OSI Systems, Inc. (NASDAQ: OSIS) today announced financial

results for the quarter ended September 30, 2011.

Deepak Chopra, OSI Systems’ Chairman and CEO, stated, “We had an

exceptional first quarter of bookings leading to a record backlog

of $413 million at quarter-end, which positions the Company well

for continued outstanding sales and earnings growth. Our strong

first quarter sales led to solid earnings growth.”

The Company reported revenues of $161.3 million for the first

quarter of fiscal 2012, an increase of $32.8 million, or 26%, from

the $128.5 million reported for the first quarter of fiscal 2011.

Net income for the first quarter of fiscal 2012 was $4.8 million,

or $0.24 per diluted share, compared to net income of $3.4 million,

or $0.18 per diluted share, for the first quarter of fiscal

2011.

As of September 30, 2011, the Company’s backlog was $413 million

compared to $304 million as of June 30, 2011, an increase of 36%.

During the three months ended September 30, 2011, the Company

generated cash flow from operations of $10 million.

Mr. Chopra continued, “Our Security division began fiscal 2012

with a tremendous first quarter and is well-positioned for

significant growth. With outstanding first quarter bookings of $185

million, our Security backlog grew to a record $319 million by

quarter-end, which is a 59% increase since the beginning of the

fiscal year. We had a number of important wins across our

diversified product portfolio and customer base. Leading the way

was a $98 million contract with the U.S. Army as part of a $248

million Indefinite Delivery, Indefinite Quantity (IDIQ)

contract.”

Mr. Chopra added, “We are also pleased with the very strong

performance in our Optoelectronics and Manufacturing division, as

sales jumped 34% over the prior year and operating income grew to

$4.9 million, a 44% increase over prior year.”

Mr. Chopra concluded, “The environment for our Healthcare

division continues to be challenging. However, despite the

difficult economic environment impacting medical equipment sales,

we reported sales of $46.5 million during the quarter, a 1%

improvement over the prior year. Going forward, with recent product

launches, increasing order activity, and newly established

long-term contracts with major healthcare Group Purchasing

Organizations (GPO’s), we anticipate an acceleration of top line

growth in this division.”

Fiscal Year 2012 Outlook

Subject to the risk factors detailed in the Safe Harbor section

of this press release, the Company announced that it is raising its

fiscal 2012 sales guidance to be between $740 million and $760

million, representing a 13% to 16% increase over fiscal 2011. In

addition, the Company is raising its earnings guidance and expects

diluted earnings per share to increase at a rate of 23% to 30% to

between $2.27 to $2.40, excluding the impact of restructuring and

other charges.

Conference Call Information

OSI Systems, Inc. will host a conference call and simultaneous

webcast over the Internet beginning at 9:00am PT (12:00pm ET),

today to discuss its results for the first quarter of fiscal 2012.

To listen, please log on to www.fulldisclosure.com or

www.osi-systems.com and follow the link that will be posted on the

front page. A replay of the webcast will be available shortly after

the conclusion of the conference call at 12:00pm PT (3:00pm ET)

until November 8, 2011. The replay can either be accessed through

the Company’s website, www.osi-systems.com, or via telephonic

replay by calling 1-888-286-8010 and entering the conference call

identification number ‘79400775’ when prompted for the replay

code.

About OSI Systems, Inc.

OSI Systems, Inc. is a vertically integrated designer and

manufacturer of specialized electronic systems and components for

critical applications. The Company sells its products in

diversified markets, including homeland security, healthcare,

defense and aerospace. The Company has more than 30 years of

experience in electronics engineering and manufacturing and

maintains offices and production facilities located in more than a

dozen countries. It implements a strategy of expansion by

leveraging its electronics and contract manufacturing capabilities

into selective end product markets through organic growth and

acquisitions. For more information on OSI Systems, Inc. or any of

its subsidiary companies, visit www.osi-systems.com. News Filter:

OSIS-E

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include information regarding the

Company’s expectations, goals or intentions about the future,

including, the Company’s predictions about future sales and

earnings. The actual results may differ materially from those

described in or implied by any forward-looking statement. In

particular, there can be no assurance that the Company will

continue to generate cash or that strong sales by its Security

division will continue to occur in the future. Other important

factors are set forth in our Securities and Exchange Commission

filings. All forward-looking statements speak only as of the date

made, and we undertake no obligation to update these

forward-looking statements.

OSI SYSTEMS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

data)

(Unaudited)

Three Months Ended

September 30,

2010

2011 Revenue $ 128,453 $ 161,317 Cost of goods sold

81,555 108,460 Gross profit 46,898 52,857

Operating expenses: Selling, general and administrative

31,976 34,367 Research and development 9,231 10,880 Restructuring

and other charges 256 — Total operating

expenses 41,463 45,247 Income from

operations 5,435 7,610 Interest and other expense, net (590

) (799 ) Income before income taxes 4,845 6,811 Income tax

expense 1,453 2,050 Net income $ 3,392

$ 4,761 Diluted income per share $ 0.18

$ 0.24 Weighted average shares outstanding – diluted

19,078 20,089

Consolidated Balance Sheets

(in thousands)

(Unaudited)

June 30, September 30, 2011 2011

Assets Cash and cash equivalents $ 55,619 $ 58,363 Accounts

receivable, net 136,716 130,607 Inventories 169,634 187,957 Other

current assets 43,317 41,149 Total current assets

405,286 418,076 Non-current assets 179,630 180,196

Total assets $ 584,916 $ 598,272

Liabilities and

Stockholders' Equity Accounts payable and accrued expenses

80,666 88,106 Other current liabilities 80,315 73,984

Total current liabilities 160,981 162,090 Long-term debt 2,756

2,641 Other long-term liabilities 36,379 44,350

Total liabilities 200,116 209,081 Total stockholders’

equity 384,800 389,191 Total liabilities and

equity $ 584,916 $ 598,272

Segment Information

(in thousands)

(Unaudited)

Three Months Ended

September 30,

2010

2011 Revenues – by Segment: Security division $

51,097 $ 72,597 Healthcare division 45,924 46,520 Optoelectronics

and Manufacturing division, including intersegment revenues 41,911

53,091 Intersegment revenues elimination (10,479 )

(10,891 ) Total $ 128,453 $ 161,317

Operating income (loss) – by Segment: Security division $

2,111 $ 3,845 Healthcare division 2,598 2,398 Optoelectronics and

Manufacturing division 3,421 4,938 Corporate (2,176 ) (3,307 )

Eliminations (519 ) (264 ) Total $ 5,435

$ 7,610

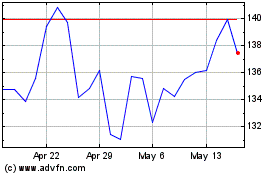

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

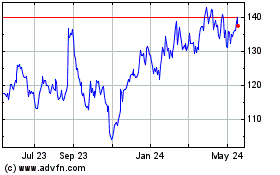

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024