Marathon Gold Corporation (“Marathon” or the “Company”; TSX: MOZ)

today announces its financial results for the third quarter ending

September 30, 2023, and provides an update on the Company’s

activities at the Valentine Gold Project (the “Project”) in the

central region of Newfoundland and Labrador (“NL”).

All figures are in Canadian dollars unless

otherwise noted.

Third Quarter Financial

Results

- Cash and

cash equivalents at September 30, 2023 of $71.0 million

and restricted cash of $244.8 million.

- Capital

Expenditures of $76.0 million for the three months ended

September 30, 2023, including $73.7 million related to construction

of the Project.

Third Quarter Project KPIs

- The Project

exceeded 800,000 hours of site work completed without a lost time

incident.

- At the end of

the third quarter, overall completion at the Project stood at

50%.

- During the

quarter, important de-risking of the Project was achieved with the

completion of earthworks at the process plant and significant

advancement of earthworks at the Tailings Management Facility

(“TMF”). Rock placement for the tailings dam footprint is now

96% complete.

- 634 Marathon

employees and contractors are employed or providing services to the

Project, 85% of whom are residents of Newfoundland and

Labrador.

- The Project’s

cost-to-complete, including contingency, was estimated at $463

million at October 31, 2022 and C$318 million at September 30,

2023.

- The

Project remains on schedule for first gold

production in the first quarter of 2025.

Highlights

- Subsequent to

the end of the quarter, the Company and Calibre Mining Corp.

(“Calibre”) announced that they entered into a definitive

arrangement agreement pursuant to which Calibre will acquire all of

the issued and outstanding common shares of Marathon it does not

already own pursuant to a court-approved plan of arrangement (the

“Transaction”). In connection with the Transaction, Calibre has

agreed to purchase on a non-brokered private placement basis

66,666,667 common shares of Marathon at C$0.60 per share for gross

proceeds of C$40 million.

- Subsequent to the end of the

quarter, the Company announced that the Minister of Environment and

Climate Change, had released the proposed addition of the Berry

Deposit to the Project from the provincial environmental assessment

process.

- On July 10,

2023, the Company closed a C$6.9 million non-brokered charity

flow-through offering at a price of C$1.0488.

- On August 7,

2023, the Company held a formal signing ceremony for the

Socio-Economic Agreement with the Miawpukek First Nation that was

concluded on May 8, 2023.

- In the quarter,

the Company announced management changes, appointing Mr. Gil Lawson

in the role of Chief Operating Officer, effective October 1, 2023,

replacing Tim Williams.

Financial Performance

The results of operations for the three and nine

months ended September 30, 2023 are summarized below (all figures

are in Canadian dollars unless otherwise noted):

| (Stated in thousands of

Canadian dollars) |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative

expense |

|

$ |

6,643 |

|

|

$ |

1,999 |

|

|

$ |

12,854 |

|

|

$ |

5,181 |

|

| Finance expense, net |

|

|

6,076 |

|

|

|

1,678 |

|

|

|

2,108 |

|

|

|

1,400 |

|

| Other

income, net |

|

|

(76 |

) |

|

|

(40 |

) |

|

|

(237 |

) |

|

|

(122 |

) |

|

Loss before tax |

|

$ |

12,643 |

|

|

$ |

3,637 |

|

|

$ |

14,725 |

|

|

$ |

6,459 |

|

|

Deferred income tax expense |

|

|

852 |

|

|

|

716 |

|

|

|

1,371 |

|

|

|

67 |

|

|

Net Loss |

|

$ |

13,495 |

|

|

$ |

4,353 |

|

|

$ |

16,096 |

|

|

$ |

6,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures¹ |

|

$ |

75,587 |

|

|

$ |

33,466 |

|

|

$ |

167,198 |

|

|

$ |

56,060 |

|

-

Capital expenditures are presented on a cash basis.

General and administrative expenses increased

from the comparable period in 2023, due to an increase in salaries

and wages, $2 million in public road repairs in the third quarter

of 2023, and $1.0 million in fees related to the sale of the

additional NSR to Franco-Nevada in the second quarter of 2023.

Finance expense, in the third quarter of 2023

included an unrealized foreign exchange loss of $5.2 million

related to the remeasurement of financial liabilities at period

end.

Capital expenditures were $42.1 million and

$111.1 million higher in the three and nine months ended September

30, 2023, respectively, than the comparable period in the prior

year primarily as a result of an increase in project construction

capital spending and the repurchase of 0.5% of the NSR on the

Project from Franco-Nevada. Major construction mobilization at the

Project commenced in January 2023, with major civils work related

to the process plant and principal facilities now complete,

including all foundations at quarter-end. Mining of the Leprechaun

pit for waste rock in support of construction of pads and haul

roads and mining of the Marathon pit for the TMF is ongoing. As of

the end of the third quarter, the permanent camp modules and

construction of the Project’s 66 kV powerline connection to the

Star Lake Generating Station have also been completed.

Qualified Persons

Disclosure of a scientific or technical nature

in this news release has been approved by Mr. Gil Lawson, P. Eng.

(Ont.), Chief Operating Officer for Marathon, Mr. Paolo Toscano,

P.Eng. (Ont.), Senior Vice President, Projects, Engineering and

Construction for Marathon, Mr. James Powell, P.Eng. (NL), Vice

President, Regulatory and Government Affairs for Marathon and Mr.

David Ross, P.Geo (NL), Vice President, Geology & Exploration

for Marathon. Mr. Lawson, Mr. Toscano, Mr. Powell and Mr. Ross are

qualified persons under National Instrument (“NI”) 43-101. Mr. Roy

Eccles, P.Geo. (NL), of APEX Geoscience Ltd. is a Qualified Person

for purposes of NI 43-101, is independent of Marathon and the

Valentine Gold Project, and has reviewed and takes responsibility

for the updated 2022 MRE prepared by John T. Boyd Company.

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold

company advancing its 100%-owned Valentine Gold Project located in

the central region of Newfoundland and Labrador, one of the top

mining jurisdictions in the world. The Project comprises a

series of five mineralized deposits along a 32-kilometre system. A

December 2022 Updated Feasibility Study outlined an open pit mining

and conventional milling operation producing 195,000 ounces of gold

a year for 12 years within a 14.3-year mine life. The Project was

released from federal and provincial environmental assessment in

2022 and construction commenced in October 2022. The Project has

estimated Proven Mineral Reserves of 1.43 Moz (23.36 Mt at 1.89

g/t) and Probable Mineral Reserves of 1.27 Moz (28.22 Mt at 1.40

g/t). Total Measured Mineral Resources (inclusive of the Mineral

Reserves) comprise 2.06 Moz (29.23 Mt at 2.19 g/t) with Indicated

Mineral Resources (inclusive of the Mineral Reserves) of 1.90 Moz

(35.40 Mt at 1.67 g/t). Additional Inferred Mineral Resources are

1.10 Moz (20.75 Mt at 1.65 g/t Au). Please see the NI 43-101

Technical Report “Valentine Gold Project, NI 43-101 Technical

Report and Feasibility Study” effective November 30, 2022,

Marathon’s Annual Information Form for the year ended December 31,

2022 and other filings made with Canadian securities regulatory

authorities available at www.sedar.com for further details and

assumptions relating to the Valentine Gold Project.

For more information, please

contact:

|

Amanda MalloughManager, Investor RelationsTel: 416

855-8202amallough@marathon-gold.com |

Matt MansonPresident & CEOmmanson@marathon-gold.com |

Julie RobertsonCFOjrobertson@marathon-gold.com |

|

|

|

|

To find out more information on Marathon Gold

Corporation and the Valentine Gold Project, please visit

www.marathon-gold.com.

Cautionary Statement Regarding

Forward-Looking Information

Certain information contained in this news

release, constitutes forward-looking information within the meaning

of Canadian securities laws (“forward-looking statements”). All

statements in this news release, other than statements of

historical fact, which address events, results, outcomes or

developments that Marathon expects to occur are forward-looking

statements. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects”, “anticipates”,

“plans”, “believes”, “estimates”, “considers”, “intends”,

“targets”, or negative versions thereof and other similar

expressions, or future or conditional verbs such as “may”, “will”,

“should”, “would” and “could”. We provide forward-looking

statements for the purpose of conveying information about our

current expectations and plans relating to the future, and readers

are cautioned that such statements may not be appropriate for other

purposes. More particularly and without restriction, this news

release contains forward-looking statements and information about

the Updated Feasibility Study and the results therefrom (including

IRR, NPV5%, Capex, FCF, AISC and other financial metrics and

economic analysis), the realization of mineral reserve and mineral

resource estimates, the future financial or operating performance

of the Company and the Project, capital and operating costs, the

ability of the Company to obtain all government approvals, permits

and third-party consents in connection with the Company’s

exploration, development and operating activities, the potential

impact of COVID-19 on the Company, the Company’s ability to

successfully advance the Project and anticipated benefits thereof,

economic analyses for the Valentine Gold Project, processing and

recovery estimates and strategies, future exploration and mine

plans, objectives and expectations and corporate planning of

Marathon, future environmental impact statements and the timetable

for completion and content thereof and statements as to

management's expectations with respect to, among other things, the

matters and activities contemplated in this news release.

Forward-looking statements involve known and

unknown risks, uncertainties and assumptions and accordingly,

actual results and future events could differ materially from those

expressed or implied in such statements. You are hence cautioned

not to place undue reliance on forward-looking statements. In

respect of the forward-looking statements concerning the

interpretation of exploration results and the impact on the

Project’s mineral resource estimate, the Company has provided such

statements in reliance on certain assumptions it believes are

reasonable at this time, including assumptions as to the continuity

of mineralization between drill holes. A mineral resource that is

classified as “inferred” or “indicated” has a great amount of

uncertainty as to its existence and economic and legal feasibility.

It cannot be assumed that any or part of an “inferred mineral

resource” or an “indicated mineral resource” will ever be upgraded

to a higher category of mineral resource. Investors are cautioned

not to assume that all or any part of mineral deposits in these

categories will ever be converted into proven and probable mineral

reserves.

By its nature, this information is subject to

inherent risks and uncertainties that may be general or specific

and which give rise to the possibility that expectations,

forecasts, predictions, projections or conclusions will not prove

to be accurate, that assumptions may not be correct and that

objectives, strategic goals and priorities will not be achieved.

Factors that could cause future results or events to differ

materially from current expectations expressed or implied by the

forward-looking statements include risks and uncertainties relating

to the interpretation of drill results, the geology, grade and

continuity of mineral deposits and conclusions of economic

evaluations; uncertainty as to estimation of mineral resources;

inaccurate geological and metallurgical assumptions (including with

respect to the size, grade and recoverability of mineral

resources); the potential for delays or changes in plans in

exploration or development projects or capital expenditures, or the

completion of feasibility studies due to changes in logistical,

technical or other factors; the possibility that future

exploration, development, construction or mining results will not

be consistent with the Company’s expectations; risks related to the

ability of the current exploration program to identify and expand

mineral resources; risks relating to possible variations in grade,

planned mining dilution and ore loss, or recovery rates and changes

in project parameters as plans continue to be refined; operational

mining and development risks, including risks related to accidents,

equipment breakdowns, labour disputes (including work stoppages and

strikes) or other unanticipated difficulties with or interruptions

in exploration and development; risks related to the inherent

uncertainty of production and cost estimates and the potential for

unexpected costs and expenses; risks related to commodity and power

prices, foreign exchange rate fluctuations and changes in interest

rates; the uncertainty of profitability based upon the cyclical

nature of the mining industry; risks related to failure to obtain

adequate financing on a timely basis and on acceptable terms or

delays in obtaining governmental or other stakeholder approvals or

in the completion of development or construction activities; risks

related to environmental regulation and liability, government

regulation and permitting; risks relating to the Company’s ability

to attract and retain skilled staff; risks relating to the timing

of the receipt of regulatory and governmental approvals for

continued operations and future development projects; political and

regulatory risks associated with mining and exploration; risks

relating to the potential impacts of the COVID-19 pandemic on the

Company and the mining industry; changes in general economic

conditions or conditions in the financial markets; and other risks

described in Marathon’s documents filed with Canadian securities

regulatory authorities, including the Annual Information Form for

the year ended December 31, 2022.

You can find further information with respect to

these and other risks in Marathon’s Annual Information Form for the

year ended December 31, 2022 and other filings made with Canadian

securities regulatory authorities available at www.sedar.com. Other

than as specifically required by law, Marathon undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances after the date on which such statement is

made, or to reflect the occurrence of unanticipated events, whether

as a result of new information, future events or results

otherwise.

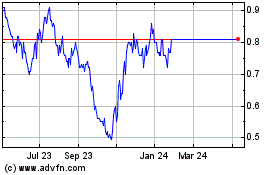

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Apr 2023 to Apr 2024