Maersk to Accelerate Buyback, Launch New $5 Billion Program

05 May 2021 - 5:24PM

Dow Jones News

By Dominic Chopping

A.P. Moeller-Maersk AS said Wednesday that it will accelerate

its share buyback program and launch a new program of up to 31

billion Danish kroner ($5.01 billion) as rising demand and freight

rates have propelled the company's earnings and cash flow

higher.

The Danish shipping giant last month upgraded guidance and

provided preliminary first-quarter earnings after saying a surge in

demand had led to bottlenecks and a shortage of containers, sending

freight rates higher.

The company posted a quarterly net profit attributable of $2.7

billion, up from $197 million in the same period the previous year,

and compared with $2.38 billion seen in a FactSet analyst

forecast.

Revenue rose 30% to $12.44 billion, in line with guidance

provided last week.

Maersk, which is considered a barometer of global trade,

confirmed that shipping volumes rose 5.7% in the quarter and that

average freight rates were 36% higher, just above the guided

35%.

The company previously announced a share buyback of up to DKK10

billion, with the first phase of DKK3.3 billion concluded last

month. The remaining DKK6.7 billion will be exercised between

mid-May and the end of September 2021, and a new program of up to

DKK31 billion will be executed over two years when the current one

is finalized.

Maersk backed guidance it gave last week.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

May 05, 2021 03:09 ET (07:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

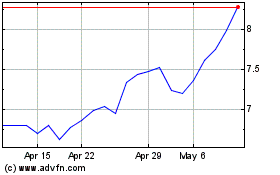

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2024 to May 2024

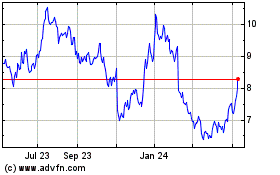

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about AP Moller Maersk AS (PK) (OTCMarkets): 0 recent articles

More AP Moller Maersk AS (PK) News Articles