| |

|

|

ETFMG

Breakwave Sea

Decarbonization

Tech ETF |

|

| ASSETS |

|

|

|

|

| Investments in securities, at value* |

|

$ |

2,934,678 |

|

| Cash |

|

|

260 |

|

| Foreign Currency* |

|

|

3,067 |

|

| Receivables: |

|

|

|

|

| Dividends and interest receivable |

|

|

195 |

|

| Securities lending income receivable |

|

|

129 |

|

| Total Assets |

|

|

2,938,329 |

|

| |

|

|

|

|

| LIABILITIES |

|

|

|

|

| Collateral received for securities

loaned (Note 7) |

|

|

402,744 |

|

| Payables: |

|

|

|

|

| Management fees payable |

|

|

1,870 |

|

| Total Liabilities |

|

|

404,614 |

|

| Net Assets |

|

$ |

2,533,715 |

|

| |

|

|

|

|

| NET ASSETS CONSIST OF: |

|

|

|

|

| Paid-in capital |

|

$ |

2,539,138 |

|

| Total distributable earnings

(accumulated losses) |

|

|

(5,423 |

) |

| Net Assets |

|

$ |

2,533,715 |

|

| |

|

|

|

|

| |

|

|

|

|

| *Identified Cost: |

|

|

|

|

| Investments in securities |

|

$ |

3,002,952 |

|

| Foreign currency |

|

|

3,029 |

|

| |

|

|

3,005,981 |

|

| |

|

|

|

|

| Shares Outstanding^ |

|

|

100,000 |

|

| Net Asset Value, Offering and

Redemption Price per Share |

|

$ |

25.34 |

|

^ No par value, unlimited number of shares authorized

The accompanying notes are an integral part of these financial statements.

ETFMG Breakwave Sea Decarbonization Tech ETF

STATEMENT OF OPERATIONS

For the Period Ended December 31, 2021 (Unaudited)1

| |

|

ETFMG

Breakwave Sea

Decarbonization

Tech ETF |

|

| INVESTMENT INCOME |

|

|

|

|

| Income: |

|

|

|

|

| Dividends from unaffiliated securities (net of foreign

witholding tax of $276) |

|

$ |

1,929 |

|

| Interest |

|

|

31 |

|

| Securities lending income |

|

|

141 |

|

| Total Investment Income |

|

|

2,101 |

|

| |

|

|

|

|

| Expenses: |

|

|

|

|

| Management fees |

|

|

6,625 |

|

| Total Expenses |

|

|

6,625 |

|

| Net Investment Loss |

|

|

(4,524 |

) |

| |

|

|

|

|

| REALIZED & UNREALIZED GAIN

(LOSS) ON INVESTMENTS |

|

|

|

|

| Net Realized Gain (Loss) on: |

|

|

|

|

| Unaffiliated investments |

|

|

74,302 |

|

| Foreign Currency |

|

|

(982 |

) |

| Net Realized Gain on Investments and

In-Kind Redemptions |

|

|

73,320 |

|

| |

|

|

|

|

| Net Change in Unrealized

Appreciation/Depreciation of: |

|

|

|

|

| Unaffiliated investments |

|

|

(68,274 |

) |

| Foreign Currency |

|

|

38 |

|

| Net Change in Unrealized

Appreciation/Depreciation of Investments |

|

|

(68,236 |

) |

| Net Realized and Unrealized Gain on

Investments |

|

|

5,084 |

|

| NET INCREASE

IN NET ASSETS RESULTING FROM OPERATIONS |

|

$ |

560 |

|

|

1 |

The Fund commenced operations on September 20, 2021. |

The accompanying notes are an integral part of these financial statements.

ETFMG Breakwave Sea Decarbonization Tech ETF

STATEMENTS OF CHANGES IN NET ASSETS

| |

|

Period Ended

December 31,

2021

(Unaudited)1 |

|

| OPERATIONS |

|

|

|

|

| Net investment loss |

|

$ |

(4,524 |

) |

| Net realized gain on investments and In-Kind Redemptions |

|

|

73,320 |

|

| Net change in unrealized appreciation/depreciation of investments |

|

|

(68,236 |

) |

| Net increase in net assets resulting from operations |

|

|

560 |

|

| |

|

|

|

|

| DISTRIBUTIONS TO SHAREHOLDERS |

|

|

|

|

| Total Distributions to Shareholders |

|

|

(5,983 |

) |

| |

|

|

|

|

| CAPITAL SHARE TRANSACTIONS |

|

|

|

|

| Net increase in net assets derived from net change in outstanding shares |

|

|

2,539,138 |

|

| Net increase in net assets |

|

|

2,533,715 |

|

| |

|

|

|

|

| NET ASSETS |

|

|

|

|

| Beginning of Period |

|

|

— |

|

| End of Period |

|

$ |

2,533,715 |

|

Summary of share transactions is as follows:

| |

|

Period Ended

December 31, 2021 |

|

| |

|

Shares |

|

|

Amount |

|

| Shares Sold |

|

|

150,000 |

|

|

$ |

3,873,923 |

|

| Shares Redeemed |

|

|

(50,000 |

) |

|

|

(1,334,785 |

) |

| Net Transactions in Fund Shares |

|

|

100,000 |

|

|

$ |

2,539,138 |

|

| |

|

|

|

|

|

|

|

|

| Beginning Shares |

|

|

— |

|

|

|

|

|

| Ending Shares |

|

|

100,000 |

|

|

|

|

|

|

1 |

The Fund commenced operations on September 20, 2021. |

The accompanying notes are an integral part of these financial statements.

ETFMG Breakwave Sea Decarbonization Tech ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the period

| |

|

Period Ended

December 31, 2021

(Unaudited)1 |

| Net Asset Value, Beginning of Period |

|

|

$ |

25.00 |

|

| Income (Loss) from Investment Operations: |

|

|

|

|

|

| Net Investment Loss2 |

|

|

|

(0.04 |

) |

| Net realized and unrealized gain on investments |

|

|

|

0.44 |

|

| Total from investment operations |

|

|

|

0.40 |

|

| Less Distributions: |

|

|

|

|

|

| From net investment income |

|

|

|

(0.04 |

) |

| From net realized gains |

|

|

|

(0.02 |

) |

| Total distributions |

|

|

|

(0.06 |

) |

| Net asset value, end of period |

|

|

$ |

25.34 |

|

| Total Return |

|

|

|

1.59 |

% |

| |

|

|

|

|

|

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets at end of period (000’s) |

|

|

$ |

2,534 |

|

| Expenses to Average Net Assets |

|

|

|

0.75 |

% |

| Net Investment Income (Loss) to Average Net Assets |

|

|

|

-0.51 |

% |

| Portfolio Turnover Rate |

|

|

|

13 |

% |

|

1 |

The Fund commenced operations on September 20, 2021. |

|

2 |

Calculated based on average shares outstanding during the period. |

The accompanying notes are an integral part of these financial statements.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited)

NOTE 1 – ORGANIZATION

The ETFMG Breakwave Sea Decarbonization Tech ETF (the “Fund”) is a series of ETF Managers

Trust (the “Trust”), an open-end management investment company consisting of multiple investment series, organized as a Delaware statutory trust on July 1, 2009. The Trust is registered with the SEC under the Investment Company Act of 1940, as

amended (the “1940 Act”), as an open-end management investment company and the offering of the Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The investment objective of the Fund is capital

appreciation. The Fund seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Marine Money Decarbonization Index (“the Index”). The Fund commenced operations on September 20,

2021.

The Fund currently offers one class of shares, which has no front end sales load, no

deferred sales charges, and no redemption fees. The Fund may issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Fund have equal rights and privileges.

Shares of the Fund are listed and traded on the NYSE Arca, Inc. Market prices for the Shares may be different

from their net asset value (“NAV”). The Fund issues and redeems Shares on a continuous basis at NAV only in blocks of 25,000 shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a

specified Index. Once created, Shares generally trade in the secondary market at market prices that change throughout the day in quantities less than a Creation Unit. Except when aggregated in Creation Units, Shares are not redeemable securities of

the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participant”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous

Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor

have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the Shares directly from the Fund. Rather, most retail investors may purchase Shares in the secondary market with the assistance of a broker and

are subject to customary brokerage commissions or fees.

Authorized Participants transacting in Creation Units for cash may pay an additional variable charge to

compensate the relevant Fund for certain transaction costs (i.e., brokerage costs) and market impact expenses relating to investing in portfolio securities. Such variable charges, if any, are included in “Transaction Fees” in the Statements of

Changes in Net Assets.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the

Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards

Board Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

The Fund may invest in certain other investment companies (underlying funds). For specific

investments in underlying funds, please refer to the complete schedule of portfolio holdings on Form N-CSR for this reporting period, which is filed with the U.S. Securities and Exchange Commission (“SEC”). For more information about the underlying

Fund’s operations and policies, please refer to those fund’s semiannual and annual reports, which are filed with the SEC.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

|

A. |

Security Valuation. Securities listed on a securities exchange, market or automated quotation system

for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they

are traded on the valuation date (or at approximately 4:00 pm Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used.

Securities for which quotations are not readily available are valued at their

respective fair values as determined in good faith by the Board of Trustees (the “Board”). When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various

factors set forth in the pricing procedures adopted by the Fund’s Board. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to

such considerations. As of December 31, 2021, did not hold any fair valued securities.

As described above, the Fund utilizes various methods to measure the fair value of its investments

on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

| |

Level 1 |

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| |

Level 2 |

Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly.

These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| |

Level 3 |

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own

assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is

affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent

that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for

instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In

such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

The following table presents a summary of the Fund’s investments in securities, at

fair value, as of December 31, 2021:

ETFMG Breakwave Sea Decarbonization Tech ETF

| Assets^ |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

| Common Stocks |

|

$ |

2,518,530 |

|

$ |

— |

|

$ |

— |

|

$ |

2,518,530 |

|

| Short-Term Investments |

|

|

13,404 |

|

|

— |

|

|

— |

|

|

13,404 |

|

| Investments Purchased with Securities Lending Collateral* |

|

|

— |

|

|

— |

|

|

— |

|

|

402,744 |

|

| Total Investments in Securities |

|

$ |

2,531,934 |

|

$ |

— |

|

$ |

— |

|

$ |

2,934,678 |

|

^ For further information regarding security characteristics, see the Schedule of

Investments.

* Certain investments that are measured at fair value using the net asset value per share (or

its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Schedule of

Investments.

|

B. |

Federal Income Taxes. The Fund has elected to be taxed as a “regulated investment company” and intends to distribute

substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provisions for federal income taxes or excise taxes have

been made.

|

To avoid imposition of the excise tax applicable

to regulated investment companies, the Fund intends to declare each year as dividends, in each calendar year, at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the

twelve months ended October 31) plus undistributed amounts, if any, from prior years.

Net capital losses incurred after October 31,

within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year.

The Fund recognizes the tax benefits of uncertain

tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund has analyzed its tax position and has concluded that no liability for unrecognized tax benefits should be recorded

related to uncertain tax positions expected to be taken in the Fund’s 2021 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal, the State of New Jersey, and the State of Delaware; however, the Fund is not aware of any tax

positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

As of December 31, 2021, management has reviewed

the tax positions for open periods (for Federal purposes, three years from the date of filing and for state purposes, four years from the date of filing), as applicable to the Fund, and has determined that no provision for income tax is required in

the Fund’s financial statements.

|

C. |

Security Transactions and Investment Income. Investment securities transactions are

accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective

securities using the effective interest method. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Income, including gains, from investments in foreign securities received by the Fund may be

subject to income, withholding or other taxes imposed by foreign countries. |

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

|

D. |

Foreign Currency Translations and Transactions. The Fund may engage in foreign currency

transactions. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment

securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of

investment securities from the fluctuations arising from changes in the market prices of securities for unrealized gains and losses. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of

changes in foreign exchange rates on realized gains or losses from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences. |

|

E. |

Distributions to Shareholders. Distributions to shareholders from net investment income are

declared and paid for the Fund on a quarterly basis. Net realized gains on securities for the Fund normally are declared and paid on an annual basis. Distributions are recorded on the ex-dividend date. |

|

F. |

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the period. Actual results

could differ from those estimates. |

|

G. |

Share Valuation. The NAV per share of the Fund is calculated by dividing the sum of the

value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not

be priced on the days on which the NYSE is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share. |

|

H. |

Guarantees and Indemnifications. In the normal course of business, the Fund enters into

contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

However, based on experience, the Fund expects the risk of loss to be remote. |

NOTE 3 – RISK FACTORS

Investing in the ETFMG Breakwave Sea Decarbonization Tech ETF may involve certain risks, as

discussed in the Fund’s prospectus, including, but not limited to, those described below. Any of these risks could cause an investor to lose money.

Equity Market Risk. The equity securities held in the Fund’s portfolio may

experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific issuers, industries, or sectors in which the Fund invests

such as political, market and economic developments, as well as events that impact specific issuers.

Management Risk. While the Fund is not actively managed, the Fund is subject to the

risks associated with decisions made by the Fund’s investment adviser if the Fund utilizes a representative sampling strategy or to the extent the Fund’s investment adviser makes decisions regarding the investment of collateral from securities on

loan.

Market Trading Risk. An investment in the Fund faces numerous market trading risks,

including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. Any of these factors, among others, may lead to the

Fund’s shares trading at a premium or discount to NAV.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

Models and Data Risk. The Index relies heavily on proprietary models as well as

information and data supplied by third parties (“Models and Data”). When Models and Data prove to be incorrect or incomplete, any decisions by the Index made in reliance thereon expose the Fund to potential risks as the Fund tracks the Index.

Non-Diversification Risk. Because the Fund is “non-diversified,” it may invest a

greater percentage of its assets in the securities of a single issuer or a small number of issuers than if it was a diversified fund. As a result, a decline in the value of an investment in a single issuer or a small number of issuers could cause the

Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio. This may increase the Fund’s volatility and have a greater impact on the Fund’s performance.

Portfolio Turnover Risk. The portfolio managers may actively and frequently trade

securities or other instruments in the Fund’s portfolio to carry out its investment strategies. A high portfolio turnover rate increases transaction costs, which may increase the Fund’s expenses.

Sector Risk. To the extent the Fund invests more heavily in particular sectors of the

economy, its performance will be especially sensitive to developments that significantly affect those sectors.

Smaller Companies Risk. Smaller companies in which the Fund may invest may be more

vulnerable to adverse business or economic events than larger, more established companies, and may underperform other segments of the market or the equity market as a whole. The securities of smaller companies also tend to be bought and sold less

frequently and at significantly lower trading volumes than the securities of larger companies. As a result, it may be more difficult for the Fund to buy or sell a significant amount of the securities of a smaller company without an adverse impact on

the price of the company’s securities, or the Fund may have to sell such securities in smaller quantities over a longer period of time, which may increase the Fund’s tracking error.

Natural Disaster/Epidemic Risk. Natural or environmental disasters, such as

earthquakes, fires, floods, hurricanes, tsunamis and other severe weather related phenomena generally, and widespread disease, including pandemics and epidemics (for example, the novel coronavirus COVID-19), have been and can be highly disruptive to

economies and markets and have recently led, and may continue to lead, to increased market volatility and significant market losses. Such natural disaster and health crises could exacerbate political, social, and economic risks previously mentioned,

and result in significant breakdowns, delays, shutdowns, social isolation, and other disruptions to important global, local and regional supply chains affected, with potential corresponding results on the operating performance of the Fund and its

investments. A climate of uncertainty and panic, including the contagion of infectious viruses or diseases, may adversely affect global, regional, and local economies and reduce the availability of potential investment opportunities, and increases

the difficulty of performing due diligence and modeling market conditions, potentially reducing the accuracy of financial projections. Under these circumstances, the Fund may have difficulty achieving its investment objective which may adversely

impact performance. Further, such events can be highly disruptive to economies and markets, significantly disrupt the operations of individual companies (including, but not limited to, the Fund’s third party service providers), sectors, industries,

markets, securities and commodity exchanges, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. These factors can cause substantial market volatility,

exchange trading suspensions and closures and can impact the ability of the Fund to complete redemptions and otherwise affect Fund performance and Fund trading in the secondary market. A widespread crisis may also affect the global economy in ways

that cannot necessarily be foreseen at the current time. How long such events will last and whether they will continue or recur cannot be predicted. Impacts from these events could have significant impact on the Fund’s performance, resulting in

losses to the Fund.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

NOTE 4 – MANAGEMENT AND OTHER CONTRACTS

ETF Managers Group, LLC (the “Adviser”), serves as the investment Adviser to the Fund.

Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Fund, and the Adviser, the Adviser provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the

direction and control of the Board and the officers of the Trust.

Under the Investment Advisory Agreement with the Fund, the Adviser has overall

responsibility for the general management and administration of the Fund and arranges for sub-Advisory, transfer agency, custody, fund administration, securities lending, and all other non-distribution related services necessary for the Fund to

operate. The Adviser bears the costs of all Advisory and non-Advisory services required to operate the Fund, in exchange for a single unitary fee. For services provided the Fund pays the Adviser at an annual rate of 0.75% of the Fund’s average daily

net assets. The Adviser has an agreement with, and is dependent on, a third party to pay the Fund’s expenses in excess of 0.75% of the Fund’s average daily net assets. Additionally, under the Investment Advisory Agreement, the Adviser has agreed to

pay all expenses of the Fund, except for: the fee paid to the Adviser pursuant to the Investment Advisory Agreement, interest charges on any borrowings, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and

sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses (collectively, “Excluded Expenses”). The Adviser has entered into

an Agreement with its affiliate, ETFMG Financial, LLC, to serve as distributor the Fund (the “Distributor”). The Distributor provides marketing support for the Fund, including distributing marketing materials related to the Fund.

U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services (the

“Administrator”) provides fund accounting, fund administration, and transfer agency services to the Fund. The Adviser compensates the Administrator for these services under an administration agreement between the two entities.

The Adviser pays each independent Trustee a quarterly fee for service to the Fund. Each

Trustee is also reimbursed by the Adviser for all reasonable out-of-pocket expenses incurred in connection with their duties as Trustee, including travel and related expenses incurred in attending Board meetings.

NOTE 5 – DISTRIBUTION PLAN

The Fund has adopted a Plan of Distribution pursuant to Rule 12b-1 under the 1940 Act. Under

the Plan, the Fund may pay compensation to the Distributor or any other distributor or financial institution with which the Trust has an agreement with respect to the Fund, with the amount of such compensation not to exceed an annual rate of 0.25% of

the Fund’s daily average net assets. For the period ended December 31, 2021, the Fund did not incur any 12b-1 expenses.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

NOTE 6 - PURCHASES AND SALES OF SECURITIES

The costs of purchases and sales of securities, excluding short-term securities and in-kind

transactions, for the period ended December 31, 2021:

| |

|

Purchases |

|

Sales |

|

| ETFMG Breakwave Sea Decarbonization Tech ETF |

|

$ |

395,252 |

|

$ |

566,465 |

|

| |

|

|

|

|

|

|

|

The costs of purchases and sales of in-kind transactions associated with creations and

redemptions for the period ended December 31, 2021:

| |

|

Purchases

In-Kind |

|

Sales In-

Kind

|

|

| |

| ETFMG Breakwave Sea Decarbonization Tech ETF |

|

$ |

3,773,380 |

|

$ |

1,089,665 |

|

Purchases in-kind are the aggregate of all in-kind purchases and sales in-kind are the

aggregate of all in-kind sales. Net capital gains or losses resulting from in-kind redemptions are excluded from the Fund’s taxable gains and are not distributed to shareholders.

There were no purchases or sales of U.S. Government obligations for the period ended

December 31, 2021.

NOTE 7 — SECURITIES LENDING

The Fund may lend up to 33 1/3% of the value of the securities in its portfolio to brokers,

dealers and financial institutions (but not individuals) under terms of participation in a securities lending program administered by U.S. Bank N.A. (“the Custodian”). The securities lending agreement requires that loans are collateralized at all

times in an amount equal to at least 102% of the value of any loaned securities at the time of the loan, plus accrued interest. The Fund receives compensation in the form of fees and earn interest on the cash collateral. The amount of fees depends on

a number of factors including the type of security and length of the loan. The Fund continues to receive interest payments or dividends on the securities loaned during the borrowing period. Gain or loss in the fair value of securities loaned that may

occur during the term of the loan will be for the account of the Fund. The Fund has the right under the terms of the securities lending agreement to recall the securities from the borrower on demand. The cash collateral is invested by the Custodian

in accordance with approved investment guidelines. Those guidelines require the cash collateral to be invested in readily marketable, high quality, short-term obligations either directly on behalf of the Fund or through one or more joint accounts,

money market funds, or short-term bond funds, including those advised by or affiliated with the Adviser; however, such investments are subject to risk of payment delays or default on the part of the issuer or counterparty or otherwise may not

generate sufficient interest to support the costs associated with securities lending. Other investment companies, in which the Fund may invest cash collateral, can be expected to incur fees and expenses for operations, such as investment Advisory and

administration fees, which would be in addition to those incurred by the Fund, and which may be received in full or in part by the Adviser. Pursuant to guidance issued by the SEC staff, fees and expenses of money market funds used for cash collateral

received in connection with loans of securities are not treated as Acquired Fund Fees and Expenses, which reflect a fund’s pro rata share of the fees and expenses incurred by other investment companies in which the Fund invests (as disclosed in the

Prospectus, as applicable). The Fund could also experience delays in recovering its securities and possible loss of income or value if the borrower fails to return the borrowed securities, although the Fund is indemnified from this risk by contract

with the securities lending agent.

ETFMG Breakwave Sea Decarbonization Tech ETF

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 (Unaudited) (Continued)

As of December 31, 2021, the value of the securities on loan and payable for collateral due

to broker were as follows:

Value of Securities on Loan Collateral Received

| Fund |

|

Values of

Securities

on Loan |

|

|

Fund

Collateral

Received* |

|

| ETFMG Breakwave Sea Decarbonization Tech ETF |

|

$ |

390,711 |

|

|

$ |

402,744 |

|

* The cash collateral received was invested in the Mount Vernon Liquid Assets Portfolio, LLC,

an investment with an overnight and continuous maturity, as shown on the Schedule of Investments.

NOTE 8 – LEGAL MATTERS

The Adviser and its parent, ETFMG, were defendants in a case filed on October 26, 2017 in

the United States District Court for the Southern District of New York by NASDAQ, Inc. (“Nasdaq”) captioned Nasdaq, Inc. v. Exchange Traded Managers Group, LLC et al., Case 1:17-cv-08252 (the “New York Action”). This action asserted claims for breach

of contract, conversion and certain other claims based on disputes arising out of contractual relationships with the Adviser relating to certain series of the Trust. The matter was the subject of a bench trial in May 2019, and on December 20, 2019,

the Court issued an Opinion and Order awarding compensatory damages to Plaintiff in the amount of $78,403,172.36, plus prejudgment interest (the “Judgment”). In its decision, the Court in the New York Action stated that its damages award, which gave

rise to the Judgment, “includes the share of profits to which Nasdaq’s venture partner PureShares was entitled[.]”

ETFMG filed a Notice of Appeal from the Judgment in the United States Court of Appeals for

the Second Circuit on January 19, 2020, Docket No. 20-300. On October 28, 2021, Nasdaq and ETFMG entered into a Judgment Payment Agreement, which settled the matter and satisfied the Judgment. On November 1, 2021, Nasdaq recorded a Satisfaction of

Judgment with the United States District Court for the Southern District of New York reflecting that the Judgment was paid in full, and ETFMG withdrew its appeal of the Judgment with prejudice before the United States Court of Appeals for the Second

Circuit.

The Trust, the Adviser, and certain officers and affiliated persons of the Adviser have been

named as defendants in an action filed December 21, 2021, in the Superior Court of New Jersey, Union County, captioned PureShares, LLC, d/b/a PureFunds et al. v. ETF Managers Group, LLC et al., Docket No. UNN-C-152-21. This action asserts breach of

contract and tort claims arising from the same facts and circumstances, and relates to the same series of the Trust, that gave rise to the New York Action. The new action seeks damages in unspecified amounts and injunctive relief. The defendants

intend to vigorously defend themselves in this new action and believe that Plaintiffs’ claims overlap with, and are barred by, those claims previously asserted by Nasdaq (and resolved on PureShares’ behalf) in the New York Action that resulted in the

Judgment, which has been satisfied.

NOTE 9 – SUBSEQUENT EVENTS

In preparing these financial statements, the Fund has evaluated events and transactions for

potential recognition or disclosure through the date the financial statements were issued. Except as disclosed in Note 8, this evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments to the financial

statements.

ETFMG Breakwave Sea Decarbonization Tech ETF

APPROVAL OF ADVISORY AGREEMENT AND BOARD CONSIDERATIONS

For the Period Ended December 31, 2021 (Unaudited)

Pursuant to Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), at a

meeting held on August 24, 2021, the Board of Trustees (the “Board”) of ETF Managers Trust (the “Trust”) considered the approval of the Amended and Restated Investment Advisory Agreement (the “Agreement”) between ETF Managers Group LLC (the

“Adviser”) and the Trust, on behalf of ETFMG Breakwave Sea Decarbonization Tech ETF (the “New Fund”).

Pursuant to Section 15 of the 1940 Act, the Agreement must be approved by the vote of a

majority of the Trustees who are not parties to the Agreement or “interested persons” of any party thereto, as defined in the 1940 Act (the “Independent Trustees”), cast in person at a meeting called for the purpose of voting on such approval. In

preparation for such meeting, the Board requests and reviews a wide variety of information from the Adviser.

In reaching its decision, the Board, including the Independent Trustees, considered all

factors it believed relevant, including: (i) the nature, extent and quality of the services to be provided to the New Fund’s shareholders by the Adviser; (ii) comparative fee and expense data for the New Fund in relation to other similar investment

companies; (iii) the extent to which economies of scale may be realized as the New Fund grows and whether the proposed advisory fee for the New Fund reflects these expected economies of scale for the benefit of the New Fund; and (iv) other financial

benefits to the Adviser and its affiliates resulting from services to be rendered to the New Fund. The Board’s review included written and oral information furnished to the Board prior to and at the meeting held on August 24, 2021, and throughout the

year. Among other things, the Adviser provided responses to a detailed series of questions, which included information about the Adviser’s operations, service offerings, personnel, risk assessment and compliance programs and financial condition.

Representatives of the Adviser discussed the services to be provided to the New Fund, the rationale for launching the New Fund, the marketing strategy and the New Fund’s proposed fees in comparison to the fees of comparable investment companies. The

Board then discussed the written and oral information that it received before the meeting and throughout the year, and the Adviser’s oral presentation and any other information that the Board received at the meeting and deliberated on the approval of

the Agreement in light of this information.

The Independent Trustees were assisted throughout the contract review process by independent

legal counsel. The Independent Trustees relied upon the advice of such counsel and their own business judgment in determining the material factors to be considered in evaluating the approval of the Agreement, and the weight to be given to each such

factor. The conclusions reached with respect to the Agreement were based on a comprehensive evaluation of all the information provided and not any single factor. Moreover, each Trustee may have placed varying emphasis on particular factors in

reaching conclusions with respect to the New Fund. The matters discussed were also considered separately by the Independent Trustees in executive session with independent legal counsel, at which no representatives of management were present.

Nature, Extent and Quality of Services Provided.

The Trustees considered the scope of services to be provided under the Advisory Agreement,

noting that the Adviser would be providing investment advisory services to the New Fund. The Board discussed the responsibilities of the Adviser, including: the investment of the New Fund’s assets in accordance with its investment objective and

monitoring compliance with various fund policies and procedures and with applicable securities regulations, and arranging for transfer agency, custody, fund administration, and all other non-distribution related services necessary for the New Fund to

operate. In considering the nature, extent and quality of the services provided by the Adviser, the Board considered the quality of the Adviser’s compliance infrastructure and risk assessment capabilities; the marketing strategy for the New Fund and

the determination of the Trust’s Chief Compliance Officer that the Adviser has appropriate compliance policies and procedures in place that are reasonably designed to prevent violations of the Federal Securities laws. The Board also took into account

the significant investments that the Adviser has made in its business to help ensure the provision of high quality services to the New Fund, such as the hiring of trading, legal and compliance personnel, and enhancements to technology and related

systems. The Board also considered the Adviser’s experience managing ETFs, as well as the Adviser’s response to the market volatility and uncertainty during the recent pandemic.

ETFMG Breakwave Sea Decarbonization Tech ETF

APPROVAL OF ADVISORY AGREEMENT AND BOARD CONSIDERATIONS

For the Period Ended December 31, 2021 (Unaudited) (Continued)

Based on the factors above, as well as those discussed below, the Board concluded that it

was satisfied with the nature, extent and quality of the services to be provided to the New Fund by the Adviser.

Historical Performance.

The Board noted that the New Fund had not yet commenced operations and that therefore there

was no prior performance to review.

Cost of Services Provided, Fall-Out Benefits and Economies of Scale.

The Board reviewed the proposed investment advisory fee for the New Fund and compared it to

the total operating expenses of other funds in the industry falling within the same style category, or peer group, as the New Fund, as determined by the Adviser. The Board noted that the expense ratio for the New Fund was higher than the average and

median expense ratio for its peer ETFs. The Board took into consideration management’s discussion of the fees, including that there are limited true peers for the New Fund because of its niche strategies and certain differences between the strategies

of the New Fund and its peer funds.

The Board also noted the importance of the fact that the advisory fee for the New Fund was a

“unified fee,” meaning that the shareholders of the New Fund would pay no expenses other than the advisory fee, interest charges on any borrowings, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale

of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses (such as, among other things and subject to Board approval, certain proxy solicitation costs and non-standard

Board-related expenses and litigation against the Board, Trustees, New Fund, Adviser, and officers of the Adviser), and distribution (12b-1) fees and expenses (the “Excluded Expenses”). The Board also noted that the Adviser would be responsible for

compensating the New Fund’s other service providers and paying the New Fund’s other expenses out of its own fee and resources. The Board further noted that because the New Fund is new, it was difficult to estimate the profitability of the New Fund to

the Adviser. The Board, however, considered collateral or “fall-out” benefits that ETFMG and its affiliates may derive as a result of their relationship with the New Fund.

The Board noted that because the New Fund is new, it also was difficult to estimate whether

the New Fund would experience economies of scale. The Board noted that the Adviser will review expenses as the New Fund’s assets grow. The Board determined to evaluate economies of scale on an ongoing basis if the New Fund achieved asset growth.

In its deliberations, the Board did not identify any single piece of information discussed

above that was all-important, controlling or determinative of its decision. Based on the Board’s deliberations and its evaluation of the information described above, the Board, including the Independent Trustees, unanimously: (a) concluded that the

terms of the Agreement are fair and reasonable; (b) concluded that the Adviser’s fees are reasonable in light of the services that the Adviser will provide to the New Fund; and (c) approved the Agreement for an initial term of two years.

ETFMG Breakwave Sea Decarbonization Tech ETF

EXPENSE EXAMPLE

Period Ended December 31, 2021 (Unaudited)

As a shareholder of ETFMG Breakwave Sea Decarbonization Tech ETF (the “Fund”) you incur two

types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing

costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1,

2021 to December 31, 2021), except as noted in footnotes below.

Actual Expenses

The first line of the table provides information about actual account values based on actual

returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value

divided by $1,000 = 8.6), then, multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values based on

a hypothetical return and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used

to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5%

hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions

paid on purchases and sales of Fund shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transactional costs were

included, your costs would have been higher.

ETFMG Breakwave Sea Decarbonization Tech ETF

| |

|

Hypothetical

Account

Value

July 1,

2021 |

|

|

Beginning

Account

Value

September 20,

2021^ |

|

|

Ending

Account

Value

December 31,

2021 |

|

|

Expenses

Paid

During

the

Period^ |

|

|

Annualized

Expense

Ratio

During

Period |

|

| Actual |

|

|

N/A |

|

|

$ |

1,000.00 |

|

|

$ |

1,015.90 |

|

|

$ |

2.13 |

(1) |

|

|

0.75 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hypothetical

(5% annual) |

|

$ |

1,000.00 |

|

|

|

N/A |

|

|

$ |

1,021.42 |

|

|

$ |

3.82 |

(2) |

|

|

0.75 |

% |

|

(^) |

Fund commenced operations on September 20, 2021. |

|

(1) |

Actual expenses are calculated using the Fund’s annualized expense ratio multiplied by the average

account value during the period, multiplied by the number of days in the most recent inception period, 103 days, and divided by the number of days in the most recent twelve-month period, 365 days. |

|

(2) |

Hypothetical expenses are calculated using the Fund’s annualized expense ratio multiplied by the

average account value during the period, multiplied by the number of days in the most recent six-month period, 184 days, and divided by the number of days in the most recent twelve-month period, 365 days. |

ETFMG Breakwave Sea Decarbonization Tech ETF

SUPPLEMENTARY INFORMATION

December 31, 2021 (Unaudited)

NOTE 1 – FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

Information regarding how often shares of the Fund traded on the Exchange at a price above

(i.e., at a premium) or below (i.e., at a discount) the NAV is available on the Fund’s website at www.etfmgfunds.com.

NOTE 2 – INFORMATION ABOUT PORTFOLIO HOLDINGS

The Fund files a complete schedule of portfolio holdings with the SEC for its first and

third fiscal quarters on Part F of Form N-PORT. Once filed, the Fund’s Part F of Form N-PORT is available without change, upon request on the SEC’s website (www.sec.gov), the Fund’s website (www.etfmgfunds.com) and is available by calling (877)

756-7873. The Fund’s portfolio holdings are posted on the Fund’s website at www.etfmgfunds.com daily.

NOTE 3 – INFORMATION ABOUT PROXY VOTING

A description of the policies and procedures the Fund uses to determine how to vote proxies

relating to portfolio securities is provided in the Statement of Additional Information (“SAI”). The SAI is available without charge upon request by calling toll-free at 1-844-ETF-MGRS (1-844-383-6477), by accessing the SEC’s website at www.sec.gov,

or by accessing the Fund’s website at www.etfmgfunds.com.

Information regarding how the Fund voted proxies relating to portfolio securities during the

period ending June 30 is available by calling toll-free at 1-844-ETF-MGRS (1-844-383-6477), or by accessing the SEC’s website at www.sec.gov.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses

before investing. This and additional information can be found in the Fund’s prospectus, which may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477) or by visiting www.etfmgfunds.com. Read the prospectus carefully before investing.

ETFMG Breakwave Sea Decarbonization Tech ETF

Board of Trustees (Unaudited)

Set forth below are the names, birth years, positions with the Trust, length of term of

office, and the principal occupations and other directorships held during at least the last five years of each of the persons currently serving as a Trustee of the Trust, as well as information about each officer. The business address of each Trustee

and officer is 30 Maple Street, 2nd Floor, Summit, New Jersey 07901. The SAI includes additional information about Fund directors and is available, without charge, upon request by calling 1-844-ETF-MGRS (1-844-383-6477).

Name and

Year of

Birth |

Position(s)

Held with the

Trust, Term

of Office and

Length of

Time Served |

Principal Occupation(s)

During Past 5 Years |

Number of

Portfolios in

Fund

Complex

Overseen

By Trustee |

Other

Directorships

Held by

Trustee During

Past 5 Years |

| Interested Trustee and Officers |

Samuel

Masucci,

III (1962) |

Trustee,

Chairman of

the Board and

President

(since 2012);

Secretary

(since 2014) |

Chief Executive Officer, Exchange Traded Managers Group

LLC (since 2013); Chief Executive Officer, ETF Managers Group LLC (since 2016); Chief Executive Officer, ETF Managers Capital LLC (commodity pool operator) (since 2014); Chief Executive Officer (2012-2016) and Chief Compliance Officer (2012-

2014), Factor Advisors, LLC (investment adviser); President and Chief Executive Officer, Factor Capital Management LLC (2012- 2014) (commodity pool operator). |

20 |

None |

John A.

Flanagan,

(1946) |

Treasurer

(since 2015) |

President, John A. Flanagan CPA, LLC

(accounting services) (since 2010); Treasurer, ETF Managers Trust (since 2015); Chief Financial Officer, ETF Managers Capital, LLC (commodity pool operator) (since 2015). |

n/a |

n/a |

Reshma

A.

Tanczos

(1978) |

Chief

Compliance

Officer (since

2016) |

Chief Compliance Officer of ETFMG

Financial LLC (since 2017); Chief Compliance Officer, ETF Managers Group LLC (since 2016); Chief Compliance Officer, ETF Managers Capital LLC (since 2016); Partner, Crow & Cushing (law firm) (2007-2016). |

n/a |

n/a |

|

* |

Mr. Masucci is an interested Trustee by virtue of his role as the Chief Executive Officer of the Adviser. |

ETFMG Breakwave Sea Decarbonization Tech ETF

Board of Trustees (Unaudited) (Continued)

Name and

Year of

Birth |

Position(s)

Held with the

Trust, Term of

Office and

Length of

Time Served |

Principal Occupation(s)

During Past 5 Years |

Number of

Portfolios in

Fund

Complex

Overseen

By Trustee |

Other

Directorships

Held by

Trustee During

Past 5 Years |

Matthew

J.

Bromberg

(1973) |

Assistant

Secretary (since

2020) |

General Counsel and Secretary of

Exchange Traded Managers Group LLC (since 2020); ETF Managers Group LLC (since 2020); ETFMG Financial LLC (since 2020); ETF Managers Capital LLC (since 2020); Partner of Dorsey & Whitney LLP (law firm) (2019-2020); General Counsel of WBI

Investments, Inc. (2016-2019); Millington Securities, Inc. (2016-2019); and Partner of Reed Smith (law firm) (2015- 2016). |

n/a |

n/a |

| Independent Trustees |

Terry

Loebs

(1963) |

Trustee (since

2014); Lead

Independent

Trustee (since

2020) |

Founder and Managing Member, Pulsenomics

LLC (index product development and consulting firm) (since 2011); Managing Director, MacroMarkets, LLC (exchange-traded products firm) (2006-2011). |

20 |

None |

Eric

Wiegel

(1960) |

Trustee (since

2020) |

Senior Portfolio Manager, Little House

Capital (2019-present); Managing Partner, Global Focus Capital LLC (2013-present); Chief Investment Officer, Insight Financial Strategist LLC (2017- 2018). |

20 |

None |

Advisor

ETF Managers Group, LLC

30 Maple Street, Suite 2, Summit, NJ 07901

Distributor

ETFMG Financial LLC

30 Maple Street, Suite 2, Summit, NJ 07901

Custodian

U.S. Bank National Association

Custody Operations

1555 North River Center Drive, Suite 302, Milwaukee, Wisconsin 53212

Transfer Agent

U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services

615 East Michigan Street, Milwaukee, Wisconsin 53202

Securities Lending Agent

U.S. Bank, National Association

Securities Lending

800 Nicolet Mall

Minneapolis, MN 55402-7020

Independent Registered Public Accounting Firm

WithumSmith + Brown, PC

1411 Broadway, 9th Floor, New York, NY 10018

Legal Counsel

Sullivan & Worcester LLP

1666 K Street NW, Washington, DC 20006

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.

|

a)

|

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

|

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

|

(a)

|

The Registrant’s Principal Executive Officer and Principal Financial Officer/Treasurer have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”))

as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d 15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the

disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and

by the Registrant’s service provider.

|

|

(b)

|

There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably

likely to materially affect, the Registrant’s internal control over financial reporting.

|

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during

the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the

registrant’s independent public accountant for the period covered by this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) ETF Managers Trust

By (Signature and Title)* /s/ Samuel Masucci III

Samuel Masucci III, Principal Executive Officer

Date 3/10/22

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed

below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Samuel Masucci III

Samuel Masucci III, Principal Executive Officer

Date 3/10/22

By (Signature and Title)* /s/ John Flanagan

John Flanagan, Principal Financial Officer/Treasurer

Date 3/10/22

* Print the name and title of each signing officer under his or her signature.

Amplify Junior Silver Mi... (AMEX:SILJ)

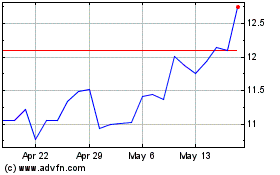

Historical Stock Chart

From Jun 2024 to Jul 2024

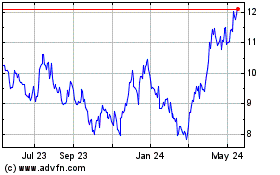

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Jul 2023 to Jul 2024