JPMorgan: Bitcoin Is Undervalued; Says Fair Price Is 28% Higher

26 May 2022 - 3:08AM

NEWSBTC

Despite the crypto bear market, JPMorgan believes bitcoin is

grossly undervalued. The bank today repeated its appraisal of

bitcoin’s fair worth of $38,000, which it awarded the

cryptocurrency in February when it was trading around $43,400. This

is almost a 28% increase over the current price of $29,757.

JPMorgan Gives Nod To Crypto As Alternative Asset Class Cryptos

have surpassed real estate as one of the bank’s favored

“alternative assets” or assets that don’t fit into traditional

categories like equities and bonds, according to a note released on

Wednesday. It stated that it still believes $38,000 is a fair price

for bitcoin. That sum was 28% higher than bitcoin’s morning price

of $29k. The bank’s strategists, including Nikolaos Panigirtzoglou,

wrote in the note: “The past month’s crypto market correction looks

more like capitulation relative to last January/February and going

forward we see upside for bitcoin and crypto markets more

generally.” Related reading | Bitcoin Rejects Downside At $29k,

Here’s Why This Is Good However, JPMorgan warned that the steep

sell-off in Bitcoin and other cryptocurrencies has been more than

in other alternative investments such as private equity, private

debt, and real estate. As a result, the bank believes that “digital

assets” have greater opportunity for recovery than other

alternative assets. The report read: “We thus replace real estate

with digital assets as our preferred alternative asset class along

with hedge funds.” The rating represents a vote of confidence in

the broader cryptocurrency market and bitcoin, which is presently

selling at less than half of its all-time high of $68,721, The

cryptocurrency market is dealing with the $50 billion collapse of

algorithmic stablecoin TerraUSD and its sibling token LUNA, in

addition to rising interest rates and the consequences from the

crisis in Ukraine. The market capitalisation of all

cryptocurrencies is now $1.2 trillion, down from $3 trillion in

November. Total crypto market cap stands at $1.2 Trillion. Source:

TradingView Despite the sector’s increased appeal, JPMorgan has

reportedly altered Bitcoin and cryptocurrencies from a “overweight”

to a “underweight” rating, implying that the bank is now less

enthusiastic about the asset class and recommends a reduced

exposure in an investing portfolio. Related reading | TA: Bitcoin

Price Moves Higher In Range, $30.6K Still Presents Resistance

Featured image from iStock photo, chart from TradingView.com

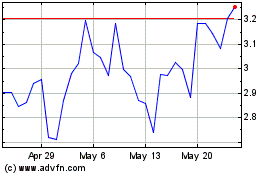

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about BOND (Cryptocurrency): 0 recent articles

More BOND News Articles