UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

March 2024

Commission File

Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its

charter)

Calle 94 N°

11-30 8° piso

Bogota, Colombia

(Address of principal executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Q4 2023 and FY 2023 Earnings Release |

| 2. |

Supplement to Fourth Quarter & Full-Year 2023 Results |

Item 1

FOR IMMEDIATE DISTRIBUTION

GEOPARK REPORTS FOURTH QUARTER

AND FULL-YEAR 2023 RESULTS

IMPROVED VOLUME DELIVERY IN 4Q2023 UNDERPINS

SUSTAINED CASH RETURNS

QUARTERLY CASH DIVIDEND OF $0.136 PER SHARE

TENDER OFFER FOR UP TO $50 MILLION SHARES

MSCI ESG RATING UPGRADED TO ‘AA’:

ESG LEADER

Bogota, Colombia – March 6, 2024 - GeoPark

Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and gas explorer,

operator, and consolidator, reports its consolidated financial results for the three-month period ended December 31, 2023 (“Fourth

Quarter” or “4Q2023”) and for the year ended December 31, 2023 (“Full Year” or “FY2023”). A

conference call to discuss these financial results will be held on March 7, 2024, at 10:00 am (Eastern Standard Time).

FOURTH QUARTER AND FULL-YEAR 2023 SUMMARY

In 2023, GeoPark delivered $451.9 million Adjusted

EBITDA, an EBITDA margin of 60%, and $111.1 million of net profit. These results were leveraged by the success of new exploration

and development campaigns and ongoing efficiencies in our operated assets. Results were achieved despite i) lower realization prices

compared to 2022, ii) lower volumes due to the effects of a partial shut-in at the CPO-5 Block (GeoPark non-operated, 30% WI) during

the first 9 months of 2023; and iii) a higher effective tax rate.

During 2023, GeoPark invested $199.0 million in

capital expenditures to drill 48 gross wells, which resulted in a 110% 2P Replacement Ratio and annual average production of 36,563 boepd.

4Q2023 quarterly average oil and gas production reached 38,315 boepd, up 10% compared to 3Q2023, supported by exploration successes in

the Llanos 123 and 87 blocks (GeoPark operated, 50% WI), CPO-5 Block and Perico Block (GeoPark non-operated, 50% WI) in Ecuador, and the

resumption of shut-in production in the CPO-5 Block.

Improved operating results during 4Q2023 translated

into $117.8 million Adjusted EBITDA for 4Q2023, the highest of 2023. Despite lower annual production and realization prices, GeoPark reported

a solid and resilient cash generation with an Adjusted EBITDA of $451.9 million, underpinned by lower production and operating costs,

lower hedge losses and lower administrative costs.

Capital efficiency was once again a key feature

of the year. Each dollar invested in capital expenditures yielded $2.3 in Adjusted EBITDA and the return on average capital employed reached

35%.

Annual net profit in 2023 reached $111.1 million

(approximately $2 per share), 51% lower than in 2022, mainly impacted by one-off costs and impairments associated with Chile’s

divestment, the appreciation of the Colombian peso and a higher total effective tax rate1. Nonetheless, GeoPark ended 2023

with a stronger balance sheet illustrating its sustained commitment to financial discipline. The cash position continued to strengthen

and reached $133.0 million at year-end, net leverage stood at 0.8 times, and the debt profile remained robust with no principal maturities

until 2027.

These financial achievements and discipline allowed

GeoPark to reward its shareholders with a 13% capital return yield2 or $61.2 million balanced between buybacks and dividends.

The 2023 buyback program allowed GeoPark to reduce its outstanding shares by 4% to 55.3 million.

In 2024 and in acknowledgement of GeoPark’s

long-standing commitment to its SPEED value system, MSCI recognized GeoPark as an ESG ‘leader’ by further upgrading its rating

to “AA” (GeoPark was rated as “B” in 2018, “BB” in 2019, “BBB” in 2021 and “A”

in both 2022 and 2023). GeoPark also received a rating upgrade by Carbon Disclosure Project (CDP) Climate and reached a “B”

rating (up from a “C” rating).

Colombia’s

licensing authority recently granted the environmental license for the Putumayo-8 Block (GeoPark operated3,

50% WI). It was the result of several years of working closely with local leaders and communities, as well as a rigorous stakeholder

participation process in coordination with local and national authorities, opening a very attractive exploration target in the Putumayo

Basin in Colombia and targeting to drill by the end of 2024.

Looking forward to 2024, GeoPark’s organic

activities will be focused on continuing the development of its core operations in the Llanos 34 (GeoPark operated, 45% WI) and CPO-5

blocks, delineating the new plays opened in 2023 and preparing new blocks for future exploration, while continuing to evaluate inorganic

options that are consistent with long-term value accretion.

Reinforcing its commitment to continue returning

value to its shareholders, GeoPark has the intention to commence a modified “Dutch Auction” tender offer (“the tender

offer”) to purchase for cash up to $50 million of GeoPark common shares at a price per share of not less than $9.00 and not greater

than $10.00, which could represent approximately 10% of outstanding shares. GeoPark intends to commence the tender offer before the end

of March and to fund it using cash on hand. If commenced, the tender offer will remain open for at least twenty (20) business days. Further

details, including the terms and conditions of the tender offer, will be provided in the offer to purchase and other documents to be filed

with the U.S. Securities and Exchange Commission (SEC) in connection with the tender offer. The tender offer is in addition to the previously

approved share repurchase program in November 2023.

Andrés Ocampo, Chief Executive Officer of

GeoPark, said: “The fourth quarter marked a strong finish to a challenging year on the production front. Despite a lower price environment

compared to 2022, GeoPark ended the year with replenished 2P reserves, sustained cash returns to shareholders, and a stronger balance

sheet. We are proud to announce our upgrade by MSCI to ‘AA’ status, placing us in the ESG ‘Leader’ bracket for

the first time. The intention to execute an extraordinary buyback announced today reflects the financial health of the company and our

confidence in our assets, which makes share buybacks rank very high in our capital allocation contest. Further, we continue to be committed

to step-changing our growth trajectory by improving our underlying base business performance as well as by expanding our portfolio of

assets. This will translate into more energy, more value, and more shared prosperity. We are working decidedly in this direction.”

Supplementary information is available at the following link:

https://ir.geopark.com/files/doc_downloads/test.pdf

1 Starting

in fiscal year 2023, Colombia introduced an income surtax whose amount depends on Brent oil prices. For 2023 the income tax surtax was

10%, bringing Colombia’s corporate tax rate to 45%.

2 Based

on GeoPark’s average market capitalization from December 1, 2023 to January 1, 2024.

3 Through

its affiliate Amerisur Exploration Colombia Limitada.

FOURTH QUARTER AND FULL-YEAR 2023 HIGHLIGHTS

Oil and Gas Production and Operations

| · | Quarterly average oil and gas production of 38,315

boepd, up 10% vs 3Q2023, due to recent exploration successes and the resumption of shut-in production in the CPO-5 Block |

| · | Annual average production of 36,563 boepd / 2023

exit production of over 38,000 boepd |

| · | 2023

exploration drilling added 5,500+ gross bopd with 48 gross wells4 drilled and

a 75% success rate5 |

| · | GeoPark’s 2024 drilling campaign will continue

delineating the new plays opened in 2023 |

Revenue, Adjusted EBITDA and Net Profit

| · | Revenue of $199.7 million / Full-year revenue

of $756.6 million |

| · | Adjusted EBITDA of $117.8 million / Full-year

Adjusted EBITDA of $451.9 million |

| · | Operating Profit of $44.3 million / Full-year

operating profit of $270.9 million |

| · | Cash flow from operations of $110.6 million /

Full-year cash flow from operations of $300.9 million |

| · | Net profit of $26.3 million / Full-year net profit

of $111.1 million ($2 basic earnings per share) |

Cost and Capital Efficiency

| · | Despite inflationary pressures, full-year cash

G&A decreased by 6% to $37.9 million |

| · | Capital expenditures of $66.6 million / Full-year

capital expenditures of $199.0 million |

| · | 2023 Adjusted EBITDA to capital expenditures ratio

of 2.3x |

| · | 2023

annual return on capital employed of 35%6 |

Balance Sheet Reflects Financial Quality

| · | Full-year interest payments decreased to $27.5

million (from $36.5 million) |

| · | Net leverage of 0.8x and no principal debt maturities

until 2027 |

| · | Cash in hand of $133.0 million |

Exceeded Shareholder Return Targets

| · | Returned

$61.2 million to shareholders in full-year 2023 through dividends and buybacks, a 13% capital

return yield7, significantly exceeding the 40-50% free cash flow return target |

| · | Shareholder

returns included $30.0 million in dividends, a 6% dividend yield8, and $31.2 million

in buybacks (retiring 3.1 million shares, or 5.5% of total shares outstanding) |

| · | Renewed share buyback program for up to 10% of

shares outstanding until December 2024 |

| · | Quarterly cash dividend of $0.136 per share, or

approximately $7.5 million, payable on March 28, 2024 |

Portfolio Management

| · | Seeking scale and sustainability, divested Chilean

operations (transaction closed in January 2024) |

GeoPark Rated as ESG Leader

| · | Colombia’s licensing authority approved

the environmental license for the Putumayo-8 Block |

| · | ESG ratings upgrade by MSCI to “AA”

from “A”, making GeoPark an ESG ‘Leader’ |

| · | Ratings upgrade by Carbon Disclosure Project (CDP)

Climate change to “B” from “C” |

| · | Finalized a Human Rights risk assessment for operations

in Colombia and Ecuador |

| · | Completed a double materiality exercise to strengthen

the sustainability strategy |

4 Including

operated and non-operated wells.

5 Including

development, appraisal, and exploration wells. Does not include injector wells and wells that are currently under evaluation.

6 ROCE

is defined as last twelve-month operating profit divided by average total assets minus current liabilities.

7 Based

on GeoPark’s average market capitalization from December 1 to December 29, 2023.

8 Based

on GeoPark’s average market capitalization from December 1 to December 29, 2023.

CONSOLIDATED OPERATING PERFORMANCE

Key performance indicators:

| Key Indicators |

4Q2023 |

3Q2023 |

4Q2022 |

FY2023 |

FY2022 |

| Oil productiona (bopd) |

35,842 |

32,510 |

35,451 |

33,958 |

35,029 |

| Gas production (mcfpd) |

14,841 |

13,610 |

17,886 |

15,632 |

21,546 |

| Average net production (boepd) |

38,315 |

34,778 |

38,433 |

36,563 |

38,620 |

| Brent oil price ($ per bbl) |

82.9 |

86.0 |

88.8 |

82.2 |

98.6 |

| Combined realized price ($ per boe) |

67.1 |

68.3 |

68.5 |

64.0 |

78.1 |

| ⁻ Oil ($ per bbl) |

73.0 |

74.6 |

73.7 |

69.5 |

85.6 |

| ⁻ Gas ($ per mcf) |

4.4 |

4.4 |

5.0 |

4.6 |

4.8 |

| Sale of crude oil ($ million) |

192.5 |

184.7 |

220.7 |

726.1 |

1,004.8 |

| Sale of purchased crude oil ($ million) |

1.3 |

2.2 |

3.1 |

5.5 |

9.5 |

| Sale of gas ($ million) |

5.9 |

5.3 |

7.1 |

25.0 |

35.3 |

| Revenue ($ million) |

199.7 |

192.1 |

231.0 |

756.6 |

1,049.6 |

| Commodity risk management contracts ($ million) |

0.0 |

0.0 |

0.5 |

0.0 |

(70.2) |

| Production & operating costsb ($ million) |

(60.9) |

(58.2) |

(77.0) |

(232.3) |

(359.8) |

| G&G, G&Ac ($ million) |

(15.3) |

(14.1) |

(17.4) |

(55.2) |

(60.6) |

| Selling expenses ($ million) |

(4.8) |

(3.8) |

(2.8) |

(13.1) |

(8.0) |

| Operating profit ($ million) |

44.3 |

80.5 |

81.7 |

270.9 |

429.1 |

| Adjusted EBITDA ($ million) |

117.8 |

115.2 |

132.1 |

451.9 |

540.8 |

| Adjusted EBITDA ($ per boe) |

39.6 |

41.0 |

39.2 |

38.2 |

40.2 |

| Net profit ($ million) |

26.3 |

24.8 |

52.2 |

111.1 |

224.4 |

| Capital expenditures ($ million) |

66.6 |

44.1 |

53.6 |

199.0 |

168.8 |

| Cash and cash equivalents ($ million) |

133.0 |

106.3 |

128.8 |

133.0 |

128.8 |

| Short-term financial debt ($ million) |

12.5 |

5.7 |

12.5 |

12.5 |

12.5 |

| Long-term financial debt ($ million) |

488.5 |

487.6 |

485.1 |

488.5 |

485.1 |

| Net debt ($ million) |

368.0 |

387.0 |

368.8 |

368.0 |

368.8 |

| Dividends paid ($ per share) |

0.134 |

0.132 |

0.127 |

0.526 |

0.418 |

| Shares repurchased (million shares) |

0.850 |

0.500 |

0.942 |

3.074 |

2.743 |

| Basic shares – at period end (million shares) |

55.328 |

56.118 |

57.622 |

55.328 |

57.622 |

| Weighted average basic shares (million shares) |

55.892 |

56.513 |

58.261 |

56.837 |

59.330 |

| a) | Includes royalties and other economic rights paid in kind in Colombia for approximately

4,923 bopd, 5,045 bopd, and 759 bopd in 4Q2023, 3Q2023 and 4Q2022, respectively. No royalties were paid in kind in other countries. Production

in Ecuador is reported before the Government’s production share. |

| b) | Production and operating costs include operating costs, royalties and economic

rights paid in cash, share-based payments and purchased crude oil. |

| c) | G&A and G&G expenses include non-cash, share-based payments for $1.8 million,

$1.7 million, and $3.3 million in 4Q2023, 3Q2023 and 4Q2022, respectively. These expenses are excluded from the Adjusted EBITDA calculation. |

All figures are expressed in US Dollars and growth

comparisons refer to the same period of the prior year, except when specified. Definitions and terms used herein are provided in the Glossary

at the end of this document. This press release and its supplementary information do not contain all of the Company’s financial

information and the Company’s consolidated financial statements and corresponding notes for the period ended December 31, 2023,

will be included in the Company’s annual report on Form 20-F.

RECONCILIATION OF ADJUSTED EBITDA TO PROFIT BEFORE

INCOME TAX

| FY2023 (In millions of $) |

Colombia |

Chile |

Brazil |

Ecuador |

Other(a) |

Total |

| Adjusted EBITDA |

446.8 |

5.0 |

6.4 |

5.2 |

(11.5) |

451.9 |

| Depreciation |

(101.7) |

(9.8) |

(2.3) |

(7.1) |

(0.0) |

(120.9) |

| Write-off of unsuccessful exploration efforts |

(29.6) |

- |

- |

- |

- |

(29.6) |

| Impairment |

- |

(13.3) |

- |

- |

- |

(13.3) |

| Share based payment |

(1.4) |

(0.1) |

(0.0) |

(0.0) |

(5.8) |

(7.3) |

| Lease Accounting - IFRS 16 |

8.4 |

0.9 |

0.9 |

0.0 |

- |

10.3 |

| Others |

(1.1) |

(4.5) |

(0.4) |

0.0 |

(14.1) |

(20.1) |

| OPERATING PROFIT (LOSS) |

321.5 |

(21.9) |

4.5 |

(1.9) |

(31.3) |

270.9 |

| Financial costs, net |

|

|

|

|

|

(39.6) |

| Foreign exchange charges, net |

|

|

|

|

|

(16.8) |

| PROFIT BEFORE INCOME TAX |

|

|

|

|

|

214.5 |

|

FY2022 (In millions of $) |

Colombia |

Chile |

Brazil |

Ecuador |

Other(a) |

Total |

| Adjusted EBITDA |

525.6 |

11.8 |

11.7 |

4.2 |

(12.5) |

540.8 |

| Depreciation |

(78.8) |

(14.1) |

(2.8) |

(0.8) |

(0.2) |

(96.7) |

| Unrealized commodity risk management contracts |

13.0 |

- |

- |

- |

- |

13.0 |

| Write-off of unsuccessful exploration efforts |

(21.3) |

- |

- |

(4.5) |

- |

(25.8) |

| Share based payment |

(1.5) |

(0.2) |

- |

(0.0) |

(9.3) |

(11.0) |

| Lease Accounting - IFRS 16 |

5.2 |

1.1 |

1.4 |

0.0 |

0.1 |

7.9 |

| Others |

1.4 |

0.7 |

0.3 |

0.0 |

(1.5) |

0.9 |

| OPERATING PROFIT (LOSS) |

443.6 |

(0.7) |

10.5 |

(1.0) |

(23.3) |

429.1 |

| Financial costs, net |

|

|

|

|

|

(53.9) |

| Foreign exchange charges, net |

|

|

|

|

|

19.7 |

| PROFIT BEFORE INCOME TAX |

|

|

|

|

|

394.9 |

| (a) | Includes Argentina and Corporate. |

CONFERENCE

CALL INFORMATION

Reporting Date for

4Q2023 Results Release, Conference Call and Webcast

GeoPark will report its

4Q2023 and Annual 2023 financial results on Wednesday, March 6, 2024, after the market close.

In conjunction with the

4Q2023 results press release, GeoPark management will host a conference call on March 7, 2024, at 10:00 am (Eastern Standard Time) to

discuss the 4Q2023 financial results.

To listen to the call, participants can access

the webcast located in the Invest with Us section of the Company’s website at www.geo-park.com,

or by clicking below:

https://events.q4inc.com/attendee/179784519

Interested parties may

participate in the conference call by dialing the numbers provided below:

United States Participants:

404-975-4839

Global Dial-In Numbers:

Click here

Passcode:

998063

Please allow extra time

prior to the call to visit the website and download any streaming media software that might be required to listen to the webcast.

An archive of the webcast

replay will be made available in the Invest with Us section of the Company’s website at www.geo-park.com after the conclusion of

the live call.

| For further information, please contact: |

| |

|

| INVESTORS: |

|

| |

|

| Stacy Steimel |

ssteimel@geo-park.com |

| Shareholder Value Director |

|

| T: +562 2242 9600 |

|

| |

|

| Miguel Bello |

mbello@geo-park.com |

| Market Access Director |

|

| T: +562 2242 9600 |

|

| |

|

| Diego Gully |

dgully@geo-park.com |

| Investor Relations Director |

|

| T: +55 21 99636 9658 |

|

| |

|

| MEDIA: |

|

| |

|

| Communications Department |

communications@geo-park.com |

GLOSSARY

| 2027 Notes |

5.500% Senior Notes due 2027 |

| |

|

| Adjusted EBITDA |

Adjusted EBITDA is defined as profit

for the period before net finance costs, income tax, depreciation, amortization, the effect of IFRS 16, certain non-cash items such as

impairments and write-offs of unsuccessful efforts, accrual of share-based payments, unrealized results on commodity risk management

contracts and other non-recurring events |

| |

|

| Adjusted EBITDA per boe |

Adjusted EBITDA divided by total

boe deliveries |

| |

|

| Operating Netback per boe |

Revenue, less production and operating

costs (net of depreciation charges and accrual of stock options and stock awards, the effect of IFRS 16), selling expenses, and realized

results on commodity risk management contracts, divided by total boe deliveries. Operating Netback is equivalent to Adjusted EBITDA net

of cash expenses included in Administrative, Geological and Geophysical and Other operating costs |

| |

|

| Bbl |

Barrel |

| |

|

| Boe |

Barrels of oil equivalent |

| |

|

| Boepd |

Barrels of oil equivalent per day |

| |

|

| Bopd |

Barrels of oil per day |

| |

|

| G&A |

Administrative Expenses |

| |

|

| G&G |

Geological & Geophysical Expenses |

| |

|

| Mcfpd |

Thousand cubic feet per day |

| |

|

|

Net Debt |

Current and non-current borrowings less cash and cash equivalents |

| |

|

|

WI |

Working interest |

NOTICE

Additional information about GeoPark can be found

in the Invest with Us section of the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts

and percentages included in this press release and its supplementary information have been rounded for ease of presentation. Percentage

figures included in this press release and its supplementary information have not in all cases been calculated on the basis of such rounded

figures, but on the basis of such amounts prior to rounding. In addition, certain other amounts that appear in this press release and

its supplementary information may not sum due to rounding.

This press release and its supplementary information

contain certain oil and gas metrics, including information per share, operating netback, reserve life index and others, which do not have

standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by

other companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company’s performance;

however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to

the performance in previous periods.

ADDITIONAL INFORMATION REGARDING

THE CONTEMPLATED TENDER OFFER

This press release and its supplementary information

is for informational purposes only, is not a recommendation to buy or sell any securities of the Company and does not constitute an offer

to buy or the solicitation of an offer to sell any securities of the Company. The tender offer described in this press release has not

yet commenced, and there can be no assurances that the Company will commence the tender offer on the terms described in this press release

or at all. The tender offer will be made only pursuant to an offer to purchase and related materials that the Company expects to distribute

to its shareholders and file with the SEC upon commencement of the expected tender offer. If the tender offer is commenced as expected,

shareholders should read carefully the Tender Offer Statement on Schedule TO, the offer to purchase and related materials because they

will contain important information, including the various terms of, and conditions to, the tender offer. If the tender offer is commenced

as expected, shareholders and investors will be able to obtain a free copy of the tender offer statement on Schedule TO, the offer to

purchase and other documents that the Company expects to file with the SEC at the SEC’s website at www.sec.gov or by calling the

information agent for the contemplated tender offer, which will be identified in the materials filed with the SEC at the commencement

of the expected tender offer.

CAUTIONARY STATEMENTS RELEVANT

TO FORWARD-LOOKING INFORMATION

This press release and its supplementary information

contain statements that constitute forward-looking statements. Many of the forward-looking statements contained in this press release

can be identified by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’

‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’

among others.

Forward-looking statements that appear in a number

of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding

various matters, including, the intended commencement of the tender offer, drilling campaign and share buyback program. Forward-looking

statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements

are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking

statements due to various factors.

Forward-looking statements speak only as of the

date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments

or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

Oil and gas production figures included in this

press release and its supplementary information are stated before the effect of royalties paid in kind, consumption and losses. Annual

production per day is obtained by dividing total production by 365 days.

Non-GAAP Measures: The Company believes

Adjusted EBITDA, free cash flow and operating netback per boe, which are each non-GAAP measures, are useful because they allow the Company

to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard

to its financing methods or capital structure. The Company’s calculation of Adjusted EBITDA, free cash flow, and operating netback

per boe may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDA: The Company defines Adjusted

EBITDA as profit for the period before net finance costs, income tax, depreciation, amortization and certain non-cash items such as impairments

and write-offs of unsuccessful exploration and evaluation assets, accrual of stock options and stock awards, unrealized results on commodity

risk management contracts and other non-recurring events. Adjusted EBITDA is not a measure of profit or cash flow as

determined by IFRS. The Company excludes the items

listed above from profit for the period in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company

within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets

were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, profit for the period or cash flow

from operating activities as determined in accordance with IFRS or as an indicator of our operating performance or liquidity. Certain

items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance,

such as a company’s cost of capital and tax structure and significant and/or recurring write-offs, as well as the historic costs

of depreciable assets, none of which are components of Adjusted EBITDA. For a reconciliation of Adjusted EBITDA to the IFRS financial

measure of profit, see the accompanying financial tables and the supplementary information.

Operating Netback per boe: Operating netback

per boe should not be considered as an alternative to, or more meaningful than, profit for the period or cash flow from operating activities

as determined in accordance with IFRS or as an indicator of the Company’s operating performance or liquidity. Certain items excluded

from operating netback per boe are significant components in understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure and significant and/or recurring write-offs, as well as the historic costs of depreciable

assets, none of which are components of operating netback per boe. The Company’s calculation of operating netback per boe may not

be comparable to other similarly titled measures of other companies.

Item 2

SUPPLEMENT TO FOURTH QUARTER & FULL-YEAR

2023 RESULTS

This document should be read in conjunction with

GeoPark’s Fourth Quarter and Full-Year Results Release, available on the Company’s website.

PRODUCTION, DELIVERIES AND REALIZED

OIL PRICES

Production:

Average net oil and gas production in 4Q2023 was 38,315 boepd, flat compared to 4Q2022, due to higher production in Colombia and Ecuador

that was offset by lower production in Chile and Brazil. Oil represented 93% and 92% of total reported production in 4Q2023 and 4Q2022,

respectively.

Consolidated oil and gas production increased 10%

compared to 3Q2023, due to recent exploration successes in Colombia and Ecuador and the resumption of shut-in production in the CPO-5

Block (GeoPark non-operated, 30% WI).

Deliveries:

Oil and gas deliveries to GeoPark’s offtakers in 4Q2023 totaled 32,339 boepd, down by 12% compared to 4Q2022, mainly due to higher

royalties and economic rights paid in kind.

The mix of royalties and economic rights paid in

kind versus in cash affects revenue as well as production and operating costs but the effect is neutral with respect to Adjusted EBITDA.

In 4Q2023, royalties and economic rights paid in kind increased significantly compared to 4Q2022, resulting in lower revenue and also

lower production and operating costs (due to lower cash royalties and economic rights paid in cash).

Reference and Realized

Oil Prices: Brent crude oil prices decreased by 6% to $82.9 per bbl during 4Q2023, and the consolidated realized oil sales

price decreased by 1% to $73.0 per bbl in 4Q2023.

A breakdown of reference and net realized oil prices

in relevant countries in 4Q2023 and 4Q2022 is shown in the tables below:

|

4Q2023 - Realized Oil Prices

($ per bbl) |

Colombia |

Chile |

Ecuador |

| Brent oil price (*) |

83.3 |

83.0 |

81.5 |

| Local marker differential |

(4.6) |

- |

- |

| Commercial, transportation discounts & other |

(5.7) |

(14.5) |

(7.2) |

| Realized oil price |

73.0 |

68.5 |

74.3 |

| Weight on oil sales mix |

96% |

1% |

3% |

|

4Q2022 - Realized Oil Prices

($ per bbl) |

Colombia |

Chile |

Ecuador |

| Brent oil price (*) |

88.8 |

87.5 |

89.3 |

| Local marker differential |

(7.2) |

- |

- |

| Commercial, transportation discounts & other |

(8.2) |

(7.3) |

(8.0) |

| Realized oil price |

73.4 |

80.2 |

81.3 |

| Weight on oil sales mix |

96% |

1% |

3% |

(*) Corresponds

to the average month of sale price ICE Brent for Colombia and Ecuador, and Dated Brent for Chile.

REVENUE AND COSTS

Revenue: Consolidated

revenue decreased by 13% to $199.7 million in 4Q2023, compared to $231.0 million in 4Q2022, mainly reflecting lower oil and gas prices

and lower deliveries.

Sales of crude oil: Consolidated oil revenue

decreased by 13% to $192.5 million in 4Q2023, mainly due to the 12% decrease in deliveries and to a lesser extent, a 1% decrease in realized

oil prices. Oil revenue was 96% of total revenue in 4Q2023 and 4Q2022.

The table below provides a breakdown of crude oil

revenue in 4Q2023 and 4Q2022:

| Oil Revenue (In millions of $) |

4Q2023 |

4Q2022 |

| Colombia (*) |

183.6 |

211.7 |

| Chile |

2.3 |

3.2 |

| Brazil |

0.1 |

0.1 |

| Ecuador |

6.4 |

5.6 |

| Oil Revenue |

192.5 |

220.7 |

(*)

Net of Commodity risk management contracts designated as cash flow hedges.

Sales of purchased crude oil: 4Q2023 sales

of purchased crude oil decreased 57% to $1.3 million, which corresponds to oil trading operations (purchasing and selling crude oil from

third parties with the cost of the oil purchased reflected in production and operating costs).

Sales of gas: Consolidated gas revenue decreased

by 18% to $5.9 million in 4Q2023 compared to $7.1 million in 4Q2022, reflecting a 12% decrease in gas prices and 7% lower gas deliveries.

Gas revenue was 3% of total revenue in 4Q2023 and 4Q2022.

The table below provides a breakdown of gas revenue

in 4Q2023 and 4Q2022:

| Gas Revenue (In millions of $) |

4Q2023 |

4Q2022 |

| Chile |

1.9 |

3.5 |

| Brazil |

3.7 |

3.5 |

| Colombia |

0.2 |

0.1 |

| Gas Revenue |

5.9 |

7.1 |

Commodity Risk

Management Contracts: Consolidated commodity risk management contracts amounted to zero in 4Q2023, compared to a $0.5 million

gain in 4Q2022.

The table below provides a breakdown of realized

and unrealized commodity risk management charges in 4Q2023 and 4Q2022:

| Commodity Risk Management (In millions of $) |

4Q2023 |

4Q2022 |

| Realized loss |

- |

(2.2) |

| Unrealized gain |

- |

2.7 |

| Commodity Risk Management Contracts |

- |

0.5 |

In 4Q2023, GeoPark had zero cost collars covering

9,000 bopd including purchased puts with an average price of $69.4 per bbl and sold calls at an average price of $91.8 per bbl. As from

January 1, 2023, commodity risk management contracts are designated and qualify as cash flow hedges, so that realized gains or losses

are recorded in revenue.

Please refer to the “Commodity Risk Management

Contracts” section below for a description of hedges in place.

Production and

Operating Costs: Consolidated production and operating costs decreased to $60.9 million in 4Q2023 from $77.0 million in 4Q2022,

mainly resulting from lower royalties and economic rights paid in cash (due to higher royalties and economic rights paid in kind), partially

offset by higher operating costs.

The table below provides a breakdown of production

and operating costs in 4Q2023 and 4Q2022:

| Production and Operating Costs (In millions of $) |

4Q2023 |

4Q2022 |

| Royalties paid in cash |

(1.3) |

(14.2) |

| Economic rights paid in cash |

(17.7) |

(34.7) |

| Operating costs |

(40.5) |

(25.3) |

| Purchased crude oil |

(1.2) |

(2.6) |

| Share-based payments |

(0.3) |

(0.2) |

| Production and Operating Costs |

(60.9) |

(77.0) |

Consolidated royalties paid in cash amounted to

$1.3 million in 4Q2023 compared to $14.2 million in 4Q2022, in line with higher volumes of royalties being paid in kind.

Consolidated economic rights paid in cash (including

high price participation, x-factor and other economic rights paid to the Colombian Government in cash) amounted to $17.7 million in 4Q2023

compared to $34.7 million in 4Q2022, in line with higher volumes of economic rights paid in kind.

Consolidated operating costs increased to $40.5

million in 4Q2023 compared to $25.3 million in 4Q2022, reflecting higher energy costs (due to lower availability of hydroelectric power

in Colombia), inflationary pressures and the revaluation of the local currency in Colombia.

Consolidated purchased crude oil charges amounted

to $1.2 million in 4Q2023 compared to $2.6 million in 4Q2022, which corresponds to oil trading operations (purchasing and selling crude

oil from third parties with the sale of purchased oil being reflected in revenue).

Selling Expenses:

Consolidated selling expenses increased to $4.8 million in 4Q2023 compared to $2.8 million in 4Q2022.

Geological &

Geophysical Expenses: Consolidated G&G expenses increased to $3.6 million in 4Q2023 compared to $2.5 million in 4Q2022.

Administrative

Expenses: Consolidated G&A decreased to $11.7 million in 4Q2023 compared to $14.9 million in 4Q2022 mainly due to lower

directors and managers remuneration and a higher allocation of G&A costs to joint operations.

Adjusted

EBITDA: Consolidated Adjusted EBITDA1

decreased by 11% to $117.8 million in 4Q2023 (on a per

boe basis, Adjusted EBITDA increased to $39.6 per boe in 4Q2023 from $39.2 per boe in 4Q2022).

| Adjusted EBITDA (In millions of $) |

4Q2023 |

4Q2022 |

| Colombia |

115.7 |

124.5 |

| Chile |

1.4 |

2.7 |

| Brazil |

1.8 |

1.7 |

| Argentina |

(0.5) |

1.8 |

| Ecuador |

3.0 |

2.6 |

| Corporate |

(3.5) |

(1.2) |

| Adjusted EBITDA |

117.8 |

132.1 |

_________________

| 1 | For reconciliations,

see “Reconciliation of Adjusted EBITDA to Profit Before Income Tax” below. |

The table below shows production, volumes sold and the breakdown of

the most significant components of Adjusted EBITDA for 4Q2023 and 4Q2022, on a per boe basis:

| Adjusted EBITDA/boe |

Colombia |

Chile |

Brazil |

Ecuador |

Totald |

| |

4Q23 |

4Q22 |

4Q23 |

4Q22 |

4Q23 |

4Q22 |

4Q23 |

4Q22 |

4Q23 |

4Q22 |

| Production (boepd) |

34,154 |

33,749 |

1,641 |

2,291 |

1,101 |

1,134 |

1,419 |

1,259 |

38,315 |

38,433 |

| Inventories, RIK & Othera |

(5,626) |

(1,274) |

32 |

(180) |

(71) |

(259) |

(482) |

(504) |

(5,976) |

(1,804) |

| Sales volume (boepd) |

28,528 |

32,475 |

1,673 |

2,111 |

1,030 |

875 |

937 |

755 |

32,339 |

36,629 |

| % Oil |

99.7% |

99.8% |

22% |

21% |

2% |

2% |

100% |

100% |

93% |

93% |

| ($ per boe) |

|

|

|

|

|

|

|

|

|

|

| Realized oil price |

73.0 |

73.4 |

68.5 |

80.2 |

87.2 |

91.2 |

74.3 |

81.3 |

73.0 |

73.7 |

| Realized gas pricec |

25.1 |

15.5 |

16.2 |

22.8 |

39.8 |

44.8 |

- |

- |

26.5 |

30.0 |

| Realized commodity risk management contracts (Cash flow hedge) |

(0.1) |

- |

- |

- |

- |

- |

- |

- |

(0.1) |

- |

| Earn-out |

(2.8) |

(2.4) |

- |

- |

- |

- |

- |

- |

(2.6) |

(2.3) |

| Combined Price |

70.0 |

70.9 |

27.8 |

34.6 |

40.6 |

45.6 |

74.3 |

81.3 |

67.1 |

68.5 |

| Realized commodity risk management contracts |

- |

(0.8) |

- |

- |

- |

- |

- |

- |

- |

(0.7) |

| Operating costse |

(14.2) |

(7.1) |

(14.8) |

(16.6) |

(13.7) |

(16.5) |

(23.1) |

(23.7) |

(14.4) |

(8.2) |

| Royalties & economic rights |

(7.1) |

(16.2) |

(1.1) |

(1.4) |

(3.2) |

(3.5) |

- |

- |

(6.4) |

(14.5) |

| Purchased crude oilb |

- |

- |

- |

- |

- |

- |

- |

- |

(0.4) |

(0.8) |

| Selling & other expenses |

(1.5) |

(0.6) |

(0.5) |

(0.4) |

- |

(0.0) |

(8.1) |

(12.1) |

(1.6) |

(0.8) |

| Operating Netback/boe |

47.2 |

46.2 |

11.4 |

16.3 |

23.7 |

25.7 |

43.1 |

45.5 |

44.3 |

43.6 |

| G&A, G&G & other |

|

|

|

|

|

|

|

|

(4.7) |

(4.4) |

| Adjusted EBITDA/boe |

|

|

|

|

|

|

|

|

39.6 |

39.2 |

| a) | RIK (Royalties in kind) & Other:

Includes royalties and other economic rights paid in kind in Colombia for approximately 4,923 bopd and 759 bopd in 4Q2023 and 4Q2022,

respectively. No royalties were paid in kind in Chile, Brazil or Ecuador. Production in Ecuador is reported before the Government’s

production share. |

| b) | Reported in the Corporate business

segment. |

| c) | Conversion rate of $mcf/$boe=1/6. |

| d) | Includes amounts recorded in the

Corporate business segment. |

| e) | Operating costs per boe included

in this table include certain adjustments to the reported figures (IFRS 16 and others). |

Operating costs per boe in Colombia are affected

by the mix of royalties and economic rights paid in kind versus paid in cash, as operating cost per boe is calculated as total operating

costs (including the cost to produce barrels that are used to pay royalties and economic rights in kind) divided by barrels delivered

to GeoPark’s offtakers (after royalties and economic rights paid in kind).

Depreciation:

Consolidated depreciation charges increased to $34.6 million in 4Q2023 compared to $30.5 million in 4Q2022.

Write-off of unsuccessful

exploration efforts: The consolidated write-off of unsuccessful exploration efforts amounted to $8.0 million in 4Q2023 compared

to $19.9 million in 4Q2022. Amounts recorded in 4Q2023 correspond to exploration costs incurred in the Llanos basin.

Other Income (Expenses):

Consolidated Other expenses increased to $18.5 million in 4Q2023 compared to $2.2 million in 4Q2022 mainly due to termination and other

costs related to the divestment in Chile, and to a lesser extent, the transfer of the working interest in the Los Parlamentos Block in

Argentina to the joint operation partner.

CONSOLIDATED NON-OPERATING RESULTS

AND PROFIT

Financial Expenses:

Net financial expenses decreased to $9.6 million in 4Q2023 from $9.9 million in 4Q2022.

Foreign Exchange:

Net foreign exchange gains amounted to $0.1 million in 4Q2023 compared to a $7.8 million gain in 4Q2022.

Income Tax:

Income taxes totaled $8.5 million in 4Q2023 compared to $27.3 million in 4Q2022, mainly resulting from income tax gains related to the

deductibility of royalties, lower profits before income taxes and the effect of fluctuations of the Colombian peso over deferred income

taxes.

Net Profit:

Net profit decreased to $26.3 million in 4Q2023 compared to $52.2 million in 4Q2022.

BALANCE SHEET

Cash and Cash Equivalents:

Cash and cash equivalents totaled $133.0 million as of December 31, 2023, compared to $128.8 million as of December 31, 2022.

This net increase is explained by the following:

| Cash and Cash Equivalents (In millions of $) |

FY2023 |

| Cash flows from operating activities |

300.9 |

| Cash flows used in investing activities |

(198.6) |

| Cash flows used in financing activities |

(98.7) |

| Currency Translation |

0.6 |

| Net increase in cash & cash equivalents |

4.2 |

Cash

flows from operating activities of $300.9 million included income tax payments of $143.2 million2.

Cash flows used in financing activities mainly

included $27.5 million related to interest payments, $31.2 million related to executing the Company’s share buyback program and

$30.0 million related to dividend payments.

Financial Debt:

Total financial debt net of issuance cost was $501.0 million, corresponding to the 2027 Notes. Short-term financial debt was $12.5 million

as of December 31, 2023, and corresponds to interest accrued on the 2027 Notes.

| Financial Debt (In millions of $) |

December 31, 2023 |

December 31, 2022 |

| 2027 Notes |

501.0 |

497.6 |

| Financial debt |

501.0 |

497.6 |

FINANCIAL RATIOSa

| (In millions of $) |

| Period-end |

Financial Debt |

Cash and Cash Equivalents |

Net Debt |

Net Debt/LTM Adj. EBITDA |

LTM Interest

Coverage |

| 4Q2022 |

497.6 |

128.8 |

368.8 |

0.7x |

14.9x |

| 1Q2023 |

491.6 |

145.4 |

346.2 |

0.7x |

15.8x |

| 2Q2023 |

499.3 |

86.4 |

412.9 |

0.8x |

15.4x |

| 3Q2023 |

493.3 |

106.3 |

387.0 |

0.8x |

15.1x |

| 4Q2023 |

501.0 |

133.0 |

368.0 |

0.8x |

14.7x |

| a) | Based

on trailing last twelve-month financial results (“LTM”). |

_________________

| 2 | Includes current

income tax payments and withholding taxes from clients for $27.6 million (included within

“Change in working capital” line item of the Statement of Cash Flow). |

Covenants in the

2027 Notes: The 2027 Notes include debt incurrence covenants that, among others, require that the Net Debt to Adjusted EBITDA

ratio should not exceed 3.25 times and the Adjusted EBITDA to Interest ratio should exceed 2.5 times for GeoPark to incur new debt.

COMMODITY RISK MANAGEMENT CONTRACTS

The table below summarizes commodity risk management

contracts in place as of the date of this release:

| Period |

Type |

Reference |

Volume

(bopd) |

Contract Terms

(Average $ per bbl) |

| |

|

|

|

Purchased Put |

Sold Call |

| 1Q2024 |

Zero cost collar |

Brent |

8,500 |

65.6 |

92.0 |

| 2Q2024 |

Zero cost collar |

Brent |

9,000 |

67.5 |

97.0 |

| 3Q2024 |

Zero cost collar |

Brent |

7,000 |

66.4 |

99.3 |

| 4Q2024 |

Zero cost collar |

Brent |

1,000 |

70.0 |

96.0 |

SELECTED INFORMATION BY BUSINESS

SEGMENT

|

Colombia

(In millions of $) |

4Q2023 |

4Q2022 |

| Sale of crude oil |

183.6 |

211.7 |

| Sale of gas |

0.2 |

0.1 |

| Revenue |

183.8 |

211.8 |

| Production and operating costsa |

(54.1) |

(69.0) |

| Adjusted EBITDA |

115.7 |

124.5 |

| Capital expenditures |

58.9 |

50.4 |

|

Chile

(In millions of $) |

4Q2023 |

4Q2022 |

| Sale of crude oil |

2.3 |

3.2 |

| Sale of gas |

1.9 |

3.5 |

| Revenue |

4.3 |

6.7 |

| Production and operating costsa |

(2.3) |

(2.4) |

| Adjusted EBITDA |

1.4 |

2.7 |

| Capital expenditures |

0.0 |

0.4 |

|

Brazil

(In millions of $) |

4Q2023 |

4Q2022 |

| Sale of crude oil |

0.1 |

0.2 |

| Sale of gas |

3.7 |

3.5 |

| Revenue |

3.8 |

3.7 |

| Production and operating costsa |

(1.4) |

(1.2) |

| Adjusted EBITDA |

1.8 |

1.7 |

| Capital expenditures |

0.0 |

0.0 |

|

Ecuador

(In millions of $) |

4Q2023 |

4Q2022 |

| Sale of crude oil |

6.4 |

5.6 |

| Sale of gas |

0.0 |

0.0 |

| Revenue |

6.4 |

5.6 |

| Production and operating costsa |

(2.0) |

(1.7) |

| Adjusted EBITDA |

3.0 |

2.6 |

| Capital expenditures |

7.7 |

2.8 |

| a) | Production and operating

costs = Operating costs + Royalties + Share-based payments + Purchased crude oil |

CONSOLIDATED STATEMENT OF INCOME

(QUARTERLY INFORMATION UNAUDITED)

| (In millions of $) |

4Q2023 |

4Q2022 |

FY2023 |

FY2022 |

|

REVENUE

|

|

|

|

|

| Sale of crude oil |

192.5 |

220.7 |

726.1 |

1,004.8 |

| Sale of purchased crude oil |

1.3 |

3.1 |

5.5 |

9.5 |

| Sale of gas |

5.9 |

7.1 |

25.0 |

35.3 |

| TOTAL REVENUE |

199.7 |

231.0 |

756.6 |

1,049.6 |

| Commodity risk management contracts |

0.0 |

0.5 |

0.0 |

(70.2) |

| Production and operating costs |

(60.9) |

(77.0) |

(232.3) |

(359.8) |

| Geological and geophysical expenses (G&G) |

(3.6) |

(2.5) |

(11.2) |

(10.5) |

| Administrative expenses (G&A) |

(11.7) |

(14.9) |

(44.0) |

(50.0) |

| Selling expenses |

(4.8) |

(2.8) |

(13.1) |

(8.0) |

| Depreciation |

(34.6) |

(30.5) |

(120.9) |

(96.7) |

| Write-off of unsuccessful exploration efforts |

(8.0) |

(19.9) |

(29.6) |

(25.8) |

| Impairment |

(13.3) |

0.0 |

(13.3) |

0.0 |

| Other |

(18.5) |

(2.2) |

(21.3) |

0.5 |

| OPERATING PROFIT |

44.3 |

81.7 |

270.9 |

429.1 |

| |

|

|

|

|

| Financial costs, net |

(9.6) |

(9.9) |

(39.6) |

(53.9) |

| Foreign exchange (loss) gain |

0.1 |

7.8 |

(16.8) |

19.7 |

| PROFIT BEFORE INCOME TAX |

34.8 |

79.5 |

214.5 |

394.9 |

| |

|

|

|

|

| Income tax |

(8.5) |

(27.3) |

(103.4) |

(170.5) |

| PROFIT FOR THE PERIOD |

26.3 |

52.2 |

111.1 |

224.4 |

SUMMARIZED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(QUARTERLY INFORMATION UNAUDITED)

| (In millions of $) |

Dec '23 |

Dec '22 |

| |

|

|

| Non-Current Assets |

|

|

| Property, plant and equipment |

686.8 |

666.8 |

| Other non-current assets |

60.0 |

69.0 |

| Total Non-Current Assets |

746.8 |

735.8 |

| |

|

|

| Current Assets |

|

|

| Inventories |

13.6 |

14.4 |

| Trade receivables |

65.0 |

71.8 |

| Other current assets |

58.1 |

23.1 |

| Cash at bank and in hand |

133.0 |

128.8 |

| Total Current Assets |

269.7 |

238.1 |

| |

|

|

| Total Assets |

1,016.5 |

974.0 |

| |

|

|

| Total Equity |

176.0 |

115.6 |

| |

|

|

| Non-Current Liabilities |

|

|

| Borrowings |

488.5 |

485.1 |

| Other non-current liabilities |

121.5 |

144.1 |

| Total Non-Current Liabilities |

610.0 |

629.2 |

| |

|

|

| Current Liabilities |

|

|

| Borrowings |

12.5 |

12.5 |

| Other current liabilities |

218.0 |

216.6 |

| Total Current Liabilities |

230.5 |

229.2 |

|

Total Liabilities

|

840.5 |

858.4 |

| Total Liabilities and Equity |

1,016.5 |

974.0 |

SUMMARIZED CONSOLIDATED STATEMENT OF CASH FLOW

(QUARTERLY INFORMATION UNAUDITED)

| (In millions of $) |

4Q2023 |

4Q2022 |

FY2023 |

FY2022 |

| |

|

|

|

|

| Cash flow from operating activities |

110.6 |

113.4 |

300.9 |

467.5 |

| Cash flow used in investing activities |

(66.2) |

(53.6) |

(198.6) |

(153.7) |

| Cash flow used in financing activities |

(17.7) |

(24.2) |

(98.7) |

(286.6) |

RECONCILIATION OF ADJUSTED EBITDA TO PROFIT BEFORE

INCOME TAX

| FY2023 (In millions of $) |

Colombia |

Chile |

Brazil |

Ecuador |

Other(a) |

Total |

| Adjusted EBITDA |

446.8 |

5.0 |

6.4 |

5.2 |

(11.5) |

451.9 |

| Depreciation |

(101.7) |

(9.8) |

(2.3) |

(7.1) |

(0.0) |

(120.9) |

| Write-off of unsuccessful exploration efforts |

(29.6) |

- |

- |

- |

- |

(29.6) |

| Impairment |

- |

(13.3) |

- |

- |

- |

(13.3) |

| Share based payment |

(1.4) |

(0.1) |

(0.0) |

(0.0) |

(5.8) |

(7.3) |

| Lease Accounting - IFRS 16 |

8.4 |

0.9 |

0.9 |

0.0 |

- |

10.3 |

| Others |

(1.1) |

(4.5) |

(0.4) |

0.0 |

(14.1) |

(20.1) |

| OPERATING PROFIT (LOSS) |

321.5 |

(21.9) |

4.5 |

(1.9) |

(31.3) |

270.9 |

| Financial costs, net |

|

|

|

|

|

(39.6) |

| Foreign exchange charges, net |

|

|

|

|

|

(16.8) |

| PROFIT BEFORE INCOME TAX |

|

|

|

|

|

214.5 |

|

FY2022 (In millions of $) |

Colombia |

Chile |

Brazil |

Ecuador |

Other(a) |

Total |

| Adjusted EBITDA |

525.6 |

11.8 |

11.7 |

4.2 |

(12.5) |

540.8 |

| Depreciation |

(78.8) |

(14.1) |

(2.8) |

(0.8) |

(0.2) |

(96.7) |

| Unrealized commodity risk management contracts |

13.0 |

- |

- |

- |

- |

13.0 |

| Write-off of unsuccessful exploration efforts |

(21.3) |

- |

- |

(4.5) |

- |

(25.8) |

| Share based payment |

(1.5) |

(0.2) |

- |

(0.0) |

(9.3) |

(11.0) |

| Lease Accounting - IFRS 16 |

5.2 |

1.1 |

1.4 |

0.0 |

0.1 |

7.9 |

| Others |

1.4 |

0.7 |

0.3 |

0.0 |

(1.5) |

0.9 |

| OPERATING PROFIT (LOSS) |

443.6 |

(0.7) |

10.5 |

(1.0) |

(23.3) |

429.1 |

| Financial costs, net |

|

|

|

|

|

(53.9) |

| Foreign exchange charges, net |

|

|

|

|

|

19.7 |

| PROFIT BEFORE INCOME TAX |

|

|

|

|

|

394.9 |

| (a) | Includes Argentina and Corporate. |

2023 RETURN ON AVERAGE CAPITAL EMPLOYED

| (In millions of $) |

2023 |

2022 |

| 2023 Operating Income (Full-year) |

270.9 |

|

| Total Assets – Year-end |

1,016.5 |

974.0 |

| Current Liabilities – Year-end |

(230.5) |

(229.2) |

| Capital Employed – Year-end |

786.0 |

744.8 |

| 2023 Average Capital Employed |

765.4 |

|

| 2023 Average Return on Average Capital Employed |

35% |

|

|

For further information, please contact:

INVESTORS: |

| |

|

|

Stacy Steimel

Shareholder Value Director

T: +562 2242 9600 |

ssteimel@geo-park.com |

| |

|

|

Miguel Bello

Market Access Director

T: +562 2242 9600 |

mbello@geo-park.com |

| |

|

|

Diego Gully

Investor Relations Director

T: +55 21 99636 9658 |

dgully@geo-park.com |

| |

|

| MEDIA: |

|

| |

|

| Communications Department |

communications@geo-park.com |

GLOSSARY

| 2027 Notes |

5.500% Senior Notes due 2027 |

| |

|

| Adjusted EBITDA |

Adjusted EBITDA is defined as profit

for the period before net finance costs, income tax, depreciation, amortization, the effect of IFRS 16, certain non-cash items such as

impairments and write-offs of unsuccessful efforts, accrual of share-based payments, unrealized results on commodity risk management

contracts and other non-recurring events |

| |

|

| Adjusted EBITDA per boe |

Adjusted EBITDA divided by total

boe deliveries |

| |

|

| Operating Netback per boe |

Revenue, less production and operating

costs (net of depreciation charges and accrual of stock options and stock awards, the effect of IFRS 16), selling expenses, and realized

results on commodity risk management contracts, divided by total boe deliveries. Operating Netback is equivalent to Adjusted EBITDA net

of cash expenses included in Administrative, Geological and Geophysical and Other operating costs |

| |

|

| bbl |

Barrel |

| |

|

| boe |

Barrels of oil equivalent |

| |

|

| boepd |

Barrels of oil equivalent per day |

| |

|

| bopd |

Barrels of oil per day |

| |

|

| G&A |

Administrative Expenses |

| |

|

| G&G |

Geological & Geophysical Expenses |

| |

|

| LTM |

Last Twelve Months |

| |

|

| mcfpd |

Thousand cubic feet per day |

| |

|

|

Net Debt |

Current and non-current borrowings less cash and cash equivalents |

| |

|

| WI |

Working interest |

NOTICE

Additional information about GeoPark can be found

in the Invest with Us section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts

and percentages included in this press release and its corresponding supplementary information have been rounded for ease of presentation.

Percentage figures included in this press release have not in all cases been calculated on the basis of such rounded figures, but on the

basis of such amounts prior to rounding. In addition, certain other amounts that appear in this press release and its corresponding supplementary

information may not sum due to rounding.

This press release and its corresponding supplementary

information contain certain oil and gas metrics, including information per share, operating netback, reserve life index and others, which

do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures

used by other companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company’s

performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not

compare to the performance in previous periods.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release and its corresponding supplementary

information contain statements that constitute forward-looking statements. Many of the forward-looking statements contained in this press

release can be identified by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’

‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’

among others.

Forward-looking statements that appear in a number

of places in this press release and its corresponding supplementary information include, but are not limited to, statements regarding

the intent, belief or current expectations, regarding various matters, including, production guidance, capital expenditures, Adjusted

EBITDA, free cash flow and shareholder returns. Forward-looking statements are based on management’s beliefs and assumptions, and

on information currently available to the management. Such statements are subject to risks and uncertainties, and actual results may differ

materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as of the

date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments

or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

Oil and gas production figures included in this

press release and its corresponding supplementary information are stated before the effect of royalties paid in kind, consumption and

losses. Annual production per day is obtained by dividing total production by 365 days.

Non-GAAP Measures: The Company believes

Adjusted EBITDA, free cash flow and operating netback per boe, which are each non-GAAP measures, are useful because they allow the Company

to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard

to its financing methods or capital structure. The Company’s calculation of Adjusted EBITDA, free cash flow, and operating netback

per boe may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDA: The Company defines Adjusted

EBITDA as profit for the period before net finance costs, income tax, depreciation, amortization and certain non-cash items such as impairments

and write-offs of unsuccessful exploration and evaluation assets, accrual of stock options and stock awards, unrealized results on commodity

risk management contracts and other non-recurring events. Adjusted EBITDA is not a measure of profit or cash flow as determined by IFRS.

The Company excludes the items listed above from profit for the period in arriving at Adjusted EBITDA because these amounts can vary substantially

from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method

by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, profit for

the period or cash flow from operating activities as determined in accordance with IFRS or as an indicator of our operating performance

or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s

financial performance, such as a company’s cost of capital and tax structure and significant and/or recurring write-offs, as well

as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. For a reconciliation of Adjusted EBITDA

to the IFRS financial measure of profit, see the accompanying financial tables.

Operating Netback per boe: Operating netback

per boe should not be considered as an alternative to, or more meaningful than, profit for the period or cash flow from operating activities

as determined in accordance with IFRS or as an indicator of the Company’s operating performance or liquidity. Certain items excluded

from operating netback per boe are significant components in understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure and significant and/or recurring write-offs, as well as the historic costs of depreciable

assets, none of which are components of operating netback per boe. The Company’s calculation of operating netback per boe may not

be comparable to other similarly titled measures of other companies.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

GeoPark Limited |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/

Jaime Caballero Uribe |

| |

|

|

|

Name: |

Jaime Caballero Uribe |

| |

|

|

|

Title: |

Chief Financial Officer |

Date:

March 7, 2024

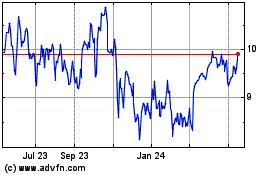

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

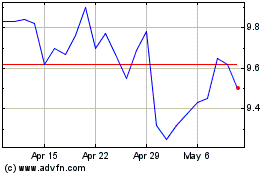

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024