UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

Annual Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

(Mark One)

☑ Annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934 (No Fee Required)

For the fiscal year ended December 31, 2023

OR

☐ Transition report pursuant to Section 15(d) of the Securities Exchange Act of 1934 (No Fee Required)

For the transition period from ___to ___

Commission file number 001-00035

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

GE RETIREMENT SAVINGS PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

General Electric Company

1 Neumann Way

Evendale, OH 45215

GE RETIREMENT SAVINGS PLAN

Financial Statements and Supplemental Schedule

December 31, 2023 and 2022

(With Report of Independent Registered Public Accounting Firm Thereon)

GE RETIREMENT SAVINGS PLAN

December 31, 2023 and 2022

Table of Contents

| | | | | |

| Page

Number(s) |

| |

| Report of Independent Registered Public Accounting Firm | 3 - 4 |

| |

| Financial Statements: | |

Statements of Net Assets Available for Plan Benefits

as of December 31, 2023 and 2022 | 5 |

| |

Statement of Changes in Net Assets Available for Plan Benefits

for the Year Ended December 31, 2023 | 6 |

| |

| Notes to Financial Statements | 7 - 16 |

| |

Supplemental Schedule: | |

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

as of December 31, 2023 | 17 |

Note: All other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and the Audit Committee of General Electric Company

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of the GE Retirement Savings Plan (the "Plan") as of December 31, 2023 and 2022, the related statement of changes in net assets available for plan benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for plan benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedule

The supplemental schedule of assets (held at end of year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

| | |

| /s/ DELOITTE & TOUCHE LLP |

| Boston, Massachusetts |

| June 11, 2024 |

| We have served as the auditor of the Plan since 2022. |

GE RETIREMENT SAVINGS PLAN

Statements of Net Assets Available for Plan Benefits

December 31, 2023 and 2022

(in thousands)

| | | | | | | | | | | |

| 2023 | | 2022 |

Assets: | | | |

| | | |

Investments at fair value (notes 4 and 5) | $ | 19,183,904 | | | $ | 24,369,083 | |

Notes receivable from participants | 166,159 | | | 206,809 | |

Employer contribution receivable (note 1) | 133,554 | | | 197,524 | |

Accrued dividends and interest | 1,448 | | | 8,008 | |

Other assets | 6,824 | | | 12,951 | |

Total assets | 19,491,889 | | | 24,794,375 | |

| | | |

| | | |

Liabilities: | | | |

| | | |

Other liabilities | 6,086 | | | 13,281 | |

Total liabilities | 6,086 | | | 13,281 | |

| | | |

Net assets available for plan benefits | $ | 19,485,803 | | | $ | 24,781,094 | |

See accompanying notes to financial statements.

GE RETIREMENT SAVINGS PLAN

Statement of Changes in Net Assets Available for Plan Benefits

Year Ended December 31, 2023

(in thousands)

| | | | | | | |

| | | |

Additions to net assets attributed to: | | | |

Investment income: | | | |

Net appreciation in fair value of investments | $ | 3,553,881 | | | |

Interest and dividend income | 261,406 | | | |

| 3,815,287 | | | |

| | | |

Interest on notes receivable from participants | 6,272 | | | |

| | | |

Contributions: | | | |

Employee cash contributions | 508,430 | | | |

| Employee non-cash contributions | 24,356 | | | |

| Employee rollovers from other qualified plans | 77,463 | | | |

| Employer cash contributions | 280,992 | | | |

Employer non-cash contributions | 8,623 | | | |

| 899,864 | | | |

| | | |

Total additions | 4,721,423 | | | |

| | | |

Deductions from net assets attributed to: | | | |

Participant withdrawals | 1,568,205 | | | |

Administrative expenses | 1,477 | | | |

Total deductions | 1,569,682 | | | |

| | | |

Net increase before asset transfers | 3,151,741 | | | |

| | | |

Transfers to other qualified plans (note 3) | (8,447,032) | | | |

| | | |

Net decrease after asset transfers | (5,295,291) | | | |

|

| | |

Net assets available for plan benefits at: |

| | |

Beginning of year | 24,781,094 | | | |

End of year | $ | 19,485,803 | | | |

See accompanying notes to financial statements.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

(1) Description of the Plan

The GE Retirement Savings Plan (the “Plan”) is a defined contribution plan sponsored by General Electric Company, operating as GE Aerospace (the “Company”).

The Plan is subject to applicable provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The assets of the Plan are held in and invested through the GE Retirement Savings Trust (the “Trust”).

Fidelity Workplace Services, LLC is the Plan’s recordkeeper. The Plan Trustees have appointed Fidelity Management Trust Company (“FMTC”) as the directed Trustee of the Trust.

SSGA Funds Management, Inc. (“SSGA FM”), an affiliate of State Street Corporation (“SSC”) is the investment advisor to three of the Plan’s investment options. State Street Global Advisors Trust Company (“SSGA TC”, and together with SSGA FM, "SSGA"), also affiliated with SSC, is the investment advisor to two of the Plan’s investment options as of December 31, 2023.

Mercer Trust Company LLC and its affiliate, Mercer Investments LLC (formerly, Mercer Investment Management, Inc.) are the manager and investment advisor, respectively, for the Mercer GE International Equity Fund.

BlackRock Institutional Trust Company, N.A. (“BlackRock”) is the investment advisor to six of the Plan’s investment options, which include passively managed funds in equity and fixed income classes (collectively referred to herein as the “Index Funds”). BlackRock is the manager to the Plan’s suite of ten Target Retirement Date Funds.

The description of the Plan is provided for general information purposes only. The complete terms of the Plan are provided in the GE Retirement Savings Plan document (the “Plan Document”). Plan information including benefits, investment options, vesting provisions and effects of plan termination is also included in Plan handbooks and other material distributed to participants.

Employee Contributions and Investment Options

Eligible employees of the Company and participating affiliates may participate in the Plan by investing up to 30% of their eligible earnings in one or more of the offered investment options.

As of December 31, 2023, the Plan's investments include:

•Separate accounts: the General Electric Common Stock Fund (the “GE Stock Fund”), the GE HealthCare Stock Fund, and Target Retirement Date Funds (“TRD Fund”). The separate accounts invest in corporate stocks and collective funds.

•Registered investment companies: the SSGA Income Fund (the “Income Fund”), the SSGA US Core Equity Fund (the “U.S. Equity Fund”) and the SSGA Small-cap Equity Fund (the Small-Cap Fund”).

•Collective funds: various index funds, the State Street Custom Short-Term Interest Non-Lending Series Fund (the “ST Interest Fund”), the State Street Custom Government Reserves Non-Lending Series Fund (the “Government Reserve Fund”), and the Mercer GE International Equity Fund.

Collectively, these investments are referred to herein as the "Funds".

The GE HealthCare Stock Fund was added to the Plan as a result of the spin-off of GE HealthCare. Participants invested in the GE Stock Fund at the time of the spin-off, automatically received units in the GE HealthCare Stock Fund. The GE HealthCare Stock Fund was fully liquidated in January 2024.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

As of December 31, 2022 the Plan also invested in the GE RSP Short-Term Interest Fund and the GE RSP Government Money Market Fund. These funds were separate accounts that invested in a variety of investment-grade debt securities such as U.S. government securities, asset-backed securities, corporate bonds and money market instruments. The Plan liquidated its holdings in these investments in 2023 and these investment options were replaced by the ST Interest Fund and Government Reserve Fund discussed above.

The Plan permits participants to invest compensation on which income taxes have and have not been paid (“after-tax” and “pre-tax”, respectively). The U.S. Internal Revenue Code (“IRC”) limits the amount of pre-tax contributions that can be made each year. The limit for participants under age 50 was generally $22,500 in 2023 and $20,500 in 2022. For participants who were at least age 50 during the year, the limit was generally $30,000 in 2023 and $27,000 in 2022. The Plan also permits participants to make Roth contributions, which are combined with pre-tax contributions for purposes of these limits.

Participants may switch their investment balances (including rebalancing) up to 12 times each quarter. Restrictions on such switches include certain restrictions on a participant’s ability to engage in frequent trading in response to Securities and Exchange Commission requirements governing mutual funds.

Employer Contributions

The Plan generally provides for employer matching contributions of 50% of employees’ contributions of up to 8% of their earnings, that is, a 4% maximum matching contribution.

Certain eligible employees on salaried benefits (whose first day of work is on or after January 1, 2011) and certain eligible employees on production benefits (whose first day of work is on or after January 1, 2012) also receive a Company Retirement Contribution generally equal to 3% of their earnings, irrespective of any employee contributions. In addition, effective January 1, 2021, participants whose benefit under the GE Pension Plan is frozen also receive the Company Retirement Contribution. The Company Retirement Contribution is credited annually (generally in the following January) for employees on salaried benefits, and each pay period for employees on production benefits. Those employees on production benefits may also be eligible for an Additional Company Retirement Contribution (“ACRC”) per year credited in the following January. For the 2023 plan year, the Company funded in January 2024 total Company Retirement Contributions of $128.2 million and ACRCs of $5.4 million. For the 2022 plan year, the Company funded in January 2023 total Company Retirement Contributions of $154.0 million and ACRCs of $5.1 million. Hereinafter, the Company Retirement Contribution and the ACRC shall be referred to collectively as “Company Retirement Contributions” (“CRCs”). The CRCs are in addition to the employer matching contribution. A participant who does not have a regular investment election on file will be electing to invest the CRCs in the TRD Fund consistent with the participant’s age.

In addition, certain employees whose benefit under the GE Pension Plan is frozen are eligible to receive an additional 2% Transition Credit for the 2021 and 2022 plan years. For the 2022 plan year, eligible participants' accounts were credited in January 2023 with Transition Credits of $38.5 million.

Newly hired non-union employees who are eligible for CRCs and who have not made an affirmative election regarding the amount (if any) of their own savings are automatically enrolled as electing to contribute 8% of eligible pay as pre-tax contributions. This election entitles these employees to the maximum 4% matching contribution. A participant who does not have a regular investment election on file will be electing to invest these contributions in the TRD Fund consistent with the participant’s age. These elections can be changed at any time before or after the employee is automatically enrolled.

Newly hired union employees who are eligible for CRCs and who have not made an affirmative election regarding the amount (if any) of their own savings are automatically enrolled as electing to contribute 2% of eligible pay as pre-tax contributions. This election entitles these employees to a 1% matching contribution. A participant who does not have

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

a regular investment election on file will be electing to invest these contributions in the TRD Fund consistent with the participant’s age. These elections can be changed at any time before or after the employee is automatically enrolled.

Rollovers from Other Qualifying Plans

Subject to Company approval, participants may elect to rollover amounts from other qualifying plans or arrangements in accordance with the IRC.

Withdrawals

Subject to certain limitations prescribed by the Plan and the IRC, terminated participants may elect retirement or other termination withdrawals in either lump sum or partial payments. Employed participants may make regular withdrawals and certain hardship withdrawals from their participant accounts (except with respect to amounts attributable to any CRCs). There are no restrictions on the number and dollar amount of partial termination withdrawals and regular withdrawals, and the Plan allows for age 59 ½ and disability withdrawal options.

Notes Receivable from Participants

The Plan permits participants, under certain circumstances, to borrow a minimum of $500 from their participant accounts (except with respect to amounts attributable to any CRCs or any non-vested matching contributions, which are not available for loans). Subject to certain IRC and Plan limits, a participant may not borrow more than the lesser of 50% of that participant’s available account value, as defined in the Plan Document, or $50,000, adjusted for prior loans. The term of any loan is up to 4.5 years unless the loan is used to acquire a principal residence for which a term of up to 15 years may be permissible. The interest rate applicable to participant loans is based on the monthly average of the composite yield on corporate bonds, published by Moody’s Investors Service. The interest rates for new loans are fixed for the term of the loan.

Loans are repaid with interest in equal payments over the term of the loan by payroll deductions, personal check, or other such methods as may be required. Participants may repay the entire principal amount with written notice and without penalty. Partial prepayments in amounts not less than the regular repayment amount are permissible without penalty and without re-amortization of the remaining principal amount. A participant may have no more than two outstanding loans from the Plan at any time (subject to limited exceptions resulting from a plan merger).

In the event of a loan default, the amount of the outstanding balance will be reported to the Internal Revenue Service in the year of the default as ordinary income.

Participant Accounts

Each participant’s account is credited with the participant’s contributions and CRCs (as applicable) and allocation of (a) employer matching contributions and (b) investment results. The benefit to which a participant is entitled is the value of the participant’s vested account.

The costs of overnight delivery requests are charged to participants and former employees are charged quarterly account recordkeeping fees.

Vesting

Participants are fully vested in their employee contributions, employer matching contributions and related investment results. Participants receiving CRCs and related earnings generally become vested in those amounts once the participant completes three years of service. This same three year vesting requirement applies to employer matching contributions for employees on salaried benefits whose first day of work is on or after January 1, 2018.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

Forfeitures

During 2023, forfeitures of approximately $7.1 million were used to reduce employer contributions in accordance with the terms of the Plan.

Plan Termination and Amendment

Although the Company has not expressed any intent to do so, it has the right under the Plan, to the extent permitted by law, to terminate the Plan in accordance with the provisions of ERISA. If the Plan is terminated, each participant’s interest will be payable in full according to the Plan's provisions. The Company also has the right under the Plan, to the extent permitted by law, to amend or replace the Plan for any reason.

Administrative and Investment Advisory Costs

Administrative costs of the Plan and certain investment advisory costs are generally borne by the Company. For the registered investment companies, collective funds, and TRD Funds, investment advisors receive a management fee for providing investment advisory services. These management fees are reflected in interest and dividend income for the registered investment companies and in net appreciation (depreciation) in fair value of investments for the collective funds and TRD Funds on the statement of changes in net assets available for plan benefits.

(2) Summary of Significant Accounting Policies

(a) Basis of Accounting

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the Unites States of America ("US GAAP").

(b) Investments

Plan investments are reported at fair value. See notes 4 and 5 for additional information.

Investment transactions are recorded on a trade date basis. Dividends are recorded on the ex-dividend date. Interest income is earned from settlement date and recognized on the accrual basis. The net appreciation (depreciation) in the fair value of investments held at year end consists of the realized gains or losses on the sales of investments and the net unrealized appreciation (depreciation) of investments.

More detailed information regarding these financial instruments, as well as the strategies and policies for their use, is contained in the documents described above under “Employee Contributions and Investment Options” in note 1.

(c) Fair Value Measurements

For financial assets and liabilities, fair value is the price the Plan would receive to sell an asset or pay to transfer a liability in an orderly transaction with a market participant at the measurement date. In the absence of active markets for the identical assets and liabilities, such measurements involve developing assumptions based on market observable data and, in the absence of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs at the measurement date.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions. Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

Level 1 - Quoted prices for identical investments in active markets.

Level 2 - Quoted prices for similar investments in active markets; quoted prices for identical or similar investments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

The Company maintains policies and procedures to value investments using the best and most relevant data available. In addition, the Company retains independent pricing vendors to assist in valuing certain investments.

The following is a description of the valuation methodologies used for the investments measured at fair value. There have been no changes in methodologies used at December 31, 2023 and 2022.

•Common stock, registered investment companies and interest-bearing cash: as applicable, valued at the closing price reported on the active market on which the individual security is traded. They are included in level 1 investments.

•Collective funds: generally valued using the net asset value (“NAV”) per share as a practical expedient for fair value provided certain criteria are met. The NAVs are determined based on the fair values of the underlying investments of the funds. Investments that are measured at fair value using the NAV as a practical expedient are not classified in the fair value hierarchy.

•Short-term money market instruments: typically valued on the basis of amortized cost which approximates fair value and these are included in Level 2.

•Debt obligations, commercial mortgage-backed securities, corporate notes, and asset-backed securities: When quoted market prices are unobservable, pricing information is obtained from an independent pricing vendor. The pricing vendor uses various pricing models for each asset class that are consistent with what other market participants would use. The inputs and assumptions to the model of the pricing vendor are derived from market observable sources including: benchmark yields, reported trades, broker/dealer quotes, issuer spreads, benchmark securities, bids, offers, and other market-related data. Since many fixed income securities do not trade on a daily basis, the methodology of the pricing vendor uses available information as applicable such as benchmark curves, benchmarking of like securities, sector groupings, and matrix pricing. The pricing vendor considers available market observable inputs in determining the evaluation for a security. Thus, certain securities may not be priced using quoted prices, but rather determined from market observable information. These investments are included in Level 2.

(d) Notes Receivable from Participants

Loans to participants are recorded at the outstanding principal balance plus accrued interest.

(e) Participant Withdrawals

Participant withdrawals are recorded when paid. Included in participant withdrawals are GE common stock cash dividends paid to participants of approximately $0.4 million during 2023.

(f) Management Estimates and Assumptions

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

(3) Asset Transfers

Effective January 1, 2023 and a result of the separation of GE HealthCare, assets and liabilities of $8,447 million were transferred out of the Plan and into the GE HealthCare Retirement Savings Plan.

(4) Investments

A summary of the fair value of the Plan's investments at December 31, 2023 and 2022 follows.

| | | | | | | | | | | |

| 2023 | | 2022 |

| (in thousands) |

Common Stock: | | | |

GE Common Stock | $ | 2,148,440 | | | $ | 2,163,947 | |

GE HealthCare Common Stock | 336,971 | | | — | |

| $ | 2,485,411 | | | $ | 2,163,947 | |

| | | |

| | | |

| | | |

Registered Investment Companies: | | | |

SSGA Income Fund | 675,953 | | | 1,061,121 | |

SSGA US Core Equity Fund | 2,895,202 | | | 3,720,869 | |

SSGA Small-Cap Equity Fund | 647,968 | | | 943,059 | |

Total Registered Investment Companies | 4,219,123 | | | 5,725,049 | |

| | | |

Collective Funds:(a) | | | |

Non-U.S. Equity Index Fund | 1,757,351 | | | 2,351,959 | |

U.S. Aggregate Bond Index Fund | 1,447,160 | | | 1,934,502 | |

U.S. Large-Cap Equity Index Fund | 2,777,984 | | | 3,377,450 | |

U.S. Mid-Cap Equity Index Fund | 859,301 | | | 1,123,519 | |

U.S. Small-Cap Equity Index Fund | 683,892 | | | 827,758 | |

U.S. Treasury Inflation-Protected Securities Index Fund | 325,265 | | | 499,978 | |

Commodity Index Daily Fund | 45,753 | | | 63,628 | |

BlackRock Developed Real Estate Index Non-Lendable Fund | 196,744 | | | 259,747 | |

Russell 1000 Index Non-Lendable Fund | 2,452,495 | | | 3,120,347 | |

State Street Custom Government Reserves Fund | 1,158,958 | | | — | |

State Street Custom Short Term Interest Fund | 281,218 | | | — | |

Mercer GE International Equity Fund | 493,249 | | | 679,743 | |

Total Collective Funds | 12,479,370 | | | 14,238,631 | |

| | | |

Other Investments: | | | |

Interest Bearing Cash | — | | | 6,891 | |

Short-Term Money Market Instruments | — | | | 1,242,831 | |

U.S. Treasury and U.S. Government Agency Debt Obligations | — | | | 717,555 | |

Commercial Mortgage-Backed, Corporate Notes and Asset-Backed Securities | — | | | 274,179 | |

Total Other Investments | — | | | 2,241,456 | |

| | | |

Total investments at fair value | $ | 19,183,904 | | | $ | 24,369,083 | |

| | | |

(a) The Target Retirement Date Funds are separate accounts that invest in a combination of the Index Funds as well as the Commodity Index Daily Fund, BlackRock Developed Real Estate Index Non-Lendable Fund and the Russell 1000 Index Non-Lendable Fund (which are not otherwise offered as direct investment options in the Plan), representing a variety of asset classes.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

(5) Fair Value Measurements

The Plan's investments measured at fair value on a recurring basis at December 31, 2023 follow.

| | | | | | | | | | | | | | | | | | | |

| Level 1 | | Level 2 | | | | Total |

Investments | (in thousands)

|

| | | | | | | |

Common Stock | $ | 2,485,411 | | $ | — | | | | $ | 2,485,411 |

Registered Investment Companies | 4,219,123 | | — | | | | 4,219,123 |

| $ | 6,704,534 | | $ | — | | | | $ | 6,704,534 |

Investments measured at net asset value (a) | | | | | | | |

Collective Funds | | | | | | | 12,479,370 |

Total investments at fair value | | | | | | | $ | 19,183,904 |

| | | | | | | |

The Plan’s investments measured at fair value on a recurring basis at December 31, 2022 follow. |

| | | | | | | |

| Level 1 | | Level 2 | | | | Total |

Investments | (in thousands)

|

| | | | | | | |

Common Stock | $ | 2,163,947 | | $ | — | | | | $ | 2,163,947 |

Registered Investment Companies | 5,725,049 | | — | | | | 5,725,049 |

Other Investments: | | | | | | | |

Interest Bearing Cash | 6,891 | | — | | | | 6,891 |

Short-Term Money Market Instruments | — | | 1,242,831 | | | | 1,242,831 |

U.S. Treasury and U.S. Government Agency Debt Obligations | — | | 717,555 | | | | 717,555 |

Commercial Mortgage-Backed, Corporate Notes and | | | | | | | |

Asset-Backed Securities | — | | 274,179 | | | | 274,179 |

Total Other Investments | 6,891 | | 2,234,565 | | | | 2,241,456 |

| $ | 7,895,887 | | $ | 2,234,565 | | | | 10,130,452 |

Investments measured at net asset value (a) | | | | | | | |

Collective Funds | | | | | | | 14,238,631 |

Total investments at fair value | | | | | | | $ | 24,369,083 |

(a) The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statements of net assets available for plan benefits. Investments in collective funds are valued based on the year-end unit net asset value (“NAV”). The NAV is used as a practical expedient to estimate fair value. These investments are priced daily and there are no unfunded commitments or redemption restrictions associated with the funds.

(6) Risk and Uncertainties

The Plan offers a number of investment options including the GE Common Stock Fund and a variety of investment funds, consisting of registered investment companies and collective funds. The registered investment companies and collective funds invest in U.S. equities, international equities and fixed income securities. Investment securities in general, are exposed to various risks, such as interest rate, credit and overall market volatility risk. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur (including in the near term) and that such changes could materially affect participant account balances and amounts reported in the statements of net assets available for plan benefits.

The Plan’s exposure to a concentration of credit risk is limited by the opportunity to diversify investments across multiple participant-directed fund elections including active and passively managed funds covering multiple asset classes. Additionally, the investments within each participant-directed fund election are further diversified into varied financial instruments, with the exception of the GE Common Stock Fund and GE HealthCare Stock Fund which primarily invests in a single security.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

As of December 31, 2023 and 2022, the following investments represents more than 10% of the fair value of the Plan's total investments.

| | | | | | | | | | | |

| 2023 | | 2022 |

| (in thousands) |

| SSGA US Core Equity Fund | $ | 2,895,202 | | | $ | 3,720,869 | |

| U.S. Large-Cap Equity Index Fund | 2,777,984 | | 3,377,450 |

| Russell 1000 Index Non-Lendable Fund | 2,452,495 | | 3,120,347 |

| GE Common Stock | 2,148,440 | | ** |

| | | |

**Investment did not exceed more than 10% of the fair value of total investments.

(7) Related Party Transactions (Parties in Interest)

The Plan’s recordkeeper, trustee, investment advisors and custodians described in note 1, as well as the Company and Plan participants, are each a “party in interest” to the Plan as defined by ERISA. Parties in interest to the Plan are noted in the Schedule H, Line 4i - Schedule of Assets. Any fees paid by the Plan with respect to those or other transactions are described in the GE Retirement Savings Plan Supplemental Information document.

The Plan's investments included the GE Common Stock Fund as of December 31, 2023 and 2022 and the GE HealthCare Common Stock Fund as of December 31, 2023. The Plan purchased $106.7 million and $117.6 million and sold $1,447.8 million and $455.4 million of the GE Common Stock Fund, respectively, during each plan year. The Plan recorded dividend income for GE Common Stock of $6.2 million, for the year ended December 31, 2023. The Plan purchased $553.4 million and sold $144.3 million of the GE HealthCare Common Stock for the year ended December 31, 2023.

(8) Tax Status

In December 2016, the Internal Revenue Service ("IRS") began publishing a Required Amendments List ("IRS List") for individually designed plans which specifies changes in qualification requirements. The list is published annually and requires plans to be amended for each item on the list, as applicable, to retain its tax-exempt status.

The IRS has notified the Company by a letter dated April 23, 2024, that the Plan is qualified under the appropriate sections of the IRC and that the related trust is tax-exempt.

The portion of a participant’s compensation contributed to the Plan as a pre-tax contribution, the Company’s matching contribution CRCs and transition credits are not subject to Federal income tax when such contributions are credited to participant accounts, subject to certain limitations. These amounts and any investment results may be included in the participant’s gross taxable income for the year in which such amounts are withdrawn from the Plan.

(9) Amendments

Effective July 1, 2023, the Plan was amended to reflect changes related to collective bargaining and certain provisions of the SECURE 2.0 Act of 2022.

(10) Subsequent Events

Subsequent events through June 11, 2024, the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

In January 2024, the GE HealthCare Stock Fund was liquidated by Newport Trust Company, the fund’s independent fiduciary. The proceeds from the liquidation were reinvested in the default investment option, which is a TRD Fund based on the participant’s age. Prior to the liquidation, participants were able to elect at any time to transfer out of the GE HealthCare Stock Fund and into other available investment options under the Plan.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

In April 2024, in connection with the spin-off of GE Vernova as an independent publicly traded company: approximately $7,520 million in assets and any related liabilities of the GE Retirement Savings Plan were transferred to the GE Vernova Retirement Savings Plan and assumed by GE Vernova; the Plan was renamed the GE Aerospace Retirement Savings Plan; and the GE Vernova Stock Fund was established. Participants who were invested in the GE Stock Fund at the time of the spin-off of GE Vernova received units of the new GE Vernova Stock Fund. The GE Vernova Stock Fund is closed to new investments (and has been since inception). The GE Vernova Stock Fund is managed by an independent fiduciary, Newport Trust Company, who is required to liquidate the GE Vernova Stock Fund as an investment option under the Plan as soon as practicable after the one-year anniversary of its establishment. A participant may elect at any time before the liquidation to transfer out of the GE Vernova Stock Fund and into other available investment options under the Plan. The proceeds from the liquidation of the GE Vernova Stock Fund will be credited to participants’ accounts. For each affected participant, the proceeds will be reinvested in the Plan’s default investment option, which is a TRD Fund based on their age.

Also effective April 2024, the GE Stock Fund is managed by an independent fiduciary, Newport Trust Company.

(11) Reconciliation of Financial Statements to Form 5500

Notes receivable from participants are classified as investments per Form 5500 instructions. In addition, any deemed distributions are not considered to be plan assets per Form 5500 and are excluded from notes receivable from participants. However, these distributions remain a plan asset for purposes of these financial statements until a distributable event occurs and they are offset against plan assets.

A reconciliation of investments per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

| | | | | | | | | | | |

| 2023 | | 2022 |

| (in thousands) |

| | | |

Total investments per financial statements | $ | 19,183,904 | | | $ | 24,369,083 | |

| | | |

Total notes receivable per financial statements | 166,159 | | | 206,809 | |

Deemed distributions | (6,420) | | | (7,544) | |

Total notes receivable per Form 5500 | 159,739 | | | 199,265 | |

| | | |

Total investments per Form 5500 | $ | 19,343,643 | | | $ | 24,568,348 | |

A reconciliation of total deductions from net assets per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

| | | | | | | |

| 2023 | | |

| (in thousands) | | |

| | | |

Total deductions from net assets per financial statements | $ | 1,569,682 | | | |

Deemed distributions offset against plan assets | (237) | | | |

New deemed distributions | (887) | | | |

Total expenses per Form 5500 | $ | 1,568,558 | | | |

A reconciliation of amounts per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

GE RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

| | | | | | | | | | | |

| 2023 | | 2022 |

| (in thousands) |

| | | |

Net assets available for plan benefits per the financial statements | $ | 19,485,803 | | | $ | 24,781,094 | |

Deemed distributions | (6,420) | | | (7,544) | |

Net assets available for plan benefits per the Form 5500 | $ | 19,479,383 | | | $ | 24,773,550 | |

| | | |

| 2023 | | |

| (in thousands) | | |

| | | |

Total net decrease after asset transfers per the financial statements | $ | (5,295,291) | | | |

Changes in deemed distributions | 1,124 | | | |

Total net loss per the Form 5500 | $ | (5,294,167) | | | |

| | | |

GE RETIREMENT SAVINGS PLAN

Employer Identification Number: 14-0689340

Plan Number: 334

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

As of December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | | | | | | Current Value* | |

| Corporate Stocks - Common | | | | | | | | |

| GE Common Stock | | | | | | | $ | 2,148,439,695 | | (b) |

| GE HealthCare Common Stock | | | | | | | 336,971,076 | | (b) |

| | | | | | | 2,485,410,771 | | |

| | | | | | | | |

| Registered Investment Companies | | | | | | | | |

| SSGA Income Fund | | | | | | | 675,953,555 | | (a),(b) |

| SSGA US Core Equity Fund | | | | | | | 2,895,201,690 | | (a),(b) |

| SSGA Small-Cap Equity Fund | | | | | | | 647,967,529 | | (a),(b) |

| Total Registered Investment Companies | | | | | | | 4,219,122,774 | | |

| | | | | | | | |

| Collective Funds | | | | | | | | |

| Non-U.S. Equity Index Fund | | | | | | | 1,757,351,045 | | (b) |

| U.S. Aggregate Bond Index Fund | | | | | | | 1,447,159,593 | | (b) |

| U.S. Large-Cap Equity Index Fund | | | | | | | 2,777,983,984 | | (b) |

| U.S. Mid-Cap Equity Index Fund | | | | | | | 859,301,135 | | (b) |

| U.S. Small-Cap Equity Index Fund | | | | | | | 683,892,188 | | (b) |

| U.S. Treasury Inflation-Protected Securities Index Fund | | | | | | | 325,264,604 | | (b) |

| Commodity Index Daily Fund | | | | | | | 45,754,048 | | (b) |

| BlackRock Developed Real Estate Index Non-Lendable Fund | | | | | | | 196,744,407 | | (b) |

| Russell 1000 Index Non-Lendable Fund | | | | | | | 2,452,495,011 | | (b) |

| Government Reserve Fund | | | | | | | 1,158,958,129 | | (a),(b) |

| ST Interest Fund | | | | | | | 281,217,709 | | (a),(b) |

| Mercer GE International Equity Fund | | | | | | | 493,248,638 | | (b) |

| Total Collective Funds | | | | | | | 12,479,370,491 | | |

| | | | | | | | |

| Total Investments | | | | | | | 19,183,904,036 | | |

| | | | | | | | |

| Notes Receivable from Participants | | Rate of Interest | | | Maturity | | | |

| | | | | | | | |

| Total Notes Receivable from Participants | | 2.70 - 9.78% | | | 1 month - 30 yrs. | | 159,739,441 | | (b)** |

| | | | | | | | |

| Total Assets (Held at End of Year) | | | | | | | $ | 19,343,643,477 | | |

| | | | | | | | |

| | | | | |

| |

Notes to Schedule of Assets: |

| |

(a) | Funds managed and administered by SSGA FM or SSGA TC. |

(b) | Represents a party in interest to the Plan. |

| |

| |

* | Cost omitted for participant directed investments. |

| ** | Includes grandfathered loans from plan mergers. Net of deemed loans. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | GE Retirement Savings Plan | |

| | | |

| | | |

| June 11, 2024 | | /s/ Robert Giglietti | |

| Date | | Robert Giglietti

Vice President - Chief Accounting Officer, Controller and Treasurer

Principal Accounting Officer | |

| | | | | | | | |

Exhibit Number | | Description of the Exhibit |

| | |

| | |

| | |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statements No. 333-194243 and 333-226398 on Form S-8 of our report dated June 11, 2024, relating to the financial statements and supplemental schedule of the GE Retirement Savings Plan, appearing in this Annual Report on Form 11-K of the GE Retirement Savings Plan for the year ended December 31, 2023.

| | |

| /s/ DELOITTE & TOUCHE LLP |

|

| Boston, Massachusetts |

| June 11, 2024 |

|

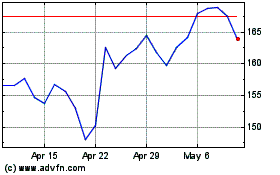

GE Aerospace (NYSE:GE)

Historical Stock Chart

From May 2024 to Jun 2024

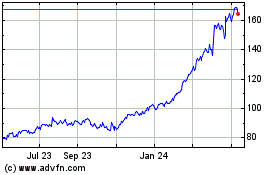

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Jun 2023 to Jun 2024