Japan Keeps Monetary Stimulus Unchanged

07 October 2015 - 12:30PM

RTTF2

The Bank of Japan refrained from adding more monetary stimulus

on Wednesday despite fears of looming recession as the slowdown in

emerging economies hurts exports and production.

The Policy Board of the BoJ governed by Haruhiko Kuroda decided

by an 8-1 majority vote to maintain its target of raising the

monetary base at an annual pace of about JPY 80 trillion.

Takahide Kiuchi proposed to lift the monetary base by about JPY

45 trillion annually.

The BoJ observed that the slowdown in emerging economies

affected exports and production. Exports and industrial production

have been more or less flat, the bank noted.

Policymakers reiterated its optimistic stance that the economy

will continue recovering moderately.

Nonetheless, in the semi-annual forecast to be released on

October 30, the bank is widely expected to downgrade its growth

outlook. The bank will also update its inflation forecast.

The decline in oil prices heavily weigh on the bank's ability to

achieve its 2 percent inflation target by the next summer.

Excluding fresh food, core consumer prices dropped 0.1 percent

in August, which was the first drop since the bank deployed its

stimulus.

The BoJ had earlier expanded the stimulus in October 2014, when

a decline in crude prices exerted pressure on its ability to

achieve inflation target.

Although the policy statement provided no clear indications that

additional stimulus is imminent, the bank will announce more easing

at its end-October meeting, Marcel Thieliant, an economist at

Capital Economics, said.

BoJ Governor Haruhiko Kuroda is set to hold his customary press

conference. The markets await indications about further easing,

with some hoping an announcement as early as this month.

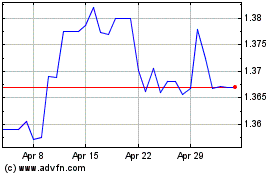

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to May 2024

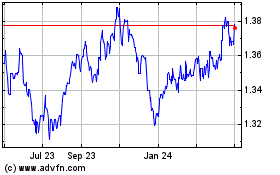

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From May 2023 to May 2024