|

|

|

|

|

|

|

|

|

ETFMG TREATMENTS, TESTING AND ADVANCEMENTS ETF

ETF Trading Symbol: GERM

Listed on NYSE Arca, Inc.

Summary Prospectus

January 29, 2021

www.etfmgfunds.com

|

Before you invest, you may want to review the ETFMG Treatments, Testing and Advancements ETF (the “Fund”) prospectus and statement of additional information, which contain more information about the Fund and its risks. The current prospectus and statement of additional information dated January 29, 2021, are incorporated by reference into this Summary Prospectus. You can find the Fund’s prospectus, statement of additional information, reports to shareholders and other information about the Fund online at https://etfmg.com/funds/germ/. You can also get this information at no cost by calling 1-844-ETFMGRS (383-6477) or by sending an e-mail request to info@etfmg.com.

Investment Objective

The Fund seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Treatments, Testing and Advancements Index (the “Index”).

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy, hold, and sell shares of the Fund (“Shares”). This table and the Example below do not include the brokerage commissions and other fees to financial intermediaries that investors may pay on their purchases and sales of Shares.

|

|

|

|

|

|

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Management Fee

|

0.68

|

%

|

|

Distribution and Service (12b-1) Fees

|

None

|

|

Other Expenses*

|

0.00

|

%

|

|

Total Annual Fund Operating Expenses

|

0.68

|

%

|

* Based on estimated amounts for the current fiscal year.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based on these assumptions your cost would be:

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. For the fiscal period June 17, 2020 (commencement of operations) through September 30, 2020, the Fund’s portfolio turnover rate was 41% of the average value of its portfolio.

Principal Investment Strategies

The Fund uses a “passive” or indexing approach to try to achieve its investment objective. Unlike many investment companies, the Fund does not try to “beat” the Index and does not seek temporary defensive positions when markets decline or appear overvalued other than those indicated in the Index.

The Fund will use a replication strategy. A replication strategy is an indexing strategy that involves investing in the securities of the Index in approximately the same proportions as in the Index. However, the Fund may utilize a representative sampling strategy with respect to the Index when a replication strategy might be detrimental to shareholders, such as when there are practical difficulties or substantial costs involved in compiling a portfolio of equity securities to follow the Index, in instances in which a security in the Index becomes temporarily illiquid, unavailable or less liquid, or as a result of legal restrictions or limitations (such as tax diversification requirements) that apply to the Fund but not the Index. The Fund rebalances its portfolio in accordance with its Index, and, therefore, any changes to the Index’s rebalance schedule will result in corresponding changes to the Fund’s rebalance schedule.

The Fund invests at least 80% of its total assets, exclusive of collateral held from securities lending, in the component securities of the Index. The Fund may invest up to 20% of its total assets in securities that are not in the Fund’s Index to the extent that the Fund’s adviser believes such investments should help the Fund’s overall portfolio track the Index. The Fund may also invest in other investment companies that principally invest in the types of instruments allowed by the investment strategies of the Fund.

The Fund may lend its portfolio securities to brokers, dealers, and other financial organizations. These loans, if and when made, may not exceed 33 1/3% of the total asset value of the Fund (including the loan collateral). By lending its securities, the Fund may increase its income by receiving payments from the borrower.

Prime Treatments, Testing and Advancements Index

The Index tracks the performance of U.S.-listed equity securities or depositary receipts of companies that (i) perform research, development, and commercialization of treatments or vaccines for infectious diseases or (ii) engage in the research, development, manufacturing, and provision of biological tests for patients. Such companies are identified by Prime Indexes (the “Index Provider”), an independent index provider that is not affiliated with the Fund’s investment adviser, based on the rules of the Index.

The Index is comprised of two groups of companies, as described below: “Treatment Companies” and “Testing Companies”. “Treatment Companies” are companies that (i) have one or more vaccines or treatments for infectious diseases in pre-clinical research, in any phase of U.S. Food and Drug Administration clinical trials, or in a commercial stage and (ii) are classified by the North American Industry Classification System as either “Pharmaceutical and Medicine Manufacturing” or “Research and Development in the Physical, Engineering, and Life Sciences”. “Testing Companies” are companies that derive more than 50% of their revenue from the research, development, manufacturing, and provision of biological tests for patients.

To qualify for inclusion in the Index, Treatments Companies and Testing Companies must have an operating company structure (as opposed to being a pass-through security). To be added to the Index, Treatments Companies and Testing Companies must have a minimum market capitalization of US$100 million and an average daily value traded over the prior three month period of $250,000. Companies already included in the Index must have a minimum market capitalization of US$50 million.

The Index has a quarterly review in each March, June, September, and December, at which times the Index is reconstituted and rebalanced by the Index Provider. The composition of the Index and the constituent weights are determined on the two Thursdays before the second Friday of each March, June, September, and December (or the next business day if this is a non-business day). Component changes are made after the market close on the third Friday of each March, June, September, and December (or the next business day if the third Friday is not a business day) and become effective at the market opening on the next trading day.

The five largest constituents with a market capitalization under US$15 billion are each weighted at 6% (30% in the aggregate). The remaining constituents with a market capitalization under US$15 billion are weighted bases on their market capitalization subject to a 4% limit per security. Constituents with a market capitalization of US$15 billion or more will be equally weighted with an aggregate weighting of 10%.

The Index is developed and owned by Prime Indexes, and the Index is calculated and maintained by Solactive AG. The Index Provider is not affiliated with Solactive AG, the Fund, or the Fund’s investment adviser.

As of January 15, 2021, the Index had 28 components, and the five largest stocks and their weightings in the Index were Laboratory Corporation of America Holdings 6.17%, Bio Rad Laboratories Inc. 5.89%, Zai Lab Limited 5.71%, Quest Diagnostics Inc. 5.49%, and Adaptive Biotechnologies Corp. 4.92%.

The Fund will concentrate its investments (i.e., hold more than 25% of its net assets) in a particular industry or group of related industries to approximately the same extent that the Index is concentrated. As of January 15, 2021, the Index was concentrated in the following industries: Pharmaceutical and Medicine Manufacturing and Research and Development in the Physical, Engineering, and Life Sciences.

The Fund rebalances its portfolio in accordance with its Index, and, therefore, any changes to the Index’s rebalance schedule will result in corresponding changes to the Fund’s rebalance schedule.

Correlation: Correlation is the extent to which the values of different types of investments move in tandem with one another in response to changing economic and market conditions. An index is a theoretical financial calculation, while the Fund is an actual investment portfolio. The performance of the Fund and the Index may vary somewhat due to transaction costs, asset valuations, foreign currency valuations, market impact, corporate actions (such as mergers and spin-offs), legal restrictions or limitations, illiquid or unavailable securities, and timing variances.

The Fund’s investment adviser expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will exceed 95%. A correlation percentage of 100% would indicate perfect correlation. If the Fund uses a replication strategy, it can be expected to have greater correlation to the Index than if it uses a representative sampling strategy.

Principal Risks

As with all funds, a shareholder is subject to the risk that his or her investment could lose money. The principal risks affecting shareholders’ investments in the Fund are set forth below. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency.

Treatment Companies and Testing Companies Risk: Treatment Companies and Testing Companies are involved in discovering, developing and commercializing novel drugs or tests with significant market potential. These companies face challenges including pre‑clinical testing and clinical trial stages of development. Clinical trials may be delayed and certain programs may never advance in the clinic or may be more costly to conduct than anticipated. Such companies may be dependent on their ability to secure significant funding for research, development, and commercialization of therapeutics, vaccines, tests, and other health care products or services. If there are delays in obtaining required regulatory and marketing approvals for products, the ability of such companies to generate revenue may be materially impaired. If regulatory approval is obtained, products will still remain subject to regulatory scrutiny with regulatory authorities having the ability to impose significant restrictions on the indicated uses or marketing. Lastly, even if a licensed product is achieved, such companies may encounter difficulties in manufacturing, product release, shelf life, testing, storage, supply chain management, or shipping.

Equity Market Risk: The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific issuers, industries, or sectors in which the Fund invests such as political, market and economic developments, as well as events that impact specific issuers. Additionally, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or other events could result in increased premiums or discounts to the Fund’s NAV.

The remaining risks are presented in alphabetical order. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Concentration Risk: The Fund’s investments will be concentrated in an industry or group of industries to the extent the Index is so concentrated. To the extent the Fund invests more heavily in particular industries, groups of industries, or sectors of the economy, its performance will be especially sensitive to developments that significantly affect those industries, groups of industries, or sectors of the economy, and the value of Fund shares may rise and fall more than the value of shares that invest in securities of companies in a broader range of industries or sectors.

Depositary Receipts Risk: The Fund may invest in depositary receipts, including American Depositary Receipts (“ADRs”). ADRs are U.S. dollar-denominated receipts representing shares of foreign-based corporations. ADRs are issued by U.S. banks or trust companies, and entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares. Investment in ADRs may be less liquid than the underlying shares in their primary trading market.

ETF Risks:

Absence of an Active Market: Although the Fund’s shares are approved for listing on the NYSE Arca, Inc. (the “Exchange”), there can be no assurance that an active trading market will develop and be maintained for Fund shares. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Fund may experience greater tracking error to its Index than it otherwise would at higher asset levels or the Fund may ultimately liquidate.

Authorized Participants (“APs”), Market Makers, and Liquidity Providers Concentration: The Fund has a limited number of financial institutions that may act as APs. In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to net asset value (“NAV”) and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

Cash Transactions: While not likely, the Fund may effect its creations and redemptions primarily for cash, rather than in-kind securities. Paying redemption proceeds in cash rather than through in-kind delivery of portfolio securities may require the fund to dispose of or sell portfolio investments at an inopportune time to obtain the cash needed to distribute redemption proceeds. This may cause the Fund to incur certain costs such as brokerage costs, and to recognize gains or losses that it might not have incurred if it had made a redemption in-kind. As a result, the Fund may pay out higher or lower annual capital gains distributions than ETFs that redeem in-kind. In addition, the costs imposed on the Fund will decrease the Fund’s NAV unless the costs are offset by a transaction fee payable by an AP.

Costs of Buying or Selling Shares: Investors buying or selling Fund shares in the secondary market will pay brokerage commissions or other charges imposed by brokers as determined by that broker. Brokerage commissions are often a fixed amount and may be a significant proportional cost for investors seeking to buy or sell relatively small amounts of shares.

Fluctuation of NAV: The NAV of Fund shares will generally fluctuate with changes in the market value of the Fund’s securities holdings. The market prices of shares will generally fluctuate in accordance with changes in the Fund’s NAV and supply and demand of shares on the Exchange. It cannot be predicted whether Fund shares will trade below, at or above their NAV. During periods of unusual volatility or market disruptions, market prices of Fund shares may deviate significantly from the market value of the Fund’s securities holdings or the NAV of Fund shares. As a result, investors in the Fund may pay significantly more or receive significantly less for Fund shares than the value of the Fund’s underlying securities or the NAV of Fund shares.

Market Trading: An investment in the Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. Any of these factors, among others, may lead to the Fund’s shares trading at a premium or discount to NAV.

Trading Issues: Although Fund shares are listed for trading on the Exchange, there can be no assurance that an active trading market for such shares will develop or be maintained. Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of any Fund will continue to be met or will remain unchanged or that the shares will trade with any volume, or at all. Further, secondary markets may be subject to erratic trading activity, wide bid/ask spreads and extended trade settlement periods in times of market stress because market makers and Authorized Participants may step away from making a market in Fund shares and in executing creation and redemption orders, which could cause a material deviation in the Fund’s market price from its NAV.

Management Risk: While the Fund is not actively managed, the Fund is subject to the risks associated with decisions made by the Fund’s investment adviser if the Fund utilizes a representative sampling strategy or to the extent the Fund’s investment adviser makes decisions regarding the investment of collateral from securities on loan.

Models and Data Risk: The Index relies heavily on proprietary quantitative models as well as information and data supplied by third parties (“Models and Data”). When Models and Data prove to be incorrect or incomplete, any decisions by the Index made in reliance thereon expose the Fund to potential risks as the Fund tracks the Index.

Natural Disaster/Epidemic Risk: Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

New Fund Risk: The Fund is a recently organized, non-diversified management investment company with limited operating history. As a result, prospective investors have a limited track record or history on which to base their investment decision. There can be no assurance that the Fund will grow to or maintain an economically viable size.

Non-Diversification Risk: Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer or a small number of issuers than if it was a diversified fund. As a result, a decline in the value of an investment in a single issuer or a small number of issuers could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio. This may increase the Fund’s volatility and have a greater impact on the Fund’s performance.

Passive Investment Risk: The Fund is not actively managed and therefore would not sell an equity security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Index. Unlike with an actively managed fund, the Fund’s investment adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic

conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Rule 144A Securities Risk: Rule 144A securities are restricted securities that can be purchased only by “qualified institutional buyers,” as defined under the Securities Act. The market for Rule 144A securities typically is less active than the market for publicly-traded securities. As such, investing in Rule 144A securities may reduce the liquidity of the Fund’s investments, and the Fund may be unable to sell the security at the desired time or price, if at all. The purchase price and subsequent valuation of Rule 144A securities normally reflect a discount, which may be significant, from the market price of comparable unrestricted securities for which a liquid trading market exists. A restricted security that was liquid at the time of purchase may subsequently become illiquid and its value may decline as a result. In addition, transaction costs may be higher for restricted securities than for more liquid securities. The Fund may also have to bear the expense of registering the securities for resale and the risk of substantial delays in effecting the registration.

Securities Lending Risk: The Fund may engage in securities lending. The Fund may lose money if the borrower of the loaned securities delays returning in a timely manner or fails to return the loaned securities. Securities lending involves the risk that the Fund could lose money in the event of a decline in the value of collateral provided for loaned securities. In addition, the Fund bears the risk of loss in connection with its investment of the cash collateral it receives from a borrower. To the extent that the value or return of the Fund’s investment of the cash collateral declines below the amount owed to the borrower, the Fund may incur losses that exceed the amount it earned on lending the security.

Tracking Error Risk: The Fund’s return may not match or achieve a high degree of correlation with the return of the Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund sought to replicate the Index. In addition, in order to minimize the market impact of an Index rebalance, the Fund may begin trading to effect the rebalance in advance of the effective date of the rebalance and continue trading after the effective date of the rebalance, which may contribute to tracking error.

Performance Information

The Fund is new and therefore does not have performance history for a full calendar year. Once the Fund has completed a full calendar year of operations, a bar chart and table will be included that will provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s returns and comparing the Fund’s performance to a broad measure of market performance. Updated performance information is available at www.etfmg.com.

Investment Adviser

ETF Managers Group LLC (the “Adviser”) serves as the investment adviser to the Fund.

Portfolio Managers

Samuel R. Masucci, III, Chief Executive Officer of the Adviser, Frank Vallario, Chief Investment Officer of the Adviser, Donal Bishnoi, Portfolio Manager of the Adviser, and Devin Ryder, Portfolio Manager of the Adviser, have been the Fund’s portfolio managers since the Fund’s inception in 2020.

Purchase and Sale of Fund Shares

Shares are listed on the Exchange, and individual Shares may only be bought and sold in the secondary market through brokers at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

Each Fund issues and redeems Shares at NAV only in large blocks known as “Creation Units,” which only APs (typically, broker-dealers) may purchase or redeem. Each Fund generally issues and redeems Creation Units in exchange for a portfolio of securities (the “Deposit Securities”) and/or a designated amount of U.S. cash.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”). Recent information about the Funds, including its NAV, market price, premiums and discounts, and bid-ask spreads is available on the Fund’s website at www.etfmg.com.

Except when aggregated in Creation Units, the Fund’s shares are not redeemable securities.

Tax Information

The distributions made by the Fund are taxable, and will be taxed as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an IRA or other tax-advantaged account. However, subsequent withdrawals from such a tax-advantaged account may be subject to federal income tax. You should consult your tax advisor about your specific tax situation.

Financial Intermediary Compensation

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), the Adviser or its affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Fund shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

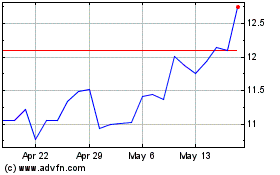

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

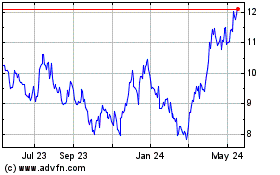

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Jul 2023 to Jul 2024