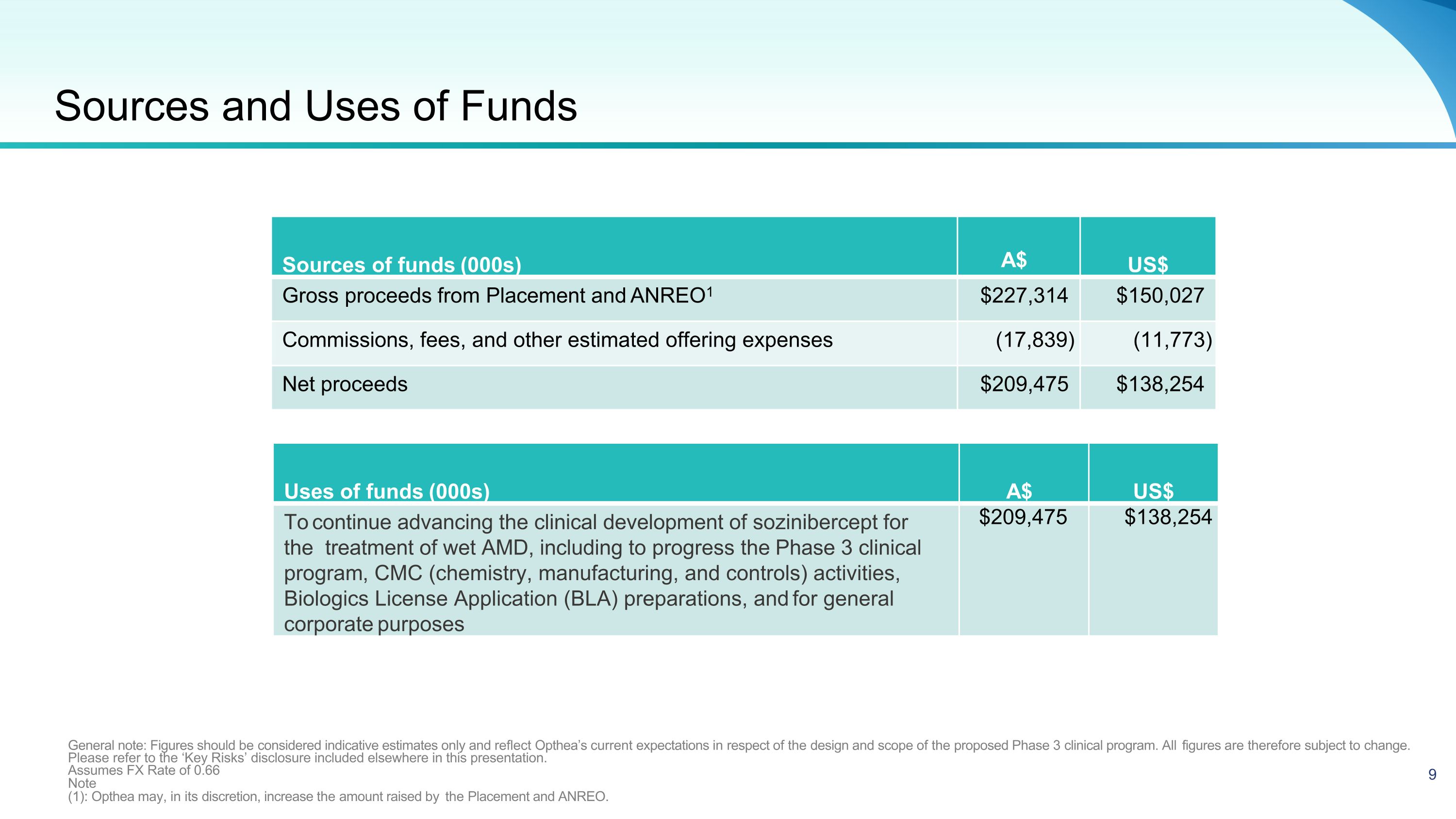

Sources of funds (000s) A$ US$ Gross proceeds from Placement and ANREO1 $227,314 $150,027 Commissions, fees, and other estimated offering expenses (17,839) (11,773) Net proceeds $209,475 $138,254 General note: Figures should be considered indicative estimates only and reflect Opthea’s current expectations in respect of the design and scope of the proposed Phase 3 clinical program. All figures are therefore subject to change. Please refer to the ‘Key Risks’ disclosure included elsewhere in this presentation. Assumes FX Rate of 0.66 Note (1): Opthea may, in its discretion, increase the amount raised by the Placement and ANREO. Uses of funds (000s) A$ US$ To continue advancing the clinical development of sozinibercept for the treatment of wet AMD, including to progress the Phase 3 clinical program, CMC (chemistry, manufacturing, and controls) activities, Biologics License Application (BLA) preparations, and for general corporate purposes $209,475 $138,254 Sources and Uses of Funds 9

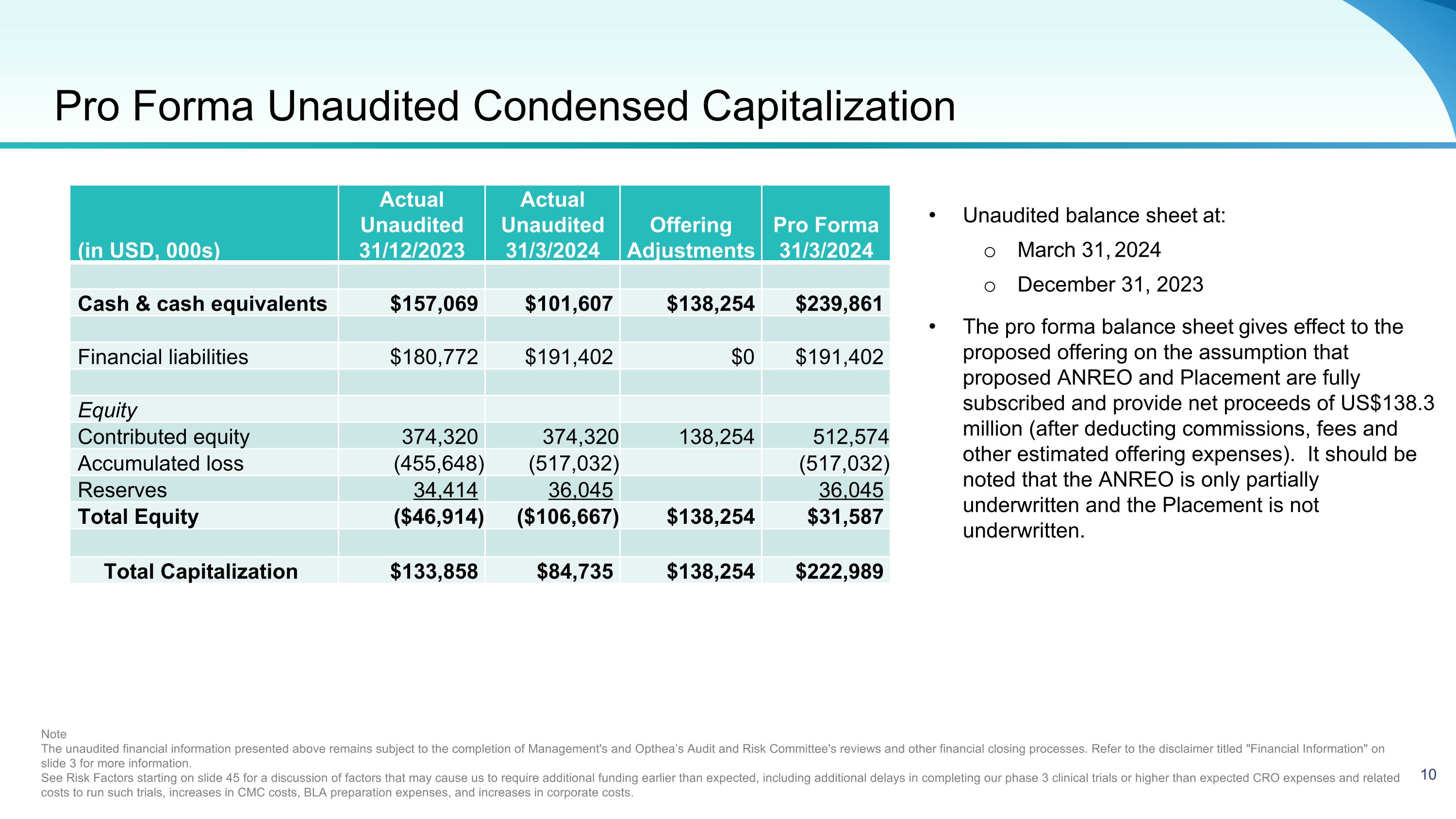

Pro Forma Unaudited Condensed Capitalization Unaudited balance sheet at: March 31, 2024 December 31, 2023 The pro forma balance sheet gives effect to the proposed offering on the assumption that proposed ANREO and Placement are fully subscribed and provide net proceeds of US$138.3 million (after deducting commissions, fees and other estimated offering expenses). It should be noted that the ANREO is only partially underwritten and the Placement is not underwritten. Note The unaudited financial information presented above remains subject to the completion of Management's and Opthea’s Audit and Risk Committee's reviews and other financial closing processes. Refer to the disclaimer titled "Financial Information" on slide 3 for more information. See Risk Factors starting on slide 45 for a discussion of factors that may cause us to require additional funding earlier than expected, including additional delays in completing our phase 3 clinical trials or higher than expected CRO expenses and related costs to run such trials, increases in CMC costs, BLA preparation expenses, and increases in corporate costs. (in USD, 000s) Actual Unaudited 31/12/2023 Actual Unaudited 31/3/2024 Offering�Adjustments Pro Forma 31/3/2024 Cash & cash equivalents $157,069 $101,607 $138,254 $239,861 Financial liabilities $180,772 $191,402 $0 $191,402 Equity Contributed equity 374,320 374,320 138,254 512,574 Accumulated loss (455,648) (517,032) (517,032) Reserves 34,414 36,045 36,045 Total Equity ($46,914) ($106,667) $138,254 $31,587 Total Capitalization $133,858 $84,735 $138,254 $222,989 10

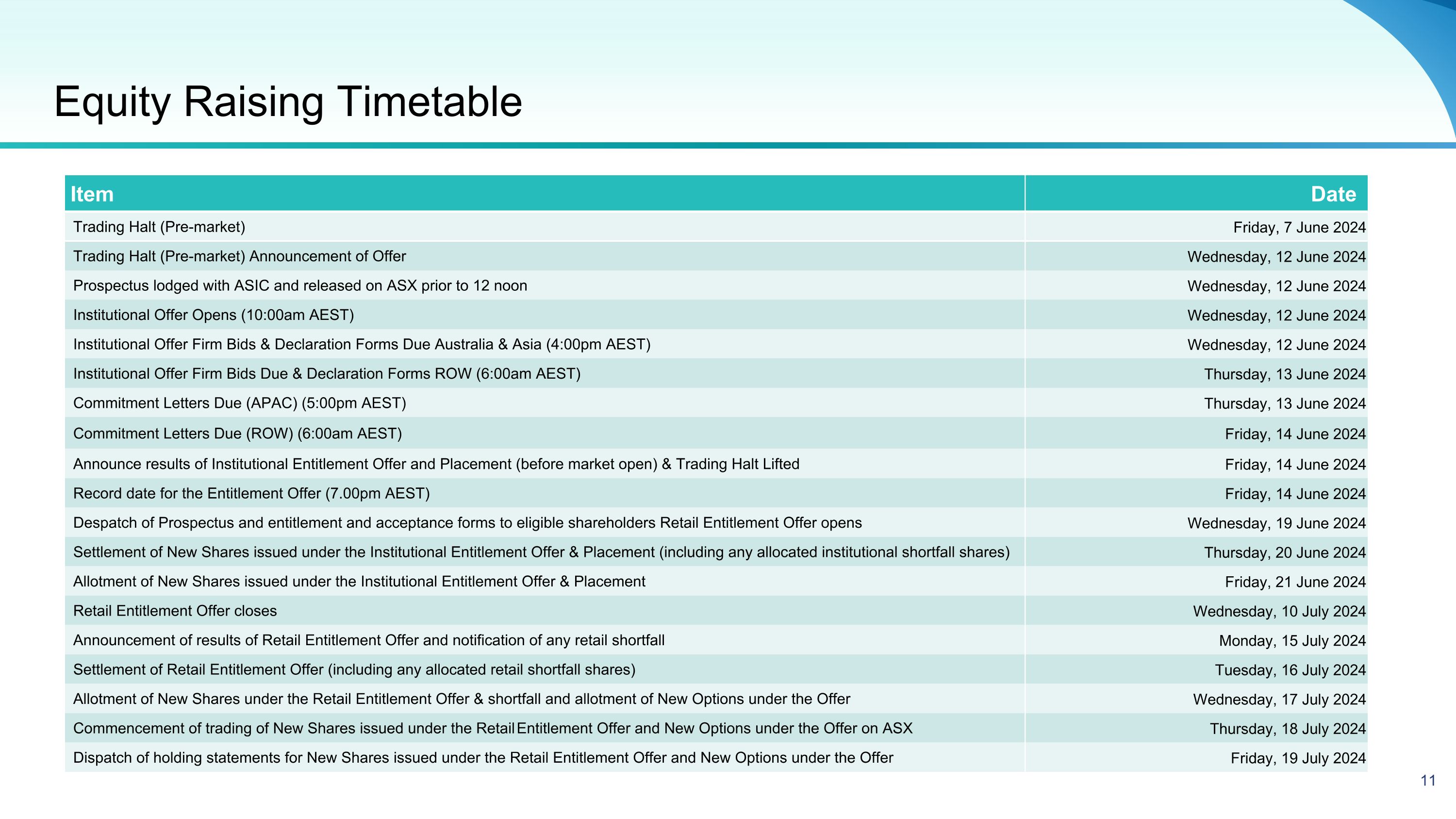

Equity Raising Timetable Item Date Trading Halt (Pre-market) Friday, 7 June 2024 Trading Halt (Pre-market) Announcement of Offer Wednesday, 12 June 2024 Prospectus lodged with ASIC and released on ASX prior to 12 noon Wednesday, 12 June 2024 Institutional Offer Opens (10:00am AEST) Wednesday, 12 June 2024 Institutional Offer Firm Bids & Declaration Forms Due Australia & Asia (4:00pm AEST) Wednesday, 12 June 2024 Institutional Offer Firm Bids Due & Declaration Forms ROW (6:00am AEST) Thursday, 13 June 2024 Commitment Letters Due (APAC) (5:00pm AEST) Thursday, 13 June 2024 Commitment Letters Due (ROW) (6:00am AEST) Friday, 14 June 2024 Announce results of Institutional Entitlement Offer and Placement (before market open) & Trading Halt Lifted Friday, 14 June 2024 Record date for the Entitlement Offer (7.00pm AEST) Friday, 14 June 2024 Despatch of Prospectus and entitlement and acceptance forms to eligible shareholders Retail Entitlement Offer opens Wednesday, 19 June 2024 Settlement of New Shares issued under the Institutional Entitlement Offer & Placement (including any allocated institutional shortfall shares) Thursday, 20 June 2024 Allotment of New Shares issued under the Institutional Entitlement Offer & Placement Friday, 21 June 2024 Retail Entitlement Offer closes Wednesday, 10 July 2024 Announcement of results of Retail Entitlement Offer and notification of any retail shortfall Monday, 15 July 2024 Settlement of Retail Entitlement Offer (including any allocated retail shortfall shares) Tuesday, 16 July 2024 Allotment of New Shares under the Retail Entitlement Offer & shortfall and allotment of New Options under the Offer Wednesday, 17 July 2024 Commencement of trading of New Shares issued under the Retail Entitlement Offer and New Options under the Offer on ASX Thursday, 18 July 2024 Dispatch of holding statements for New Shares issued under the Retail Entitlement Offer and New Options under the Offer Friday, 19 July 2024

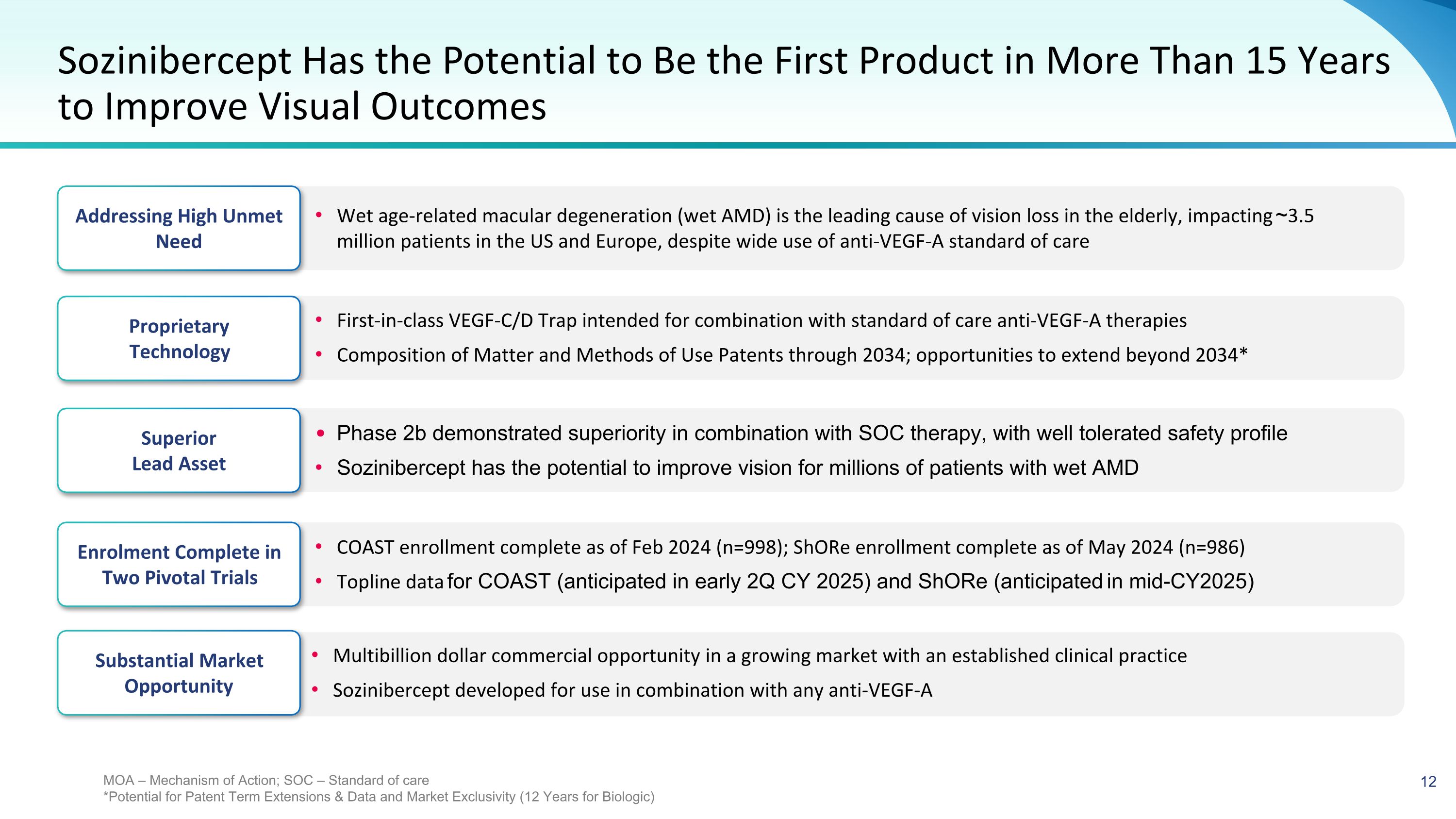

First-in-class VEGF-C/D Trap intended for combination with standard of care anti-VEGF-A therapies Composition of Matter and Methods of Use Patents through 2034; opportunities to extend beyond 2034* Sozinibercept Has the Potential to Be the First Product in More Than 15 Years to Improve Visual Outcomes Addressing High Unmet Need Enrolment Complete in Two Pivotal Trials Substantial Market Opportunity Wet age-related macular degeneration (wet AMD) is the leading cause of vision loss in the elderly, impacting ~3.5 million patients in the US and Europe, despite wide use of anti-VEGF-A standard of care COAST enrollment complete as of Feb 2024 (n=998); ShORe enrollment complete as of May 2024 (n=986) Topline data for COAST (anticipated in early 2Q CY 2025) and ShORe (anticipated in mid-CY2025) Superior Lead Asset Phase 2b demonstrated superiority in combination with SOC therapy, with well tolerated safety profile Sozinibercept has the potential to improve vision for millions of patients with wet AMD Multibillion dollar commercial opportunity in a growing market with an established clinical practice Sozinibercept developed for use in combination with any anti-VEGF-A MOA – Mechanism of Action; SOC – Standard of care *Potential for Patent Term Extensions & Data and Market Exclusivity (12 Years for Biologic) Proprietary Technology

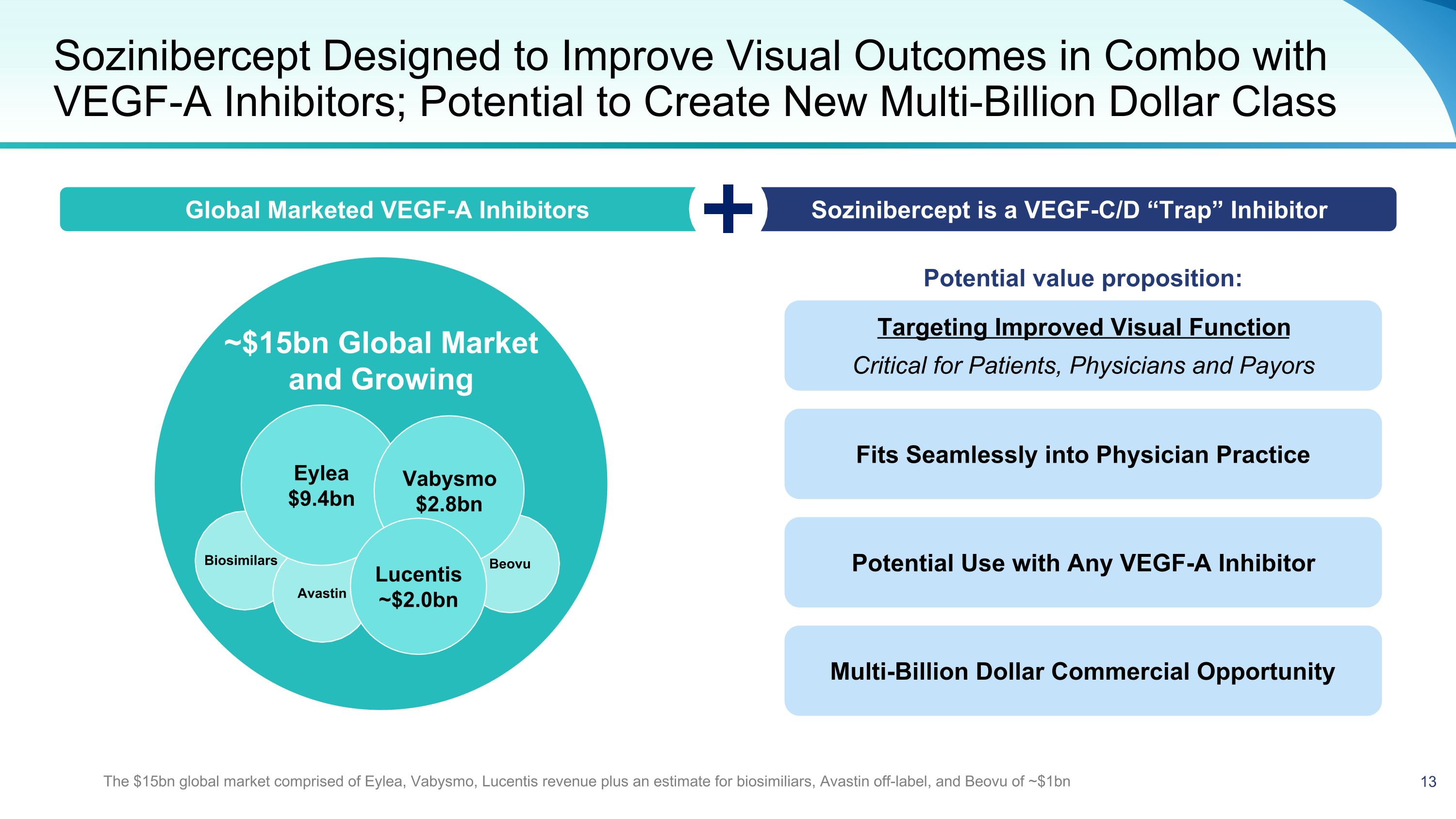

~$15bn Global Market and Growing Sozinibercept Designed to Improve Visual Outcomes in Combo with VEGF-A Inhibitors; Potential to Create New Multi-Billion Dollar Class Beovu Avastin Eylea $9.4bn Vabysmo $2.8bn Lucentis ~$2.0bn Potential value proposition: Targeting Improved Visual Function Critical for Patients, Physicians and Payors Global Marketed VEGF-A Inhibitors Sozinibercept is a VEGF-C/D “Trap” Inhibitor Fits Seamlessly into Physician Practice Potential Use with Any VEGF-A Inhibitor Multi-Billion Dollar Commercial Opportunity Biosimilars The $15bn global market comprised of Eylea, Vabysmo, Lucentis revenue plus an estimate for biosimiliars, Avastin off-label, and Beovu of ~$1bn

Experienced Leadership Team�Expertise and Track Record to Make a Positive Impact on the Retinal Community Fred Guerard, PharmD, MS Chief Executive Officer Peter Lang Chief Financial Officer Megan Baldwin, PhD, MAICD Founder, Chief Innovation Officer & Executive Director Judith Robertson Chief Commercial Officer Arshad M. Khanani, MD, MA, FASRS Managing Partner, Director of Clinical Research and Director of Fellowship at Sierra Eye Associates, and Clinical Professor at the University of Nevada, Reno School of Medicine Management Team Chief Medical Advisor Clinical Advisory Board Charles C. Wykoff, MD, PhD Director of Research, Retina Consultants of Texas, Chairman of Research and Clinical Trials Committee, Retina Consultants of America Tim Jackson, PhD, MB, ChB, FRCophth National Health Service, Consultant at Kings Hospital College Hospital, London Jason Slakter, MD Clinical Profession at New York University School of Medicine and partner at Vitreous Retina Macula Consultants of New York

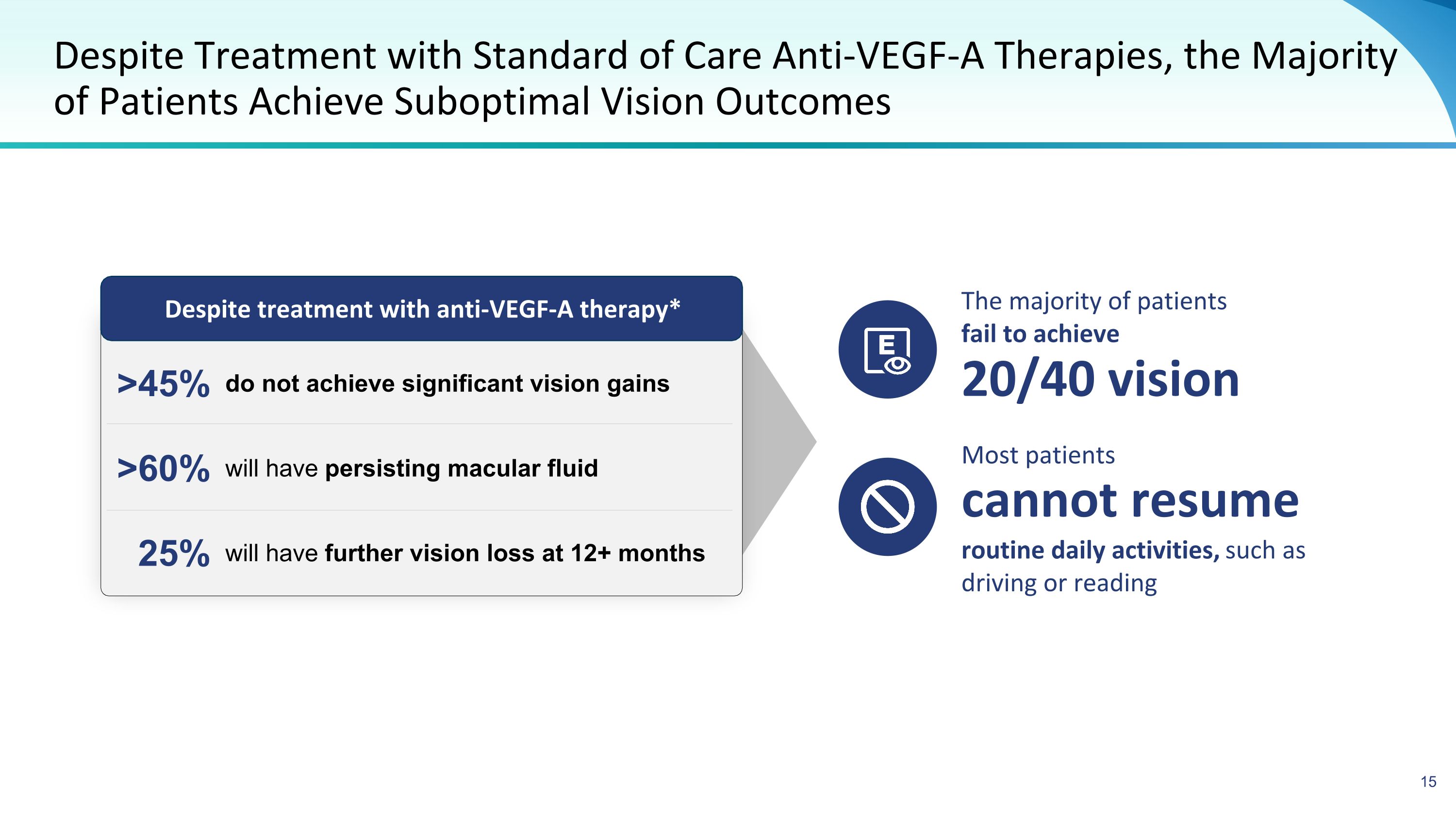

do not achieve significant vision gains 25% Despite Treatment with Standard of Care Anti-VEGF-A Therapies, the Majority of Patients Achieve Suboptimal Vision Outcomes Despite treatment with anti-VEGF-A therapy* will have further vision loss at 12+ months will have persisting macular fluid >60% >45% The majority of patients fail to achieve 20/40 vision Most patients routine daily activities, such as driving or reading cannot resume

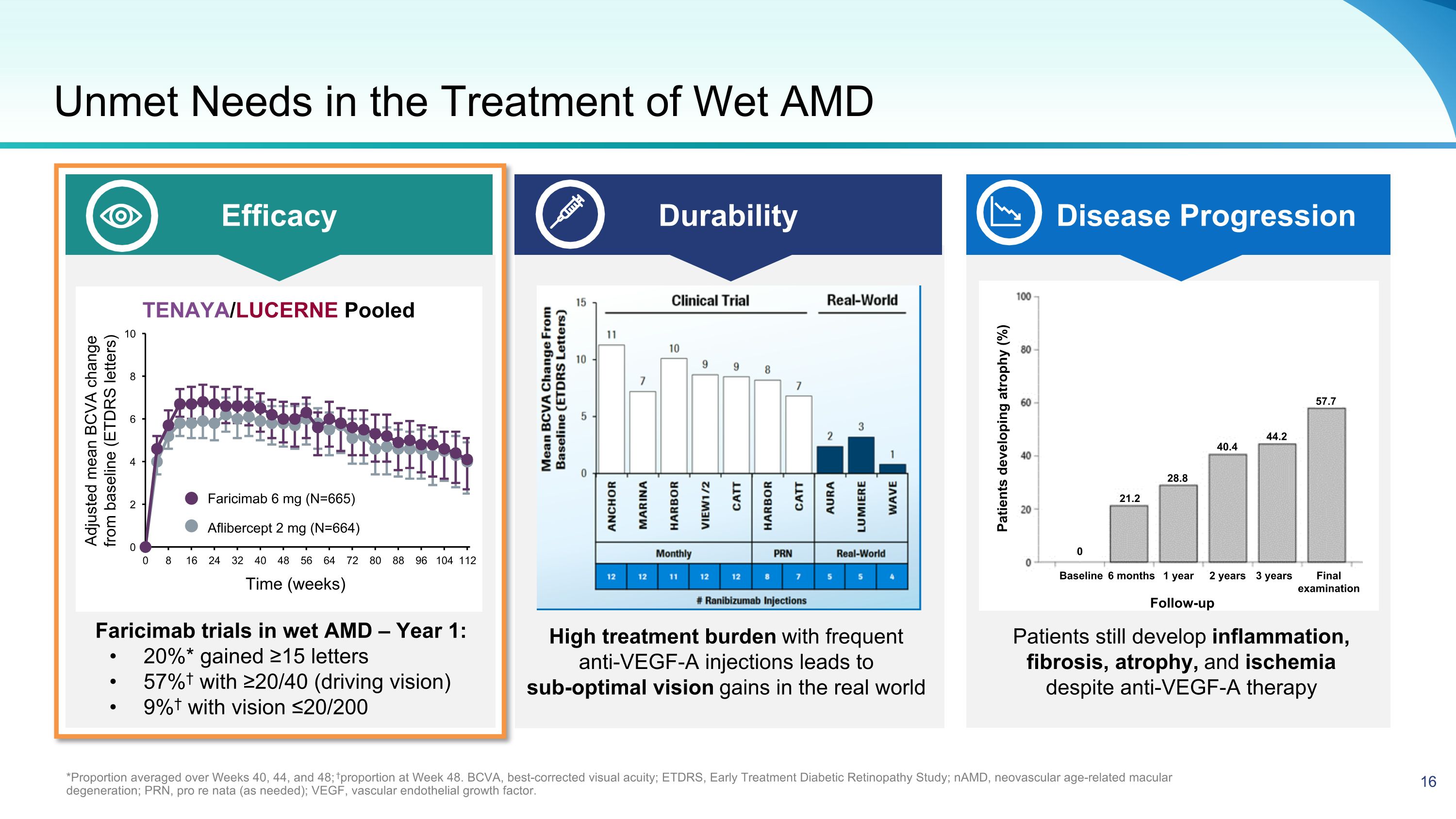

Unmet Needs in the Treatment of Wet AMD *Proportion averaged over Weeks 40, 44, and 48; †proportion at Week 48. BCVA, best-corrected visual acuity; ETDRS, Early Treatment Diabetic Retinopathy Study; nAMD, neovascular age-related macular degeneration; PRN, pro re nata (as needed); VEGF, vascular endothelial growth factor. Efficacy Durability Disease Progression Faricimab trials in wet AMD – Year 1: 20%* gained ≥15 letters 57%† with ≥20/40 (driving vision) 9%† with vision ≤20/200 High treatment burden with frequent anti-VEGF-A injections leads to sub-optimal vision gains in the real world Patients still develop inflammation, fibrosis, atrophy, and ischemia �despite anti-VEGF-A therapy Follow-up Patients developing atrophy (%) Baseline 6 months 1 year 2 years 3 years Final�examination 57.7 44.2 40.4 28.8 21.2 0 Adjusted mean BCVA change from baseline (ETDRS letters) Aflibercept 2 mg (N=664) Faricimab 6 mg (N=665) TENAYA/LUCERNE Pooled

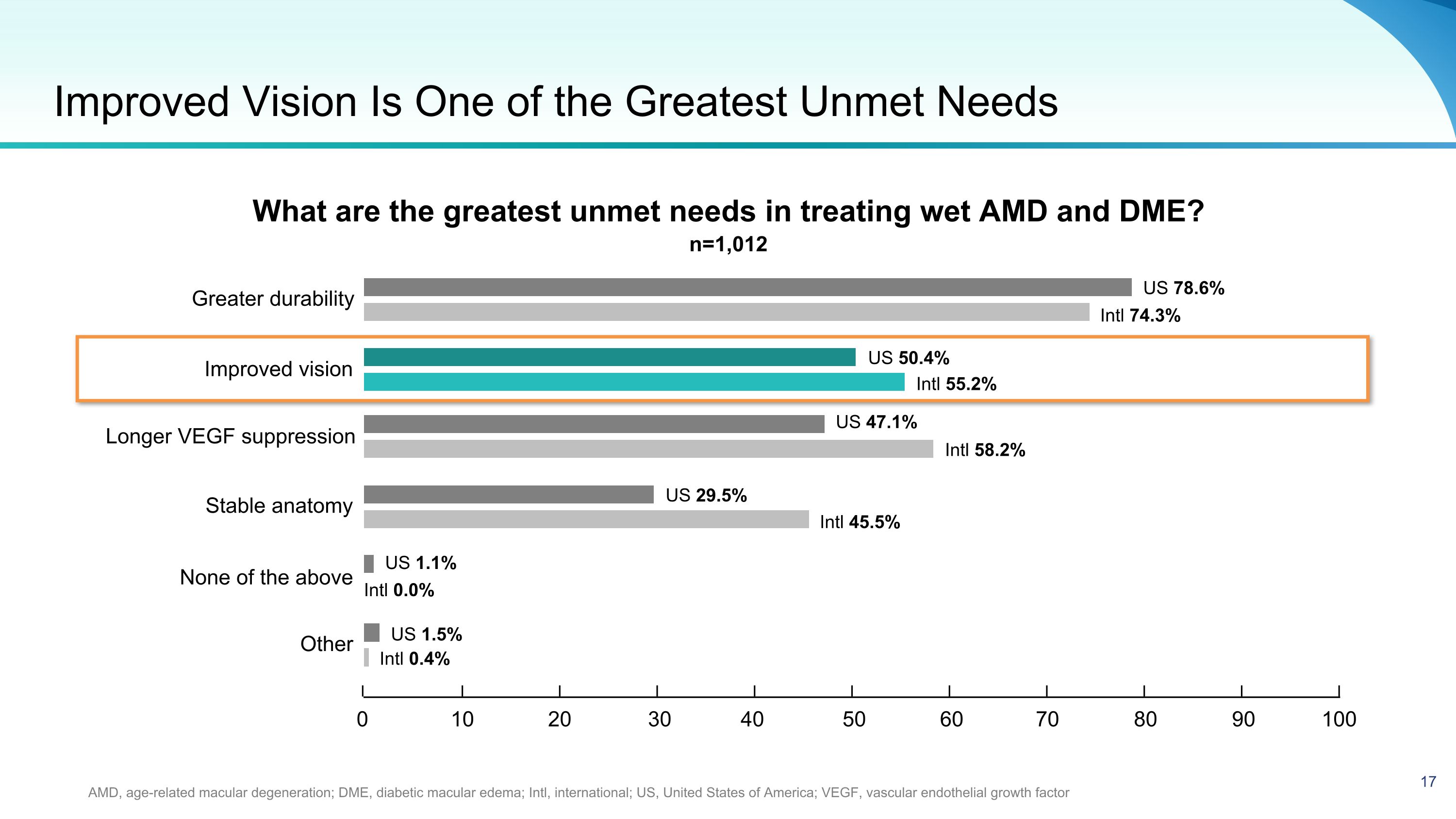

Improved Vision Is One of the Greatest Unmet Needs AMD, age-related macular degeneration; DME, diabetic macular edema; Intl, international; US, United States of America; VEGF, vascular endothelial growth factor What are the greatest unmet needs in treating wet AMD and DME? US 1.5% Intl 0.4% Greater durability Improved vision Longer VEGF suppression Stable anatomy Other US 47.1% Intl 0.0% US 78.6% Intl 74.3% US 50.4% Intl 55.2% Intl 58.2% US 29.5% Intl 45.5% US 1.1% 0 10 20 30 40 50 60 70 80 90 100 None of the above n=1,012

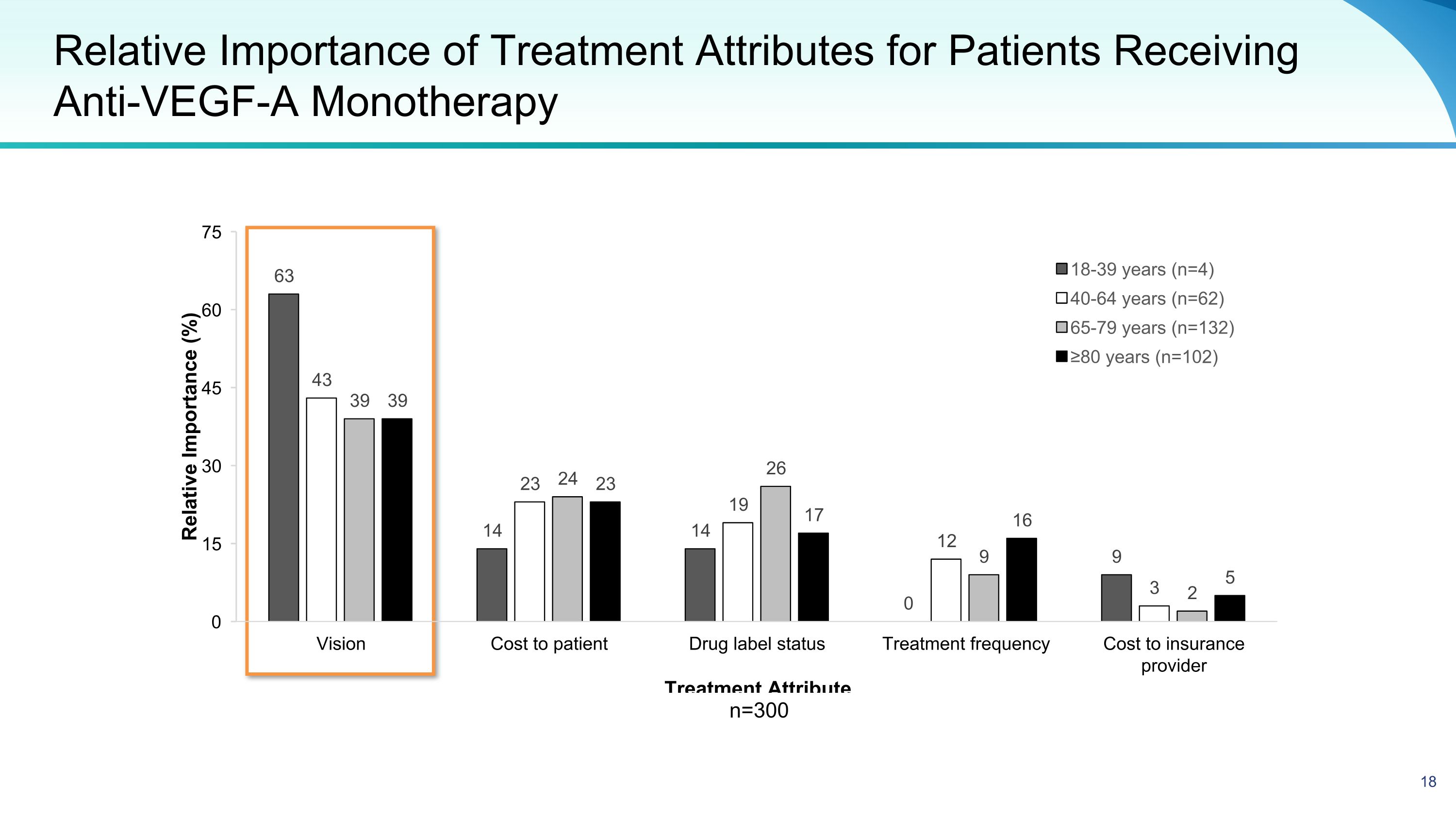

Relative Importance of Treatment Attributes for Patients Receiving Anti-VEGF-A Monotherapy n=300

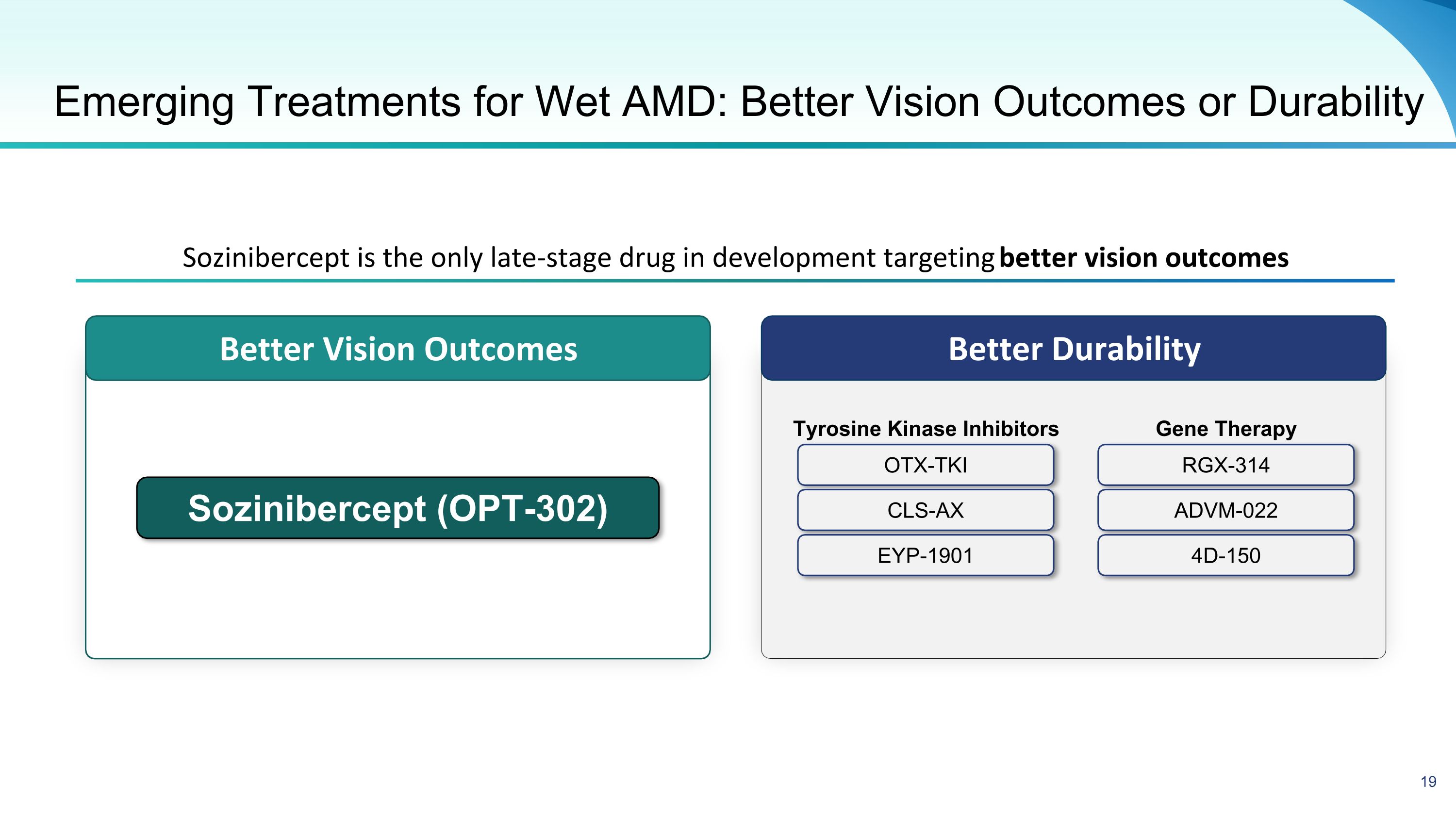

Better Durability Better Vision Outcomes Emerging Treatments for Wet AMD: Better Vision Outcomes or Durability Sozinibercept (OPT-302) Sozinibercept is the only late-stage drug in development targeting better vision outcomes OTX-TKI CLS-AX EYP-1901 RGX-314 ADVM-022 4D-150 Tyrosine Kinase Inhibitors Gene Therapy

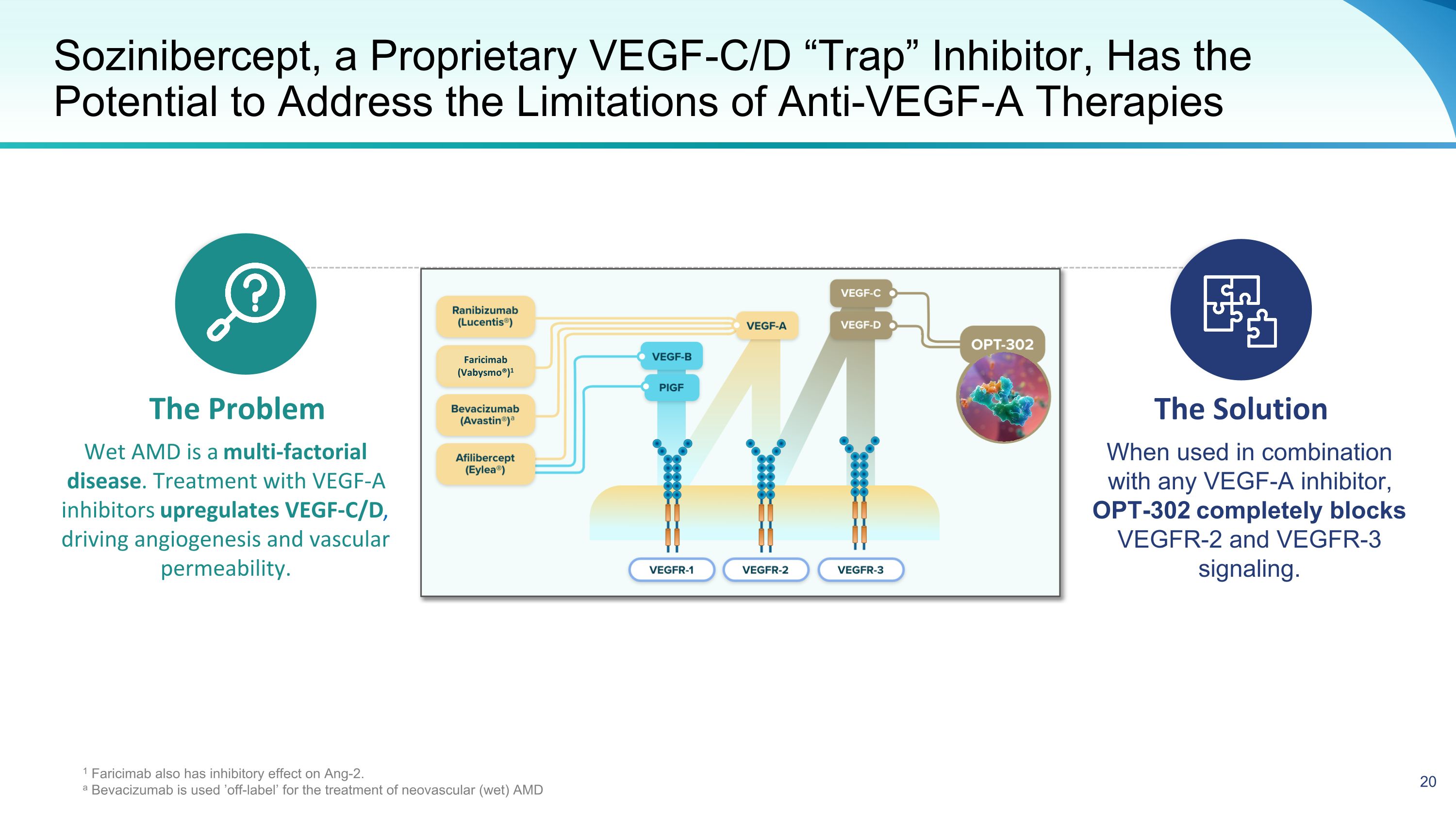

Sozinibercept, a Proprietary VEGF-C/D “Trap” Inhibitor, Has the Potential to Address the Limitations of Anti-VEGF-A Therapies The Problem The Solution Wet AMD is a multi-factorial disease. Treatment with VEGF-A inhibitors upregulates VEGF-C/D, driving angiogenesis and vascular permeability. When used in combination with any VEGF-A inhibitor, OPT-302 completely blocks VEGFR-2 and VEGFR-3 signaling. 1 Faricimab also has inhibitory effect on Ang-2. a Bevacizumab is used ’off-label’ for the treatment of neovascular (wet) AMD Faricimab (Vabysmo®)1

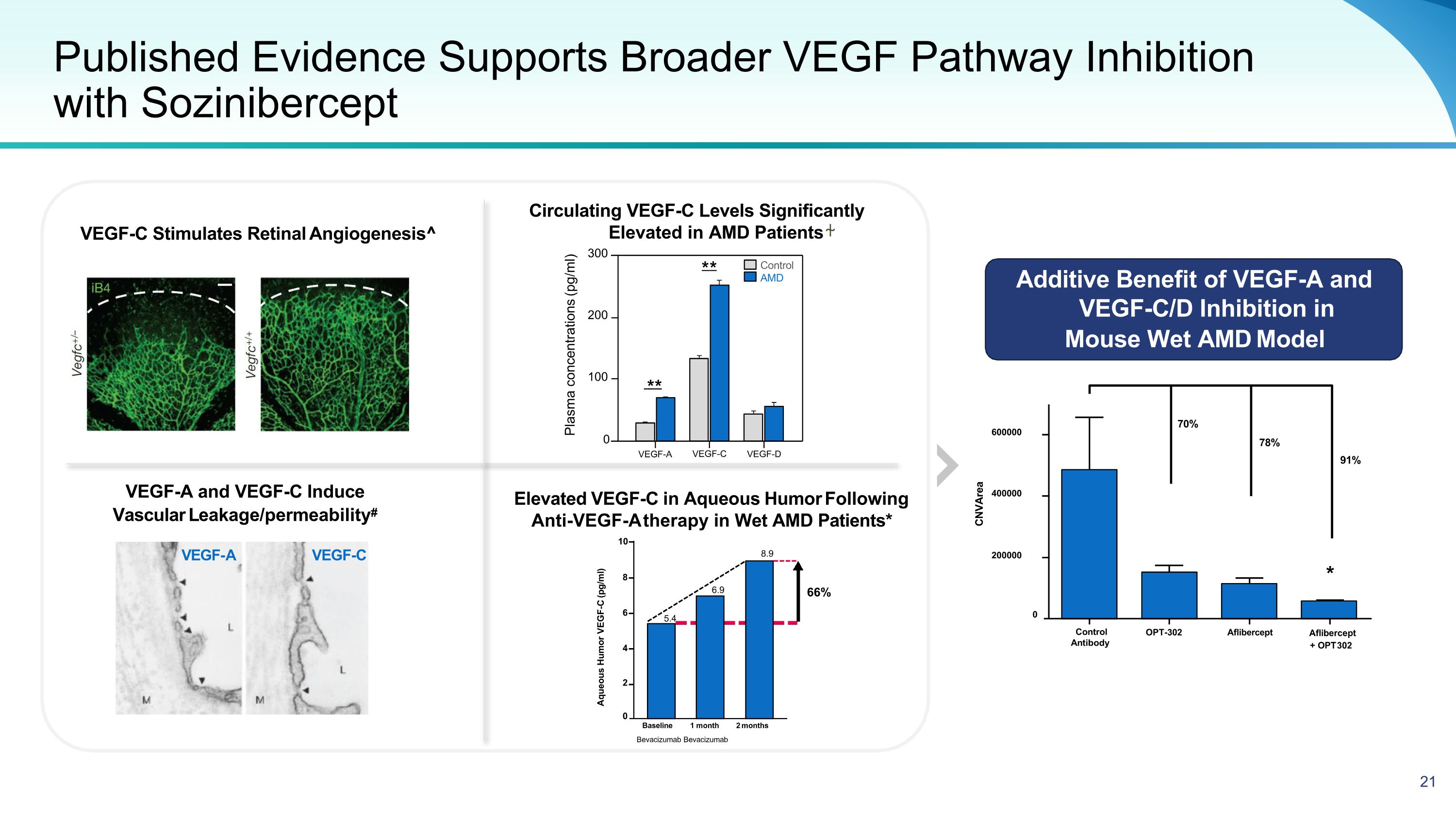

Published Evidence Supports Broader VEGF Pathway Inhibition �with Sozinibercept VEGF-A and VEGF-C Induce Vascular Leakage/permeability# VEGF-A VEGF-C VEGF-C Stimulates Retinal Angiogenesis^ Circulating VEGF-C Levels Significantly Elevated in AMD Patients ⍭ Elevated VEGF-C in Aqueous Humor Following Anti-VEGF-A therapy in Wet AMD Patients* Additive Benefit of VEGF-A and VEGF-C/D Inhibition in Mouse Wet AMD Model ** ** Control AMD Plasma concentrations (pg/ml) 300 200 100 0 Control Antibody OPT-302 Aflibercept Aflibercept + OPT 302 CNVArea 70% 78% 91% * 0 200000 400000 600000 Aqueous Humor VEGF-C (pg/ml) 10 8 66% 6 5.4 6.9 8.9 4 2 0 Baseline 1 month 2 months Bevacizumab Bevacizumab VEGF-A VEGF-C VEGF-D

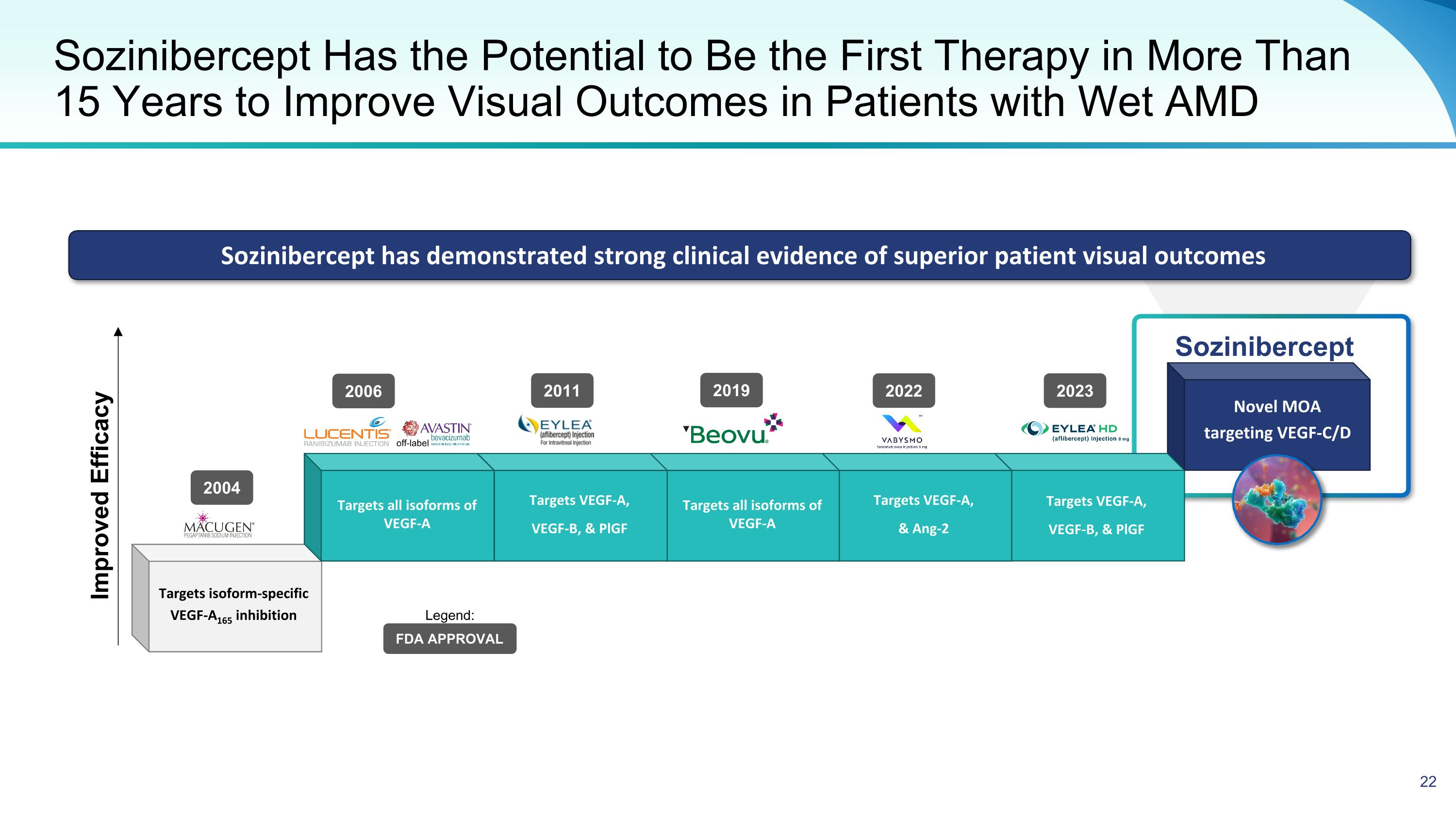

Novel MOA targeting VEGF-C/D Sozinibercept Targets VEGF-A, VEGF-B, & PlGF Targets VEGF-A, & Ang-2 Targets all isoforms of VEGF-A Sozinibercept Has the Potential to Be the First Therapy in More Than 15 Years to Improve Visual Outcomes in Patients with Wet AMD Targets VEGF-A, VEGF-B, & PlGF Targets all isoforms of VEGF-A Targets isoform-specific VEGF-A165 inhibition Sozinibercept has demonstrated strong clinical evidence of superior patient visual outcomes Improved Efficacy 2004 2006 2011 2022 off-label FDA APPROVAL Legend: 2023 2019

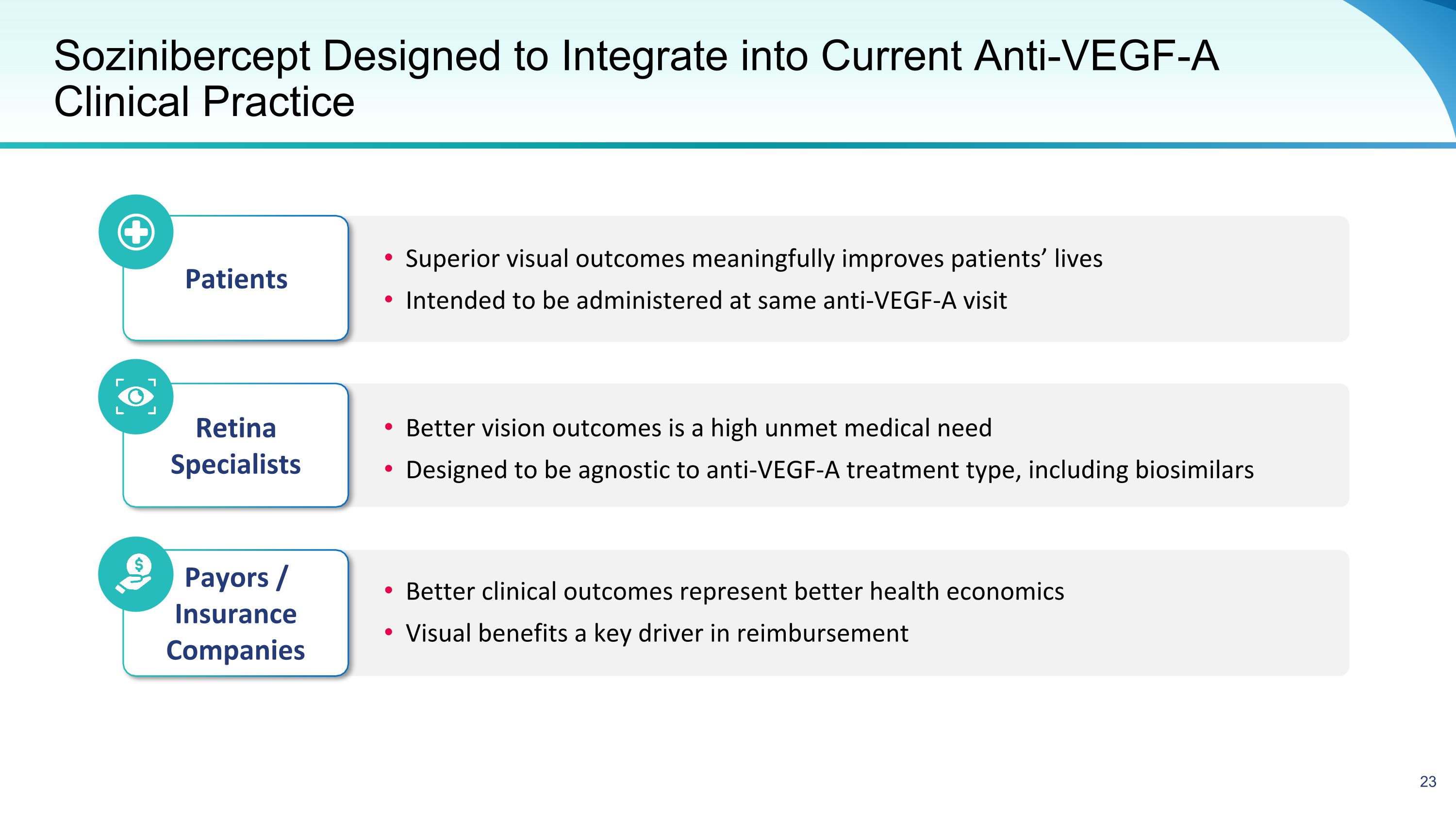

Sozinibercept Designed to Integrate into Current Anti-VEGF-A Clinical Practice Superior visual outcomes meaningfully improves patients’ lives Intended to be administered at same anti-VEGF-A visit Patients Better vision outcomes is a high unmet medical need Designed to be agnostic to anti-VEGF-A treatment type, including biosimilars Retina Specialists Better clinical outcomes represent better health economics Visual benefits a key driver in reimbursement Payors / Insurance Companies

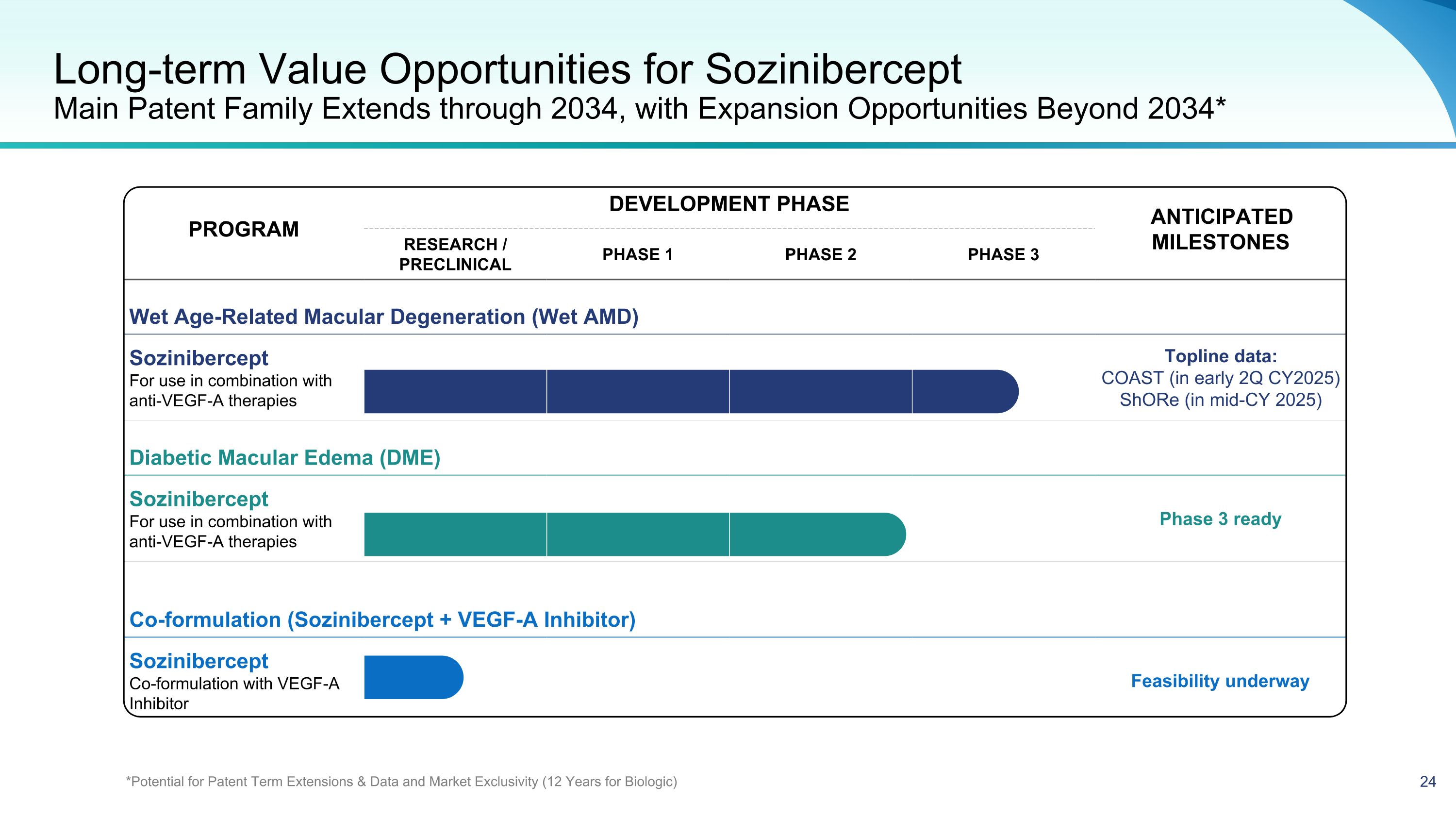

PROGRAM DEVELOPMENT PHASE ANTICIPATED MILESTONES PROGRAM RESEARCH / PRECLINICAL PHASE 1 PHASE 2 PHASE 3 ANTICIPATED MILESTONES Wet Age-Related Macular Degeneration (Wet AMD) Sozinibercept For use in combination with anti-VEGF-A therapies Topline data: COAST (in early 2Q CY2025) ShORe (in mid-CY 2025) Diabetic Macular Edema (DME) Sozinibercept For use in combination with anti-VEGF-A therapies Phase 3 ready Co-formulation (Sozinibercept + VEGF-A Inhibitor) Sozinibercept Co-formulation with VEGF-A Inhibitor Feasibility underway Long-term Value Opportunities for Sozinibercept�Main Patent Family Extends through 2034, with Expansion Opportunities Beyond 2034* *Potential for Patent Term Extensions & Data and Market Exclusivity (12 Years for Biologic)

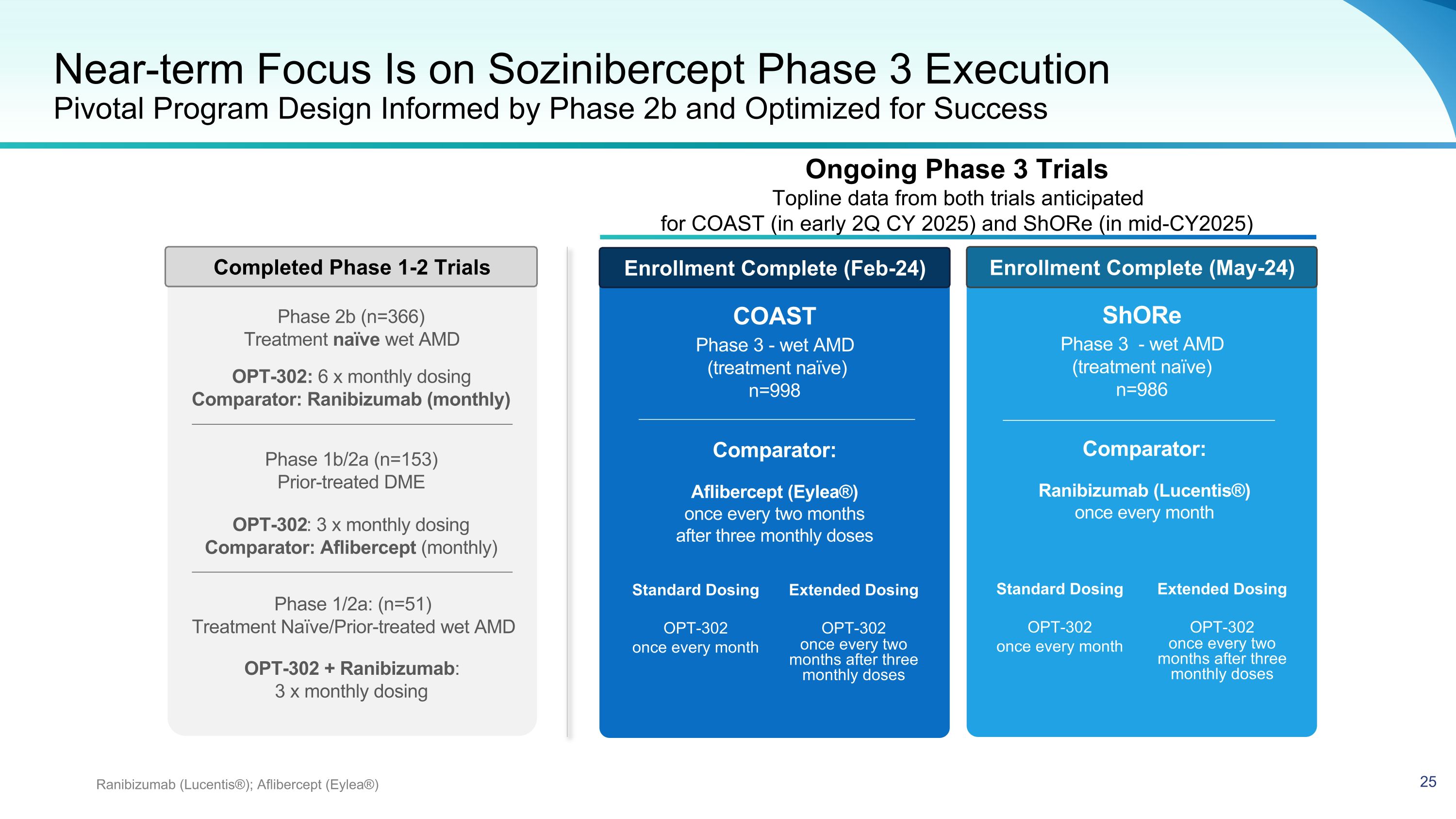

Near-term Focus Is on Sozinibercept Phase 3 Execution�Pivotal Program Design Informed by Phase 2b and Optimized for Success Ranibizumab (Lucentis®); Aflibercept (Eylea®) COAST Phase 3 - wet AMD (treatment naïve) n=998 Comparator: Aflibercept (Eylea®) once every two months after three monthly doses ShORe Phase 3 - wet AMD (treatment naïve) n=986 Comparator: Ranibizumab (Lucentis®) once every month Standard Dosing OPT-302 once every month Extended Dosing OPT-302 once every two months after three monthly doses Standard Dosing OPT-302 once every month Extended Dosing OPT-302 once every two months after three monthly doses Phase 1/2a: (n=51) Treatment Naïve/Prior-treated wet AMD OPT-302 + Ranibizumab: 3 x monthly dosing OPT-302: 3 x monthly dosing Comparator: Aflibercept (monthly) Phase 1b/2a (n=153) Prior-treated DME OPT-302: 6 x monthly dosing Comparator: Ranibizumab (monthly) Phase 2b (n=366) Treatment naïve wet AMD Enrollment Complete (Feb-24) Enrollment Complete (May-24) Completed Phase 1-2 Trials Ongoing Phase 3 Trials Topline data from both trials anticipated �for COAST (in early 2Q CY 2025) and ShORe (in mid-CY2025)

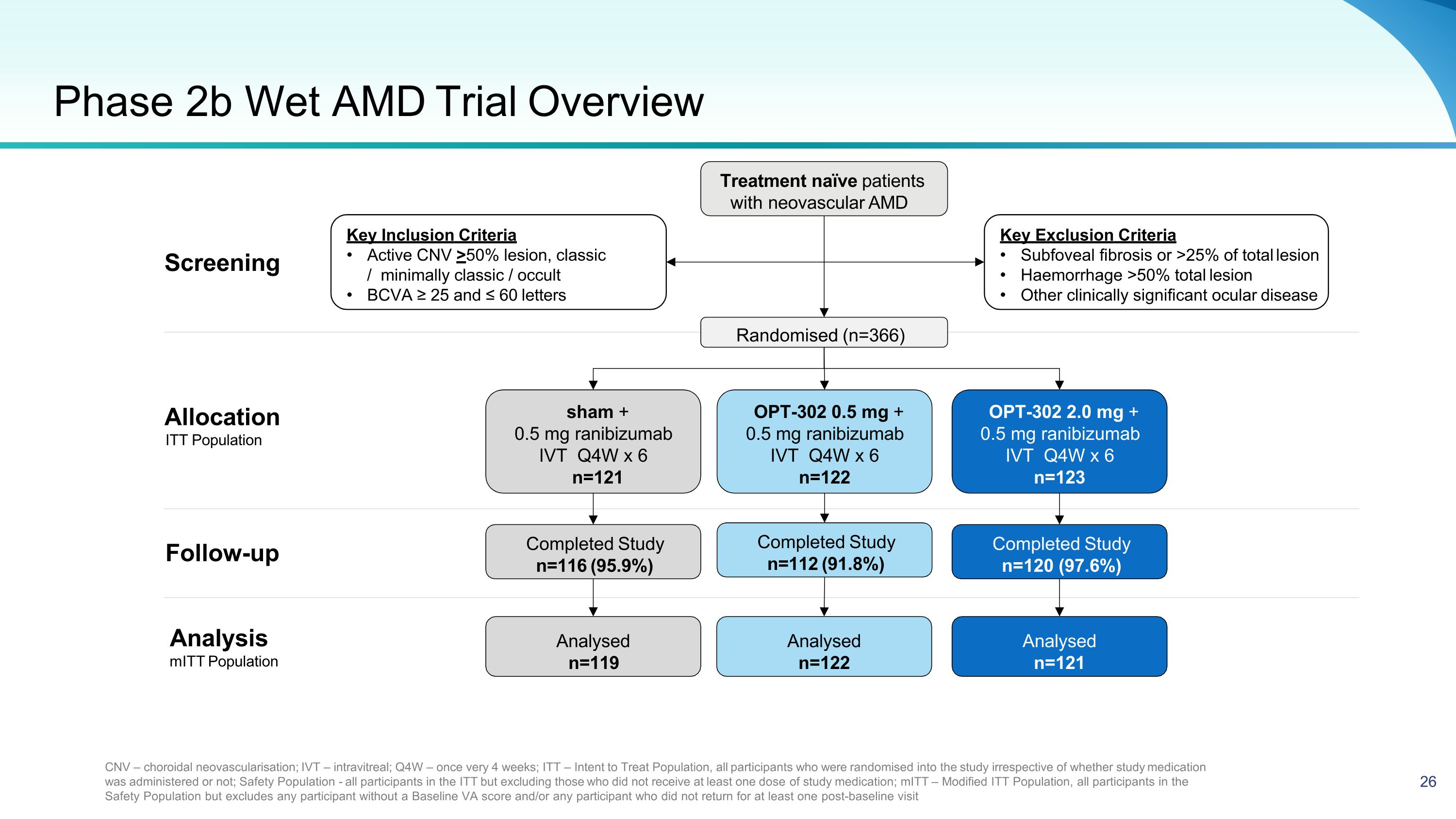

Phase 2b Wet AMD Trial Overview Treatment naïve patients with neovascular AMD Key Exclusion Criteria Subfoveal fibrosis or >25% of total lesion Haemorrhage >50% total lesion Other clinically significant ocular disease Key Inclusion Criteria Active CNV >50% lesion, classic / minimally classic / occult BCVA ≥ 25 and ≤ 60 letters CNV – choroidal neovascularisation; IVT – intravitreal; Q4W – once very 4 weeks; ITT – Intent to Treat Population, all participants who were randomised into the study irrespective of whether study medication was administered or not; Safety Population - all participants in the ITT but excluding those who did not receive at least one dose of study medication; mITT – Modified ITT Population, all participants in the Safety Population but excludes any participant without a Baseline VA score and/or any participant who did not return for at least one post-baseline visit Follow-up Randomised (n=366) OPT-302 0.5 mg + 0.5 mg ranibizumab IVT Q4W x 6 n=122 sham + 0.5 mg ranibizumab IVT Q4W x 6 n=121 OPT-302 2.0 mg + 0.5 mg ranibizumab IVT Q4W x 6 n=123 Completed Study n=112 (91.8%) Completed Study n=116 (95.9%) Completed Study n=120 (97.6%) Analysed n=122 Analysed n=119 Analysed n=121 Analysis mITT Population Allocation ITT Population Screening

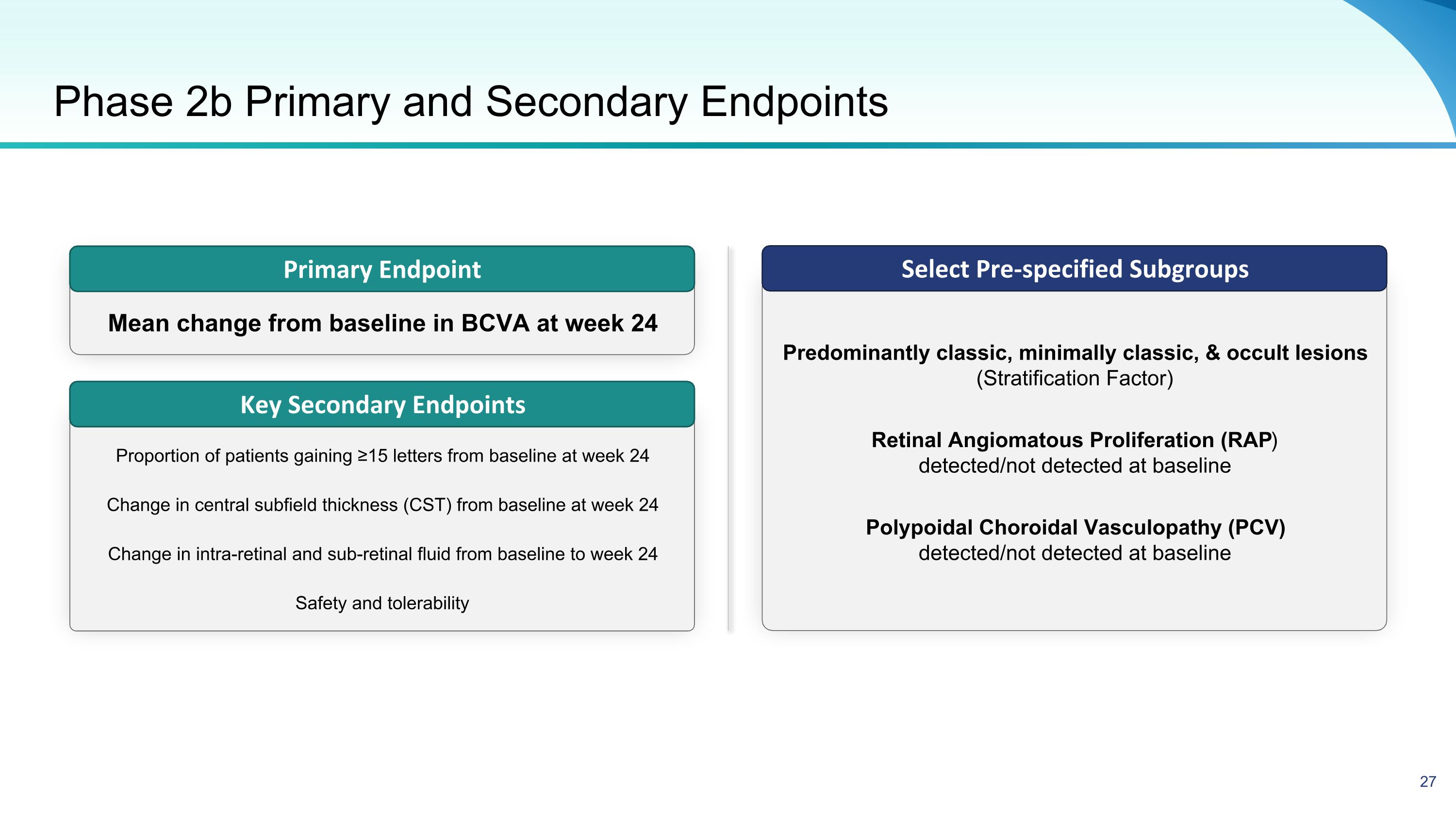

Phase 2b Primary and Secondary Endpoints Select Pre-specified Subgroups Primary Endpoint Key Secondary Endpoints Mean change from baseline in BCVA at week 24 Proportion of patients gaining ≥15 letters from baseline at week 24 Change in central subfield thickness (CST) from baseline at week 24 Change in intra-retinal and sub-retinal fluid from baseline to week 24 Safety and tolerability Predominantly classic, minimally classic, & occult lesions (Stratification Factor) Retinal Angiomatous Proliferation (RAP) detected/not detected at baseline Polypoidal Choroidal Vasculopathy (PCV) detected/not detected at baseline

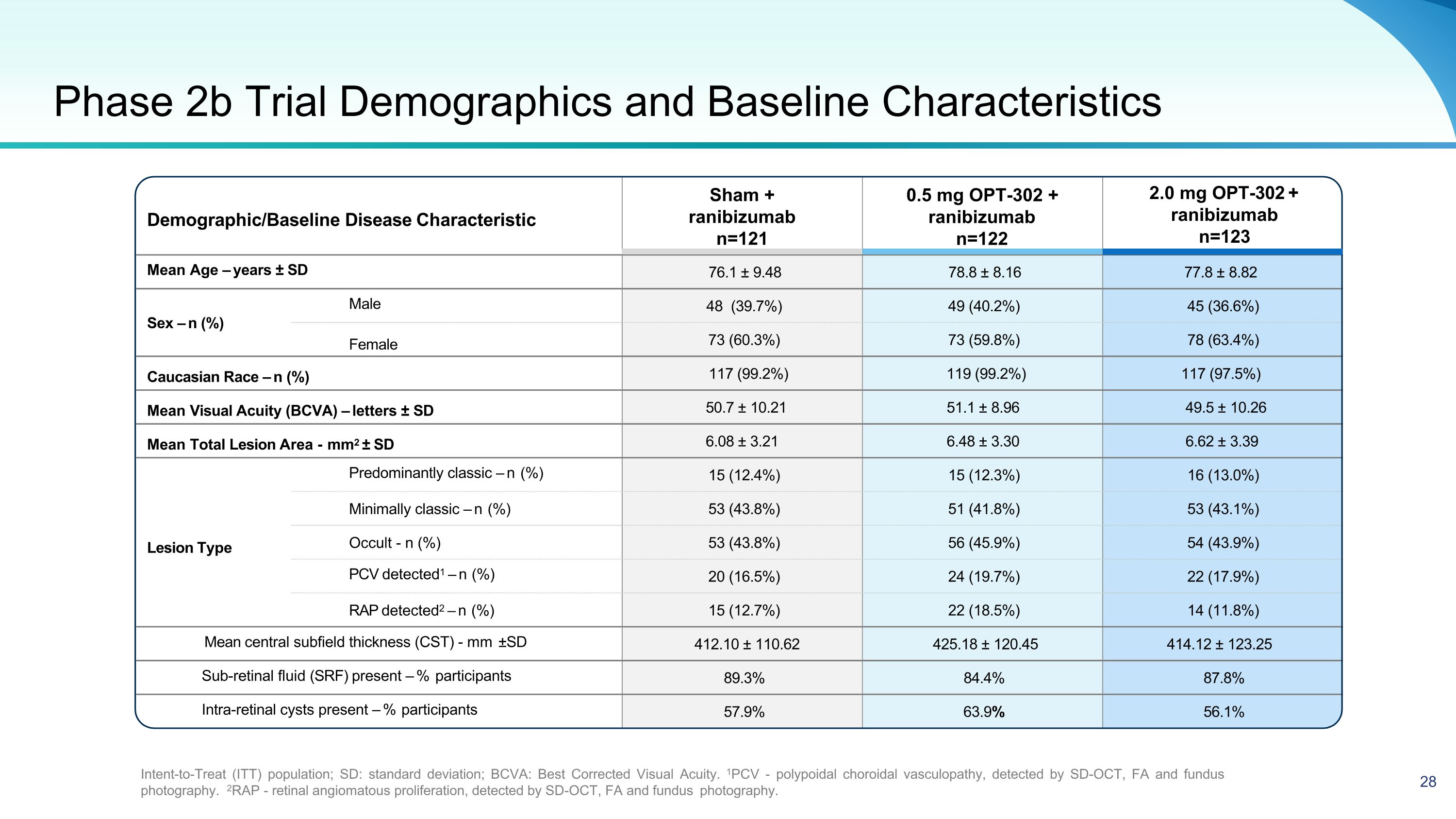

Demographic/Baseline Disease Characteristic 2.0 mg OPT-302 + ranibizumab n=123 Mean Age – years ± SD 76.1 ± 9.48 78.8 ± 8.16 77.8 ± 8.82 Sex – n (%) Male 48 (39.7%) 49 (40.2%) 45 (36.6%) Female 73 (60.3%) 73 (59.8%) 78 (63.4%) Caucasian Race – n (%) 117 (99.2%) 119 (99.2%) 117 (97.5%) Mean Visual Acuity (BCVA) – letters ± SD 50.7 ± 10.21 51.1 ± 8.96 49.5 ± 10.26 Mean Total Lesion Area - mm2 ± SD 6.08 ± 3.21 6.48 ± 3.30 6.62 ± 3.39 Predominantly classic – n (%) 15 (12.4%) 15 (12.3%) 16 (13.0%) Minimally classic – n (%) 53 (43.8%) 51 (41.8%) 53 (43.1%) Lesion Type Occult - n (%) 53 (43.8%) 56 (45.9%) 54 (43.9%) PCV detected1 – n (%) 20 (16.5%) 24 (19.7%) 22 (17.9%) RAP detected2 – n (%) 15 (12.7%) 22 (18.5%) 14 (11.8%) Mean central subfield thickness (CST) - mm ±SD 412.10 ± 110.62 425.18 ± 120.45 414.12 ± 123.25 Sub-retinal fluid (SRF) present – % participants 89.3% 84.4% 87.8% Intra-retinal cysts present – % participants 57.9% 63.9% 56.1% Phase 2b Trial Demographics and Baseline Characteristics Intent-to-Treat (ITT) population; SD: standard deviation; BCVA: Best Corrected Visual Acuity. 1PCV - polypoidal choroidal vasculopathy, detected by SD-OCT, FA and fundus photography. 2RAP - retinal angiomatous proliferation, detected by SD-OCT, FA and fundus photography. Sham + ranibizumab n=121 0.5 mg OPT-302 + ranibizumab n=122

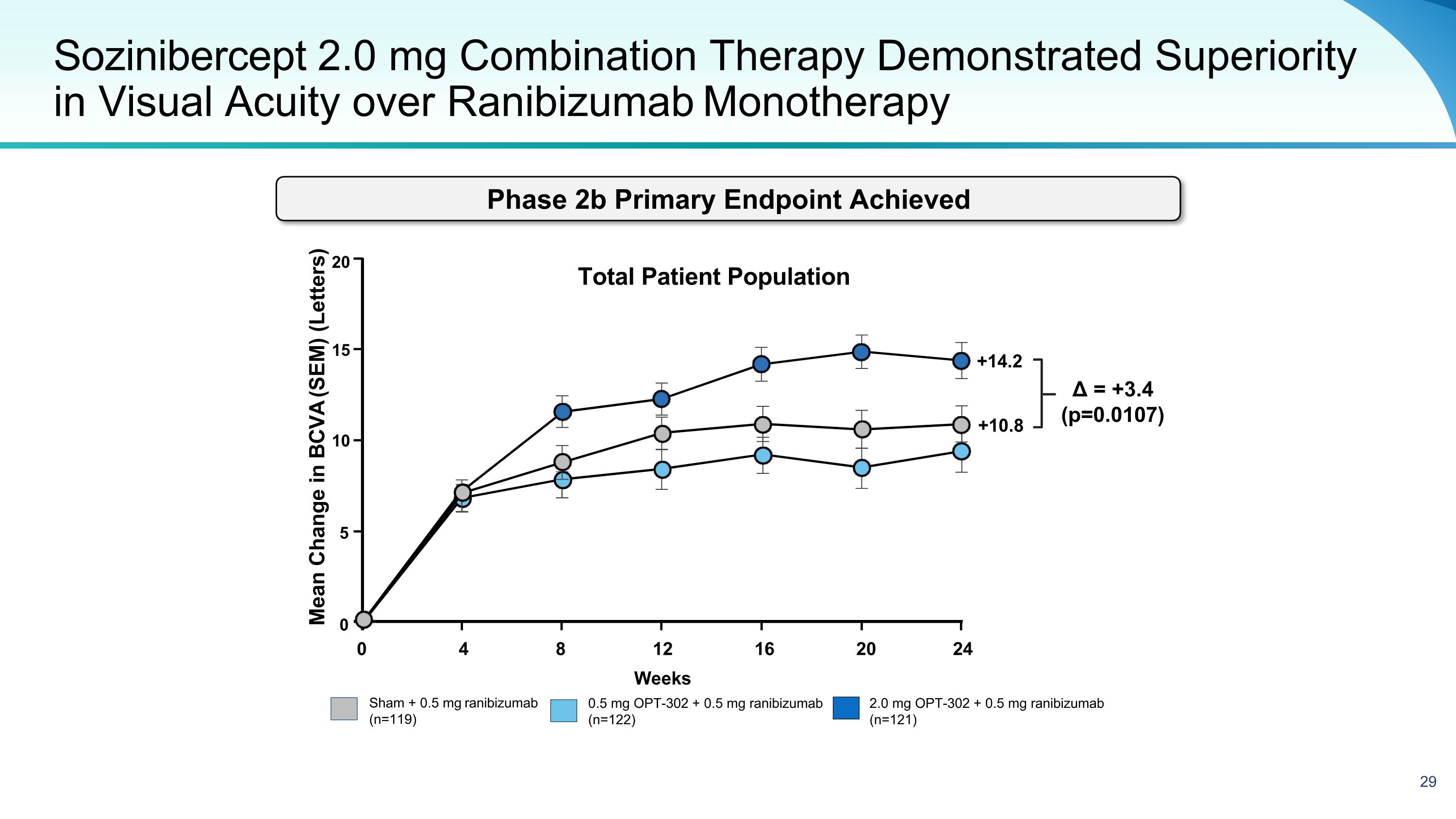

Sozinibercept 2.0 mg Combination Therapy Demonstrated Superiority in Visual Acuity over Ranibizumab Monotherapy Sham + 0.5 mg ranibizumab (n=119) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=121) 0.5 mg OPT-302 + 0.5 mg ranibizumab (n=122) Mean Change in BCVA (SEM) (Letters) Δ = +3.4 (p=0.0107) 20 15 10 5 0 0 4 8 16 20 24 12 Weeks Total Patient Population +14.2 +10.8 Phase 2b Primary Endpoint Achieved

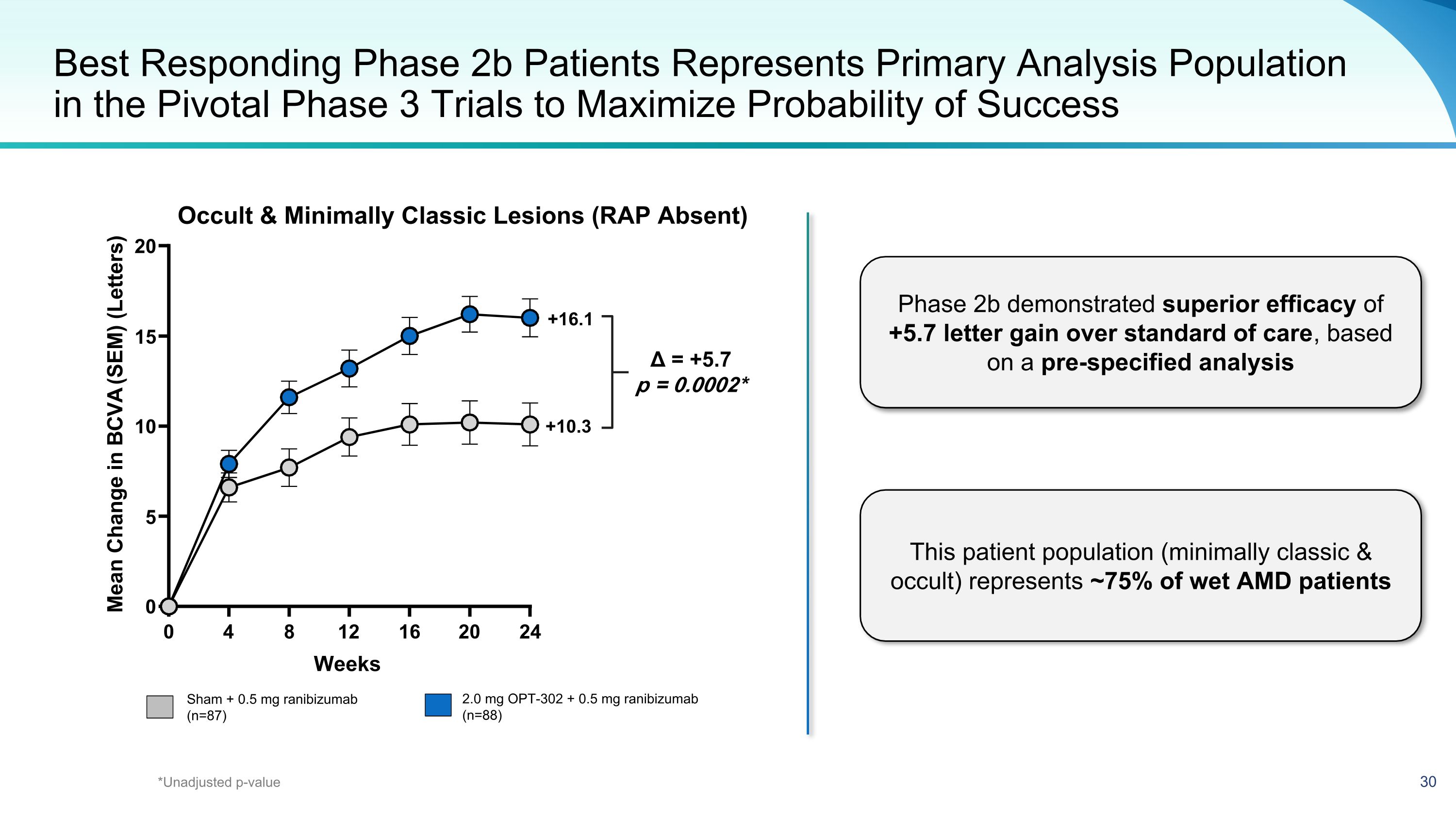

Best Responding Phase 2b Patients Represents Primary Analysis Population in the Pivotal Phase 3 Trials to Maximize Probability of Success Sham + 0.5 mg ranibizumab (n=87) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=88) +10.3 +16.1 Δ = +5.7 p = 0.0002* Occult & Minimally Classic Lesions (RAP Absent) *Unadjusted p-value Phase 2b demonstrated superior efficacy of +5.7 letter gain over standard of care, based on a pre-specified analysis This patient population (minimally classic & occult) represents ~75% of wet AMD patients 0 4 8 12 16 20 24 0 5 10 15 20 Weeks M e a n c h a n g e i n B C V A ( S E M ) ( l e t t e r s ) Mean Change in BCVA (SEM) (Letters)

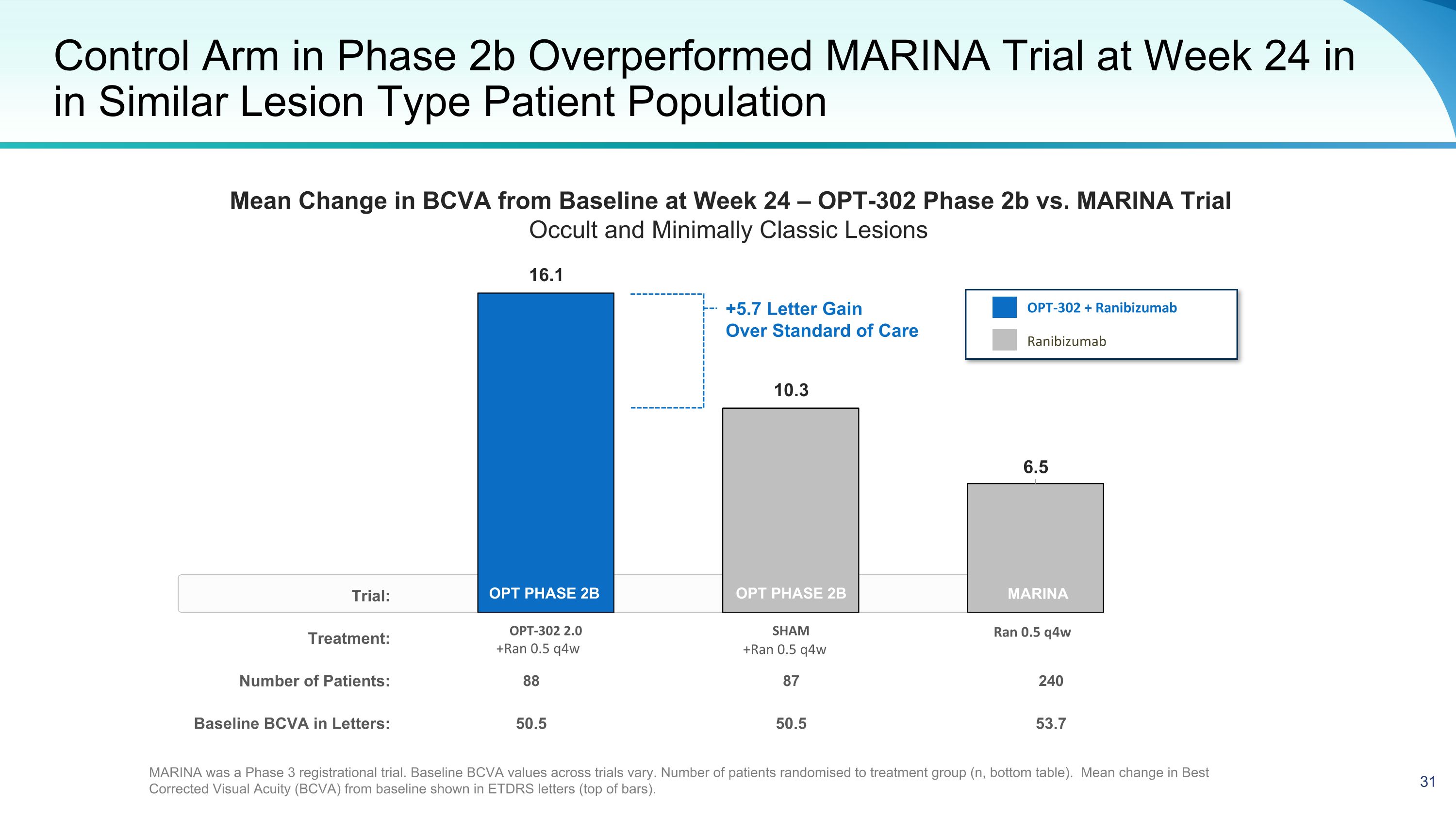

Trial: Treatment: Number of Patients: 88 87 240 Baseline BCVA in Letters: 50.5 50.5 53.7 Control Arm in Phase 2b Overperformed MARINA Trial at Week 24 in in Similar Lesion Type Patient Population OPT PHASE 2B +Ran 0.5 q4w +Ran 0.5 q4w Ran 0.5 q4w OPT-302 + Ranibizumab Ranibizumab OPT PHASE 2B MARINA was a Phase 3 registrational trial. Baseline BCVA values across trials vary. Number of patients randomised to treatment group (n, bottom table). Mean change in Best Corrected Visual Acuity (BCVA) from baseline shown in ETDRS letters (top of bars). +5.7 Letter Gain Over Standard of Care MARINA Mean Change in BCVA from Baseline at Week 24 – OPT-302 Phase 2b vs. MARINA Trial Occult and Minimally Classic Lesions

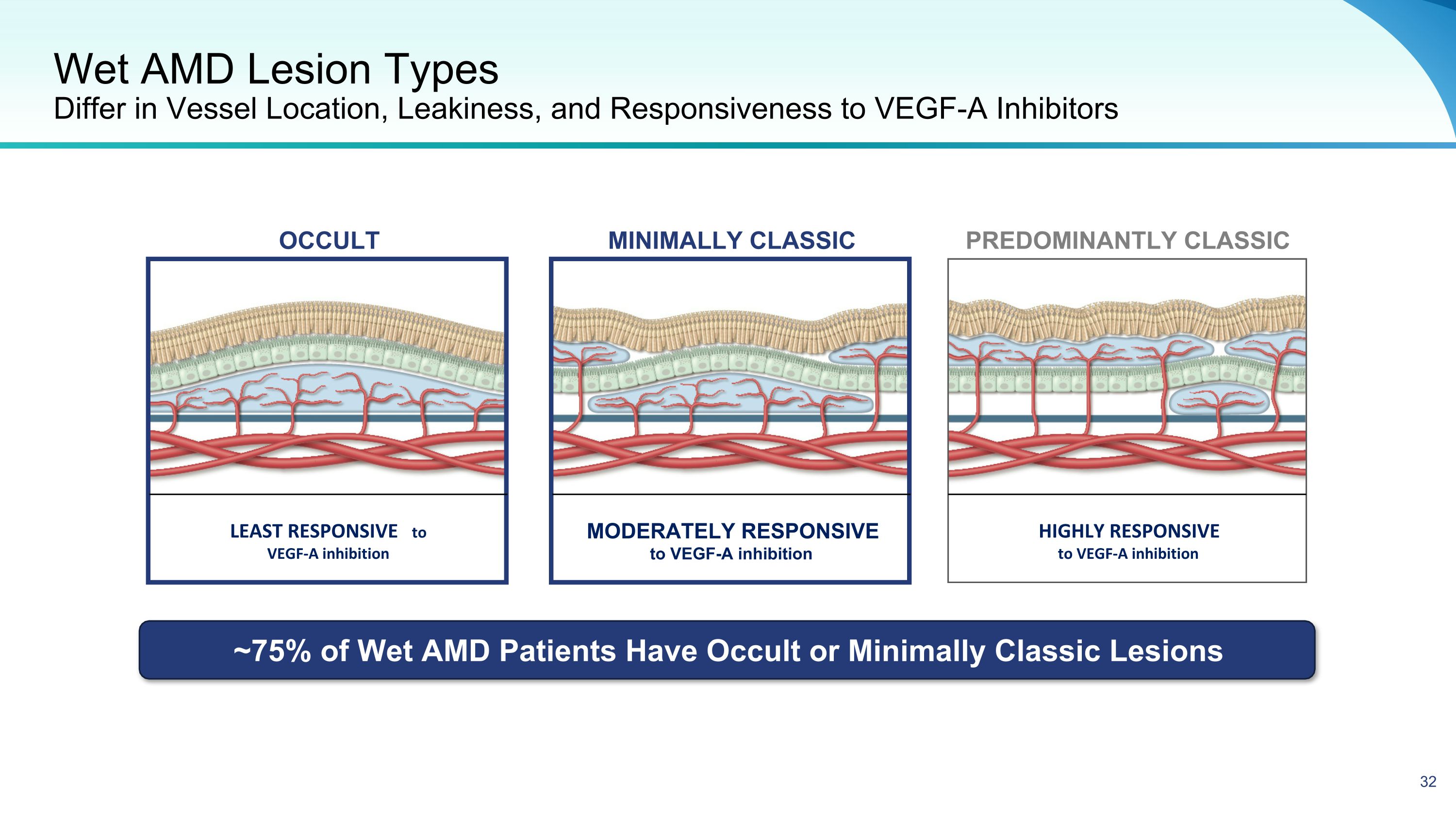

Wet AMD Lesion Types�Differ in Vessel Location, Leakiness, and Responsiveness to VEGF-A Inhibitors LEAST RESPONSIVE to VEGF-A inhibition MODERATELY RESPONSIVE to VEGF-A inhibition HIGHLY RESPONSIVE �to VEGF-A inhibition Predominantly Classic MINIMALLY CLASSIC OCCULT ~75% of Wet AMD Patients Have Occult or Minimally Classic Lesions

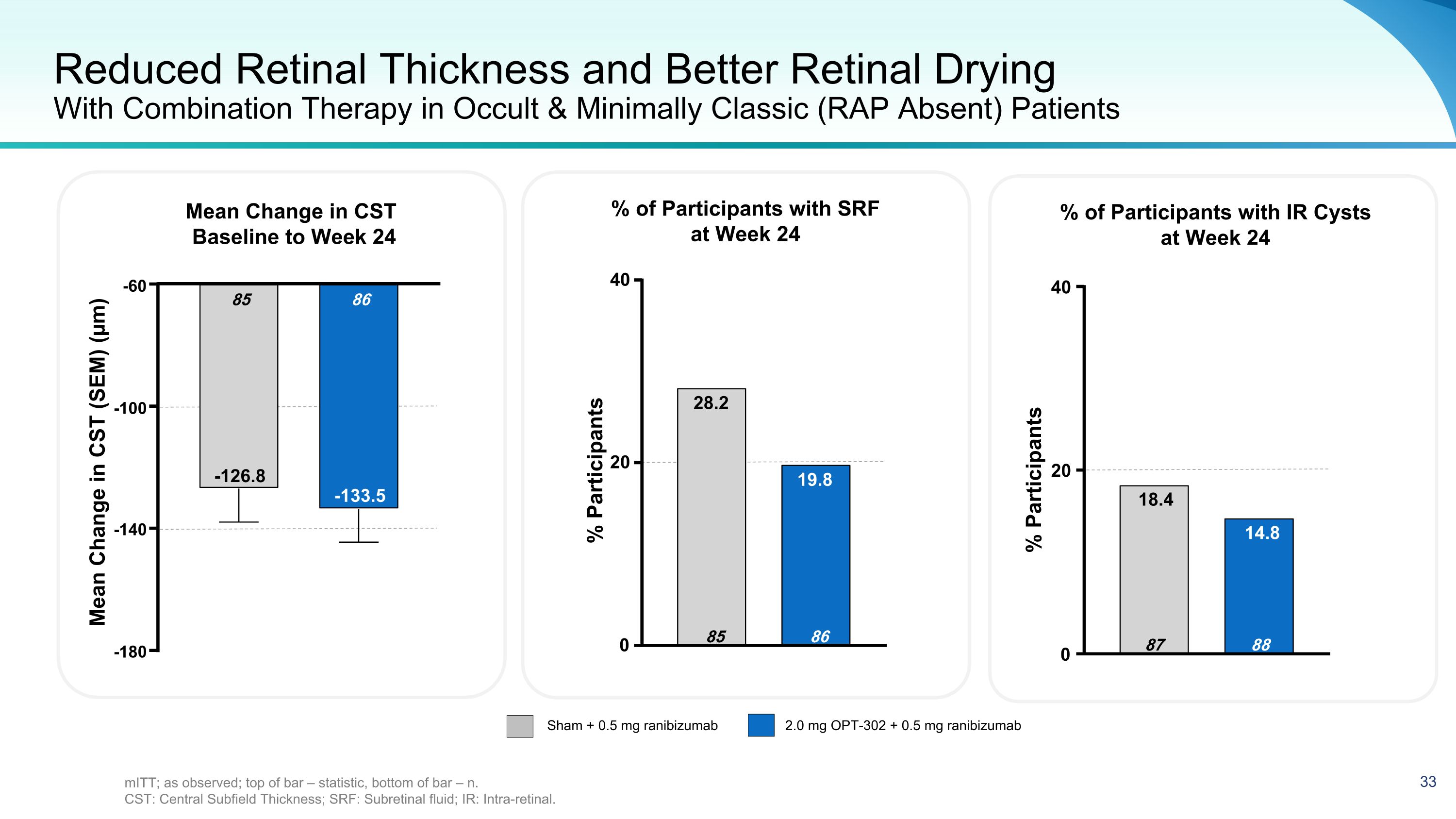

Reduced Retinal Thickness and Better Retinal Drying�With Combination Therapy in Occult & Minimally Classic (RAP Absent) Patients Mean Change in CST Baseline to Week 24 Sham + 0.5 mg ranibizumab 2.0 mg OPT-302 + 0.5 mg ranibizumab % of Participants with IR Cysts at Week 24 % of Participants with SRF at Week 24 % Participants -180 -140 -100 -60 86 -133.5 85 -126.8 Mean Change in CST (SEM) (µm) 0 20 40 88 14.8 87 18.4 0 20 40 86 19.8 85 28.2 % Participants mITT; as observed; top of bar – statistic, bottom of bar – n. CST: Central Subfield Thickness; SRF: Subretinal fluid; IR: Intra-retinal.

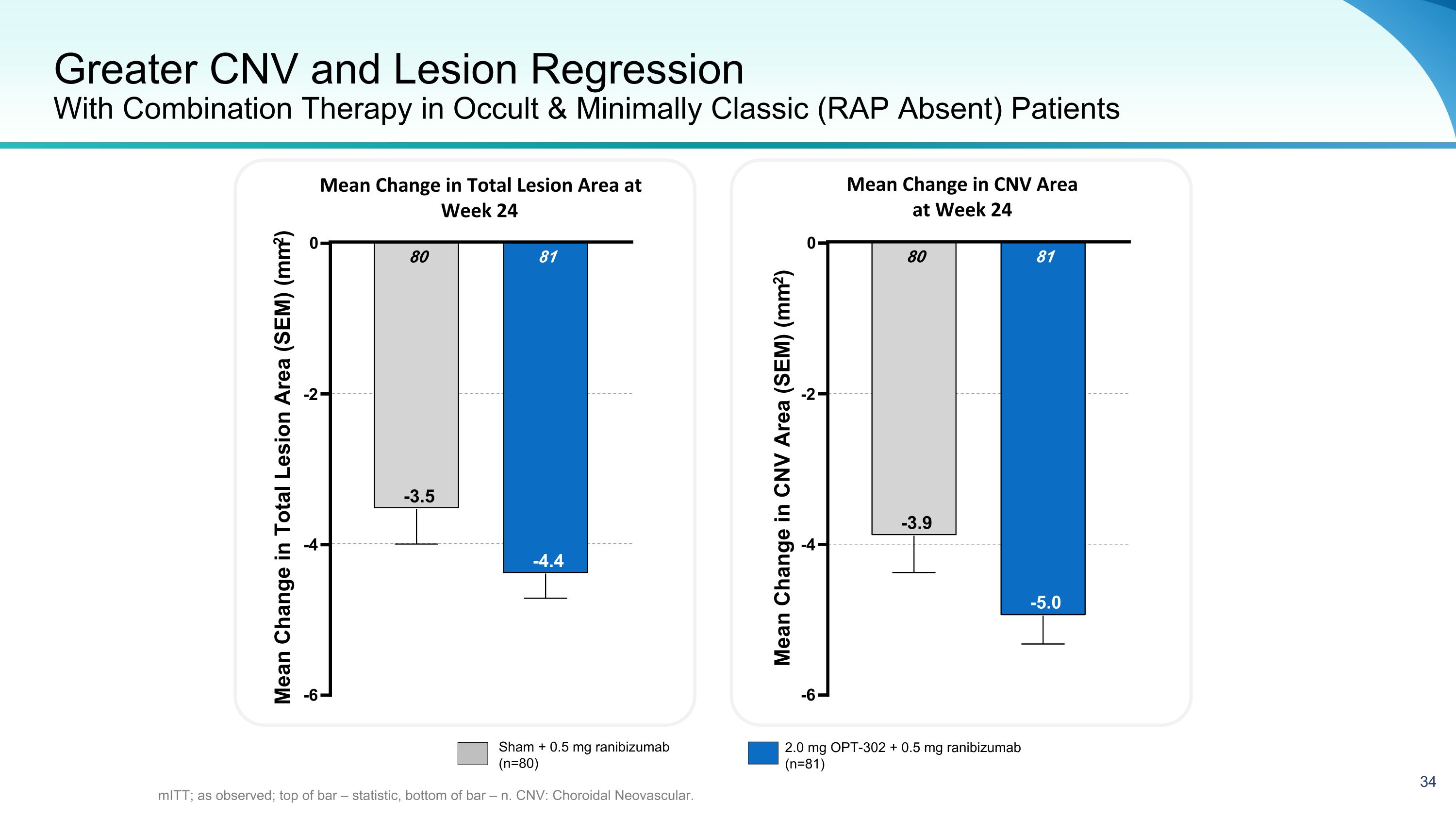

Greater CNV and Lesion Regression�With Combination Therapy in Occult & Minimally Classic (RAP Absent) Patients mITT; as observed; top of bar – statistic, bottom of bar – n. CNV: Choroidal Neovascular. Mean Change in Total Lesion Area at Week 24 Mean Change in CNV Area �at Week 24 -6 -4 -2 0 81 -4.4 80 -3.5 Mean Change in Total Lesion Area (SEM) (mm2) -6 -4 -2 0 81 -5.0 80 -3.9 Mean Change in CNV Area (SEM) (mm2) Sham + 0.5 mg ranibizumab (n=80) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=81)

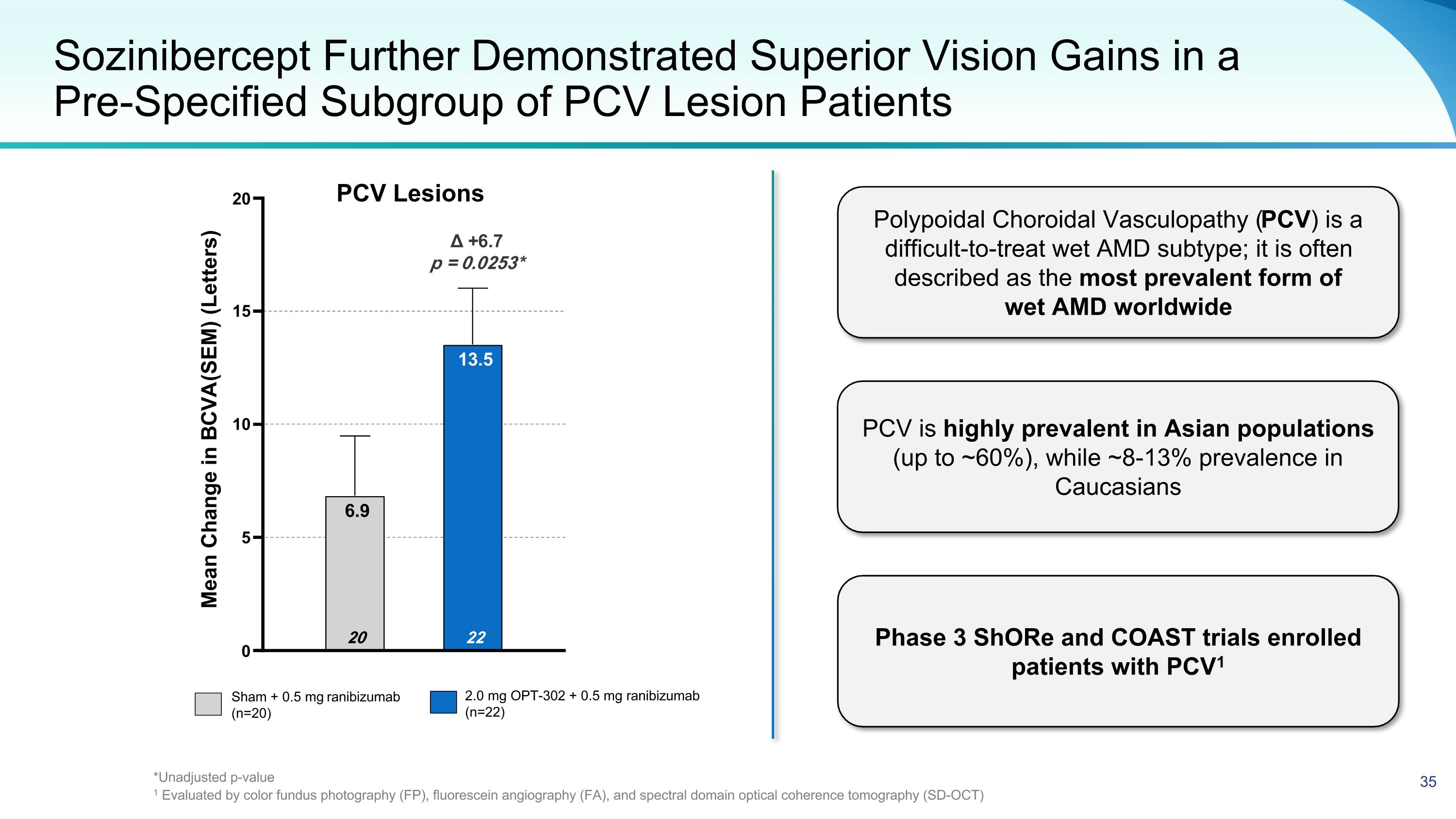

Sozinibercept Further Demonstrated Superior Vision Gains in a �Pre-Specified Subgroup of PCV Lesion Patients Sham + 0.5 mg ranibizumab (n=20) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=22) Δ +6.7 p = 0.0253* 0 5 10 15 20 22 13.5 20 6.9 Mean Change in BCVA (SEM) (Letters) Polypoidal Choroidal Vasculopathy (PCV) is a difficult-to-treat wet AMD subtype; it is often described as the most prevalent form of wet AMD worldwide PCV is highly prevalent in Asian populations (up to ~60%), while ~8-13% prevalence in Caucasians Phase 3 ShORe and COAST trials enrolled patients with PCV1 PCV Lesions *Unadjusted p-value 1 Evaluated by color fundus photography (FP), fluorescein angiography (FA), and spectral domain optical coherence tomography (SD-OCT)

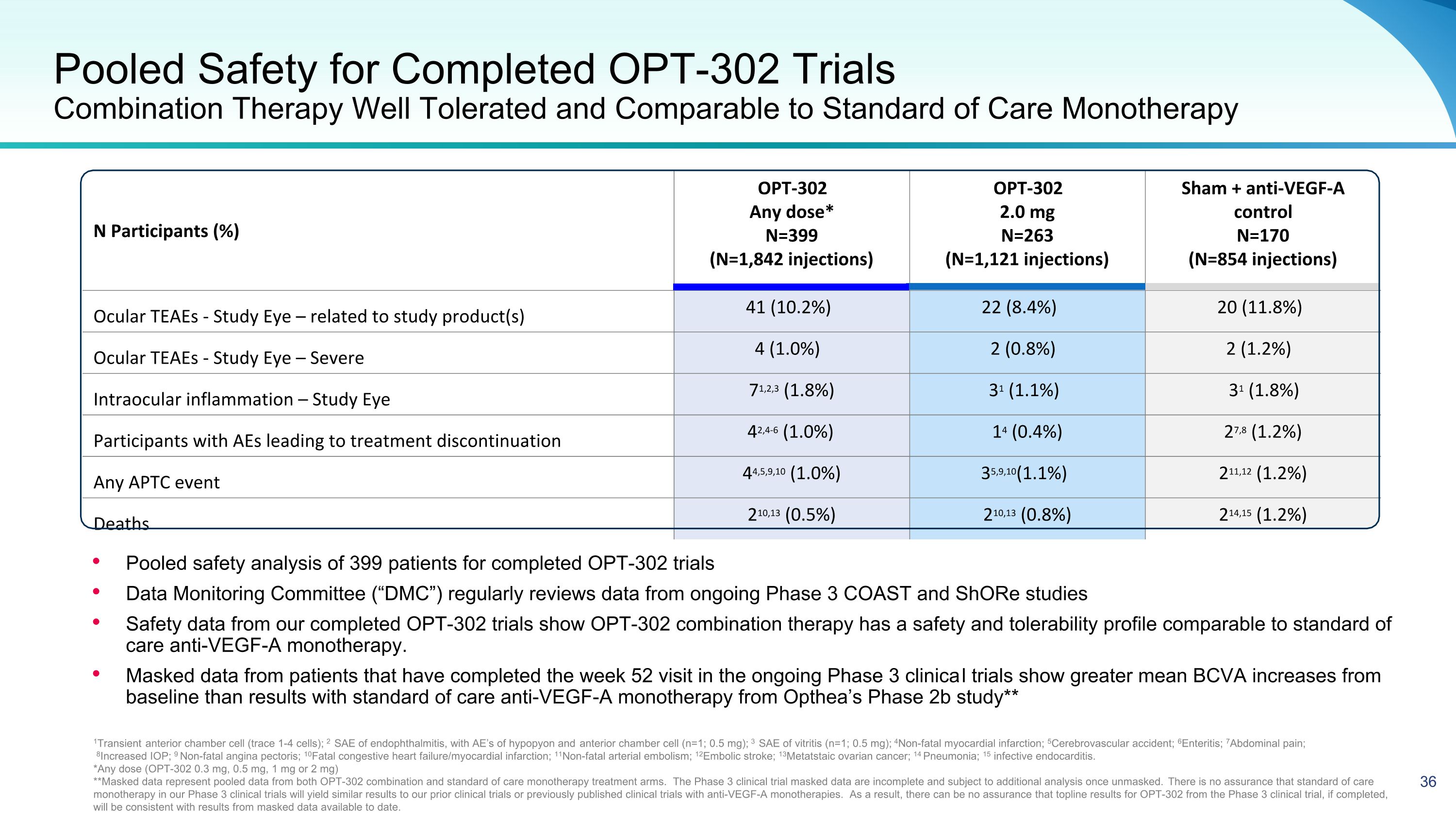

Pooled Safety for Completed OPT-302 Trials�Combination Therapy Well Tolerated and Comparable to Standard of Care Monotherapy N Participants (%) OPT-302 Any dose* N=399 (N=1,842 injections) OPT-302 2.0 mg N=263 (N=1,121 injections) Sham + anti-VEGF-A control N=170 (N=854 injections) Ocular TEAEs - Study Eye – related to study product(s) 41 (10.2%) 22 (8.4%) 20 (11.8%) Ocular TEAEs - Study Eye – Severe 4 (1.0%) 2 (0.8%) 2 (1.2%) Intraocular inflammation – Study Eye 71,2,3 (1.8%) 31 (1.1%) 31 (1.8%) Participants with AEs leading to treatment discontinuation 42,4-6 (1.0%) 14 (0.4%) 27,8 (1.2%) Any APTC event 44,5,9,10 (1.0%) 35,9,10(1.1%) 211,12 (1.2%) Deaths 210,13 (0.5%) 210,13 (0.8%) 214,15 (1.2%) 1Transient anterior chamber cell (trace 1-4 cells); 2 SAE of endophthalmitis, with AE’s of hypopyon and anterior chamber cell (n=1; 0.5 mg); 3 SAE of vitritis (n=1; 0.5 mg); 4Non-fatal myocardial infarction; 5Cerebrovascular accident; 6Enteritis; 7Abdominal pain; 8Increased IOP; 9 Non-fatal angina pectoris; 10Fatal congestive heart failure/myocardial infarction; 11Non-fatal arterial embolism; 12Embolic stroke; 13Metatstaic ovarian cancer; 14 Pneumonia; 15 infective endocarditis. *Any dose (OPT-302 0.3 mg, 0.5 mg, 1 mg or 2 mg) **Masked data represent pooled data from both OPT-302 combination and standard of care monotherapy treatment arms. The Phase 3 clinical trial masked data are incomplete and subject to additional analysis once unmasked. There is no assurance that standard of care monotherapy in our Phase 3 clinical trials will yield similar results to our prior clinical trials or previously published clinical trials with anti-VEGF-A monotherapies. As a result, there can be no assurance that topline results for OPT-302 from the Phase 3 clinical trial, if completed, will be consistent with results from masked data available to date. Pooled safety analysis of 399 patients for completed OPT-302 trials Data Monitoring Committee (“DMC”) regularly reviews data from ongoing Phase 3 COAST and ShORe studies Safety data from our completed OPT-302 trials show OPT-302 combination therapy has a safety and tolerability profile comparable to standard of care anti-VEGF-A monotherapy. Masked data from patients that have completed the week 52 visit in the ongoing Phase 3 clinical trials show greater mean BCVA increases from baseline than results with standard of care anti-VEGF-A monotherapy from Opthea’s Phase 2b study**

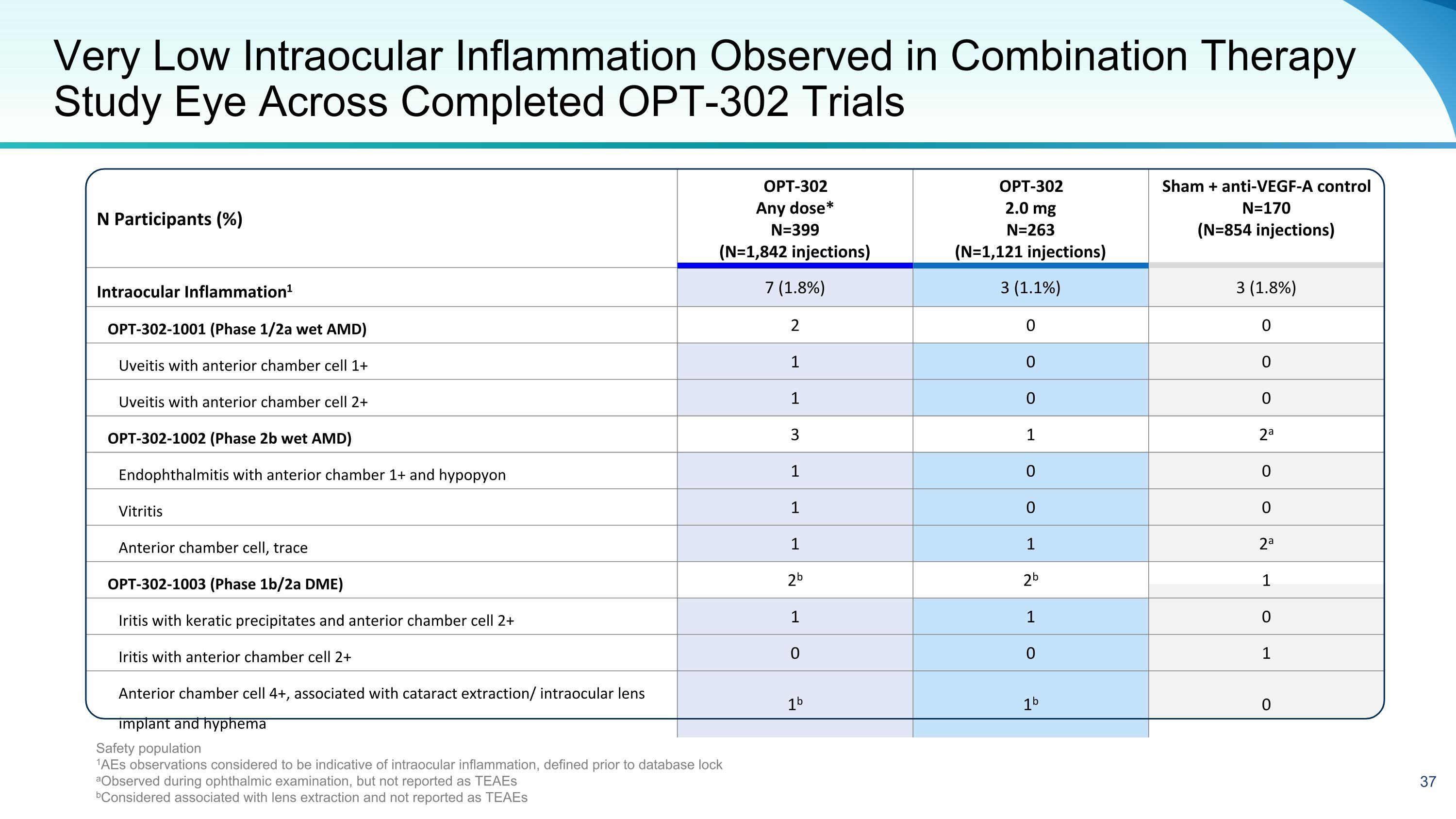

N Participants (%) OPT-302 Any dose* N=399 (N=1,842 injections) OPT-302 2.0 mg N=263 (N=1,121 injections) Sham + anti-VEGF-A control N=170 (N=854 injections) Intraocular Inflammation1 7 (1.8%) 3 (1.1%) 3 (1.8%) OPT-302-1001 (Phase 1/2a wet AMD) 2 0 0 Uveitis with anterior chamber cell 1+ 1 0 0 Uveitis with anterior chamber cell 2+ 1 0 0 OPT-302-1002 (Phase 2b wet AMD) 3 1 2a Endophthalmitis with anterior chamber 1+ and hypopyon 1 0 0 Vitritis 1 0 0 Anterior chamber cell, trace 1 1 2a OPT-302-1003 (Phase 1b/2a DME) 2b 2b 1 Iritis with keratic precipitates and anterior chamber cell 2+ 1 1 0 Iritis with anterior chamber cell 2+ 0 0 1 Anterior chamber cell 4+, associated with cataract extraction/ intraocular lens implant and hyphema 1b 1b 0 Very Low Intraocular Inflammation Observed in Combination Therapy Study Eye Across Completed OPT-302 Trials Safety population 1AEs observations considered to be indicative of intraocular inflammation, defined prior to database lock aObserved during ophthalmic examination, but not reported as TEAEs bConsidered associated with lens extraction and not reported as TEAEs

Phase 3 Clinical Program Is Informed by Phase 2b Results and Optimized for Success Hierarchical primary analysis first conducted in the high-responding occult and minimally classic population (RAP absent), followed by total patient population Two robust pivotal trials studying sozinibercept in combination with Eylea® and Lucentis® in treatment naïve patients with wet AMD Phase 3 designed to support broad label for use in combination with any VEGF-A inhibitor for all wet AMD patients (treatment naïve and prior treated)

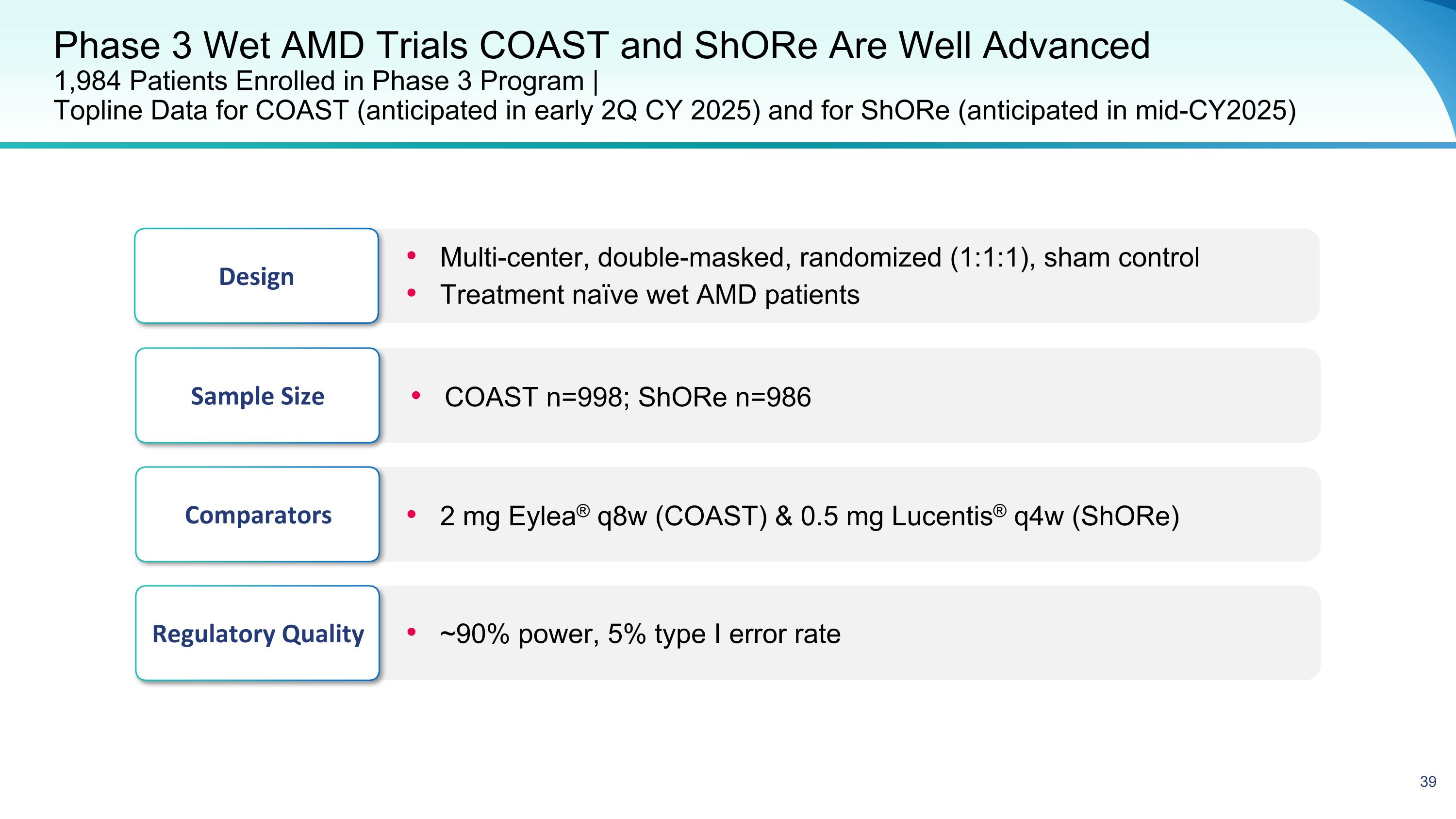

Phase 3 Wet AMD Trials COAST and ShORe Are Well Advanced�1,984 Patients Enrolled in Phase 3 Program | �Topline Data for COAST (anticipated in early 2Q CY 2025) and for ShORe (anticipated in mid-CY2025) Design Multi-center, double-masked, randomized (1:1:1), sham control Treatment naïve wet AMD patients Regulatory Quality ~90% power, 5% type I error rate Sample Size COAST n=998; ShORe n=986 Comparators 2 mg Eylea® q8w (COAST) & 0.5 mg Lucentis® q4w (ShORe)

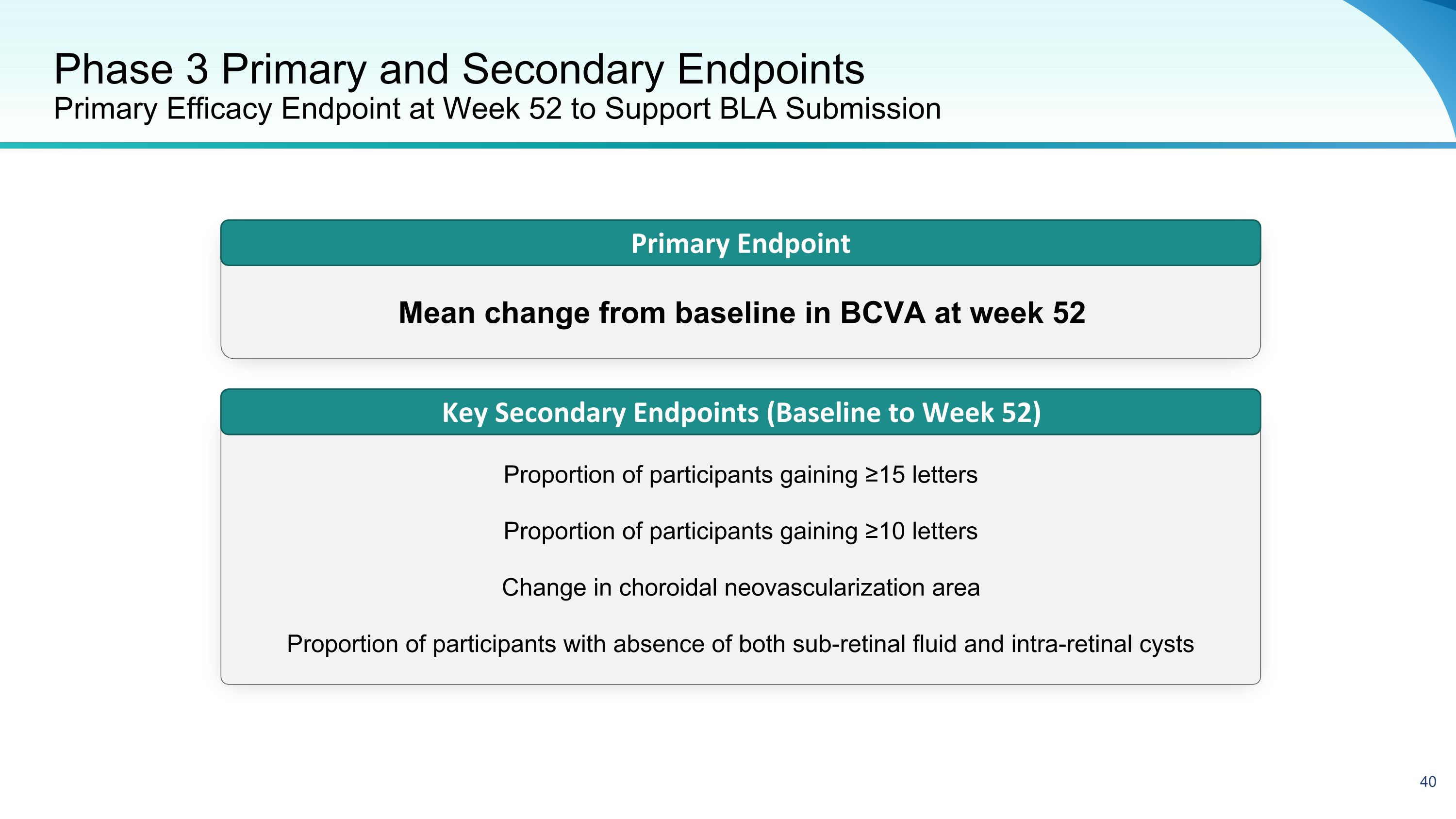

Phase 3 Primary and Secondary Endpoints�Primary Efficacy Endpoint at Week 52 to Support BLA Submission Primary Endpoint Key Secondary Endpoints (Baseline to Week 52) Mean change from baseline in BCVA at week 52 Proportion of participants gaining ≥15 letters Proportion of participants gaining ≥10 letters Change in choroidal neovascularization area Proportion of participants with absence of both sub-retinal fluid and intra-retinal cysts

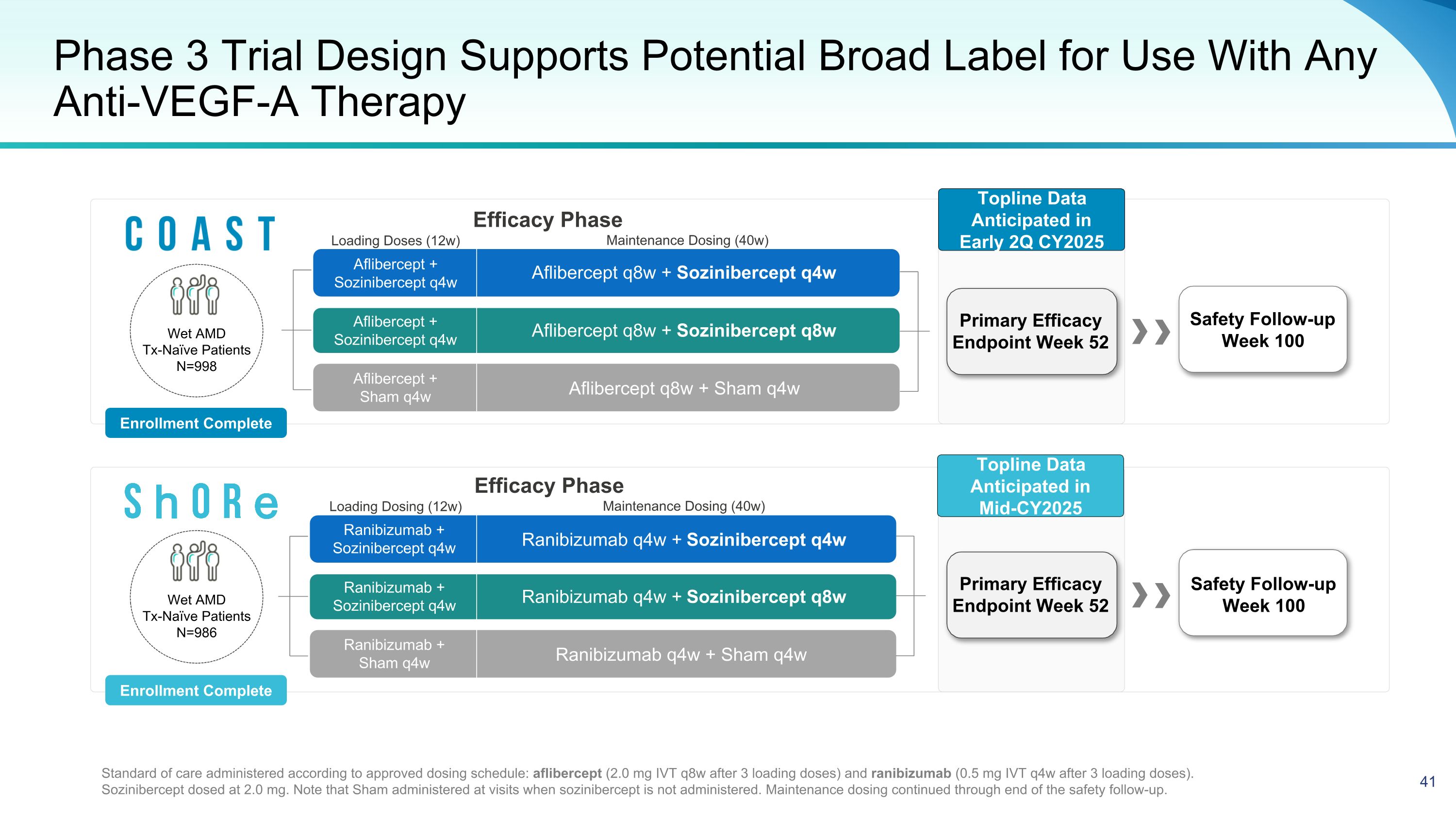

Phase 3 Trial Design Supports Potential Broad Label for Use With Any Anti-VEGF-A Therapy Ranibizumab q4w + Sozinibercept q4w Ranibizumab q4w + Sham q4w Ranibizumab q4w + Sozinibercept q8w Aflibercept q8w + Sozinibercept q4w Aflibercept q8w + Sham q4w Aflibercept q8w + Sozinibercept q8w Safety Follow-up Week 100 Standard of care administered according to approved dosing schedule: aflibercept (2.0 mg IVT q8w after 3 loading doses) and ranibizumab (0.5 mg IVT q4w after 3 loading doses). Sozinibercept dosed at 2.0 mg. Note that Sham administered at visits when sozinibercept is not administered. Maintenance dosing continued through end of the safety follow-up. Safety Follow-up Week 100 Aflibercept + Sozinibercept q4w Aflibercept + Sozinibercept q4w Aflibercept + Sham q4w Ranibizumab + Sozinibercept q4w Ranibizumab + Sozinibercept q4w Ranibizumab + Sham q4w Wet AMD Tx-Naïve Patients N=986 Enrollment Complete Enrollment Complete Maintenance Dosing (40w) Loading Dosing (12w) Efficacy Phase Maintenance Dosing (40w) Loading Doses (12w) Efficacy Phase Wet AMD Tx-Naïve Patients N=998 Topline Data Anticipated in Early 2Q CY2025 Primary Efficacy Endpoint Week 52 Primary Efficacy Endpoint Week 52 Topline Data Anticipated in Mid-CY2025

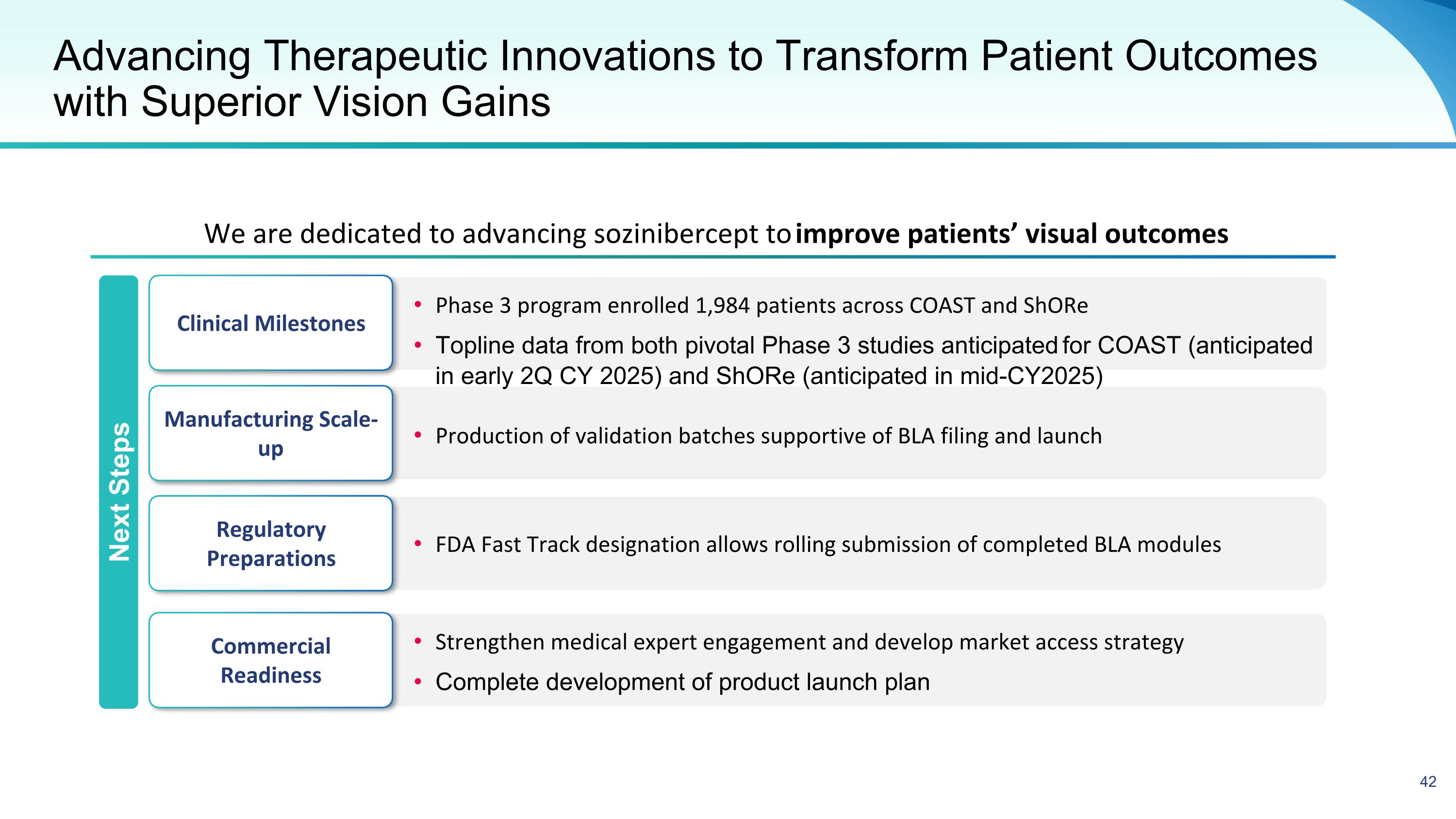

Advancing Therapeutic Innovations to Transform Patient Outcomes with Superior Vision Gains We are dedicated to advancing sozinibercept to improve patients’ visual outcomes Clinical Milestones Manufacturing Scale-up Regulatory Preparations Commercial Readiness Phase 3 program enrolled 1,984 patients across COAST and ShORe Topline data from both pivotal Phase 3 studies anticipated for COAST (anticipated in early 2Q CY 2025) and ShORe (anticipated in mid-CY2025) FDA Fast Track designation allows rolling submission of completed BLA modules Production of validation batches supportive of BLA filing and launch Strengthen medical expert engagement and develop market access strategy Complete development of product launch plan Next Steps

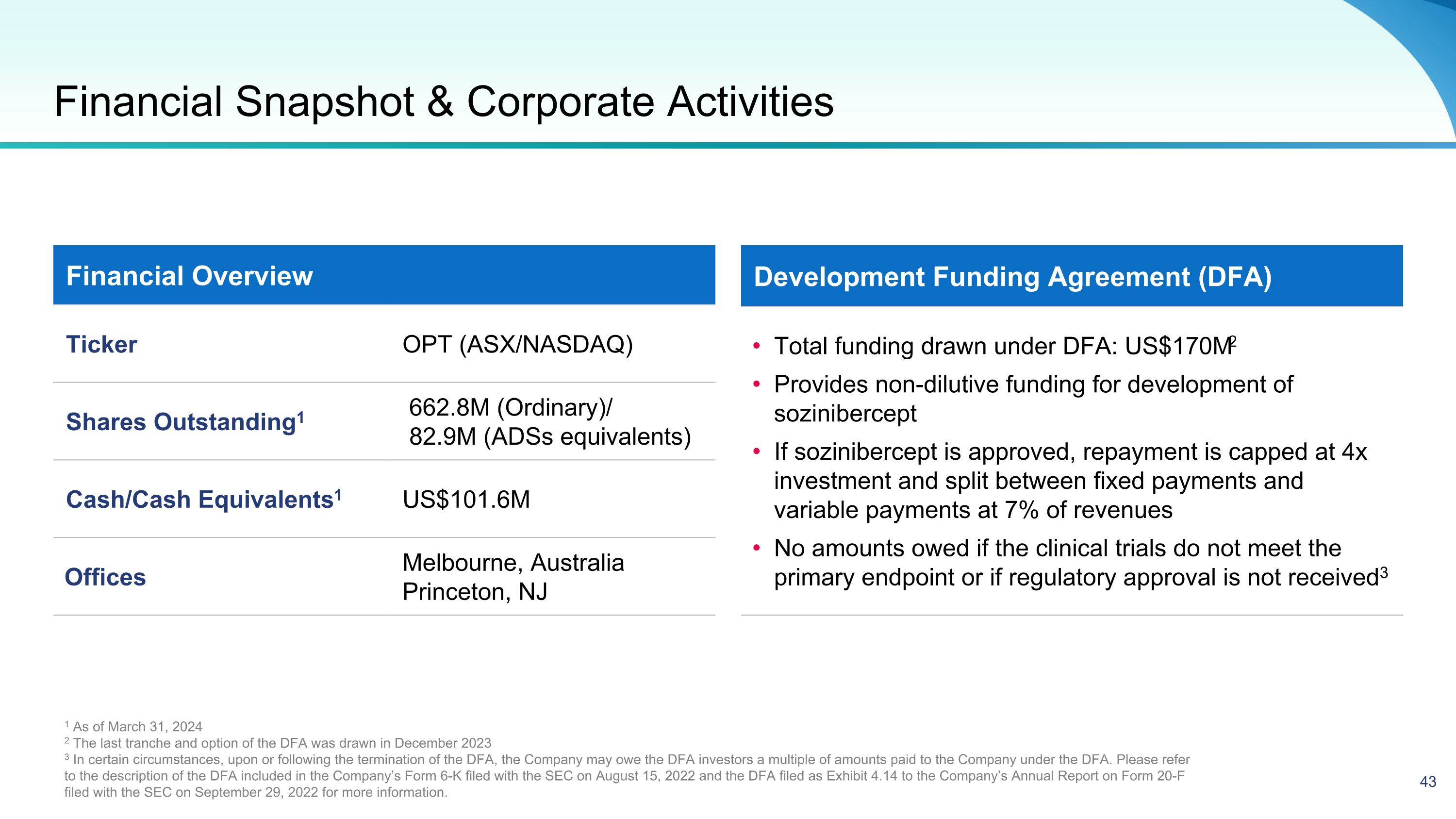

Financial Snapshot & Corporate Activities Financial Overview Ticker OPT (ASX/NASDAQ) Shares Outstanding1 662.8M (Ordinary)/ 82.9M (ADSs equivalents) Cash/Cash Equivalents1 US$101.6M Offices Melbourne, Australia Princeton, NJ Development Funding Agreement (DFA) Total funding drawn under DFA: US$170M2 Provides non-dilutive funding for development of sozinibercept If sozinibercept is approved, repayment is capped at 4x investment and split between fixed payments and variable payments at 7% of revenues No amounts owed if the clinical trials do not meet the primary endpoint or if regulatory approval is not received3 1 As of March 31, 2024 2 The last tranche and option of the DFA was drawn in December 2023 3 In certain circumstances, upon or following the termination of the DFA, the Company may owe the DFA investors a multiple of amounts paid to the Company under the DFA. Please refer to the description of the DFA included in the Company’s Form 6-K filed with the SEC on August 15, 2022 and the DFA filed as Exhibit 4.14 to the Company’s Annual Report on Form 20-F filed with the SEC on September 29, 2022 for more information.

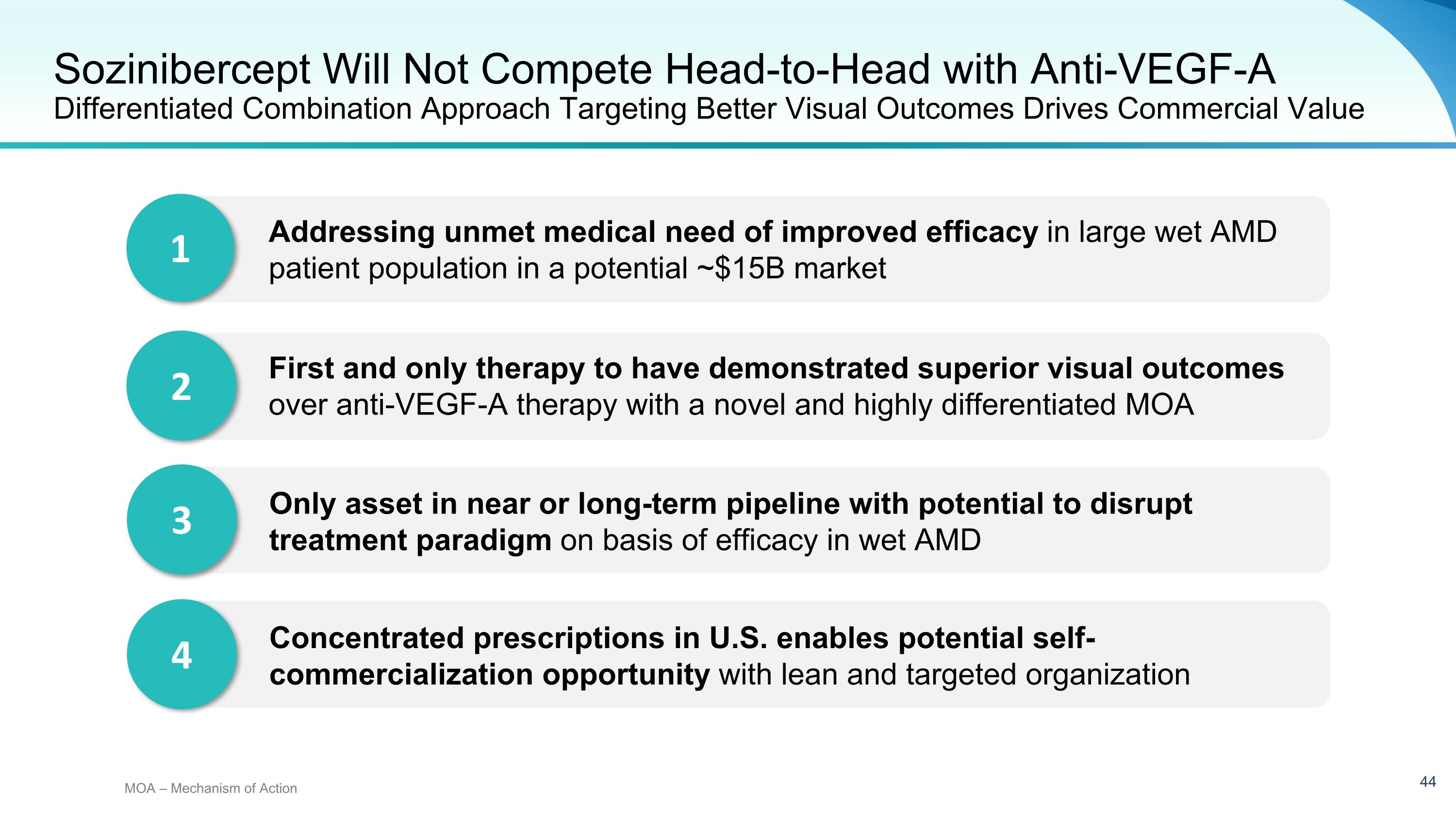

Addressing unmet medical need of improved efficacy in large wet AMD patient population in a potential ~$15B market 1 Sozinibercept Will Not Compete Head-to-Head with Anti-VEGF-A�Differentiated Combination Approach Targeting Better Visual Outcomes Drives Commercial Value First and only therapy to have demonstrated superior visual outcomes over anti-VEGF-A therapy with a novel and highly differentiated MOA Only asset in near or long-term pipeline with potential to disrupt treatment paradigm on basis of efficacy in wet AMD Concentrated prescriptions in U.S. enables potential self-commercialization opportunity with lean and targeted organization 2 3 4 MOA – Mechanism of Action

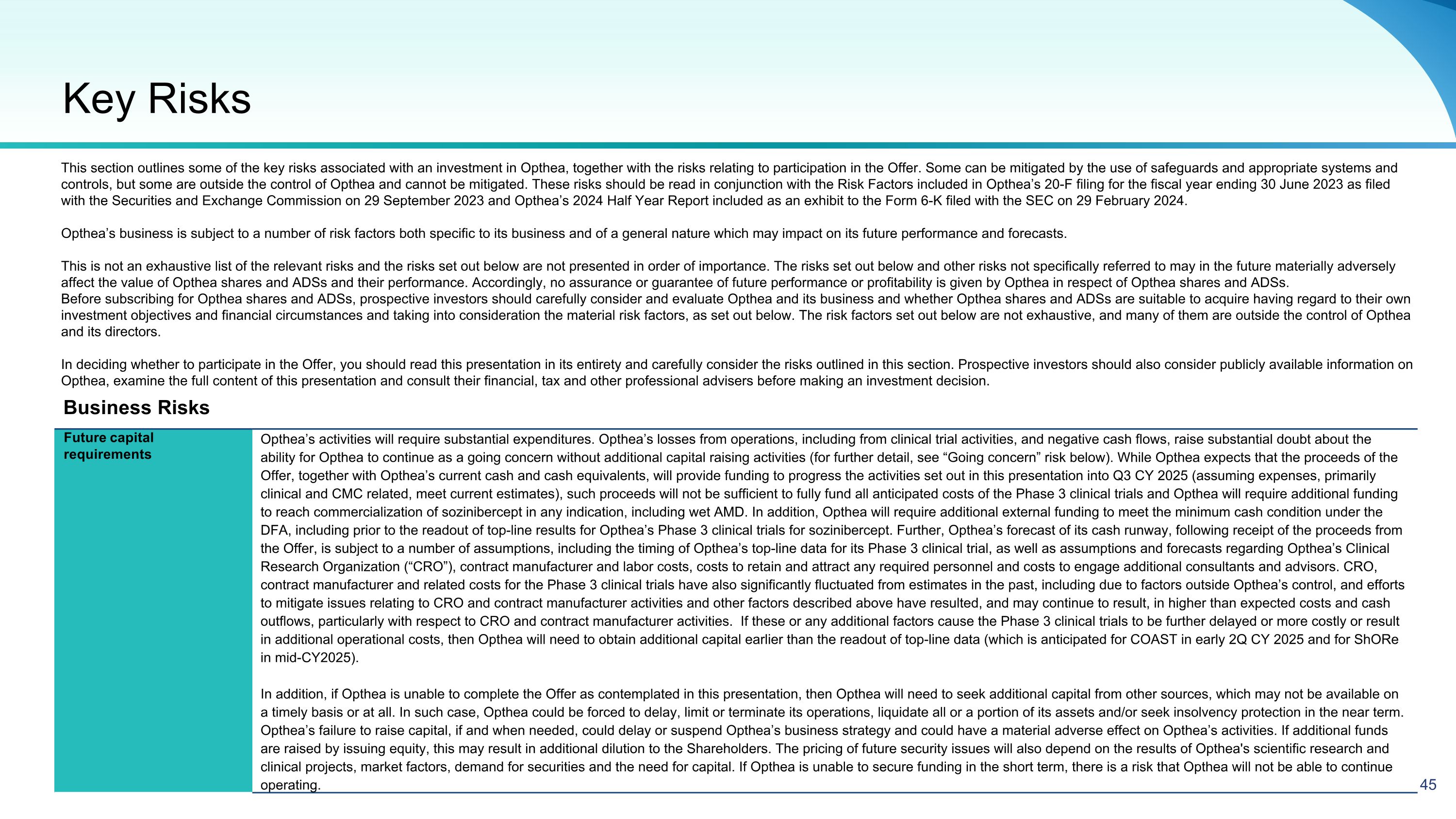

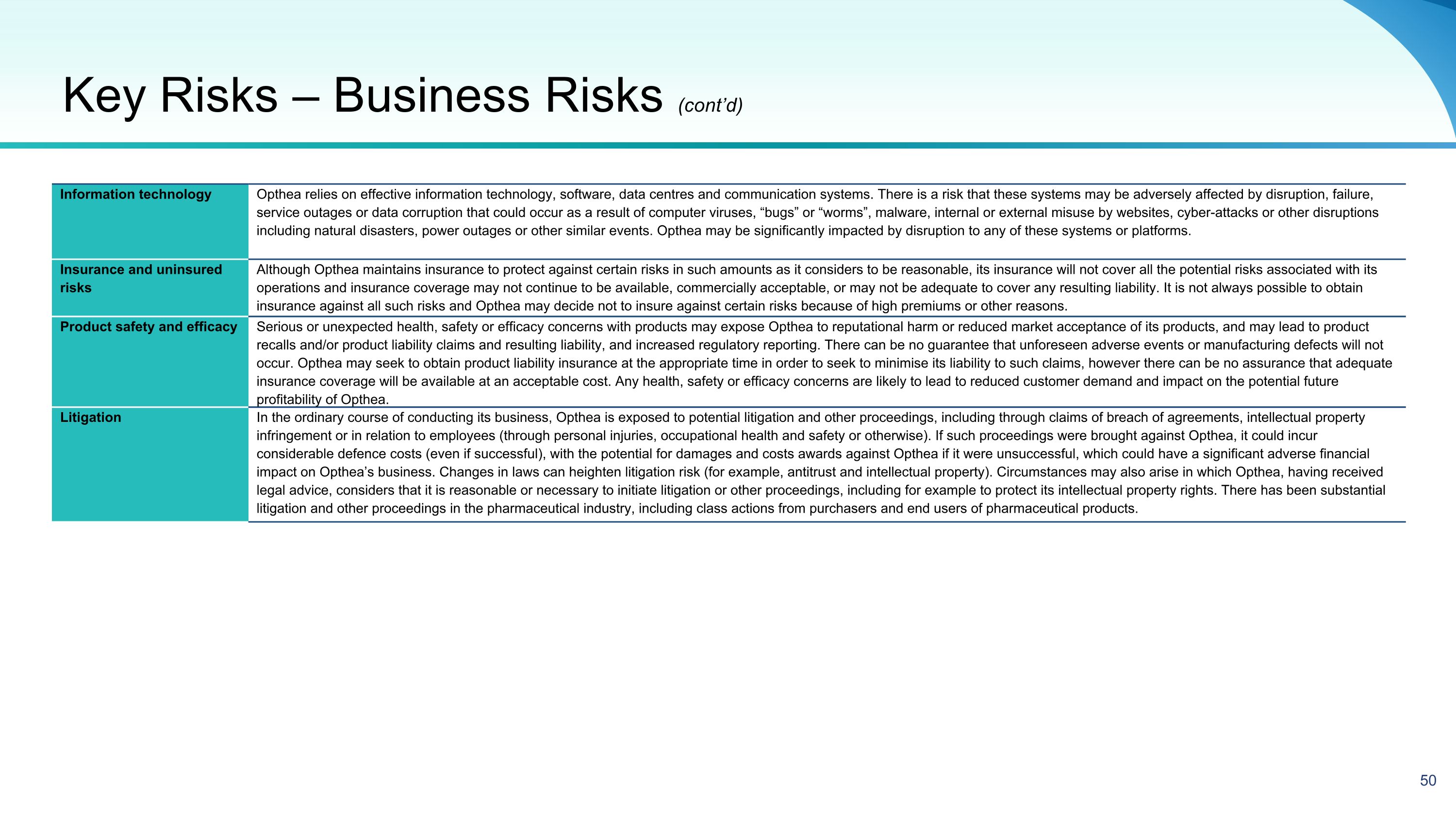

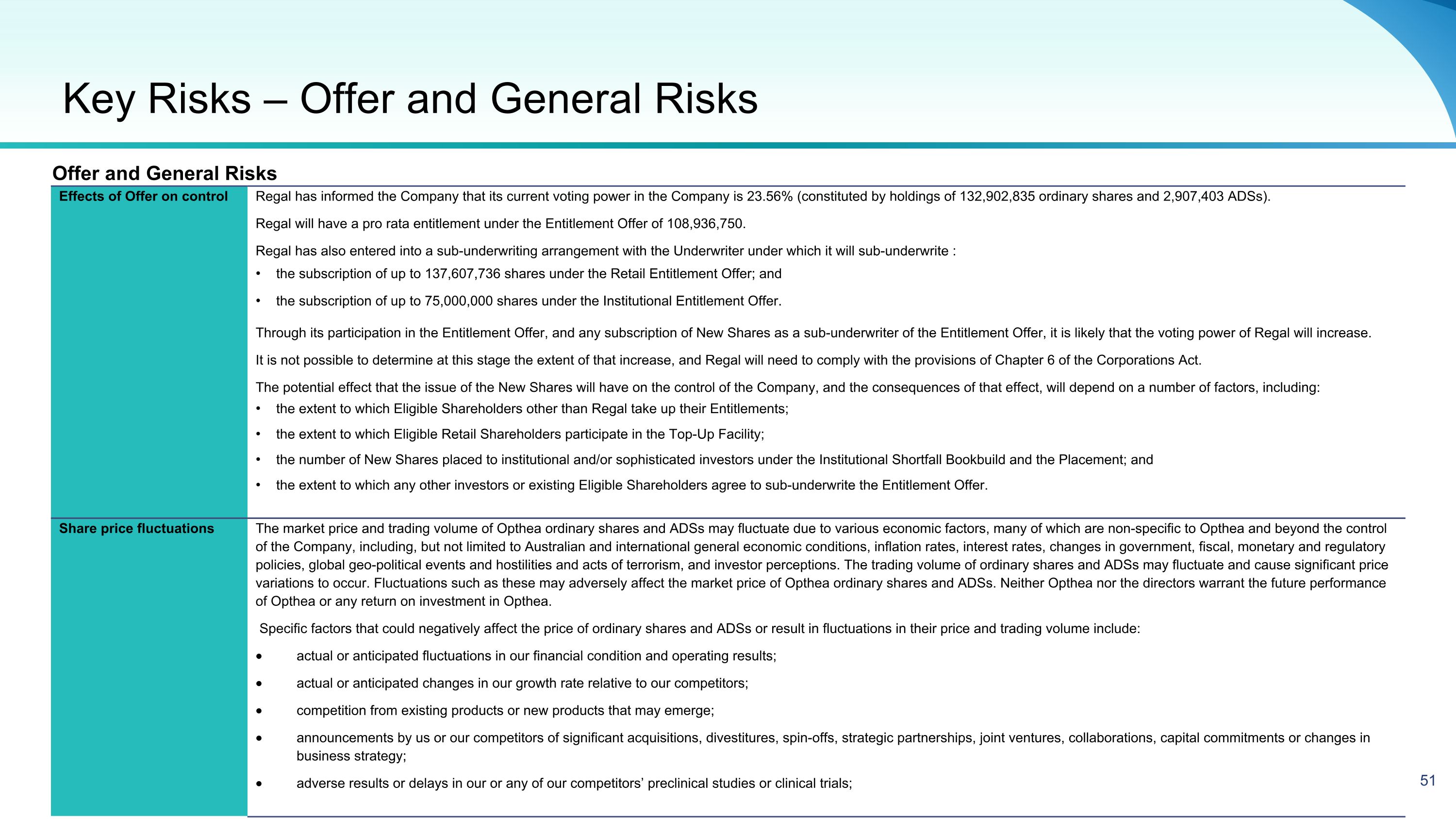

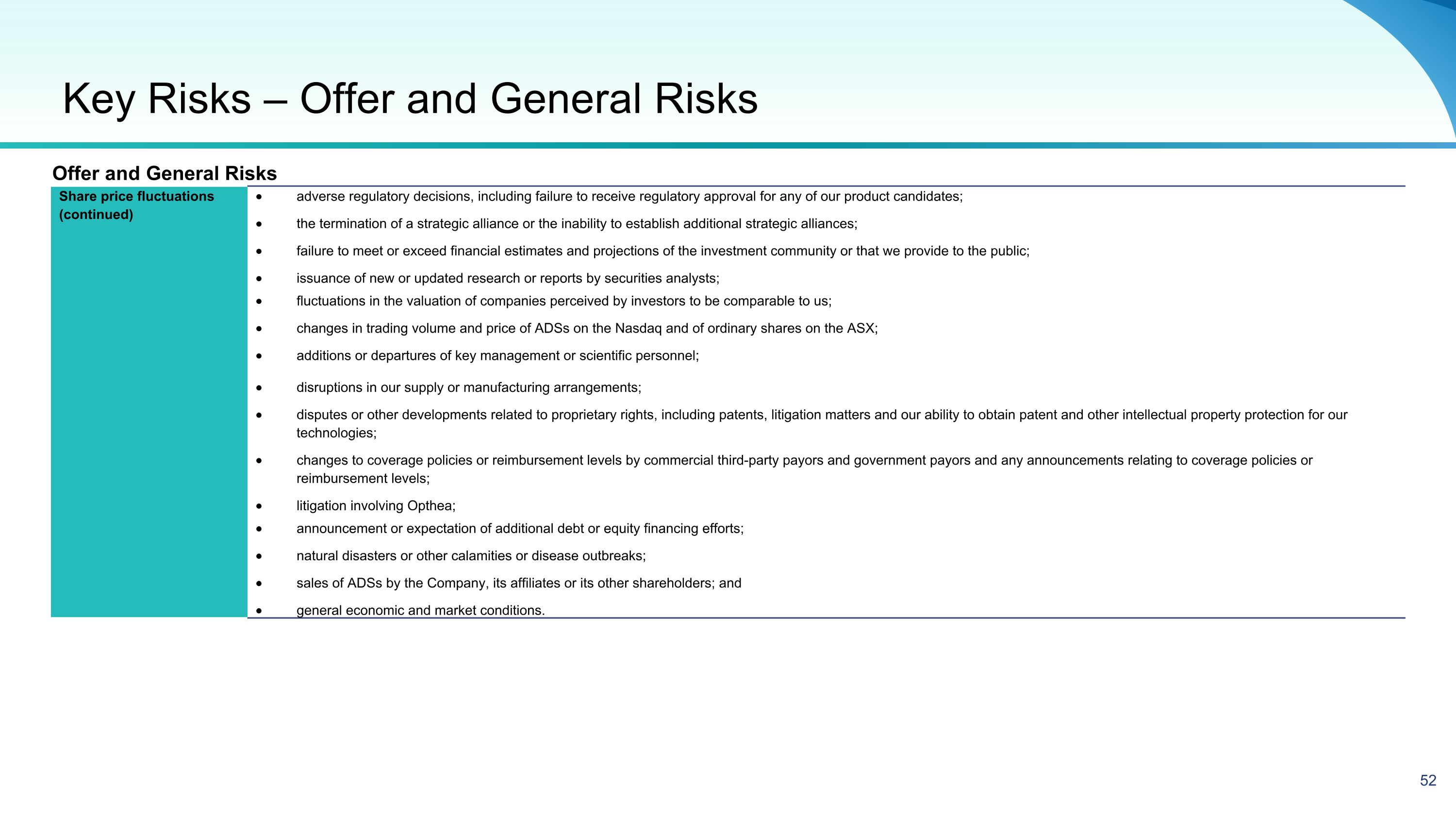

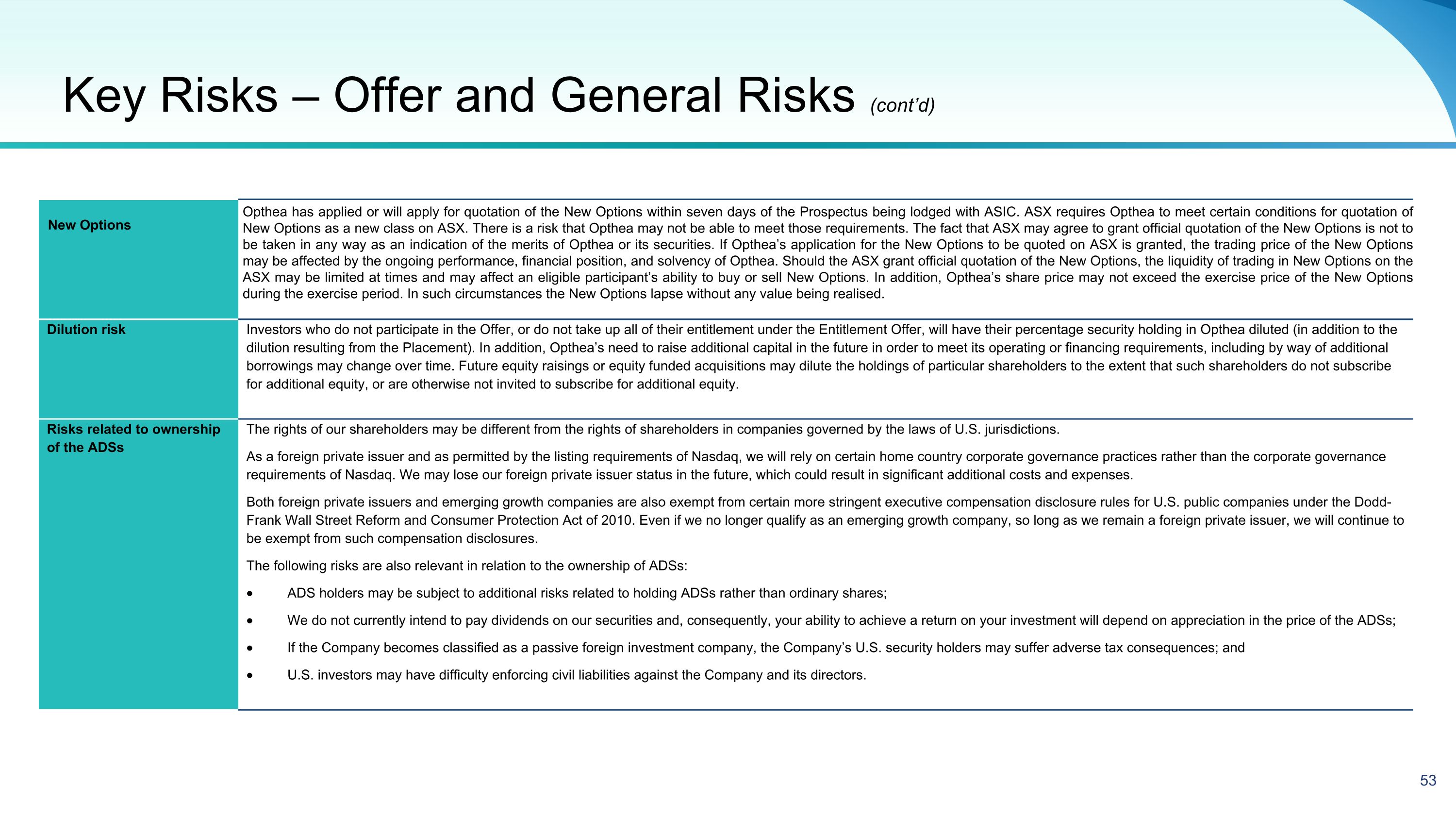

Key Risks 48 Future capital requirements Opthea’s activities will require substantial expenditures. Opthea’s losses from operations, including from clinical trial activities, and negative cash flows, raise substantial doubt about the ability for Opthea to continue as a going concern without additional capital raising activities (for further detail, see “Going concern” risk below). While Opthea expects that the proceeds of the Offer, together with Opthea’s current cash and cash equivalents, will provide funding to progress the activities set out in this presentation into Q3 CY 2025 (assuming expenses, primarily clinical and CMC related, meet current estimates), such proceeds will not be sufficient to fully fund all anticipated costs of the Phase 3 clinical trials and Opthea will require additional funding to reach commercialization of sozinibercept in any indication, including wet AMD. In addition, Opthea will require additional external funding to meet the minimum cash condition under the DFA, including prior to the readout of top-line results for Opthea’s Phase 3 clinical trials for sozinibercept. Further, Opthea’s forecast of its cash runway, following receipt of the proceeds from the Offer, is subject to a number of assumptions, including the timing of Opthea’s top-line data for its Phase 3 clinical trial, as well as assumptions and forecasts regarding Opthea’s Clinical Research Organization (“CRO”), contract manufacturer and labor costs, costs to retain and attract any required personnel and costs to engage additional consultants and advisors. CRO, contract manufacturer and related costs for the Phase 3 clinical trials have also significantly fluctuated from estimates in the past, including due to factors outside Opthea’s control, and efforts to mitigate issues relating to CRO and contract manufacturer activities and other factors described above have resulted, and may continue to result, in higher than expected costs and cash outflows, particularly with respect to CRO and contract manufacturer activities. If these or any additional factors cause the Phase 3 clinical trials to be further delayed or more costly or result in additional operational costs, then Opthea will need to obtain additional capital earlier than the readout of top-line data (which is anticipated for COAST in early 2Q CY 2025 and for ShORe in mid-CY2025). In addition, if Opthea is unable to complete the Offer as contemplated in this presentation, then Opthea will need to seek additional capital from other sources, which may not be available on a timely basis or at all. In such case, Opthea could be forced to delay, limit or terminate its operations, liquidate all or a portion of its assets and/or seek insolvency protection in the near term. Opthea’s failure to raise capital, if and when needed, could delay or suspend Opthea’s business strategy and could have a material adverse effect on Opthea’s activities. If additional funds are raised by issuing equity, this may result in additional dilution to the Shareholders. The pricing of future security issues will also depend on the results of Opthea's scientific research and clinical projects, market factors, demand for securities and the need for capital. If Opthea is unable to secure funding in the short term, there is a risk that Opthea will not be able to continue operating. This section outlines some of the key risks associated with an investment in Opthea, together with the risks relating to participation in the Offer. Some can be mitigated by the use of safeguards and appropriate systems and controls, but some are outside the control of Opthea and cannot be mitigated. These risks should be read in conjunction with the Risk Factors included in Opthea’s 20-F filing for the fiscal year ending 30 June 2023 as filed with the Securities and Exchange Commission on 29 September 2023 and Opthea’s 2024 Half Year Report included as an exhibit to the Form 6-K filed with the SEC on 29 February 2024. Opthea’s business is subject to a number of risk factors both specific to its business and of a general nature which may impact on its future performance and forecasts. This is not an exhaustive list of the relevant risks and the risks set out below are not presented in order of importance. The risks set out below and other risks not specifically referred to may in the future materially adversely affect the value of Opthea shares and ADSs and their performance. Accordingly, no assurance or guarantee of future performance or profitability is given by Opthea in respect of Opthea shares and ADSs. Before subscribing for Opthea shares and ADSs, prospective investors should carefully consider and evaluate Opthea and its business and whether Opthea shares and ADSs are suitable to acquire having regard to their own investment objectives and financial circumstances and taking into consideration the material risk factors, as set out below. The risk factors set out below are not exhaustive, and many of them are outside the control of Opthea and its directors. In deciding whether to participate in the Offer, you should read this presentation in its entirety and carefully consider the risks outlined in this section. Prospective investors should also consider publicly available information on Opthea, examine the full content of this presentation and consult their financial, tax and other professional advisers before making an investment decision. Business Risks

Going concern For the half year ended 31 December 2023, Opthea incurred a loss after income tax of US$ 96.2 million and had net cash outflows from operating activities of $69.4 million. At 31 December 2023, Opthea had cash and cash equivalents of US$157.1 million and was in a net liability position of US$46.9 million. At 31 March 2024, Opthea had cash and cash equivalents of US$101.6 million. As Opthea is still in the research and development phase, its ability to continue its development activities as a going concern is dependent upon its ability to raise sufficient capital. Opthea does not have any other committed external sources of funds and expects to fund future cash needs through this Offer, additional capital raising activities or collaborations within the US and Australian markets to leverage greater market exposure and to commercialize sozinibercept. Opthea will need to raise additional funds or reduce expenditures to continue as a Going concern. Based on that, a material uncertainty exists which may cast significant doubt as to whether Opthea will continue as a going concern. If Opthea is unable to continue as a going concern Opthea’s investors may suffer a total loss of their investment. Underwriting risk Opthea has entered into an underwriting agreement with MST Financial Services Pty Ltd (“Underwriter”). The Underwriter has agreed to act as placement agent in relation to the Placement, lead manager and bookrunner in relation to the Entitlement Offer and underwriter in relation to a portion of the Entitlement Offer, subject to certain terms and conditions. Details of the fees payable to the Underwriter are included in the Appendix 3B released to ASX on the date of this presentation. If certain customary conditions are not satisfied or certain customary termination events occur, then the Underwriter may terminate the underwriting agreement. Termination of the underwriting agreement will also effectively terminate any subunderwriting arrangements then in place between the underwriter and any subunderwriters. A summary of the underwriting agreement including events which may trigger termination of the underwriting agreement is set out in “Summary of underwriting agreement” below. If the underwriting agreement is terminated by the Underwriter, Opthea would need to find alternative financing to meet its future funding requirements. There is no guarantee that alternative funding could be sourced, either at all or on satisfactory terms and conditions. See also the ‘Future capital requirements’ disclosure above. Termination of the underwriting agreement could materially adversely affect Opthea’s business, cash flow, financial condition and results of operations. It should also be noted that the Entitlement Offer is only partially underwritten and the Placement is not underwritten. Accordingly, the amount that will be raised under the Offer is uncertain and as such could be insufficient to fund all anticipated costs of the Phase 3 clinical trials to top-line data (anticipated for COAST in early 2Q CY 2025 and for ShORe in mid-CY2025). See “Future capital requirements” risk noted above. Development Funding Agreement The DFA, which amounts to US$170 million (see below for further details), contains several terms that require compliance by the company in conduct of the study including the governance by a Joint Steering Committee (“JSC”) for changes in the original protocols, study design or timelines. Certain modifications require JSC approval and it will be difficult for the company to make modifications on their own. The DFA also contains terms that require Opthea to maintain a minimum cash and cash equivalents balance of US$60 million, or the Minimum Amount, and to provide notice to Ocelot (the SPV established by Carlyle and Abingworth for the purposes of providing funding to Opthea) and the co-investor of Carlyle and Abingworth if Opthea’s cash and cash equivalents balance drops below US$50 million. Following such notice Opthea needs to use its best efforts to commence a public offering or private placement to make up the shortfall of the Minimum Amount and if Opthea is unable to consummate such financing each investor has the right, but not the obligation to increase funding under the DFA to make up for such shortfall. The termination provisions in the DFA on the part of Ocelot and the co-investor are extensive and give Ocelot and the co-investor a wide range of conditions to terminate the agreement. In the event of termination, unless mutual or for breach by Ocelot or the co-investor, amounts owed by Opthea will be multiples of the invested capital to date. As of 31 December 2023, Ocelot has invested US$120 million, and the co-investor has invested US$50 million. Key Risks – Business Risks (cont’d)

Access to capital The Opthea business model requires ongoing re-investment into clinical trials with no revenues currently contracted. As such, Opthea will continue to rely upon cash, raised through equity or debt, on acceptable terms, to fund the business as an on-going concern, including in respect of its Phase 3 clinical trials. However, the DFA limits the type of financing Opthea may pursue in the future and Opthea may be unable to raise additional funds or enter into such other agreements or arrangements when needed on favourable terms, or at all. Any unforeseen events which restrict the ability of Opthea to access capital is likely to affect Opthea’s ability to continue operating. Clinical development Clinical trials are inherently risky, and may prove unsuccessful or non-efficacious, impracticable or costly, which may impact profitability and commercial potential. Operating our clinical trials can be impacted by in part by supply chain issues, global and regional inflation, national and local recessions, hiring qualified staff at sites, Opthea’s CRO and distribution locations, local regulatory approvals, importation and custom requirements and administrative delays. Failure, or negative or inconclusive results, missing data or data quality issues, can occur at many stages in development, and the results of earlier clinical trials are not necessarily predictive of future results and data from clinical trials to date may not be indicative of results obtained when these trials are completed or in later - stage trials. A clinical trial may fail to meet its primary or secondary endpoints and as a result inhibit product development, prevent regulatory requirements being met for marketing approval and restrict successful commercialisation. In addition, data obtained from trials is susceptible to varying interpretations, and regulators may not interpret the data as favourably as Opthea, which may delay, limit or prevent regulatory approval. Sozinibercept may fail to demonstrate a safety profile or sufficient evidence of therapeutic efficacy in future clinical studies to support its ongoing clinical development. In addition, the ability to recruit DME, or other types, of patients into future clinical studies, or secure clinical locations in which to conduct those studies, may not occur at a sufficient rate to maintain future program timelines. Clinical data Opthea maintains sensitive clinical data. Opthea or systems used by Opthea may be subject to a cyber security attack or data breaches by employees or external parties with either permitted or unauthorized access. There is therefore a risk that sensitive data may be exposed to the public or be permanently lost. A cyber security attack or data breach may also have implications for Opthea’s obligations under any relevant data protection or privacy legislation. Failure to comply with such legislation or regulations can result in penalties, negative publicity and damage to its brand and reputation. Research and development activities Opthea’s future success is dependent on the performance of sozinibercept in clinical trials and whether it proves to be a safe and effective treatment. Sozinibercept is an experimental product in clinical development and product commercialisation resulting in potential product sales and revenues is not likely to occur until some time in the future , if ever, and there is no guarantee that it will be successful. Sozinibercept requires additional research and development, including ongoing clinical evaluation of safety and efficacy in clinical trials and regulatory approval prior to marketing authorisation. Drug development is associated with a high failure rate and until Opthea is able to provide further clinical evidence of sozinibercept’s ability to improve outcomes in patients with eye disease, the future success of the product developed remains speculative. Research and development risks include uncertainty of the outcome of results, difficulties or delays in development and general uncertainty around the scientific development of novel pharmaceutical products and any of these risks, if they were to materialize, could impact Opthea’s progress and could have a material adverse effect on Opthea’s future financial performance. Key Risks – Business Risks (cont’d)