Gap Sees Better-Than-Expected Profit for Holiday Quarter

07 February 2017 - 9:42AM

Dow Jones News

By Maria Armental

Gap. Inc. expects to top profit targets for the year, following

stronger-than-expected sales during the holiday quarter.

Shares, down 3% over the past 12 months, rose 3% to $23.69 in

after-hours trading.

Over all, the company said sales rose 1% to $4.43 billion in the

fourth quarter, breaking a string of declines and beating analysts'

projections of $4.4 billion despite a challenging backdrop for

retailers.

Meanwhile, sales at stores open for at least a year improved 2%,

as Old Navy and Gap sales offset a 3% decline at Banana

Republic.

The San Francisco retailer has been trying to rebuild its brands

and recapture market share from online competitors and so-called

off-price and fast-fashion retailers under the direction of Chief

Executive Art Peck, a decade-plus Gap veteran who took over the top

executive role in 2015.

On Monday, the retailer, which is slated to report results on

Feb. 23, said it expects to make 54 cents to 55 cents a share in

the fourth quarter, or 50 cents to 51 cents a share on an adjusted

basis, easily topping analysts' projected 43 cents a share, or 45

cents on an adjusted basis.

For the recently ended business year, it expects to make $1.68

to $1.69 a share, or $2.01 to $2.02 on an adjusted basis, compared

with its earlier view of $1.41 to $1.50 a share, or $1.87 to $1.92

on an adjusted basis.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 06, 2017 17:27 ET (22:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

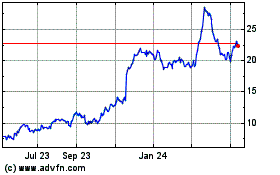

Gap (NYSE:GPS)

Historical Stock Chart

From Jun 2024 to Jul 2024

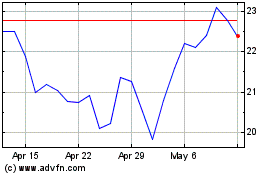

Gap (NYSE:GPS)

Historical Stock Chart

From Jul 2023 to Jul 2024