OSI Systems, Inc. (NASDAQ:OSIS) today announced financial

results for the quarter ended September 30, 2012.

Deepak Chopra, OSI Systems’ Chairman and CEO, stated, “Our first

quarter results reflect continued strong performance. Our success

was evident throughout all of OSI as each of our divisions achieved

double-digit sales growth, which led to record first quarter

profitability.”

The Company reported revenues of $181.7 million for the first

quarter of fiscal 2013, an increase of $20.4 million, or 13%, from

the $161.3 million reported for the first quarter of fiscal 2012.

Net income for the first quarter of fiscal 2013 was $6.3 million,

or $0.31 per diluted share, compared to net income of $4.8 million,

or $0.24 per diluted share, for the first quarter of fiscal

2012.

As of September 30, 2012, the Company’s backlog was $1.1 billion

compared to $413 million as of September 30, 2011, an increase of

155%. During the three months ended September 30, 2012, the Company

generated cash flow from operations of $42 million. Capital

expenditures totaled $63 million as the Company invested in

building infrastructure and capital equipment for the screening

services program in Mexico, and acquired a new building to serve as

the future headquarters for the Healthcare division.

Mr. Chopra continued, “Our Security Division reported a 14%

topline increase for our fifth consecutive quarter of double-digit

sales growth. This quarter was highlighted by the success of our

products at the London Olympic Games and the significant progress

made under our multi-year turnkey screening services agreement with

Mexico's tax and customs authority.”

Mr. Chopra added, “Our Healthcare division continued to build on

the momentum seen in the second half of last year as first quarter

sales increased 11%. With this solid topline growth and the

successful launch of recent new product offerings, we believe that

fiscal 2013 will be another strong year for our Healthcare

division.”

Mr. Chopra concluded, “We are also pleased with the

performance in our Optoelectronics and Manufacturing Division, as

third party sales increased 12% over the prior year as our customer

base expanded positioning us well for the future.”

Fiscal Year 2013 Outlook

Subject to the risk factors detailed in the Safe Harbor section

of this press release, the Company announced that it is raising its

earnings guidance and expects diluted earnings per share to

increase at a rate of 21% to 31% to between $2.77 to $3.00 per

share, excluding the impact of restructuring and other charges. In

addition, the Company is raising its sales guidance to $870 million

- $895 million, representing a 10% to 13% increase over fiscal

2012.

Conference Call Information

OSI Systems, Inc. will host a conference call and simultaneous

webcast over the Internet beginning at 9:00am PT (12:00pm ET),

today to discuss its results for the first quarter of fiscal 2013.

To listen, please visit the investor relations section of OSI

Systems website, http://investors.osi-systems.com/index.cfm and

follow the link that will be posted on the front page. A replay of

the webcast will be available shortly after the conclusion of the

conference call until November 6, 2012. The replay can either be

accessed through the Company’s website, www.osi-systems.com, or via

telephonic replay by calling 1-888-286-8010 and entering the

conference call identification number '85433472' when prompted for

the replay code.

About OSI Systems, Inc.

OSI Systems, Inc. is a vertically integrated designer and

manufacturer of specialized electronic systems and components for

critical applications. The Company sells its products in

diversified markets, including homeland security, healthcare,

defense and aerospace. The Company has more than 35 years of

experience in electronics engineering and manufacturing and

maintains offices and production facilities located in more than a

dozen countries. It implements a strategy of expansion by

leveraging its electronics and contract manufacturing capabilities

into selective end product markets through organic growth and

acquisitions. For more information on OSI Systems Inc. or any of

its subsidiary companies, visit www.osi-systems.com. News Filter:

OSIS-E

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to the Company’s current

expectations, beliefs, projections and similar expressions

concerning matters that are not historical facts. They are not

intended to be guarantees of future performance. Forward-looking

statements involve uncertainties, risks, assumptions and

contingencies, many of which are outside the Company’s control and

which cause actual results to differ materially from those

described in or implied by any forward-looking statement. Such

statements include, but are not limited to, information provided

regarding expected revenues and earnings growth in fiscal 2013,

sales of recently-introduced products and expectations surrounding

the performance of the Company under its agreement with SAT in

Mexico. All forward-looking statements are based on currently

available information and speak only as of the date on which they

are made. The Company assumes no obligation to update any

forward-looking statement made in this press release that becomes

untrue because of subsequent events, new information or otherwise,

except to the extent it is required to do so in connection with its

ongoing requirements under Federal securities laws. For a further

discussion of these and other factors that could cause the

Company’s future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended June

30, 2012.

OSI SYSTEMS, INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations

(in thousands, except per share

data)

(Unaudited)

Three Months Ended

September 30, 2011

2012 Revenue $ 161,317 $ 181,694 Cost of goods sold

108,460 120,339 Gross profit 52,857 61,355

Operating expenses: Selling, general and administrative 34,367

39,925 Research and development 10,880 11,316

Total operating expenses 45,247 51,241

Income from operations 7,610 10,114 Interest and other

expense, net (799 ) (1,097 ) Income before income

taxes 6,811 9,017 Income tax expense 2,050

2,678 Net income $ 4,761 $ 6,339

Diluted income per share $ 0.24 $ 0.31 Weighted

average shares outstanding – diluted 20,089

20,571

Consolidated Balance Sheets

(in thousands) (unaudited)

June 30,

2012 September 30, 2012 Assets Cash and cash

equivalents $ 91,452 $ 73,707 Accounts receivable, net 156,867

146,784 Inventories 195,178 195,388 Other current assets

39,616 39,248 Total current assets 483,113 455,127

Non-current assets 266,783 331,598 Total Assets $

749,896 $ 786,725

Liabilities and Stockholders'

Equity Current portion of long-term debt $ 215 $ 1,677 Accounts

payable and accrued expenses 75,252 105,182 Other current

liabilities 85,182 75,172 Total current liabilities

160,649 182,031 Long-term debt 2,467 12,161 Advances from customers

100,000 93,750 Other long-term liabilities 52,661

56,415 Total liabilities 315,777 344,357 Total stockholders’ equity

434,119 442,368 Total Liabilities and Equity $

749,896 $ 786,725

Segment Information (in

thousands) (unaudited)

Three Months Ended September 30,

2011 2012

Revenues – by Segment: Security division $ 72,597 $ 82,916

Healthcare division 46,520 51,581 Optoelectronics and Manufacturing

division, including intersegment revenues 53,091 57,147

Intersegment revenues elimination (10,891 ) (9,950 )

Total $ 161,317 $ 181,694

Operating

income (loss) – by Segment: Security division $ 3,845 $ 4,465

Healthcare division 2,398 3,881 Optoelectronics and Manufacturing

division 4,938 4,833 Corporate (3,307 ) (3,249 ) Eliminations

(264 ) 184 Total $ 7,610 $

10,114

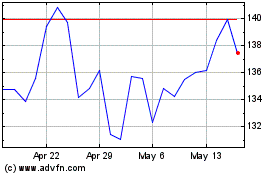

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

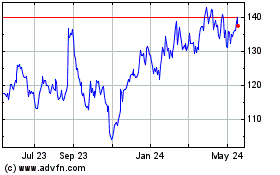

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024