Fitch Downgrades Gap to Junk Status -- Update

12 May 2016 - 12:49AM

Dow Jones News

By Austen Hufford

Fitch Ratings on Wednesday downgraded Gap Inc.'s credit rating

to junk status, days after the clothing retailer warned of weak

sales across its brands and said it would take steps to streamline

its business.

Fitch cut the credit rating of Gap's debt by one notch to BB+

from BBB-, bringing it below investment grade. Many potential

debtholders aren't allowed to buy non-investment-grade debt.

Fitch said it was concerned about declines in comparable-store

sales and gross margin and on Gap's "continued reliance" on

large-scale cost-reduction programs to protect profitability in the

face of sales declines.

"Gap continues to see material declines in traffic, and while

traffic declines are an issue across the mall space, Gap's outsized

declines are an indication that customer loyalty is waning as

product continues to disappoint," the ratings agency said.

Gap is being squeezed by fast-fashion retailers such as H&M

operator Hennes & Mauritz AB and Zara owner Inditex SA, which

push low-price items and shift their selections quickly. To combat

the sales slump, Gap CEO Art Peck has brought in new executives and

promised to source goods more quickly.

Fitch said Gap is in the challenging middle-market apparel

sector, stuck between higher-end aspirational brands and lower-end,

fast-fashion brands.

The company has also been shrinking its footprint, by closing

dozens of locations in its home market. On Monday, the company

indicated it would revamp its overseas operations.

Gap's debt is still rated as investment grade by Standard &

Poor's and Moody's. Fitch said Gap's rating outlook is stable.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

May 11, 2016 10:34 ET (14:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

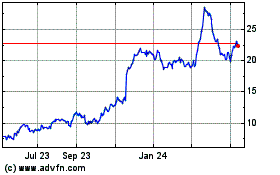

Gap (NYSE:GPS)

Historical Stock Chart

From Aug 2024 to Sep 2024

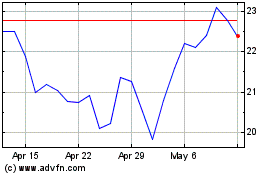

Gap (NYSE:GPS)

Historical Stock Chart

From Sep 2023 to Sep 2024