Gap Forecasts a Profit Decline, Lower Stock Buybacks--Update

26 February 2016 - 9:00AM

Dow Jones News

By Maria Armental

Gap Inc. on Thursday said it expects profit to fall in the

current business year and that it would reduce capital spending and

buy back fewer shares as it looks to pay down debt.

The retailer said its board had approved an additional $1

billion to buy back shares--but said the buyback would fall short

of its historic average as it directs some of its cash toward debt

payments.

Gap, which ended the year with about $1.31 billion in long-term

debt, spent $1.4 billion on stock buybacks and dividend payouts in

its latest business year.

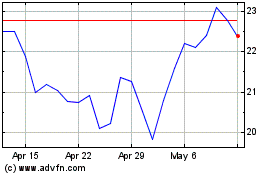

Shares of the company declined 3.9% to $26.60 in after-hours

trading. The stock has recovered sharply in the past month, adding

20%--but it is still down 32% in the past 12 months.

The retailer projects adjusted profit of $2.20 to $2.25 for the

current year, which would be a decline from $2.43 a share in fiscal

2015. Analysts surveyed by Thomson Reuters projected $2.42 a

share.

Gap said it set aside about $650 million for capital projects,

down from the $726 million it spent in 2015.

Gap has been trying to revamp its namesake brand. The company

last year brought on new leadership--including former Banana

Republic veteran Wendi Goldman, who had led Victoria's Secret's

Pink line--and said it would layoff workers and close stores as

part of a broader cost-cutting move.

In the latest period, sales at its Gap stores fell 4%, or 6% on

a comparable basis.

Comparable sales, which Gap defines as stores open for at least

a year along with online sales, are a key metric for retailers,

stripping out the impact of recently opened or closed stores.

Banana Republic reported with a 10% comparable-sales decline

from the year earlier, while Old Navy continued to post strong

sales, up 5% in the latest period.

Over all, for the 13 weeks ended Jan. 30, Gap reported a profit

of $214 million, or 53 cents a share, down from $319 million, or 75

cents a share, a year earlier. Excluding charges related to the Gap

brand overhaul, profit was 57 cents a share.

Net sales fell 7% to $4.39 billion with online sales accounting

for $803 million. On a comparable sales basis, sales fell 7%. In

the year-ago period, the company reported a 2% increase in

comparable sales.

The stronger dollar, the company said, lowered sales by about

$100 million.

Analysts surveyed by Thomson Reuters had projected 57 cents a

share on $4.46 billion in sales.

Gross margin narrowed to 32.8% from 35.2% a year earlier.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 25, 2016 16:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

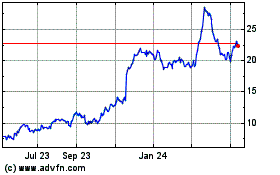

Gap (NYSE:GPS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Jul 2023 to Jul 2024