Wi2Wi Announces Pricing of Private Placement Offering

19 November 2013 - 9:04AM

Marketwired Canada

NOT FOR DISTRIBUTION IN THE UNITED STATES WIRE SERVICES OR DISSEMINATION IN THE

UNITED STATES

Wi2Wi Corporation (TSX VENTURE:YTY) ("Wi2Wi" or the "Company") today announced

that it has priced the fully marketed private placement offering previously

announced on November 7, 2013, (the "Offering"). The Offering will be made on a

best efforts fully marketed private placement basis for total gross proceeds of

up to C$4,000,000. Each Unit shall be comprised of one common share priced at

$0.20 and one-half of one common share purchase warrant (each whole common share

purchase warrant, a "Warrant"). Each whole Warrant shall entitle the holder

thereof to acquire one common share of the Company at a exercise price of $0.25

for a period of 24 months following the closing of the Offering. The Offering is

being led by Paradigm Capital Inc. who is also acting as sole book-runner on

behalf of a syndicate including Byron Capital Markets Ltd. and M Partners Inc.

(collectively, the "Agents").

In addition, the Company has granted the Agents (as defined below) an option

(the "Agents' Option") exercisable in whole or in part to increase the size of

the Offering by up to 15% of the base offering size, which Agents' Option shall

be exercisable, by notice in writing to Wi2Wi, until the 30th day following the

Closing (as defined below). If the Agents' Option is exercised in full, the

total gross proceeds of the Private Placement to Wi2Wi will be $4,600,000.

The closing of the Offering ("Closing") is expected to occur on or about

December 4, 2013 or such other date or dates as agreed by the Company and the

Agents (the "Closing Date"). All securities issued in the Offering will be

subject to a statutory four month hold period. Completion of the Offering is

subject to a number of conditions, including, without limitation, receipt of all

regulatory approvals, including approval of the TSX Venture Exchange.

The net proceeds of the private placement will be used for general corporate and

working capital purposes.

About Wi2Wi

Wi2Wi is a leader in industrial-class WiFi, WiFi-Bluetooth and GPS

system-in-a-package (SiPs). Wi2Wi focuses on industrial (including Automotive),

medical, infrastructure (including smart-home/smart building) and government

markets worldwide. Wi2Wi's products and value-added services provide highly

integrated, multifunctional wireless sub systems as complete wireless

connectivity solutions for the Machine-to-Machine (M2M) and portable device

applications globally. The Wi2Wi product range is designed for long life and

under a wide range of temperature variables.

DISCLAIMERS: Forward-Looking Statements: This news release contains certain

forward-looking statements, including statements relating to the closing of the

proposed Offering and use of proceed thereof, increasing future revenue and

profitability and management's assessment of growth opportunities and interest

in the Company's products, future plans and operations, and the timing thereof,

that involve substantial known and unknown risks and uncertainties, certain of

which are beyond the Company's control. Such risks and uncertainties include,

without limitation, risks associated with delays resulting from or inability to

obtain required regulatory approvals, ability to access sufficient capital, the

impact of general economic conditions in Canada, the United States and overseas,

industry conditions, stock market volatility. The Company's actual results,

performance or achievements could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no assurances can

be given that any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do so, what benefits, including the

amount of proceeds, that the Company will derive there from. Readers are

cautioned that the foregoing list of factors is not exhaustive. Additional

information on these and other factors that could affect the Company's

operations and financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com).

Forward-looking statements are made based on management's beliefs, estimates and

opinions on the date the statements are made and the Company undertakes no

obligation to update forward-looking statements and if these beliefs, estimates

and opinions or other circumstances should change, except as required by

applicable law. All subsequent forward-looking statements, whether written or

oral, attributable to the Company or persons acting on its behalf are expressly

qualified in their entirety by these cautionary statements. Furthermore, the

forward-looking statements contained in this news release are made as at the

date of this news release and the Company does not undertake any obligation to

update publicly or to revise any of the included forward-looking statements,

whether as a result of new information, future events or otherwise, except as

may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Common Shares: 81,548,688

FOR FURTHER INFORMATION PLEASE CONTACT:

Wi2Wi Corporation

Dr. Reza Ahy

Chief Executive Officer

(408) 416-4200

reza@wi2Wi.com

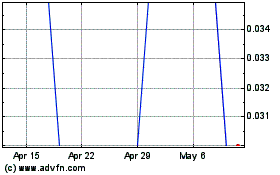

Wi2Wi (TSXV:YTY)

Historical Stock Chart

From May 2024 to Jun 2024

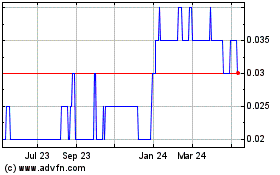

Wi2Wi (TSXV:YTY)

Historical Stock Chart

From Jun 2023 to Jun 2024