U.S. Dollar Appreciates Ahead Of Fed Minutes

22 May 2024 - 11:11PM

RTTF2

The U.S. dollar was higher against its major counterparts in the

New York session on Wednesday, as investors awaited minutes of the

U.S. Federal Reserve's latest policy meeting for clues on the

timing of the first cut.

The Fed will release the minutes of the April 30-May 1 policy

meeting later today.

The minutes could have an impact on the outlook for interest

rates following recent comments from some Fed officials suggesting

rates may need to remain higher for longer than anticipated.

Fed governor Chris Waller said Tuesday that a continued

softening in data over the next three to five months would allow

the U.S. central bank to cut interest rates at the end of this

year.

While the likelihood rates will be lower by September remains

high, the chances have fallen to 67.0 percent from close to 90

percent last week, according to CME Group's FedWatch Tool.

Data from the National Association of Realtors showed that U.S.

existing home sales unexpectedly saw further downside in the month

of April.

NAR said existing home sales slumped by 1.9 percent to an annual

rate of 4.14 million in April after tumbling by 3.7 percent to a

revised rate of 4.22 million in March.

Economists had expected existing home sales to rise by 0.5

percent to an annual rate of 4.21 million from the 4.19 million

originally reported for the previous month.

The greenback firmed to 8-day highs of 156.61 against the yen

and 1.3678 against the loonie, off its early lows of 156.07 and

1.3623, respectively. The greenback is seen finding resistance

around 159.5 against the yen and 1.38 against the loonie.

The greenback advanced to 1-week highs of 1.0821 against the

euro and 0.6632 against the aussie, from an early low of 156.07 and

a 2-day low of 0.6685, respectively. The currency is likely to

locate resistance around 1.06 against the euro and 0.64 against the

aussie.

The greenback rebounded to 0.6104 against the kiwi, up from an

early more than 2-month low of 0.6152. Next key resistance for the

currency is seen around the 0.58 level.

The greenback touched 0.9158 against the franc, its highest

level since May 2. The greenback may challenge resistance around

the 0.93 level.

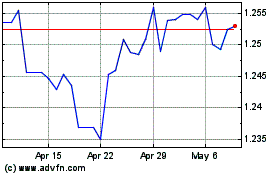

The greenback edged up to 1.2700 against the pound, from an

early fresh 2-month low of 1.2761. On the upside, 1.24 is possibly

seen as its next resistance level.

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From May 2024 to Jun 2024

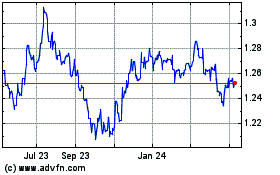

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Jun 2023 to Jun 2024