MICROS Stays Neutral - Analyst Blog

26 April 2012 - 2:38AM

Zacks

We reiterate our Neutral recommendation on MICROS

Systems Inc. (MCRS). Even though a few important contract

wins dominated the overall performance of the company, its failure

to get rid of a few lingering downsides obstructed its exit from

the precarious zone.

The major highlights of the past quarter were the continued

winning and extension of projects. These included eminent patrons

such as Bertucci’s Italian Restaurant, Wynn

Resorts (WYNN), Ruby Tuesday (RT), etc.,

which averred their faith in the advanced solutions such as Table

Management System (TMS), Simphony Enterprise, etc. provided by

MICROS through the years.

Investors’ interests have been of utmost importance to

management under any condition. Currently, MICROS has a 2.2 million

share repurchase authorization that was announced in fiscal first

quarter 2012. With regard to this, the company bought back 500,000

shares for $46.05 per share during its second quarter, bringing the

total number of shares left to be acquired at 1.8 million.

As the company looks ahead, a few growth drivers keep management

prescient of a bolstered performance in 2012. Among these is the

software-as-a-service (SAAS) businesses which are looking favorable

at least for the time being. Moreover, the emerging economies,

especially from the Asia-Pacific region appear a haven for success

in the upcoming quarters.

Even with all these approbatory factors, the scenario does not

appear to be picture-perfect. Presence of competitors such as

NCR Corporation (NCR), Mentor Graphics

Corp. (MENT) and FARO Technologies Inc.

(FARO) pose major causes of concern for MICROS to retain its

position in the industry.

One factor to which we can ascribe the ongoing pervasive

detrimental effects on MICROS’ performance is the latest recession.

Customer expenditures have been badly hit and even though recovery

is on the way, the shaky European market continues to abate

revenues for the company as it traverses through 2012.

We had observed that the company had incurred nearly 51% of its

sales from international operations in its fiscal year 2011.

Furthermore, in its second quarter of fiscal 2012, MICROS’

international revenues accounted for about 57% of its gross sales.

This over-dependence on offshore markets can have adverse effects

on its own performance accruing from exchange rate instability.

We believe that MICROS needs to take a few more aggressive

stances to grapple with its downsides, thus allowing us to aver a

more affirmative rating on the long-term performance of its stock.

In the short run, we have a Zacks #3 Rank on the stock which

translates into a short-term Hold rating.

FARO TECH INC (FARO): Free Stock Analysis Report

MICROS SYS (MCRS): Free Stock Analysis Report

MENTOR GRAPHICS (MENT): Free Stock Analysis Report

NCR CORP-NEW (NCR): Free Stock Analysis Report

RUBY TUESDAY (RT): Free Stock Analysis Report

WYNN RESRTS LTD (WYNN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

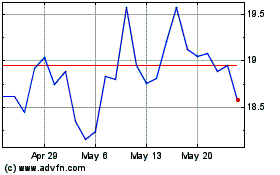

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jun 2024 to Jul 2024

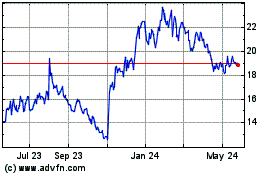

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jul 2023 to Jul 2024