TELLURIAN INC. /DE/0000061398false00000613982024-02-232024-02-230000061398us-gaap:CommonStockMember2024-02-232024-02-230000061398tell:A825SeniorNotesDue2028Member2024-02-232024-02-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 23, 2024

Tellurian Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-5507 | | 06-0842255 |

(State or other jurisdiction

of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| 1201 Louisiana Street, | Suite 3100, | Houston, | TX | | | 77002 |

| (Address of principal executive offices) | | | (Zip Code) |

(Registrant’s telephone number, including area code): (832) 962-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | TELL | | NYSE | American LLC |

| 8.25% Senior Notes due 2028 | | TELZ | | NYSE | American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 23, 2024, Tellurian Inc. issued a press release reporting financial results for the year ended December 31, 2023 and related information. A copy of the press release is attached to this report as Exhibit 99.1.

The information in this Current Report on Form 8-K, including the information set forth in Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | | | | | | | |

| | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document (included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | |

| | TELLURIAN INC. |

| | |

| | |

Date: February 23, 2024 | By: | /s/ Simon G. Oxley |

| | Title | Executive Vice President and

Chief Financial Officer |

NEWS RELEASE – HOLD for release, 23 February 2024

Tellurian reports 2023 financial results and Driftwood LNG progress

HOUSTON, Texas – (BUSINESS WIRE) February 23, 2024 -- Tellurian Inc. (Tellurian or the Company) (NYSE American: TELL) reported its full year 2023 financial results today. During 2023, Tellurian took significant steps to advance the Driftwood LNG project, having driven over 14,000 piles at site and making progress on concrete foundations for critical equipment thus de-risking site construction. Tellurian also secured the Federal Energy Regulatory Commission (FERC) Certificate for the Company’s pipelines (Lines 200 and 300) and continued to advance the fabrication of Baker Hughes zero-emissions ICL compressors for the pipeline.

Subsequent to year end, Tellurian amended its senior secured notes and senior convertible notes to provide financial flexibility. While Tellurian provided additional collateral relating to the Driftwood Project until the repayment of the senior secured notes, this should not interfere with the commercialization or financing of the Driftwood Project and Tellurian expects that its improved near-term liquidity will enable a higher degree of engagement with potential counterparties and financing sources.

Chief Executive Officer Octávio Simões said, “Tellurian ended 2023 with an exemplary safety record. Driftwood’s recent FERC order extension to construct all five plants, with a capacity of ~27.6 million tonnes per annum (mtpa), coupled with its non-free trade agreement export authorization, have differentiated the project and have intensified our commercial discussions. In addition, we have received very favorable feedback from interested parties on the potential sale of our upstream assets and believe our financial discipline will provide a sustainable path forward. As disclosed in our financial statements, we have made significant progress in executing our plans to alleviate substantial doubt.”

Upstream segment results

| | | | | | | | |

| Three Months Ended December 31, 2023 | Three Months Ended December 31, 2022 |

| Net production | 16.4 Bcf | 20.7 Bcf |

| Revenue | $40.0 million | $102.5 million |

| Operating (loss) profit | $(11.3) million | $47.5 million |

| Adjusted EBITDA** | $21.7 million | $80.2 million |

Operating activities

Tellurian produced 72.5 Bcf of natural gas for the year ended December 31, 2023. As of December 31, 2023, Tellurian's natural gas assets include 30,034 net acres and interests in 161 producing wells.

Consolidated financial results

Tellurian generated approximately $166.1 million in natural gas revenue, driven by decreased realized natural gas prices and increased production volumes for the year ended December 31, 2023, compared to $391.9 million in total revenues for 2022. Tellurian reported a net loss of approximately $166.2 million, or $0.29 per share (basic and diluted), for the year ended December 31, 2023, compared to a net loss of $49.8 million, or $0.09 per share (basic and diluted), for 2022.

As of December 31, 2023, Tellurian had approximately $1.3 billion in total assets, including approximately $75.8 million of cash and cash equivalents.

** Non-GAAP measure – see the end of this press release for a definition and a reconciliation to the most comparable GAAP measure.

| | |

| 1201 Louisiana Street Suite 3100 | Houston, TX 77002 | TEL + 1 832 962 4000 | www.tellurianinc.com |

About Tellurian Inc.

Tellurian intends to create value for shareholders by building a low-cost, global natural gas business, profitably delivering natural gas to customers worldwide. Tellurian is developing a portfolio of LNG marketing and infrastructure assets that includes an ~ 27.6 mtpa LNG export facility and an associated pipeline. Tellurian is based in Houston, Texas, and its common stock is listed on the NYSE American under the symbol “TELL”.

For more information, please visit www.tellurianinc.com. Follow us on Twitter at twitter.com/TellurianLNG

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of U.S. federal securities laws. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “plan,” “potential,” “project,” “proposed,” “should,” “will,” “would,” and similar expressions are intended to identify forward- looking statements. Forward-looking statements herein relate to, among other things, the capacity, timing, construction, and other aspects of the Driftwood LNG project, and commercial and financing activities. These statements involve a number of known and unknown risks, which may cause actual results to differ materially from expectations expressed or implied in the forward-looking statements. These risks include the matters discussed in Item 1A of Part I of the Annual Report on Form 10-K of Tellurian for the fiscal year ended December 31, 2023, filed by Tellurian with the Securities and Exchange Commission (the SEC) on February 23, 2024, and other Tellurian filings with the SEC, all of which are incorporated by reference herein. The forward-looking statements in this press release speak as of the date of this release. Although Tellurian may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so except as required by securities laws.

Contact

| | | | | |

Media: Joi Lecznar EVP Public and Government Affairs Phone +1.832.962.4044 joi.lecznar@tellurianinc.com | Investors: Matt Phillips Vice President, Investor Relations Phone +1.832.320.9331 matthew.phillips@tellurianinc.com |

| | |

| 1201 Louisiana Street Suite 3100 | Houston, TX 77002 | TEL + 1 832 962 4000 | www.tellurianinc.com |

Explanation and Reconciliation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes that upstream segment Adjusted EBITDA may provide financial statement users with additional meaningful comparisons between current results and the results of the Company’s peers and of prior periods.

Upstream segment Adjusted EBITDA excludes certain charges or expenditures. Upstream segment Adjusted EBITDA is a supplemental measure of performance and should not be viewed as a substitute for any GAAP measure.

Management presents Upstream segment Adjusted EBITDA because (i) it is consistent with the manner in which the Company’s position and performance are measured relative to the position and performance of its peers and (ii) it is more comparable to earnings estimates provided by securities analysts.

| | | | | | | | | | | | | | | | | | | | | | | |

| Upstream segment Adjusted EBITDA (in thousands): |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Upstream segment operating (loss) profit | $(11,263) | | $47,493 | | $(55,501) | | $130,663 |

| Add back: | | | | | | | |

| Depreciation, depletion and amortization | $26,281 | | $21,525 | | $95,202 | | $43,966 |

| Allocated corporate general and administrative | $6,645 | | $11,230 | | $38,150 | | $42,385 |

| Upstream segment Adjusted EBITDA | $21,663 | | $80,248 | | $77,851 | | $217,014 |

| | |

| 1201 Louisiana Street Suite 3100 | Houston, TX 77002 | TEL + 1 832 962 4000 | www.tellurianinc.com |

Cover

|

Feb. 23, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 23, 2024

|

| Entity Registrant Name |

TELLURIAN INC. /DE/

|

| Entity Central Index Key |

0000061398

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-5507

|

| Entity Tax Identification Number |

06-0842255

|

| Entity Address, Address Line One |

1201 Louisiana Street,

|

| Entity Address, Address Line Two |

Suite 3100,

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

832

|

| Local Phone Number |

962-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common stock, par value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

TELL

|

| Security Exchange Name |

NYSE

|

| 8.25% Senior Notes due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

8.25% Senior Notes due 2028

|

| Trading Symbol |

TELZ

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_A825SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

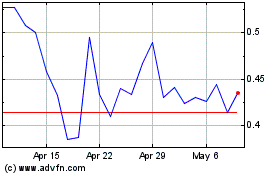

Tellurian (AMEX:TELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

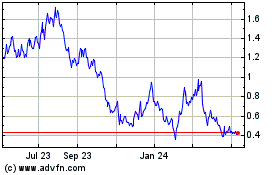

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2023 to Apr 2024