0000037785FALSE00000377852024-06-112024-06-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 8-K

_______________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 11, 2024

__________________________________________________________________________

FMC CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________________________

| | | | | | | | | | | |

| Delaware | 1-2376 | 94-0479804 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | |

| 2929 Walnut Street | Philadelphia | Pennsylvania | 19104 |

| (Address of Principal Executive Offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 215-299-6000

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

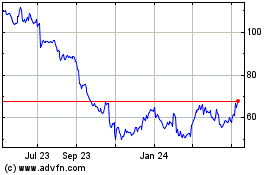

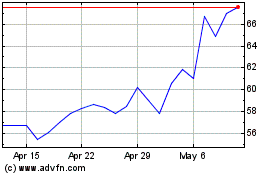

| Common Stock, par value $0.10 per share | | FMC | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | | | | | | | | | | | | | |

Emerging growth company | ☐ | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. | |

| ☐ |

|

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

The Board of Directors (the “Board”) of FMC Corporation (the “Company”) has appointed Pierre R. Brondeau as Chief Executive Officer in addition to his role as Chairman of the Board. He succeeds Mark A. Douglas, who has stepped down from his roles as President and Chief Executive Officer and resigned as a member of the Board. In addition, the Board has appointed Ronaldo Pereira to the role of President of the Company. Messrs. Brondeau and Pereira assumed their new roles effective June 11, 2024. Mr. Douglas will serve as an executive advisor to the senior management team through September 1, 2024. In connection with the foregoing and in accordance with the Company’s Restated By-Laws, the Board reduced the size of the Board to ten members.

Information with respect to Mr. Brondeau required by Items 401(b) and 401(e) of Regulation S-K is contained in the Company’s Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Shareholders, filed on March 15, 2024, and is incorporated by reference into this Current Report on Form 8-K. Information with respect to Mr. Pereira required by Items 401(b) and 401(e) of Regulation S-K is contained in the Company’s Annual Report on Form 10-K for the Company’s 2023 fiscal year, filed on February 27, 2024, and is incorporated by reference into this Current Report on Form 8-K. Neither Mr. Brondeau nor Mr. Pereira has any family relationships with any of the Company’s directors or executive officers and neither is party to any transactions listed in Item 404(a) of Regulation S-K. Further, other than the Offer Letter described below in the case of Mr. Brondeau, no arrangement or understanding exists between Mr. Brondeau, Mr. Pereira or any other person pursuant to which Mr. Brondeau or Mr. Pereira was selected as Chief Executive Officer or President, respectively.

Brondeau Offer Letter

In his connection with his appointment as Chief Executive Officer, the Company entered into an offer letter with Mr. Brondeau effective on June 11, 2024 setting forth the terms of his employment (the “Offer Letter”). The Offer Letter provides that Mr. Brondeau will receive an annual base salary of $1,300,000 per year and a target annual incentive opportunity of 135% of his annual base salary (which will be prorated for his period of service as Chief Executive Officer in 2024). He will be considered for long-term incentive awards and eligible to participate in the Company’s employee benefit plans on the same basis as similarly situated executives of the Company. While employed as Chief Executive Officer, Mr. Brondeau will continue to be nominated for reelection to the Board annually and will serve as Chairman of the Board, but he will not be eligible to receive cash director fees or additional director equity grants pursuant to any non-employee director plans or programs maintained by the Company. On June 11, 2024, he will be granted a one-time sign-on equity award with a grant date fair value of $8,500,000, 50% of which will be in the form of restricted stock units and 50% of which will be in the form of stock options (the “Sign-On Award”). The Sign-On Award will cliff vest on June 11, 2026, generally subject to his continued employment through such date, with accelerated vesting upon his earlier cessation of service as Chief Executive Officer in circumstances where a successor Chief Executive Officer has been appointed by the Board and he has facilitated an orderly transition of his duties to such successor.

Douglas Separation Agreement

On June 11, 2024, the Company entered into a separation agreement with Mr. Douglas (the “Separation Agreement”), which provides that Mr. Douglas will remain a non-officer employee of the Company through September 1, 2024 or his earlier death or disability (the “Termination Date”), upon which date his employment will be terminated. Subject to his continued employment in good standing through the Termination Date, upon his termination of employment, he will be eligible to receive (1) a lump sum cash severance payment equal to two times his annual base salary and target annual bonus, (2) a 2024 annual bonus based on actual performance and prorated for the portion of the year that Mr. Douglas served as Chief Executive Officer, (3) a lump sum cash payment equal to 12 months of the monthly premium for continued health care coverage under COBRA, (4) a lump sum cash payment equal to $20,000 for use for career transition or such other purposes as determined by Mr. Douglas, and (5) continued vesting of his outstanding equity awards through September 1, 2024, with his continued employment through such date resulting in Mr. Douglas satisfying the definitions of “Retirement,” “Normal Retirement” and “Approved Retirement” contained therein and his awards to be treated in accordance with such provisions on and following September 1, 2024. All benefits under the Separation Agreement are subject to Mr. Douglas’s compliance with the terms of the Separation Agreement (including confidentiality and non-disparagement covenants that apply in perpetuity and cooperation, non-compete and non-solicitation covenants that apply while Mr. Douglas is employed and for 24 months thereafter) and his execution and non-revocation of a release of claims against the Company.

The foregoing summaries of the Offer Letter and the Separation Agreement are qualified in their entirety by reference to the Offer Letter and the Separation Agreement, which are attached to this Current Report as Exhibits 10.1 and 10.2 and incorporated by reference into this Item 5.02.

Pereira Compensation Changes

In connection with his appointment as the Company’s President, the Compensation and Human Capital Committee of the Board determined that Mr. Pereira’s annual base salary would be increased to $738,000, retroactive to June 1, 2024, that his target annual short-term incentive opportunity would be increased to 85% of his annual base salary and that his target annual long-term incentive opportunity would be increased to $1,700,000.

ITEM 7.01 REGULATION FD DISCLOSURE

On June 11, 2024, the Company issued a press release with respect to certain of the matters described in this report (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 to this report.

The information in Item 7.01 of this Current Report, including the exhibit attached hereto as Exhibit 99.1, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| FMC CORPORATION

(Registrant) |

| | | |

| By: | /s/ MICHAEL F. REILLY |

| | Michael F. Reilly

Executive Vice President, General Counsel, Chief Compliance Officer and Secretary |

Date: June 11, 2024

| | | | | | | | | | | | | | |

| | FMC Corporation |

| 2929 Walnut Street |

| Philadelphia, PA 19104 |

| USA |

| | | | 215.299.6000 |

| | | | fmc.com |

| | | | |

June 11, 2024

Pierre R. Brondeau

[address redacted]

Dear Pierre,

This letter outlines the terms of your employment as Chief Executive Officer of FMC Corporation (the “Company”). We look forward to benefiting from your experience, knowledge and leadership in your new role with the Company, effective as of June 11, 2024 (the “Start Date”).

Positions; Duties; Location. You agree to serve as Chief Executive Officer of the Company and will continue to serve as the Chairman of the Board of Directors of the Company (the “Board”). You and the Company acknowledge that your employment with the Company will be “at will,” which means that either you or the Company may terminate your employment for any reason, at any time, with or without notice. You will have such responsibilities, power and authority as those normally associated with such position in public companies of a similar stature and will report solely and directly to the Board. Your principal place of employment will be the Company’s headquarters in Philadelphia, Pennsylvania, subject to reasonable business travel at the Company’s request.

Base Salary. During your employment as Chief Executive Officer, you will be paid an annual base salary of $1,300,000, payable in accordance with the Company’s normal payroll practices and subject to all applicable taxes and withholdings.

Annual Incentive Opportunity. Your target annual incentive opportunity will be equal to 135% of your annual base salary, with your actual earned annual incentive (if any) determined in accordance with the terms and conditions of the Company’s annual incentive plan based on the achievement of Company and individual performance goals. Your 2024 annual incentive will be prorated for your period of service as Chief Executive Officer during the Company’s 2024 fiscal year in accordance with the terms of the annual incentive plan.

Long Term Incentive Plan. You will be considered for Long Term Incentive (LTI) awards. These awards are granted at the discretion of the company, are typically made in the first quarter of each year and delivered in the form of Restricted Stock Units, Nonqualified Stock Options and

Performance Restricted Stock Units. For your reference, in 2023 the LTI mix for the CEO was 50% PRSUs, 30% Nonqualified Stock Options and 20% Restricted Stock Units. PRSU awards are dependent on company performance against metrics as determined by the Compensation Committee.

Sign-On Equity Award. On June 11, 2024, you will be granted a one-time sign-on equity award (the “Sign-On Award”) under the Company’s 2023 Incentive Stock Plan (the “Plan”) with a grant date fair value of $8,500,000, fifty percent (50%) of which will be in the form of stock options and fifty percent (50%) of which will be in the form of restricted stock units. Subject to your continued employment as Chief Executive Officer and the terms and conditions of the Plan and applicable award agreements, the Sign-On Award will cliff vest on the second anniversary of the Start Date, with accelerated vesting upon your earlier cessation of service as Chief Executive Officer in circumstances where a successor Chief Executive Officer has been appointed by the Board and you have facilitated an orderly transition of your duties to such successor. Upon your cessation of employment under the accelerated vesting scenario, the stock option component of the Sign-On Award would be subject to exercise within five years from your last day of employment. The Sign-On Award will otherwise be subject to the terms and conditions of the applicable award agreements.

Employee Benefits. During your employment as Chief Executive Officer, you will be eligible to participate in the Company’s employee benefit plans on the terms applicable to Company senior executives generally (subject to the applicable eligibility and other requirements set forth therein), and will be reimbursed for all business-related expenses incurred by you in performing your duties hereunder in accordance with the Company’s policies and procedures as in effect from time to time.

Vacation. You will be eligible for five (5) weeks of vacation annually, in accordance with the U.S. Vacation Policy.

Board Service. During your employment as Chief Executive Officer, you will continue to be nominated for reelection to the Board annually and will serve as Chairman of the Board during your service on the Board, but you will not be eligible to receive cash director fees or additional director equity grants pursuant to any non-employee director plans or programs maintained by the Company. You will continue to vest in any equity awards previously granted to you in your capacity as a member of the Board based on your continued service on the Board.

Governing Law. This offer letter will be governed by the laws of the State of Delaware, without reference to principles of conflict of laws.

Indemnification. You will be covered as an insured officer under the Company’s director and officer liability insurance policies, as in effect from time to time, to the same extent, and on the same terms, as other executive officers of the Company, and in accordance with the Company’s by-laws, as they may be amended and restated from time to time.

Section 409A. The payments and benefits provided under this offer letter are intended to comply with, or be exempt from, the requirements of Section 409A of the Internal Revenue Code of 1986, as amended, and the provisions of this offer letter shall be interpreted and applied consistently with such intent.

[Signature Page Follows.]

Please confirm that the foregoing accurately expresses our mutual understanding by signing and returning this offer letter.

| | | | | | | | | | | |

| Sincerely, |

| | | |

| | | |

| | | |

| | | |

| /s/ K’LYNNE JOHNSON |

| K’Lynne Johnson |

| Chair, Compensation and Human Capital Comm |

| | | | | | |

| Accepted and Agreed: |

| | |

| | |

| /s/ PIERRE R. BRONDEAU |

Pierre R. Brondeau |

SEPARATION AGREEMENT

This Separation Agreement (“Agreement”) is entered into as of the 11 day of June, 2024 (the “Effective Date”) by and between FMC Corporation (the “Company”), with its Corporate Headquarters at 2929 Walnut Street, Philadelphia, PA, 19104, and Mark A. Douglas (“Executive”) (collectively, the “Parties”).

WHEREFORE, Executive serves as President and Chief Executive Officer of the Company and a member of the Company’s Board of Directors (the “Board”);

WHEREFORE, the Parties now desire to enter into a mutually satisfactory arrangement concerning, among other things, Executive’s separation from service with the Company and its subsidiaries, and other matters related thereto; and

WHEREFORE, in consideration of the promises contained herein, and for good and valuable consideration, receipt of which is hereby acknowledged, and fully intending to be legally bound hereby, the Parties agree as follows:

I.CESSATION OF OFFICER AND DIRECTOR POSITIONS AND TRANSITIONAL EMPLOYMENT

1.Effective as of the Effective Date, Executive shall cease to serve in the position of President and Chief Executive Officer of the Company. Accordingly, effective as of the Effective Date, Executive hereby resigns as a member of the Board and from any other position he holds with any of the Company’s subsidiaries. While the Parties agree that such resignations are intended to be self-effectuating, Executive further agrees to execute any documentation the Company determines necessary or appropriate to facilitate such resignations.

2.From the Effective Date through September 1, 2024 (the “Termination Date”), Executive shall continue as a non-officer employee of the Company and shall continue to participate in the broad-based compensation and benefit plans of the Company and its subsidiaries in which he currently participates or to which he is a party through the Termination Date. Executive hereby acknowledges and agrees that his employment with the Company and its subsidiaries shall terminate on the Termination Date. In the event of Executive’s death or Disability (as defined in Section 22(e)(3) of the Internal Revenue Code of 1986, as amended (together with any Treasury regulations promulgated or other Treasury guidance thereunder, the “Code”)) termination prior to September 1, 2024, such earlier date shall be treated as the Termination Date. During the period from the Effective Date through the Termination Date, Executive shall be permitted to perform his duties and responsibilities on a remote basis in his reasonable discretion, and Executive shall not be required to travel or attend in-person meetings in connection with any services hereunder (other than as may be required pursuant to Section III.2 below).

3.No later than the Termination Date, Executive agrees to return to the Company all Company property (other than de minimis items), including, without limitation, any Company vehicle, computer equipment, software, access badge, corporate credit cards, electronically stored files, and physical files and/or documents containing information concerning the Company, its business or its business relationships. Notwithstanding the

foregoing, Executive shall be permitted to retain his contacts, calendars and personal correspondence and any compensation related information or documentation.

II.SEPARATION BENEFITS

1.In consideration of Executive’s execution of this Agreement and Executive’s agreement to be legally bound by its terms, specifically including without limitation the covenants in Sections III and IV of this Agreement, and subject to Section II.2 of this Agreement, following the Termination Date, the Company shall pay or provide the following payments and benefits to Executive as set forth below (the “Separation Benefits”):

a.a cash payment equal to any base salary and vacation pay accrued but unpaid or unused as of the Termination Date, which shall be paid in a lump sum on the first regularly scheduled payroll date following the Termination Date, and reimbursement of all business expenses, if any, Executive may have incurred in accordance with the Company’s policy as currently in effect, which shall be paid in accordance with such policy and subject to Section V.4;

b.a cash severance payment in an amount equal to $5,710,500 (the “Severance Payment”), which is calculated to be equal to the following: the sum of Executive’s annual base salary and target annual bonus as of the Effective Date multiplied by 2, which shall be paid in a lump sum on the first regularly scheduled payroll date after the Release becomes effective;

c.a cash payment equal to the annual bonus (based on actual performance) in respect of calendar year 2024 pursuant to the Company’s 2024 annual incentive plan, prorated based on a fraction, the numerator of which is the number of days elapsed between (and including) January 1, 2024, and the Effective Date, and the denominator of which is 366. The amount of the annual bonus shall be based on actual performance shall be determined by the Board or the Compensation and Human Capital Committee thereof in a manner consistent with that used for the Company’s executive officer group generally (without use of any negative discretion unless such discretion is applied uniformly to the Company’s executive officer group); provided that any individual performance metrics shall be deemed met at not less than the 1.0 level of performance. This prorated bonus shall be paid in a lump sum when such bonuses are paid to the Company’s executive officer group generally, but in no event later than March 15 of the year following the year in which the Termination Date occurs;

d.a cash payment in an amount equal to $22,404, equal to the product of (i) the employee premium for health care continuation coverage under Section 4980B of the Code or other applicable law for Executive and his eligible covered dependents equivalent to the coverage which they were receiving immediately prior to the Termination Date, and (ii) 12, which shall be paid in a lump sum on the first regularly scheduled payroll date after the Release becomes effective;

e.a cash payment in an amount equal to $20,000 for use for career transition or such other purposes as determined by Executive, which shall be paid in a lump sum on the first regularly scheduled payroll date after the Release becomes effective; and

f.Executive’s outstanding equity and equity-based awards shall continue to vest in accordance with their terms through September 1, 2024. The Company acknowledges and agrees that Executive’s employment through the September 1, 2024, would result in Executive satisfying the definitions of “Retirement,” “Normal Retirement” and “Approved Retirement” in each applicable award agreement and that any applicable succession planning requirement associated with retirement treatment is hereby waived. As a result, the Company acknowledges and agrees that all of Executive’s outstanding equity and equity-based awards shall be treated upon and following September 1, 2024, in accordance with the “Retirement,” “Normal Retirement” and “Approved Retirement” provisions of such awards, as applicable.

2.Executive’s entitlement to the Separation Benefits set forth in Sections I.1.b through f above is subject to Executive’s (or, in the event of the Executive’s death or Disability, as applicable, Executive’s beneficiaries’ or estate’s or representatives’) execution of the release of claims in the form attached as Exhibit A to this Agreement (the “Release”) within 21 calendar days following the Termination Date (180 days in the event of death), and the non-revocation of the Release during the seven-day period following each such execution of the Release. If not revoked, the Release shall be considered effective on the eighth day after it is executed by Executive (or, in the event of Executive’s death or Disability, as applicable, Executive’s beneficiaries or estate or representatives).

3.Executive acknowledges that the payments and benefits to which he becomes entitled pursuant to this Section II and otherwise solely on account of the termination of his employment shall not be considered in determining his benefits under any plan, agreement, policy or arrangement of the Company and its subsidiaries, including but not limited to the Company’s 401(k) plan. The payments and benefits provided under this Section II shall be in full satisfaction of the obligations of the Company and its subsidiaries to Executive under this Agreement or any other plan, agreement, policy or arrangement of the Company and its subsidiaries upon his termination of employment, and in no event shall Executive entitled to severance pay or benefits beyond those specified in this Section II.

III.CONFIDENTIALITY, NONDISCLOSURE, COOPERATION AND NON-DISPARAGEMENT

1.Protecting Confidential Company Information. Subject to Section III.5 below, Executive agrees and covenants that Executive will not use, disclose, make available, publish, or communicate, whether directly or indirectly, to anyone at any time, any Confidential Information acquired during his employment with the Company or an affiliate. Executive expressly represents that as of the time of signing this Agreement, Executive has not accessed, used, copied or removed any documents, records, files, media, or other resources containing Confidential Information except during Executive’s employment as appropriate and necessary for the performance of Executive’s job duties for the Company. Executive affirms that, pursuant to Section I.3 above, Executive shall return all documents and other items provided to Executive by the Company, developed or obtained by Executive in connection with Executive’s employment with the Company, or otherwise belonging to the Company. For purposes of this Agreement, “Confidential Information” includes, but is not limited to, all information not generally known to the public or within the Company’s industry, in spoken, printed, electronic or any other form or medium, relating directly or indirectly to business or financial information, trade

secrets, processes, practices, methods, know-how and any confidential or proprietary information relating to the business and affairs of the Company, or of any other person or entity that has entrusted information to the Company in confidence. Executive further agrees to continue to comply with the terms of any applicable Confidential & Intellectual Property Agreement that Executive has entered into with the Company. Executive hereby grants consent to notification by the Company to any new employer about Executive’s obligations under this paragraph and represents that Executive has not to date misused or disclosed Confidential Information to any unauthorized party. Executive hereby acknowledges receipt of the following notice pursuant to 18 U.S.C § 1833(b)(1): “An individual shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that (A) is made (i) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.”

2.Cooperation. During Executive’s employment and for the twenty-four (24)-month period following the Termination Date (or, for any litigation or investigation matters pending or known as of the Effective Date, during Executive’s employment and until the final resolution of such matters) (such period, the “Cooperation Period”), Executive agrees to complete such reasonable acts as from time to time may be necessary or useful in the Company’s good faith reasonable discretion to apply for, secure, maintain, reissue, extend or defend the Company’s worldwide rights in its Confidential Information or other intellectual property or in any or all letters patent in any country worldwide, so as to secure to the Company the full benefits of such information or discoveries and otherwise as needed to protect the Company’s rights and interests. In addition, during the Cooperation Period, Executive agree to make himself reasonably available, subject to Executive’s reasonable personal and professional commitments, to cooperate with the Company’s and its attorneys’ reasonable requests for cooperation in connection with any matter that Executive directly handled or supervised during Executive’s employment with the Company or with any investigation of any claims against the Company about which Executive is reasonably likely to have direct knowledge. Executive understands and agrees that such reasonable cooperation may include, but shall not be limited to, making himself reasonably available to the Company and its attorneys upon reasonable notice for interviews and factual investigations; appearing at the Company’s reasonable request to give truthful testimony; and turning over all relevant documents to the Company that are or may come into Executive’s possession; provided, however, that the Company shall not require Executive to breach obligations of confidentiality to a third party or disregard Executive’s attorney-client privilege or engage in any other actions not legally permitted. Without limiting the generality of the foregoing, to the extent that the Company seeks Executive’s assistance, the Company will use best efforts to provide Executive with reasonable advance notice of its need for assistance. Further, the Company will reimburse Executive in accordance with the Company’s policy, for all reasonable out-of-pocket travel and other expenses that Executive incur as a result of Executive’s cooperation pursuant to this Section III.2, including reasonable attorneys’ fees, if reasonably appropriate. Executive shall not be required to cooperate against his personal or professional legal interests.

3.Non-disparagement. Subject to Section III.4 below and to the extent permitted by applicable law, Executive agrees not to make or publish any public statement (orally, in writing, or in any other form) or instigate, assist, or participate in the making or publication of any public statement which is disparaging, defamatory or detrimental in any way to: (a) the Company or its subsidiaries, (b) the Company’s or its subsidiaries’ services, affairs, or operations, or (c) any of its past or present directors and executive officers. The Company agrees not to make or publish, and shall instruct its present directors and executive officers not to make or publish, any public statement (orally, in writing, or in any other form) or instigate, assist, or participate in the making or publication of any public statement which is disparaging, defamatory or detrimental in any way to: (x) Executive or (y) Executive’s reputation, integrity or professionalism. Notwithstanding the foregoing, either party hereto may make disparaging or negative statements pursuant to truthful testimony in connection with a governmental or regulatory investigation or in connection with a legal or arbitration process.

4.Protected Rights. Nothing in this Agreement or the Release (i) restricts or impedes Executive from exercising protected rights, to the extent such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation, or order, (ii) waives Executive’s right to testify in an administrative, legislative, or judicial proceeding concerning alleged criminal conduct or alleged sexual harassment on the part of the Company, or on the part of the agents or employees of the Company, when Executive has been required or requested to attend such a proceeding pursuant to a court order, subpoena, or written request from an administrative agency or the legislature, (iii) prevents or restricts Executive from communicating with, filing a charge or complaint with or from participating in an investigation or proceeding conducted by the Equal Employment Opportunity Commission, the National Labor Relations Board, the Securities and Exchange Commission (the “SEC”), or any other federal, state or local agency charged with the enforcement of any laws, including providing documents or other information, or making other disclosures that are protected under whistleblower provisions of federal law or regulation or from otherwise making disclosures protected under whistleblower provisions of federal law or regulation (including Section 21F of the Securities Exchange Act of 1934 and the regulations promulgated thereunder) or limit Executive’s right to receive an award for information provided to the SEC or any other securities regulatory agency, in each case without the necessity of prior authorization from the Company or the need to notify the Company that he has done so, (iv) prevents Executive from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Executive has reason to believe is unlawful, including but not limited to retaliation, a wage-and-hour violation, or sexual assault, or other conduct that is recognized as unlawful under state, federal or common law, or that is recognized as against a clear mandate of public policy, whether occurring in the workplace, at work-related events coordinated by or through the Company, or between employees, or between the Company and an employee, whether on or off the employment premises, (v) prevents Executive from exercising any rights Executive may have under Section 7 of the National Labor Relations Act to engage in protected, concerted activity with other employees (such as discussing wages, benefits, or other terms and conditions of employment or raising complaints about working conditions for Executive’s own and other employees’ mutual aid or protection), or (vi)

prevents Executive from testifying truthfully pursuant to any legal process between Executive and the Company or any of its affiliates and/or their respective directors or executive officers.

IV.NON-COMPETE AND NON-SOLICITATION COVENANTS

1.Restrictive Covenants. In recognition of, and in consideration for, the Separation Benefits to be paid to Executive pursuant to Section II of this Agreement, Executive agrees to be bound by the provisions of this Section IV (together with the covenants set forth in Section III, the “Restrictive Covenants”).

a.Executive covenants that, during Executive’s employment with the Company and for the 24-month period immediately following the Termination Date (the “Restricted Period”), Executive will not do any of the following, directly or indirectly:

i.be employed by, consult with or engage in any Competing Business, as defined below; or

ii.influence or attempt to influence any employee, consultant, supplier, licensor, licensee, contractor, agent, strategic partner, distributor, customer or other person to terminate or modify any written or oral agreement, arrangement or course of dealing with the Company or any of its subsidiaries; or

iii.solicit for employment or employ or retain (or arrange to have any other person or entity employ or retain) any person who has been employed or retained by the Company or any of its subsidiaries within the 12 month period immediately preceding the date of such solicitation, employment or retention; provided, however, that this restriction will not apply to any person whose employment by the Company or any of its subsidiaries was terminated by the Company or any such affiliate during such 12 month period.

provided; however, that the foregoing restrictions shall not apply to (A) general solicitations that are not specifically directed to employees or other service providers of the Company and its subsidiaries, (B) serving as a reference at the request of an employee or (C) actions taken in the good faith performance of Executive’s duties for and/or for the benefit of the Company and its subsidiaries.

b.Definitions. For purposes of this Agreement:

“Competing Business” means any company, entity, or Affiliate (defined below) of any of the following: Bayer AG (including without limitation Monsanto Company), BASF SE, China National Chemical Corporation (including without limitation Syngenta AG and/or ADAMA Ltd.), Corteva Inc., UPL Limited, and/or any person or entity which, as of the Termination Date or during the Restricted Period, has obtained or has or will have applied for a USEPA pesticide registration for Chlorantraniliprole Technical, it being understood and agreed that, in regard to the latter category of entities, in no event shall a company that distributes chlorantraniliprole-

containing end-use products but does not hold or has applied for a registration for Chlorantraniliprole Technical shall be considered a “Competing Business.” Notwithstanding the foregoing, Executive’s provision of services to an entity or person or their subsidiaries that is not a Competing Business but becomes part of a Competing Business solely as a result of an acquisition, merger, business combination or similar event shall not be considered a violation of Section IV.1.a.

“Affiliate” as used above means any company or entity directly or indirectly controlling or controlled by or under direct or indirect common control with such company or entity (including without limitation its respective officers, directors and employees). For this purpose, “control” means the power to direct the management and policies of a person through the ownership of securities, by contract or otherwise and the terms “controlling” and “controlled” have meanings correlative to the foregoing. For the avoidance of doubt, Affiliate shall not include other entities (that are not Competing Businesses) owned by a private equity sponsor of any of the entities referenced above.

c.Acknowledgements. Executive acknowledges that the Restrictive Covenants are reasonable and necessary to protect the legitimate interests of the Company and its subsidiaries, that the duration and scope of the Restrictive Covenants are reasonable given the nature of this Agreement and Executive’s position within the Company. Executive acknowledges that the Company and its subsidiaries have a legitimate business interest in and right to protect its Confidential Information, goodwill and employee, customer and other relationships, and that the Company and its subsidiaries would be seriously damaged by the disclosure of Confidential Information and the loss or deterioration of its employee, customer and other relationships. Executive further acknowledges that the Company and its subsidiaries are entitled to seek to protect and preserve the going concern value of the Company and its subsidiaries to the extent permitted by law. Executive further acknowledges that, although Executive’s compliance with the covenants contained in this Agreement may prevent Executive from earning a livelihood in a business similar to the business of the Company and its subsidiaries, Executive’s experience and capabilities are such that Executive has other opportunities to earn a livelihood and adequate means of support for Executive and Executive’s dependents.

d.Remedies and Enforcement.

i.Specific Enforcement. The parties hereto acknowledges that any material breach, willfully or otherwise, of the Restrictive Covenants may cause continuing and irreparable injury to the other party for which monetary damages may not be an adequate remedy. Neither party shall not, in any action or proceeding to enforce any of the provisions of this Agreement, assert the claim or defense that such an adequate remedy at law exists. In the event of any actual or threatened material breach of any of the Restrictive Covenants, and failure to cure after being given a reasonable period of time to cure, the parties hereto shall be entitled to seek (without the necessity of showing economic loss or other actual damage)

injunctive or other similar equitable relief in any court, without any requirement that a bond or other security be posted. In addition, in the event of any material breach of any of the Restrictive Covenants by Executive during the twenty-four (24)-month period following the Termination Date, the Company shall be entitled to cease payment of the compensation and benefits contemplated by Section II to the extent not previously paid or provided (including any portion of the Severance Payment not yet paid) and seek the prompt return of any portion of such compensation and the value of such benefits previously paid or provided. The preceding sentences shall not be construed as a waiver of the rights that either party hereto may have for damages under this Agreement or otherwise, and all such rights shall be unrestricted, and this Agreement will not in any way limit remedies of law or in equity otherwise available to the parties hereto.

ii.Judicial Modification. If any court determines that any of the Restrictive Covenants, or any part thereof, is unenforceable because of the duration or scope of such provision, such court shall have the power to modify such provision and, in its modified form, such provision will then be enforceable.

iii.Enforceability. If any court holds the Restrictive Covenants unenforceable by reason of their breadth or scope or otherwise, it is the intention of the parties hereto that such Restrictive Covenants shall be modified such that they are enforceable and enforced as so modified.

iv.Disclosure of Restrictive Covenants. Executive agrees to disclose the existence and terms of the Restrictive Covenants to any potential employer or employer that Executive may work for during the Restricted Period.

v.Extension of Restricted Period. If Executive materially breaches Section IV.1 in any respect, the restrictions contained in that section will be extended for a period equal to the period of the material breach prior to the Company becoming aware of such breach if the Company does not take action to cause Executive to cease the breach.

V.MISCELLANEOUS

1.No Mitigation; No Offset. In no event shall Executive be obligated to seek other employment or take any other action by way of mitigation of the amounts payable to Executive under any of the provisions of this Agreement, and such amounts shall not be reduced whether or not Executive obtains other employment and shall not be offset by any amounts alleged to be owed by Executive to the Company.

2.Tax Withholding. The Company and its subsidiaries shall withhold from the benefits and payments described herein all income and employment taxes required to be withheld by applicable law.

3.Successors. This Agreement shall inure to the benefit of, be enforceable by and be binding upon Executive’s legal representatives. This Agreement shall inure to the benefit

of, be enforceable by and be binding upon the Company and its successors and assigns. As used in this Agreement, “Company” shall mean the Company as hereinbefore defined and any successor to its business and/or assets as aforesaid which assumes and agrees to perform this Agreement by operation of law, or otherwise. Notwithstanding anything to the contrary in this Agreement, in the event of Executive’s death, the Company shall provide Executive’s estate (or beneficiaries) with any payments due to Executive under this Agreement.

4.Notices. All notices, requests, demands or other communications under this Agreement shall be in writing and shall be deemed to have been duly given when delivered in person or deposited in the United States mail, postage prepaid, by registered or certified mail, return receipt requested, to the party to whom such notice is being given as follows:

| | | | | |

| As to Executive: | Executive’s last address on the books and records of the Company |

|

| As to the Company: | FMC Corporation |

| 2929 Walnut Street |

| Philadelphia, PA 19104 |

| Attention: General Counsel |

Any party may change his or its address or the name of the person to whose attention the notice or other communication shall be directed from time to time by serving notice thereof upon the other party as provided herein.

4.Section 409A. The Separation Benefits are intended to comply with, or be exempt from, Section 409A of the Code (“Section 409A”). Notwithstanding the foregoing, the Company makes no representations that the payments and/or benefits provided in this Agreement comply with Section 409A and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by Executive on account of non-compliance with Section 409A. The parties shall in good faith attempt to modify any provisions in this Agreement not in compliance with Section 409A. To the extent that any provision hereof is modified in order to comply with Section 409A, such modification shall be made in good faith and agreed upon with Executive and shall, to the maximum extent reasonably possible, maintain the original intent and economic benefit to Executive and the Company of the applicable provision without violating the provisions of Section 409A. All reimbursements and in-kind benefits provided under this Agreement that are subject to Section 409A shall be made in accordance with the requirements of Section 409A, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during Executive’s lifetime (or during a shorter period of time specified in this Agreement); (ii) the amount of expenses eligible for reimbursement, or in-kind benefits provided, during a calendar year may not affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other calendar year; (iii) the reimbursement of an eligible expense will be made no later than the last day of the calendar year following the year in which the expense is incurred; and (iv) the right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit. Each payment of compensation under this Agreement shall be treated as a separate payment of compensation for purposes of applying the exclusion under Section 409A of the Code for short- term deferral amounts,

the separation pay exception or any other exception or exclusion under Section 409A of the Code. In no event may Executive, directly or indirectly, designate the calendar year of any payment under this Agreement, and, if the period during which Executive may execute or revoke the Release spans two taxable years, payments subject to the execution and non-revocation of the Release shall be paid (or commence) on the later of (i) the first business day of such second taxable year or (ii) the eighth calendar day after Executive’s execution of the Release. Notwithstanding any other provision of this Agreement to the contrary, if Executive is considered a “specified employee” for purposes of Section 409A of the Code (as determined in accordance with the methodology established by the Company and its subsidiaries as in effect on the Termination Date), any payment that constitutes nonqualified deferred compensation within the meaning of Section 409A of the Code that is otherwise due to Executive under this Agreement during the six-month period immediately following Executive’s separation from service (as determined in accordance with Section 409A of the Code) on account of Executive’s separation from service shall be accumulated and paid to Executive on the first business day of the seventh month following his separation from service (the “Delayed Payment Date”). If Executive dies during the postponement period, the amounts and entitlements delayed on account of Section 409A of the Code shall be paid to the personal representative of his estate on the first to occur of the Delayed Payment Date or 30 calendar days after the date of Executive’s death.

5.Headings and Captions. The headings and captions of this Agreement are not part of the provisions hereof and shall have no force or effect.

6.Amendments. This Agreement may not be amended or modified otherwise than by a written agreement executed by the parties hereto or their respective successors and legal representatives.

7.Entire Agreement. The provisions of this Agreement set forth the entire agreement between Executive and the Company regarding Executive’s termination of employment. In the event a court or agency of competent jurisdiction determines that any term or provision contained in this Agreement is illegal, invalid or unenforceable, such illegality, invalidity or unenforceability shall not affect the other terms and provisions of this Agreement, which shall continue in full force and effect.

8.Legal Fees. The Company will reimburse Executive for reasonable and documented legal fees incurred in connection with the negotiation of this Agreement, up to a maximum amount of $50,000, within 30 calendar days after delivery of an invoice therefore.

9.Counterparts. This Agreement may be executed in counterparts, all of which taken together shall constitute an instrument enforceable and binding upon the undersigned parties.

10.Governing Law. This Agreement shall be governed by the laws of the State of Delaware, without reference to that jurisdiction’s choice of law rules.

11.Indemnification; Directors’ and Officers’ Insurance. The Company shall indemnify, advance expenses to, and hold harmless Executive in connection with the performance of Executive’s duties as President and Chief Executive Officer of the Company and as a member of the Board, in each case, prior to the Effective Date, and with respect to

Executive’s employment pursuant to this Agreement through the Termination Date, to the fullest extent permitted by law and the governance instruments of the Company. The Company shall cover Executive under directors’ and officers’ liability insurance to the same extent as other similarly situated former officers and directors of the Company.

THE REST OF THIS PAGE IS INTENTIONALLY BLANK

IN WITNESS WHEREOF, EXECUTIVE AND THE COMPANY, INTENDING TO BE LEGALLY BOUND, HAVE EXECUTED THIS INSTRUMENT ON THE DATE SET FORTH BELOW:

| | | | | | | | |

| June 10, 2024 | | June 11, 2024 |

| Date Signed | | Date Signed |

| /s/ MARK A. DOUGLAS | | /s/ FMC CORPORATION |

| Mark A. Douglas | | FMC Corporation |

[Signature Page to Separation Agreement]

EXHIBIT A

RELEASE OF CLAIMS

This General Release of all Claims (this “Release”) is entered into as of September 1, 2024, by and between FMC Corporation (the “Company”), with its Corporate Headquarters at 2929 Walnut Street, Philadelphia, PA, 19104, and Mark A. Douglas (“Executive”) (collectively, the “Parties”).

In consideration of the payments and benefits (the “Separation Benefits”) set forth in Section II of the Separation Agreement between Executive and the Company, dated as of June 11, 2024 (the “Separation Agreement”), Executive agrees as follows:

I.WAIVER AND RELEASE OF CLAIMS

In consideration of the Separation Benefits described herein, Executive agrees, on behalf of Executive and Executive’s heirs, administrators, representatives, attorneys, successors, executors, assigns and agents (the “Releasers”), to fully and forever waive and release the Company, and the Company’s past and present subsidiaries, affiliates and joint ventures and all of the current and former officers, directors, owners, partners, supervisors, agents, employees, attorneys, insurers, employee benefit plans (including such plans’ administrators and fiduciaries) or assigns of the aforementioned (the “Released Parties”), from any and all legally waivable claims, rights, contracts, agreements, liabilities, promises, torts, demands, causes of action, obligations, promises, controversies, damages, actions, suits, demands, costs, losses, debts and expenses arising at any time up to and including the date that Executive executes this Release, whether known or unknown, to the extent arising from or related to Executive’s service as a director of the Company and Executive’s employment and termination of employment with the Company and its subsidiaries, known or unknown, suspected or unsuspected and any claims of wrongful discharge, breach of contract, implied contract, promissory estoppel, defamation, slander, libel, tortious conduct, employment discrimination or claims under any similar federal, state or local employment statute, law, order or ordinance. This Release specifically includes, but is not limited to, claims for discrimination based upon any protected characteristic (such as age, race, sex, national origin, ancestry, religion, sexual orientation, physical or mental handicap and disability status), breach of contract, or any other claim for relief or remedy (including attorneys’ fees, costs, and expenses) under any city, state, local or federal laws, including but not limited to, claims under the Age Discrimination in Employment Act (ADEA), the Older Workers Benefit Protection Act, Title VII of the Civil Rights Act of 1964, the Equal Pay Act, the Americans with Disabilities Act, as amended, the Worker Adjustment and Retraining Notification (WARN) Act, the Rehabilitation Act of 1973, the Family and Medical Leave Act, the Employee Retirement Income Security Act of 1974, all as amended, and the civil rights, employment and labor laws of any city, locality, state and the United States, including, but not limited to the following (as applicable):

•the District of Columbia Human Rights Act, the District of Columbia Prohibition of Employment Discrimination on the Basis of Tobacco Use Act, the District of Columbia Whistleblower Protection Act for Employees of D.C. Contractors, the District of Columbia Family and Medical Leave Act, the District of Columbia Parental Leave Act, the District of Columbia Accrued Sick and Safe Leave Act, and the District of Columbia Wage Payment and Collection Law;

•the New Jersey Law Against Discrimination, the New Jersey Conscientious Employee Protection Act, the New Jersey Equal Pay Act, the New Jersey Family Leave Act, the New Jersey Wage Payment Law, the New Jersey Wage and Hour Law, the New Jersey Workers’ Compensation Law’s Anti-Retaliation Provisions, and the New Jersey Security and Financial Empowerment Act; and

•the Pennsylvania Human Relations Act, the Pennsylvania Equal Pay Law, and the Pennsylvania Whistleblower Law.

II.EXCLUDED CLAIMS; PROTECTED RIGHTS

Claims that are not being released under this Release include: (a) Executive’s rights to enforce the Separation Agreement or receive the Separation Benefits; (b) Executive’s rights as a stockholder and/or holder of equity awards of the Company; (c) any accrued or vested benefit entitlements pursuant to the terms of a any applicable plan, policy, practice, program, contract or agreement with the Company; (d) workers’ compensation, unemployment, state disability and/or paid family leave insurance benefits pursuant to the terms of applicable state law; (d) continuation coverage benefits under the Consolidated Omnibus Budget Reconciliation Act of 1985 and any state law equivalents; (e) any unreimbursed reimbursable business expenses; (f) any rights under to indemnification and/or advancement of expenses under the Company’s organizational documents or under the Company’s directors’ and officers’ insurance policies; (g) any claims that are not legally waivable as a matter of law; (h) any claims arising after the date Executive signs this Release; and (i) Executive’s rights to communicate directly with, cooperate with, or provide information to, any federal, state or local government authority or regulator.

Nothing in this Release shall release Executive from his obligations under the Separation Agreement or any other agreement between Executive and the Company, and Executive acknowledges that the Company will have available to it all remedies under the Separation Agreement and at law and at equity. Nothing in the Separation Agreement or this Release (i) restricts or impedes Executive from exercising protected rights, to the extent such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation, or order, (ii) waives Executive’s right to testify in an administrative, legislative, or judicial proceeding concerning alleged criminal conduct or alleged sexual harassment on the part of the Company, or on the part of the agents or employees of the Company, when Executive has been required or requested to attend such a proceeding pursuant to a court order, subpoena, or written request from an administrative agency or the legislature, (iii) prevents or restricts Executive from communicating with, filing a charge or complaint with or from participating in an investigation or proceeding conducted by the Equal Employment Opportunity Commission, the National Labor Relations Board, the Securities and Exchange Commission (the “SEC”), or any other federal, state or local agency charged with the enforcement of any laws, including providing documents or other information, or making other disclosures that are protected under whistleblower provisions of federal law or regulation or from otherwise making disclosures protected under whistleblower provisions of federal law or regulation (including Section 21F of the Securities Exchange Act of 1934 and the regulations promulgated thereunder) or limit Executive’s right to receive an award for information provided to the SEC or any other securities regulatory agency, in each case without the necessity of prior authorization from the Company or the need to notify the Company that he has done so, (iv) prevents Executive from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Executive has reason to believe is unlawful, including but not limited to

retaliation, a wage-and-hour violation, or sexual assault, or other conduct that is recognized as unlawful under state, federal or common law, or that is recognized as against a clear mandate of public policy, whether occurring in the workplace, at work-related events coordinated by or through the Company, or between employees, or between the Company and an employee, whether on or off the employment premises, or (v) prevents Executive from exercising any rights Executive may have under Section 7 of the National Labor Relations Act to engage in protected, concerted activity with other employees (such as discussing wages, benefits, or other terms and conditions of employment or raising complaints about working conditions for Executive’s own and other employees’ mutual aid or protection). By signing this Release, however, Executive is waiving Executive’s right to recover any individual relief (including back pay, front pay, reinstatement or other legal or equitable relief) in any charge, complaint, or lawsuit or other proceeding brought by Executive or on Executive’s behalf by any third party, except for any right Executive may have to receive a payment from a government agency (and not the Company) for information provided to the government agency.

III.EXECUTIVE REPRESENTATIONS

Executive specifically represents, warrants, and confirms that, as of the date of this Release:

1.Executive has not filed any claims, complaints, or actions of any kind against the Company with any court of law, or local, state or federal government or agency;

2.To the maximum extent permitted by law, Executive has not filed, nor will he ever file, a lawsuit asserting any claims which are released by this Release, or to accept any benefit from any lawsuit which might be filed by another person or government entity based in whole or in part on any event, act, or omission which is the subject of this Release;

3.Executive has not made any claims or allegations to the Company related to sexual harassment or sexual abuse, and none of the payments set forth in the Separation Agreement are related to sexual harassment or sexual abuse;

4.Executive has been properly paid for all hours worked for the Company;

5.Executive has received all salary, wages, commissions, bonuses, and other compensation due to Executive through and including the Termination Date (as defined in the Separation Agreement); and

6.Executive has not engaged in any unlawful conduct relating to the business of the Company.

IV.KNOWING & VOLUNTARY ACKNOWLEDGMENTS BY EXECUTIVE

Executive acknowledges and agrees that the following is true and correct:

1.Executive knowingly and voluntarily accepts the terms of this Release, including its release of claims (both known and unknown), as evidenced by his signature below;

2.Executive acknowledges and agrees that Executive has read and understands the terms and the effect of this Release, including its release of claims;

3.Executive acknowledges that Executive has been specifically advised by this writing to consult with, and has had an opportunity to consult with, an attorney of Executive’s own choosing before executing this Release;

4.Executive understands and agrees that Executive is receiving additional benefits and valuable consideration, which Executive would not otherwise be entitled to receive upon separation from employment, and these benefits are being given as consideration in exchange for executing the Separation Agreement and this Release, including the general release. Executive further acknowledges that Executive is not entitled to any additional payment or consideration not specifically referenced in the Separation Agreement. Nothing in this Release or the Separation Agreement shall be deemed or construed as an express or implied policy or practice of the Company to provide the Separation Benefits or other benefits to any individuals other than Executive;

5.Executive acknowledges that Executive has been given a reasonable period of time of at least twenty-one (21) calendar days from the date of Executive’s receipt of this Release to consider it before signing it;

6.Executive acknowledges that Executive has been given seven (7) calendar days after signing this Agreement to revoke Executive’s signature by giving written notice of Executive’s revocation as provided in Section V below during the seven (7) day revocation period;

7.By executing this Release, Executive affirmatively states that he has had sufficient and reasonable time to review this Release and to consult with an attorney concerning his legal rights prior to the final execution of this Release, has carefully read this Release and fully understands its terms and he has entered into this Release, knowingly, freely and voluntarily;

8.Executive acknowledges that this Release will not become effective and enforceable until eight (8) calendar days after Executive’s execution of the Release, assuming it has not been timely revoked by Executive;

9.Executive further acknowledges that if Executive does not sign and return this Release within twenty-one (21) calendar days after the Termination Date, then it shall become void and unenforceable and the Company will not owe the Separation Benefits to Executive; and

10.Executive acknowledges that neither the Company nor any Released Parties have made any representation or promise concerning the terms and effects of this Agreement other than those contained herein.

V.RETURN OF AGREEMENT; NOTICE AND REVOCATION

Executive shall return this signed Release to, and any notice including notice of revocation permitted under this Release shall be made in writing to the Company’s Corporate Headquarters at 2929 Walnut Street, Philadelphia, PA, 19104, attention: Chief Human Resources Officer.

VI.NO ADMISSION OF LIABILITY

Execution of this Release shall not constitute an admission of liability or wrongdoing of any kind by either party, and both the Company and Executive specifically deny any such liability.

VII.MISCELLANEOUS

This Release will be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to any choice of law or conflicting provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the laws of any jurisdiction other than the State of Delaware to be applied. In furtherance of the foregoing, the internal law of the State of Delaware will control the interpretation and construction of this agreement, even if under such jurisdiction’s choice of law or conflict of law analysis, the substantive law of some other jurisdiction would ordinarily apply. The provisions of this Release are severable, and if any part or portion of it is found to be unenforceable, the other paragraphs shall remain fully valid and enforceable.

VIII.Company Release

The Company, on behalf of the Released Parties (to the extent of those members of the Released Parties for whom the Company has legal authority) and their successors and assigns, irrevocably and unconditionally releases you of and from all claims which they had, now have or may have against you, through the date the Company signs this Agreement, for or by reason of any matter, cause or thing whatsoever, whether known or unknown, within the reasonable scope of your employment. The foregoing release does not apply to or extend to (i) any acts of gross negligence, (ii) any willful acts of misconduct or fraud which the Company may not have actual knowledge of as of the date of this Agreement, (iii) any breach of the Company’s Code of Ethics and Business Conduct (unless de minimis) or (iv) any claims the Company is not permitted to release under applicable law, including any claims under the Company’s Dodd-Frank Clawback Policy.

IN WITNESS WHEREOF, EXECUTIVE, INTENDING TO BE LEGALLY BOUND, HAS EXECUTED THIS RELEASE ON THE DATE SET FORTH BELOW:

| | | | | | | | |

| | |

| Date Signed | | Date Signed |

| | |

| Mark A. Douglas | | FMC Corporation |

[Signature Page to Release]

| | | | | | | | | | | | | | |

| | FMC Corporation |

| 2929 Walnut Street |

| Philadelphia, PA 19104 |

| USA |

| News Release | | | | 215.299.6000 |

| | | fmc.com |

| | | | |

| For Release: Immediate | | | |

| | | | |

| | Media contact: Amie Leopold +1.215.299.6223 |

| | Amie.Leopold@fmc.com |

| | Investor Contact: Curt Brooks +1.215.299.6137 |

| | Curt.Brooks@fmc.com |

FMC Corporation Board of Directors appoints Pierre Brondeau chairman and chief executive officer

FMC president and CEO Mark Douglas steps down from his position.

Executive vice president Ronaldo Pereira has been elected FMC president.

Company reaffirms second quarter 2024 revenue and earnings guidance ranges.

PHILADELPHIA, June 11, 2024 – FMC Corporation (NYSE: FMC) today announced that its Board of Directors has appointed Pierre Brondeau to be chief executive officer in addition to his role as board chairman. He succeeds current president and CEO Mark Douglas, who has stepped down from FMC following more than 14 years with the company. In addition, the Board of Directors has appointed Ronaldo Pereira as president of FMC Corporation. Brondeau and Pereira assume their new roles effective immediately. Douglas will serve as an executive advisor to the senior management team through September 1.

Brondeau was chairman and CEO of FMC from 2010 until his retirement in June 2020, and has continued to serve as chairman of the board during the last four years. He presided over a period of significant growth at FMC, transforming the company into an agricultural sciences leader. During Brondeau’s prior tenure as CEO, FMC embarked on significant M&A transactions, increased R&D investments and expanded into new geographies, delivering total shareholder return of more than 325 percent from 2010 to 2020.

Page 2 / FMC Corporation Board of Directors appoints Pierre Brondeau chairman and chief executive officer

“Pierre is a respected executive in the chemical and specialty materials industries with a track record of delivering strong, consistent earnings performance,” said C. Scott Greer, lead independent director of the FMC board. “Furthermore, he is highly regarded and well known by FMC’s executive management team, many who worked closely with Pierre when he previously served as CEO. The board is confident that the transition will be seamless, and that Pierre is the right leader to drive FMC forward.”

Pereira has been with FMC for nearly 28 years, most recently serving as executive vice president and president of the Americas region. As FMC president, Pereira will have expanded responsibilities, including executive oversight for all commercial, sales and marketing globally, as well as overseeing the Sustainability, External Affairs, Regulatory and Marketing functions. He will also retain oversight of the Plant Health business.

“Ronaldo is a highly respected crop protection industry veteran with broad commercial experience and a successful track record of building and growing our business throughout Latin America and North America,” said Brondeau. “He is passionate about this industry and our customers. I look forward to working closely with him to aggressively drive profitable growth this year while continuing to execute on our longer-term growth strategy.”

“Mark Douglas’ leadership, vision and commitment to bring the best technologies and products to the agricultural industry have left a lasting, positive mark on FMC,” said Greer. “During his tenure, he transformed what had been a solid FMC business segment into a global crop protection leader driven by innovation, operational agility and a customer-first model. In an industry that values and needs advanced products to protect crops from destructive pests and disease, Mark dramatically strengthened FMC’s technology pipeline, launched novel precision agriculture technologies and built a new Plant Health business featuring the latest biological and pheromone solutions. Mark led FMC during a time of significant challenges in the industry. Under his leadership as CEO, the company successfully navigated the impacts of an unprecedented pandemic, delivered industry-leading safety performance and announced aggressive new sustainability targets. The board extends its gratitude and appreciation to Mark for his 14 years of unwavering commitment and leadership to FMC.”

Page 3 / FMC Corporation Board of Directors appoints Pierre Brondeau chairman and chief executive officer

Brondeau said, “FMC is a strong company with a deep R&D pipeline, a broad and robust product portfolio, strong operating discipline and a highly experienced management team. The company has a bright future, and I look forward to working with our leadership to bring the best crop protection products and services to our customers while delivering exceptional financial performance.”

The company reaffirms second quarter 2024 revenue and earnings guidance ranges1.

About Pierre Brondeau

Dr. Brondeau has served as chairman of the board since October 2010, and was also chief executive officer of FMC from January 2010 until June 2020; president from January 2010 until May 2018; and executive chairman from June 2020 to April 2021. Before joining the Company as president and CEO in January 2010, Dr. Brondeau served as president and CEO, Dow Advanced Materials Division, until his retirement in September 2009. Prior to Dow’s acquisition of Rohm and Haas Company in April 2009, he was president and chief operating officer of Rohm and Haas from May 2008. Dr. Brondeau held numerous executive positions during his tenure at Rohm and Haas from 1989 through May 2008 in Europe and the United States, with global responsibilities for marketing, sales, research and development, engineering, technology and operations. Dr. Brondeau previously served as a member of the board of directors of TE Connectivity Ltd., Marathon Oil Corporation and Livent Corporation.

About FMC

FMC Corporation is a global agricultural sciences company dedicated to helping growers produce food, feed, fiber and fuel for an expanding world population while adapting to a changing environment. FMC’s innovative crop protection solutions – including biologicals, crop nutrition, digital and precision agriculture – enable growers, crop advisers and turf and pest management professionals to address their toughest challenges economically while protecting the environment. With approximately 6,200 employees at more than 100 sites worldwide, FMC is committed to discovering new herbicide, insecticide and fungicide active ingredients, product formulations and pioneering technologies that are consistently better for the planet. Visit fmc.com to learn more and follow us on LinkedIn®.

Statement under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995: FMC and its representatives may from time to time make written or oral statements that are “forward-looking” and provide other than historical information, including statements contained in this press release, in FMC’s other filings with the SEC, and in presentations, reports or letters to FMC stockholders.

In some cases, FMC has identified these forward-looking statements by such words or phrases as “outlook”, "will likely result," "is confident that," "expect," "expects," "should," "could," "may," "will continue to," "believe," "believes," "anticipates," "predicts," "forecasts," "estimates,"

Page 4 / FMC Corporation Board of Directors appoints Pierre Brondeau chairman and chief executive officer

"projects," "potential," "intends" or similar expressions identifying "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including the negative of those words or phrases. Such forward-looking statements are based on our current views and assumptions regarding future events, future business conditions and the outlook for the company based on currently available information. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These statements are qualified by reference to the risk factors included in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Form 10-K"), the section captioned "Forward-Looking Information" in Part II of the 2023 Form 10-K and to similar risk factors and cautionary statements in all other reports and forms filed with the Securities and Exchange Commission ("SEC"). We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Forward-looking statements are qualified in their entirety by the above cautionary statement.

We specifically decline to undertake any obligation, and specifically disclaims any duty, to publicly update or revise any forward-looking statements that have been made to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as may be required by law.

(1)Second quarter 2024 revenue and earnings guidance ranges provided in the FMC May 6, 2024 earnings release.

# # #

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC