SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

March 30, 2020

Commission

File Number: 0-17601

BONSO

ELECTRONICS INTERNATIONAL INC.

(Exact

name of Registrant as specified in its charter)

British

Virgin Islands

(Jurisdiction

of incorporation or organization)

Unit

1404, 14/F, Cheuk Nang Centre,

9

Hillwood Road, Tsimshatsui

Kowloon,

Hong Kong

(Address

of principal executive offices)

Albert

So, Chief Financial Officer and Secretary

Tel:

(852) 2605-5822 Fax: (852) 2691-1724

Email:

albert@bonso.com

Unit

1404, 14/F, Cheuk Nang Centre,

9

Hillwood Road, Tsimshatsui

Kowloon,

Hong Kong

(Name,

Telephone, email and/or fax number and address of Company Contact Person)

[Indicate by check mark

whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.]

Form 20-F ___X__ Form

40-F ______

[Indicate

by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes _____ No ___X__

TABLE

OF CONTENTS

REPORT

FOR THE SIX-MONTH PERIOD ENDED SEPTEMBER 30, 2019 ON FORM 6-K

|

|

|

Page

|

|

Consolidated Financial Statements

|

|

3

|

|

Unaudited Consolidated Balance Sheets as of September 30, 2019 and Audited Consolidated

Balance Sheets as of March 31, 2019

|

|

3

|

|

Unaudited Consolidated Statements of Operations and Comprehensive Loss for the Six-Month

Periods Ended September 30, 2019, and September 30, 2018

|

|

4

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

5

|

|

Liquidity and Capital Resources

|

|

7

|

|

Stock Repurchase Program

|

|

7

|

|

Exhibits

|

|

7

|

|

Signature

|

|

8

|

99.1 Press Release disclosing

Results of Operations dated March 30, 2020.

Unaudited

Consolidated Balance Sheets

(Expressed

in United States Dollars)

|

|

|

March

31,

|

|

September

30,

|

|

|

|

2019

|

|

2019

|

|

|

|

$

in thousands

|

|

$

in thousands

|

|

|

|

(Audited)

|

|

(Unaudited)

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

7,527

|

|

|

|

6,999

|

|

|

Trade receivables, net

|

|

|

600

|

|

|

|

688

|

|

|

Other receivables, deposits and prepayments

|

|

|

1,341

|

|

|

|

1,525

|

|

|

Inventories, net

|

|

|

829

|

|

|

|

470

|

|

|

Income tax recoverable

|

|

|

5

|

|

|

|

5

|

|

|

Financial instruments

at fair value

|

|

|

102

|

|

|

|

1,025

|

|

|

Total current assets

|

|

|

10,404

|

|

|

|

10,712

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment in life settlement contracts

|

|

|

153

|

|

|

|

155

|

|

|

Other intangible assets

|

|

|

2,338

|

|

|

|

2,064

|

|

|

Property, plant and

equipment, net

|

|

|

9,591

|

|

|

|

8,749

|

|

|

Total

assets

|

|

|

22,486

|

|

|

|

21,680

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’

equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Bank loans - secured

|

|

|

445

|

|

|

|

1,338

|

|

|

Accounts payable

|

|

|

443

|

|

|

|

918

|

|

|

Contract liabilities

|

|

|

17

|

|

|

|

0

|

|

|

Accrued charges and deposits

|

|

|

3,168

|

|

|

|

3,088

|

|

|

Payable to affiliated party

|

|

|

54

|

|

|

|

0

|

|

|

Current portion of capital

lease obligations

|

|

|

28

|

|

|

|

18

|

|

|

Total current liabilities

|

|

|

4,155

|

|

|

|

5,362

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital lease obligations, net of current

portion

|

|

|

5

|

|

|

|

0

|

|

|

Long-term deposit received

|

|

|

692

|

|

|

|

592

|

|

|

Long-term loan

|

|

|

2,485

|

|

|

|

2,399

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

7,337

|

|

|

|

8,353

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock par value $0.003 per share

|

|

|

|

|

|

|

|

|

|

- authorized shares - 23,333,334

|

|

|

|

|

|

|

|

|

|

- issued shares: Mar 31, 2019 - 5,543,639; Sep 30, 2019 - 5,543,639

|

|

|

17

|

|

|

|

17

|

|

|

outstanding shares: Mar 31, 2019 - 4,670,773; Sep 30, 2019

- 4,644,920

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

22,474

|

|

|

|

22,474

|

|

|

Treasury stock at cost: Mar 31, 2019 - 872,866;

Sep 30, 2019 - 898,719

|

|

|

-2,773

|

|

|

|

-2,841

|

|

|

Accumulated deficit

|

|

|

-6,492

|

|

|

|

-7,080

|

|

|

Accumulated

other comprehensive income

|

|

|

1,923

|

|

|

|

757

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,149

|

|

|

|

13,327

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

and stockholders’ equity

|

|

|

22,486

|

|

|

|

21,680

|

|

Unaudited

Consolidated Statements of Operations and Comprehensive Income

(Expressed

in United States Dollars)

|

|

|

Six months ended

September 30, 2018

|

|

Six months ended

September 30, 2019

|

|

|

|

$ in thousands

|

|

$ in thousands

|

|

|

|

(unaudited)

|

|

(unaudited)

|

|

|

|

|

|

|

|

Net revenue

|

|

|

5,631

|

|

|

|

4,409

|

|

|

Cost of revenue

|

|

|

-3,602

|

|

|

|

-3,448

|

|

|

Gross profit

|

|

|

2,029

|

|

|

|

961

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

-2,099

|

|

|

|

-2,058

|

|

|

Other income, net

|

|

|

16

|

|

|

|

82

|

|

|

Loss from operations

|

|

|

-54

|

|

|

|

-1,015

|

|

|

Non-operating (expenses)

/ income, net

|

|

|

-34

|

|

|

|

427

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

-88

|

|

|

|

-588

|

|

|

Income tax expense

|

|

|

0

|

|

|

|

0

|

|

|

Net loss

|

|

|

-88

|

|

|

|

-588

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss, net of tax:

|

|

|

|

|

|

|

|

|

|

Foreign currency translation

adjustments, net of tax

|

|

|

-1,424

|

|

|

|

-1,166

|

|

|

Comprehensive loss

|

|

|

-1,512

|

|

|

|

-1,754

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings / (loss) per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

4,715,384

|

|

|

|

4,644,920

|

|

|

Diluted weighted average number of shares outstanding

|

|

|

4,715,384

|

|

|

|

4,644,920

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share (in U.S.Dollars)

|

|

|

-0.02

|

|

|

|

-0.13

|

|

|

Loss per common share

(in U.S.Dollars) - assuming dilution

|

|

|

-0.02

|

|

|

|

-0.13

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Overview

Bonso

Electronics designs, develops, manufactures, assembles and markets a comprehensive line of electronic scales, weighing instruments,

health care products and pet electronics products.

During

the six-month period ended September 30, 2019, our net revenue decreased approximately $1,222,000, or 21.7%, as compared to the

six-month period ended September 30, 2018. The primary reason for the decrease in net revenue was the decreased overall demand

for our electronic products during the period and a decline in rental income after the lease of our Shenzhen factory was terminated.

We recognized a net loss of approximately $588,000 for the six-month period ended September 30, 2019, as compared to a net loss

of approximately $88,000 during the six-month period ended September 30, 2018.

On

March 30, 2020, the Company issued a press release disclosing its results of operations for the six-month period ended September

30, 2019. A copy of this press release is attached to this Form 6-K as exhibit 99.1.

Results

of Operations

Six-Month

Period Ended September 30, 2019 Compared to the Six-Month Period Ended September 30, 2018

Net

Revenue. During the six-month period ended September 30, 2019, our net revenue decreased 21.7%, or approximately $1,222,000,

from approximately $5,631,000 for the six-month period ended September 30, 2018 to approximately $4,409,000. The decreased revenue

was primarily the result of a decrease in overall demand for our products and a decline in rental income after the lease of our

Shenzhen factory was terminated.

Cost

of Revenue. During the six-month period ended September 30, 2019, cost of revenue decreased to approximately $3,448,000 from

approximately $3,602,000 during the six-month period ended September 30, 2018, a decrease of approximately $154,000, or 4.3%.

As a percentage of revenue, the cost of revenue increased from 64.0% to 78.2%. The increase was primarily the result of the decline

in rental income during the six-month period ended September 30, 2019 after the lease of our Shenzhen factory was terminated,

while there were similar level of maintenance and depreciation costs for the Shenzhen factory in both periods.

Gross

Margin. As a result of the factors noted above, gross margin decreased by $1,068,000 from $2,029,000 in the six months ended

September 30, 2018 to $961,000 during the six months ended September 30, 2019. As a percentage of revenue, gross margin declined

to 21.8% during the six-month period ended September 30, 2019 as compared to 36.0% during the same period in the prior year.

Selling,

General and Administrative Expenses. Selling, general and administrative expenses decreased by 2.0%, or approximately $41,000,

from approximately $2,099,000 for the six-month period ended September 30, 2018 to approximately $2,058,000 for the six-month

period ended September 30, 2019. As a percentage of Net Revenue, selling, general and administrative expenses were 37.3% during

the six months ended September 30, 2018, compared to 46.7% for the six months ended September 30, 2019. The decrease of $41,000

was primarily the result of reduced salary and related costs during the six-month period ended September 30, 2019, compared to

the same period in the prior year.

Other

Income, Net. Other income, net increased approximately $66,000, or 412.5%, from approximately $16,000 for the six-month period

ended September 30, 2018 to approximately $82,000 for the six-month period ended September 30, 2019. The increase was a result

of increased gain from investment in marketable securities during the six-month period ended September 30, 2019.

Loss

From Operations. As a result of the above changes, the loss from operations was approximately $1,015,000 for the six-month

period ended September 30, 2019, compared to a loss from operations of approximately $54,000 for the six-month period ended September

30, 2018, an increase of approximately $961,000.

Non-operating

(Expenses) / Income, Net. Non-operating (expenses) / income, net increased from a loss of approximately $34,000 for the six-month

period ended September 30, 2018 to a gain of approximately $427,000 for the six-month period ended September 30, 2019. The increase

in net non-operating income was primarily the result of increased interest income and foreign exchange gain during the six-month

period ended September 30, 2019. The increase in interest income was the result of increased amounts on fixed deposit with banks

during the six-month period ended September 30, 2019.

Net

Loss. As a result of the above changes, net loss increased from a net loss of approximately $88,000 for the six-month period

ended September 30, 2018 to a net loss of approximately $588,000 for the six-month period ended September 30, 2019, an increase

of approximately $500,000.

Foreign

Currency Translation Adjustments, Net of Tax. Foreign currency translation adjustments, net of tax decreased from

a loss of approximately $1,424,000 for the six-month period ended September 30, 2018 to a loss of approximately $1,166,000 for

the six-month period ended September 30, 2019, a decrease of approximately $258,000. The loss was primarily attributable

to the result of the revaluation of assets denominated in Chinese Yuan (“CNY”) due to different CNY/USD exchange rates

at the balance sheet dates of March 31, 2019 and September 30, 2019.

Comprehensive

Loss. As a result of the factors described above, comprehensive loss increased from a loss of approximately $1,512,000

for the six-month period ended September 30, 2018, to a loss of approximately $1,754,000 for the six-month period ended September

30, 2019.

Liquidity

and Capital Resources

We

have financed our growth and cash needs to date primarily from internally generated funds and bank debt. We do not use off-balance

sheet financing arrangements, such as securitization of receivables or obtaining access to assets through special purpose entities,

as sources of liquidity. Our primary uses of cash have been to fund operations, expansions and upgrades of our manufacturing facilities.

As

of September 30, 2019, we had approximately $7,000,000 in cash and cash equivalents as compared to approximately $7,527,000 as

of March 31, 2019. At September 30, 2019, working capital was approximately $5,350,000, compared to approximately $6,249,000 at

March 31, 2019. The decrease was the result of loss generated from operations, during the six-month period ended September 30,

2019.

We

believe that our cash flows from operations, our current cash balance and funds available under our working capital and credit

facilities will be sufficient to meet our working capital needs and planned capital expenditures for the next twelve months.

Stock

Repurchase Program

The

following table contains the Company’s purchases of equity securities during the six-month period ended September 30, 2019.

|

Issuer

Purchases of Equity Securities

|

|

Period

|

|

(a)

Total Number of Shares (or Units) Purchased

|

|

(b)

Average Price Paid per Share (or Unit)

|

|

(c)

Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs

|

|

(d) Maximum

Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs

|

April 1, 2019 to

April

30, 2019

|

|

|

1,320

|

|

|

$

|

2.63

|

|

|

|

1,320

|

|

|

$

|

3,130,936

|

|

May 1, 2019 to

May 31, 2019

|

|

|

9,006

|

|

|

$

|

2.65

|

|

|

|

9,006

|

|

|

$

|

3,107,101

|

|

June 1, 2019 to

June 30, 2019

|

|

|

7,078

|

|

|

$

|

2.73

|

|

|

|

7,078

|

|

|

$

|

3,087,767

|

|

July 1, 2019 to

July 31, 2019

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

3,087,767

|

|

August 1, 2019 to

August 31, 2019

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

3,087,767

|

|

September 1, 2019 to

September 30,

2019

|

|

|

8,449

|

|

|

$

|

2.38

|

|

|

|

8,449

|

|

|

$

|

3,067,638

|

|

|

TOTAL

|

|

|

25,853

|

|

|

$

|

2.58

|

|

|

|

25,853

|

|

|

|

|

|

During the six-month period

ended September 30, 2019, the Company has purchased 25,853 shares of its common stock under the share repurchase program. As of

September 30, 2019, the Company (through its subsidiary) had repurchased an aggregate of 932,719 shares of its common stock. The

Company may from time to time repurchase additional shares of its Common Stock under this program.

Exhibits

99.1 Press

Release disclosing Results of Operations dated March 30, 2020.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

March

30, 2020

|

|

BONSO ELECTRONICS INTERNATIONAL,

INC.

(Registrant)

|

|

|

|

|

|

By:

|

/s/ Albert So

|

|

|

|

Albert So, Chief Financial Officer

and Secretary

|

Bonso Electronics (NASDAQ:BNSO)

Historical Stock Chart

From May 2024 to Jun 2024

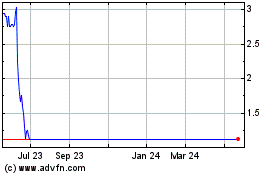

Bonso Electronics (NASDAQ:BNSO)

Historical Stock Chart

From Jun 2023 to Jun 2024