UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K dated August 1, 2023

Commission File Number: 001-14846

AngloGold Ashanti Limited

(Name of registrant)

112 Oxford Road

Houghton Estate, Johannesburg, 2198

(Private Bag X 20, Rosebank, 2196)

South Africa

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Enclosure: Press release ANGLOGOLD ASHANTI TRADING STATEMENT FOR THE SIX MONTHS ENDED 30 June 2023

AngloGold Ashanti Limited

(Incorporated in the Republic of South Africa)

Reg. No. 1944/017354/06

ISIN: ZAE000043485 – JSE share code: ANG

CUSIP: 035128206 – NYSE share code: AU

(“AngloGold Ashanti” or “AGA” or the “Company”)

1 August 2023

NEWS RELEASE

ANGLOGOLD ASHANTI TRADING STATEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2023

AngloGold Ashanti will release results for the six months ended 30 June 2023 (the “Period”) on the Johannesburg Stock Exchange News Service on 4 August 2023.

With reference to the Listings Requirements of the JSE Limited, issuers are required to publish a trading statement as soon as they become reasonably certain that the financial results for the period to be reported on next will differ by at least 20% from those of the previous corresponding reporting period (“comparative period”). The comparative period is for the six months ended 30 June 2022.

Expected Headline Earnings and Basic Earnings

Shareholders are advised that AngloGold Ashanti has reasonable certainty that basic earnings for the Period are expected to be between $25 million and $54 million, resulting in basic earnings per share (“EPS”) between 6 US cents and 13 US cents, a decrease of between 82% to 92% from the comparative period. Basic earnings and EPS for the comparative period were $298 million and 71 US cents, respectively.

Headline earnings for the Period are expected to be between $125 million and $155 million, with headline earnings per share (“HEPS”) between 30 US cents and 37 US cents, a decrease of between 48% to 58% from the comparative period. Headline earnings and HEPS for the comparative period were $300 million and 71 US cents, respectively.

The expected decrease in basic earnings for the Period versus the comparative period is the result of non-cash impairments and derecognitions at our Brazilian operations which totaled $103 million net of tax, or 24 US cents. These non-cash impairments related to continued operational underperformance at Córrego do Sítio, Cuiabá’s Queiroz metallurgical plant which suspended operating activities while the buttress at the Calcinados tailings storage facility (“TSF”) is designed and completed, and derecognition of legacy TSFs no longer in use.

Both basic earnings and headline earnings were further impacted by higher non-cash environmental provisions of $38m net of tax, or 9 US cents, for legacy TSFs following implementation of new legislation in Brazil relating to emergency response and safety management for TSFs, the effect of continued industry-wide inflation which impacted operating costs by about $111m, or 26 US cents, increased investment in exploration and evaluation costs, the effect of the transition to third-party gold concentrate sales at the Cuiabá mine complex and the Siguiri carbon-in-leach (“CIL”) tank failure in May 2023.

Operational Performance

Gold production for the Period is expected to be 1.236Moz, compared to 1.233Moz for the comparative period.

Gold production is expected to be marginally higher year-on-year, following a stronger second quarter, with increased production contributions from Obuasi, Sunrise Dam, Geita, Iduapriem and Tropicana. The increase in gold production was mainly driven by higher overall recovered grade for the group, partially offset by lower tonnes processed, including at AGA Mineração following the transition to gold concentrate sales, at Geita following the planned mill shutdown, which has been completed, and at Siguiri following the CIL tank failure, which has since been repaired.

The financial information on which this trading statement is based has not been reviewed or reported on by AngloGold Ashanti’s external auditors.

Johannesburg

1 August 2023

JSE Sponsor: The Standard Bank of South Africa Limited

CONTACTS

Media

Andrea Maxey: +61 08 9425 4603 / +61 400 072 199 amaxey@anglogoldashanti.com

General inquiries media@anglogoldashanti.com

Investors

Yatish Chowthee: +27 11 637 6273 / +27 78 364 2080 yrchowthee@anglogoldashanti.com

Andrea Maxey: +61 08 9425 4603 / +61 400 072 199 amaxey@anglogoldashanti.com

Certain statements contained in this document, other than statements of historical fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, production, total cash costs, all-in sustaining costs, all-in costs, cost savings and other operating results, return on equity, productivity improvements, growth prospects and outlook of AngloGold Ashanti’s operations, individually or in the aggregate, including the achievement of project milestones, commencement and completion of commercial operations of certain of AngloGold Ashanti’s exploration and production projects and the completion of acquisitions, dispositions or joint venture transactions, AngloGold Ashanti’s liquidity and capital resources and capital expenditures, the consequences of the COVID-19 pandemic and the outcome and consequences of any potential or pending litigation or regulatory proceedings or environmental, health and safety issues, are forward-looking statements regarding AngloGold Ashanti’s operations, economic performance and financial condition. These forward-looking statements or forecasts involve known and unknown risks, uncertainties and other factors that may cause AngloGold Ashanti’s actual results, performance or achievements to differ materially from the anticipated results, performance or achievements expressed or implied in these forward-looking statements. Although AngloGold Ashanti believes that the expectations reflected in such forward-looking statements and forecasts are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of, among other factors, changes in economic, social, political and market conditions, including related to inflation or international conflicts, the success of business and operating initiatives, changes in the regulatory environment and other government actions, including environmental approvals, fluctuations in gold prices and exchange rates, the outcome of pending or future litigation proceedings, any supply chain disruptions, any public health crises, pandemics or epidemics (including the COVID-19 pandemic), and other business and operational risks and other factors, including mining accidents. For a discussion of such risk factors, refer to AngloGold Ashanti’s annual report on Form 20-F for the year ended 31 December 2022 filed with the United States Securities and Exchange Commission (SEC). These factors are not necessarily all of the important factors that could cause AngloGold Ashanti’s actual results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. Consequently, readers are cautioned not to place undue reliance on forward-looking statements. AngloGold Ashanti undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by applicable law. All subsequent written or oral forward-looking statements attributable to AngloGold Ashanti or any person acting on its behalf are qualified by the cautionary statements herein.

Non-GAAP financial measures

This communication may contain certain “Non-GAAP” financial measures. AngloGold Ashanti utilises certain Non-GAAP performance measures and ratios in managing its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the reported operating results or cash flow from operations or any other measures of performance prepared in accordance with IFRS. In addition, the presentation of these measures may not be comparable to similarly titled measures other companies may use.

Website: www.anglogoldashanti.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AngloGold Ashanti Limited

Date: August 1, 2023

By: /s/ LM GOLIATH

Name: LM Goliath

Title: Company Secretary

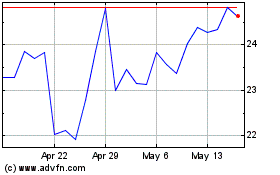

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Apr 2024 to May 2024

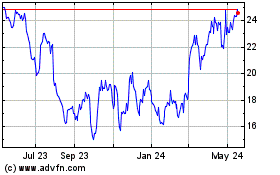

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From May 2023 to May 2024