Canadian Pension Funds to Buy Chicago Toll Road

14 November 2015 - 10:30AM

Dow Jones News

Three Canadian pension giants on Friday said they would buy a

Chicago toll road for $2.8 billion, underscoring pension funds'

continued interest in infrastructure projects and the steady cash

flows they provide.

Canada Pension Plan Investment Board, Ontario Municipal

Employees Retirement System and Ontario Teachers' Pension Plan will

acquire Skyway Concession Co., operator of a 7.8-mile toll road

that connects downtown Chicago with the city's southeastern

suburbs, from infrastructure funds managed by Australia's Macquarie

Group Ltd. and a unit of Spanish conglomerate Ferrovial SA

Canada's pension funds have been actively investing in bridges,

toll roads, power utilities and other infrastructure projects.

These assets typically don't generate the same kind of growth as

equity investments, but often provide stable revenue streams which

help offset volatility elsewhere in the funds' portfolios.

The three Canadian pension funds will each hold an equal share

of Skyway, which operates and maintains the toll road under a

concession that runs through 2104. They are paying a total of $1.54

billion and using debt to finance the rest of the $2.8 billion

cost. Macquarie and Ferrovial acquired the toll road in January

2005 for $1.83 billion from the city of Chicago.

A spokesman for CPPIB, Canada's largest pension fund, wasn't

immediately available for comment on the Skyway deal. On Thursday,

the fund, which oversees 272.9 billion Canadian dollars ($205.5

billion) in assets, announced a 1.6% return in its fiscal second

quarter ended Sept. 30 despite declines in global equity markets

during that period. The fund attributed the outperformance in part

to its stake in the Highway 407 toll road in Ontario as well as

other infrastructure assets.

When the S&P 500 stock index is down, "the 407 is going to

continue plodding along, providing us with those resilient cash

flows," CPPIB's Chief Executive Mark Wiseman said Thursday.

About 7.1% of CPPIB's assets are infrastructure. Ontario

Teachers' has about 23% of its C$152.4 billion in assets in

infrastructure and real estate holdings, while about 18% of OMERS'

C$72 billion fund is in infrastructure.

An Ontario Teachers' spokeswoman declined to comment and a

spokeswoman for OMERS couldn't be reached for comment.

Toll-road investments aren't without risks. Last year, the

operator of a toll road in Indiana filed for bankruptcy after

struggling with excessive debt and lower-than-expected traffic.

Australia's IFM Investors agreed in March to invest $5.725

billion in the Indiana toll road. IFM, which is owned by 30

Australian pension funds, said it planned to invest heavily in the

toll road to improve customer service, betting the highway would

benefit from U.S. economic growth and the critical role it plays in

that country's transport network.

Chicago Skyway's recent traffic volumes and toll revenues

weren't available. The latest figures available on Chicago Skyway's

website date back to 2003. In that year, the toll road, which was

built in 1958, served 17.4 million motorists and generated $39.7

million in toll revenue.

Write to Ben Dummett at ben.dummett@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 13, 2015 18:15 ET (23:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

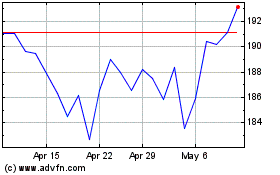

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2024 to May 2024

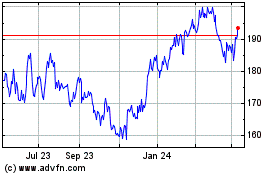

Macquarie (ASX:MQG)

Historical Stock Chart

From May 2023 to May 2024