Border Announces Asset Purchase, Officer Appointment and Proposed Private Placement

01 August 2014 - 4:00AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

Border Petroleum Limited (TSX VENTURE:BOR) ("Border" or the "Corporation") is

pleased to announce the entering into of an asset purchase agreement, the

appointment of a Vice President, Production, a proposed private placement and

the grant of options, all as further detailed below.

The Acquisition

Border has entered into a purchase and sale agreement dated July 31, 2014

("PSA") with a private, arm's length Calgary based junior oil and gas company,

whereby the Corporation will acquire certain oil and gas assets (the "Producing

Assets") for a purchase price of $2,800,000 payable in cash. The Producing

Assets are located in the Chip Lake, Royce, Mulligan and Blueridge areas of

North/North Central Alberta and as of the effective date of June 1, 2014

produced approximately 160 bbls of oil equivalent per day comprised of 40

bbls/day of light oil, 25 bbls/d of NGL's and approximately 575 mcf/d of natural

gas (the "Acquisition"). The Acquisition provides Border with additional

development opportunities in the Charlie Lake, Belly River and Rock Creek

formations insofar as management of Border has identified low risk development

opportunities in these areas via existing well recompletions and low risk

development drilling locations.

Officer Appointment

Border announces that Mr. Russell Tracy, P. Eng. has been appointed to the

position of Vice President, Production, subject to TSX Venture Exchange

approval. Mr. Tracy was recently the Production Engineer of CanEra Energy and

prior thereto had roles in Production & Operations at NAL Resources and Canadian

Forest Oil Ltd. Mr. Tracy brings a total of 10 years of direct, field and

production related experience to Border.

Private Placement

Border announces that it intends to complete a private placement of common

shares of the Corporation issued on a flow-through basis pursuant to the Income

Tax Act (Canada) (the "Flow-Through Shares") at a price of $0.06 per

Flow-Through Share and units ("Units") of the Corporation at a price of $0.05

per Unit. Each Unit will be comprised of one common share of the Corporation

(the "Common Shares") and one-half of a share purchase warrant (the "Warrant").

Each full Warrant will entitle the holder to acquire one additional Common Share

at a price of $0.06 per share for a period of 2 years (the "Private Placement").

Total gross proceeds from the issuance of the Common Shares and Flow-Through

Shares will be between $1,500,000 and $1,800,000 depending on the split of

subscriptions received for Common Shares or Flow-Through Shares, with a maximum

of 30,000,000 shares being issued in total in respect of the Private Placement.

The Flow-Through Shares and Common Shares will be issued utilizing exemptions

from the prospectus requirements and will be subject to a four month hold period

from the date of issuance. The net proceeds of the Private Placement will be

used to further development opportunities that have been identified on the

Producing Assets, as well as to fund potential additional acquisitions that have

been identified over the past few months. The Corporation will not be paying a

finder's fee in relation to the Acquisition and does not intend to pay

commission in respect of the Private Placement.

Grant of Options

The Corporation also announces that it has granted 2,700,000 options ("Options")

to officers, directors, employees and consultants. Each Option entitles the

holder to acquire one Common Share at a price of $0.06 per Common Share for a

period of 5 years. One third of the Options will vest immediately and the

remaining Options will vest as to 1/3 on each of the first and second year

anniversaries of the date of grant.

The Acquisition, Private Placement, Officer Appointment and Option Grant remain

subject to TSX Venture Exchange approval.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

As used in this press release, "boe" or "bbls of oil equivalent per day" means

barrel of oil equivalent on the basis of 6 mcf of natural gas to 1 bbl of oil.

Boe may be misleading, particularly if used in isolation. A boe conversion ratio

of 6 mcf: 1 bbl is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead.

Forward-Looking Statements

Certain statements in this news release, including statements regarding Border's

intended use of proceeds from the Private Placement, constitute forward-looking

statements. The forward-looking statements contained in this document are based

on certain key expectations and assumptions made by Border, including with

respect to, expectations and assumptions concerning timing of receipt of

required regulatory approvals with respect to the Acquisition and Private

Placement. Although Border believes that the expectations and assumptions on

which the forward-looking statements are based are reasonable, undue reliance

should not be placed on the forward-looking statements because Border can give

no assurance that they will prove to be correct.

Since forward-looking statements address future events and conditions, by their

very nature they involve inherent risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a number of factors

and risks. These include, but are not limited to, the failure to obtain

necessary regulatory approvals, risks associated with the oil and gas industry

in general (e.g., operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or development projects

or capital expenditures; the uncertainty of reserve estimates; the uncertainty

of estimates and projections relating to production, costs and expenses, and

health, safety and environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or changes in

plans with respect to exploration or development projects or capital

expenditures.

The forward-looking statements contained in this document are made as of the

date hereof and Border undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Border Petroleum Limited

Al Kroontje

(403) 539-4447

Border Petroleum Limited

2000, 840 - 7th Avenue SW

Calgary, AB T2P 3G2

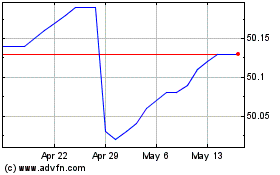

Purpose High Interest Sa... (TSX:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

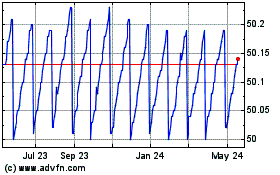

Purpose High Interest Sa... (TSX:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024