BlackRock Overtakes Grayscale To Become The Largest Bitcoin Fund In The World With $20 Billion AUM

31 May 2024 - 2:00AM

NEWSBTC

American multinational investment company BlackRock, has recently

achieved a monumental milestone, recording over $20 billion in

total assets. The BlackRock Spot Bitcoin ETF has successfully

surpassed Grayscale to become the largest Bitcoin fund in the

world. BlackRock Overtakes Grayscale BlackRock iShares

Bitcoin Trust has recently become the world’s largest Bitcoin fund,

overtaking its primary rival, Grayscale Bitcoin Trust (GBTC).

Related Reading: Shiba Inu Open Interest Explodes 85% Amid 15%

Price Jump, Why This Is Important As of Tuesday, May 28,

BlackRock’s Spot Bitcoin ETF held around $19.68 billion in Assets

Under Management (AUM), overthrowing Grayscale’s Bitcoin ETF with

$19.65 billion and surpassing the third largest, Fidelity

Investments, which recorded $11.1 billion in AUM. Over the past two

days, BlackRock has recorded more inflows, pushing its AUM to more

than $20 billion presently. Following the launch of its Spot

Bitcoin ETF on January 11, Grayscale has consistently recorded

massive outflows worth billions of dollars. For years, the asset

management company was the world’s largest Bitcoin fund, reaching a

peak of about $44 billion in 2021. However, since its

conversion into an ETF at the beginning of 2024, investors have

pulled out almost $18 billion from Grayscale’s Bitcoin fund. On May

3, GBTC recorded its first inflow, receiving approximately $63

million, and effectively ending its 82-day streak of

outflows. Its previous outflows had already significantly

weakened Grayscale’s position as the largest Bitcoin ETF. In

contrast, BlackRock’s Spot Bitcoin ETF has been recording millions

of inflows since its launch, making it unsurprising that IBIT has

eventually surpassed Grayscale’s GBTC. BlackRock has only recorded

a handful of outflows and minimal zero flows. Its highest recorded

inflow occurred on March 12, with IBIT gathering approximately $849

million in a single day. Additionally, BlackRock’s Spot Bitcoin ETF

witnessed its first outflow on May 1, losing about $36.9 million.

On the same day, Grayscale had reported outflows of more than $167

million. Investors are likely favoring BlackRock’s Spot

Bitcoin ETF due to its relatively affordable ETF management fees,

which decreased from 0.30% to 0.25%. On the other hand, Grayscale

has the highest ETF management fees among all the 11 approved

United States Spot Bitcoin ETFs. While the asset management

company has promised to slash fees, Grayscale’s Bitcoin Trust’s

current ETF management fees remain as high as 1.5% annually. Still

Leading Spot Bitcoin ETF Net Inflows According to Farside data, for

the past week, BlackRock has been leading the Spot Bitcoin ETF

race, recording the most inflows out of the 11 Spot Bitcoin

ETFs. Related Reading: Shiba Inu Price Prediction: SHIB Shows

Unusually High Strength Against Dogecoin Excluding May 27, when all

United States Spot Bitcoin ETFs saw zero flows, BlackRock recorded

a total of $127.1 million for the first two days. BlackRock’s

Bitcoin Trust saw $102.5 million in inflows on Wednesday, while

Grayscale’s Spot Bitcoin ETF witnessed outflows of $105.2 million.

Currently, Grayscale is still recording more outflows, losing $31.1

million as of writing. Featured image created with Dall.E, chart

from Tradingview.com

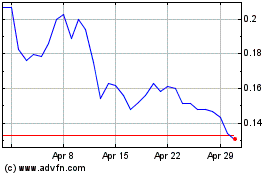

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From May 2024 to Jun 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024