National Australia Bank Bad-Debt Charge Rises, Margin Slips

15 August 2016 - 8:42AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--National Australia Bank Ltd. (NAB.AU) has

seen a rise in bad-debt costs, stung by its exposure to mining and

agriculture, and an increase in funding costs that has weighed on

its key profit margin.

The bank's net profit was about 1.6 billion Australian dollars

(US$1.2 billion) in the three months through June. It didn't

provide a year-earlier comparison, but the unaudited figure is a

drop from the A$1.85 billion reported for the same period a year

ago.

The economies of Australia and New Zealand remain resilient and

continue to grow amid heightened global uncertainty, Chief

Executive Andrew Thorburn said Monday. Funding costs for the latest

period were higher, although asset quality remains strong and the

bank remained focused on controlling costs, he said.

Since taking the helm in August 2014, Mr. Thorburn has refocused

the bank on its core franchises in Australia and New Zealand in a

bid to close a return-on-equity gap with the country's other big

banks.

Early in the year it listed CYBG PLC (CYBG.LN), a company that

housed its British operations Clydesdale Bank and Yorkshire Bank.

That came after it agreed a deal last year to sell an 80% interest

in its life-insurance business to Nippon Life Insurance Co. and

sold its remaining stake in regional U.S. lender Great Western

Bancorp Inc. (GWB), which it floated on the New York Stock Exchange

the year before.

A A$4.2 billion loss for spinning off the U.K. operations

pitched NAB to a first-half loss, although it opted to hold its

interim dividend steady.

Third-quarter cash earnings--a measure followed by analysts that

excludes some one-time costs and gains--were about 3% lower that a

year earlier at A$1.6 billion from the bank's continuing

operations, NAB said.

It said its revenue for the quarter was broadly stable against

the quarterly average of the first half of the financial year as

growth in lending was offset by lower net interest margin. NAB's

net interest margin, a profit measure based on the difference

between the rate at which a bank borrows and lends, was slightly

lower, excluding impacts on markets and treasury operations, it

said.

The bank's charge for bad and doubtful debts rose 21% to A$228

million for the quarter, an increase NAB said largely reflected an

unusually low charge a year earlier as well as an increase in the

bank's collective overlay for mining and agriculture. The ratio of

impaired assets and loans 90 days or more past due to gross loans

and acceptances was 0.81% at the end of June against 0.78% on March

31.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 14, 2016 18:27 ET (22:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

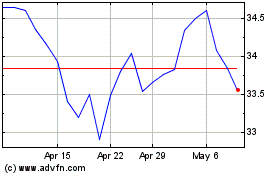

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Apr 2023 to Apr 2024