NZ Dollar Falls After New Zealand PM John Key's Comments

28 July 2014 - 6:12PM

RTTF2

The NZ dollar weakened against the other major currencies in the

Asian session on Monday, as the nation's Prime Minister John Key

said he agreed with the Reserve Bank of New Zealand's view that the

currency is over-valued.

In a post-Cabinet media conference, Key said "I would agree with

the governor that the New Zealand dollar is overvalued if you

compared it against a reduction in commodity prices."

Regarding RBNZ intervention, Key opined that "If they choose to

do that they have a mandate under which to intervene."

Traders await Fonterra Cooperative Group's milk price forecast

for 2014/15 on tomorrow and RBNZ currency intervention statistics

on Wednesday. Economists expect the Fonterra Cooperative Group to

revise down its milk price payout from its initial estimate.

The NZ dollar fell to a 1-1/2-month of 0.8532 against the U.S.

dollar, from an early high of 0.8557. At last week's close, the

kiwi was trading at 0.8544 against the greenback. If the kiwi

extends its downtrend, it is likely to find support around the 0.84

area.

Pulling away from an early high of 87.10 against the yen, the

kiwi slipped to nearly a 2-month low of 86.87. The kiwi may test

support near the 86.26 area.

Against the Australian dollar and the euro, the kiwi dropped to

1.1000 and 1.5735 from early highs of 0.0972 and 1.5690,

respectively. Continuation of bearish trend may lead the kiwi to a

support around 1.11 against the aussie and 1.58 against the

euro.

Looking ahead, U.S. Markit's purchasing manager's index for July

and pending home sales for June are due in the New York

session.

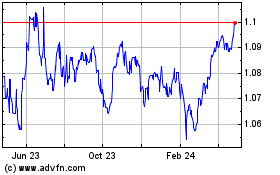

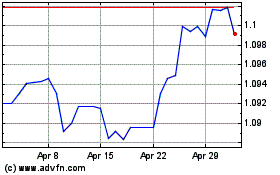

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024