0001581068false00015810682023-10-302023-10-300001581068brx:BrixmorOperatingPartnershipLPMember2023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 30, 2023

Brixmor Property Group Inc.

Brixmor Operating Partnership LP

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-36160 | | 45-2433192 |

| Delaware | | 333-256637-01 | | 80-0831163 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

450 Lexington Avenue

New York, New York 10017

(Address of Principal Executive Offices, and Zip Code)

(212) 869-3000

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

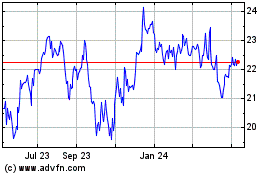

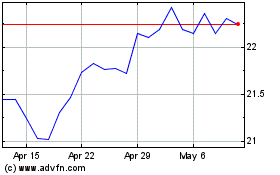

| Common Stock, par value $0.01 per share | BRX | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Brixmor Property Group Inc. Yes ☐ No ☑ Brixmor Operating Partnership LP Yes ☐ No ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Brixmor Property Group Inc. ☐ Brixmor Operating Partnership LP ☐

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2023, Brixmor Property Group Inc. (the “Company”) issued a press release announcing its financial results and Supplemental Disclosure pertaining to its operations for the third quarter ended September 30, 2023. The press release is furnished as Exhibit 99.1 to this Report and the Supplemental Disclosure is furnished as Exhibit 99.2 to this Report.

As provided in General Instruction B.2 of Form 8-K, the information in this Item 2.02 and Exhibits 99.1 and 99.2 to this Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibits are attached to this Current Report on Form 8-K

| | | | | | | | |

| | Press release issued October 30, 2023. |

| | |

| | Brixmor Property Group Inc. Supplemental Financial Information for the third quarter ended September 30, 2023. |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| | |

Date: October 30, 2023 | BRIXMOR PROPERTY GROUP INC. |

| | |

| By: | /s/ Steven F. Siegel |

| Name: | Steven F. Siegel |

| Title: | Executive Vice President, |

| | General Counsel and Secretary |

| | |

| BRIXMOR OPERATING PARTNERSHIP LP |

| | |

| By: | Brixmor OP GP LLC, its general partner |

| | |

| By: | BPG Subsidiary LLC, its sole member |

| | |

| By: | /s/ Steven F. Siegel |

| Name: | Steven F. Siegel |

| Title: | Executive Vice President, |

| | General Counsel and Secretary |

Exhibit 99.1

450 Lexington Avenue : New York, NY 10017 : 800.468.7526

FOR IMMEDIATE RELEASE

CONTACT:

Stacy Slater

Senior Vice President, Investor Relations

800.468.7526

stacy.slater@brixmor.com

BRIXMOR PROPERTY GROUP REPORTS THIRD QUARTER 2023 RESULTS

NEW YORK, OCTOBER 30, 2023 - Brixmor Property Group Inc. (NYSE: BRX) (“Brixmor” or the “Company”) announced today its operating results for the three and nine months ended September 30, 2023. For the three months ended September 30, 2023 and 2022, net income was $0.21 per diluted share and $0.26 per diluted share, respectively.

Key highlights for the three months ended September 30, 2023 include:

•Executed 1.7 million square feet of new and renewal leases, with rent spreads on comparable space of 22.3%, including 0.8 million square

feet of new leases, with rent spreads on comparable space of 52.7%

•Realized total leased occupancy of 93.9%, anchor leased occupancy of 95.7%, and record small shop leased occupancy of 89.8%

◦Leased to billed occupancy spread totaled 390 basis points

◦Total signed but not yet commenced lease population represented 2.8 million square feet and a record $62.1 million of annualized base rent

•Reported an increase in same property NOI of 4.8%, including a contribution from base rent of 400 basis points

•Reported Nareit FFO of $152.2 million, or $0.50 per diluted share

•Stabilized $18.5 million of reinvestment projects at an average incremental NOI yield of 8%, with the in process reinvestment pipeline totaling $490.7 million at an expected average incremental NOI yield of 9%

•Completed $17.0 million of dispositions

•Promoted Angela M. Aman to President, Chief Financial Officer and Treasurer from Executive Vice President, Chief Financial Officer and Treasurer and Brian T. Finnegan to Senior Executive Vice President and Chief Operating Officer from Executive Vice President, Chief Revenue Officer

•Appointed John Peter ("JP") Suarez, retired Executive Vice President, Regional Chief Executive Officer and Chief Administration Officer, Walmart International, to the Company’s board of directors

•Published the Company's annual Corporate Responsibility Report on July 5, 2023 (view the 2022 report at https://www.brixmor.com/corporate-responsibility)

Subsequent events:

•Increased quarterly dividend by 4.8% to $0.2725 per common share, which represents an annualized yield of approximately 5.5% as of October 27, 2023

•Updated previously provided NAREIT FFO per diluted share expectations for 2023 to $2.02 - $2.04 from $1.99 - $2.04 and same property NOI growth expectations for 2023 to 3.5% - 4.0% from 2.5% - 3.5%

“We are very pleased to report another quarter of outperformance across all fronts,” commented James Taylor, CEO. “It’s a quarter that once again demonstrates the cumulative effects and momentum of our transformative, value-added business plan, the compelling returns and growth in cash flows that our plan continues to produce, the durability of demand from vibrant retailers to be in our centers, and, most importantly, the strength of our team.”

450 Lexington Avenue : New York, NY 10017 : 800.468.7526 FINANCIAL HIGHLIGHTS

Net Income

•For the three months ended September 30, 2023 and 2022, net income was $63.7 million, or $0.21 per diluted share, and $79.7 million, or $0.26 per diluted share, respectively.

•For the nine months ended September 30, 2023 and 2022, net income was $232.4 million, or $0.77 per diluted share, and $247.0 million, or $0.82 per diluted share, respectively.

Nareit FFO

•For the three months ended September 30, 2023 and 2022, Nareit FFO was $152.2 million, or $0.50 per diluted share, and $147.7 million, or $0.49 per diluted share, respectively. Results for the three months ended September 30, 2023 and 2022 include items that impact FFO comparability, including transaction expenses, net, litigation and other non-routine legal expenses, and gain (loss) on extinguishment of debt, net, of $(0.1) million, or $(0.00) per diluted share, and $(0.4) million, or $(0.00) per diluted share, respectively.

•For the nine months ended September 30, 2023 and 2022, Nareit FFO was $460.9 million, or $1.52 per diluted share, and $442.0 million, or $1.47 per diluted share, respectively. Results for the nine months ended September 30, 2023 and 2022 include items that impact FFO comparability, including transaction expenses, net, litigation and other non-routine legal expenses, and gain (loss) on extinguishment of debt, net, of $4.2 million, or $0.01 per diluted share, and $(1.8) million, or $(0.01) per diluted share, respectively.

Same Property NOI Performance

•For the three months ended September 30, 2023, the Company reported an increase in same property NOI of 4.8% versus the comparable 2022 period.

•For the nine months ended September 30, 2023, the Company reported an increase in same property NOI of 4.2% versus the comparable 2022 period.

Dividend

•The Company’s Board of Directors declared a quarterly cash dividend of $0.2725 per common share (equivalent to $1.09 per annum) for the fourth quarter of 2023, which represents a 4.8% increase.

•The dividend is payable on January 16, 2024 to stockholders of record on January 3, 2024, representing an ex-dividend date of January 2, 2024.

PORTFOLIO AND INVESTMENT ACTIVITY

Value Enhancing Reinvestment Opportunities

•During the three months ended September 30, 2023, the Company stabilized four value enhancing reinvestment projects with a total aggregate net cost of approximately $18.5 million at an average incremental NOI yield of 8% and added ten new reinvestment projects to its in process pipeline. Projects added include eight anchor space repositioning projects and two outparcel development projects, with a total aggregate net estimated cost of approximately $39.5 million at an expected average incremental NOI yield of 9%.

•At September 30, 2023, the value enhancing reinvestment in process pipeline was comprised of 55 projects with an aggregate net estimated cost of approximately $490.7 million at an expected average incremental NOI yield of 9%. The in process pipeline includes 24 anchor space repositioning projects with an aggregate net estimated cost of approximately $109.8 million at an expected incremental NOI yield of 7% - 14%; ten outparcel development projects with an aggregate net estimated cost of approximately $21.7 million at an expected average incremental NOI yield of 10%; and 21 redevelopment projects with an aggregate net estimated cost of approximately $359.2 million at an expected average incremental NOI yield of 8%.

450 Lexington Avenue : New York, NY 10017 : 800.468.7526 •An in-depth review of an in process redevelopment project, which highlights the Company's reinvestment capabilities, Shops at Palm Lakes (Miami-Fort Lauderdale-Pompano Beach, FL CBSA), can be found at this link: https://www.brixmor.com/blog/shops-at-palm-lakes-redev.

•Follow Brixmor on LinkedIn for video updates on reinvestment projects at https://www.linkedin.com/company/brixmor.

Acquisitions

•During the three months ended September 30, 2023, the Company did not complete any acquisitions.

•During the nine months ended September 30, 2023, the Company terminated a ground lease and acquired the associated land parcel at an existing center for $1.8 million.

Dispositions

•During the three months ended September 30, 2023, the Company generated approximately $17.0 million of gross proceeds on the disposition of one shopping center, as well as one partial property, comprised of 0.1 million square feet of gross leasable area.

•During the nine months ended September 30, 2023, the Company generated approximately $168.3 million of gross proceeds on the disposition of nine shopping centers, as well as eight partial properties, comprised of 1.3 million square feet of gross leasable area.

CAPITAL STRUCTURE

•At September 30, 2023, the Company had $1.3 billion in liquidity and no debt maturities until June 2024.

•The Company's net principal debt to adjusted EBITDA was 6.1x.

GUIDANCE

•The Company has updated its previously provided NAREIT FFO per diluted share expectations for 2023 to $2.02 - $2.04 from $1.99 - $2.04 and same property NOI growth expectations for 2023 to 3.5% - 4.0% from 2.5% - 3.5%.

•Expectations for 2023 Nareit FFO:

◦Do not contemplate any additional tenants moving to or from a cash basis of accounting, either of which may result in significant volatility in straight-line rental income

◦Do not include any additional items that impact FFO comparability, including transaction expenses, net, litigation and other non-routine legal expenses, and gain or loss on future extinguishment of debt or any one-time items

•The following table provides a reconciliation of the range of the Company's 2023 estimated net income to Nareit FFO:

| | | | | | | | | | | | | | |

| (Unaudited, dollars in millions, except per share amounts) | | 2023E | | 2023E Per Diluted Share |

| Net income | | $294 - $300 | | $0.98 - $1.00 |

| Depreciation and amortization related to real estate | | 357 | | 1.18 |

| Gain on sale of real estate assets | | (59) | | (0.20) |

| Impairment of real estate assets | | 18 | | 0.06 |

| Nareit FFO | | $610 - $616 | | $2.02 - $2.04 |

450 Lexington Avenue : New York, NY 10017 : 800.468.7526 CONNECT WITH BRIXMOR

•For additional information, please visit https://www.brixmor.com;

•Follow Brixmor on:

◦LinkedIn at https://www.linkedin.com/company/brixmor

◦Facebook at https://www.facebook.com/Brixmor

◦Instagram at https://www.instagram.com/brixmorpropertygroup; and

◦YouTube at https://www.youtube.com/user/Brixmor.

CONFERENCE CALL AND SUPPLEMENTAL INFORMATION

The Company will host a teleconference on Tuesday, October 31, 2023 at 10:00 AM ET. To participate, please dial 877.704.4453 (domestic) or 201.389.0920 (international) within 15 minutes of the scheduled start of the call. The teleconference can also be accessed via a live webcast at https://www.brixmor.com in the Investors section. A replay of the teleconference will be available through midnight ET on November 14, 2023 by dialing 844.512.2921 (domestic) or 412.317.6671 (international) (Passcode:13740606) or via the web through October 31, 2024 at https://www.brixmor.com in the Investors section.

The Company’s Supplemental Disclosure will be posted at https://www.brixmor.com in the Investors section. These materials are also available to all interested parties upon request to the Company at investorrelations@brixmor.com or 800.468.7526.

NON-GAAP PERFORMANCE MEASURES

The Company presents the non-GAAP performance measures set forth below. These measures should not be considered as alternatives to, or more meaningful than, net income (calculated in accordance with GAAP) or other GAAP financial measures, as an indicator of financial performance and are not alternatives to, or more meaningful than, cash flow from operating activities (calculated in accordance with GAAP) as a measure of liquidity. Non-GAAP performance measures have limitations as they do not include all items of income and expense that affect operations, and accordingly, should always be considered as supplemental financial results to those calculated in accordance with GAAP. The Company’s computation of these non-GAAP performance measures may differ in certain respects from the methodology utilized by other REITs and, therefore, may not be comparable to similarly titled measures presented by such other REITs. Investors are cautioned that items excluded from these non-GAAP performance measures are relevant to understanding and addressing financial performance. A reconciliation of net income to these non-GAAP performance measures is presented in the attached tables.

Nareit FFO

Nareit FFO is a supplemental, non-GAAP performance measure utilized to evaluate the operating and financial performance of real estate companies. Nareit defines FFO as net income (loss), calculated in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains and losses from the sale of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated joint ventures calculated to reflect FFO on the same basis. Considering the nature of its business as a real estate owner and operator, the Company believes that Nareit FFO is useful to investors in measuring its operating and financial performance because the definition excludes items included in net income that do not relate to or are not indicative of the Company’s operating and financial performance, such as depreciation and amortization related to real estate, and items which can make periodic and peer analyses of operating and financial performance more difficult, such as gains and losses from the sale of certain real estate assets and impairment write-downs of certain real estate assets.

450 Lexington Avenue : New York, NY 10017 : 800.468.7526 Same Property NOI

Same property NOI is a supplemental, non-GAAP performance measure utilized to evaluate the operating performance of real estate companies. Same property NOI is calculated (using properties owned for the entirety of both periods and excluding properties under development and completed new development properties that have been stabilized for less than one year) as total property revenues (base rent, expense reimbursements, adjustments for revenues deemed uncollectible, ancillary and other rental income, percentage rents, and other revenues) less direct property operating expenses (operating costs and real estate taxes). Same property NOI excludes (i) lease termination fees, (ii) straight-line rental income, net, (iii) accretion of below-market leases, net of amortization of above-market leases and tenant inducements, (iv) straight-line ground rent expense, net, (v) income or expense associated with the Company's captive insurance company, (vi) depreciation and amortization, (vii) impairment of real estate assets, (viii) general and administrative expense, and (ix) other income and expense (including interest expense and gain on sale of real estate assets). Considering the nature of its business as a real estate owner and operator, the Company believes that NOI is useful to investors in measuring the operating performance of its portfolio because the definition excludes various items included in net income that do not relate to, or are not indicative of, the operating performance of the Company’s properties, such as lease termination fees, straight-line rental income, net, income or expense associated with the Company’s captive insurance company, accretion of below-market leases, net of amortization of above-market leases and tenant inducements, straight-line ground rent expense, net, depreciation and amortization, impairment of real estate assets, general and administrative expense, and other income and expense (including interest expense and gain on sale of real estate assets). The Company believes that same property NOI is also useful to investors because it further eliminates disparities in NOI by only including NOI of properties owned for the entirety of both periods presented and excluding properties under development and completed new development properties that have been stabilized for less than one year and therefore provides a more consistent metric for comparing the operating performance of the Company's real estate between periods.

ABOUT BRIXMOR PROPERTY GROUP

Brixmor (NYSE: BRX) is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers. Its 364 retail centers comprise approximately 65 million square feet of prime retail space in established trade areas. The Company strives to own and operate shopping centers that reflect Brixmor’s vision “to be the center of the communities we serve” and are home to a diverse mix of thriving national, regional and local retailers. Brixmor is a proud real estate partner to over 5,000 retailers including The TJX Companies, The Kroger Co., Publix Super Markets and Ross Stores.

Brixmor announces material information to its investors in SEC filings and press releases and on public conference calls, webcasts and the “Investors” page of its website at https://www.brixmor.com. The Company also uses social media to communicate with its investors and the public, and the information Brixmor posts on social media may be deemed material information. Therefore, Brixmor encourages investors and others interested in the Company to review the information that it posts on its website and on its social media channels.

SAFE HARBOR LANGUAGE

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in our Form 10-K for the year ended December 31, 2022 and in this report, as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at https://www.sec.gov. These factors include (1) changes in national, regional, and local economies, due to

450 Lexington Avenue : New York, NY 10017 : 800.468.7526 global events such as international military conflicts, international trade disputes, a foreign debt crisis, foreign currency volatility, or due to domestic issues, such as government policies and regulations, tariffs, energy prices, market dynamics, general economic contractions, rising interest rates, inflation, unemployment, or limited growth in consumer income or spending; (2) local real estate market conditions, including an oversupply of space in, or a reduction in demand for, properties similar to those in our Portfolio (defined hereafter); (3) competition from other available properties and e-commerce; (4) disruption and/or consolidation in the retail sector, the financial stability of our tenants, and the overall financial condition of large retailing companies, including their ability to pay rent and/or expense reimbursements that are due to us; (5) in the case of percentage rents, the sales volumes of our tenants; (6) increases in property operating expenses, including common area expenses, utilities, insurance, and real estate taxes, which are relatively inflexible and generally do not decrease if revenue or occupancy decrease; (7) increases in the costs to repair, renovate, and re-lease space; (8) earthquakes, wildfires, tornadoes, hurricanes, damage from rising sea levels due to climate change, other natural disasters, epidemics and/or pandemics, civil unrest, terrorist acts, or acts of war, any of which may result in uninsured or underinsured losses; and (9) changes in laws and governmental regulations, including those governing usage, zoning, the environment, and taxes. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other periodic filings. The forward-looking statements speak only as of the date of this report, and we expressly disclaim any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except to the extent otherwise required by law.

###

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | | |

Unaudited, dollars in thousands, except share information | | | |

| | | | | | | |

| | | | | As of | | As of |

| | | | | 9/30/23 | | 12/31/22 |

| Assets | | | |

| | Real estate | | | |

| | | Land | $ | 1,795,807 | | | $ | 1,820,358 | |

| | | Buildings and tenant improvements | 8,455,194 | | | 8,405,969 | |

| | | Construction in progress | 161,549 | | | 129,310 | |

| | | Lease intangibles | 511,881 | | | 542,714 | |

| | | | | 10,924,431 | | | 10,898,351 | |

| | | Accumulated depreciation and amortization | (3,131,183) | | | (2,996,759) | |

| | Real estate, net | 7,793,248 | | | 7,901,592 | |

| | Cash and cash equivalents | 861 | | | 16,492 | |

| | Restricted cash | 17,822 | | | 4,767 | |

| | Marketable securities | 20,609 | | | 21,669 | |

| | Receivables, net | 262,774 | | | 264,146 | |

| | Deferred charges and prepaid expenses, net | 167,997 | | | 154,141 | |

| | Real estate assets held for sale | 10,013 | | | 10,439 | |

| | Other assets | 62,566 | | | 62,684 | |

| Total assets | $ | 8,335,890 | | | $ | 8,435,930 | |

| | | | | | | |

| Liabilities | | | |

| | Debt obligations, net | $ | 4,919,157 | | | $ | 5,035,501 | |

| | Accounts payable, accrued expenses and other liabilities | 548,353 | | | 535,419 | |

| Total liabilities | 5,467,510 | | | 5,570,920 | |

| | | | | | | |

| Equity | | | |

| | Common stock, $0.01 par value; authorized 3,000,000,000 shares; | | | |

| | | 309,723,386 and 309,042,754 shares issued and 300,596,394 and 299,915,762 | | | |

| | | shares outstanding | 3,006 | | | 2,999 | |

| | Additional paid-in capital | 3,303,935 | | | 3,299,496 | |

| | Accumulated other comprehensive income | 12,192 | | | 8,851 | |

| | Distributions in excess of net income | (450,753) | | | (446,336) | |

| Total equity | 2,868,380 | | | 2,865,010 | |

| Total liabilities and equity | $ | 8,335,890 | | | $ | 8,435,930 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| Unaudited, dollars in thousands, except per share amounts | | | | | | |

| | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Revenues | | | | | | | |

| | Rental income | $ | 307,118 | | | $ | 304,643 | | | $ | 927,440 | | | $ | 908,903 | |

| | Other revenues | 196 | | | 102 | | | 1,111 | | | 602 | |

| Total revenues | 307,314 | | | 304,745 | | | 928,551 | | | 909,505 | |

| | | | | | | | | |

| Operating expenses | | | | | | | |

| | Operating costs | 35,058 | | | 33,299 | | | 106,658 | | | 102,592 | |

| | Real estate taxes | 42,156 | | | 44,179 | | | 130,556 | | | 128,123 | |

| | Depreciation and amortization | 96,254 | | | 84,773 | | | 272,807 | | | 254,132 | |

| | Impairment of real estate assets | — | | | — | | | 17,836 | | | 4,597 | |

| | General and administrative | 29,182 | | | 29,094 | | | 86,868 | | | 86,796 | |

| Total operating expenses | 202,650 | | | 191,345 | | | 614,725 | | | 576,240 | |

| | | | | | | | | |

| Other income (expense) | | | | | | | |

| | Dividends and interest | 273 | | | 88 | | | 345 | | | 198 | |

| | Interest expense | (47,364) | | | (48,726) | | | (143,529) | | | (143,934) | |

| | Gain on sale of real estate assets | 6,712 | | | 15,768 | | | 59,037 | | | 60,667 | |

| | Gain (loss) on extinguishment of debt, net | 6 | | | — | | | 4,356 | | | (221) | |

| | Other | (555) | | | (789) | | | (1,645) | | | (2,937) | |

| Total other income (expense) | (40,928) | | | (33,659) | | | (81,436) | | | (86,227) | |

| | | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | $ | 232,390 | | | $ | 247,038 | |

| | | | | | | | | |

| Net income per common share: | | | | | | | |

| | Basic | $ | 0.21 | | | $ | 0.26 | | | $ | 0.77 | | | $ | 0.82 | |

| | Diluted | $ | 0.21 | | | $ | 0.26 | | | $ | 0.77 | | | $ | 0.82 | |

| Weighted average shares: | | | | | | | |

| | Basic | 301,007 | | | 300,213 | | | 300,955 | | | 299,626 | |

| | Diluted | 302,511 | | | 301,341 | | | 302,447 | | | 300,784 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FUNDS FROM OPERATIONS (FFO) | | | | | |

| Unaudited, dollars in thousands, except per share amounts | | | | | | | |

| | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended | |

| | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 | |

| | | | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | $ | 232,390 | | | $ | 247,038 | | |

| | Depreciation and amortization related to real estate | 95,160 | | | 83,712 | | | 269,714 | | | 250,991 | | |

| | Gain on sale of real estate assets | (6,712) | | | (15,768) | | | (59,037) | | | (60,667) | | |

| | Impairment of real estate assets | — | | | — | | | 17,836 | | | 4,597 | | |

| Nareit FFO | $ | 152,184 | | | $ | 147,685 | | | $ | 460,903 | | | $ | 441,959 | | |

| | | | | | | | | | |

| Nareit FFO per diluted share | $ | 0.50 | | | $ | 0.49 | | | $ | 1.52 | | | $ | 1.47 | | |

| Weighted average diluted shares outstanding | 302,511 | | | 301,341 | | | 302,447 | | | 300,784 | | |

| | | | | | | | | | |

| Items that impact FFO comparability | | | | | | | | |

| | Transaction expenses, net | $ | (103) | | | $ | (250) | | | $ | (198) | | | $ | (1,131) | | |

| | Litigation and other non-routine legal expenses | — | | | (157) | | | — | | | (492) | | |

| | Gain (loss) on extinguishment of debt, net | 6 | | | — | | | 4,356 | | | (221) | | |

| Total items that impact FFO comparability | $ | (97) | | | $ | (407) | | | $ | 4,158 | | | $ | (1,844) | | |

| Items that impact FFO comparability, net per share | $ | (0.00) | | | $ | (0.00) | | | $ | 0.01 | | | $ | (0.01) | | |

| | | | | | | | | | |

| Additional Disclosures | | | | | | | | |

| | Straight-line rental income, net (1) | $ | 5,088 | | | $ | 6,393 | | | $ | 16,510 | | | $ | 17,883 | | |

| | Accretion of below-market leases, net of amortization of above-market leases and tenant inducements | 2,178 | | | 2,517 | | | 6,414 | | | 6,721 | | |

| | Straight-line ground rent expense, net (2) | 8 | | | (2) | | | 25 | | | (167) | | |

| | | | | | | | | | |

| Dividends declared per share | $ | 0.260 | | | $ | 0.240 | | | $ | 0.780 | | | $ | 0.720 | | |

| Dividends declared | $ | 78,155 | | | $ | 71,979 | | | $ | 234,451 | | | $ | 215,777 | | |

| Dividend payout ratio (as % of Nareit FFO) | 51.4 | % | | 48.7 | % | | 50.9 | % | | 48.8 | % | |

| | | | | | | | | | |

| (1) Includes straight-line rental income reversals and re-establishments of ($1.8 million) and less than $0.1 million during the three months ended September 30, 2023 and 2022, respectively. Includes straight-line rental income reversals and re-establishments of ($1.0 million) and ($0.1 million) during the nine months ended September 30, 2023 and 2022, respectively. |

| (2) Straight-line ground rent expense, net is included in Operating costs on the Consolidated Statements of Operations. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SAME PROPERTY NOI ANALYSIS | | | | | | |

| Unaudited, dollars in thousands | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | Three Months Ended | | | | Nine Months Ended | | |

| | | | 9/30/23 | | 9/30/22 | | Change | | 9/30/23 | | 9/30/22 | | Change |

| Same Property NOI Analysis | | | | | | | | | | | |

| Number of properties | 357 | | | 357 | | | — | | | 347 | | | 347 | | | — | |

| Percent billed | 90.0 | % | | 89.7 | % | | 0.3 | % | | 90.1 | % | | 89.8 | % | | 0.3 | % |

| Percent leased | 93.9 | % | | 93.4 | % | | 0.5 | % | | 93.8 | % | | 93.5 | % | | 0.3 | % |

| | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | |

| | Base rent | $ | 220,803 | | | $ | 212,295 | | | | | $ | 636,684 | | | $ | 607,404 | | | |

| | Expense reimbursements | 68,068 | | | 66,134 | | | | | 197,084 | | | 185,442 | | | |

| | Revenues deemed uncollectible | (503) | | | (682) | | | | | (3,357) | | | 6,294 | | | |

| | Ancillary and other rental income / Other revenues | 5,977 | | | 6,189 | | | | | 17,252 | | | 17,266 | | | |

| | Percentage rents | 1,495 | | | 1,243 | | | | | 7,181 | | | 7,011 | | | |

| | | | 295,840 | | | 285,179 | | | 3.7 | % | | 854,844 | | | 823,417 | | | 3.8 | % |

| Operating expenses | | | | | | | | | | | |

| | Operating costs | (33,983) | | | (32,287) | | | | | (100,391) | | | (95,061) | | | |

| | Real estate taxes | (41,705) | | | (42,885) | | | | | (119,086) | | | (118,506) | | | |

| | | | (75,688) | | | (75,172) | | | 0.7 | % | | (219,477) | | | (213,567) | | | 2.8 | % |

| Same property NOI | $ | 220,152 | | | $ | 210,007 | | | 4.8 | % | | $ | 635,367 | | | $ | 609,850 | | | 4.2 | % |

| | | | | | | | | | | | | | |

| NOI margin | 74.4 | % | | 73.6 | % | | | | 74.3 | % | | 74.1 | % | | |

| Expense recovery ratio | 89.9 | % | | 88.0 | % | | | | 89.8 | % | | 86.8 | % | | |

| | | | | | | | | | | | | | |

| Percent Contribution to Same Property NOI Performance: | | | | | | | | | | | |

| | | | Change | | Percent Contribution | | | | Change | | Percent Contribution | | |

| | Base rent | $ | 8,508 | | | 4.0 | % | | | | $ | 29,280 | | | 4.8 | % | | |

| | Revenues deemed uncollectible | 179 | | | 0.1 | % | | | | (9,651) | | | (1.6) | % | | |

| | Net expense reimbursements | 1,418 | | | 0.7 | % | | | | 5,732 | | | 1.0 | % | | |

| | Ancillary and other rental income / Other revenues | (212) | | | (0.1) | % | | | | (14) | | | 0.0 | % | | |

| | Percentage rents | 252 | | | 0.1 | % | | | | 170 | | | 0.0 | % | | |

| | | | | | 4.8 | % | | | | | | 4.2 | % | | |

| | | | | | | | | | | | | | |

| Reconciliation of Net Income to Same Property NOI | | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | | | $ | 232,390 | | | $ | 247,038 | | | |

| Adjustments: | | | | | | | | | | | |

| | Non-same property NOI | (1,740) | | | (7,658) | | | | | (29,142) | | | (41,749) | | | |

| | Lease termination fees | (934) | | | (694) | | | | | (3,879) | | | (2,754) | | | |

| | Straight-line rental income, net | (5,088) | | | (6,393) | | | | | (16,510) | | | (17,883) | | | |

| | Accretion of below-market leases, net of amortization of above-market leases and tenant inducements | (2,178) | | | (2,517) | | | | | (6,414) | | | (6,721) | | | |

| | Straight-line ground rent expense, net | (8) | | | 2 | | | | | (25) | | | 167 | | | |

| | Depreciation and amortization | 96,254 | | | 84,773 | | | | | 272,807 | | | 254,132 | | | |

| | Impairment of real estate assets | — | | | — | | | | | 17,836 | | | 4,597 | | | |

| | General and administrative | 29,182 | | | 29,094 | | | | | 86,868 | | | 86,796 | | | |

| | Total other (income) expense | 40,928 | | | 33,659 | | | | | 81,436 | | | 86,227 | | | |

| Same property NOI | $ | 220,152 | | | $ | 210,007 | | | | | $ | 635,367 | | | $ | 609,850 | | | |

| | | | | |

| |

| > | SUPPLEMENTAL DISCLOSURE |

| |

| |

| Three Months Ended September 30, 2023 |

| |

| | | | | | | | | | | | | | | | | |

| TABLE OF CONTENTS | | |

| | | | | |

| | | | Page | |

| | | | |

| | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Note: Financial and operational information is unaudited. | | |

| | | | | |

| For additional information, please visit https://www.brixmor.com; follow Brixmor on LinkedIn at https://www.linkedin.com/company/brixmor, Facebook at https://www.facebook.com/Brixmor, Instagram at https://www.instagram.com/brixmorpropertygroup, and Youtube at https://www.youtube.com/user/Brixmor. |

| | | | | |

| This Supplemental Disclosure may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to the Company’s expectations regarding the performance of its business, its financial results, its liquidity and capital resources and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including those described under the sections entitled “Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, as such factors may be updated from time to time in the Company's periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in the Company’s other periodic filings with the SEC. The forward looking statements speak only as of the date of this release, and the Company expressly disclaims any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except to the extent otherwise required by law. |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GLOSSARY OF TERMS | | | | | | |

| | | | | | | | | | | | |

| Term | | Definition | | | | | | | |

| | | | | | | | | | | | |

| Adjusted SOFR | | Secured Overnight Financing Rate, plus 0.10%. | |

| | | | | | | | | | | | |

| Anchor Spaces | | Spaces equal to or greater than 10,000 square feet ("SF") of GLA. | |

| | | | | | | | | | | | |

| Anchor Space Repositioning | | Anchor leasing that is primarily focused on reconfiguring or significantly remerchandising existing space with minimal work required outside of normal tenant improvement and landlord costs. | |

| | | | | | | | | | | | |

| Annualized Base Rent ("ABR") | | Contractual monthly base rent as of a specified date, under leases that have been signed or commenced as of the specified date, multiplied by 12. Annualized base rent differs from how rent is calculated in accordance with GAAP for purposes of financial statements. See Straight-line Rent definition for additional information. For purposes of calculating ABR, all signed or commenced leases with an initial term of one year or greater are included and all signed leases on space that will be vacated by existing tenants in the near term are excluded. | |

| | | | | | | | | |

| ABR PSF | | ABR divided by leased GLA, excluding the GLA of lessee-owned leasehold improvements. | |

| | | | | |

| Billed GLA | | Aggregate GLA of all commenced leases with an initial term of one year or greater, as of a specified date. | |

| | | | | |

| Core-Based Statistical Areas ("CBSA") | Defined by the United States Census Bureau as the collection of both Metropolitan and Micropolitan Statistical Areas. Metropolitan Statistical Areas are defined as a region associated with at least one urbanized area that has a population of at least 50,000 and comprises the central county or counties containing the core, plus adjacent outlying counties having a high degree of social and economic integration with the central county or counties as measured through commuting. Micropolitan Statistical Areas are defined as a region with at least one urbanized area that has a population of at least 10,000 but less than 50,000, plus adjacent territories that have a high degree of social and economic integration with the central county or counties as measured through commuting.

References to CBSA rank are based on population estimates from Synergos Technologies, Inc. | |

| | | | | | | | | | | | |

| EBITDA, EBITDAre, Adjusted EBITDA & Cash Adjusted EBITDA | Supplemental, non-GAAP performance measures. Please see below for more information on the limitations of non-GAAP performance measures. A reconciliation of net income to each of these measures is provided on page 7. EBITDA is calculated as the sum of net income (loss), calculated in accordance with GAAP, excluding (i) interest expense, (ii) federal and state taxes, and (iii) depreciation and amortization. EBITDAre, which is computed in accordance with Nareit's definition, represents EBITDA excluding (i) gains and losses from the sale of certain real estate assets, (ii) gains and losses from change in control, (iii) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Adjusted EBITDA represents EBITDAre excluding (i) gain (loss) on extinguishment of debt, net and (ii) other items that the Company believes are not indicative of the Company's operating performance. Cash Adjusted EBITDA represents Adjusted EBITDA excluding (i) straight-line rental income, net, (ii) accretion of below-market leases, net of amortization of above-market leases and tenant inducements and (iii) straight-line ground rent expense, net. EBITDA, EBITDAre, Adjusted EBITDA, and Cash Adjusted EBITDA are calculated after adjustments for unconsolidated joint ventures to reflect each measure on the same basis. | |

| | | | | | | | | | | | |

| Essential Tenants | | Businesses deemed necessary for day-to-day living, such as grocery, pharmacy, and general merchandise (discount) businesses. | |

| | | | | | | | | | | | |

| Generally Accepted Accounting Principals ("GAAP") | | GAAP refers to a common set of United States of America accounting rules, standards, and procedures issued by the Financial Accounting Standards Board. | |

| | | | | | | | | | | | |

| Gross Leasable Area ("GLA") | | Represents the total amount of leasable property square footage. | |

| | | | | | | | | | | | |

| Leased GLA | | Aggregate GLA of all signed or commenced leases with an initial term of one year or greater, as of a specified date, excluding all signed leases on space that will be vacated by existing tenants in the near term. | |

| | | | | | | | | | | | |

| Local Tenants | | Single-state operators with fewer than 20 locations. | |

| | | | | | | | | | | | |

| Major Tenants | | Any grocer and all national / regional anchor tenants. | |

| | | | | | | | | | | | |

| Nareit | | National Association of Real Estate Investment Trusts. | |

| | | | | | | | | | | | |

| Nareit Funds From Operations (“FFO") | A supplemental, non-GAAP performance measure. Please see below for more information on the limitations of non-GAAP performance measures. A reconciliation of net income to Nareit FFO is provided on page 8. Nareit defines FFO as net income (loss), calculated in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains and losses from the sale of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated joint ventures calculated to reflect FFO on the same basis. | |

| | | | | | | | | | | | |

| National / Regional Tenants | | Multi-state operators or single-state operators with 20 or more locations and state agencies and government offices. Includes franchise locations. | |

| | | | | | | | | | | | |

| Net Effective Rent Before Tenant Specific Landlord Work | Average ABR PSF over the lease term adjusted for tenant improvements and allowances (excluding base building costs) and third party leasing commissions. For purposes of calculating net effective rent before tenant specific landlord work, ABR PSF includes the GLA of lessee-owned leasehold improvements. | |

| | | | | | | | | | | | |

| Net Operating Income ("NOI") | | A supplemental, non-GAAP performance measure. Please see below for more information on the limitations of non-GAAP performance measures. A reconciliation of net income to NOI is provided on page 10. Calculated as total property revenues (base rent, expense reimbursements, adjustments for revenues deemed uncollectible, ancillary and other rental income, percentage rents, and other revenues) less direct property operating expenses (operating costs and real estate taxes). NOI excludes (i) lease termination fees, (ii) straight-line rental income, net, (iii) accretion of below-market leases, net of amortization of above-market leases and tenant inducements, (iv) straight-line ground rent expense, net, (v) depreciation and amortization, (vi) impairment of real estate assets, (vii) general and administrative expense, and (viii) other income and expense (including interest expense and gain on sale of real estate assets). | |

| | | | | | | | | | | | |

| New Development | | Refers to ground up development of new shopping centers. Does not refer to outparcel development. | |

| | | | | | | | | | | | |

| New Development & Reinvestment Stabilization | | New Development and Reinvestment projects are deemed stabilized upon reaching 90.0% billed occupancy of the impacted space. New Development projects are included in the operating portfolio upon the earlier of (i) reaching 90.0% billed occupancy of the impacted space or (ii) one year after the associated assets are placed in service. | |

| | | | | | | | | | | | |

| NOI Yield | | Calculated as the projected incremental NOI as a percentage of the estimated incremental third party costs of a specified project, net of any project specific credits (lease termination fees or other ancillary credits). | |

| | | | | | | | | | | | |

| Non-owned Major Tenants | | Also known as shadow anchors. Refers to tenants that are situated on parcels that are owned by unrelated third parties, but, due to their location within or immediately adjacent to a shopping center, appear to the consumer as a retail tenant of the shopping center and, as a result, attract additional consumer traffic to the center. | |

| | | | | | | | | | | | |

| Outparcel(s) | | Refers to a portion of a shopping center, separate from the main retail buildings and generally located on the outer edge of a property, which may currently, or in the future, contain one or several freestanding buildings. | |

| | | | | | | | | | | | |

| Outparcel Development | | Construction of a new outparcel. May also refer to the demolition of an existing outparcel building to accommodate the construction of a new outparcel. | |

| | | | | | | | | | | | |

| Percent Billed | | Billed GLA as a percentage of total GLA. | |

| | | | | | | | | | | | |

| Percent Leased | | Leased GLA as a percentage of total GLA. | |

| | | | | | | | | | | | |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GLOSSARY OF TERMS | | | | | | |

| | | | | | | | | | | | |

| Term | | Definition | | | | | | | |

| PSF | | Per square foot of GLA. | |

| | | | | | | | | | | | |

| Redevelopment | | Larger scale projects that typically involve new construction, reconfiguration, significant remerchandising, and upgrades or demolition of a portion of the shopping center to accommodate new retailers. | |

| | | | | | | | | | | | |

| Reinvestment Projects | | Represents anchor space repositioning, outparcel development, and/or redevelopment projects. | |

| | | | | | | | | | | | |

| Rent Spread | | Represents the percentage change in contractual ABR PSF in the first year of the new lease relative to contractual ABR PSF in the last year of the old lease. Rent spreads are presented only for leases deemed comparable. For purposes of calculating rent spreads, ABR PSF includes the GLA of lessee-owned leasehold improvements. | |

| | | | | | | | | | | | |

| New Rent Spread | | Includes new leases signed on units that were occupied within the prior 12 months. New leases signed on units that have been vacant for longer than 12 months, new leases signed on first generation space, and new leases that are ancillary in nature regardless of term are deemed non-comparable and excluded from New Rent Spreads. | |

| | | | | | | | | | | | |

| Renewal Rent Spread | | Includes renewal leases signed with the same tenant in all or a portion of the same location or that include the expansion into space that was occupied within the prior 12 months. Renewals that include the expansion of an existing tenant into space that has been vacant for longer than 12 months and renewals that are ancillary in nature regardless of term are deemed non-comparable and excluded from Renewal Rent Spreads. | |

| | | | | | | | | | | | |

| Option Rent Spread | | Includes contractual renewal options exercised by tenants in the same location to extend the term of an expiring lease. | |

| | | | | | | | | | | | |

| Total Rent Spread | | Combined spreads for new, renewal, and option leases. | |

| | | | |

| Same Property NOI | | A supplemental, non-GAAP performance measure. Please see below for more information on the limitations of non-GAAP performance measures. A reconciliation of net income to Same Property NOI is provided on page 11. Represents NOI of properties owned for the entirety of both periods and excluding properties under development and completed New Development properties that have been stabilized for less than one year. Same Property NOI excludes income or expense associated with the Company's captive insurance company. | |

| | | | | | | | | | | | |

| | | | Number of Properties in Same Property NOI Analysis: | | | | | | | |

| | | | | | | Three Months

Ended 9/30/23 | | Nine Months

Ended 9/30/23 | | | |

| | | | Total properties in Brixmor Property Group portfolio | | 364 | | 364 | | | |

| | | | | Acquired properties excluded from Same Property NOI | | — | | (7) | | | |

| | | | | Additional exclusions (1) | | (7) | | (10) | | | |

| | | | | Same Property NOI pool (2) | | 357 | | 347 | | | |

| | | | | | | | | | | | |

| | | | (1) Additional exclusions for the three months ended September 30, 2023 and 2022 include six properties that were subject to partial dispositions in 2023 and 2022 and one property that was subject to a partial acquisition in 2023. Additional exclusions for the nine months ended September 30, 2023 and 2022 include nine properties that were subject to partial dispositions in 2023 and 2022 and one property that was subject to a partial acquisition in 2023. | | | |

| | | | (2) The Same Property NOI pool includes the balance of a shopping center when an outparcel has been acquired or if a partial disposition can be disaggregated from the remaining property. Two outparcels acquired in 2022 are excluded from the Same Property NOI pool for the nine months ended September 30, 2023, and 2022. | | | |

| | | | | | | | | | | | |

| Small Shop Spaces | | Spaces less than 10,000 SF of GLA. | | |

| | | | | | | | | | | | |

| Secured Overnight Financing Rate ("SOFR") | | SOFR is a benchmark interest rate for dollar-denominated derivatives and loans that replaced the London Interbank Offered Rate ("LIBOR"). | |

| | | | | | | | | | | | |

| Straight-line Rent | | Non-cash revenue recognized related to the GAAP requirement to average a tenant's contractual base rent over the life of the lease. The Company commences recognizing rental revenue based on the date it makes the underlying asset available for use by the tenant. The cumulative difference between rental revenue recognized and contractual payment terms is recognized as deferred rent and included in Receivables, net on the Consolidated Balance Sheets. The Company periodically evaluates the collectability of its receivables related to straight-line rent. Any receivables that are deemed to be uncollectible are recognized as a reduction to straight-line rental income, net. | |

| | | | | | | | | | | | |

| Year Built | | Year of most recent redevelopment or year built if no redevelopment has occurred. | | |

| | | | | | | | | | | | |

| Non-GAAP Performance Measures | | | | | | | | | | | |

| | | | | | | | | | | | |

| The Company presents the non-GAAP performance measures set forth below. These measures should not be considered as alternatives to, or more meaningful than, net income (calculated in accordance with GAAP) or other GAAP financial measures, as an indicator of financial performance and are not alternatives to, or more meaningful than, cash flow from operating activities (calculated in accordance with GAAP) as a measure of liquidity. Non-GAAP performance measures have limitations as they do not include all items of income and expense that affect operations, and accordingly, should always be considered as supplemental financial results to those calculated in accordance with GAAP. The Company’s computation of these non-GAAP performance measures may differ in certain respects from the methodology utilized by other REITs and, therefore, may not be comparable to similarly titled measures presented by such other REITs. Investors are cautioned that items excluded from these non-GAAP performance measures are relevant to understanding and addressing financial performance. | |

| | | | | | | | | | | | |

| The Company believes that the non-GAAP performance measures it presents are useful to investors for the following reasons: | |

| • EBITDA, EBITDAre, Adjusted • EBITDA & Cash Adjusted EBITDA | | Considering the nature of its business as a real estate owner and operator, the Company believes that EBITDA, EBITDAre, Adjusted EBITDA, and Cash Adjusted EBITDA are useful to investors in measuring its operating performance because they exclude items included in net income that do not relate to or are not indicative of the operating performance of the Company’s real estate. The Company believes EBITDA, EBITDAre, Adjusted EBITDA, and Cash Adjusted EBITDA are widely known and understood measures of performance, independent of a company's capital structure and items which can make periodic and peer analyses of performance more difficult, and that these metrics can provide investors with a more consistent basis by which to compare the Company with its peers. | |

| | | | | | | | | | | | |

| • Nareit FFO | | Considering the nature of its business as a real estate owner and operator, the Company believes that Nareit FFO is useful to investors in measuring its operating and financial performance because the definition excludes items included in net income that do not relate to or are not indicative of the Company’s operating and financial performance, such as depreciation and amortization related to real estate, and items which can make periodic and peer analyses of operating and financial performance more difficult, such as gains and losses from the sale of certain real estate assets and impairment write-downs of certain real estate assets. | |

| | | | | | | | | | | | |

| • NOI and Same Property NOI | | Considering the nature of its business as a real estate owner and operator, the Company believes that NOI is useful to investors in measuring the operating performance of its portfolio because the definition excludes various items included in net income that do not relate to, or are not indicative of, the operating performance of the Company’s properties, such as lease termination fees, straight-line rental income, net, accretion of below-market leases, net of amortization of above-market leases and tenant inducements, straight-line ground rent expense, net, income or expense associated with the Company's captive insurance company, depreciation and amortization, impairment of real estate assets, general and administrative expense, and other income and expense (including interest expense and gain on sale of real estate assets). The Company believes that Same Property NOI is also useful to investors because it further eliminates disparities in NOI by only including NOI of properties owned for the entirety of both periods presented and excluding properties under development and completed New Development properties that have been stabilized for less than one year and therefore provides a more consistent metric for comparing the operating performance of the Company's real estate between periods. | |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RESULTS OVERVIEW & GUIDANCE | | | | |

Unaudited, dollars in thousands, except per share and per square foot amounts | | | | | | |

| | | | | | | | | | | | | |

| | | | | Three Months Ended | | Nine Months Ended | | |

| Summary Financial Results | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 | | |

| | Total revenues (page 6) | | $ 307,314 | | $ 304,745 | | $ 928,551 | | $ 909,505 | | |

| | Net income (page 6) | | 63,736 | | 79,741 | | 232,390 | | 247,038 | | |

| | Net income per diluted share (page 6) | | 0.21 | | 0.26 | | 0.77 | | 0.82 | | |

| | NOI (page 10) | | 221,892 | | 217,665 | | 664,509 | | 651,599 | | |

| | EBITDA (page 7) | | 207,951 | | 213,785 | | 650,671 | | 647,136 | | |

| | EBITDAre (page 7) | | 201,239 | | 198,017 | | 609,470 | | 591,066 | | |

| | Adjusted EBITDA (page 7) | | 201,336 | | 198,424 | | 605,312 | | 592,910 | | |

| | Cash Adjusted EBITDA (page 7) | | 194,062 | | 189,516 | | 582,363 | | 568,473 | | |

| | Nareit FFO (page 8) | | 152,184 | | 147,685 | | 460,903 | | 441,959 | | |

| | Nareit FFO per diluted share (page 8) | | 0.50 | | 0.49 | | 1.52 | | 1.47 | | |

| | | Items that impact FFO comparability, net per share (page 8) | | (0.00) | | (0.00) | | 0.01 | | (0.01) | | |

| | Dividends declared per share (page 8) | | 0.260 | | 0.240 | | 0.780 | | 0.720 | | |

| | Dividend payout ratio (as % of Nareit FFO) (page 8) | | 51.4 | % | | 48.7 | % | | 50.9 | % | | 48.8 | % | | |

| | | | | | | | | | | | | |

| | | | | Three Months Ended |

| Summary Operating and Financial Ratios | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 |

| | | | 74.2 | % | | 73.5 | % | | 73.4 | % | | 73.0 | % | | 73.7 | % |

| | Same property NOI performance (page 11) (1) | | 4.8 | % | | 2.7 | % | | 4.9 | % | | 7.3 | % | | 3.6 | % |

| | Fixed charge coverage, current quarter annualized (page 13) | | 4.3x | | 4.3x | | 4.2x | | 4.1x | | 4.1x |

| | Fixed charge coverage, trailing twelve months (page 13) | | 4.2x | | 4.1x | | 4.1x | | 4.1x | | 4.1x |

| | Net principal debt to Adjusted EBITDA, current quarter annualized (page 13) (2) | | 6.1x | | 6.1x | | 6.1x | | 6.4x | | 6.4x |

| | Net principal debt to Adjusted EBITDA, trailing twelve months (page 13) (2) | | 6.1x | | 6.1x | | 6.2x | | 6.4x | | 6.5x |

| | | | | | | | | | | | | |

| Outstanding Classes of Stock | | As of 9/30/23 | | As of 6/30/23 | | As of 3/31/23 | | As of 12/31/22 | | As of 9/30/22 |

| | Common shares outstanding (page 13) | | 300,596 | | 300,593 | | 300,548 | | 299,916 | | 299,913 |

| | | | | | | | | | | | | |

| | | | | Three Months Ended |

| Summary Acquisitions and Dispositions | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 |

| | Aggregate purchase price of acquisitions (page 17) | | $ — | | $ 1,803 | | $ — | | $ — | | $ — |

| | Aggregate sale price of dispositions (page 18) | | 16,975 | | 26,771 | | 124,550 | | 112,800 | | 29,100 |

| | NOI adjustment for acquisitions and dispositions, net (3) | | (141) | | | | | | | | |

| | | | | | | | | | | | | |

| Summary Portfolio Statistics (4) | | As of 9/30/23 | | As of 6/30/23 | | As of 3/31/23 | | As of 12/31/22 | | As of 9/30/22 |

| | Number of properties (page 27) | | 364 | | 365 | | 367 | | 373 | | 378 |

| | | | 90.0 | % | | 90.4 | % | | 90.0 | % | | 90.2 | % | | 89.6 | % |

| | | | 93.9 | % | | 94.1 | % | | 94.0 | % | | 93.8 | % | | 93.3 | % |

| | | | $ 16.77 | | $ 16.60 | | $ 16.46 | | $ 16.19 | | $ 16.02 |

| | New lease rent spread (page 30) | | 52.7 | % | | 22.4 | % | | 43.4 | % | | 43.8 | % | | 32.2 | % |

| | New & renewal lease rent spread (page 30) | | 22.3 | % | | 15.4 | % | | 19.2 | % | | 18.3 | % | | 14.2 | % |

| | Total - new, renewal & option lease rent spread (page 30) | | 17.5 | % | | 12.9 | % | | 14.9 | % | | 14.8 | % | | 10.9 | % |

| | Total - new, renewal & option GLA (page 30) | | 2,733,476 | | 2,302,495 | | 2,453,972 | | 2,589,069 | | 2,791,073 |

| | | | | | | | | | | | | |

| 2023 Guidance | | Current | | Previous

(at 7/31/2023) | | YTD | | | | |

| | Nareit FFO per diluted share | | $2.02 - $2.04 | | $1.99 - $2.04 | | $1.52 | | | | |

| | Same property NOI performance | | 3.5% - 4.0% | | 2.5% - 3.5% | | 4.2% | | | | |

| | | | | | | | | | | | | |

| (1) Reflects same property NOI as reported for the specified period. |

| (2) Net principal debt is as of the end of each specified period. |

| (3) Represents an estimate of the incremental NOI that the Company would have recognized if the assets that were acquired during the quarter had been owned for the full quarter, adjusted for one-time items, net of NOI recognized during the quarter for the assets that were disposed of during the quarter. |

| (4) Reflects portfolio statistics as reported for the specified period. |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 3 | |

| | | | | |

| |

| > | FINANCIAL SUMMARY |

| |

| |

| Supplemental Disclosure |

| Three Months Ended September 30, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | | | |

Unaudited, dollars in thousands, except share information | | | | |

| | | | | | | | |

| | | | | As of | | As of | |

| | | | | 9/30/23 | | 12/31/22 | |

| Assets | | | | |

| | Real estate | | | | |

| | | Land | $ | 1,795,807 | | | $ | 1,820,358 | | |

| | | Buildings and tenant improvements | 8,455,194 | | | 8,405,969 | | |

| | | Construction in progress | 161,549 | | | 129,310 | | |

| | | Lease intangibles | 511,881 | | | 542,714 | | |

| | | | | 10,924,431 | | | 10,898,351 | | |

| | | Accumulated depreciation and amortization | (3,131,183) | | | (2,996,759) | | |

| | Real estate, net | 7,793,248 | | | 7,901,592 | | |

| | Cash and cash equivalents | 861 | | | 16,492 | | |

| | Restricted cash | 17,822 | | | 4,767 | | |

| | Marketable securities | 20,609 | | | 21,669 | | |

| | Receivables, net | 262,774 | | | 264,146 | | |

| | Deferred charges and prepaid expenses, net | 167,997 | | | 154,141 | | |

| | Real estate assets held for sale | 10,013 | | | 10,439 | | |

| | Other assets | 62,566 | | | 62,684 | | |

| Total assets | $ | 8,335,890 | | | $ | 8,435,930 | | |

| | | | | | | | |

| Liabilities | | | | |

| | Debt obligations, net | $ | 4,919,157 | | | $ | 5,035,501 | | |

| | Accounts payable, accrued expenses and other liabilities | 548,353 | | | 535,419 | | |

| Total liabilities | 5,467,510 | | | 5,570,920 | | |

| | | | | | | | |

| Equity | | | | |

| | Common stock, $0.01 par value; authorized 3,000,000,000 shares; | | | | |

| | | 309,723,386 and 309,042,754 shares issued and 300,596,394 and 299,915,762 | | | | |

| | | shares outstanding | 3,006 | | | 2,999 | | |

| | Additional paid-in capital | 3,303,935 | | | 3,299,496 | | |

| | Accumulated other comprehensive income | 12,192 | | | 8,851 | | |

| | Distributions in excess of net income | (450,753) | | | (446,336) | | |

| Total equity | 2,868,380 | | | 2,865,010 | | |

| Total liabilities and equity | $ | 8,335,890 | | | $ | 8,435,930 | | |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| Unaudited, dollars in thousands, except per share amounts | | | | | | |

| | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Revenues | | | | | | | |

| | Rental income | $ | 307,118 | | | $ | 304,643 | | | $ | 927,440 | | | $ | 908,903 | |

| | Other revenues | 196 | | | 102 | | | 1,111 | | | 602 | |

| Total revenues | 307,314 | | | 304,745 | | | 928,551 | | | 909,505 | |

| | | | | | | | | |

| Operating expenses | | | | | | | |

| | Operating costs | 35,058 | | | 33,299 | | | 106,658 | | | 102,592 | |

| | Real estate taxes | 42,156 | | | 44,179 | | | 130,556 | | | 128,123 | |

| | Depreciation and amortization | 96,254 | | | 84,773 | | | 272,807 | | | 254,132 | |

| | Impairment of real estate assets | — | | | — | | | 17,836 | | | 4,597 | |

| | General and administrative | 29,182 | | | 29,094 | | | 86,868 | | | 86,796 | |

| Total operating expenses | 202,650 | | | 191,345 | | | 614,725 | | | 576,240 | |

| | | | | | | | | |

| Other income (expense) | | | | | | | |

| | Dividends and interest | 273 | | | 88 | | | 345 | | | 198 | |

| | Interest expense | (47,364) | | | (48,726) | | | (143,529) | | | (143,934) | |

| | Gain on sale of real estate assets | 6,712 | | | 15,768 | | | 59,037 | | | 60,667 | |

| | Gain (loss) on extinguishment of debt, net | 6 | | | — | | | 4,356 | | | (221) | |

| | Other | (555) | | | (789) | | | (1,645) | | | (2,937) | |

| Total other income (expense) | (40,928) | | | (33,659) | | | (81,436) | | | (86,227) | |

| | | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | $ | 232,390 | | | $ | 247,038 | |

| | | | | | | | | |

| Net income per common share: | | | | | | | |

| | Basic | $ | 0.21 | | | $ | 0.26 | | | $ | 0.77 | | | $ | 0.82 | |

| | Diluted | $ | 0.21 | | | $ | 0.26 | | | $ | 0.77 | | | $ | 0.82 | |

| Weighted average shares: | | | | | | | |

| | Basic | 301,007 | | | 300,213 | | | 300,955 | | | 299,626 | |

| | Diluted | 302,511 | | | 301,341 | | | 302,447 | | | 300,784 | |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | | | | |

| Unaudited, dollars in thousands | | | | | | | |

| | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| | | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | $ | 232,390 | | | $ | 247,038 | |

| | Interest expense | 47,364 | | | 48,726 | | | 143,529 | | | 143,934 | |

| | Federal and state taxes | 597 | | | 545 | | | 1,945 | | | 2,032 | |

| | Depreciation and amortization | 96,254 | | | 84,773 | | | 272,807 | | | 254,132 | |

| EBITDA | 207,951 | | | 213,785 | | | 650,671 | | | 647,136 | |

| | Gain on sale of real estate assets | (6,712) | | | (15,768) | | | (59,037) | | | (60,667) | |

| | Impairment of real estate assets | — | | | — | | | 17,836 | | | 4,597 | |

| EBITDAre | $ | 201,239 | | | $ | 198,017 | | | $ | 609,470 | | | $ | 591,066 | |

| | | | | | | | | |

| EBITDAre | $ | 201,239 | | | $ | 198,017 | | | $ | 609,470 | | | $ | 591,066 | |

| | Transaction expenses, net | 103 | | | 250 | | | 198 | | | 1,131 | |

| | Litigation and other non-routine legal expenses | — | | | 157 | | | — | | | 492 | |

| | (Gain) loss on extinguishment of debt, net | (6) | | | — | | | (4,356) | | | 221 | |

| | Total adjustments | 97 | | | 407 | | | (4,158) | | | 1,844 | |

| Adjusted EBITDA | $ | 201,336 | | | $ | 198,424 | | | $ | 605,312 | | | $ | 592,910 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 201,336 | | | $ | 198,424 | | | $ | 605,312 | | | $ | 592,910 | |

| | Straight-line rental income, net (1) | (5,088) | | | (6,393) | | | (16,510) | | | (17,883) | |

| | Accretion of below-market leases, net of amortization of above-market leases and tenant inducements | (2,178) | | | (2,517) | | | (6,414) | | | (6,721) | |

| | Straight-line ground rent expense, net (2) | (8) | | | 2 | | | (25) | | | 167 | |

| | Total adjustments | (7,274) | | | (8,908) | | | (22,949) | | | (24,437) | |

| Cash Adjusted EBITDA | $ | 194,062 | | | $ | 189,516 | | | $ | 582,363 | | | $ | 568,473 | |

| | | | | | | | | |

| (1) For more information regarding straight-line rental income reversals and re-establishments please see page 8, footnote 1. |

| (2) Straight-line ground rent expense, net is included in Operating costs on the Consolidated Statements of Operations. |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FUNDS FROM OPERATIONS (FFO) | | | | | |

| Unaudited, dollars in thousands, except per share amounts | | | | | | | |

| | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended | |

| | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 | |

| | | | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | $ | 232,390 | | | $ | 247,038 | | |

| | Depreciation and amortization related to real estate | 95,160 | | | 83,712 | | | 269,714 | | | 250,991 | | |

| | Gain on sale of real estate assets | (6,712) | | | (15,768) | | | (59,037) | | | (60,667) | | |

| | Impairment of real estate assets | — | | | — | | | 17,836 | | | 4,597 | | |

| Nareit FFO | $ | 152,184 | | | $ | 147,685 | | | $ | 460,903 | | | $ | 441,959 | | |

| | | | | | | | | | |

| Nareit FFO per diluted share | $ | 0.50 | | | $ | 0.49 | | | $ | 1.52 | | | $ | 1.47 | | |

| Weighted average diluted shares outstanding | 302,511 | | | 301,341 | | | 302,447 | | | 300,784 | | |

| | | | | | | | | | |

| Items that impact FFO comparability | | | | | | | | |

| | Transaction expenses, net | $ | (103) | | | $ | (250) | | | $ | (198) | | | $ | (1,131) | | |

| | Litigation and other non-routine legal expenses | — | | | (157) | | | — | | | (492) | | |

| | Gain (loss) on extinguishment of debt, net | 6 | | | — | | | 4,356 | | | (221) | | |

| Total items that impact FFO comparability | $ | (97) | | | $ | (407) | | | $ | 4,158 | | | $ | (1,844) | | |

| Items that impact FFO comparability, net per share | $ | (0.00) | | | $ | (0.00) | | | $ | 0.01 | | | $ | (0.01) | | |

| | | | | | | | | | |

| Additional Disclosures | | | | | | | | |

| | Straight-line rental income, net (1) | $ | 5,088 | | | $ | 6,393 | | | $ | 16,510 | | | $ | 17,883 | | |

| | Accretion of below-market leases, net of amortization of above-market leases and tenant inducements | 2,178 | | | 2,517 | | | 6,414 | | | 6,721 | | |

| | Straight-line ground rent expense, net (2) | 8 | | | (2) | | | 25 | | | (167) | | |

| | | | | | | | | | |

| Dividends declared per share | $ | 0.260 | | | $ | 0.240 | | | $ | 0.780 | | | $ | 0.720 | | |

| Dividends declared | $ | 78,155 | | | $ | 71,979 | | | $ | 234,451 | | | $ | 215,777 | | |

| Dividend payout ratio (as % of Nareit FFO) | 51.4 | % | | 48.7 | % | | 50.9 | % | | 48.8 | % | |

| | | | | | | | | | |

| (1) Includes straight-line rental income reversals and re-establishments of ($1.8 million) and less than $0.1 million during the three months ended September 30, 2023 and 2022, respectively. Includes straight-line rental income reversals and re-establishments of ($1.0 million) and ($0.1 million) during the nine months ended September 30, 2023 and 2022, respectively. |

| (2) Straight-line ground rent expense, net is included in Operating costs on the Consolidated Statements of Operations. | |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 8 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL BALANCE SHEET DETAIL | |

| Unaudited, dollars in thousands | | | | |

| | | | | | | |

| | | | As of | | As of | |

| | | | 9/30/23 | | 12/31/22 | |

| | | | | | | |

| Receivables, net | | | | |

| | Straight-line rent receivable, net | $ | 174,120 | | | $ | 159,823 | | |

| | Tenant receivables, net | 81,995 | | | 97,825 | | |

| | Other | 6,659 | | | 6,498 | | |

| Total receivables, net | $ | 262,774 | | | $ | 264,146 | | |

| | | | | | | |

| Deferred charges and prepaid expenses, net | | | | |

| | Deferred charges, net | $ | 137,455 | | | $ | 132,283 | | |

| | Prepaid expenses, net | 30,542 | | | 21,858 | | |

| Total deferred charges and prepaid expenses, net | $ | 167,997 | | | $ | 154,141 | | |

| | | | | | | |

| Other assets | | | | |

| | Right-of-use asset | $ | 32,739 | | | $ | 35,754 | | |

| | Furniture, fixtures and leasehold improvements, net | 13,588 | | | 13,800 | | |

| | Interest rate swaps | 12,659 | | | 9,640 | | |

| | Other | 3,580 | | | 3,490 | | |

| Total other assets | $ | 62,566 | | | $ | 62,684 | | |

| | | | | | | |

| Accounts payable, accrued expenses and other liabilities | | | | |

| | Accounts payable and other accrued expenses | $ | 293,929 | | | $ | 269,286 | | |

| | Below market leases, net | 86,294 | | | 96,837 | | |

| | Dividends payable | 81,559 | | | 81,633 | | |

| | Lease liability | 36,598 | | | 39,923 | | |

| | | | | | |

| | | | | | |

| | Other | 49,973 | | | 47,740 | | |

| Total accounts payable, accrued expenses and other liabilities | $ | 548,353 | | | $ | 535,419 | | |

| | | | | | | | |

| Supplemental Disclosure - Three Months Ended September 30, 2023 | Page 9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOI & SUPPLEMENTAL STATEMENT OF OPERATIONS DETAIL | | |

| Unaudited, dollars in thousands | | | | | | | |

| | | | | | | | | | |

| | | | Three Months Ended | | Nine Months Ended |

| | | | 9/30/23 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Net Operating Income Detail | | | | | | | |

| | Base rent | $ | 223,079 | | | $ | 220,023 | | | $ | 668,380 | | | $ | 650,896 | |

| | Expense reimbursements | 68,927 | | | 68,433 | | | 211,404 | | | 199,982 | |

| | Revenues deemed uncollectible | (544) | | | (925) | | | (3,591) | | | 5,958 | |

| | Ancillary and other rental income / Other revenues | 6,092 | | | 6,357 | | | 18,261 | | | 18,174 | |

| | Percentage rents | 1,560 | | | 1,253 | | | 7,294 | | | 7,137 | |

| | Operating costs | (35,066) | | | (33,297) | | | (106,683) | | | (102,425) | |

| | Real estate taxes | (42,156) | | | (44,179) | | | (130,556) | | | (128,123) | |

| Net operating income | $ | 221,892 | | | $ | 217,665 | | | $ | 664,509 | | | $ | 651,599 | |

| | | | | | | | | | |

| Operating Ratios | | | | | | | |

| | NOI margin (NOI / revenues) | 74.2 | % | | 73.7 | % | | 73.7 | % | | 73.9 | % |

| | Expense recovery ratio (expense reimbursements / (operating costs + real estate taxes)) | 89.3 | % | | 88.3 | % | | 89.1 | % | | 86.7 | % |

| | | | | | | | | | |

| Reconciliation of Net Income to Net Operating Income | | | | | | | |

| Net income | $ | 63,736 | | | $ | 79,741 | | | $ | 232,390 | | | $ | 247,038 | |