UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO-C

(Rule 14d-100)

TENDER OFFER STATEMENT

UNDER SECTION 14(D)(1) OR (13)(E)(1)

OF THE SECURITIES EXCHANGE

ACT OF 1934

MORPHOSYS

AG

(Name of Subject Company (Issuer))

NOVARTIS

DATA42 AG

an indirect wholly owned subsidiary of

NOVARTIS

AG

(Name of Filing Persons (Offerors))

American

Depositary Shares, each representing ¼ of an Ordinary Shares, no-par value

Ordinary Shares, no-par value

(Title of Class of Securities)

617760202

(CUSIP Number of Class of Securities)

Karen L. Hale

Chief Legal Officer

Novartis

AG

Lichstrasse 35

CH-4056 Basel

Switzerland

Telephone: +41-61-324-1111

(Name, Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Jenny Hochenberg

Freshfields Bruckhaus Deringer US LLP

601 Lexington Avenue

New York, NY 10022

Telephone: +1 212-277-4000

CALCULATION OF FILING

FEE

| Transaction Valuation |

|

Amount of Filing Fee* |

| Not applicable |

|

Not applicable |

| * |

Pursuant to General Instruction D to Schedule TO, a filing fee is not required in connection with this filing because it relates solely to preliminary communications made before the commencement of a tender offer. |

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: None |

|

Filing Party: N/A |

| Form of Registration No.: N/A |

|

Date Filed: N/A |

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| |

x |

Third-party tender offer subject to Rule 14d-1. |

| |

¨ |

Issuer tender offer subject to Rule 13e-4. |

| |

¨ |

Going-private transaction subject to Rule 13e-3. |

| |

¨ |

Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a

final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es)

below to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

The

pre-commencement communications filed under cover of this Tender Offer Statement on Schedule TO are being filed by Novartis AG, a

company organized under the laws of Switzerland (the “Parent” or “Novartis”), and Novartis data42 AG

(the “Bidder”), an indirect wholly owned subsidiary of the Parent, related to a planned tender offer by the Bidder for

all of the outstanding ordinary shares, no-par value, of MorphoSys AG, a publicly listed stock corporation

(Aktiengesellschaft) incorporated under the laws of Germany (the “Company”), at an offer price of EUR 68.00 per

share in cash, without interest, pursuant to the Business Combination Agreement, dated as of February 5, 2024, by and among the

Parent, the Bidder and the Company.

Forward Looking Statements

This communication contains statements of historical fact or “forward

looking statements” including with respect to the proposed acquisition of the Company by Novartis. Forward-looking statements can

generally be identified by words such as “potential,” “can,” “will,” “plan,” “may,”

“could,” “would,” “expect,” “anticipate,” “look forward,” “believe,”

“committed,” “investigational,” “pipeline,” “launch,” or similar terms, or by express

or implied discussions regarding the ability of Novartis and the Company to complete the transactions contemplated by the business combination

agreement (including the parties’ ability to satisfy the conditions to the consummation of the offer contemplated thereby and the

other conditions set forth in the business combination agreement), the expected timetable for completing the transaction, the benefits

sought to be achieved in the proposed transaction, the potential effects of the proposed transaction on Novartis and the Company, the

potential marketing approvals, new indications or labeling for the product candidates the Company is developing, including Pelabresib,

or regarding expected benefits and success of, or potential future revenues from such products. You should not place undue reliance on

these statements. Such forward-looking statements are based on our current beliefs and expectations regarding future events, and are subject

to significant known and unknown risks and uncertainties. Such risks and uncertainties include, but are not limited to: the risk that

the closing conditions for the proposed transaction will not be satisfied, including the risk that the necessary regulatory approvals

may not be obtained or may be obtained subject to conditions that are not anticipated; uncertainty as to the percentage of the Company

shareholders that will support the proposed transaction and tender their shares in the offer; the risk of shareholder litigation relating

to the proposed transaction, including resulting expense or delay; the possibility that the proposed transaction will not be completed

in the expected timeframe or at all, potential adverse effects to the businesses of Novartis or the Company during the pendency of the

proposed transaction, such as employee departures or distraction of management from business operations, the potential that the expected

benefits and opportunities of the proposed transaction, if completed, may not be realized or may take longer to realize than expected,

risks related to the integration of the Company into Novartis subsequent to the closing of the proposed transaction and the timing of

such integration. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual

results may vary materially from those set forth in the forward-looking statements. A further list and descriptions of these risks uncertainties

and other factors can be found in the current Form 20-F filed by Novartis with the U.S. Securities and Exchange Commission (the “SEC”).

Novartis is providing the information in this communication as of this

date and does not undertake any obligation to update any forward-looking statements contained in this communication as a result of new

information, future events or otherwise.

Important Information about the Tender Offer

The tender offer described in this communication has not yet commenced,

and this communication is neither an offer to purchase nor a solicitation of an offer to sell securities. The terms and conditions of

the tender offer will be published in, and the offer to purchase ordinary shares of the Company will be made only pursuant to, the offer

document and related offer materials prepared by Novartis and the Bidder and as approved by the German Federal Financial Supervisory Authority

(Bundesanstalt für Finanzdienstleistungsaufsicat or “BaFin”). Once the necessary permission from BaFin has been

obtained, the offer document and related offer materials will be published in Germany and also filed with the SEC on Schedule TO at the

time the tender offer is commenced. The Company intends to file a solicitation/recommendation statement on Schedule 14D-9 with the SEC

with respect to the tender offer and to publish a recommendation statement pursuant to Sec. 27 of the German Securities Acquisition and

Takeover Act.

INVESTORS AND SECURITY HOLDERS ARE STRONGLY ADVISED TO READ THE

TENDER OFFER STATEMENT, INCLUDING AN OFFER TO PURCHASE, MEANS TO TENDER AND RELATED TENDER OFFER DOCUMENTS THAT WILL BE FILED BY NOVARTIS

AND THE BIDDER WITH THE SEC AND THE RELATED SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 THAT WILL BE FILED BY THE COMPANY

WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Once filed,

these documents will be available at no charge on the SEC’s website at www.sec.gov. In addition, a copy of the offer to purchase,

means to tender and certain other related tender offer documents (once they become available) may also be obtained for free on Novartis’

website at www.novartis.com/investors/morphosys-acquisition. A copy of the solicitation/recommendation statement will be made available

by the Company at www.morphosys.com/en/investors/Novartis-TakeoverOffer or by contacting the Company’s investor relations

department at +49 89 89927 179. These materials may also be obtained through the information agent for the tender offer, which will be

named in the tender offer materials.

EXHIBIT INDEX

Exhibit 99.1

|

Novartis International AG

Novartis Global Communications

CH-4002 Basel

Switzerland

https://www.novartis.com

https://twitter.com/novartisnews |

MEDIA & INVESTOR RELEASE

Novartis to strengthen oncology pipeline

with agreement to acquire MorphoSys AG for EUR 68 per share or an aggregate of EUR 2.7bn in cash

| · | Transaction

to include pelabresib, a late-stage BET inhibitor for myelofibrosis (MF) and tulmimetostat,

an early-stage investigational dual inhibitor of EZH2 and EZH1 for solid tumors or lymphomas |

| · | Pelabresib

recently met its primary endpoint of spleen volume reduction and demonstrated favorable trends

in symptom improvement with a well-tolerated safety profile in Phase 3 MANIFEST-2 study,

when administered in combination with ruxolitinib in JAK inhibitor-naive MF patients1 |

| · | Pelabresib

and ruxolitinib combination offers potential for practice changing, first line of treatment

in myelofibrosis with regulatory filing with the U.S. FDA planned for H2 2024 |

| · | Transaction

aligns with Novartis strategic focus on oncology, and strengthens company’s efforts

in developing next-generation treatment options for cancer |

| · | EUR

68 per share (or EUR 2.7bn aggregate) all-cash transaction unanimously approved by Novartis

and MorphoSys Boards, expected to close in H1 2024, subject to customary closing conditions,

including a minimum acceptance threshold of 65% of outstanding shares tendered in the takeover

offer and regulatory approvals |

Basel, February 05, 2024 –

Novartis today announced that it has entered into an agreement to make a voluntary public takeover offer to acquire MorphoSys AG (FSE:

MOR; NASDAQ: MOR), a Germany-based, global biopharmaceutical company developing innovative medicines in oncology. The acquisition, which

is subject to customary closing conditions, including a minimum acceptance threshold of 65% of outstanding shares tendered in the takeover

offer and regulatory approvals, further expands and complements Novartis pipeline in oncology, one of its priority therapeutic areas,

while also enhancing Novartis global footprint in hematology.

Upon completion of the acquisition,

Novartis will own pelabresib (CPI-0610), a novel and potentially practice changing treatment option with a well-tolerated safety profile

provided in combination with ruxolitinib for patients with myelofibrosis (MF). It will also include tulmimetostat (CPI-0209), an early-stage

investigational dual inhibitor of enhancer of zeste homolog 1 and 2 (EZH1 and EZH2) proteins currently being tested in patients with

solid tumors or lymphomas.

Pelabresib in combination with ruxolitinib

recently met its primary endpoint of spleen volume reduction in the Phase 3 MANIFEST-2 study in JAK inhibitor-naive MF patients1.

The combination also demonstrated favorable trends in symptom improvement as evidenced by key secondary endpoints of absolute and 50%

change in total symptom score (TSS) at week 24 compared to baseline. All four clinical hallmarks of disease in myelofibrosis –

splenomegaly, disease-associated symptoms, anemia and bone marrow fibrosis – were improved with the pelabresib and ruxolitinib

combination. In the earlier Phase 2 MANIFEST trial, the third arm of the study with a patient population comparable to MANIFEST-2, showed

durable improvements in both spleen volume and total symptom score up to week 602. Regulatory filing with the U.S. FDA is

planned for the second half of 2024.

“We are excited about the opportunity

of bringing pelabresib, a potential next-generation treatment combined with ruxolitinib, to people living with myelofibrosis, a rare

and debilitating form of blood cancer,” said Shreeram Aradhye, M.D., President, Development and Chief Medical Officer of Novartis.

“With the planned acquisition of MorphoSys, we aim to further strengthen our leading pipeline and portfolio in oncology, adding

to our capabilities and expertise. Building on our long-standing development partnership with MorphoSys, we look forward to continuing

our work together to realize the full impact and value of their investigational medicines for patients with unmet needs.”

Pelabresib is an investigational small

molecule designed to promote anti-tumor activity by selectively inhibiting the function of bromodomain and extra-terminal domain (BET)

proteins to decrease the expression of abnormally expressed genes in cancer. Pelabresib is also being studied in patients with essential

thrombocythemia (ET), which is currently in Phase 2 in second line of treatment. Besides pelabresib, MorphoSys’ pipeline includes

a broad portfolio of partnered assets of which some are in partnership with Novartis, including ianalumab (VAY736) which is studied across

multiple immunological diseases and in hematology.

Transaction Details

Under the agreed transaction, which

has been unanimously approved by the Board of Directors of both companies, Novartis will make a voluntary public takeover offer for all

no-par value bearer shares of MorphoSys AG for EUR 68 per share (or an aggregate of EUR 2.7bn).

The transaction is subject to customary

closing conditions, including acceptance of the takeover offer by at least 65% of MorphoSys AG’s outstanding shares and receipt

of regulatory approvals and is expected to close in the first half of 2024. Until the transaction closes, MorphoSys AG will continue

to operate as a separate, independent company.

About Pelabresib (CPI-0610)

Pelabresib (CPI-0610) is an investigational

small molecule designed to promote anti-tumor activity selectively by inhibiting the function of bromodomain and extra-terminal domain

(BET) proteins to decrease the expression of abnormally expressed genes in cancer. Pelabresib is being investigated as a treatment for

myelofibrosis and has not yet been approved by any regulatory authorities. The development of pelabresib was funded in part by The Leukemia

and Lymphoma Society®.

About Myelofibrosis

Myelofibrosis is a blood cancer –

belonging to a group of diseases called myeloproliferative neoplasms – caused by genetic abnormalities in bone marrow stem cells

and characterized by four hallmarks: enlarged spleen, anemia, impaired bone marrow microenvironment causing fibrosis, and debilitating

disease-associated symptoms, including severe fatigue, night sweats, itching, increased bleeding and significant pain caused by their

enlarged spleen. For many living with myelofibrosis, the combination of symptoms often severely impacts their quality of life. At diagnosis,

several factors, such as age, genetics and bloodwork, help determine a patient’s long-term prognosis. About 90% of newly diagnosed

patients have intermediate- to high-risk disease, which has a worse prognosis and a higher likelihood of disease-associated symptoms.

While JAK inhibitors, the current standard of care, address some aspects of the disease, no agent provides broad disease control. There

is an urgent need for novel, well-tolerated therapeutic options capable of changing the natural course of myelofibrosis to provide patients

with deep and durable responses across its four hallmarks.

About Tulmimetostat (CPI-0209),

Tulmimetostat (CPI-0209) is an investigational compound designed to exert anti-tumor activity by inhibiting the function of enhancer

of zeste homolog 1 and 2 (EZH2 and EZH1) proteins to reactivate silenced genes like tumor suppressor genes. Tulmimetostat is being tested

as a once-daily oral treatment in a Phase 1/2 trial (NCT04104776) in patients with advanced solid tumors or lymphomas, including ARID1A-mutated

ovarian clear cell carcinoma and endometrial carcinoma, diffuse large B-cell lymphoma, peripheral T-cell lymphoma, BAP1-mutated mesothelioma

and castration-resistant prostate cancer.

Forward Looking Statements

This press release contains statements

of historical fact or “forward looking statements”, including with respect to the proposed acquisition of MorphoSys by Novartis.

Forward-looking statements can generally be identified by words such as “potential,” “can,” “will,”

“plan,” “may,” “could,” “would,” “expect,” “anticipate,” “look

forward,” “believe,” “committed,” “investigational,” “pipeline,” “launch,”

or similar terms, or by express or implied discussions regarding the ability of Novartis and MorphoSys to complete the transactions contemplated

by the business combination agreement (including the parties’ ability to satisfy the conditions to the consummation of the offer

contemplated thereby and the other conditions set forth in the business combination agreement), the expected timetable for completing

the transaction, the benefits sought to be achieved in the proposed transaction, the potential effects of the proposed transaction on

Novartis and MorphoSys, the potential marketing approvals, new indications or labeling for the product candidates MorphoSys is developing,

including Pelabresib, or regarding expected benefits and success of, or potential future revenues from such products. You should not

place undue reliance on these statements. Such forward-looking statements are based on our current beliefs and expectations regarding

future events, and are subject to significant known and unknown risks and uncertainties. Such risks and uncertainties include, but are

not limited to: the risk that the closing conditions for the proposed transaction will not be satisfied, including the risk that the

necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; uncertainty as

to the percentage of MorphoSys’ shareholders that will support the proposed transaction and tender their shares in the offer; the

risk of shareholder litigation relating to the proposed transaction, including resulting expense or delay; the possibility that the proposed

transaction will not be completed in the expected timeframe or at all, potential adverse effects to the businesses of Novartis or MorphoSys

during the pendency of the proposed transaction, such as employee departures or distraction of management from business operations, the

potential that the expected benefits and opportunities of the proposed transaction, if completed, may not be realized or may take longer

to realize than expected, risks related to the integration of the MorphoSys into Novartis subsequent to the closing of the proposed transaction

and the timing of such integration. Should one or more of these risks or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those set forth in the forward-looking statements. A further list and descriptions

of these risks uncertainties and other factors can be found in the current Form 20-F filed by Novartis AG with the U.S. Securities and

Exchange Commission (the “SEC”). Novartis is providing the information in this press release as of this date and does not

undertake any obligation to update any forward-looking statements contained in this press release as a result of new information, future

events or otherwise.

Important Information about the Tender

Offer

This press release is neither an offer

to sell or purchase nor a solicitation of an offer to sell or purchase MorphoSys shares. Moreover, this announcement is neither an offer

to purchase nor a solicitation to purchase shares of Novartis data42 AG. The final terms and further provisions regarding the takeover

offer (also referred to a tender offer) will be in the offer document once its publication has been approved by the German Federal Financial

Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicat or “BaFin”). Novartis data42 AG reserves the

right to deviate from the basic terms presented herein in the final terms and provisions. Investors and holders of MorphoSys shares are

strongly recommended to read the offer document and all other documents in connection with the public takeover offer as soon as they

are published, as they will contain important information.

Subject to the exceptions described

in the offer document and any exceptions granted by the relevant regulatory authorities, a public takeover offer is not being made, directly

or indirectly, in or into those jurisdictions where to do so would constitute a violation pursuant to the laws of such jurisdiction.

The tender offer described in this press

release has not yet commenced, and this press release is neither an offer to purchase nor a solicitation of an offer to sell securities.

The terms and conditions of the tender offer will be published in, and the offer to purchase ordinary shares of MorphoSys will be made

only pursuant to, the offer document and related offer materials prepared by Novartis and Novartis data42 AG and as approved by BaFin.

Once the necessary permission from BaFin has been obtained, the offer document and related offer materials will be published in Germany

and also filed with the SEC on Schedule TO at the time the tender offer is commenced. MorphoSys intends to file a solicitation/recommendation

statement on Schedule 14D-9 with the SEC with respect to the tender offer and to publish a recommendation statement pursuant to Sec.

27 of the German Securities Acquisition and Takeover Act.

In order to reconcile certain areas

where German law and U.S. law conflict, Novartis and Novartis data42 AG expect to request no-action and exemptive relief from the SEC

to conduct the tender in the manner described in the offer document.

Novartis and its affiliates or brokers

(acting as agents of Novartis data42 AG or its affiliates, if any) may, to the extent permitted by applicable laws or regulations, directly

or indirectly, acquire shares in MorphoSys or enter into agreements to acquire shares outside of the tender offer before, during or after

the term of the tender offer. This also applies to other securities convertible into, exchangeable for or exercisable for shares of MorphoSys.

These purchases may be concluded via the stock exchange at market prices or outside the stock exchange on negotiated terms. If such purchases

or agreements to purchase are made, they will be made outside the United States and will comply with applicable law, including, to the

extent applicable, the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder (including pursuant to any

requested no-action and exemptive relief from the SEC).

All information regarding such purchases

will be disclosed in accordance with the laws or regulations applicable in Germany or any other relevant jurisdiction. In addition, the

financial advisors of Novartis may also act in the ordinary course of trading in securities of MorphoSys, which may include purchases

or agreements to purchase such securities.

INVESTORS AND SECURITY HOLDERS ARE

STRONGLY ADVISED TO READ THE TENDER OFFER STATEMENT, INCLUDING AN OFFER TO PURCHASE, MEANS OF TENDER AND RELATED TENDER OFFER DOCUMENTS

THAT WILL BE FILED BY NOVARTIS AND NOVARTIS DATA42 AG WITH THE SEC AND THE RELATED SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE

14D-9 THAT WILL BE FILED BY MORPHOSYS WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Once filed, these documents will be

available at no charge on the SEC’s website at www.sec.gov. In addition, a copy of the offer to purchase, means of tender and certain

other related tender offer documents (once they become available) may also be obtained for free on Novartis AG’s website at www.novartis.com/investors/morphosys-acquisition.

A copy of the solicitation/recommendation statement will be made available by MorphoSys at morphosys.com/en/investors/Novartis-TakeoverOffer

or by contacting MorphoSys’ investor relations department at +49 89 89927 179. These materials may also be obtained through the

information agent for the tender offer, which will be named in the tender offer materials.

About Novartis

Novartis is an innovative medicines

company. Every day, we work to reimagine medicine to improve and extend people’s lives so that patients, healthcare professionals

and societies are empowered in the face of serious disease. Our medicines reach more than 250 million people worldwide.

Reimagine medicine with us: Visit us

at https://www.novartis.com and connect with us on LinkedIn, Facebook,

X/Twitter and Instagram.

References

| 1. | 2023-12-11_Rampal

R_MANIFEST-2_ASH 2023_Oral 628 |

| 2. | 2023_Manifest

Arm 3 results_Mascarenas et al J Clin Oncol 41:4993-5004 |

# # #

Novartis Media Relations

E-mail: media.relations@novartis.com

|

|

|

| Central |

|

North America |

|

| Richard Jarvis |

+41 79 584 2326 |

Julie Masow |

+1 862 579 8456 |

Anja von Treskow

Anna Schäfers |

+41 79 392 9697

+41 79 801 7267 |

Michael Meo

Marlena Abdinoor |

+1 862 274 5414

+1 617 335 9525 |

Switzerland

Satoshi Sugimoto |

+41 79 619 2035 |

|

|

| |

|

|

|

Novartis Investor Relations

Central investor relations line:

+41 61 324 7944

E-mail: investor.relations@novartis.com

|

|

| Central |

|

North America |

|

| Samir Shah |

+41 61 324 7944 |

Sloan Simpson |

+1 862 345 4440 |

| Isabella Zinck |

+41 61 324 7188 |

Jonathan Graham |

+1 201 602 9921 |

| Nicole Zinsli-Somm |

+41 61 324 3809 |

Parag Mahanti |

+1 973 876 4912 |

| Imke Kappes |

+41 61 324 8269 |

|

|

| Zain Iqbal |

+41 61 324 0390 |

|

|

Exhibit 99.2

Novartis data42 AG

Publication of the decision to launch a voluntary

public takeover offer

(freiwilliges öffentliches Übernahmeangebot) in accordance with sec. 10 para. 1 sentence 1 in conjunction

with sec. 29 para.

1 and sec. 34 of the German Securities Acquisition and Takeover Act

(Wertpapiererwerbs- und Übernahmegesetz)

Bidder:

Novartis data42 AG

Lichtstraße 35

4056 Basel, Switzerland

registered with the commercial register office of the Canton of Basel-City

under company number

CHE- 477.907.492

Target Company:

MorphoSys AG

Semmelweisstrasse 7

82152 Planegg

registered in the commercial register of the local court of Munich

under HRB 121023.

ISIN: DE0006632003

Novartis data42 AG (in future: Novartis BidCo

AG) (BidCo), a wholly-owned (indirect) subsidiary of Novartis AG (Novartis), has decided on 5 February 2024, to offer to the shareholders

of MorphoSys AG (MorphoSys), by way of a voluntary public takeover offer, to acquire all no-par value bearer shares in MorphoSys, each

representing a pro rata amount of the registered share capital of MorphoSys of EUR 1.00 per share (ISIN: DE0006632003) (MorphoSys

Shares) against payment of a cash consideration in the amount of EUR 68.00 per MorphoSys Share.

BidCo and Novartis also entered into a business

combination agreement with MorphoSys, which contains the principal terms and conditions of the takeover offer, as well as the mutual intentions

and understandings relating thereto.

The consummation of the transaction will be subject

to certain closing conditions. These will include, inter alia, receipt of the required antitrust clearances and achieving a minimum acceptance

of at least 65% of the MorphoSys Shares.

BidCo further reserves the right, to the extent

legally permissible, to modify the final terms and conditions of the offer and to deviate from the above conditions and other key parameters,

including by providing for additional conditions.

The offer document and further notifications relating

to the takeover offer will be published on the internet under www.novartis.com/investors/morphosys-acquisition.

Forward Looking Statements

This announcement contains statements of historical

fact or “forward looking statements”, including with respect to the proposed acquisition of MorphoSys by Novartis. Forward-looking

statements can generally be identified by words such as “potential,” “can,” “will,” “plan,”

“may,” “could,” “would,” “expect,” “anticipate,” “look forward,”

“believe,” “committed,” “investigational,” “pipeline,” “launch,” or similar

terms, or by express or implied discussions regarding the ability of Novartis and MorphoSys to complete the transactions contemplated

by the business combination agreement (including the parties’ ability to satisfy the conditions to the consummation of the offer

contemplated thereby and the other conditions set forth in the business combination agreement), the expected timetable for completing

the transaction, the benefits sought to be achieved in the proposed transaction, the potential effects of the proposed transaction on

Novartis and MorphoSys, the potential marketing approvals, new indications or labeling for the product candidates MorphoSys is developing,

including Pelabresib, or regarding expected benefits and success of, or potential future revenues from such products. You should not place

undue reliance on these statements. Such forward-looking statements are based on our current beliefs and expectations regarding future

events, and are subject to significant known and unknown risks and uncertainties. Such risks and uncertainties include, but are not limited

to: the risk that the closing conditions for the proposed transaction will not be satisfied, including the risk that the necessary regulatory

approvals may not be obtained or may be obtained subject to conditions that are not anticipated; uncertainty as to the percentage of MorphoSys

shareholders that will support the proposed transaction and tender their shares in the offer; the risk of shareholder litigation relating

to the proposed transaction, including resulting expense or delay; the possibility that the proposed transaction will not be completed

in the expected timeframe or at all, potential adverse effects to the businesses of Novartis or MorphoSys during the pendency of the proposed

transaction, such as employee departures or distraction of management from business operations, the potential that the expected benefits

and opportunities of the proposed transaction, if completed, may not be realized or may take longer to realize than expected, risks related

to the integration of the MorphoSys into Novartis subsequent to the closing of the proposed transaction and the timing of such integration.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary

materially from those set forth in the forward-looking statements. A further list and descriptions of these risks uncertainties and other

factors can be found in the current Form 20-F filed by Novartis with the U.S. Securities and Exchange Commission (SEC).

Novartis is providing the information in this

announcement as of this date and does not undertake any obligation to update any forward-looking statements contained in this announcement

as a result of new information, future events or otherwise.

Important Information about the Tender Offer

This announcement is neither an offer to sell

or purchase nor a solicitation of an offer to sell or purchase MorphoSys shares. Moreover, this announcement is neither an offer to purchase

nor a solicitation to purchase shares of BidCo. The final terms and further provisions regarding the takeover offer (also referred to

a tender offer) will be in the offer document once its publication has been approved by the German Federal Financial Supervisory Authority

(Bundesanstalt für Finanzdienstleistungsaufsicht or BaFin). BidCo reserves the right to deviate from the basic terms presented

herein in the final terms and provisions. Investors and holders of MorphoSys shares are strongly recommended to read the offer document

and all other documents in connection with the public takeover offer as soon as they are published, as they will contain important information.

Subject to the exceptions described in the offer

document and any exceptions granted by the relevant regulatory authorities, a public takeover offer is not being made, directly or indirectly,

in or into those jurisdictions where to do so would constitute a violation pursuant to the laws of such jurisdiction.

The

tender offer described in this announcement has not yet commenced, and this announcement is neither an offer to purchase nor a solicitation

of an offer to sell securities. The terms and conditions of the tender offer will be published in, and the offer to purchase ordinary

shares of MorphoSys will be made only pursuant to, the offer document and related offer materials prepared by Novartis and BidCo and as

approved by BaFin. Once the necessary permission from BaFin has been obtained,

the offer document and related offer materials will be published in Germany and also filed with the SEC on Schedule TO at the time the

tender offer is commenced. MorphoSys intends to file a solicitation/recommendation statement on Schedule 14D-9 with the SEC with respect

to the tender offer and to publish a recommendation statement pursuant to Sec. 27 of the German Securities Acquisition and Takeover Act.

In order to reconcile certain areas where German

law and U.S. law conflict, Novartis and BidCo expect to request no-action and exemptive relief from the SEC to conduct the tender in the

manner described in the offer document.

Novartis and its affiliates or brokers (acting

as agents of BidCo or its affiliates, if any) may, to the extent permitted by applicable laws or regulations, directly or indirectly,

acquire shares in MorphoSys or enter into agreements to acquire shares outside of the tender offer before, during or after the term of

the tender offer. This also applies to other securities convertible into, exchangeable for or exercisable for shares of MorphoSys. These

purchases may be concluded via the stock exchange at market prices or outside the stock exchange on negotiated terms. If such purchases

or agreements to purchase are made, they will be made outside the United States and will comply with applicable law, including, to the

extent applicable, the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder (including pursuant to any

requested no-action and exemptive relief from the SEC).

All information regarding such purchases will

be disclosed in accordance with the laws or regulations applicable in Germany or any other relevant jurisdiction. In addition, the financial

advisors of Novartis may also act in the ordinary course of trading in securities of MorphoSys, which may include purchases or agreements

to purchase such securities.

INVESTORS AND SECURITY HOLDERS ARE STRONGLY

ADVISED TO READ THE TENDER OFFER STATEMENT, INCLUDING AN OFFER TO PURCHASE, MEANS TO TENDER AND RELATED TENDER OFFER DOCUMENTS) THAT WILL

BE FILED BY NOVARTIS AND BIDCO WITH THE SEC AND THE RELATED SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 THAT WILL BE FILED

BY MORPHOSYS WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Once filed, these documents will be available

at no charge on the SEC’s website at www.sec.gov. In addition, a copy of the offer to purchase, means to tender and certain other

related tender offer documents (once they become available) may also be obtained for free on Novartis’s website at www.novartis.com/investors/morphosys-acquisition.

A copy of the solicitation/recommendation statement will be made available by MorphoSys at www.morphosys.com/en/investors/Novartis-TakeoverOffer

or by contacting MorphoSys’s investor relations department at +49 89 89927 179. These materials may also be obtained through the

information agent for the tender offer, which will be named in the tender offer materials.

Basel, 5 February 2024

Novartis data42 AG

Administrative Board

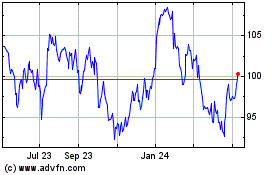

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

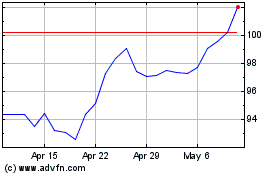

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024