00008504602023FYfalse00008504602023-01-012023-12-3100008504602023-06-30iso4217:USD00008504602024-02-15xbrli:shares00008504602023-12-3100008504602022-12-31iso4217:USDxbrli:shares00008504602022-01-012022-12-3100008504602021-01-012021-12-310000850460us-gaap:CommonStockMember2020-12-310000850460us-gaap:AdditionalPaidInCapitalMember2020-12-310000850460us-gaap:TreasuryStockCommonMember2020-12-310000850460us-gaap:RetainedEarningsMember2020-12-3100008504602020-12-310000850460us-gaap:RetainedEarningsMember2021-01-012021-12-310000850460us-gaap:CommonStockMember2021-01-012021-12-310000850460us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000850460us-gaap:TreasuryStockCommonMember2021-01-012021-12-310000850460us-gaap:CommonStockMember2021-12-310000850460us-gaap:AdditionalPaidInCapitalMember2021-12-310000850460us-gaap:TreasuryStockCommonMember2021-12-310000850460us-gaap:RetainedEarningsMember2021-12-3100008504602021-12-310000850460us-gaap:RetainedEarningsMember2022-01-012022-12-310000850460us-gaap:CommonStockMember2022-01-012022-12-310000850460us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000850460us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000850460us-gaap:CommonStockMember2022-12-310000850460us-gaap:AdditionalPaidInCapitalMember2022-12-310000850460us-gaap:TreasuryStockCommonMember2022-12-310000850460us-gaap:RetainedEarningsMember2022-12-310000850460us-gaap:RetainedEarningsMember2023-01-012023-12-310000850460us-gaap:CommonStockMember2023-01-012023-12-310000850460us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000850460us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000850460us-gaap:CommonStockMember2023-12-310000850460us-gaap:AdditionalPaidInCapitalMember2023-12-310000850460us-gaap:TreasuryStockCommonMember2023-12-310000850460us-gaap:RetainedEarningsMember2023-12-31wire:segment0000850460us-gaap:ShippingAndHandlingMember2023-01-012023-12-310000850460us-gaap:ShippingAndHandlingMember2022-01-012022-12-310000850460us-gaap:ShippingAndHandlingMember2021-01-012021-12-310000850460us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-31wire:customer0000850460us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2023-12-310000850460us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2023-12-310000850460us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-310000850460us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-12-310000850460us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310000850460us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310000850460us-gaap:BuildingMember2023-08-310000850460us-gaap:BuildingMember2023-09-010000850460us-gaap:LandAndLandImprovementsMember2023-12-310000850460us-gaap:LandAndLandImprovementsMember2022-12-310000850460us-gaap:ConstructionInProgressMember2023-12-310000850460us-gaap:ConstructionInProgressMember2022-12-310000850460us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000850460us-gaap:BuildingAndBuildingImprovementsMember2022-12-310000850460us-gaap:MachineryAndEquipmentMember2023-12-310000850460us-gaap:MachineryAndEquipmentMember2022-12-310000850460us-gaap:FurnitureAndFixturesMember2023-12-310000850460us-gaap:FurnitureAndFixturesMember2022-12-3100008504602021-02-092021-02-09wire:bank0000850460wire:CreditAgreementMember2021-02-090000850460wire:CreditAgreementMember2021-02-092021-02-090000850460wire:BloombergShortTermBankYieldIndexMemberwire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionOneMembersrt:MinimumMember2022-10-202022-10-20xbrli:pure0000850460wire:BloombergShortTermBankYieldIndexMemberwire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionOneMembersrt:MaximumMember2022-10-202022-10-200000850460us-gaap:FederalFundsEffectiveSwapRateMemberwire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionTwoMembersrt:MaximumMember2022-10-202022-10-200000850460wire:BloombergShortTermBankYieldIndexMemberwire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionTwoMember2022-10-202022-10-200000850460wire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionTwoMemberus-gaap:BaseRateMembersrt:MinimumMember2022-10-202022-10-200000850460wire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionTwoMemberus-gaap:BaseRateMembersrt:MaximumMember2022-10-202022-10-200000850460wire:CreditAgreementMembersrt:MinimumMember2022-10-202022-10-200000850460wire:CreditAgreementMembersrt:MaximumMember2022-10-202022-10-200000850460us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000850460us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000850460us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000850460wire:EmployeeStockGrantMember2023-01-012023-12-310000850460wire:EmployeeStockGrantMember2022-01-012022-12-310000850460wire:EmployeeStockGrantMember2021-01-012021-12-310000850460us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000850460us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000850460us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000850460us-gaap:StockAppreciationRightsSARSMember2023-01-012023-12-310000850460us-gaap:StockAppreciationRightsSARSMember2022-01-012022-12-310000850460us-gaap:StockAppreciationRightsSARSMember2021-01-012021-12-310000850460us-gaap:RestrictedStockMember2023-01-012023-12-310000850460us-gaap:RestrictedStockMember2022-01-012022-12-310000850460us-gaap:RestrictedStockMember2021-01-012021-12-310000850460us-gaap:RestrictedStockUnitsRSUMember2023-12-310000850460us-gaap:RestrictedStockUnitsRSUMember2022-12-310000850460wire:EmployeeStockGrantMember2023-05-012023-05-31wire:director0000850460wire:EmployeeStockGrantMember2022-05-012022-05-310000850460wire:EmployeeStockGrantMember2022-09-012022-09-300000850460wire:EmployeeStockGrantMember2021-05-012021-05-310000850460us-gaap:StockAppreciationRightsSARSMember2023-12-310000850460us-gaap:StockAppreciationRightsSARSMember2022-12-310000850460us-gaap:RestrictedStockMember2021-01-012023-12-310000850460us-gaap:RestrictedStockMember2023-12-310000850460us-gaap:RestrictedStockMember2022-12-310000850460us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000850460us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000850460us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000850460us-gaap:SubsequentEventMember2024-02-1600008504602023-01-012023-03-3100008504602023-04-012023-06-3000008504602023-07-012023-09-3000008504602023-10-012023-12-3100008504602022-01-012022-03-3100008504602022-04-012022-06-3000008504602022-07-012022-09-3000008504602022-10-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-20278 | | |

|

ENCORE WIRE CORPORATION (Exact name of registrant as specified in its charter) |

|

| | | | | | | | | | | |

| Delaware | | 75-2274963 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 1329 Millwood Road | | |

| McKinney, | Texas | | 75069 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (972) 562-9473

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | WIRE | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | | ☐ | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

| | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☒ |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | o |

| Indicate by check mark whether any of these error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ý No

The aggregate market value of the Common Stock held by non-affiliates of the registrant computed by reference to the price at which the Common Stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $2,125,052,538 (Note: The aggregate market value of Common Stock held by the Company’s directors, executive officers, immediate family members of such directors and executive officers, 10% or greater stockholders and other stockholders deemed to be affiliates was excluded from the computation of the foregoing amount. The characterization of such persons as “affiliates” should not be construed as an admission that any such person is an affiliate of the Registrant for any other purpose).

Number of shares of Common Stock outstanding as of February 15, 2024: 15,763,916

DOCUMENTS INCORPORATED BY REFERENCE

Listed below are documents, parts of which are incorporated herein by reference, and the part of this report into which the document is incorporated:

(1)Proxy statement for the 2024 annual meeting of stockholders – Part III

ENCORE WIRE CORPORATION

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2023

Table of Contents | | | | | |

| PAGE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART I

Item 1. Business.

General

Encore Wire Corporation is a Delaware corporation, incorporated in 1989, with its principal executive office and manufacturing plants located at 1329 Millwood Road, McKinney, Texas 75069. The Company’s telephone number is (972) 562-9473. As used in this annual report, unless otherwise required by the context, the terms “we,” “our,” “Company,” “Encore,” and “Encore Wire” refer to Encore Wire Corporation.

The Company manufactures a broad range of electrical wire and cables, used to distribute power from the transmission grid to the wall outlet or switch. Encore’s diversified product portfolio and low-cost of production positions it exceptionally well to play a key role in the transition to a more sustainable and reliable energy infrastructure. Our products are proudly made in America at our vertically-integrated, single-site, Texas campus.

The Company sells its products through manufacturers’ representatives to wholesale electrical distributors servicing the residential, commercial, and industrial sectors.

Strategy

Encore Wire’s strategy is to combine its industry-leading service model with its world-class operations to meet demand profitability with loyal electrical distributor customers in a high-performance industry. Encore’s customer service, expansive single-campus model, low-cost production, centralized distribution, product innovation, and deep company culture have promoted Encore’s growth and should contribute to its future success.

Customer Service: Customer loyalty has been a key driver of Encore’s success, which it has earned through an intense focus on customer needs, building and maintaining strong relationships, exceeding performance and service expectations with an industry-leading order fill rate, and rapidly handling customer orders, shipments, and inquiries. Encore maintains broad and deep product inventories based on our customers’ needs, and believes that the speed and completeness with which it fills orders are critical to marketing its products.

Single-Campus Model: Encore’s single-site campus is a key competitive advantage. It enables a cohesive culture of collaboration and performance, low-cost manufacturing, distribution and administration efficiencies, speed to manufacture and ship products, exceptional quality and safety programs, manufacturing flexibility and agility, acute cost control, optimized raw material planning and usage, and a resilience to supply chain issues experienced by others in our industry.

Product Innovation: Encore has been a leader in bringing new ideas and innovative products to a “commodity” product line.

Encore pioneered the widespread use of Colored Insulation on feeder sizes of commercial wire, as well as colors on residential (non-metallic) cable. Encore’s colors have become the industry standard and have improved job-site safety, provided handling efficiencies for electrical distributors, and reduced installation times for electrical contractors. Use of colors also enables building inspectors to immediately identify installed wire.

Encore Wire’s patented SmartColor ID® system for metal-clad and armor-clad cables allows for quick and accurate identification of gauge, number of conductors, wire and jacket type.

Our spool-free PullPro® is a lightweight, portable, durable case weighing less than thirty pounds that requires no additional tools for a tangle-free wire pull. With no spools to crack or discard, it improves job-site scrap rates and reduces trash and waste.

We believe our Reel Payoff® is the industry's first self-spinning wooden reel, which allows pulling on or off the pallet with no additional tools.

Additionally, Encore currently has multiple patents and patent-pending innovations that range from process improvements to packaging solutions.

Low-Cost Production: Encore’s low-cost production capability features an efficient plant design and an incentivized work force.

Efficient Plant Design: Encore’s automated wire manufacturing equipment is integrated in an efficient design that reduces material handling, labor and in-process inventory.

Incentivized Work Force: The Company has a long term incentive plan that enhances the motivation of its salaried manufacturing supervisors. The Company also has a comprehensive safety program creating a world-class culture by engaging employees, identifying and eliminating risk, and training employees to be successful. The Company provides a 401(k) retirement savings plan to all employees and a monthly operations incentive plan for hourly employees.

Products

Encore offers an electrical building wire product line that consists primarily of NM-B cable, UF-B cable, THHN/THWN-2, XHHW-2, USE-2, RHH/RHW-2 and other types of wire products, including SEU, SER, Photovoltaic, URD, tray cable, metal-clad and armored cable. All of these products are manufactured with copper or aluminum as the current-carrying component of the conductor. The principal bases for differentiation among stock-keeping units are product type, conductor type, diameter, insulation, length, color, and packaging.

Manufacturing

The efficiency of Encore’s manufacturing facility is a key element of its low-cost production capability. Encore’s wire manufacturing lines have been integrated so that the handling of product is substantially reduced throughout the production process. The manufacturing process for the Company’s various products involves multiple steps, including casting, drawing, stranding, compounding, insulating, cabling, jacketing and armoring.

Encore manufactures and tests all of its products in accordance with the Underwriters Laboratories (UL) standards, a nationally recognized testing and standards agency.

Customers

Encore sells its wire to wholesale electrical distributors throughout the United States. Most distributors supply products to electrical contractors. Encore’s customers are numerous and diversified. Encore has two customers, each of whom slightly exceeds 10% of the Company's total sales. Encore has no customer, the loss of which would have a material adverse effect on the Company.

Encore believes that the speed and completeness with which it fills customers’ orders is crucial to its ability to service demand for its products. The Company also believes that, for a variety of reasons, many customers strive to maintain lean inventories. Because of this trend, the Company seeks to maintain sufficient inventories to satisfy customers’ orders promptly.

Marketing and Distribution

Encore markets its products throughout the United States through independent manufacturers’ representatives.

Encore maintains the majority of its finished product inventory at its service center in McKinney, Texas. In order to provide flexibility in handling customer requests for immediate shipment, additional finished product inventories are maintained at warehouses owned and operated by some of the Company's independent manufacturers’ representatives located strategically across the United States.

Finished goods are typically shipped to customers by trucks operated by common carriers. The decision regarding the carrier to be used is based primarily on availability and cost.

The Company invoices its customers directly for products purchased and pays the manufacturer's representative a commission based on pre-established rates. The Company determines customer credit limits. The Company lowered its reserve for credit losses by $1.3 million and recorded credit losses of $0.05 million in 2023. The company recorded no reserve for credit losses in 2022, but reserved $1.5 million for credit losses in 2021. The manufacturers’ representatives have no discretion to determine prices charged for the Company’s products and all sales are subject to Company approval.

Human Capital

General

The Company fosters a culture for our employees based on the old-fashioned values of service, professionalism and stewardship. We encourage our employees to do the right thing under any circumstances and to conform to our Code of Conduct and Ethics. These values are a key aspect of our human capital retention and they inform our employment and compensation philosophies.

Employees

Encore believes that its hourly employees are highly motivated and that their motivation contributes significantly to Encore’s efficient operation. The Company believes that competitive hourly compensation coupled with sound management practices focuses its employees on maintaining high production standards and product quality.

As of December 31, 2023, Encore had 1,629 employees, 1,350 of whom were paid hourly wages and were primarily engaged in the operation and maintenance of the Company’s manufacturing and warehouse facilities. The Company’s remaining employees were executive, supervisory, administrative, sales and clerical personnel. The Company considers its relations with its employees to be good. The Company has no collective bargaining agreements with any of its employees.

Compensation and Benefits

The Company rewards employees with competitive compensation and benefits packages, including attractive medical plans, a 401(K) retirement savings plan, opportunities for annual bonuses, and, for eligible employees, long-term incentives and a deferred compensation plan. The Company believes that long term incentives, like stock-based compensation, are a critical part of its compensation program and allows the Company to attract and retain talented employees.

Health and Safety

Employee health and safety is a top priority for the Company. The Company is committed to providing a safe and healthy work environment and to conducting its business in a safe and environmentally protective manner. All employees and officers are expected to perform their duties consistent with site specific safety and environmental rules and regulations and site application of Company best practices. The Company understands how the health of its employees impacts not only their work, but their family life, too. The Company offers an Occumed On-Site Clinic with a nurse practitioner for employees and their immediate families. For many, the Occumed On-Site Clinic provides basic health screenings and treatment equal to those at a general practice facility which otherwise might not be possible. The Company also offers a wide range of health and wellness services to assist its employees and their families with making good lifestyle choices.

Diversity and Inclusion

The Company is committed to and values hiring employees with varied personal and professional backgrounds, perspectives and experiences, promoting a culture of diversity and inclusion. The diversity of the Company’s employees is a tremendous asset. The Company is firmly committed to providing equal opportunity in all aspects of employment and will not tolerate acts of discrimination or harassment. The Company is committed to employing and advancing in employment all persons without regard to their race, color, sex, religion, national origin, citizenship, age, gender identity, sexual orientation, marital status, genetic information, veteran status, disability, or other protected categories.

Raw Materials

The principal raw materials used by Encore in manufacturing its products are copper cathode, copper scrap, PVC thermoplastic compounds, XLPE compounds, aluminum, steel, paper, and nylon, all of which are readily available from a number of suppliers. Copper is the principal raw material used by the Company in manufacturing its products, constituting 80.8% of the dollar value of all raw materials used by the Company during 2023. Copper requirements for manufacturing our wire are purchased primarily from miners and commodity brokers at prices determined each month primarily based on the average daily COMEX closing prices for copper for that month, plus a negotiated premium. The Company also purchases raw materials necessary to manufacture various PVC thermoplastic compounds. These raw materials include PVC resin, clay, and plasticizer.

The Company produces copper rod from purchased copper cathode and copper scrap in its own rod fabrication facility. The Company reprocesses copper scrap generated by its operations as well as copper scrap purchased from others. In 2023, the Company’s copper rod fabrication facility manufactured the majority of the Company’s copper rod requirements. The Company purchases aluminum rod from various suppliers for aluminum wire production.

The Company also compounds its own wire jacket and insulation compounds. The process involves the mixture of PVC raw material components to produce the PVC used to insulate the Company’s wire and cable products. The raw materials include PVC resin, clay, and plasticizer. During the last year, the Company’s plastic compounding facility produced the vast majority of the Company’s PVC requirements.

Competition

The electrical wire and cable industry is highly competitive. The Company competes with several companies who manufacture and sell wire and cable products beyond the building wire segment in which the Company competes. The Company’s primary competitors include Southwire Company, LLC, Cerrowire (a Marmon/Berkshire Hathaway company), General Cable (a company of the Prysmian Group) and AFC Cable Systems, Inc. (a part of Atkore International).

For all our products, the Company believes that it is competitive with respect to all relevant factors, including order fill rate, quality, pricing, and breadth of product line.

Compliance with Governmental and Environmental Regulations

The Company is subject to federal, state and local laws covering a wide variety of subject matters, including environmental protection laws and regulations governing the Company’s operations and the use, handling, disposal and remediation of hazardous substances currently or formerly used by the Company. The laws and regulations often impose costly compliance requirements that carry substantial penalties for failure to comply. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent and costly pollution control or waste handling, storage, transport, disposal, or cleanup requirements could materially and adversely affect our operations and financial position, as well as the wire and cable industry in general. Management believes the Company complies with all such rules including certain environmental permitting and reporting requirements. Historically, compliance with laws and regulations, including environmental regulations, has not had a material impact on the capital expenditures, earnings and competitive position of the Company.

Intellectual Property Matters

From time to time, the Company files patent applications with the United States Patent and Trademark Office. The Company currently owns several patents and pending patent applications. The Company also owns several registered trademarks and pending trademark applications with the U.S. Patent and Trademark Office. The current registrations for the marks will expire on various dates from 2023 to 2031, but each registration can be renewed indefinitely as long as the respective mark continues to be used in commerce and the requisite proof of continued use or renewal application, as applicable, is filed. These trademarks provide source identification for the goods manufactured and sold by the Company and allow the Company to achieve brand recognition within the industry.

Internet Address/SEC Filings

The Company’s Internet address is https://www.encorewire.com. Under the “Investors” section of our website, the Company provides a link to our electronic Securities and Exchange Commission (“SEC”) filings, including our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, director and officer beneficial ownership reports filed pursuant to Section 16 of the Securities Exchange Act of 1934, as amended, and any amendments to these reports. All such reports are available free of charge and are available as soon as reasonably practicable after the Company files such material with, or furnishes it to, the SEC.

The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at https://www.sec.gov.

Information about our Executive Officers

Information regarding Encore’s executive officers including their respective ages as of February 16, 2024, is set forth below: | | | | | | | | | | | |

| Name | Age | | Position with Company |

| Daniel L. Jones | 60 | | Chairman of the Board of Directors, President and Chief Executive Officer |

| | | |

| Bret J. Eckert | 57 | | Executive Vice President and Chief Financial Officer |

Mr. Jones has held the office of President and Chief Executive Officer of the Company since February 2006. He performed the duties of the Chief Executive Officer in an interim capacity from May 2005 to February 2006. From May 1998 until February 2005, Mr. Jones was President and Chief Operating Officer of the Company. He previously held the positions of Chief Operating Officer from October 1997 until May 1998, Executive Vice President from May 1997 to October 1997, Vice President-Sales and Marketing from 1992 to May 1997, after serving as Director of Sales since joining the Company in November 1989. He has also served as a member of the Board of Directors since May 1992 and was named Chairman of the Board in 2014.

Mr. Eckert has held the office of Executive Vice President since December 2022. He served as Vice President-Finance, Treasurer, Secretary and Chief Financial Officer of Encore since January 2020. He joined the Company in August 2019 as Vice President-Finance. Prior to joining the Company, Bret served as Executive Managing Director for the Houston office of Riveron Consulting LLC, a business advisory firm, from June 2018 to August 2019. Previously he was Senior Vice President and Chief Financial Officer of Atmos Energy Corporation in Dallas for approximately five years. He spent the first twenty-two years of his career with Ernst & Young LLP where he was a partner for ten years.

All executive officers are elected annually by the Board of Directors to serve until the next annual meeting of the Board or until their respective successors are chosen and qualified.

Item 1A. Risk Factors.

The following are risk factors that could affect the Company’s business, financial results, and results of operations. These risk factors should be carefully considered in evaluating us and our common stock. Any of these risks, many of which are beyond our control, could materially and adversely affect our financial condition, results of operations or cash flows, or cause our actual results to differ materially from those projected in any forward-looking statements contained in this Annual Report on Form 10-K. Before purchasing the Company’s stock, an investor should know that making such an investment involves some risks, including the risks described below. If any of the risks mentioned below or other unknown risks actually occur, the Company’s business, financial condition, or results of operations could be negatively affected. In that case, the trading price of its stock could fluctuate significantly. We may also face other risks and uncertainties that are not presently known, are not currently believed to be material, or are not identified below because they are common to all businesses. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

Risks Related to Our Business and Industry

Supply and Availability of Raw Materials, Supply Chain Constraints and Profitability Margins

The success of our business depends on our ability to meet customer demand of a commodity product in a highly competitive market, and sourcing an adequate supply of raw materials, including copper, is vital to our business and operations. While the Company generally believes our supply of raw materials is adequate, the Company could experience instances of limited supply of certain raw materials, resulting in extended lead times and higher prices.

Shortages or interruptions (including due to labor or political disputes) in the supply of our raw materials could disrupt our operations, and our business and financial condition could be materially adversely affected by such disruptions. Limitations inherent within our supply chain of certain raw materials, including competitive, governmental, and legal limitations, natural disasters, and other events, could impact costs, and future increases in the costs of these items, including, for example, the adoption of new tariffs by the United States and other countries, and a resurgence of the COVID-19 pandemic could adversely affect our profitability and availability of raw materials. There can be no assurance that future price increases will be successfully passed through to customers or that we will be able to find alternative suppliers.

Product Pricing and Volatility of Copper Market

Price competition for copper electrical wire and cable is significant, and the Company sells its products in accordance with prevailing market prices. Wire and cable prices can, and frequently do, change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. Copper, a commodity product, is the principal raw material used in the Company’s manufacturing operations. The price of copper fluctuates depending on general economic conditions and in relation to supply and demand and other factors, including changes in regulatory, geopolitical, political, social, economic, tax or monetary policies, and it causes monthly variations in the cost of copper purchased by the Company. The SEC allows shares of physically backed copper exchange traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like them hold copper cathode as collateral against their shares. The acquisition of copper cathode by copper ETFs may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase the Company’s cost of copper. In addition to rising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased copper price volatility. While the Company has experienced increased profitability in recent quarters, the Company cannot predict future copper prices or the effect of fluctuations in the costs of copper on the Company’s future operating results and, as a result, cannot predict how long the Company's increased profitability will continue and whether such positive financial trends will be sustained. Consequently, fluctuations in copper prices caused by market forces can significantly affect the Company’s financial results.

Industry Conditions and Cyclicality

The residential, commercial and industrial construction industry, which is the end user of the Company’s products, is cyclical and is affected by a number of factors, including the general condition of the economy, market demand, and changes in interest rates. Industry sales of electrical wire and cable products tend to parallel general construction activity, which includes remodeling. Data on remodeling is not readily available. However, remodeling activity historically trends up when new construction slows down. Construction activity is affected by the ability of our end users to finance projects, which may be severely reduced due to a widespread outbreak of contagious disease, including an epidemic or pandemic such as the COVID-19 pandemic. Residential, commercial and industrial construction could decline if companies and consumers are unable to finance construction projects or if the economy precipitously declines or stalls, which could result in delays or cancellations of capital projects.

Deterioration in the financial condition of the Company’s customers due to industry and economic conditions may result in reduced sales, an inability to collect receivables and payment delays or losses due to a customer’s bankruptcy or insolvency. Although the Company’s bad debt experience has been low in recent years, the Company’s inability to collect receivables may increase the amounts the Company must expense against its bad debt reserve, decreasing the Company’s profitability. A downturn in the residential, commercial or industrial construction industries and general economic conditions may have a material adverse effect on the Company.

Competition

The electrical wire and cable industry is highly competitive. The Company competes with several manufacturers of wire and cable products that have substantially greater resources than the Company does. Some of these competitors are owned and operated by large, diversified companies. The principal elements of competition in the wire and cable industry are, in the opinion of the Company, pricing, product availability and quality and, in some instances, breadth of product line. The Company believes that it is competitive with respect to all of these factors. While the number of manufacturers producing

wire and cable has declined in the past, there can be no assurance that new competitors will not emerge or that existing producers will not employ or improve upon the Company’s manufacturing and marketing strategy.

Risks Related to Our Operations

Operating Results May Fluctuate

Encore’s results of operations may fluctuate as a result of a number of factors, including fluctuation in the demand for and shipments of the Company’s products. Therefore, comparisons of results of operations, including recent periods of increased profitability, have been and will be impacted by the volume of such orders and shipments, and the Company cannot predict if periods of increased profitability will continue in the future. In addition, the Company's operating results could be adversely affected by the following factors, among others, such as variations in the mix of product sales, price changes in response to competitive factors, increases in raw material costs, freight and other significant costs, the loss of key manufacturer’s representatives who sell the Company’s product line, increases in utility costs (particularly electricity and natural gas), various types of insurance coverage, and interruptions in plant operations resulting from the interruption of raw material supplies and other factors. Additionally, our results of operations could be impacted by macro-economic and geopolitical conditions as well as other outside factors, including changes in regulatory, geopolitical, political, social, economic, tax or monetary policies, and other factors.

Reliance on Senior Management

Encore’s future operating results depend, in part, upon the continued service of its senior management, including, Mr. Daniel L. Jones, Chairman, President and Chief Executive Officer, and Mr. Bret J. Eckert, the Company’s Executive Vice President and Chief Financial Officer (neither of whom is bound by an employment agreement). The Company’s future success will depend upon its continuing ability to attract and retain highly qualified managerial and technical personnel. Competition for such personnel is intense, and there can be no assurance that the Company will retain its key managerial and technical employees or that it will be successful in attracting, assimilating or retaining other highly qualified personnel in the future.

Patent and Intellectual Property Disputes

Disagreements about patents and intellectual property rights occur in the wire and cable industry. The unfavorable resolution of a patent or intellectual property dispute could preclude the Company from manufacturing and selling certain products or could require the Company to pay a royalty on the sale of certain products. Patent and intellectual property disputes could also result in substantial legal fees and other costs.

Cybersecurity Breaches and other Disruptions to our Information Technology Systems

The efficient operation of our business is dependent on our information technology systems to process, transmit and store sensitive electronic data, including employee, distributor and customer records, and to manage and support our business operations and manufacturing processes. The secure maintenance of this information is critical to our operations. Despite our security measures, our information technology system may be vulnerable to attacks by hackers or breaches due to errors or malfeasance by employees and others who have access to our system, or other disruptions during the process of upgrading or replacing computer software or hardware, power outages, computer viruses, telecommunication or utility failures or natural disasters. Any such event could compromise our information technology systems, expose our customers, distributors and employees to risks of misuse of confidential information, impair our ability to effectively and timely operate our business and manufacturing processes, and cause other disruptions, which could result in legal claims or proceedings, disrupt our operations and the services we provide to customers, damage our reputation, and cause a loss of confidence in our products and services, any of which could adversely affect our results of operations and competitive position.

Climate Change

Future deterioration of the environment due to climate change or increased severe weather related events associated with climate change could affect both our operations and the operations of our suppliers and customers. Climate change may be associated with extreme weather conditions such as more intense hurricanes, thunderstorms, tornadoes and snow or ice storms, as well as rising sea levels. Additionally, the Company could experience disruptions or limitations to access of water. Our suppliers may face similar challenges, which could impact our supply chain. Demand for our products may be

impacted regionally as local climates adapt to global environmental changes. However, at this time, we are unable to determine the extent to which climate change may lead to increased storm or weather hazards affecting our operations.

Risks Related to Ownership of Our Stock

Common Stock Price May Fluctuate

Future announcements concerning Encore or its competitors or customers, quarterly variations in operating results, announcements of technological innovations, the introduction of new products or changes in product pricing policies by the Company or its competitors, developments regarding proprietary rights, changes in earnings estimates by analysts, or reports regarding the Company or its industry in the financial press or investment advisory publications, among other factors, could cause the market price of the common stock to fluctuate substantially. These fluctuations, as well as general economic, political and market conditions, such as recessions, world events, military conflicts or market or market-sector declines, may materially and adversely affect the market price of the common stock.

Beneficial Ownership of the Company’s Common Stock by a Small Number of Stockholders

A small number of significant stockholders beneficially own greater than 36% of the Company’s outstanding common stock. Depending on stockholder turnout for a stockholder vote, these stockholders, acting together, could be able to control the election of directors and certain matters requiring majority approval by the Company’s stockholders. The interests of this group of stockholders may not always coincide with the Company’s interests or the interests of other stockholders.

In the future, these stockholders could sell large amounts of common stock over relatively short periods of time. The Company cannot predict if, when or in what amounts stockholders may sell any of their shares. Sales of substantial amounts of the Company’s common stock in the public market by existing stockholders or the perception that these sales could occur, may adversely affect the market price of our common stock by creating a public perception of difficulties or problems with the Company’s business.

Future Sales of Common Stock Could Affect the Price of Common Stock

No prediction can be made as to the effect, if any, that future sales of shares or the availability of shares for sale will have on the market price of the common stock prevailing from time to time. Sales of substantial amounts of common stock, or the perception that such sales might occur, could adversely affect prevailing market prices of the common stock.

Risks Related to Laws and Regulations

Environmental Liabilities

The Company is subject to federal, state and local environmental protection laws and regulations governing the Company’s operations and the use, handling, disposal and remediation of hazardous substances currently or formerly used by the Company. A risk of environmental liability is inherent in the Company’s current manufacturing activities in the event of a release or discharge of a hazardous substance generated by the Company. Under certain environmental laws, including the Comprehensive Environmental Response, Compensation and Liability Act, as amended; the Resource Conservation and Recovery Act, as amended; and comparable state statutes and regulations promulgated thereunder, the Company could be held jointly and severally responsible for the remediation of any hazardous substance contamination at the Company’s facilities and at third party waste disposal sites and could also be held liable for any consequences arising out of human exposure to such substances or other environmental damage. We believe that we are in substantial compliance with applicable requirements related to waste handling, and that we hold all necessary and up-to-date permits, registrations and other authorizations to the extent that our operations require them under such laws and regulations. However, there can be no assurance that the costs of complying with environmental, health and safety laws and requirements in the Company’s current operations or the liabilities arising from past releases of, or exposure to, hazardous substances, will not result in future expenditures by the Company that could materially and adversely affect the Company’s financial results, cash flow or financial condition.

Our Targets Related to Sustainability and Emissions Reduction Initiatives, Including our Public Statements and Disclosures Regarding Them, May Expose Us to Numerous Risks

We have developed, and will continue to develop, targets related to our environmental, social, and governance ("ESG") initiatives. Statements in this and other reports we file with the SEC and other public statements related to these initiatives

reflect our current plans and expectations and are not a guarantee the targets will be achieved or achieved on the currently anticipated timeline. Our ability to achieve our ESG targets, including emissions reductions, is subject to numerous factors and conditions, some of which are outside of our control, and failure to achieve our announced targets or comply with ethical, environmental or other standards, including reporting standards, may expose us to government enforcement actions or private litigation and adversely impact our business. Further, our continuing efforts to research, establish, accomplish and accurately report on these targets may create additional operational risks and expenses and expose us to reputational, legal and other risks.

Investor and regulator focus on ESG matters continues to increase. If our ESG initiatives do not meet our investors' or other stakeholders' evolving expectations and standards, investment in our stock may be viewed as less attractive and our reputation, contractual, employment and other business relationships may be adversely impacted.

Regulations Related to Conflict-free Minerals May Force Us to Incur Additional Expenses

In August 2012, the SEC adopted disclosure requirements related to certain minerals sourced from the Democratic Republic of Congo or adjoining countries, as required by Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The SEC rules implementing Section 1502 of the Dodd-Frank Act require us to perform due diligence, and report whether “conflict minerals,” which are defined as tin, tantalum, tungsten and gold, necessary to the functionality of a product we purchase originated from the Democratic Republic of Congo or an adjoining country. Since 2014, we have been required to file with the SEC on an annual basis a specialized disclosure report on Form SD regarding such matters. As our supply chain is complex, we may incur significant costs to determine the source and custody of conflict minerals that are used in the manufacture of our products in order to comply with these regulatory requirements in the future. We may also face reputation challenges if we are unable to verify the origins for all conflict minerals used in our products, or if we are unable to conclude that our products are “conflict free.” Over time, conflict minerals reporting requirements may affect the sourcing, price and availability of our products, and may affect the availability and price of conflict minerals that are certified as conflict free. Accordingly, we may incur significant costs as a consequence of regulations related to conflict-free minerals, which may adversely affect our business, financial condition or results of operations.

Risks Related to Taxes

Changes in Tax Laws Could Increase Our Tax Rate and Adversely Affect Our Results of Operations

A change in tax laws is one of many factors that impact the Company’s effective tax rate, and any such change could adversely impact our effective tax rate, financial condition and results of operations.

The Inflation Reduction Act (“IRA”) was enacted on August 16, 2022. The IRA includes provisions imposing a 1% excise tax on share repurchases that occur after December 31, 2022, and introduces a 15% corporate alternative minimum tax on “adjusted financial statement income” of certain large corporations (generally, corporations reporting at least $1 billion of average adjusted pre-tax net income on their consolidated financial statements). Based on application of currently available guidance, the Company does not expect the IRA to have a material adverse impact to its financial statements.

It cannot be predicted whether or when tax laws, rules, regulations or ordinances may be enacted, issued, or amended that could materially and adversely impact our financial position, results of operations, or cash flows.

General Risk Factors

Outbreak of Contagious Disease

Our business and the businesses of our suppliers, distributors and customers could be adversely affected by the effects of a widespread outbreak of contagious diseases, including COVID-19, or any ongoing variants. Any outbreak of contagious diseases, and other adverse public health developments, could cause a disruption in our supply chain, distribution and demand for our products. The duration of any such disruption and the related financial impact from COVID-19, or any ongoing variants, and other epidemics and pandemics cannot be reasonably estimated at this time. Although the effects of the COVID-19 pandemic during 2023 were not as significant as prior years, new variants continued to cause waves of COVID-19 cases around the world. The occurrence or continuation of any of these events could lead to decreased revenues and limit our ability to execute on our business plan, which could adversely affect our business, financial condition and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 1C. Cybersecurity.

Cybersecurity Risk Management and Strategy

We have developed and implemented a cybersecurity risk management program intended to protect the confidentiality, integrity, and availability of our critical systems and information.

Our cybersecurity risk management program is aligned to the Company's business strategy. It shares common methodologies, reporting channels and governance processes that apply to the other areas of enterprise risk, including legal, compliance, strategic, operational, and financial risk. Key elements of our cybersecurity risk management program include:

•risk assessments designed to help identify material cybersecurity risks to our critical systems, information, products, services, and our broader enterprise information technology environment;

•a security team principally responsible for managing our cybersecurity risk assessment processes and our response to cybersecurity incidents;

•the use of external service providers, where appropriate, to assess, test or otherwise assist with aspects of our security procedures;

•training and awareness programs for team members that include periodic and ongoing assessments to drive adoption and awareness of cybersecurity processes and procedures;

•a cybersecurity incident response plan that includes procedures for responding to cybersecurity incidents; and

•a third-party risk management process for service providers, suppliers, and vendors.

In the last three fiscal years, the Company has not experienced any material cybersecurity incidents. For a discussion of whether and how any risks from cybersecurity threats, including as a result of any previous cybersecurity incidents, have materially affected or are reasonably likely to materially affect us, including our business strategy, results of operations or financial condition, refer to Item 1A. Risk Factors - "Cybersecurity Breaches and other Disruptions to our Information Technology Systems", which is incorporated by reference into this Item 1C.

Cybersecurity Governance

The Board regularly receives reports from our executive officers and third parties on cybersecurity matters. In addition, the Board receives reports addressing cybersecurity as part of our overall enterprise risk management program and to the extent cybersecurity matters are addressed in regular business updates.

Management is responsible for developing cybersecurity programs, including as may be required by applicable law or regulation. These individuals' expertise in IT and cybersecurity generally has been gained from a combination of education, including relevant degrees and/or certifications, and prior work experience. They are informed by their respective cybersecurity teams about, and monitor, the prevention, detection, mitigation and remediation of cybersecurity incidents as part of the cybersecurity programs described above.

Item 2. Properties.

Encore maintains its corporate office and manufacturing plants in McKinney, Texas, approximately 32 miles north of downtown Dallas. The Company’s facilities are located on a combined site of approximately 460 acres and consist of buildings containing over 3.0 million square feet of floor space. The corporate office, plants and equipment are owned by the Company and are not mortgaged to secure any of the Company’s existing indebtedness. Encore believes that its plants and equipment are suited to its present needs, comply with applicable federal, state and local laws and regulations, and are properly maintained and adequately insured.

Item 3. Legal Proceedings.

For information on the Company’s legal proceedings see Note 10 to the Company’s financial statements included in Item 8 to this report and incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

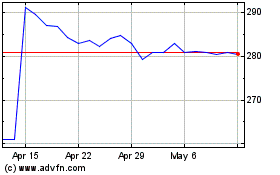

The Company’s common stock is traded and quoted on the NASDAQ Stock Market’s Global Select Market under the symbol “WIRE.” As of February 15, 2024, there were 30 holders of record of the Company’s common stock.

The Company currently expects to continue to make periodic cash dividends consistent with its historical practice.

Issuer Purchases of Equity Securities

Note 9 to the Company’s financial statements included in Item 8 to this report is hereby incorporated herein by reference.

The following table provides information relating to our purchases of shares of our common stock during the three months ended December 31, 2023. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | | (b) | | (c) | | (d) |

Period | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (1) |

October 1, 2023 – October 31, 2023 | | 476,300 | | | | $ | 178.77 | | | | 476,300 | | | | 813,617 | |

November 1, 2023 – November 30, 2023 | | — | | | | — | | | | — | | | | 813,617 | |

December 1, 2023 – December 31, 2023 | | — | | | | — | | | | — | | | | 813,617 | |

| | 476,300 | | | | $ | 178.77 | | | | 476,300 | | | | |

(1) On November 10, 2006, the Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to an authorized number of shares of its common stock from time to time in the open market or private transactions at the Company's discretion. This authorization originally expired on December 31, 2007, and the Company’s Board of Directors has authorized several increases and annual extensions of this stock repurchase program, most recently in June 2023, authorizing the repurchase of up to 2,000,000 shares of our common stock. As of December 31, 2023, 813,617 shares remained authorized for repurchase through March 31, 2024. Under this program, the Company repurchased 2,661,792 shares of its stock in 2023, 2,055,470 shares in 2022 and 475,557 shares in 2021.

Subsequently, in February 2024, the Board of Directors extended the repurchase authorization for up to 2,000,000 shares of our common stock through March 31, 2025.

Performance Graph

The following graph is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, respectively.

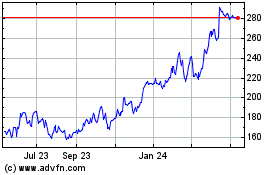

The graph below sets forth the cumulative total stockholder return, which assumes reinvestment of dividends, of a $100 investment in the Company’s common stock, the Russell 2000 Index, the Company’s self-determined peer group for the year ended December 31, 2022 (the “Prior Peer Group”), and the Company’s self-determined peer group for the year ended December 31, 2023 (the “Peer Group”) for the five years ended December 31, 2023.

The Prior Peer Group consisted of Belden Inc., Apogee Enterprises, Inc., Atkore International Group, Inc., Patrick Industries, Inc., Gibraltar Industries, Inc., Nexans S.A., and Prysmian S.P.A. For the year ended December 31, 2023, the Company replaced Nexans S.A. and Prysmian S.P.A, changing its Peer Group to include Barnes Group Inc., Fluor Corporation, Freeport-McMoran Inc., Gates Industrial Corporation Plc, Griffon Corporation, Mueller Industries Inc., Resideo Technologies Inc., Rush Enterprises Inc., Sunrun Inc., and WESCO International Inc. The Company believes that

the updated Peer Group better reflects a broader group of peers with a more comparable median market capitalization who either sell building products or electrical components to the Company’s end-use customers or directly compete with the Company in certain product categories.

| | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, |

| Total Return For: | | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Encore Wire Corporation | | $ | 100.00 | | $ | 114.56 | | $ | 121.13 | | $ | 286.40 | | $ | 275.47 | | $ | 427.90 | |

| Russell 2000 Index | | 100.00 | | 125.52 | | 150.58 | | 172.90 | | 137.56 | | 160.85 | |

| Peer Group | | 100.00 | | 117.54 | | 186.44 | | 253.33 | | 233.11 | | 279.74 | |

| Prior Peer Group | | 100.00 | | 143.07 | | 182.78 | | 241.41 | | 232.86 | | 294.36 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Notes

(1)Data presented in the performance graph is complete through December 31, 2023.

(2)The Peer Group is self-determined and consists of the following companies: Barnes Group Inc., Fluor Corporation, Freeport-McMoran Inc., Gates Industrial Corporation Plc, Griffon Corporation, Mueller Industries Inc., Belden Inc., Patrick Industries, Inc., Apogee Enterprises, Inc., Gibraltar Industries, Inc., Atkore Inc., Resideo Technologies Inc., Rush Enterprises Inc., Sunrun Inc., and WESCO International Inc.

(3)The Prior Peer Group is self-determined and consists of the following companies: Belden Inc., Patrick Industries, Inc., Apogee Enterprises, Inc., Gibraltar Industries, Inc., Atkore Inc., Nexans S.A., and

Prysmian S.P.A. The performance graph presented in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 16, 2023, consisted of this peer group.

(4)Each peer group index uses only the peer group’s performance and excludes the performance of the Company. Each peer group index uses beginning of period market capitalization weighting.

(5)Each data line represents annual index levels derived from compounded daily returns that include all dividends.

(6)The index level for all data lines was set to $100.00 on December 31, 2018.

Item 6. [Reserved].

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

The following management’s discussion and analysis is intended to provide a better understanding of key factors, drivers and risks regarding the Company and the building wire industry.

Executive Overview

Encore Wire sells a commodity product in a highly competitive market. Management believes that the historical strength of the Company’s growth and earnings is in large part attributable to the following main factors:

•industry-leading order fill rates and responsive customer service;

•single-site, vertically integrated business model;

•deep supplier relationships for key raw materials;

•product innovations and product line expansions based on listening to and understanding customer needs and market trends;

•low cost manufacturing operations, resulting from a state-of-the-art manufacturing complex;

•low distribution and freight costs due in large part to the “one campus” business model;

•a focused management team leading a skilled work force; and

•a team of experienced independent manufacturers’ representatives with strong customer relationships across the United States.

These factors, and others, have allowed Encore Wire to grow from a startup in 1989 to what management believes is one of the largest electric building wire companies in the United States of America. Encore has built a loyal following of customers throughout the United States. These customers have developed a brand preference for Encore Wire in a commodity product line due to the reasons noted above, among others. The Company prides itself on striving to grow sales by expanding its product offerings where profit margins are acceptable. Senior management monitors gross margins daily, frequently extending down to the individual order level. Management strongly believes that this “hands-on” focused approach to the building wire business has been an important factor in the Company's success, and will lead to continued success.

Investment in residential, commercial, and industrial infrastructure drives demand for the Company’s wire and cable products. In 2023, pounds shipped increased 6.7% in copper wire versus 2022. In 2022, pounds shipped increased 7.9% in copper wire versus 2021. In 2021, pounds shipped increased 10.8% in copper wire versus 2020.

General

The Company’s operating results are driven by several key factors, including the volume of product produced and shipped, the cost of copper and other raw materials, the competitive pricing environment in the wire industry and the

resulting influence on gross margins, and the efficiency with which the Company’s plants operate during the period, among others. Price competition for electrical wire and cable is significant and the Company sells its products in accordance with prevailing market prices. Copper, a commodity product, is the principal raw material used by the Company in manufacturing its products. The price of copper fluctuates, depending on general economic conditions, in relation to supply and demand, and other factors, which causes monthly variations in the cost of copper purchased by the Company. Additionally, the SEC allows shares of physically backed copper exchange traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like it hold copper cathode as collateral against their shares. The acquisition of copper cathode by Copper ETFs may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase the Company’s cost of copper. In addition to rising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased price volatility for copper. The Company cannot predict copper prices in the future or the effect of fluctuations in the cost of copper on the Company’s future operating results. Wire prices can, and frequently do change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. Historically, the cost of aluminum has been much lower and less volatile than copper. The tables below highlight the range of closing prices of copper on the COMEX exchange for the periods shown.

COMEX COPPER CLOSING PRICE 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| October

2023 | | November

2023 | | December

2023 | | Quarter Ended

Dec. 31, 2023 | | Year-to-Date

Dec. 31, 2023 |

| High | $ | 3.65 | | | $ | 3.83 | | | $ | 3.94 | | | $ | 3.94 | | | $ | 4.27 | |

| Low | 3.54 | | | 3.58 | | | 3.72 | | | 3.54 | | | 3.54 | |

| Average | 3.60 | | | 3.72 | | | 3.85 | | | 3.72 | | | 3.85 | |

COMEX COPPER CLOSING PRICE 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | October

2022 | | November

2022 | | December

2022 | | Quarter Ended

Dec. 31, 2022 | | Year-to-Date

Dec. 31, 2022 |

| High | $ | 3.63 | | | $ | 3.95 | | | $ | 3.88 | | | $ | 3.95 | | | $ | 4.93 | |

| Low | 3.36 | | | 3.46 | | | 3.75 | | | 3.36 | | | 3.21 | |

| Average | 3.47 | | | 3.68 | | | 3.82 | | | 3.66 | | | 4.00 | |

COMEX COPPER CLOSING PRICE 2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| October

2021 | | November

2021 | | December

2021 | | Quarter Ended

Dec. 31, 2021 | | Year-to-Date

Dec. 31, 2021 |

| High | $ | 4.76 | | | $ | 4.46 | | | $ | 4.47 | | | $ | 4.76 | | | $ | 4.78 | |

| Low | 4.16 | | | 4.27 | | | 4.18 | | | 4.16 | | | 3.54 | |

| Average | 4.45 | | | 4.37 | | | 4.33 | | | 4.38 | | | 4.25 | |

COMEX COPPER CLOSING PRICE 2023 by Quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

March 31, 2023 | | Quarter Ended

June 30, 2023 | | Quarter Ended

Sept. 30, 2023 | | Quarter Ended

Dec. 31, 2023 | | Year-to-Date

Dec. 31, 2023 |

| High | $ | 4.27 | | | $ | 4.12 | | | $ | 3.99 | | | $ | 3.94 | | | $ | 4.27 | |

| Low | 3.74 | | | 3.55 | | | 3.63 | | | 3.54 | | | 3.54 | |

| Average | 4.08 | | | 3.84 | | | 3.77 | | | 3.72 | | | 3.85 | |

COMEX COPPER CLOSING PRICE 2022 by Quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

March 31, 2022 | | Quarter Ended

June 30, 2022 | | Quarter Ended

Sept. 30, 2022 | | Quarter Ended

Dec. 31, 2022 | | Year-to-Date

Dec. 31, 2022 |

| High | $ | 4.93 | | | $ | 4.80 | | | $ | 3.71 | | | $ | 3.95 | | | $ | 4.93 | |

| Low | 4.30 | | | 3.71 | | | 3.21 | | | 3.36 | | | 3.21 | |

| Average | 4.55 | | | 4.33 | | | 3.50 | | | 3.66 | | | 4.00 | |

Results of Operations

The following table presents certain items of income and expense as a percentage of net sales for the periods indicated. | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | 2022 | | 2021 |

| Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of goods sold: | | | | | |

| Copper | 52.2 | % | | 44.0 | % | | 46.7 | % |

| Other raw materials | 12.5 | % | | 12.0 | % | | 10.5 | % |

| Depreciation | 1.2 | % | | 0.8 | % | | 0.8 | % |

| Labor and overhead | 8.7 | % | | 6.9 | % | | 6.6 | % |

| LIFO adjustment | (0.1) | % | | (0.6) | % | | 1.9 | % |

| | | | | |

| Total cost of goods sold | 74.5 | % | | 63.1 | % | | 66.5 | % |

| | | | | |

| Gross profit | 25.5 | % | | 36.9 | % | | 33.5 | % |

| Selling, general and administrative expenses | 7.9 | % | | 6.5 | % | | 6.5 | % |

| Operating income | 17.6 | % | | 30.4 | % | | 27.0 | % |

| Net interest and other income | 1.3 | % | | 0.3 | % | | — | % |

| | | | | |

| Income before income taxes | 18.9 | % | | 30.7 | % | | 27.0 | % |

| Provision for income taxes | 4.4 | % | | 6.9 | % | | 6.1 | % |

| | | | | |

| Net income | 14.5 | % | | 23.8 | % | | 20.9 | % |

The following discussions and analyses relate to factors that have affected the operating results of the Company for the years ended December 31, 2023, 2022 and 2021. Reference should also be made to the Financial Statements and the related notes included under “Item 8. Financial Statements and Supplementary Data” of this Annual Report. Additional information about results for year end 2021 and certain year-on-year comparisons between 2022 and 2021 can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Net sales for the twelve months ended December 31, 2023 were $2.568 billion compared to $3.018 billion during the same period in 2022 and $2.593 billion during the same period in 2021. Copper unit volume, measured in pounds of copper contained in the wire sold, increased 6.7% in the year ended December 31, 2023 versus the year ended December 31, 2022. The 14.9% decrease in net sales dollars in 2023 versus 2022 was primarily the result of a 12.3% decrease in copper wire sales, driven by a 17.8% decrease in the average selling price of copper wire, partially offset by a 6.7% increase in copper wire pounds shipped. Additionally, aluminum net sales represented 12.9% of net sales for the year ended December 31, 2023 compared to 15.4% for the year ended December 31, 2022. The 16.4% increase in net sales dollars in 2022 versus 2021 was primarily the result of a 7.4% increase in copper wire sales, driven by a 7.9% increase in copper wire pounds shipped, partially offset by a 0.5% decrease in the average selling price of copper wire due to moderate decreases in copper commodity prices in the trailing six months of 2022.

Cost of goods sold was $1.912 billion, or 74.5% of net sales, in 2023 versus $1.905 billion, or 63.1% of net sales, in 2022 and $1.725 billion, or 66.5% of net sales in 2021. Gross profit decreased to $655.9 million, or 25.5% of net sales in 2023, compared to $1.112 billion, or 36.9% of net sales, in 2022 and $867.7 million, or 33.5% of net sales, in 2021.

Gross profit percentage for the twelve months ended December 31, 2023 was 25.5% compared to 36.9% during the same period in 2022 and 33.5% during the same period in 2021. The average selling price of wire per copper pound sold decreased 17.8% in the twelve months ended December 31, 2023 versus the twelve months ended December 31, 2022, while the average cost of copper per pound purchased decreased 3.7%. The overall increase in total volumes shipped, offset by an anticipated decrease in the average sales price during 2023, resulted in the decreased gross profit margin for the full year of 2023 when compared to 2022. The average selling price of wire per copper pound sold decreased 0.5% in the twelve months ended December 31, 2022 versus the twelve months ended December 31, 2021, while the average cost of copper per pound purchased decreased 2.7%.

Net income for the twelve months ended December 31, 2023 was $372.4 million versus $717.8 million in the same period in 2022 and $541.4 million in the same period in 2021. Fully diluted net earnings per common share were $21.62 in the twelve months ended December 31, 2023 versus $36.91 in the same period in 2022 and $26.22 in the same period in 2021.

Inventories consist of the following at December 31 (in thousands): | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 | | 2021 |

| Raw materials | $ | 64,512 | | | $ | 69,567 | | | $ | 54,012 | |

| Work-in-process | 55,921 | | | 42,611 | | | 40,422 | |

| Finished goods | 139,348 | | | 138,943 | | | 123,401 | |

| Total | 259,781 | | | 251,121 | | | 217,835 | |

| Adjust to LIFO cost | (96,102) | | | (97,934) | | | (117,019) | |

| | | | | |

| Inventory | $ | 163,679 | | | $ | 153,187 | | | $ | 100,816 | |

The quantity of total copper inventory on hand in 2023 was consistent with our quantity of total copper inventory on hand in 2022. The other materials category, which includes a large number of raw materials, had quantity and price changes that included increases and decreases in various other materials. This resulted in a last-in, first-out (LIFO) method adjustment decreasing cost of sales by $1.8 million in 2023. We utilize the LIFO method because it results in a better matching of costs and revenues.

The quantity of total copper inventory on hand increased in 2022, compared to 2021. The other materials category, which includes a large number of raw materials, had quantity changes that included increases and decreases in various other materials. This resulted in a LIFO method adjustment decreasing cost of sales by $19.1 million in 2022.

Based on copper and other raw material prices, there were no lower of cost or market (LCM) adjustments necessary in the periods presented above.

Gross profit was $655.9 million, or 25.5% of net sales, in 2023 compared to $1.112 billion, or 36.9% of net sales, in 2022 and $867.7 million, or 33.5% of net sales, in 2021. The changes in gross profit were due to the factors discussed above.

Selling expenses, which are made up of freight and sales commissions, were $115.2 million in 2023, $133.7 million in 2022 and $109.5 million in 2021. Freight costs decreased in 2023 as a result of a decrease in overall freight rates compared to 2022. In 2022, freight costs increased as a result of increased sales volumes and an increase in overall freight rates, as compared to 2021. Commission costs decreased commensurate with the sales dollar decrease. As a percentage of net sales, selling expenses were 4.5% in 2023, 4.4% in 2022, and 4.2% in 2021. General and administrative expenses were $90.6 million in 2023, $63.7 million in 2022 and $57.6 million in 2021. As a percentage of net sales, general and administrative expenses were 3.5% in 2023 versus 2.1% in 2022 and 2.2% in 2021. Accounts receivable write-offs were $45 thousand in 2023 and zero in 2022 and 2021. The Company decreased the reserve for credit losses in 2023 by $1.3 million, did not record a reserve for credit losses in 2022, and increased the reserve by $1.5 million in 2021.

Net interest and other income was $33.3 million in 2023, $9.8 million in 2022 and $0.2 million in 2021. Both the increase in 2023 and 2022 reflect the economic impact of the pandemic and its effect on interest rates during the years and the resulting interest earned.

Our effective tax rate was 23.2% in 2023, 22.4% in 2022 and 22.6% in 2021. The differences between the provisions for income taxes and the income taxes computed using the federal income tax statutory rate are primarily due to state taxes and non-deductible expenses.

As a result of the foregoing factors, the Company’s net income was $372.4 million in 2023, $717.8 million in 2022 and $541.4 million in 2021.

Liquidity and Capital Resources

The following table summarizes the Company’s cash flow activities (in thousands): | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | 2021 |

| Net cash provided by operating activities | $ | 455,206 | | | $ | 688,883 | | | $ | 418,418 | |

| Net cash used in investing activities | (164,535) | | | (148,350) | | | (118,155) | |

| Net cash used in financing activities | (460,593) | | | (248,966) | | | (44,396) | |

| Net increase in cash and cash equivalents | $ | (169,922) | | | $ | 291,567 | | | $ | 255,867 | |

| Annual dividends paid | $ | 1,376 | | | $ | 1,548 | | | $ | 1,633 | |