Gap Core Sales Fell 2% in February -- Update

04 March 2016 - 9:41AM

Dow Jones News

By Josh Beckerman

Gap Inc. said its core sales declined 2% in February, hurt by

another double-digit drop at its Banana Republic chain.

For the four weeks ended Feb. 27, comparable sales were flat at

the Gap and Old Navy brands but declined 11% at Banana Republic, on

top of a 5% drop last year.

Comparable sales, which Gap defines as stores open for at least

a year along with online sales, are a key metric for retailers,

stripping out the effect of recently opened or closed stores.

The company said it has been encouraged by the response to

spring products at its flagship brand and remains focused on

improving results across its portfolio.

Gap has been trying to revamp its namesake brand. The company

last year brought on new leadership-- including former Banana

Republic veteran Wendi Goldman, who had led Victoria's Secret's

Pink line--and said it would lay off workers and close stores as

part of a broader cost-cutting move.

In January, Banana Republic posted a 17% core sales decline,

with smaller declines at Gap's other two main brands.

Retailers have faced challenges recently, including unusually

warm weather that has reduced demand for coats, sweaters and other

winter gear. In addition, tourists visiting the U.S. are spending

less due to a stronger dollar. These issues have prompted some

retailers to cut prices to attract shoppers.

Last week, Gap said it expects its profit to decline this year

and said it would reduce capital spending and buy back fewer shares

as it looks to pay down debt.

In after-hours trading, Gap's shares were flat at $28.54.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

March 03, 2016 17:26 ET (22:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

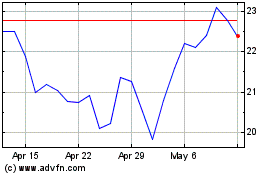

Gap (NYSE:GPS)

Historical Stock Chart

From Jun 2024 to Jul 2024

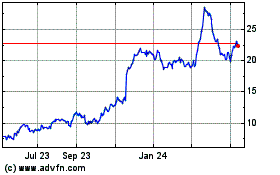

Gap (NYSE:GPS)

Historical Stock Chart

From Jul 2023 to Jul 2024