Mogul John Malone Says Viacom Assets are 'Undervalued' Because of Ongoing Turmoil

08 July 2016 - 2:41AM

Dow Jones News

By Joe Flint

Sun Valley, IDAHO -- Cable mogul John Malone said Thursday that

beleaguered media giant Viacom Inc. has undervalued cable assets

and indicated he has no interest in investing in its Paramount

Pictures movie studio, which is trying to sell a minority

stake.

Mr. Malone, who as chairman of Liberty Media Corp. is one of

media's best-known deal-makers -- he orchestrated the recent merger

of Charter Communications Inc. and Time Warner Inc. -- is bullish

on television, but the movie business makes him nervous.

"Theatrical is a tough business and you can run hot and cold,"

he told reporters at Allen & Co.'s annual gathering of business

leaders in Sun Valley, Idaho. As for the opportunity to invest in

Paramount, "that would not be where I would go if it was my

decision," he said.

However, other Viacom properties such as its cable networks are

under-appreciated, he said. "They've got some great assets and

right at the moment because of the turmoil they're substantially

undervalued."

The turmoil he is referring to is the struggle for control of

Viacom, as the health of its controlling shareholder, 93-year-old

Sumner Redstone, declines. Viacom Inc. Chairman Philippe Dauman and

Mr. Redstone's daughter, Shari Redstone, are on opposite sides of a

legal battle that will determine the makeup of Viacom's board and

who will oversee Mr. Redstone's assets after he dies or is declared

incapacitated.

The drama has led to speculation that Viacom, which split with

CBS Corp. in 2006, might recombine with the broadcaster, uniting

Mr. Redstone's assets back under one roof. Mr. Malone declined to

speculate on that but did say CBS Chief Executive Leslie Moonves

"would do a terrific job if they wanted to go that way."

Meanwhile, Mr. Malone said the planned union of the movie and

television production company Lions Gate Entertainment Corp. and

the pay-TV channel Starz will give the combined firm more leverage

when it comes to making and acquiring content.

"This gives them the opportunity to be bigger, be a little more

aggressive in investing in content," said Mr. Malone, who is on the

board of Lionsgate and is Starz's largest voting shareholder. He

said both companies currently are "sub-scale in the space."

A vocal advocate of industry consolidation, both in distribution

and content, Mr. Malone said there are still more deals to be done

but not necessarily huge ones. As cable, satellite and telecom

companies combine, it is important for their suppliers, programmers

and content producers, to also have size and leverage, he says.

Write to Joe Flint at joe.flint@wsj.com

(END) Dow Jones Newswires

July 07, 2016 12:26 ET (16:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

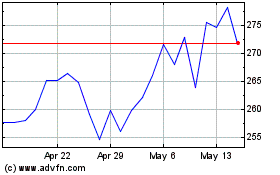

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

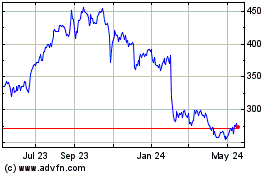

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024