OSI Systems, Inc. (NASDAQ:OSIS), a vertically integrated

provider of solutions in Security, Healthcare, and specialized

electronics, today announced financial results for the second

quarter ended December 31, 2009.

Deepak Chopra, OSI Systems’ Chairman and CEO, stated, “We have

again demonstrated significantly improved earnings and strong free

cash flow, as well as improved margins in each of our divisions.

These achievements are the direct result of our initiatives to

improve our overall operating efficiencies. With outstanding

bookings and a record backlog, we are poised for significant sales

and earnings growth in the second half of our fiscal year.”

The Company reported revenues of $150.6 million for the second

quarter of fiscal 2010, a decrease of 5% as compared to the same

period a year ago. Net income for the second quarter of fiscal 2010

was $7.0 million, or $0.39 per diluted share, compared to net

income of $4.2 million, or $0.24 per diluted share, for the second

quarter of fiscal 2009.

For the six months ended December 31, 2009, the Company reported

revenues of $284.4 million, a decrease of 7% as compared to the

same period a year ago. Net income for the six months ended

December 31, 2009 was $9.5 million, or $0.53 per diluted share,

compared to net income of $4.3 million, or $0.24 per diluted share,

for the six months ended December 31, 2008.

Excluding the impact of restructuring and other charges, net

income for the second quarter of fiscal 2010 would have been

approximately $7.4 million or $0.41 per diluted share compared to a

net income of $6.0 million or $0.34 per diluted share for the

second quarter of fiscal 2009 and net income for the first half of

fiscal 2010 would have been approximately $9.9 million or $0.56 per

diluted share compared to a net income of $6.7 million or $0.37 per

diluted share for the first half of fiscal 2009. These non-GAAP

figures are provided to allow for the comparison of underlying

earnings, net of restructuring and other charges, thus providing

additional insight into the on-going operations of the Company.

As of December 31, 2009, the Company’s backlog was $240 million

compared to $203 million as of June 30, 2009, an increase of 18%.

During the three and six months ended December 31, 2009, the

Company generated cash flow from operations of $12.9 million and

$23.4 million, respectively.

Mr. Chopra continued, "Our Security division is well positioned

to achieve significant operating margin expansion. With an expanded

set of customers and product offerings we generated strong bookings

which lead to a record Security division backlog of $164 million, a

41% increase since the beginning of the fiscal year. Major recent

contract wins including a Screening Solution agreement with the

Puerto Rico Ports Authority, which for the Company is a

first-of-its-kind turnkey cargo scanning solution for port security

and a $35 million order to construct baggage handling systems and

install integrated baggage screening equipment at multiple Mexican

airports demonstrate our diversified capabilities. In addition, we

expect to benefit from the recent announcements by the TSA and

other international authorities to expand the use of full body

scanners at airport security checkpoints. We are currently

fulfilling the initial order quantities from the $173 million

Indefinite Delivery, Indefinite Quantity (IDIQ) contract with the

TSA, which is for multiple units of the Rapiscan Secure 1000 Single

Pose advanced checkpoint security screening system.”

Mr. Chopra concluded, “Our Healthcare division achieved an

operating profit of $6.0 million, or an 11% operating margin,

during the quarter, a significant increase over the second quarter

of fiscal 2009, in spite of 4% lower revenues. Although the climate

for our Healthcare division has improved, it continues to be a

challenging environment. To leverage our new product introductions

in the Healthcare segment, we are expanding sales efforts by

increasing our presence at small-to-medium sized hospitals and

outpatient surgery centers in the U.S. As demonstrated by this

quarter’s results, we are well-positioned to experience strong

operating margins as top line growth returns to the Healthcare

segment."

Fiscal Year 2010 Outlook

Subject to the risk factors detailed in the Safe Harbor section

of this press release, the Company is raising its fiscal 2010

earnings guidance and expects earnings per diluted share to

increase at a rate of 35% - 45% to between $1.23 to $1.32,

excluding the impact of restructuring and other non-recurring

charges. In addition, the Company is reiterating its annual revenue

guidance of $620 million to $640 million with growth in second half

revenues of the fiscal year led by the Company’s Security

division.

Conference Call Information

OSI Systems, Inc. will host a conference call and simultaneous

webcast over the Internet beginning at 9:00am PT (12:00pm ET),

today to discuss its results for the second quarter of fiscal 2010.

To listen, please log on to www.fulldisclosure.com or

www.osi-systems.com and follow the link that will be posted on the

front page. A replay of the webcast will be available shortly after

the conclusion of the conference call at 12:00pm PT (3:00pm ET)

until February 10, 2010. The replay can either be accessed through

the Company’s website, www.osi-systems.com, or via telephonic

replay by calling 1-888-286-8010 and entering the conference call

identification number ‘55924741’ when prompted for the replay

code.

About OSI Systems, Inc.

OSI Systems, Inc. is a vertically integrated designer and

manufacturer of specialized electronic systems and components for

critical applications. The Company sells its products in

diversified markets, including homeland security, healthcare,

defense and aerospace. The Company has more than 30 years of

experience in electronics engineering and manufacturing and

maintains offices and production facilities located in more than a

dozen countries. It implements a strategy of expansion by

leveraging its electronics and contract manufacturing capabilities

into selective end product markets through organic growth and

acquisitions. For more information on OSI Systems Inc. or any of

its subsidiary companies, visit www.osi-systems.com. News Filter:

OSIS-E

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include information regarding the

Company’s expectations, goals or intentions about the future,

including, the Company’s predictions about the cash generating

potential of its businesses and future earnings. The actual results

may differ materially from those described in or implied by any

forward-looking statement. In particular, there can be no assurance

that the Company will continue to generate cash, that strong sales

by its Security division will continue to occur in the future, or

that cost-cutting measures in its Healthcare division will

ultimately prove beneficial. Other important factors are set forth

in our Securities and Exchange Commission filings. All

forward-looking statements speak only as of the date made, and we

undertake no obligation to update these forward-looking

statements.

OSI SYSTEMS, INC. AND SUBSIDIARIES Consolidated

Statements of Operations (in thousands, except per share

data) (Unaudited) Three

Months Ended Six Months Ended

December 31,

December 31, 2008

2009 2008

2009 Revenue $ 159,042 $ 150,621 $ 307,203 $ 284,382

Cost of goods sold 104,623 94,256

203,149 183,550 Gross profit 54,419

56,365 104,054 100,832 Operating expenses: Selling, general

and administrative 35,727 34,610 73,268 66,890 Research and

development 8,669 10,353 18,882 18,342 Restructuring and other

charges 2,798 607 3,599

607 Total operating expenses 47,194

45,570 95,749 85,839

Income from operations 7,225 10,795 8,305 14,993 Interest expense

and other, net

(863 ) (784 ) (1,758 ) (1,389 ) Income

before income taxes 6,362 10,011 6,547 13,604 Income tax expense

2,200 3,059 2,253

4,142 Net income $ 4,162 $ 6,952 $ 4,294

$ 9,462 Diluted income per share $ 0.24 $ 0.39

$ 0.24 $ 0.53 Weighted average shares

outstanding – diluted 17,558 18,014

17,765 17,906

Consolidated Balance

Sheets (in thousands) (Unaudited)

June 30, December

31, 2009 2009

Assets

Cash and cash equivalents $ 25,172 $ 27,568 Accounts receivable,

net 110,453 117,134 Inventories 150,763 128,884 Other current

assets 36,855 38,479 Total current assets 323,243

312,065 Non-current assets 151,585 161,047 Total

Assets $ 474,828 $ 473,112

Liabilities and Stockholders'

Equity Bank lines of credit $ 4,000 $ - Current portion of

long-term debt 8,557 7,572 Accounts payable and accrued expenses

68,813 55,222 Other current liabilities 54,265 58,144

Total current liabilities 135,635 120,938 Long-term debt 39,803

30,938 Other long-term liabilities 23,390 29,463

Total liabilities 198,828 181,339 Total shareholders’ equity

276,000 291,773 Total Liabilities and Equity $ 474,828 $

473,112

SEGMENT INFORMATION (in thousands)

(unaudited)

Three Months Ended Six Months Ended

December 31, December 31, 2008

2009 2008

2009 Revenues – by Segment Group: Security

Group $ 67,067 $ 59,092 $ 125,752 $ 106,427 Healthcare Group 59,695

57,048 114,522 104,010 Optoelectronics and Manufacturing Group

including intersegment revenues 44,745 43,663 89,626 89,454

Intersegment revenues elimination (12,465 ) (9,182 )

(22,697 ) (15,509 ) Total $ 159,042 $ 150,621

$ 307,203 $ 284,382

Operating income

(loss) – by Segment Group: Security Group $ 4,846 $ 4,134 $

7,894 $ 6,102 Healthcare Group 2,285 5,808 460 7,303

Optoelectronics and Manufacturing Group 3,195 3,257 7,057 6,718

Corporate (2,712 ) (2,689 ) (6,896 ) (5,969 ) Eliminations

(389 ) 285 (210 ) 839 Total $

7,225 $ 10,795 $ 8,305 $ 14,993

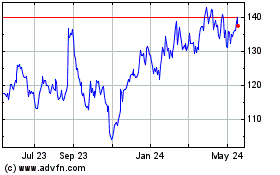

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

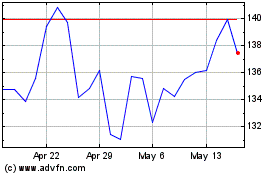

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024