Are Stocks Waiting for Guidance? - Real Time Insight

10 July 2012 - 12:12AM

Zacks

Stocks seem to be at an interesting point.

Trading at 13X this year's expected EPS of about $103 on the

S&P 500, they are arguably cheap.

But they stay cheap because of the financial

crisis in Europe and slowing US economic data.

And here we are coming into 2Q earnings season

which is expected to hand us a not-altogether thrilling boost of 2%

from last year. And that's after 1Q gave us 9.2%

growth.

I think the stock market should be trading lower

since corporate profits (both the expectations for them and

their reality) have topped in a sluggish US economy, to say nothing

of Europe getting worse.

But here we are holding above the post-EU summit

gap up to S&P 1,348.

Other than bulls having some technical points in

their favor, are investors waiting to hear from a good chunk of

companies -- especially their forward guidance -- before hitting

the buy or sell buttons again?

I think the selling will resume if the guidance

from a few sectors cites global growth worries.

What will make the buyers come in? (other than a

big round of stimulus from China).

SPDR-DJ IND AVG (DIA): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHARS-BR 20+ (TLT): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

(VIX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

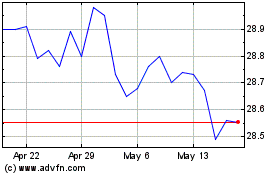

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Jun 2024 to Jul 2024

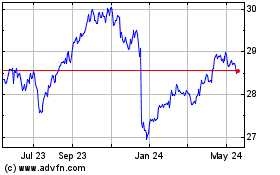

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Invesco DB US Dollar Index Bullish Fund (American Stock Exchange): 0 recent articles

More Powershares DB USD Index Bullish News Articles