0001031623false00010316232023-12-012023-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 1, 2023

Gulf Island Fabrication, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Louisiana |

001-34279 |

72-1147390 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

2170 Buckthorne Place, Suite 420

The Woodlands, Texas 77380

(Address of principal executive offices)(Zip Code)

(713) 714-6100

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, no par value per share |

GIFI |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On December 4, 2023, Gulf Island Fabrication, Inc. (the “Company”) issued a press release (the “Press Release”) announcing board authorization of a stock repurchase program for up to $5.0 million of the Company’s common stock, effective December 15, 2023 through December 15, 2024. A copy of the Press Release is attached as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

GULF ISLAND FABRICATION, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Westley S. Stockton |

|

|

|

|

Westley S. Stockton |

|

|

|

|

Executive Vice President, Chief Financial Officer, Treasurer and Secretary (Principal Financial Officer and Principal Accounting Officer) |

Dated: |

December 4, 2023 |

|

|

|

Exhibit 99.1

GULF ISLAND

ANNOUNCES SHARE REPURCHASE PROGRAM

THE WOODLANDS, TX - Gulf Island Fabrication, Inc. (NASDAQ: GIFI) (the “Company”), a leading steel fabricator and service provider to the industrial and energy sectors, today announced that its Board of Directors (“Board”) has approved a share repurchase program authorizing the repurchase of up to $5.0 million of the Company’s outstanding common stock, effective from December 15, 2023 through December 15, 2024.

“Gulf Island is committed to a balanced capital allocation strategy that is designed to maximize total shareholder returns,” stated Richard Heo, Gulf Island’s President and Chief Executive Officer. “The approval by our Board of a share repurchase program demonstrates our solid financial position and confidence in our business outlook. This share repurchase program will not impact the pursuit of our growth objectives, and our capital allocation strategy will continue to prioritize investments in organic growth opportunities combined with the acquisition of complementary assets in key target markets.”

The timing and amount of any share repurchases will be at the discretion of management and will depend on a variety of factors. Share repurchases under the program may be made from time to time through transactions in the open market, in privately negotiated transactions or by other means in accordance with applicable laws. The share repurchase program does not obligate the Company to repurchase any shares and may be modified, increased, suspended or terminated at any time at the Board’s discretion. The Company does not expect to incur debt to fund the share repurchase program.

ABOUT GULF ISLAND

Gulf Island is a leading fabricator of complex steel structures and modules and provider of specialty services, including project management, hookup, commissioning, repair, maintenance, scaffolding, coatings, welding enclosures, civil construction and staffing services to the industrial and energy sectors. The Company’s customers include U.S. and, to a lesser extent, international energy producers; refining, petrochemical, LNG, industrial and power operators; and EPC companies. The Company is headquartered in The Woodlands, Texas and its primary operating facilities are located in Houma, Louisiana.

CAUTIONARY STATEMENT

This release contains forward-looking statements. Forward-looking statements, within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, are all statements other than statements of historical facts, such as statements regarding the Company’s execution of any share repurchases under the share repurchase program and future allocation of cash flows. The words “anticipates,” “may,” “can,” “plans,” “expects,” “projects,” “likely,” “will,” “potential” and any similar expressions are intended to identify those assertions as forward-looking statements.

The Company cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause its actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, changes in the Company’s cash requirements, financial position or investment plans; changes in general market, economic, tax, regulatory or industry conditions; and other factors described under “Risk Factors” in Part I, Item 1A of the Company’s annual report on Form 10-K for the year ended December 31, 2022, as updated by subsequent filings with the SEC. The timing and amount of any share repurchases will be at the discretion of management and will depend on a variety of factors including, but not limited to, the Company’s operating performance, cash flow and financial position, the market price of the shares and general economic and market conditions. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion.

Additional factors or risks that the Company currently deems immaterial, that are not presently known to the Company or that arise in the future could also cause the Company’s actual results to differ materially from its expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which the Company’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, which it cannot control. Further, the Company may make changes to its business plans that could affect its results. The Company cautions investors that it undertakes no obligation to publicly update or revise any forward-looking statements, which speak only as of the date made, for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, and notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes.

COMPANY INFORMATION

|

|

Richard W. Heo |

Westley S. Stockton |

Chief Executive Officer |

Chief Financial Officer |

713.714.6100 |

713.714.6100 |

v3.23.3

Document and Entity Information

|

Dec. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 01, 2023

|

| Entity Registrant Name |

Gulf Island Fabrication, Inc.

|

| Entity Central Index Key |

0001031623

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-34279

|

| Entity Incorporation, State or Country Code |

LA

|

| Entity Tax Identification Number |

72-1147390

|

| Entity Address, Address Line One |

2170 Buckthorne Place

|

| Entity Address, Address Line Two |

Suite 420

|

| Entity Address, City or Town |

The Woodlands

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77380

|

| City Area Code |

713

|

| Local Phone Number |

714-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value per share

|

| Trading Symbol |

GIFI

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

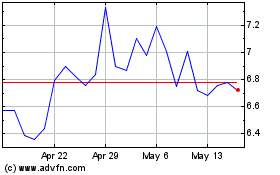

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Apr 2024 to May 2024

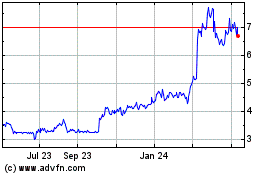

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From May 2023 to May 2024