UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its

charter)

Calle 94 N°

11-30 8° piso

Bogota, Colombia

(Address of principal

executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated October 19, 2023 titled “GeoPark Announces Third

Quarter 2023 Operational Update” |

Item

1

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES THIRD QUARTER 2023 OPERATIONAL

UPDATE

RESTORED INDICO FIELD PRODUCTION IN THE CPO-5

BLOCK

MORE EXPLORATION SUCCESS IN COLOMBIA AND ECUADOR

MULTIPLE EXPLORATION CATALYSTS UNDERWAY

Bogota, Colombia – October 19, 2023 - GeoPark

Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and gas explorer,

operator and consolidator, today announces its operational update for the three-month period ended September 30, 2023.

Oil and Gas Production Back Online

| · | GeoPark

is currently producing approximately 39,000 boepd1 |

| · | 3Q2023 consolidated average oil and gas production

of 34,778 boepd, below its potential mainly due to temporarily shut-in production in the CPO-5 block (GeoPark non-operated, 30% WI) in

Colombia and in the Fell block (GeoPark operated, 100% WI) in Chile |

| · | 12 rigs currently in operation (7 drilling rigs

and 5 workover rigs), including 5 drilling rigs on exploration and appraisal wells |

Colombia - Llanos Basin: New Exploration Success

and Drilling High-Potential Prospects

Llanos 34 Block (GeoPark operated, 45% WI):

| · | The third horizontal development well initiated

testing in early October 2023 and is currently producing approximately 1,800 bopd from the Mirador formation |

| · | GeoPark has already spudded the fourth and fifth

horizontal wells, which are expected to reach total depth in November 2023 |

| · | The block is currently producing

approximately 54,200 bopd gross (vs 53,367 bopd gross in 3Q2023) |

CPO-5 Block:

| · | The operator spudded the Halcon 1 exploration

well in late September, targeting the exploration potential of the Guadalupe formation in the northern part of the CPO-5 block, close

to the southern part of the Llanos 34 block, expected to reach total depth in late October 2023 |

| · | In

late September 2023, the operator received approval from the regulator (ANH) to resume production

in the Indico 6 and Indico 7 wells2, which are currently producing 7,500-8,000

bopd gross in aggregate. These wells could potentially increase and stabilize their combined

production at approximately 9,000 bopd gross before year-end, depending on reservoir performance |

| · | The block is currently producing

approximately 23,800 bopd gross (vs 16,877 bopd gross in 3Q2023) |

Llanos 123 Block (GeoPark operated, 50% WI-Hocol

50% WI):

| · | The Toritos 1 exploration well reached total depth

in September 2023 |

| · | Logging information indicated hydrocarbon potential

in the Barco (Guadalupe) and Gacheta formations |

| · | The well initiated testing activities in late

September 2023 and is currently producing approximately 1,370 bopd of 14 degrees API with a 1.5% water cut from the Barco (Guadalupe)

formation |

| · | The block is currently producing approximately

2,140 bopd gross (vs 626 bopd gross in 3Q2023) |

__________________

1 Estimated

average production from October 10, 2023, to October 16, 2023.

2 These

two wells were drilled in late 2022 and have been shut-in following the ANH request that the operator suspend production until certain

required surface facilities were completed.

Ecuador - Oriente Basin: New Exploration Success

Perico Block (GeoPark non-operated, 50% WI):

| · | The Perico Centro 1 exploration well reached total

depth in September 2023 |

| · | Preliminary logging information indicated hydrocarbon

potential in the U-sand formation |

| · | The well initiated testing in late September 2023

and is currently producing approximately 830 bopd of 28 degrees API with a 1% water cut |

| · | The block is currently producing

approximately 2,400 bopd gross (vs 1,318 bopd gross in 3Q2023) |

Returning More Value to Shareholders and Maintaining

a Strong Balance Sheet

| · | Quarterly

Dividend of $0.132 per share, or $7.5 million, paid on September 7, 2023, representing an

annualized dividend of approximately $30 million (or $0.52 per share), a 5% dividend yield3 |

| · | Repurchased 2.2 million shares, or 4% of total

shares outstanding, for $23.6 million since January 1, 2023 |

| · | Cash

and cash equivalents of $106 million4 as

of September 30, 2023 |

Upcoming Catalysts

| · | Drilling 10-12 gross wells in 4Q2023, targeting

attractive conventional, short-cycle development and exploration projects |

| - | CPO-5 block: Currently drilling the Halcon 1 exploration well |

| - | Llanos 123 block: Currently drilling the Bisbita Centro 1 exploration well |

| - | Llanos 87 block (GeoPark operated, 50% WI-Hocol 50% WI): Currently drilling the Zorzal Este 1 exploration

well |

| - | Llanos 34 block: Currently drilling 2 additional horizontal development wells |

| - | Perico block: Currently drilling the Perico Norte 4 appraisal well |

__________________

3 Based on GeoPark’s average market capitalization

from September 1 to September 29, 2023.

4 Unaudited.

GeoPark Chief Financial Officer Transition

GeoPark announced that Veronica Davila, Chief Financial

Officer, will be stepping down from her role to pursue new career opportunities effective November 30, 2023. The Company has commenced

a formal search process for a replacement and has appointed Ignacio Mazariegos to serve as interim Chief Financial Officer, upon

Ms. Davila’s departure.

Mr. Mazariegos joined GeoPark in 2010 and currently

serves as Director of New Business, where he leads and supports the Company’s growth and profitability through acquisitions and

strategic partnerships. Mr. Mazariegos and Ms. Davila will work closely over the coming weeks to ensure a smooth transition.

Andres Ocampo, Chief Executive Officer said: “On

behalf of our entire team, I would like to thank Veronica for her commitment and contributions to GeoPark. Since joining the Company

in 2016, Veronica has been a valuable team member, and we wish her well in her future endeavors.”

Breakdown of Quarterly Production by Country

The following table shows production figures for

3Q2023, as compared to 3Q2022:

| |

3Q2023 |

|

3Q2022 |

| |

Total

(boepd) |

Oil

(bopd)a |

Gas

(mcfpd) |

|

Total

(boepd) |

% Chg. |

| Colombia |

31,780 |

31,668 |

672 |

|

33,338 |

-5% |

| Ecuador |

659 |

659 |

- |

|

1,194 |

-45% |

| Chile |

1,565 |

172 |

8,361 |

|

2,425 |

-35% |

| Brazil |

774 |

11 |

4,578 |

|

1,439 |

-46% |

| Total |

34,778 |

32,510 |

13,610 |

|

38,396 |

-9% |

| a) | Includes royalties and other economic rights paid in kind in Colombia for approximately

5,045 bopd in 3Q2023. No royalties were paid in kind in Ecuador, Chile or Brazil. Production in Ecuador is reported before the Government’s

production share of approximately 194 bopd. |

Quarterly Production

| (boepd) |

3Q2023 |

2Q2023 |

1Q2023 |

4Q2022 |

3Q2022 |

| Colombia |

31,780 |

33,045 |

32,580 |

33,749 |

33,338 |

| Ecuador |

659 |

634 |

990 |

1,259 |

1,194 |

| Chile |

1,565 |

1,690 |

1,988 |

2,291 |

2,425 |

| Brazil |

774 |

1,212 |

1,020 |

1,134 |

1,439 |

| Total a |

34,778 |

36,581 |

36,578 |

38,433 |

38,396 |

| Oil |

32,510 |

33,672 |

33,801 |

35,451 |

34,875 |

| Gas |

2,268 |

2,909 |

2,777 |

2,982 |

3,521 |

| a) | In Colombia, production includes royalties paid in kind, and in Ecuador it is shown

before the Government’s production share. |

Oil and Gas Production Update

Consolidated:

Oil and gas production in 3Q2023 was 34,778 boepd,

down by 9% compared to 3Q2022, due to lower production in Colombia, Chile, Brazil and Ecuador. Oil represented 93% and 91% of total reported

production in 3Q2023 and 3Q2022, respectively.

GeoPark

is currently producing approximately 39,000 boepd5.

__________________

5 Estimated

average production from October 10, 2023, to October 16, 2023.

Colombia:

Average net oil and gas production in Colombia

decreased by 5% to 31,780 boepd in 3Q2023 compared to 33,338 boepd in 3Q2022, mainly resulting from lower production in the Llanos 34

and CPO-5 blocks, partially offset by higher production in the Platanillo block (GeoPark operated, 100% WI) and to a lesser extent, new

production coming on in the Llanos 123 block.

Oil and gas production in GeoPark’s main

blocks in Colombia:

| · | Llanos

34 block net average production decreased by 7% to 24,015 bopd (or 53,367 bopd gross) in 3Q2023 compared to 3Q2022, mainly due to the

natural decline of the fields and to a lesser extent temporary local blockades that partially affected production and operations for

10 days |

| · | CPO-5 block net average production decreased by

10% to 5,063 bopd (or 16,877 bopd gross) in 3Q2023 compared to 3Q2022. Production in 3Q2023 has been below its potential due to shut-ins

of the Indico 6 and Indico 7 wells, which are currently producing approximately 7,500-8,000 bopd gross in aggregate. These two wells could

potentially increase and stabilize their combined production at approximately 9,000 bopd gross before year-end, depending on reservoir

performance |

| · | Platanillo

block average production increased by 35% to 2,027 bopd in 3Q2023 compared to 3Q2022 |

| · | Llanos

123 block net average production was 313 bopd (or 626 bopd gross) in 3Q2023, reflecting partial production from the Saltador 1 exploration

well that initiated testing during the quarter |

Recent Activity in the Llanos Basin

Llanos 34 Block

| · | The

third horizontal development well initiated testing in early October 2023 and is currently producing approximately 1,800 bopd from the

Mirador formation |

| · | GeoPark has already spudded the fourth and fifth

horizontal wells, which are expected to reach total depth in November 2023 |

CPO-5 Block

| · | The

operator spudded the Halcon 1 exploration well in late September, targeting the exploration potential of the Guadalupe formation in the

northern part of the CPO-5 block, close to the southern part of the Llanos 34 block |

| · | Preliminary

activities are underway to acquire over 230 square kilometers of 3D seismic, expected to be executed in early 2024 |

| · | This

3D seismic acquisition is expected to add additional exploration prospects to GeoPark’s organic exploration inventory |

Llanos 123 Block

| · | The

Toritos 1 exploration well reached total depth in September 2023 |

| · | Logging

information indicated hydrocarbon potential in the Barco (Guadalupe) and Gacheta formations |

| · | Testing

activities initiated in late September 2023, and the well is currently producing approximately 1,370 bopd of 14 degrees API with a 1.5%

water cut from the Barco (Guadalupe) formation |

| · | The

Saltador 1 exploration well, which started testing in July 2023, was the first exploration success in the Llanos 123 block and continues

producing approximately 760 bopd of 16 degrees API with a 4% water cut from the Barco (Guadalupe) formation |

| · | Based

on these positive results, on October 12, 2023, GeoPark spudded a new exploration well, Bisbita Centro 1, targeting an exploration prospect

located 1.5 km south of the Saltador 1 well |

Llanos 87 Block

| · | GeoPark spudded the Zorzal Este 1 exploration

well on October 5, 2023, and it is expected to reach total depth in early November 2023 |

Llanos 124 Block (GeoPark operated, 50% WI-Hocol

50% WI):

| · | Cucarachero 1 exploration well reached total depth

in August 2023 |

| · | The well encountered reservoir in the Cuervo formation

with no evidence of hydrocarbons |

Llanos 86 and Llanos 104 Blocks (GeoPark operated,

50% WI-Hocol 50% WI):

| · | The Llanos 86 and Llanos 104 blocks are adjacent

to the eastern side of the CPO-5 block |

| · | Preliminary activities are underway to acquire

over 650 square kilometers of 3D seismic, expected to be executed in early 2024 |

| · | This 3D seismic acquisition is expected to add

additional exploration prospects to GeoPark’s organic exploration inventory |

Ecuador:

Average net oil production in Ecuador before the

Government’s share decreased 45% to 659 bopd in 3Q2023, (approximately 465 bopd after the Government’s share), compared to 1,194

bopd in 3Q2022, mainly due to the natural decline of the fields.

Ecuador is currently producing approximately 2,400

bopd gross, following the successful drilling and testing of the Yin 2 and the Perico Centro 1 wells.

The Government’s production share varies

with oil prices and is approximately 30-40%, considering an Oriente crude oil price of $70-100 per bbl.

Recent Activity in the Perico Block

| · | The Perico Centro 1 exploration well reached total

depth in September 2023 |

| · | Preliminary logging information indicated hydrocarbon

potential in the U-sand formation |

| · | The well initiated testing in late September 2023

and is currently producing approximately 830 bopd of 28 degrees API with a 1% water cut |

| · | The Yin 2 well started production tests in mid-August

2023 and is currently producing approximately 740 bopd of 30 degrees API with a 1% water cut from the U-sand formation |

| · | Based on these positive results, on October 8,

2023 the operator spudded a new appraisal well, the Perico Norte 4, which is expected to reach total depth in late October 2023 |

Chile:

Average net production in Chile decreased 35% to

1,565 boepd in 3Q2023 compared to 2,425 boepd in 3Q2022, resulting from the natural decline of the fields, limited drilling activities

and temporarily shut-in oil production due to commercial negotiations. GeoPark reached an agreement with the oil off-taker and as of August

2023 it gradually started reopening temporarily shut-in oil production of 400 bopd.

The production mix was 89% natural gas (vs 84%

in 3Q2022) and 11% light oil (vs 16% in 3Q2022).

Brazil:

Average net production in the Manati field (GeoPark

non-operated, 10% WI) in Brazil decreased 46% to 774 boepd in 3Q2023 compared to 1,439 boepd in 3Q2022. Production in Manati was temporarily

interrupted for 24 days during 3Q2023 due to lower gas demand. Production restarted in late September 2023 and the Manati field’s

net production is approximately 1,550 boepd.

The production mix was 99% natural gas and 1% oil

and condensate in both 3Q2023 and 3Q2022.

Other News

Notice of change of Auditor (from EY Argentina to EY Colombia)

GeoPark announced that it changed its auditors

from Pistrelli, Henry Martin y Asociados S.R.L. (or EY Argentina) to Ernst & Young Audit S.A.S. (or EY Colombia), being both member

firms of EY Global Limited.

EY Argentina resigned as auditor of GeoPark effective

September 29, 2023, and GeoPark’s Board of Directors appointed EY Colombia, as the successor auditor of the Company until the next

Annual General Meeting.

EY Argentina’s audit reports on GeoPark’s

consolidated financial statements as of and for the years ended December 31, 2022 and 2021 did not contain an adverse opinion or disclaimer

of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. In addition, there have

been no reportable events or disagreements (as defined in Item 16F(a)(1) (iv) and (v) of Form 20-F) between GeoPark and

EY Argentina.

Reporting Date for 3Q2023 Results Release, Conference Call and Webcast

GeoPark will report its 3Q2023 financial results

on Wednesday, November 8, 2023, after the market close. In conjunction with the 3Q2023 results press release, GeoPark management will

host a conference call on November 9, 2023, at 10:00 am (Eastern Daylight Time) to discuss the 3Q2023 financial results.

To listen to the call, participants can access

the webcast located in the “Invest with Us” section of the Company’s website at www.geo-park.com, or by clicking below:

https://events.q4inc.com/attendee/344411932

Interested parties may participate in the conference

call by dialing the numbers provided below:

United States Participants:

+1 (646) 904-5544

International Participants:

+1 (833) 470-1428

Passcode: 865697

Please allow extra time prior to the call to visit

the website and download any streaming media software that might be required to listen to the webcast.

An archive of the webcast replay will be made available

in the “Invest with Us” section of the Company’s website at www.geo-park.com after the conclusion of the live call.

|

For

further information, please contact:

INVESTORS:

| |

| |

|

| Stacy Steimel |

ssteimel@geo-park.com |

| Shareholder Value Director |

|

| T: +562 2242 9600 |

|

| |

|

| Miguel Bello |

mbello@geo-park.com |

| Market Access Director |

|

| T: +562 2242 9600 |

|

| |

|

| Diego Gully |

dgully@geo-park.com |

| Investor Relations Director |

|

| T: +55 21 99636 9658 |

|

| |

|

| MEDIA: |

|

| Communications Department |

communications@geo-park.com |

NOTICE

Additional information about GeoPark can be found

in the “Invest with Us” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts

and percentages included in this press release have been rounded for ease of presentation. Percentages included in this press release

have not in all cases been calculated on the basis of such rounded amounts, but on the basis of such amounts prior to rounding. For this

reason, certain percentages in this press release may vary from those obtained by performing the same calculations on the basis of the

amounts in the financial statements. Similarly, certain other amounts included in this press release may not sum due to rounding.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements contained in this press release can be identified by the use of forward-looking

words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’

‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number

of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding

various matters, including, production guidance, shareholder returns, Adjusted EBITDA, capital expenditures and free cash flow. Forward-looking

statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements

are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking

statements due to various factors.

Forward-looking statements speak only as of the

date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments

or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

Oil and gas production figures included in this

release are stated before the effect of royalties paid in kind, consumption and losses. Annual production per day is obtained by dividing

total production by 365 days.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

GeoPark Limited |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Verónica Dávila |

| |

|

|

|

Name: |

Verónica Dávila |

| |

|

|

|

Title: |

Chief Financial Officer |

Date:

October 19, 2023

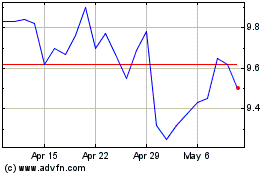

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2024 to May 2024

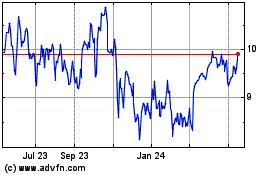

GeoPark (NYSE:GPRK)

Historical Stock Chart

From May 2023 to May 2024