BASF Profit Dented by Oil, Gas Business -- Update

27 October 2016 - 5:26PM

Dow Jones News

By William Wilkes

FRANKFURT--BASF SE (BAS.XE) reported a fall in third-quarter

profit due to smaller contributions from its oil and gas segment

and reiterated its full-year outlook.

The German chemical company's net profit was 888 million euros

($968.26 million) in the three months ending Sept. 30, down 27%

from EUR1.21 billion a year earlier. BASF had released preliminary

results on Oct. 11.

Revenue declined 20% to EUR14.01 billion following the

divestiture of BASF's natural gas trading and storage business to

Russia's OAO Gazprom. Earnings before interest and taxes, EBIT

decreased 22% to EUR1.46 billion.

BASF said the recent fire at its Ludwigshafen factory complex

will negatively impact earnings for the business year, but the

company reiterated its guidance for the year.

BASF's overall earnings have been weighed down for nearly two

years by low global oil prices, which have directly hit its

wholly-owned oil and gas division, Wintershall Holding GmbH.

Germany's largest crude oil and natural gas producer,

Wintershall contributes about 30% to BASF's total cash flow. The

division offers BASF a strategic hedge when oil prices are high,

and in the past, it has been able sustain the chemical divisions'

need for energy and raw material.

BASF's chemical divisions have also been hurt by low raw

material prices. The company cited this volatility in June when it

said it would delay a final decision on investing in the

construction of a methane-to-propylene complex at a BASF site in

Texas, a project that has been under consideration for about two

years.

-Write to William Wilkes at william.wilkes@wsj.com

(END) Dow Jones Newswires

October 27, 2016 02:11 ET (06:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

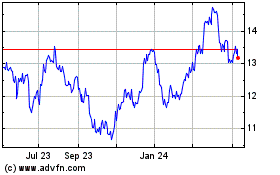

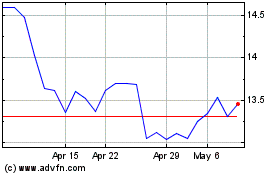

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2023 to Apr 2024