Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (“Calibre”) and

Marathon Gold Corporation (TSX: MOZ) (“Marathon” and collectively

the “Parties”) are pleased to announce that the Parties have

entered into a definitive arrangement agreement (the “Arrangement

Agreement”) whereby Calibre will acquire all of the issued and

outstanding common shares of Marathon pursuant to a court-approved

plan of arrangement (the “Transaction”). The Transaction will

create an Americas-focused, high-margin, high-growth, mid-tier gold

producer with estimated average annual gold production of

approximately 500 koz during 2025 – 2026E1. The combined company

will have a strong balance sheet with a combined cash balance of

US$148 million2 and significant free cash flow generated from

Calibre’s existing mines. This financial strength is expected to

facilitate the seamless construction of the Valentine Gold Project

(“Valentine”) and a continuous flow of exciting discovery and

resource-building drill results from Nicaragua, Nevada and

Newfoundland & Labrador.

Highlights of the Transaction

Key highlights of the Transaction include:

- Creates a high-margin, cash flow

focused, mid-tier gold producer in the Americas1 with estimated

annual production of 500 koz Au per year (2025 – 2026E

average)

- Strong balance sheet with estimated

combined cash of approximately US$148 million2 and significant free

cash flow generation, ensuring the seamless completion of Valentine

during the final 50% of construction

- Significant combined mineral

endowment of over 4.0 million ounces of mineral reserves, 8.6

million ounces of measured and indicated mineral resources

(inclusive of mineral reserves) and 4.0 million ounces of inferred

mineral resources (as further detailed in the tables below)3

- Peer leading production growth of

80% (2024 – 2026E)1

- Approximately 60% NAV in tier-1

mining jurisdictions1 with pro-forma market capitalization of

approximately US$750 million, providing scale, enhanced trading

liquidity, and a strong re-rating potential as a mid-tier gold

producer

- Valentine to add expected average

annual gold production of 195 koz at low projected All-in

Sustaining Costs (“AISC”) of US$1,007 per ounce through the first

12 years of production beginning in 20254

- Robust annual cash flow from

operations of US$380 million (2025 – 2026E)1

- A continuous flow of exciting

discovery and resource-building drill results from Nicaragua,

Nevada, and Newfoundland & Labrador

- A proven team and board, led

by Darren Hall (CEO), Blayne Johnson (Chairman) and

Doug Forster (Lead Director) with a track record of operational

excellence and shareholder value creation

- In connection with the Transaction,

Calibre has agreed to purchase on a non-brokered private placement

basis 66,666,667 common shares of Marathon at C$0.60 per share for

gross proceeds of C$40 million (the “Concurrent Private

Placement”), representing a 14.2% equity interest in Marathon on an

issued and outstanding basis; closing is expected to be completed

on November 14, 2023 and is not contingent on closing of the

Transaction.

Blayne Johnson, Chairman of Calibre,

stated: “The combination with Marathon perfectly aligns

with Calibre's commitment to building a diversified mid-tier gold

producer, focused on quality assets with strong re-rate potential

for all shareholders. This transformative merger creates a

projected 500,000 oz gold producer and offers our shareholders

diversification and exposure to high-quality, long-life production

in a tier-1 jurisdiction. I have no doubt that the union of

Marathon's experienced team and well advanced Valentine Project

based in Canada, with Calibre's production assets, robust treasury,

free cash flow, flawless track record in execution and high impact

exploration opportunities will unlock significant value for the

shareholders of both companies. I would also like to thank Clive

Johnson and B2Gold for not only entrusting us to progress the

Nicaragua assets, but for the continued support of our team

including their vote supporting this transaction.

As founders of Calibre, we are as excited for

the future of this combined company as we were when we merged

Newmarket Gold with Kirkland Lake to establish a company of similar

size and annual production."

Darren Hall, President and Chief

Executive Officer of Calibre, stated: “Calibre has

delivered on its commitment to create significant value for its

shareholders through a disciplined approach to operations and

exploration. This Transaction builds on that commitment, adding a

high-quality gold asset in the final stages of construction with

strong exploration upside in one of the top mining jurisdictions in

the world. With Calibre’s strong operational expertise and robust

cash flow, I am confident that together with the Marathon team, we

will continue to meet or beat expectations. I look forward to

working with the team in Newfoundland & Labrador as

they have done an excellent job de-risking, engineering and

advancing construction on the Valentine Project.”

Matt Manson, President and Chief

Executive Officer of Marathon, stated: “The business

combination with Calibre offers Marathon shareholders the

opportunity to participate in the growth of an important new

mid-tier gold producer on track to produce 500,000 oz of gold a

year. Through this Transaction, Valentine will be fully funded to

production without additional debt, royalties, or shareholder

equity. The combined company will have three high quality, cash

flowing gold assets, a strong balance sheet, and leadership with

proven credentials in value creation. The Transaction offers the

ability to fully realise the potential of Valentine without the

limitations of the single asset project developer. Shareholders

will continue to participate in the success of Valentine’s

development, supplemented now with a renewed focus on exploration

and discovery and the considerable upside potential of Calibre’s

own proven operations and cash flow growth. We are proud of the

work accomplished to date by the Marathon team, and strongly

recommend this Transaction in the interests of shareholders,

Marathon’s employees and community partners, and the Province of

Newfoundland & Labrador.”

Benefits to Marathon Shareholders

- Meaningful upfront premium of 32%

based on spot and 61% based on Calibre’s and Marathon’s 20-day

volume weighted average prices (“VWAP”) as at November 10, 2023,

the day prior to announcement of the Transaction

- Combination with an established 250

koz - 275 koz per year gold producer with a record of fiscal

discipline and a proven history of shareholder value creation

- Retain significant and de-risked

exposure to Valentine while immediately graduating from developer

to a mid-tier gold producer, benefitting from asset

diversification, enhanced trading liquidity, broader analyst and

institutional investor following, index inclusions and potential

share price re-rating

- Access to a strong balance sheet

and robust free cash flow generation to ensure seamless

construction of Valentine and concurrently fund exploration

initiatives

- Meaningful exposure to future value

catalysts across the combined asset portfolio

Benefits to Calibre Shareholders

- Adds a material high-quality

near-term producing asset in Canada, which will enhance Calibre’s

operating platform in tier-1 jurisdictions

- Valentine provides near-term

production and cash flow growth, first gold expected in Q1

2025

- Combined company production to grow

to approximately 500 koz by 2025 when adding an average of 195 koz

per year from Valentine through the first 12 years of

production1,4

- Valentine to add a significant

mineral endowment of 2.7 million ounces of mineral reserves and

3.96 million ounces of measured and indicated mineral resources and

1.10 million ounces of inferred mineral resources (as further

detailed in the tables below)3

- Jurisdiction diversification

resulting in approximately 60% of the combined company’s net asset

value in Canada and the U.S., repositioning the combined company

for higher market trading multiples

- Exposure to significant exploration

and resource expansion potential outside of the Valentine

resource

- Accretive to Calibre on key

operating and financial per share metrics

Transaction Details

Pursuant to the Transaction, Marathon

shareholders will receive 0.6164 of a Calibre common share for each

Marathon common share held (the “Consideration”). The Consideration

implies a value of C$0.84 per Marathon common share and gross

Transaction equity value consideration of C$345 million on a fully

diluted in-the-money basis. This represents a premium of 32% based

on spot and 61% based on Calibre’s and Marathon’s 20-day VWAP as at

November 10, 2023. Existing shareholders of Calibre and Marathon

will own approximately 66% and 34% of the combined company,

respectively. Marathon will also be entitled to nominate one member

to the board of directors of Calibre.

In connection with the Transaction, Calibre

agreed to purchase 66,666,667 common shares of Marathon at C$0.60

per share for gross proceeds of C$40 million pursuant to the

Concurrent Private Placement, representing a 14.2% equity interest

in Marathon on an issued and outstanding basis. Closing of the

Concurrent Private Placement is expected to be completed on

November 14, 2023 and is not contingent on closing of the

Transaction.

The Transaction will be completed pursuant to a

court-approved plan of arrangement under the Canada Business

Corporations Act. The Transaction will be subject to the approval

of at least 66-⅔% of the votes cast by Marathon shareholders at a

special meeting of Marathon shareholders and a simple majority of

disinterested shareholders (if required under applicable laws). The

issuance of common shares by Calibre as the Consideration in

connection with the Transaction is subject to the approval of a

majority of the votes cast by the shareholders of Calibre at a

special meeting of Calibre shareholders. In addition to shareholder

approvals, the Transaction is also subject to the receipt of

certain regulatory, court and Toronto Stock Exchange (“TSX”)

approvals and other closing conditions customary in transactions of

this nature.

The Arrangement Agreement includes, among other

things, a non-solicitation covenant on the part of Marathon

(subject to customary fiduciary out provisions) and a right for

Calibre to match any competing offer that constitutes a superior

proposal. Under certain circumstances, Calibre would be entitled to

a C$17.5 million termination fee and Marathon would be entitled to

a C$17.5 million reverse termination fee.

Officers and directors of Calibre, along with

B2Gold Corp., which hold approximately 27% of the outstanding

Calibre common shares, have entered into voting support agreements

pursuant to which they have agreed, among other things, to vote

their Calibre common shares in favour of the Transaction. Officers

and directors of Marathon which hold approximately 0.9% of the

outstanding Marathon common shares, have entered into voting

support agreements pursuant to which they have agreed, among other

things, to vote their Marathon common shares in favour of the

Transaction.

Sprott Private Resource Lending II

(Collector-2), LP and Sprott Resource Lending Corp. (collectively,

“Sprott”) have provided a conditional waiver of certain provisions

of, and defaults and events of default arising under, the amended

and restated credit agreement dated January 24, 2023 between

Marathon, as borrower, and Sprott relevant to or arising as a

result of the Transaction. Such waivers are subject to and

conditional upon the satisfaction of certain conditions prior to

closing of the Transaction.

Full details of the Transaction will be included

in the respective management information circulars of Calibre and

Marathon, expected to be mailed to shareholders in mid-December

2023. Both shareholders’ meetings and closing of the Transaction

are expected in January 2024.

None of the securities to be issued pursuant to

the Transaction have been or will be registered under the United

States Securities Act of 1933, as amended (the “U.S. Securities

Act”), or any state securities laws, and any securities issuable in

the Transaction are anticipated to be issued in reliance upon

available exemptions from such registration requirements pursuant

to Section 3(a)(10) of the U.S. Securities Act and applicable

exemptions under state securities laws. This press release does not

constitute an offer to sell or the solicitation of an offer to buy

any securities.

Board of Directors’ Recommendations

The Arrangement Agreement has been unanimously

approved by the Board of Directors of each of the Parties,

including in the case of Marathon, following the unanimous

recommendation of a Special Committee of independent directors of

Marathon (the “Special Committee”). Both Boards of Directors

unanimously recommend that their respective shareholders vote in

favour of the Transaction.

TD Securities Inc. has provided an opinion to

the Board of Directors of Calibre, stating that, as of the date of

such opinion, and based upon and subject to the assumptions,

limitations and qualifications stated in such opinion, the

Consideration to be paid under the Transaction is fair, from a

financial point of view to Calibre.

Maxit Capital LP has provided an opinion to the

Board of Directors of Marathon and Canaccord Genuity Corp. has

provided an opinion to the Special Committee, respectively, stating

that as of the date of such opinion, based upon and subject to the

assumptions, limitations and qualifications set forth therein, the

Consideration to be received by Marathon shareholders pursuant to

the Transaction is fair, from a financial point of view, to

Marathon shareholders (other than Calibre).

Concurrent Private Placement

In connection with the Transaction, Calibre and

Marathon also entered into a subscription agreement, pursuant to

which Calibre has agreed to purchase 66,666,667 common shares of

Marathon at a price of C$0.60 per share, for gross proceeds of C$40

million pursuant to the Concurrent Private Placement. On closing of

the Concurrent Private Placement, Calibre will own 14.2% of the

issued and outstanding common shares of Marathon. Immediately prior

to the closing of the Concurrent Private Placement, Calibre owned

no common shares of Marathon.

Marathon intends to use the proceeds of the

Concurrent Private Placement solely to fund the development and

construction of Valentine in accordance with its budget, as agreed

to with Calibre pursuant to the Arrangement Agreement.

In connection with the Concurrent Private

Placement, Calibre and Marathon also entered into an investor

rights agreement which contains certain investor rights granted by

Marathon to Calibre, including: (a) providing Calibre with the

right to nominate one director to the board of directors of

Marathon so long as Calibre holds 10% or more of the outstanding

common shares of Marathon on a partially diluted basis effective on

the earlier to occur of: (i) the Arrangement Agreement being

terminated in accordance with its terms; and (ii) 120 days

following the closing of the Concurrent Private Placement; (b)

registration rights and piggy back registration rights in favour of

Calibre; and (c) equity and convertible debt participation rights

to allow Calibre to maintain its pro rata interest. The purpose of

the Concurrent Private Placement is for investment purposes only.

As discussed above, Calibre has entered into the Arrangement

Agreement to acquire all of the issued and outstanding common

shares of Marathon pursuant to the Transaction.

The Concurrent Private Placement is expected to

close on or before November 14, 2023 and is subject to TSX and

other customary regulatory approvals. The common shares of Marathon

issued to Calibre pursuant to the Concurrent Private Placement will

be subject to a statutory four month hold period in accordance with

applicable securities regulations. No finder’s fee will be payable

in connection with the Concurrent Private Placement.

Calibre will file an early warning report in

respect of its increase in ownership of the common shares of

Marathon, which report will be available under Calibre’s profile on

www.sedarplus.ca. For further information or to obtain a copy of

the report, please contact Calibre as detailed below.

Advisors and Counsel

Trinity Advisors Corporation and TD Securities

Inc. are acting as financial advisors to Calibre. Scotiabank and

Raymond James Ltd. are providing capital market advisory services

to Calibre, Cassels Brock & Blackwell LLP is acting as Canadian

legal advisor to Calibre and Dorsey & Whitney LLP and

GreenbergTraurig LLP are acting as U.S. legal advisors to

Calibre.

Maxit Capital LP is acting as financial advisor

to Marathon and Canaccord Genuity Corp. is acting as financial

advisor to the Special Committee. National Bank is providing

capital market advisory services to Marathon. Mason Law and Norton

Rose Fulbright Canada LLP are acting as Canadian legal advisors to

Marathon and Norton Rose Fulbright US LLP is acting as U.S. legal

advisor to Marathon.

Conference Call and Webcast

Calibre and Marathon will hold a joint

conference call and webcast on November 13, 2023 at 10:00 a.m.

(Toronto time) to discuss the Transaction.

Toll-free Canada /

US: 1 (800) 715 - 9871International: 1 (800) 715 - 9871 Audience

Passcode: 2348243Login to the webcast:

https://edge.media-server.com/mmc/p/strokapu

The webcast will be archived on both the Calibre

and Marathon websites until the Transaction closes.

Calibre Qualified Person

Darren Hall, MAusIMM, President and Chief

Executive Officer of Calibre is a “qualified person” as set out

under National Instrument 43-101 Standards of Disclosure for

Mineral Projects (“NI 43-101”) and has reviewed and approved the

scientific and technical information in this news release with

respect to Calibre and its assets. Mr. Hall has verified the data

disclosed in this news release and no limitations were imposed on

his verifications process.

Marathon Qualified Person

Disclosure of a scientific or technical nature

with respect to Marathon and its assets in this news release has

been approved by Mr. Gil Lawson, P. Eng. (Ont.), Chief Operating

Officer for Marathon and Mr. David Ross, P.Geo (NL), Vice

President, Geology & Exploration for Marathon. Mr. Lawson and

Mr. Ross are qualified persons under National Instrument NI 43-101.

Mr. Roy Eccles, P.Geo. (NL), of APEX Geoscience Ltd. is a Qualified

Person for purposes of NI 43-101, is independent of Marathon and

Valentine, and has reviewed and takes responsibility for the

updated 2022 MRE prepared by John T. Boyd Company.

About Calibre Mining Corp.

Calibre (TSX:CXB) is a Canadian-listed, Americas

focused, growing mid-tier gold producer with a strong pipeline of

development and exploration opportunities across Nevada and

Washington in the USA, and Nicaragua. Calibre is focused on

delivering sustainable value for shareholders, local communities

and all stakeholders through responsible operations and a

disciplined approach to growth. With a strong balance sheet, a

proven management team, strong operating cash flow, accretive

development projects and district-scale exploration opportunities

Calibre will unlock significant value.

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold

company advancing its 100%-owned Valentine Gold Project located in

the central region of Newfoundland & Labrador, one of the top

mining jurisdictions in the world. The Valentine Gold Project

comprises a series of five mineralized deposits along a

32-kilometre system. A December 2022 Updated Feasibility Study

outlined an open pit mining and conventional milling operation

producing 195,000 ounces of gold a year for 12 years within a

14.3-year mine life. The Valentine Gold Project was released from

federal and provincial environmental assessment in 2022 and

construction commenced in October 2022.

For further information, please contact:

Ryan KingSVP Corporate Development & IRT:

604.628.1012E: calibre@calibremining.comW:

www.calibremining.com

Calibre’s head office is located at Suite 1560,

200 Burrard St., Vancouver, British Columbia, V6C 3L6.

https://twitter.com/CalibreMiningCo

https://www.facebook.com/CalibreMining

https://ca.linkedin.com/company/calibre-mining-corp-cxb-

https://www.youtube.com/@calibreminingcorp

Amanda MalloughManager,

Investor RelationsT: 416.855.8202E: amallough@marathon-gold.comW:

www.marathon-gold.com

Marathon’s head office is located at 36 Lombard

St., 6th Floor, Toronto, Ontario, M5C 2X3.

Cautionary Note Regarding Forward

Looking Information

This news release includes certain

“forward-looking information” and “forward-looking statements”

(collectively “forward-looking statements”) within the meaning of

applicable Canadian securities legislation, including statements

regarding the plans, intentions, beliefs and current expectations

of Calibre and Marathon with respect to future business activities

and operating performance. All statements in this news release that

address events or developments that Calibre and Marathon expect to

occur in the future are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

often identified by words such as "expect", "plan", "anticipate",

"project", "target", "potential", "schedule", "forecast", "budget",

"estimate", "intend" or "believe" and similar expressions or their

negative connotations, or that events or conditions "will",

"would", "may", "could", "should" or "might" occur, and include

information regarding: (i) expectations regarding whether the

proposed Transaction will be consummated, including whether

conditions to the consummation of the Transaction will be

satisfied, or the timing for completing the Transaction and

receiving the required regulatory and court approvals, (ii) the

anticipated timing of the shareholders’ meetings of Calibre and

Marathon and the mailing of the information circulars in respect of

the meetings; (iii) expectations regarding the potential benefits

and synergies of the Transaction and the ability of the combined

company to successfully achieve business objectives, including

integrating the companies or the effects of unexpected costs,

liabilities or delays, (iv) expectations regarding additional

mineral reserves and future production, (v) expectations regarding

financial strength, free cash flow generation, trading liquidity,

and capital markets profile, (vi) expectations regarding future

exploration and development, growth potential for Calibre’s and

Marathon’s operations, (vii) the availability of the exemption

under Section 3(a)(10) of the U.S. Securities Act to the securities

issuable in the Transaction, (viii) expectations with respect to

annual gold production of Calibre, Marathon or the combined

company, (ix) expectations regarding the use of proceeds of the

Concurrent Private Placement, along with the timing for closing of

the Concurrent Private Placement and the ability to obtain the

necessary regulatory approvals in regards thereto, and (x)

expectations for other economic, business, and/or competitive

factors.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

Calibre’s and Marathon’s control. These forward-looking statements

are qualified in their entirety by cautionary statements and risk

factor disclosure contained in filings made by Calibre and Marathon

with the Canadian securities regulators, including Calibre’s and

Marathon’s respective annual information form, Calibre’s financial

statements and related MD&A for the financial year ended

December 31, 2022 and its interim financial statements and related

MD&A for the three and nine months ended September 30, 2023,

and Marathon’s financial statements and related MD&A for the

financial year ended December 31, 2022 and its interim financial

statements and related MD&A for the three and nine months ended

September 30, 2023, all filed with the securities regulatory

authorities in certain provinces of Canada and available under each

of Calibre’s and Marathon’s respective profile at

www.sedarplus.com. The risk factors are not exhaustive of the

factors that may affect Calibre’s and Marathon’s forward-looking

statements.

Calibre’s and Marathon’s forward-looking

statements are based on the applicable assumptions and factors

management considers reasonable as of the date hereof, based on the

information available to management of Calibre and Marathon at such

time. Calibre and Marathon do not assume any obligation to update

forward-looking statements if circumstances or management’s

beliefs, expectations or opinions should change other than as

required by applicable securities laws. There can be no assurance

that forward-looking statements will prove to be accurate, and

actual results, performance or achievements could differ materially

from those expressed in, or implied by, these forward-looking

statements. Accordingly, undue reliance should not be placed on

forward-looking statements.

Foot Notes:1. Based on consensus estimates

sources from Refinitiv, public disclosure of Marathon and Calibre,

respectively, and available broker estimates 2. Calibre Mining cash

position and Marathon Gold cash position, FX USD:CAD of 0.72:1 as

at September 30, 2023 3. See Mineral Resource and Reserve

Statements & Notes for Calibre Mining and Marathon Gold at the

end of this press release and on www.sedarplus.ca and

www.calibremining.com and www.marathon-gold.com. 4. See Marathon

Gold news release dated December 7, 2022.

Technical Data: Tables and Notes:

All estimates have been prepared using CIM (2014) definitions.

Mineral resources that are not mineral reserves do not have

demonstrated economic viability. Mineral Resources are inclusive of

Mineral Reserves. Numbers may not add due to rounding.

Calibre Mining Mineral Resource and

Reserve TablesNicaragua Mineral Resource and

Reserve Statements – December 31, 2022 (or as noted

below)1,2,3,4,5,6All

notes with parameters are at the end of this press release.

|

|

Tonnage |

Grade |

Grade |

Contained Au |

Contained Ag |

|

|

(kt) |

(g/t Au) |

(g/t Ag) |

(koz) |

(koz) |

|

Probable Reserves |

6,269 |

5.37 |

16.25 |

1,082 |

3,275 |

|

El Limon Complex |

3,714 |

5.50 |

5.21 |

657 |

622 |

|

La Libertad Complex |

2,556 |

5.18 |

32.29 |

426 |

2,654 |

|

Measured & Indicated Resources (Inclusive of

probable reserves) |

16,806 |

3.37 |

8.98 |

1,823 |

4,814 |

|

El Limon Complex |

13,313 |

2.97 |

2.05 |

1,270 |

877 |

|

La Libertad Complex |

3,493 |

4.92 |

35.38 |

553 |

3,937 |

|

Inferred Resources |

59,056 |

1.30 |

7.09 |

2,462 |

13,460 |

|

El Limon Complex |

1,597 |

4.26 |

3.27 |

218 |

167 |

|

La Libertad Complex |

6,433 |

3.65 |

41.19 |

754 |

8,487 |

|

Primavera (January 31, 2017) |

44,974 |

0.54 |

1.15 |

782 |

1,661 |

|

Cerro Aeropuerto (April 11, 2011) |

6,052 |

3.64 |

16.16 |

708 |

3,145 |

USA Mineral Resource and Reserve

Statements – December 31, 20227,8,9,10All

notes with parameters are at the end of this press release.

|

|

Tonnage |

Grade |

Grade |

Contained Au |

Contained Ag |

|

|

(kt) |

(g/t Au) |

(g/t Ag) |

(koz) |

(koz) |

|

Proven & Probable Reserves |

19,788 |

0.37 |

|

264 |

|

|

Pan Mine |

19,788 |

0.37 |

|

264 |

|

|

Measured & Indicated Resources (Inclusive of

probable reserves) |

98,212 |

0.88 |

6.44 |

2,780 |

9,399 |

|

Pan Mine |

33,790 |

0.33 |

|

359 |

|

|

Gold Rock (Mar 31, 2020) |

18,996 |

0.66 |

|

403 |

|

|

Golden Eagle (Mar 31, 2020) |

45,426 |

1.38 |

6.44 |

2,018 |

9,399 |

|

Inferred Resources |

11,643 |

0.75 |

4.43 |

281 |

765 |

|

Pan Mine |

3,246 |

0.40 |

|

42 |

|

|

Gold Rock (Mar 31, 2020) |

3,027 |

0.87 |

|

84 |

|

|

Golden Eagle (Mar 31, 2020) |

5,370 |

0.90 |

4.43 |

155 |

765 |

Notes: Calibre Mining Mineral Resource and Reserve

Statements

Note 1 and 2 - La Libertad Complex Mineral Resource and

Reserve Notes

- For additional information see “NI 43-101 Technical Report on

the La Libertad Complex, Nicaragua” dated March 29, 2022, and

effective December 31, 2021, which is available under Calibre’s

profile on www.sedarplus.ca

Note 3 and 4 – El Limon Complex Mineral

Resource and

Reserve Notes

- For additional information see “NI 43-101 Technical Report on

the El Limón Complex, León and Chinadego Departments, Nicaragua”

dated March 30, 2021 and effective December 31, 2021, which is

available under Calibre’s profile on www.sedarplus.ca

Note 5 – Cerro Aeropuerto (Borosi)

Mineral Resource Notes

- The effective date of the Mineral

Resource is April 11, 2011.

- For additional information ‘NI

43-101 Technical Report and Resource Estimation of the Cerro

Aeropuerto and La Luna Deposits, Borosi Concessions, Nicaragua’ by

Todd McCracken, dated April 11, 2011.

Note 6 – Primavera (Borosi) Mineral

Resource Notes

- The effective date of the Mineral

Resource is January 31, 2017.

Note 7 and 8 – Pan Open Pit Mineral

Resource and Reserve

Notes

- Mineral Reserves stated above are

contained within and are not additional to the Mineral Resource,

the exception being leach pad inventory. Mineral Resources are

based on 100% ownership.

- For additional information “NI

43-101 Updated Technical Report on Resources and Reserves, Pan Gold

Project, White Pine County, Nevada” dated March 16, 2023, and

effective December 31, 2022, which is available under Calibre’s

profile on www.sedarplus.ca

Note 9 – Gold Rock Mineral Resource

Notes

- The effective date of the Mineral

Resource is March 31, 2020.

Note 10 – Golden Eagle Mineral Resource

Notes

- The effective date of the Mineral

Resource is March 31, 2020

Marathon Gold Mineral Resource and

Reserve Table1,2All notes with parameters

are at the end of this press release.

|

|

Tonnage |

Grade |

Contained Au |

|

|

(kt) |

(g/t Au) |

(koz) |

|

Proven & Probable Reserves |

51,600 |

1.62 |

2,700 |

|

Marathon |

21,300 |

1.56 |

1,100 |

|

Leprechaun |

15,100 |

1.73 |

426 |

|

Berry |

15,100 |

1.60 |

800 |

|

Measured & Indicated Resources (Inclusive of

Mineral Reserves) |

64,624 |

1.90 |

3,955 |

|

Leprechaun |

15,589 |

2.15 |

1,078 |

|

Sprite |

701 |

1.74 |

39 |

|

Berry |

17,159 |

1.97 |

1,086 |

|

Marathon |

30,090 |

1.76 |

1,701 |

|

Victory |

1,085 |

1.46 |

51 |

|

Inferred Resources |

20,752 |

1.65 |

1,100 |

|

Leprechaun |

4,856 |

1.58 |

246 |

|

Sprite |

1,250 |

1.26 |

51 |

|

Berry |

5,332 |

1.49 |

255 |

|

Marathon |

6,984 |

2.02 |

454 |

|

Victory |

2,330 |

1.26 |

95 |

Notes: Marathon Gold Mineral Resource and Reserve

Statements

- The Mineral Resource has an effective date of June 15, 2022

(Marathon/Leprechaun/Berry) and November 20, 2020

(Sprite/Victory).

- For additional information see “Valentine Gold Project, NI

43-101 Technical Report and Feasibility Study, Newfoundland and

Labrador, Canada” dated December 20, 2022, with an effective date

of November 30, 2022 which is available under Marathon’s profile at

www.sedarplus.ca

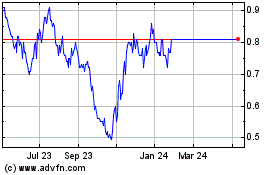

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Nov 2023 to Nov 2024