Athletic-Gear Makers Run Into a Problem: Their Workout Clothing Is Too Sporty

05 April 2016 - 4:50AM

Dow Jones News

By Sara Germano

At a time when workout gear is fashionable, companies that make

and sell sportswear are facing a strange predicament: their gear is

too sporty for some.

Karyn Riale, chief buyer for high-end gym chain Equinox, has

stopped carrying traditional brands such as Adidas at the shops in

its locations. Instead, Ms. Riale said she prefers to make room for

what she calls lifestyle brands like Michi, which makes

mesh-paneled leggings called "Psyloque" and "Suprastelle."

Foot Locker Inc. also is adjusting the selection at its stores

after noticing that upstart brands with higher style quotients such

as Alala and Koral are performing well, and activewear endorsed by

celebrities, including Rihanna, is driving sales.

"We believe we have overemphasized the performance aspect of

what our customers want in terms of athletically inspired apparel,"

Chief Executive Dick Johnson said in late February. Shoppers are

"very, very informed about style," and want to look good "going out

after class for a juice or coffee," he noted.

As a result, some mainstay sports brands and retailers are

rethinking the balance between performance and fashion. The success

of women-centric athletic companies such as Lululemon Athletica

Inc. and Gap Inc.'s Athleta have paved the way for hundreds of

brands to jump on the athleisure bandwagon, according to NPD Group

sports industry analyst Matt Powell. As of last year, Mr. Powell

said there were more than 800 brands competing and no single one

has the lion's share of the market yet.

Last Thursday, pop star Beyoncé launched a line of athletic

clothes of her owned called Ivy Park that will be available at

retailers, including Nordstrom and Topshop, later this month.

While the overall sales of women's athletic apparel are growing

at a fast clip of 19%, according to NPD Group, there are signs that

the retail market for women's performance gear is slowing.

According to SportsOneSource, which tracks traditional sportswear

retailers and other national chains, sales of women's performance

apparel are flat so far this year, after 3% growth last year.

"There is a lot more competition now. There are a number of new

brands," said Neil Schwartz, vice president of business development

for SportsOneSource. Its data don't capture international sales or

direct-to-consumer sales, which have been a growing piece of

business for Nike Inc. and others.

The big three performance brands -- Nike, Under Armour Inc. and

Adidas AG -- which started out targeting men with high-performance

materials, are turning their attention to the women's market, which

they see fueling growth in the years to come. Under Armour recently

hired new executives to lead its women's apparel and footwear

divisions. CEO Kevin Plank in January forecast its women's business

to eventually outsell its men's business.

Nike forecasts sales of women's products will roughly double by

2020, though its share of total sales will remain about the same.

In its last fiscal year, women's gear accounted for 22% of Nike

brand's $25.8 billion sales.

Its approach to women's gear remains performance oriented. In a

statement, Nike said it begins its product design process by

addressing technical needs for athletes, but "performance-inspired

design doesn't mean sacrificing style, as how you look and feel are

integral to how you play."

Meanwhile, Adidas' recently hired head of its women's segment,

Nicole Vollebregt, is exploring new retail options, including

getting its gear back in some of the shops at Equinox's gyms. The

German sportswear company has brought in former Lululemon CEO

Christine Day to help advise on retail strategy and collaborations

with smaller brands in the women's business.

Its Reebok brand has teamed up with New York-based graffiti

artist Upendo Taylor to make exclusive products for New York-based

Bandier, a two-year-old boutique with locations in New York and

Dallas.

National sportswear retail chains are struggling to get the

model right for women's stores.

Foot Locker is paring back its Lady Foot Locker outlets to make

way for a new model of bigger stores called Six:02. Dick's Sporting

Goods Inc. has put expansion plans of its new Chelsea Collective

boutiques on hold after it had to alter the merchandise in its

initial two locations, according to a person familiar with the

matter. The boutiques have been "helpful" in learning more about

consumer tastes, Chief Executive Ed Stack recently said.

The moves seek to appeal to shoppers like Chelsea Lee, a

magazine designer who works out at hip-hop dance classes at studios

around Manhattan at least three times a week, who want more style

in their gear. Ms. Lee said she frequently buys new sports bras but

avoids pure-sports brands like Under Armour because they lacked the

fashion factor.

"It sounds silly to say that they look so athletic, because I'm

doing something athletic," Ms. Lee said, "but it doesn't look cool

enough to me."

Write to Sara Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

April 04, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

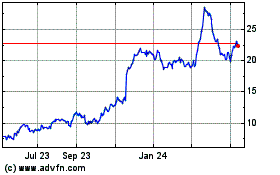

Gap (NYSE:GPS)

Historical Stock Chart

From Jun 2024 to Jul 2024

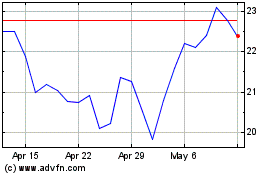

Gap (NYSE:GPS)

Historical Stock Chart

From Jul 2023 to Jul 2024