By Alex MacDonald

LONDON--Mark Cutifani is bracing for a day of reckoning.

The Anglo American PLC chief executive is facing what analysts

expect to be a disappointing full-year earnings announcement on

Tuesday as low commodity prices cut deeper into the mining

industry.

Meanwhile, investors are piling pressure on Anglo to move more

quickly on a restructuring program that was launched when Mr.

Cutifani took over in 2013 and now involves more radical elements

that include getting rid of a huge chunk of its mines and cutting

more than half of its workforce.

Though Mr. Cutifani has said the company has made substantial

headway, some investors remain frustrated.

"PIC is concerned with the slow progress on restructuring," said

Daniel Matjila, chief executive of South Africa's state-owned

Public Investment Corporation, Anglo American's largest

shareholder. The process, he said, "could have been done much

faster."

"The market is running out of patience," said Patrice Rassou,

head of equities at South Africa's Sanlam Investment Management,

which FactSet says holds $26 million worth of Anglo shares.

Those views reflect the frustration investors have had with the

99-year-old mining company, which helped fuel the growth of South

Africa's metals industry. Since Mr. Cutifani took over, Anglo's

shares have dropped 78%.

Anglo, among the world's largest miners, is forecast to report a

57% drop in underlying earnings before interest and taxes to $2.1

billion for 2015, according to a FactSet poll of 20 analysts. Net

profit could be much lower than that if, as expected, the

commodities slump forces the company to write down the value of its

assets again, Macquarie Group analyst Alon Olsha said.

An Anglo spokesman declined to respond to shareholder views on

its performance and said it would detail its asset-sales plan on

Tuesday, when it reports its full-year results.

Mr. Cutifani has been upbeat about Anglo's progress on its

restructuring, saying it has achieved an estimated $1.6 billion in

cost and productivity improvements in three years, with plans to

save another $2.1 billion this year and next. It has also sold $2

billion of assets in the first three years and plans to sell more

than $2 billion this year and next.

Anglo's shares have been more resilient this year. They closed

up 18% at 323.75 pence a share on Friday, broadly in line with the

gains of many other miners, and are up 25% in 2016.

But the company has struggled more than its peers to cope with a

prolonged downturn in the price miners can charge for the materials

they dig up and ship across the world. Copper and iron-ore

prices--two of Anglo's most important earnings drivers--have fallen

25% and 40%, respectively, in the past year. Few predict a

meaningful rebound in 2016.

The continued slump forced Mr. Cutifani to go further than his

original three-year turnaround plan in December. He laid out a more

radical plan to achieve $3.7 billion in cost and productivity

improvements and $4 billion in assets sales between 2013 and

2017.

The company now plans to get rid of more than half of its mines

and shed 85,000 jobs, shrinking to a workforce of about 50,000 by

an unspecified date. The company has also suspended its dividend

and cut capital expenditure on growth projects.

That was among several dramatic responses to the slump across

the industry. Rival Swiss miner Glencore PLC eliminated its

dividend and is trying to reduce its net debt by more than $10

billion. Rio Tinto PLC lowered its dividend last week, a move

expected to be followed by the world's largest miner, BHP Billiton

Ltd.

Anglo did receive a vote of confidence from London-based

Schroders Investment Management Ltd., its 11th largest shareholder,

according to FactSet, who said in a December letter to Anglo's CEO

that it remains a long-term supportive shareholder and believes the

company has taken the right action by cutting its dividend and

capital expenditure.

Anglo on Tuesday must show that its asset-sales program is under

way and demonstrate more urgency in cutting costs and boosting

operational performance, said Mr. Rassou of Sanlam Investment

Management.

"I think that's the biggest issue," he said. "The pace of

execution rather than simply the intent...The industry is in a

race."

Mr. Cutifani told investors in December that the company would

specify which assets it plans to sell when it reports its full-year

results in February. Anglo now says its ill-fated $13.5 billion

Minas Rio iron-ore mine in Brazil, is no longer a priority asset,

indicating it could be sold.

If the company is unable to find buyers, Mr. Cutifani said Anglo

would prefer to shut them down rather than lose money.

Andrew Lapping, deputy chief investment officer at South African

investment fund Allan Gray, an Anglo shareholder, said the company

has made strides but may be too focused on selling assets over

cutting costs at a time when mines aren't selling well.

"For me the main focus should be improving the mines from the

inside rather than selling assets [that are] distressed," he said.

"If the focus of the restructuring plan is selling assets, they're

going to struggle."

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

February 14, 2016 08:09 ET (13:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

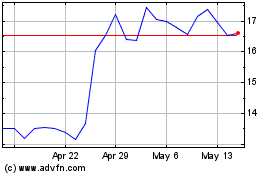

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

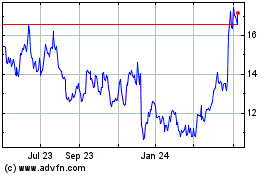

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024