Hyperion Exploration Corp. Announces Fourth Quarter and Year Ended December 31, 2013 Financial Results and Operations Update

24 April 2014 - 9:30PM

Marketwired Canada

Hyperion Exploration Corp. ("Hyperion" or the "Company") (TSX VENTURE:HYX)

announces it has filed on SEDAR its audited annual financial statements, related

Management's Discussion and Analysis ("MD&A) and Annual Information Form ("AIF")

for the year ended December 31, 2013. The financial statements, MD&A and AIF

will be available for review at www.sedar.com or www.hyperionexploration.com.

Financial and Operational Highlights

----------------------------------------------------------------------------

Three Months Ended Year Ended

December 31, December 31,

----------------------------------------------------------------------------

2013 2012 2013 2012

----------------------------------------------------------------------------

FINANCIAL ($000'S except per

share amounts)

----------------------------------------------------------------------------

Oil sales (net of financial

contract settlements) 3,296 5,938 17,032 23,432

----------------------------------------------------------------------------

NGL sales 694 896 3,721 2,812

----------------------------------------------------------------------------

Natural gas sales 915 1,106 2,788 2,970

----------------------------------------------------------------------------

Total Oil, NGL, & Natural gas 4,905 7,940 23,541 29,214

----------------------------------------------------------------------------

Funds inflow (outflow) from

operations3 1,696 4,313 10,208 15,255

----------------------------------------------------------------------------

Per common share basic & FD

($) 0.03 0.08 0.19 0.28

----------------------------------------------------------------------------

Net earnings (loss) 222 (13,348) (13,560) (11,945)

----------------------------------------------------------------------------

Per common share basic & FD

($) nm (0.25) (0.25) (0.22)

----------------------------------------------------------------------------

Capital expenditures (net of

dispositions) 364 5,929 8,157 43,386

----------------------------------------------------------------------------

Net debt 3 (31,840) (33,871) (31,840) (33,871)

----------------------------------------------------------------------------

Unused credit facilities 14,365 21,192 14,365 21,192

----------------------------------------------------------------------------

PRODUCTION

----------------------------------------------------------------------------

Oil (bbls/day) 409 738 520 761

----------------------------------------------------------------------------

NGL (bbls/day) 142 195 150 156

----------------------------------------------------------------------------

Natural gas (mcf/day) 2,651 3,430 3,029 3,147

----------------------------------------------------------------------------

Total (boe/day ) (6:1) 993 1,505 1,175 1,442

----------------------------------------------------------------------------

Per 1 million common share

basic & FD (boe/day )1 18.324 27.773 21.682 26.610

----------------------------------------------------------------------------

REALIZED PRICES (excluding

financial contracts)

----------------------------------------------------------------------------

Oil ($/bbl) 89.42 82.26 91.06 83.01

----------------------------------------------------------------------------

NGL ($/bbl) 53.04 49.98 50.82 49.38

----------------------------------------------------------------------------

Natural gas ($/mcf) 3.75 3.51 3.37 2.58

----------------------------------------------------------------------------

Average ($/boe) 53.69 54.81 54.90 54.80

----------------------------------------------------------------------------

OPERATING NETBACK ($'S/BOE)3

----------------------------------------------------------------------------

Oil, natural gas and NGL sales 53.69 54.81 54.90 54.80

----------------------------------------------------------------------------

Royalties 7.69 4.32 6.94 6.70

----------------------------------------------------------------------------

Operating and transportation

expenses 13.16 11.32 13.00 12.22

----------------------------------------------------------------------------

Operating netback 32.84 39.17 34.96 35.88

----------------------------------------------------------------------------

COMMON SHARES (000'S)

----------------------------------------------------------------------------

Basic and fully diluted common

shares o/s, end of period2 54,190 54,190 54,190 54,190

----------------------------------------------------------------------------

Weighted average basic and fully

diluted common shares o/s2 54,190 54,190 54,190 54,190

----------------------------------------------------------------------------

1. Weighted average basic and fully diluted common share count used in

calculation. Figures not adjusted for net debt.

2. Basic and fully diluted common shares outstanding are equal as all

dilutive instruments are considered anti-dilutive under IFRS.

3. Certain financial measures such as "funds flow", "funds flow per boe",

"funds flow per share", "operating netback", and "Net debt" do not have

standardized meaning prescribed by Canadian generally accepted

accounting principles ("GAAP"). Management believes that in addition to

net income, funds flow from operations and netback are useful

supplemental measures as they provide an indication of the results

generated by the Corporation's principal business activities before the

consideration of how those activities are financed or how the results

are taxed. Investors are cautioned, however, that these measures should

not be construed as alternatives to net income determined in accordance

with IFRS, as an indication of Hyperion's performance. These financial

measures do not have a standardized meaning prescribed by IFRS and are,

therefore, unlikely to be comparable to similar measures presented by

other issuers. "Funds flow" is calculated based on cash flows from

operating activities before changes in non-cash working capital,

transaction costs from acquisitions and decommissioning expenditures

incurred. "Operating netback" is calculated by deducting royalties,

production expenses and transportation expenses from oil and gas

revenue. "Funds flow from operations per share" is calculated using

weighted average number of shares outstanding consistent with the net

income (loss) per share calculation. "Net debt" represents bank debt and

accounts payable and accrued liabilities less accounts receivable and

prepaid expenses and deposits.

Operations Update and Outlook

As disclosed in July 2013, the Corporation engaged independent advisors to

assist in a strategic process to explore opportunities to maximize shareholder

value. During this process the Corporation has been focused on reducing its

indebtedness. Accordingly, the Corporation has not drilled or completed any new

wells since the third quarter of 2013 and minimal capital has been spent on

production optimization and maintenance. This will continue to be the plan

through the first half of 2014. The Corporation's free cash flow is being

applied towards reducing its indebtedness.

The Corporation has further reduced indebtedness with the sale of the oil and

natural gas assets at Chip Lake on January 31, 2014 for total cash

consideration, net of adjustments, of $3.1 million. Post sale of Chip Lake and

as disclosed in the April 2, 2014 press release, Hyperion has a Proved plus

Probable Developed Producing reserves ("P+PDP") Net Asset Value ("NAV") of $0.86

per share with no future development capital ("FDC") required and total Proved

plus Probable ("P+P") NAV of $1.44 per share with FDC of $54.3 million. These

NAV calculations include management's estimates of value for undeveloped land

($11.6 million), proprietary seismic and other assets ($1.3 million).

The revolving credit facility was amended to $30 million as a result of the

disposition and reduction in the borrowing base. However, there was no change to

the unused acquisition/development facility of $10 million. The annual review of

Hyperion's credit facilities is underway and will be completed in May. The

Corporation estimates net debt at the end of the first quarter to be

approximately $27 million. Production for the first quarter, based on field

estimates, is estimated to be 820 boepd.

One option being evaluated as part of the strategic process is to identify

sources of capital to advance the extended reach horizontal ("ERH") development

drilling program at Niton/McLeod. Based on industry results, drilling an ERH

well has the potential to more than double the initial production of a short

reach horizontal ("SRH") well. The evolution to ERH wells in the Cardium at

Niton/McLeod (29,030 net acres) is expected to improve capital efficiency in

excess of 20% and accelerate capital payouts to less than 1.5 years. Based on

lands currently captured, and with the successful implementation of an ERH

development program, the Company has an unbooked inventory of 51.6 ERH and 31.0

SRH wells at Niton/McLeod. All wells at Niton/McLeod included in the reserves

evaluated in the McDaniel Report were based upon SRH wells. Going forward the

Company plans to convert wells currently booked as SRH to ERH where it has

sufficient contiguous lands.

About Hyperion

Hyperion is a publicly traded, junior light oil and gas company with core

operations in the Niton/McLeod, Garrington, North Pembina, and Buck Lake areas.

The common shares of the Company trade on the TSX Venture Exchange under the

trading symbol "HYX".

Forward-Looking and Cautionary Statements:

This press release contains certain forward-looking statements (forecasts) under

applicable securities laws relating to future events or future performance.

Forward-looking statements are necessarily based upon assumptions and judgements

with respect to the future. In some cases, forward-looking statements can be

identified by terminology such as "may", "will", "should", "expect", "projects",

"plans", "anticipates" and similar expressions. These statements represent

management's expectations or beliefs concerning, among other things, future

operating results and various components thereof affecting the economic

performance of Hyperion. Undue reliance should not be placed on these

forward-looking statements which are based upon management's assumptions and are

subject to known and unknown risks and uncertainties, including the business

risks discussed above, which may cause actual performance and financial results

in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking statements.

Accordingly, readers are cautioned that events or circumstances could cause

results to differ materially from those predicted. These statements speak only

as of the date specified in the statements.

In particular, this press release may contain forward looking statements

pertaining to the following:

-- the performance characteristics of the Company's oil and natural gas

properties;

-- oil and natural gas production levels;

-- capital expenditure programs;

-- the quantity of the Company's oil and natural gas reserves and

anticipated future cash flows from such reserves;

-- projections of commodity prices and costs;

-- supply and demand for oil and natural gas;

-- expectations regarding the ability to raise capital and to continually

add to reserves through acquisitions and development; and

-- treatment under governmental regulatory regimes.

The Company's actual results could differ materially from those anticipated in

the forward looking statements contained throughout this press release as a

result of the material risk factors set forth below, and elsewhere in this press

release:

-- volatility in market prices for oil and natural gas;

-- liabilities inherent in oil and natural gas operations;

-- uncertainties associated with estimating oil and natural gas reserves;

-- competition for, among other things, capital, acquisitions of reserves,

undeveloped lands and skilled personnel;

-- incorrect assessments of the value of acquisitions and exploration and

development programs;

-- geological, technical, drilling and processing problems;

-- fluctuations in foreign exchange or interest rates and stock market

volatility;

-- failure to realize the anticipated benefits of acquisitions;

-- general business and market conditions; and

-- changes in income tax laws or changes in tax laws and incentive programs

relating to the oil and gas industry.

These factors should not be construed as exhaustive. Unless required by law,

Hyperion does not undertake any obligation to publicly update or revise any

forward looking statements, whether as a result of new information, future

events or otherwise.

Barrels of oil equivalent (boe) may be misleading, particularly if used in

isolation. A boe conversion ratio of six thousand cubic feet (mcf) of natural

gas to one barrel (bbl) of oil is based on an energy conversion method primarily

applicable at the burner tip and is not intended to represent a value

equivalency at the wellhead. All boe conversions in this press release are

derived by converting natural gas to oil in the ratio of six thousand cubic feet

of natural gas to one barrel of oil. Certain financial amounts are presented on

a per boe basis, such measurements may not be consistent with those used by

other companies.

Estimated values contained in this press release do not represent fair market value.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Hyperion Exploration Corp.

Trevor Spagrud

President and CEO

(403) 930-0701

tspagrud@hyperionexploration.com

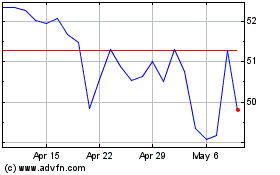

Altus (TSX:AIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

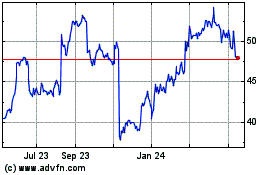

Altus (TSX:AIF)

Historical Stock Chart

From Apr 2023 to Apr 2024