UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 26, 2024

Date of Report (date of earliest event reported)

___________________________________

Burke & Herbert Financial Services Corp.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Virginia (State or other jurisdiction of incorporation or organization) | 001-41633 (Commission File Number) | 92-0289417 (I.R.S. Employer Identification Number) |

100 S. Fairfax Street Alexandria, VA 22314 |

(Address of principal executive offices and zip code) |

(703) 666-3555 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.50 | BHRB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On January 26, 2024, Burke & Herbert Financial Services Corp. (the " Company ") issued a press release announcing its results of operations and financial condition for the fourth quarter and the year ended December 31, 2023. A copy of the press release is included as Exhibit 99.1 to this report.

Item 8.01 - Other Events

On January 26, 2024, the Company announced its Board of Directors declared a regular quarterly cash dividend on the Company's common stock of $0.53 per share, payable on March 1, 2024, to shareholders of record as of the close of business on February 15, 2024.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 26th day of January, 2024.

| | | | | |

| Burke & Herbert Financial Services Corp. |

| |

By: | /s/ Roy E. Halyama |

Name: | Roy E. Halyama |

Title: | Executive Vice President, CFO |

Burke & Herbert Financial Services Corp. Announces Fourth Quarter and Full Year 2023 Results and Declares Common Stock Dividend

For Immediate Release

January 26, 2024

Alexandria, VA – Burke & Herbert Financial Services Corp. (the “Company” or “Burke & Herbert”) (Nasdaq: BHRB) reported financial results for the quarter ended and year ended December 31, 2023. In addition, at its meeting on January 25, 2024, the board of directors declared a $0.53 per share regular cash dividend to be paid on March 1, 2024, to shareholders of record as of the close of business on February 15, 2024.

•Net income totaled $5.1 million for the quarter compared to $4.1 million the previous quarter and $13.4 million for the same quarter in 2022. Diluted earnings per share for the quarter was $0.67, compared to $0.55 the previous quarter and $1.78 for the same quarter in 2022.

•Excluding significant items1, operating net income (non-GAAP2) totaled $6.2 million for the quarter, compared to $5.6 million the previous quarter and $13.6 million for the same quarter in 2022. Excluding significant items1, adjusted diluted earnings per share (non-GAAP2) for the quarter was $0.83, compared to $0.75 the previous quarter and $1.82 for the same quarter in 2022.

•For the twelve months ended December 31, 2023, net income totaled $22.7 million, or $3.02 per diluted share, compared to $44.0 million, or $5.89 per diluted share, for the twelve months ended December 31, 2022.

•Excluding significant items1, operating net income (non-GAAP2) for the twelve months ended December 31, 2023, totaled $25.8 million, or $3.43 per adjusted diluted share (non-GAAP2), compared to $44.3 million, or $5.93 per adjusted diluted earnings per share (non-GAAP2), for the twelve months ended December 31, 2022.

The Company notes the following highlights:

•Balance sheet remains strong with ample liquidity. Total liquidity, including all available borrowing capacity with cash and cash equivalents, totaled $959.5 million at the end of the fourth quarter.

•Total loans increased $17.1 million during the quarter ending December 31, 2023, ending at $2.1 billion.

•Total deposits increased $16.3 million compared to the prior quarter, ending the quarter at $3.0 billion, and resulting in a loan-to-deposit ratio of 70%.

•Asset quality remains stable across the loan portfolio with adequate reserves.

•The Company continues to be well-capitalized, ending the quarter with 16.8% Common Equity Tier 1 capital to risk-weighted assets, 17.9% Total risk-based capital to risk-weighted assets, and a leverage ratio of 11.3%.

•On December 6, 2023, the Company and Summit Financial Group, Inc. (“Summit”) (Nasdaq: SMMF) announced that at special meetings of their respective shareholders held on December 6, 2023, Burke & Herbert and Summit shareholders approved the merger of Summit with and into Burke & Herbert, pursuant to the Agreement and Plan of Reorganization, dated as of August 24, 2023, by and between Burke & Herbert and Summit. The closing of the proposed merger remains subject to regulatory approvals and certain other customary closing conditions.

(1) Significant items include items such as listing and merger-related expenses and are further described below in our non-GAAP reconciliation tables.

(2) Non-GAAP financial measures referenced in this release are used by management to measure performance in operating the business that management believes enhances investors’ ability to better understand the underlying business performance and trends related to core business activities. Reconciliations of non-GAAP operating measures to the most directly comparable GAAP financial measures are included in the non-GAAP reconciliation tables in this release. Non-GAAP measures should not be used as a substitute for the closest comparable GAAP measurements.

1

From David P. Boyle, Company Chair, President and Chief Executive Officer

“The past year was a transformational period for the Company. Despite the multiple challenges facing our industry and the resulting pressure on earnings, we remained focused on controlling what we can control. We increased loans, maintained a strong liquidity position, continued to make investments in our businesses, listed our shares on the Nasdaq stock exchange, moved to our new corporate center, and announced our intention to combine with Summit Financial Group in a merger of peers. I’m proud of the team and the strategic focus we maintained in order to deliver long-term value to our customers, our employees, our communities, and our shareholders.”

Results of Operations

Fourth Quarter 2023 - Comparison to prior year quarter

Net income for the three months ended December 31, 2023, was $5.1 million or $8.3 million lower than the three months ended December 31, 2022, primarily due to merger-related costs, increased funding costs, and the sale of corporate buildings that resulted in a $4.5 million gain in the prior year quarter, partially offset by a recapture of credit loss provision in the current quarter.

Total revenue (non-GAAP2) for the three months ended December 31, 2023, was $27.1 million or 16% lower than the three months ended December 31, 2022, and included $27.3 million in interest and fees on loans and $10.4 million in investment security income, which was a 29% increase and a 7% decrease, respectively, over the prior year three months ended December 31, 2022. Overall, interest income for the three months ended December 31, 2023, was $38.2 million or 17% higher than the three months ended December 31, 2022. The increase in interest income for the Company’s loans was due to increased loan balances and higher rates, and the interest income decrease in investment securities was due to a lower level of investment securities. Loans, net of allowance for credit losses, ended the quarter at $2.1 billion or 11% higher than December 31, 2022, while the investment portfolio fair value ended the quarter at $1.2 billion or 9% lower than the prior year quarter.

The increase in interest income was offset by an increase in interest expense, which was $15.9 million for the three months ended December 31, 2023, or $11.2 million higher than the prior year quarter. The rapid rise in the interest rate environment resulted in an increase in the Company’s cost of funds that outpaced the resulting benefit of higher rates on assets. The Company’s deposit and borrowing interest expense was $12.5 million and $3.4 million, or $10.5 million and $0.7 million higher, respectively, for the three months ended December 31, 2022. Total deposits ended the quarter at $3.0 billion, which was slightly higher than the balance in the prior year. Non-interest-bearing deposits decreased by 14% to $830.3 million and borrowed funds decreased by 21% to $272.0 million from the prior year quarter ended December 31, 2022, reflecting the changing deposit mix from non-interest-bearing to interest-bearing, which increased by 11%, resulting in higher interest expense. Overall, net interest income decreased by $5.6 million from the prior year quarter.

Non-interest income for the three months ended December 31, 2023, increased by $0.6 million from the same period last year and was $4.8 million in the current period. The increase in other non-interest income was primarily due to the strategic sale of securities that resulted in a loss of $0.5 million in the prior year quarter.

For the three months ended December 31, 2023, the Company recorded a recapture of credit losses of $0.8 million, compared to a provision for credit losses of $0.1 million in the prior year quarter due to improving portfolio credit quality. Total revenue (non-GAAP2) after provision for credit losses was $27.9 million for the three months ended December 31, 2023, which was a decrease of 13% compared to the same period last year.

Non-interest expense increased by $5.8 million, or 35%, for the three months ended December 31, 2023, from the prior year three months ended December 31, 2022. The increase was primarily due to other non-interest expenses associated with merger-related activities. The Company incurred expenses during the fourth quarter of 2023 related to the pending merger with Summit that included legal, consulting, investment banking, and integration-ready related costs. In addition, the prior year quarter non-interest expense also included the gain on sale of corporate buildings.

As of December 31, 2023, total shareholders’ equity was $314.8 million or $41.3 million higher than December 31, 2022, primarily the result of higher fair value marks for the security portfolio resulting in lower accumulated other comprehensive loss by $36.0 million.

Twelve months ended December 31, 2023 - Comparison to prior full year period

Net income for the twelve months ended December 31, 2023, was $22.7 million or $21.3 million lower than the twelve months ended December 31, 2022, primarily due to increased funding costs, listing and merger-related costs, and the change in provision for credit losses that included a recapture of credit losses in the prior full year period.

Total revenue (non-GAAP2) for the twelve months ended December 31, 2023, was $111.7 million or 8% lower than the twelve months ended December 31, 2022, and included $101.8 million in interest and fees on loans and $42.8 million in investment security income, which was a 38% increase and an 11% increase, respectively, over the prior full year period. Overall, interest income for the twelve months ended December 31, 2023, was $146.9 million or 30% higher than the twelve months ended December 31, 2022. The increase in interest income for the Company’s loans was due to increased loan balances and higher rates and the interest income increase on investment securities was due to higher rates.

The increase in interest income was offset by an increase in interest expense, which was $53.1 million for the twelve months ended December 31, 2023, or $44.2 million higher than the prior full year period. The rapidly rising rate environment resulted in an increase in the Company’s cost of funds that outpaced the resulting benefit of higher rates on assets. The Company’s deposit and borrowing interest expense was $39.2 million and $13.9 million, or $35.5 million and $8.7 million higher, respectively, for the twelve months ended December 31, 2023, than for the twelve months ended December 31, 2022. Overall, net interest income decreased by $9.9 million from the prior full year period.

Non-interest income for the twelve months ended December 31, 2023, increased $0.9 million from the same full year period last year to $18.0 million. The increase was primarily due to higher other non-interest income revenue of $0.5 million. Within other non-interest income, the Company received an increase in dividend income from the Federal Home Loan Banks and increased fee income from customer swap activity when compared to the prior full year period ended December 31, 2022. The Company also recognized lower losses on the sale of securities resulting in a year-over-year increase of $0.3 million. This increase in non-interest income was partially offset by lower income generated from service charges and fees, which decreased by $0.2 million.

For the twelve months ended December 31, 2023, the Company recorded a provision for credit losses of $0.2 million compared to a recapture of credit losses of $7.5 million in the prior full year period. The provision recapture, in 2022, was a result of removing COVID-19 qualitative factors and the sale of a non-performing loan note. Total revenue (non-GAAP2) after provision for credit losses was $111.5 million for the twelve months ended December 31, 2023, which was a decrease of 13% compared to the same full year period last year and primarily due to the change in provision for credit losses and higher funding costs.

Non-interest expense increased by $10.5 million, or 14%, for the twelve months ended December 31, 2023, from the prior year twelve months. The increase was primarily driven by other non-interest expenses, which increased by $8.6 million due to costs associated with the listing of our common stock on the Nasdaq stock exchange and the filing of a Form 10 Registration Statement with the U.S. Securities Exchange Commission (“SEC”) to register our common stock under the Securities Exchange Act of 1934, as amended (together, “Listing-related”), and with costs incurred for the pending merger with Summit. Additionally, the Company sold corporate buildings for a gain in the prior year, which lowered other non-interest expense for the prior full year period.

Regulatory capital ratios

The Company continues to be well-capitalized with capital ratios that are above regulatory requirements. As of December 31, 2023, our Common Equity Tier 1 capital to risk-weighted asset and Total risk-based capital to risk-weighted asset ratios were 16.8% and 17.9%, respectively, and significantly above the well-capitalized requirements of 6.5% and 10%, respectively. The leverage ratio was 11.3% compared to a 5% level to be considered well-capitalized.

Burke & Herbert Bank & Trust Company (“the Bank”), the Company’s wholly-owned bank subsidiary, also continues to be well-capitalized with capital ratios that are above regulatory requirements. As of December 31, 2023, the Bank’s Common Equity Tier 1 capital to risk-weighted asset and Total risk-based capital to risk-weighted asset ratios were 16.8% and 17.8%, respectively, and significantly above the well-capitalized requirements. In addition, the Bank’s leverage ratio of 11.3% is considered to be well-capitalized.

For more information about the Company’s financial condition, including additional disclosures pertinent to recent events in the banking industry, please see our financial statements and supplemental information attached to this release.

About Burke & Herbert

Burke & Herbert Financial Services Corp. is the financial holding company for Burke & Herbert Bank & Trust Company. Burke & Herbert Bank & Trust Company is the oldest continuously operating bank under its original name headquartered in the greater Washington DC Metro area. The Bank offers a full range of business and personal financial solutions designed to meet customers’ banking, borrowing, and investment needs and has over 20 branches throughout the Northern Virginia region and commercial loan offices in Fredericksburg, Loudoun County, Richmond, and in Bethesda, Maryland. Learn more at www.burkeandherbertbank.com.

Member FDIC; Equal Housing Lender

Cautionary Note Regarding Forward-Looking Statements

This communication includes “forward–looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions, and expectations of Burke & Herbert regarding the proposed merger, revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed merger; the expected cost savings, synergies, returns and other anticipated benefits from the proposed merger; and other statements that are not historical facts.

Forward–looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “will,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward-looking statements include, without limitation, those relating to the terms, timing, and closing of the proposed merger.

Additionally, forward–looking statements speak only as of the date they are made; Burke & Herbert does not assume any duty, and does not undertake, to update such forward–looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward–looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in or implied by such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Burke & Herbert. Such statements are based upon the current beliefs and expectations of the management of Burke & Herbert and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Burke & Herbert and Summit; the outcome of any legal proceedings that may be instituted against Burke & Herbert or Summit; the possibility that the proposed merger will not close when expected, or at all, because required regulatory or other approvals are not received or other conditions to the closing are not satisfied on a timely basis, or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed merger); the ability of Burke & Herbert and Summit to meet expectations regarding the timing, completion, and accounting and tax treatments of the proposed merger; the risk that any announcements relating to the proposed merger could have adverse effects on the market price of the common stock of either or both parties to the proposed merger; the possibility that the anticipated benefits of the proposed merger will not be realized when expected, or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Burke & Herbert and Summit do business; certain restrictions during the pendency of the proposed merger that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes, or at all and to successfully integrate Summit’s operations and those of Burke & Herbert; such integration may be more difficult, time-consuming or costly than expected; revenues following the proposed merger may be lower than expected; Burke & Herbert’s and Summit’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by Burke & Herbert’s issuance of additional shares of its capital stock in connection with the proposed merger; effects of the announcement, pendency, or completion of the proposed merger on the ability of Burke & Herbert and Summit to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed merger and other factors that may affect future results of Burke & Herbert and Summit; and the other factors discussed in the “Risk Factors” section of Burke & Herbert’s Registration Statement on Form 10, as amended and as ordered effective by the SEC on April 21, 2023, and in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Burke & Herbert’s Quarterly Report on Form 10–Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, and other reports Burke & Herbert files with the SEC.

Burke & Herbert Financial Services Corp.

Consolidated Statements of Income (unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2023 | | 2022 | | 2023 | | 20223 |

| Interest income | | | | | | | |

| Loans, including fees | $ | 27,315 | | | $ | 21,154 | | | $ | 101,800 | | | $ | 73,640 | |

| Taxable securities | 9,049 | | | 9,515 | | | 37,179 | | | 29,616 | |

| Tax-exempt securities | 1,372 | | | 1,716 | | | 5,615 | | | 8,940 | |

| Other interest income | 444 | | | 189 | | | 2,302 | | | 437 | |

| Total interest income | 38,180 | | | 32,574 | | | 146,896 | | | 112,633 | |

| Interest expense | | | | | | | |

| Deposits | 12,487 | | | 2,019 | | | 39,195 | | | 3,742 | |

| Borrowed funds | 3,361 | | | 2,630 | | | 13,856 | | | 5,136 | |

| Other interest expense | 28 | | | 15 | | | 86 | | | 63 | |

| Total interest expense | 15,876 | | | 4,664 | | | 53,137 | | | 8,941 | |

| Net interest income | 22,304 | | | 27,910 | | | 93,759 | | | 103,692 | |

| | | | | | | |

| Provision for (recapture of) credit losses | (750) | | | 98 | | | 214 | | | (7,466) | |

| Net interest income after credit loss expense | 23,054 | | | 27,812 | | | 93,545 | | | 111,158 | |

| | | | | | | |

| Non-interest income | | | | | | | |

| Fiduciary and wealth management | 1,358 | | | 1,314 | | | 5,354 | | | 5,309 | |

| Service charges and fees | 1,711 | | | 1,725 | | | 6,670 | | | 6,855 | |

| Net gains (losses) on securities | — | | | (517) | | | (112) | | | (454) | |

| Income from company-owned life insurance | 1,124 | | | 1,022 | | | 2,844 | | | 2,656 | |

| Other non-interest income | 631 | | | 671 | | | 3,196 | | | 2,721 | |

| Total non-interest income | 4,824 | | | 4,215 | | | 17,952 | | | 17,087 | |

| | | | | | | |

| Non-interest expense | | | | | | | |

| Salaries and wages | 9,964 | | | 10,198 | | | 39,247 | | | 39,438 | |

| Pensions and other employee benefits | 2,285 | | | 1,743 | | | 9,401 | | | 7,700 | |

| Occupancy | 1,571 | | | 1,315 | | | 6,035 | | | 5,621 | |

Equipment rentals, depreciation, and maintenance | 1,539 | | | 1,472 | | | 5,770 | | | 5,768 | |

| Other operating | 6,941 | | | 1,733 | | | 25,983 | | | 17,419 | |

| Total non-interest expense | 22,300 | | | 16,461 | | | 86,436 | | | 75,946 | |

| Income before income taxes | 5,578 | | | 15,566 | | | 25,061 | | | 52,299 | |

| | | | | | | |

| Income tax expense | 500 | | | 2,213 | | | 2,369 | | | 8,286 | |

| Net income | $ | 5,078 | | | $ | 13,353 | | | $ | 22,692 | | | $ | 44,013 | |

(3) The full year 2022 Consolidated Income statement is audited.

6

Burke & Herbert Financial Services Corp.

Consolidated Balance Sheets

(In thousands)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| (Unaudited) | | (Audited) |

| Assets | | | |

| Cash and due from banks | $ | 8,896 | | | $ | 9,124 | |

| Interest-earning deposits with banks | 35,602 | | | 41,171 | |

| Cash and cash equivalents | 44,498 | | | 50,295 | |

| Securities available-for-sale, at fair value | 1,248,439 | | | 1,371,757 | |

| Restricted stock, at cost | 5,964 | | | 16,443 | |

| Loans held-for-sale, at fair value | 1,497 | | | — | |

| Loans | 2,087,756 | | | 1,887,221 | |

| Allowance for credit losses | (25,301) | | | (21,039) | |

| Net loans | 2,062,455 | | | 1,866,182 | |

| Premises and equipment, net | 61,128 | | | 53,170 | |

| Accrued interest receivable | 15,895 | | | 15,481 | |

| Company-owned life insurance | 94,159 | | | 92,487 | |

| Other assets | 83,544 | | | 97,083 | |

Total Assets | $ | 3,617,579 | | | $ | 3,562,898 | |

| | | |

| Liabilities and Shareholders’ Equity | | | |

| Liabilities | | | |

| Non-interest-bearing deposits | $ | 830,320 | | | $ | 960,692 | |

| Interest-bearing deposits | 2,171,561 | | | 1,959,708 | |

| Total deposits | 3,001,881 | | | 2,920,400 | |

| Borrowed funds | 272,000 | | | 343,100 | |

| Accrued interest and other liabilities | 28,948 | | | 25,945 | |

| Total Liabilities | 3,302,829 | | | 3,289,445 | |

| | | |

| Shareholders’ Equity | | | |

| Common Stock | 4,000 | | | 4,000 | |

| Additional paid-in capital | 14,495 | | | 12,282 | |

| Retained earnings | 427,333 | | | 424,391 | |

| Accumulated other comprehensive income (loss) | (103,494) | | | (139,495) | |

| Treasury stock | (27,584) | | | (27,725) | |

| Total Shareholders’ Equity | 314,750 | | | 273,453 | |

| Total Liabilities and Shareholders’ Equity | $ | 3,617,579 | | | $ | 3,562,898 | |

Burke & Herbert Financial Services Corp.

Supplemental Information (unaudited)

As of or for the three months ended

(In thousands, except ratios and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31 | | September 30 | | June 30 | | March 31 | | December 31 |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| | | | | | | | | |

| Per common share information |

| Basic earnings | $ | 0.68 | | | $ | 0.55 | | | $ | 0.81 | | | $ | 1.01 | | | $ | 1.80 | |

| Diluted earnings | 0.67 | | | 0.55 | | | 0.80 | | | 1.00 | | | 1.78 | |

| Cash dividends | 0.53 | | | 0.53 | | | 0.53 | | | 0.53 | | | 0.53 | |

| Book value | 42.37 | | | 36.46 | | | 39.05 | | | 39.02 | | | 36.82 | |

| | | | | | | | | |

| Balance sheet-related (at period end, unless indicated) |

| Assets | $ | 3,617,579 | | | $ | 3,585,188 | | | $ | 3,569,226 | | | $ | 3,671,186 | | | $ | 3,562,898 | |

| Average earning assets | 3,332,733 | | | 3,337,282 | | | 3,379,534 | | | 3,331,920 | | | 3,255,213 | |

| Loans (gross) | 2,087,756 | | | 2,070,616 | | | 2,000,969 | | | 1,951,738 | | | 1,887,221 | |

| Loans (net) | 2,062,455 | | | 2,044,505 | | | 1,975,050 | | | 1,926,034 | | | 1,866,182 | |

| Securities, available-for-sale, at fair value | 1,248,439 | | | 1,224,395 | | | 1,252,190 | | | 1,362,785 | | | 1,371,757 | |

| Non-interest-bearing deposits | 830,320 | | | 853,385 | | | 876,396 | | | 906,723 | | | 960,692 | |

| Interest-bearing deposits | 2,171,561 | | | 2,132,233 | | | 2,128,867 | | | 2,125,668 | | | 1,959,708 | |

| Deposits, total | 3,001,881 | | | 2,985,618 | | | 3,005,263 | | | 3,032,391 | | | 2,920,400 | |

| Brokered deposits | 389,011 | | | 389,018 | | | 389,051 | | | 389,185 | | | 100,273 | |

| Uninsured deposits | 677,308 | | | 670,735 | | | 681,908 | | | 715,053 | | | 843,431 | |

| Borrowed funds | 272,000 | | | 299,000 | | | 249,000 | | | 321,700 | | | 343,100 | |

Unused borrowing capacity4 | 914,980 | | | 883,525 | | | 958,962 | | | 809,127 | | | 622,186 | |

| Equity | 314,750 | | | 270,819 | | | 290,072 | | | 289,783 | | | 273,453 | |

| Accumulated other comprehensive income (loss) | (103,494) | | | (146,159) | | | (126,177) | | | (123,809) | | | (139,495) | |

(4) Includes Federal Home Loan Bank and correspondent bank availability.

8

Burke & Herbert Financial Services Corp.

Supplemental Information (unaudited)

As of or for the three months ended

(In thousands, except ratios and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| December 31 | | September 30 | | June 30 | | March 31 | | December 31 |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| | | | | | | | | |

| Ratios |

| Return on average assets (annualized) | 0.56 | % | | 0.45 | % | | 0.67 | % | | 0.85 | % | | 1.51 | % |

| Return on average equity (annualized) | 7.30 | % | | 5.60 | % | | 8.34 | % | | 10.83 | % | | 20.66 | % |

Net interest margin (non-GAAP2) | 2.70 | % | | 2.76 | % | | 2.87 | % | | 3.06 | % | | 3.46 | % |

| Efficiency ratio | 82.20 | % | | 82.50 | % | | 75.12 | % | | 70.25 | % | | 51.24 | % |

Loan-to-deposit ratio | 69.55 | % | | 69.35 | % | | 66.58 | % | | 64.36 | % | | 64.62 | % |

Common Equity Tier 1 (CET1) capital ratio5 | 16.79 | % | | 16.36 | % | | 17.47 | % | | 17.40 | % | | 17.89 | % |

Total risk-based capital ratio4 | 17.82 | % | | 17.39 | % | | 18.57 | % | | 18.50 | % | | 18.81 | % |

Leverage ratio5 | 11.27 | % | | 11.27 | % | | 11.11 | % | | 11.09 | % | | 11.30 | % |

| | | | | | | | | |

| Income statement |

| Interest income | $ | 38,180 | | | $ | 37,272 | | | $ | 37,116 | | | $ | 34,328 | | | $ | 32,574 | |

| Interest expense | 15,876 | | | 14,383 | | | 13,324 | | | 9,554 | | | 4,664 | |

| Non-interest income | 4,824 | | | 4,289 | | | 4,625 | | | 4,214 | | | 4,215 | |

Total revenue (non-GAAP2) | 27,128 | | | 27,178 | | | 28,417 | | | 28,988 | | | 32,125 | |

| Non-interest expense | 22,300 | | | 22,423 | | | 21,348 | | | 20,365 | | | 16,461 | |

Pretax, pre-provision earnings (non-GAAP2) | 4,828 | | | 4,755 | | | 7,069 | | | 8,623 | | | 15,664 | |

| Provision for (recapture of) credit losses | (750) | | | 235 | | | 214 | | | 515 | | | 98 | |

| Income before income taxes | 5,578 | | | 4,520 | | | 6,855 | | | 8,108 | | | 15,566 | |

| Income tax expense | 500 | | | 464 | | | 821 | | | 584 | | | 2,213 | |

| Net income | $ | 5,078 | | | $ | 4,056 | | | $ | 6,034 | | | $ | 7,524 | | | $ | 13,353 | |

| | | | | | | | | |

(5) Ratios are for Burke & Herbert Bank & Trust Company for all periods presented.

9

Burke & Herbert Financial Services Corp.

Non-GAAP Reconciliations (unaudited)

(In thousands, except ratios and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating net income (non-GAAP) |

| | For the three months ended |

| | December 31 | | September 30 | | June 30 | | March 31 | | December 31 |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| Net income | | $ | 5,078 | | | $ | 4,056 | | | $ | 6,034 | | | $ | 7,524 | | | $ | 13,353 | |

| Add back significant items (tax effected): | | | | | | | | | | |

| Listing-related | | — | | | — | | | 79 | | | 160 | | | 251 | |

| Merger-related | | 1,141 | | | 1,592 | | | 92 | | | — | | | — | |

| Total significant items | | 1,141 | | | 1,592 | | | 171 | | | 160 | | | 251 | |

| Operating net income | | $ | 6,219 | | | $ | 5,648 | | | $ | 6,205 | | | $ | 7,684 | | | $ | 13,604 | |

| | | | | | | | | | |

| Weighted average diluted shares | | 7,508,289 | | | 7,499,278 | | | 7,514,955 | | | 7,504,473 | | | 7,490,087 | |

Adjusted diluted EPS | | $ | 0.83 | | | $ | 0.75 | | | $ | 0.83 | | | $ | 1.02 | | | $ | 1.82 | |

| | | | | | | | | | |

| | For the twelve months ended | | | | | | |

| | December 31 | | December 31 | | | | | | |

| | 2023 | | 2022 | | | | | | |

| Net income | | $ | 22,692 | | | $ | 44,013 | | | | | | | |

| Add back significant items (tax effected): | | | | | | | | | | |

| Listing-related | | 239 | | | 251 | | | | | | | |

| Merger-related | | 2,825 | | | — | | | | | | | |

| Total significant items | | 3,064 | | | 251 | | | | | | | |

| Operating net income | | $ | 25,756 | | | $ | 44,264 | | | | | | | |

| | | | | | | | | | |

| Weighted average diluted shares | | 7,506,855 | | | 7,467,717 | | | | | | | |

Adjusted diluted EPS | | $ | 3.43 | | | $ | 5.93 | | | | | | | |

Operating net income is a non-GAAP measure that is derived from net income adjusted for significant items. The Company believes that operating net income is useful in periods with certain significant items, such as listing-related or merger-related expenses. The operating net income is more reflective of management’s ability to grow the business and manage expenses. The Company only incurred these significant items beginning from the fourth quarter of 2022.

Burke & Herbert Financial Services Corp.

Non-GAAP Reconciliations (unaudited)

(In thousands, except ratios and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Revenue (non-GAAP) | | |

| | For the three months ended |

| | December 31 | | September 30 | | June 30 | | March 31 | | December 31 |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| Interest income | | $ | 38,180 | | | $ | 37,272 | | | $ | 37,116 | | | $ | 34,328 | | | $ | 32,574 | |

| Interest expense | | 15,876 | | | 14,383 | | | 13,324 | | | 9,554 | | | 4,664 | |

| Non-interest income | | 4,824 | | | 4,289 | | | 4,625 | | | 4,214 | | | 4,215 | |

| Total revenue (non-GAAP) | | $ | 27,128 | | | $ | 27,178 | | | $ | 28,417 | | | $ | 28,988 | | | $ | 32,125 | |

| | | | | | | | | | |

| | For the twelve months ended | | | | | | |

| | December 31 | | December 31 | | | | | | |

| | 2023 | | 2022 | | | | | | |

| Interest income | | $ | 146,896 | | | $ | 112,633 | | | | | | | |

| Interest expense | | 53,137 | | | 8,941 | | | | | | | |

| Non-interest income | | 17,952 | | | 17,087 | | | | | | | |

| Total revenue (non-GAAP) | | $ | 111,711 | | | $ | 120,779 | | | | | | | |

Total revenue is a non-GAAP measure and is derived from total interest income less total interest expense plus total non-interest income. We believe that total revenue is a useful tool to determine how the Company is managing its business and demonstrates how stable our revenue sources are from period to period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pretax, Pre-Provision Earnings (non-GAAP) | | |

| | For the three months ended |

| | December 31 | | September 30 | | June 30 | | March 31 | | December 31 |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| Income before taxes | | $ | 5,578 | | | $ | 4,520 | | | $ | 6,855 | | | $ | 8,108 | | | $ | 15,566 | |

| Provision for (recapture of) credit losses | | (750) | | | 235 | | | 214 | | | 515 | | | 98 | |

| Pretax, pre-provision earnings (non-GAAP) | | $ | 4,828 | | | $ | 4,755 | | | $ | 7,069 | | | $ | 8,623 | | | $ | 15,664 | |

| | | | | | | | | | |

| | For the twelve months ended | | | | | | |

| | December 31 | | December 31 | | | | | | |

| | 2023 | | 2022 | | | | | | |

| Income before taxes | | $ | 25,061 | | | $ | 52,299 | | | | | | | |

| Provision for (recapture of) credit losses | | 214 | | | (7,466) | | | | | | | |

| Pretax, pre-provision earnings (non-GAAP) | | $ | 25,275 | | | $ | 44,833 | | | | | | | |

Pretax, pre-provision earnings is a non-GAAP measure and is based on adjusting income before income taxes and to exclude provision for (recapture of) credit losses. We believe that pretax, pre-provision

Burke & Herbert Financial Services Corp.

Non-GAAP Reconciliations (unaudited)

(In thousands, except ratios and per share amounts)

earnings is a useful tool to help evaluate the ability to provide for credit costs through operations and provides an additional basis to compare results between periods by isolating the impact of provision for (recapture of) credit losses, which can vary significantly between periods.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Margin & Taxable-Equivalent Net Interest Income (non-GAAP) | | |

| | As of or for the three months ended |

| | December 31 | | September 30 | | June 30 | | March 31 | | December 31 |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| Net interest income | | $ | 22,304 | | | $ | 22,889 | | | $ | 23,792 | | | $ | 24,774 | | | $ | 27,910 | |

| Taxable-equivalent adjustments | | 365 | | | 366 | | | 375 | | | 387 | | | 455 | |

| Net interest income (Fully Taxable-Equivalent - FTE) | | $ | 22,669 | | | $ | 23,255 | | | $ | 24,167 | | | $ | 25,161 | | | $ | 28,365 | |

| | | | | | | | | | |

| Average earning assets | | $ | 3,332,733 | | | $ | 3,337,282 | | | $ | 3,379,534 | | | $ | 3,331,920 | | | $ | 3,255,213 | |

| Net interest margin (non-GAAP) | | 2.70 | % | | 2.76 | % | | 2.87 | % | | 3.06 | % | | 3.46 | % |

| | | | | | | | | | |

| | As of or for the twelve months ended | | | | | | |

| | December 31 | | December 31 | | | | | | |

| | 2023 | | 2022 | | | | | | |

| Net interest income | | $ | 93,759 | | | $ | 103,692 | | | | | | | |

| Taxable-equivalent adjustments | | 1,493 | | | 2,375 | | | | | | | |

| Net interest income (Fully Taxable-Equivalent - FTE) | | $ | 95,252 | | | $ | 106,067 | | | | | | | |

| | | | | | | | | | |

| Average earning assets | | $ | 3,345,347 | | | $ | 3,327,272 | | | | | | | |

| Net interest margin (non-GAAP) | | 2.85 | % | | 3.19 | % | | | | | | |

The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use net interest income on a fully taxable-equivalent (FTE) basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. FTE net interest income is calculated by adding the tax benefit on certain financial interest earning assets, whose interest is tax-exempt, to total interest income then subtracting total interest expense. Management believes FTE net interest income is a standard practice in the banking industry, and when net interest income is adjusted on an FTE basis, yields on taxable, nontaxable, and partially taxable assets are comparable; however, the adjustment to an FTE basis has no impact on net income and this adjustment is not permitted under GAAP. FTE net interest income is only used for calculating FTE net interest margin, which is calculated by annualizing FTE net interest income and then dividing by the average earning assets. The tax-rate used for this adjustment is 21%. Net interest income shown elsewhere in this presentation is GAAP net interest income.

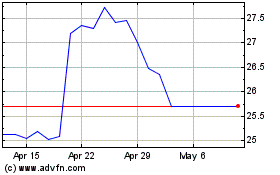

Summit Financial (NASDAQ:SMMF)

Historical Stock Chart

From Apr 2024 to May 2024

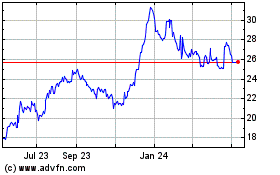

Summit Financial (NASDAQ:SMMF)

Historical Stock Chart

From May 2023 to May 2024