Swiss Franc Climbs Against Most Majors

25 April 2014 - 6:48PM

RTTF2

The Swiss franc advanced against most major currencies in early

European deals on Friday, as weakness in European stocks lifted the

appeal of safe-haven assets.

Ukraine worries intensified after its troops killed five

pro-Moscow rebels on Thursday and Russia commenced military drills

near the border. U.S. Secretary of State John Kerry accused Russia

of failing up to commitments and warned that the window for Moscow

to change its course in Ukraine was closing.

Thomas Jordan, Chairman of the Governing Board of the Swiss

National Bank, told today that Swiss franc remains still high,

which poses threat of deflation.

"With interest rates close to zero and a Swiss franc which is

still high, the minimum exchange rate continues to be the SNB's

most important monetary policy instrument for ensuring appropriate

monetary conditions," Jordan said at the meeting of shareholders of

the Swiss National Bank in Berne.

The franc advanced to 1.2186 against the euro and 1.4801 against

the pound. The next possible resistance for the franc lies around

1.47 against the pound and 1.21 against the euro.

The franc rose to 0.8807 against the greenback, its highest

since April 23. This may be compared to yesterday's close of

0.8813. If the franc extends gain, it is likely to face resistance

around the 0.875 zone.

Looking ahead, the U.S. flash services PMI and

Reuters/University of Michigan's final consumer sentiment index for

April are set for release in the New York session.

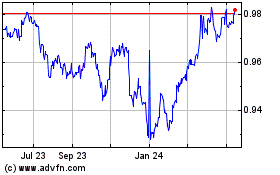

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

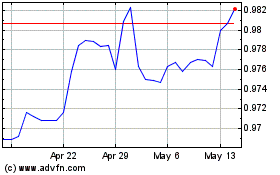

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024