Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 May 2024 - 7:01AM

Edgar (US Regulatory)

Nuveen

Core

Equity

Alpha

Fund

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

LONG-TERM

INVESTMENTS

-

100.2%

X

–

COMMON

STOCKS

-

98.8%

X

227,943,432

Automobiles

&

Components

-

0.6%

7,560

(b)

Tesla

Inc

$

1,328,972

Total

Automobiles

&

Components

1,328,972

Banks

-

2.7%

2,985

Bank

of

America

Corp

113,191

29,890

Citigroup

Inc

1,890,244

21,470

JPMorgan

Chase

&

Co

4,300,441

Total

Banks

6,303,876

Capital

Goods

-

8.2%

9,820

AGCO

Corp

1,208,056

4,710

Curtiss-Wright

Corp

1,205,477

12,950

Esab

Corp

1,431,882

29,770

Flowserve

Corp

1,359,894

6,200

General

Dynamics

Corp

1,751,438

15,280

General

Electric

Co

2,682,099

9,220

Honeywell

International

Inc

1,892,405

3,770

Lockheed

Martin

Corp

1,714,860

3,270

Northrop

Grumman

Corp

1,565,218

1,160

Parker-Hannifin

Corp

644,716

5,290

Trane

Technologies

PLC

1,588,058

22,120

Vertiv

Holdings

Co,

Class

A

1,806,540

Total

Capital

Goods

18,850,643

Commercial

&

Professional

Services

-

2.2%

7,680

Booz

Allen

Hamilton

Holding

Corp

1,140,019

10,580

Leidos

Holdings

Inc

1,386,932

6,540

MSA

Safety

Inc

1,266,079

50,840

Vestis

Corp

979,687

1,890

Waste

Management

Inc

402,853

Total

Commercial

&

Professional

Services

5,175,570

Consumer

Discretionary

Distribution

&

Retail

-

6.2%

57,400

(b),(c)

Amazon.com

Inc

10,353,812

68,720

(b)

Coupang

Inc

1,222,529

3,790

Home

Depot

Inc/The

1,453,844

5,620

Ross

Stores

Inc

824,791

3,840

TJX

Cos

Inc/The

389,453

Total

Consumer

Discretionary

Distribution

&

Retail

14,244,429

Consumer

Durables

&

Apparel

-

0.7%

32,040

Tapestry

Inc

1,521,259

Total

Consumer

Durables

&

Apparel

1,521,259

Consumer

Services

-

2.2%

550

Booking

Holdings

Inc

1,995,334

2,750

Domino's

Pizza

Inc

1,366,420

18,660

Starbucks

Corp

1,705,337

Total

Consumer

Services

5,067,091

Consumer

Staples

Distribution

&

Retail

-

2.9%

540

Costco

Wholesale

Corp

395,620

23,670

Kroger

Co/The

1,352,267

15,080

(b)

Performance

Food

Group

Co

1,125,571

Nuveen

Core

Equity

Alpha

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Consumer

Staples

Distribution

&

Retail

(continued)

6,930

Target

Corp

$

1,228,066

42,387

Walmart

Inc

2,550,426

Total

Consumer

Staples

Distribution

&

Retail

6,651,950

Energy

-

3.3%

43,210

Baker

Hughes

Co

1,447,535

1,669

Chevron

Corp

263,268

1,760

Coterra

Energy

Inc

49,069

8,710

EOG

Resources

Inc

1,113,486

10,430

Exxon

Mobil

Corp

1,212,383

25,080

HF

Sinclair

Corp

1,514,080

240

Ovintiv

Inc

12,456

11,980

Valero

Energy

Corp

2,044,866

Total

Energy

7,657,143

Equity

Real

Estate

Investment

Trusts

(REITs)

-

1.4%

32,870

Americold

Realty

Trust

Inc

819,120

6,600

Lamar

Advertising

Co,

Class

A

788,106

28,590

Ventas

Inc

1,244,809

5,390

Welltower

Inc

503,642

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

3,355,677

Financial

Services

-

6.8%

34,080

(b)

Affirm

Holdings

Inc

1,269,821

13,850

(b)

Berkshire

Hathaway

Inc,

Class

B

5,824,202

10,430

(b)

Block

Inc

882,169

790

CME

Group

Inc

170,079

1,901

Mastercard

Inc,

Class

A

915,465

2,200

MSCI

Inc

1,232,990

25,060

(b)

PayPal

Holdings

Inc

1,678,769

16,900

State

Street

Corp

1,306,708

11,260

Tradeweb

Markets

Inc,

Class

A

1,172,954

4,160

Visa

Inc,

Class

A

1,160,973

Total

Financial

Services

15,614,130

Food,

Beverage

&

Tobacco

-

3.8%

13,060

Bunge

Global

SA

1,338,911

1,300

Coca-Cola

Co/The

79,534

20,420

General

Mills

Inc

1,428,788

15,710

PepsiCo

Inc

2,749,407

20,700

Philip

Morris

International

Inc

1,896,534

71,550

WK

Kellogg

Co

1,345,140

Total

Food,

Beverage

&

Tobacco

8,838,314

Health

Care

Equipment

&

Services

-

5.6%

22,650

(b)

Boston

Scientific

Corp

1,551,298

12,120

Cardinal

Health

Inc

1,356,228

19,390

(b)

Centene

Corp

1,521,727

4,880

Cigna

Group/The

1,772,367

3,180

Humana

Inc

1,102,570

2,620

(b)

IDEXX

Laboratories

Inc

1,414,617

6,050

(b)

Insulet

Corp

1,036,970

20,960

Medtronic

PLC

1,826,664

2,700

UnitedHealth

Group

Inc

1,335,690

Total

Health

Care

Equipment

&

Services

12,918,131

Household

&

Personal

Products

-

0.8%

11,940

Procter

&

Gamble

Co/The

1,937,265

Total

Household

&

Personal

Products

1,937,265

Shares

Description

(a)

Value

Insurance

-

1.4%

8,870

Marsh

&

McLennan

Cos

Inc

$

1,827,043

4,780

Willis

Towers

Watson

PLC

1,314,500

Total

Insurance

3,141,543

Materials

-

1.2%

6,390

Ecolab

Inc

1,475,451

27,130

Westrock

Co

1,341,579

Total

Materials

2,817,030

Media

&

Entertainment

-

10.4%

30,500

(b),(c)

Alphabet

Inc,

Class

A

4,603,365

36,710

(b),(c)

Alphabet

Inc,

Class

C

5,589,465

46,910

Comcast

Corp,

Class

A

2,033,548

13,570

Meta

Platforms

Inc

6,589,321

2,640

(b)

Netflix

Inc

1,603,351

3,480

(b)

Spotify

Technology

SA

918,372

21,720

Walt

Disney

Co/The

2,657,659

Total

Media

&

Entertainment

23,995,081

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

7.6%

17,060

AbbVie

Inc

3,106,626

33,580

Bristol-Myers

Squibb

Co

1,821,043

2,950

Eli

Lilly

&

Co

2,294,982

21,459

Johnson

&

Johnson

3,394,599

210

(b)

Medpace

Holdings

Inc

84,872

23,991

Merck

&

Co

Inc

3,165,612

130

(b)

Mettler-Toledo

International

Inc

173,068

1,810

(b)

Neurocrine

Biosciences

Inc

249,635

68,190

Pfizer

Inc

1,892,273

810

(b)

Regeneron

Pharmaceuticals

Inc

779,617

763

Thermo

Fisher

Scientific

Inc

443,463

800

Zoetis

Inc

135,368

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

17,541,158

Real

Estate

Management

&

Development

-

0.2%

2,190

(b)

Jones

Lang

LaSalle

Inc

427,247

Total

Real

Estate

Management

&

Development

427,247

Semiconductors

&

Semiconductor

Equipment

-

9.5%

3,290

(b)

Advanced

Micro

Devices

Inc

593,812

10,080

Applied

Materials

Inc

2,078,799

1,610

Broadcom

Inc

2,133,910

12,880

(b)

Cirrus

Logic

Inc

1,192,173

1,520

Micron

Technology

Inc

179,193

14,690

NVIDIA

Corp

13,273,296

14,670

QUALCOMM

Inc

2,483,631

Total

Semiconductors

&

Semiconductor

Equipment

21,934,814

Software

&

Services

-

12.4%

5,190

(b)

Adobe

Inc

2,618,874

560

(b)

Atlassian

Corp

Ltd,

Class

A

109,262

6,050

(b)

Cadence

Design

Systems

Inc

1,883,244

7,940

(b)

DocuSign

Inc

472,827

42,745

Microsoft

Corp

17,983,676

10,931

Salesforce

Inc

3,292,198

5,880

(b)

VeriSign

Inc

1,114,319

16,980

(b)

Zoom

Video

Communications

Inc,

Class

A

1,109,983

Total

Software

&

Services

28,584,383

Nuveen

Core

Equity

Alpha

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Investments

in

Derivatives

Shares

Description

(a)

Value

Technology

Hardware

&

Equipment

-

7.0%

85,738

(c)

Apple

Inc

$

14,702,352

4,250

Motorola

Solutions

Inc

1,508,665

Total

Technology

Hardware

&

Equipment

16,211,017

Transportation

-

0.1%

3,850

(b)

Alaska

Air

Group

Inc

165,512

Total

Transportation

165,512

Utilities

-

1.6%

22,760

Evergy

Inc

1,214,929

18,200

Sempra

1,307,306

21,190

Xcel

Energy

Inc

1,138,962

Total

Utilities

3,661,197

Total

Common

Stocks

(cost

$166,597,510)

227,943,432

Shares

Description

(a)

Value

X

–

EXCHANGE-TRADED

FUNDS

-

1.4%

X

3,264,783

6,210

iShares

Core

S&P

500

ETF

$

3,264,783

Total

Exchange-Traded

Funds

(cost

$2,912,025)

3,264,783

Type

Description

(d)

Number

of

Contracts

Notional

Amount

(e)

Exercise

Price

Expiration

Date

Value

OPTIONS

PURCHASED

-

0.0%

Put

S&P

500

Index

10

$

4,500,000

$

4500

4/19/24

$

1,675

Total

Options

Purchased

(cost

$4,024)

10

$

4,500,000

1,675

Total

Long-Term

Investments

(cost

$169,513,559)

231,209,890

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

2.3%

–

REPURCHASE

AGREEMENTS

-

2.3%

X

5,297,002

$

5,297

(f)

Fixed

Income

Clearing

Corp

(FICC)

1.600%

4/01/24

$

5,297,002

Total

Repurchase

Agreements

(cost

$5,297,002)

5,297,002

Total

Short-Term

Investments

(cost

$5,297,002)

5,297,002

Total

Investments

(cost

$174,810,561

)

-

102.5%

236,506,892

Other

Assets

&

Liabilities,

Net

- (2.5)%

(5,672,892)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

230,834,000

Options

Written

Type

Description(d)

Number

of

Contracts

Notional

Amount

(e)

Exercise

Price

Expiration

Date

Value

Call

Russell

2000

Index/Old

(11)

$

(2,420,000)

$

2,200

4/19/24

$

(12,980)

Call

S&P

500

Index

(25)

(13,000,000)

5,200

4/19/24

(237,125)

Call

S&P

500

Index

(55)

(29,150,000)

5,300

4/19/24

(193,325)

Call

S&P

500

Index

(15)

(8,100,000)

5,400

4/19/24

(12,225)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Type

Description(d)

Number

of

Contracts

Notional

Amount

(e)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(30)

$

(15,900,000)

$

5,300

4/30/24

$

(156,000)

Total

Options

Written

(premiums

received

$494,936)

(136)

$(68,570,000)

$(611,655)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

227,943,432

$

–

$

–

$

227,943,432

Exchange-Traded

Funds

3,264,783

–

–

3,264,783

Options

Purchased

1,675

–

–

1,675

Short-Term

Investments:

Repurchase

Agreements

–

5,297,002

–

5,297,002

Investments

in

Derivatives:

Options

Written

(611,655)

–

–

(611,655)

Total

$

230,598,235

$

5,297,002

$

–

$

235,895,237

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

(d)

Exchange-traded,

unless

otherwise

noted.

(e)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

(f)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.600%

dated

3/28/24

to

be

repurchased

at

$5,297,944

on

4/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

4.750%

and

maturity

date

2/15/41,

valued

at

$5,403,030.

ETF

Exchange-Traded

Fund

REIT

Real

Estate

Investment

Trust

S&P

Standard

&

Poor's

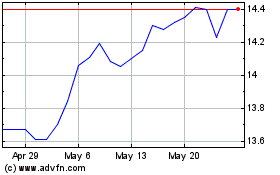

Nuveen Core Equity Alpha (NYSE:JCE)

Historical Stock Chart

From May 2024 to Jun 2024

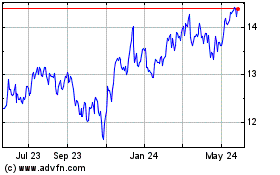

Nuveen Core Equity Alpha (NYSE:JCE)

Historical Stock Chart

From Jun 2023 to Jun 2024