The Logic and Potential Pitfalls of a Verizon-Charter Merger

27 January 2017 - 8:59AM

Dow Jones News

By Ryan Knutson and Shalini Ramachandran

Why would the nation's largest wireless carrier want to buy the

nation's second-largest cable company?

As it explores a potential merger with Charter Communications

Inc., Verizon Communications Inc. is signaling that the future of

wireless is in wires.

Unlike cellular networks built over the past three decades,

which rely on tall towers that can cover thousands of people over

miles, next-generation networks will be designed around large

numbers of antennas that cover only a few dozen people. Each of

those antennas needs a wire connecting it back to the internet.

Cable companies, which spent decades stringing wires deep inside

cities to deliver cable TV to homes, are particularly well suited

to supply those connections.

Densely penetrated high-speed wires are especially valuable for

5G, the next evolution in wireless network technology. Verizon,

with 114 million wireless customers, hopes its 5G technology will

enable the wireless delivery of gigabit-per-second speeds,

something currently only possible over wires.

Verizon has a fiber-optic network in nine northeastern states,

and acquiring Charter would greatly expand its footprint. Verizon

recently sold some of its wires in California, Florida and Texas,

but much of that network was made of copper, which isn't useful for

high speeds.

Verizon's interest is preliminary and it's unclear that a deal

will materialize, but a Charter acquisition would be hard for it to

swallow. Verizon has more than $100 billion of debt, and Charter

has about $60 billion. Analysts say the combined company would

likely face a downgrade of its credit rating, which would make

borrowing money more expensive.

Craig Moffett, an analyst at MoffettNathanson, said the debt

hurdle may be enough to prevent a deal from happening.

"Here's the challenge: First Verizon has to figure out how they

would pay for it, and then you would have to think about how you

can get it through the Federal Communications Commission and DOJ,"

he said. "I'm not sure it can make it through the first

hurdle."

The regulatory challenge is no small hurdle, either. Gene

Kimmelman, a former Justice Department antitrust official, said

these types of deals lead to fewer options for internet access and

"create enormous bottlenecks to the free flow of information on the

internet."

Other analysts were equally skeptical. In a note to clients,

Citigroup analysts wrote that the "strategic logic of

Verizon-Charter combination [is] far from compelling." The Citi

analysts believe large parts of Charter's network wouldn't be very

useful for 5G. "Bottom Line: We think it's very unlikely that

Verizon acquires Charter."

The combined company would have roughly 20 million pay-TV

subscribers, thus helping it negotiate better content deals. But

contracts with content providers expire over time so the savings

couldn't be immediately realized. J.P. Morgan analysts pegged

programming cost savings at just $300 million annually. It would

also be difficult for Verizon to realize much savings from

combining its wire-based Fios network with Charter's cables since

they're based on different technologies.

Meantime, Verizon's wireless business is under pressure from

surging rivals. Earlier this week, Verizon reported its third

consecutive quarterly sales decline after six years of growth.

Combing with Charter would also help diversify its revenue

stream.

A deal would further diverge Verizon and AT&T, rivals that

once behaved in near lockstep. Verizon would be close to matching

AT&T's large pay-TV customer base, but it would have a more

robust broadband network. AT&T's 2015 acquisition of DirecTV

didn't add broadband internet infrastructure. And AT&T has

placed a bet on content with its proposed purchase of Time Warner

Inc.

"While they might look vaguely similar on the surface, in

reality they're not remotely the same," Mr. Moffett said. Verizon's

"strategy would seemingly be in support of their wireless business

where AT&T's strategy would seem to be diversify away from

it."

A Verizon-Charter combination would be less about bundling cable

TV, internet and cellphone service into a single package, as

AT&T is doing with DirecTV. Verizon could sell bundles where it

has Fios, but it chooses not to because bundling usually leads to

discounting.

Verizon has also said it isn't interested in investing in the

legacy television business, and instead has been focused on

developing short-form mobile content that appeals to young people.

That mobile video strategy, which involved the launch of its go90

app, has been slow to take off. Verizon recently laid off more than

150 employees in its go90 unit.

(END) Dow Jones Newswires

January 26, 2017 16:44 ET (21:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

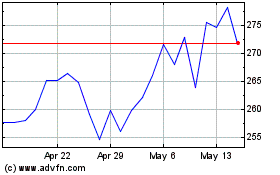

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

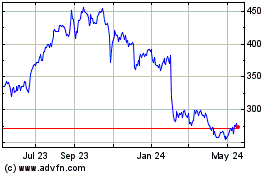

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024