SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

|

(Amendment No. 1)*

|

| |

|

Charter Communications, Inc.

|

(Name of Issuer)

| |

|

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE

|

(Title of Class of Securities)

(CUSIP Number)

| |

|

Arthur R. Block, Esq.

Senior Vice President,

General Counsel and Secretary

Comcast Corporation

One Comcast Center

Philadelphia, Pennsylvania 19103-2838

(215) 286-1700

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

| |

|

Copy to:

David L. Caplan, Esq.

William J. Chudd, Esq.

Bruce K. Dallas, Esq.

Davis Polk & Wardwell

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

|

October 2, 2014

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

NOTE: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

|

*

|

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

(Continued on following pages)

|

(1)

|

Names of reporting persons

Comcast Corporation

|

|

(2)

|

Check the appropriate box if a member of a group

(a) o

(b) x

|

|

(3)

|

SEC use only

|

|

(4)

|

Source of funds

OO

|

|

(5)

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

o

|

|

(6)

|

Citizenship or place of organization

Pennsylvania

|

|

Number of shares beneficially owned by each reporting person with:

|

(7)

|

Sole voting power

0

|

| |

(8)

|

Shared voting power

27,755,422*

|

| |

(9)

|

Sole dispositive power

0

|

| |

(10)

|

Shared dispositive power

0

|

|

(11)

|

Aggregate amount beneficially owned by each reporting person

|

|

(12)

|

Check if the aggregate amount in Row (11) excludes certain shares

o

|

|

(13)

|

Percent of class represented by amount in Row (11)

25.5%**

|

|

(14)

|

Type of reporting person

CO

|

|

*

|

Excludes Liberty Media Corporation’s 1,083,296 warrants to purchase shares of Charter Communications, Inc.’s Class A Common Stock.

|

|

**

|

For purposes of calculating beneficial ownership of Comcast Corporation, the total number of shares of Charter Communications, Inc.’s Class A Common Stock outstanding is 108,644,877 as of June 30, 2014, as reported by Charter Communications, Inc. in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2014 filed with the Securities and Exchange Commission on July 31, 2014.

|

Item 1. Security and Issuer.

This Amendment No. 1 (this “Amendment No. 1”) amends and supplements the Schedule 13D initially filed with the Securities and Exchange Commission on May 5, 2014 (the “Original Schedule 13D”) by Comcast Corporation (“Comcast”) relating to the issued and outstanding shares of Class A Common Stock, par value $0.001 per share (the “Issuer Common Stock”), of Charter Communications, Inc., a Delaware corporation (the “Issuer”). Beginning on the date this Amendment No. 1 is filed, all references in the Original Schedule 13D to the Schedule 13D shall be deemed to refer to the Original Schedule 13D as amended by this Amendment No. 1. Only those items reported in this Amendment No. 1 are amended and all other items in the Original Schedule 13D are unchanged.

Item 3. Source and Amount of Funds or Other Consideration

Item 3 is hereby amended and restated by replacing the last paragraph thereof with the following text:

“On May 8, 2014, the Stockholder publicly announced that it would spin off certain of its assets, including its holdings of the Issuer Common Stock, into a separate publicly traded company, Liberty Broadband Corporation (“Liberty Broadband”). In connection with the announced spin off of Liberty Broadband (the “Liberty Spinoff”), Comcast, the Stockholder and Liberty Broadband entered into an agreement on October 2, 2014 (the “Assignment and Assumption Agreement”) pursuant to which, subject to the terms and conditions thereof, the Stockholder assigned all of its rights, benefits and obligations under the Voting Agreement to Liberty Broadband effective immediately prior to, and subject to the completion of, the Liberty Spinoff.

The descriptions of the Transactions Agreement, the Voting Agreement and the Assignment and Assumption Agreement contained herein are qualified in their entirety by reference to such agreements, which are attached hereto as Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 respectively and are incorporated herein by reference.”

Item 7. Material to be Filed as Exhibits.

The following documents are filed as exhibits:

|

Exhibit No.

|

|

Description

|

|

99.3

|

|

Assignment and Assumption Agreement dated as of October 2, 2014 among Comcast Corporation, Liberty Media Corporation and Liberty Broadband Corporation.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: October 10, 2014

|

Comcast Corporation

|

| |

|

|

By

|

/s/ Arthur R. Block |

| |

Name: Arthur R. Block

|

| |

Title: Senior Vice President, General Counsel and Secretary

|

EXHIBITS INDEX

|

Exhibit No.

|

|

Description

|

|

99.1*

|

|

Comcast/Charter Transactions Agreement dated as of April 25, 2014 between Comcast Corporation and Charter Communications, Inc. (incorporated by reference to Exhibit 2.1 of the Current Report on Form 8-K filed by Comcast Corporation on April 28, 2014).

|

|

99.2*

|

|

Voting Agreement dated as of April 25, 2014 between Comcast Corporation and Liberty Media Corporation (incorporated by reference to Exhibit 2.2 of the Current Report on Form 8-K filed by Comcast Corporation on April 28, 2014).

|

|

99.3

|

|

Assignment and Assumption Agreement dated as of October 2, 2014 among Comcast Corporation, Liberty Media Corporation and Liberty Broadband Corporation.

|

*Previously filed.

Exhibit 99.3

EXECUTION VERSION

ASSIGNMENT AND ASSUMPTION AGREEMENT

THIS ASSIGNMENT AND ASSUMPTION AGREEMENT, dated as of October 2, 2014 (this “Assignment”), is by and among Comcast Corporation, a Pennsylvania corporation (“Cobra”), Liberty Media Corporation, a Delaware corporation (the “Assignor”), and Liberty Broadband Corporation, a Delaware corporation (the “Assignee”). Capitalized terms used and not otherwise defined herein have the meanings given such terms in the Voting Agreement (as defined below).

RECITALS

WHEREAS, Cobra and Assignor are parties to that certain Voting Agreement, dated as of April 25, 2014 (the “Voting Agreement”);

WHEREAS, Assignee is a wholly owned subsidiary of Assignor as of the date hereof;

WHEREAS, Assignor has determined to engage in a transaction whereby all Cheetah Stock and Warrants beneficially owned by Assignor, together with certain other assets, will be contributed to Assignee (or a subsidiary of Assignee) and then all of the capital stock of Assignee will be distributed by means of a pro-rata dividend (the “Broadband Spin-Off”) to the holders of Assignor’s Series A common stock, Series B common stock and Series C common stock; and

WHEREAS, in accordance with Section 5.01 of the Voting Agreement, the parties desire to effect the assignment by Assignor and the assumption by Assignee of Assignor’s rights, benefits and obligations under the Voting Agreement in connection with the Broadband Spin-Off.

NOW, THEREFORE, in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1. Assignment and Assumption. Effective immediately prior to the Broadband Spin-Off (but subject to the consummation of the Broadband Spin-Off):

|

|

a.

|

Subject to Section 2 below, Assignor assigns all of its rights, benefits and obligations under the Voting Agreement to Assignee; and

|

|

|

b.

|

Assignee accepts such assignment of rights and benefits hereof and assumes and agrees to perform all obligations of Assignor under the Voting Agreement to be performed following the effective time of the Broadband Spin-Off.

|

Section 2. Acknowledgement. The parties hereby acknowledge and agree that, upon the effectiveness of the Broadband Spin-Off:

|

|

a.

|

Assignee shall be substituted for Assignor as the “Stockholder” under the Voting Agreement for all purposes thereunder and the term “Stockholder” as used in the Voting Agreement will thereafter be deemed to refer to Assignee; provided that, Assignor shall remain subject to, and bound by, Section 5.03 of the Voting Agreement as the “Stockholder” thereunder and the term “Stockholder” as used in Section 5.03 of the Voting Agreement will be deemed to refer to each of Assignor and Assignee (and references to the “Stockholder” in the definition of the term “Related Entity” in Section 3.06 of the Voting Agreement, as such term “Related Entity” is used in Section 5.03 of the Voting Agreement, shall be deemed to refer to each of Assignor (to the extent the term “Stockholder” as used in Section 5.03 of the Voting Agreement refers to Assignor) and Assignee (to the extent the term “Stockholder” as used in Section 5.03 of the Voting Agreement refers to Assignee)); provided further that, nothing herein shall release Assignor from any liability for breach of any provision of the Voting Agreement occurring prior to consummation of the Broadband Spin-Off; and

|

|

|

b.

|

Notice to the “Stockholder” in Section 7.02 of the Voting Agreement shall be made to:

|

if to Liberty Media Corporation, to:

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, CO 80112

|

Attention:

|

Richard N. Baer, Senior Vice President and General Counsel

|

| |

Pamela L. Coe, Senior Vice President, Deputy General Counsel and Secretary

|

|

Facsimile No.:

|

(720) 875-5382

|

|

Email:

|

legalnotices@libertymedia.com

|

with a copy (which shall not constitute notice) to:

Baker Botts L.L.P.

30 Rockefeller Plaza

New York, NY 10112

|

Attention:

|

Frederick H. McGrath

Renee L. Wilm

|

|

Facsimile No.:

|

(212) 259-2530

|

|

Email:

|

frederick.mcgrath@bakerbotts.com

renee.wilm@bakerbotts.com

|

if to Liberty Broadband Corporation, to:

Liberty Broadband Corporation

c/o Liberty Media Corporation

12300 Liberty Boulevard

Englewood, CO 80112

|

Attention:

|

Richard N. Baer, Senior Vice President and General Counsel

|

| |

Pamela L. Coe, Senior Vice President, Deputy General Counsel and Secretary

|

|

Facsimile No.:

|

(720) 875-5382

|

|

Email:

|

legalnotices@libertymedia.com

|

with a copy (which shall not constitute notice) to:

Baker Botts L.L.P.

30 Rockefeller Plaza

New York, NY 10112

|

Attention:

|

Frederick H. McGrath

|

| |

Renee L. Wilm

|

|

Facsimile No.:

|

(212) 259-2530

|

|

Email:

|

frederick.mcgrath@bakerbotts.com renee.wilm@bakerbotts.com

|

Section 3. Governing Law. This Assignment shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to the conflicts of law rules of such state.

Section 4. Counterparts; Effectiveness. This Assignment may be signed in any number of counterparts, each of which will be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. This Assignment will become effective when each party will have received a counterpart hereof signed by each other party. Until and unless each party has received a counterpart hereof signed by each other party, this Assignment will have no effect and no party will have any right or obligation hereunder (whether by virtue of any other oral or written agreement or other communication). Electronic or facsimile signatures shall be deemed to be original signatures.

Section 5. Exclusive Jurisdiction. The parties hereto agree that any suit, action or proceeding seeking to enforce any provision of, or based on any matter arising out of or in connection with, this Assignment or the transactions contemplated hereby (whether brought by any party or any of its affiliates or against any party or any of its affiliates) will be brought in the Delaware Chancery Court or, if such court shall not have jurisdiction, any federal court located in the State of Delaware or other Delaware state court, and each of the parties hereby irrevocably consents to the exclusive jurisdiction of such courts (and of the appropriate appellate courts therefrom) in any such suit, action or proceeding and irrevocably waives, to the fullest extent permitted by law, any objection that it may now or hereafter have to the laying of the

venue of any such suit, action or proceeding in any such court or that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum. Process in any such suit, action or proceeding may be served on any party anywhere in the world, whether within or without the jurisdiction of any such court. Without limiting the foregoing, each party agrees that service of process on such party as provided in Section 7.02 of the Voting Agreement shall be deemed effective service of process on such party.

Section 6. WAIVER OF JURY TRIAL. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS ASSIGNMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

[Signature page follows.]

IN WITNESS WHEREOF, the parties hereto have caused this Assignment to be duly executed as of the day and year first above written.

| |

COMCAST CORPORATION

|

| |

By:

|

/s/ Robert S. Pick

|

| |

|

Name:

|

Robert S. Pick

|

| |

|

Title

|

SVP

|

[Signature Page to Assignment and Assumption of Voting Agreement]

| |

LIBERTY MEDIA CORPORATION

|

| |

By:

|

/s/ Richard N. Baer

|

| |

|

Name:

|

Richard N. Baer

|

| |

|

Title

|

Senior Vice President and General Counsel

|

[Signature Page to Assignment and Assumption of Voting Agreement]

| |

LIBERTY BROADBAND CORPORATION

|

| |

By:

|

/s/ Richard N. Baer

|

| |

|

Name:

|

Richard N. Baer

|

| |

|

Title

|

Senior Vice President and General Counsel

|

[Signature Page to Assignment and Assumption of Voting Agreement]

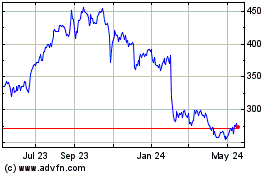

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

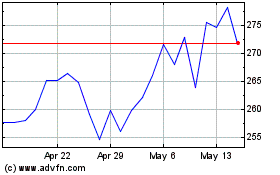

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024