Filed by FirstSun Capital Bancorp

(Commission File No.: 333-258176)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed to be filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: HomeStreet, Inc.

Commission File No.: 001-35424

Date: January 16, 2024

| | | | | |

| FirstSun Capital Bancorp and HomeStreet, Inc. Merger Information |

Employee FAQs

•What was announced?

◦On January 16, 2024 we announced FirstSun Capital Bancorp will merge with Seattle-based HomeStreet, Inc., the holding company of HomeStreet Bank. HomeStreet, Inc. and HomeStreet Bank will merge with and into FirstSun and Sunflower Bank, respectively.

◦The transaction will be transformative and will create a premier bank operating in some of the nation’s best markets in the Southwest and West Coast.

◦The merged bank’s headquarters will be in Dallas, Texas.

◦HomeStreet Bank will retain its brand name in its current markets of operation.

◦The merged holding company will be traded on Nasdaq under the FSUN ticker symbol.

◦After closing, the merged bank will have approximately $17 billion in total assets with 129 branch locations.

•Who are HomeStreet, Inc. and HomeStreet Bank?

◦HomeStreet, Inc. (NASDAQ:HMST) is a diversified financial services company headquartered in Seattle, Washington, serving consumers and businesses in the Western United States and Hawaii. The Company is principally engaged in real estate lending, including mortgage banking activities, and commercial and consumer banking. Its principal subsidiary is HomeStreet Bank.

•Why is FirstSun Capital Bancorp combining with HomeStreet?

◦The newly combined footprint will include some of the largest growth markets in the United States, now including Seattle, Washington and Los Angeles, California.

◦This combination will bring Sunflower Bank into new markets of operation in Washington, California, Oregon, and Hawaii, where it will continue operations under the name HomeStreet brand.

◦This combination will also allow Sunflower Bank to expand take advantage of lending offices in Idaho and Utah.

•What does this mean for me and my job? How will this impact my day-to-day responsibilities? Will this affect our reporting structure?

◦Today’s announcement is just the beginning of the process, and it will have no immediate impact on your day-to-day responsibilities.

◦It is important to remember that until the transaction closes, which we expect to occur in late 2024, FirstSun Capital Bancorp and HomeStreet, Inc. (and each of our banks) will continue to operate as separate, independent companies.

| | | | | |

| FirstSun Capital Bancorp and HomeStreet, Inc. Merger Information |

◦In the coming weeks and months, an integration planning team, which will be made up of leaders from both companies, will begin the planning process for integrating the companies’ operations.

•Will some positions be eliminated as a result of the transaction?

◦Part of the integration process will be to decide on the right talent for the combined company, and as in any transaction between companies of this size, we expect some overlap in functions and a necessary focus on achieving cost savings.

◦The best thing everyone can do right now is continue to perform at the highest level you possibly can to deliver value for our clients.

◦It is also important to remember that we have only just announced the signing of the merger agreement. Many decisions about how we will combine the companies have not yet been finalized.

◦As always, we are committed to transparency and keeping you and our clients informed as we move through this process.

◦Rest assured, we are committed to supporting our team and treating all team members with respect and dignity through this transition.

•Should I expect changes to my compensation or benefits?

◦We do not expect any changes to your benefits and compensation at this time. Any changes to compensation and benefits will be communicated to you well in advance.

•What are the shared values of the two organizations?

◦We both operate full-service banks with a relationship focus that were founded over 100 years ago.

◦Both organizations share a deep commitment to supporting and giving back to the communities we serve.

•When will the transaction be completed? What approvals are required?

◦The transaction is expected to close in the middle of 2024, subject to satisfaction of customary closing conditions, including receipt of required regulatory approvals and a contingent capital raise.

◦It is important to remember that until that time, FirstSun Capital Bancorp and HomeStreet, Inc. (and each of our banks) will continue to operate as separate, independent companies.

•Can I buy or sell FirstSun Capital Bancorp or HomeStreet, Inc. stock now?

◦FirstSun Capital Bancorp and HomeStreet, Inc. investor and shareholder policies will continue in effect until the merger closes. All employees remain subject to FirstSun’s Insider Trading Policy.

| | | | | |

| FirstSun Capital Bancorp and HomeStreet, Inc. Merger Information |

◦As a reminder, the FirstSun Insider Trading Policy is posted on Insight and we encourage you to review it.

•What will happen to FirstSun Capital Bancorp’s brands?

◦The combined bank holding company will operate under the FirstSun Capital Bancorp name, and the combined bank subsidiary will operate under the Sunflower Bank, N.A. charter.

◦The combined bank holding company will trade on the Nasdaq stock market under the FSUN ticker symbol.

◦HomeStreet Bank will retain its brand name in its current markets of operation.

•Who will lead the combined company?

◦Following the closing, three board of directors seats in the combined bank holding company will be filled by the CEO of Homestreet, Inc., and by two other former board members of Homestreet, Inc.

◦Mollie Hale Carter, Executive Chairman of FirstSun, and Neal Arnold, CEO, President, COO & Director of FirstSun, will retain the same roles in the combined company.

◦Mark Mason, who currently serves in leading roles, including CEO, of Homestreet, Inc. and HomeStreet Bank will serve as Executive Vice Chairman of the combined bank holding company and the combined bank following the merger.

◦Rob Cafera will continue as Chief Financial Officer of FirstSun Capital Bancorp and Sunflower Bank.

◦Additional appointments will be announced in the coming weeks and months.

•Where will the combined company be headquartered?

◦The corporate headquarters of the combined bank holding company will be located in Denver, Colorado and the headquarters of the combined bank will be located in Dallas, Texas.

•What are the plans to integrate the companies?

◦In the coming weeks and months, the integration planning team made up of leaders from both companies will study processes and begin the work of bringing these two organizations together.

◦There is still a lot of work ahead and decisions to be made. We kindly ask that you be patient and understand that we might not be able to answer every question immediately.

◦As always, we are committed to transparency and will continue to keep you and our clients updated as necessary along the way. In the meantime, please remain focused on serving our clients.

| | | | | |

| FirstSun Capital Bancorp and HomeStreet, Inc. Merger Information |

•How will this affect our clients? If my clients ask me a question about the merger, how should I respond?

◦This combination will create a premier financial institution with the ability to offer enhanced services to clients and to increase shareholder value. The transaction will grow our presence in complementary high-growth markets throughout the Southwest and West with minimal operating overlap.

◦Importantly, both organizations are committed to preserving exceptional client experiences, and that is currently the focus.

◦More information will be communicated to clients as we near the completion of the merger. Again, we are at the beginning stages of this process and both organizations will operate independently until the merger is complete.

◦Feel free to explain to clients that we are still in the very early stages of the merger and will share specifics as they become available. Nothing has changed at this point in time. Until the merger receives all necessary approvals, clients are encouraged to rely on official bank communication channels for timely, up-to-date, and accurate information.

•What if I have additional questions that are not covered in the Frequently Asked Questions (FAQs)?

◦We kindly ask that you understand that we might not be able to answer every question immediately. Human Resources will work on providing a response to your questions and will continue to update the FAQs regularly with new information as the merger and the resulting integration of the companies proceeds.

•What should I say if I’m contacted by the media or receive inquiries from individuals outside the company?

◦It is important that we speak with one voice on this matter. If you receive any media inquiries, please direct them immediately to jeanne.lipson@sunflowerbank.com, so we can respond on your behalf. Any questions from investors should be directed to stockholder.relations@sunflowerbank.com.

_____________________

Cautionary Note Regarding Forward-Looking Statements

Statements included in this press release which are not historical in nature are intended to be, and hereby are identified as, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of FirstSun and HomeStreet with respect to their planned merger and the expected timing of the closing of the transaction. Words such as "may," "will," "believe," "anticipate," "expect," "intend," "opportunity," "continue," "should," and "could" and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are

| | | | | |

| FirstSun Capital Bancorp and HomeStreet, Inc. Merger Information |

subject to risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include, among others, the following:

•the failure to obtain necessary regulatory approvals when expected or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction);

•the failure of HomeStreet to obtain shareholder approval, or the failure of either party to satisfy any of the other closing conditions to the transaction on a timely basis or at all;

•the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement;

•the possibility that the anticipated benefits of the transaction, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where FirstSun and HomeStreet do business, or as a result of other unexpected factors or events;

•diversion of management's attention from ongoing business operations and opportunities;

•potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction;

•the outcome of any legal proceedings that may be instituted against FirstSun or HomeStreet; and

•other factors that may affect future results of FirstSun or HomeStreet including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and actions of the Federal Reserve Board and legislative and regulatory actions and reforms.

Further information regarding additional factors that could affect the forward-looking statements can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking Statements” (in the case of FirstSun), “Forward-Looking Statements” (in the case of HomeStreet), and “Risk Factors” in FirstSun’s and HomeStreet’s Annual Reports on Form 10-K for the year ended December 31, 2022, and other documents subsequently filed by FirstSun and HomeStreet with the SEC. FirstSun and HomeStreet disclaim any obligation to update or revise any forward-looking statements contained in this press release, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by law.

Additional Information About the Merger and Where to Find It

This communication is being made in respect of the proposed merger transaction between FirstSun and HomeStreet. In connection with the proposed merger, FirstSun will file a registration statement on Form S-4 with the SEC to register FirstSun's shares that will be issued to HomeStreet's shareholders in connection with the merger. The registration statement will include a proxy statement of HomeStreet and a prospectus of FirstSun, as well as other relevant documents concerning the proposed transaction. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

| | | | | |

| FirstSun Capital Bancorp and HomeStreet, Inc. Merger Information |

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

A free copy of the proxy statement/prospectus, when it becomes available, as well as other documents filed with the SEC by FirstSun may be obtained at the SEC's Internet site at http://www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by (i) FirstSun on its website at https://ir.firstsuncb.com/investor-relations/default.aspx - “Financials and Filings”, and (ii) HomeStreet on its website at https://ir.homestreet.com/sec-filings/all-filings/default.aspx.

Participants in the Solicitation

FirstSun, HomeStreet and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from shareholders of HomeStreet in connection with the proposed Merger. Information regarding the directors and executive officers of FirstSun and HomeStreet and other persons who may be deemed participants in the solicitation of the shareholders of HomeStreet in connection with the proposed Merger will be included in the proxy statement/prospectus for HomeStreet special meeting of shareholders, which will be filed by FirstSun with the SEC. Information about the directors and officers of FirstSun and their ownership of FirstSun’s common stock can be found in FirstSun’s annual report on Form 10-K, as filed with the SEC on March 16, 2023, and other documents subsequently filed by FirstSun with the SEC. Information about the directors and officers of HomeStreet and their ownership of HomeStreet’s common stock can be found in HomeStreet’s definitive proxy statement in connection with its 2023 annual meeting of shareholders, as filed with the SEC on April 11, 2023, and other documents subsequently filed by HomeStreet with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed Merger filed with the SEC when they become available.

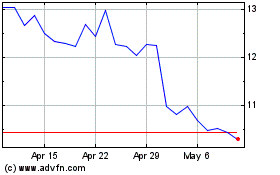

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2024 to May 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From May 2023 to May 2024