Form 8-K - Current report

22 October 2024 - 6:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 21, 2024 |

HUGOTON ROYALTY TRUST

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Texas |

001-10476 |

58-6379215 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Argent Trust Company Trustee 3838 Oak Lawn Ave, Suite 1720 |

|

Dallas, Texas |

|

75219-4518 |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (855) 588-7839 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s) |

|

Name of each exchange on which registered

|

Units of Beneficial Interest |

|

HGTXU |

|

OTCQB |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 21, 2024, the Registrant issued a news release that it will not declare a monthly cash distribution for the month of October 2024. A copy of the news release is furnished as Exhibit 99.1.

The information in this Current Report, including the news release attached hereto, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities of that Section.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

HUGOTON ROYALTY TRUST |

|

|

By: |

ARGENT TRUST COMPANY, TRUSTEE |

Date: |

October 21, 2024 |

By: |

/s/ NANCY WILLIS |

|

|

|

Nancy Willis |

|

|

|

Director of Royalty Trust Services |

|

|

EXXON MOBIL CORPORATION |

|

|

By: |

/s/ KRISTY WALKER |

|

|

|

Kristy Walker |

|

|

|

Unconventional Finance General Manager |

EXHIBIT 99.1

[NEWS RELEASE LETTERHEAD OF HUGOTON ROYALTY TRUST APPEARS HERE]

HUGOTON ROYALTY TRUST

DECLARES NO OCTOBER CASH DISTRIBUTION

Dallas, Texas, October 21, 2024 – Argent Trust Company, as Trustee of the Hugoton Royalty Trust (the “Trust”) (OTCQB: HGTXU) announced today there would not be a cash distribution to the holders of its units of beneficial interest for October 2024 due to the excess cost positions on all three of the Trust’s conveyances of net profits interests. The Trust’s cash reserve was reduced by $89,000 for the payment of Trust expenses. To the extent net profits income is received in future months, the Trustee anticipates replenishing the cash reserve prior to declaring any future distributions to unitholders. Replenishment of the cash reserve may include any increase in the cash reserve total, as determined by the Trustee. The following table shows underlying gas and oil sales and average prices attributable to the net overriding royalty for both the current month and prior month. Underlying gas and oil sales volumes attributable to the current month were primarily produced in August.

|

|

|

|

|

|

|

|

|

|

|

Underlying Sales |

|

|

|

|

Volumes (a) |

|

Average Price |

|

|

Gas |

|

Oil |

|

Gas |

|

Oil |

|

|

(Mcf) |

|

(Bbls) |

|

(per Mcf) |

|

(per Bbl) |

|

|

|

|

|

|

|

|

|

Current Month Distribution |

|

719,000 |

|

24,000 |

|

$4.09 |

|

$75.13 |

|

|

|

|

|

|

|

|

|

Prior Month Distribution |

|

737,000 |

|

15,000 |

|

$2.80 |

|

$75.57 |

|

(a)Sales volumes are recorded in the month the Trust receives the related net profits income. Because of this, sales volumes may fluctuate from month to month based on the timing of cash receipts. |

XTO Energy has advised the Trustee that it has included underlying sales volumes of approximately 11,000 Bbls and 51,000 Mcf from four new non-operated wells drilled in Major County, Oklahoma and has deducted development costs of $84,000, production expense of $1,707,000, and overhead of $979,000 in determining the royalty calculation for the Trust for the current month.

Current Month Distribution

XTO Energy has advised the Trustee that out of period plant product revenue for the Oklahoma Working Interest net profits interests contributed to a higher average gas price for the current month. Excluding these out of period plant product revenues, the average gas price would have been $1.97 per Mcf for the current month. This had no effect on the cash distribution in the current or prior month.

Excess Costs

XTO Energy has advised the Trustee that excess costs increased by $53,000 on properties underlying the Kansas net profits interests. Underlying cumulative excess costs remaining on the Kansas net profits interests total $1,483,000, including accrued interest of $95,000.

XTO Energy has advised the Trustee that $1,734,000 of excess costs were recovered on properties underlying the Oklahoma net profits interests. However, after the partial recovery, there were no remaining proceeds from the properties underlying the Oklahoma net profits interests to be included in the current month’s distribution. Underlying cumulative excess costs remaining on the Oklahoma net profits interests total $1,133,000, including accrued interest of $364,000.

XTO Energy has advised the Trustee that excess costs increased by $450,000 on properties underlying the Wyoming net profits interests. Underlying cumulative excess costs remaining on the Wyoming net profits interests total $6,756,000, including accrued interest of $284,000.

Development Costs

As previously disclosed, XTO Energy advised the Trustee that it elected to participate in the development of four non-operated wells in Major County, Oklahoma. As of the date hereof, $10.2 million underlying ($8.2 million net to the Trust) in development costs have been charged to the Trust for the four non-operated wells. Two wells were completed in second quarter 2023, the third was completed in fourth quarter 2023, and the fourth was completed in first quarter 2024. The Trustee and XTO Energy will continue to provide material updates on the four non-operated wells in subsequent communications.

For more information on the Trust, including the annual tax information, distribution amounts, and historical press releases, please visit our website at www.hgt-hugoton.com.

Statements made in this press release regarding future events or conditions are forward looking statements. Actual future results, including development costs and timing, and future net profits, could differ materially due to changes in natural gas and oil prices and other economic conditions affecting the gas and oil industry and other factors described in Part I, Item 1A of the Trust's Annual Report on Form 10-K for the year ended December 31, 2023.

* * *

|

|

Contact: |

Nancy Willis Director of Royalty Trust Services Argent Trust Company, Trustee 855-588-7839 |

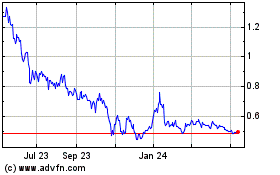

Hugoton Royalty (QB) (USOTC:HGTXU)

Historical Stock Chart

From Oct 2024 to Nov 2024

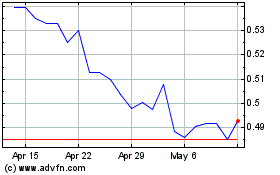

Hugoton Royalty (QB) (USOTC:HGTXU)

Historical Stock Chart

From Nov 2023 to Nov 2024