Mutual Fund Summary Prospectus (497k)

31 July 2013 - 7:21AM

Edgar (US Regulatory)

SUMMARY PROSPECTUS

Rainier High Yield Fund – RAIHX/RIMYX

Institutional Shares/Original Shares

Before you invest,

you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information and other information about the Fund online at

http://www.rainierfunds.com/LiteratureAndForms/pages/LitandFormsInd.aspx

. You may also obtain this information at no cost by calling 1-800-248-6314. The Fund’s Prospectus and Statement of Additional Information, both dated July 31,

2013, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE

The Rainier High Yield Fund (the “High Yield Fund” or “Fund”) seeks to earn a high level of current income. Capital appreciation is a

secondary objective.

FEES AND EXPENSES OF THE FUND

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

Institutional

|

|

|

Original

|

|

|

Shareholder Fees

|

|

|

None

|

|

|

|

None

|

|

|

(fees paid directly from your investment)

|

|

|

|

|

|

|

|

|

|

Annual Fund Operating Expenses

|

|

|

|

|

|

|

|

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

Management Fees

|

|

|

0.55%

|

|

|

|

0.55%

|

|

|

Distribution and Service (12b-1) Fees

|

|

|

0.00%

|

|

|

|

0.25%

|

|

|

Other Expenses

|

|

|

0.23%

|

|

|

|

0.23%

|

|

|

|

|

|

Acquired Fund Fees and Expenses

(1)

|

|

|

0.01%

|

|

|

|

0.01%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.79%

|

|

|

|

1.04%

|

|

|

Fee Waiver and/or Expense Reimbursement

(2)

|

|

|

-0.13%

|

|

|

|

-0.13%

|

|

|

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

|

|

0.66%

|

|

|

|

0.91%

|

|

|

|

|

(1)

Acquired Fund Fees

and Expenses represent indirect expenses incurred by the Fund that result from investing in shares of one or more other investment companies. The operating expenses in this fee table will not correlate to the expense ratio in the Financial

Highlights, because the financial statements include only the direct operating expenses incurred by the Fund and not the indirect costs of investing in other investment companies.

(2)

Rainier has contractually agreed to reduce its fees

and/or pay Fund expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for shares of the Fund to 0.65% and 0.90% of the Fund’s average net assets of its Institutional and Original Shares,

respectively (the “Expense Caps”). This obligation excludes acquired fund fees and expenses, loads, taxes, interest, brokerage commissions, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as

litigation, and other expenses not incurred in the ordinary course of the Fund’s business. The Expense Caps will remain in effect until at least July 31, 2014. The Expense Caps may not be changed by Rainier during that period without prior

approval of the Board of Trustees. The obligation may be terminated at any time by the Board of Trustees upon written notice to Rainier, and will terminate if the Management Agreement is terminated.

EXAMPLE

This example is intended to help you

compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The example assumes that you invest

$10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking

into account the contractual expense limitation). Although your actual cost may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

Institutional

|

|

$

|

67

|

|

|

$

|

239

|

|

|

$

|

426

|

|

|

$

|

966

|

|

|

Original

|

|

$

|

93

|

|

|

$

|

318

|

|

|

$

|

561

|

|

|

$

|

1,259

|

|

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio

turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s

performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 32.74% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

In pursuing its goal, the Fund invests at least 80% of its assets in below investment grade bonds of corporate issuers. These “high yield” securities, also called “junk bonds,” will

generally be rated BB or lower by Standard & Poor’s Rating Group (“S&P”) or will be of equivalent quality rating from another Nationally Recognized Statistical Ratings Organization. If a bond is unrated, Rainier may

determine whether it is of comparable quality and therefore eligible for the Fund’s investment.

The Fund will purchase securities of

companies in any capitalization range – small, medium or large. The Fund’s principal investments include domestic corporate debt securities, structured notes including collateralized loan obligations, asset-backed securities,

mortgage-backed securities, foreign debt securities (including Yankees and emerging markets securities), fixed and floating rate bonds, as well as zero coupon bonds. There is no minimum quality rating for investments, and, as such, the Fund may

invest in securities that no longer make payments of interest or principal, including defaulted securities. The Fund intends

Rainier High Yield

Fund P / 1

to focus primarily on securities with credit ratings (or equivalent quality) between the range of BB and B of the high-yield market.

The Fund may also invest in private placements and “Rule 144A” securities, which are subject to resale restrictions. The Fund is permitted to invest up to 15% of its net assets in equity

securities such as common stock, preferred stock, warrants, rights and exchange-traded funds (“ETFs”). The Fund may also invest up to 20% of its assets in investment grade securities, including U.S. Treasury and

U.S. government agency securities. The Fund may invest up to 25% of its assets in foreign securities issues (including emerging markets), including those denominated in U.S. dollars.

The Fund may purchase bonds of any maturity, but the Fund will normally have a dollar-weighted average maturity between two and fifteen years. The average maturity may be less than two years if Rainier

believes a temporary defensive posture is appropriate. In addition, duration may be one of the characteristics considered in security selection, but the Fund does not focus on bonds with any particular duration. Duration is a measure of interest

rate risk using the expected life of a debt security that was developed to be a more precise alternative to the concept of “term to maturity.” Duration incorporates a bond’s yield, coupon interest payments, final maturity, call and

put features and prepayment exposure into one measure.

The Fund may sell a security if it achieves the valuation target or the underlying

fundamentals deteriorate compared to the portfolio manager’s expectations, or when swapped for a more attractive security.

PRINCIPAL INVESTMENT

RISKS

Since the Fund is invested in securities whose prices change daily, there is the risk that an investor could lose money. An

investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The following risks could affect the value of your investment:

|

•

|

|

High-Yield Risk – Below investment grade debt securities are speculative and involve a greater risk of default and price change due to changes in

the issuers’ creditworthiness. The market prices of these debt securities may fluctuate more than the market prices of investment grade debt securities and may decline significantly in periods of general economic difficulty.

|

|

•

|

|

Bond Risk – As with most debt funds, the income on and value of your shares in the Fund will fluctuate along with interest rates. When interest

rates rise, the market prices of the debt securities the Fund owns usually decline.

|

|

|

|

Generally, the longer the Fund’s average portfolio maturity and/or the lower the average quality of its portfolio, the greater the price fluctuation. The price of any security owned by the

Fund may also fall in response to events affecting the issuer of the security, such as events affecting its ability to continue to make principal and interest payments or maintain its credit rating. Bond risks also include liquidity risks,

mortgage-related and other asset-backed securities risks and prepayment risks.

|

|

•

|

|

Market Risk – The securities markets could decline or companies represented in the Fund may weaken or otherwise not meet market expectations. The

securities markets may be subject to significant volatility which may increase the risks associated with an investment in the Fund.

|

|

•

|

|

Equities Risk – Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value.

|

|

•

|

|

Management Risk – Like all managed funds, there is a risk that Rainier’s strategy for managing the Fund may not achieve the desired results

or may be less effective than other strategies in a particular market environment.

|

|

•

|

|

Foreign Securities and Emerging Markets Risks – Foreign securities and emerging markets involve additional risks, including political and economic

instability, nationalization, expropriation or confiscatory taxation, differences in financial reporting standards, less publicly available information, currency-rate fluctuations, less or more strict regulation of securities markets and less

liquidity and more volatility than domestic markets.

|

|

•

|

|

Unrated Securities Risk – Unrated securities may be less liquid than comparable rated securities and involve greater risks.

|

|

•

|

|

ETF Risk – ETFs have the risks of the investments they make and that they will not achieve their investment objectives. In addition, ETFs may be

less liquid and thus their share values more volatile than the values of the investments they hold. Fund assets invested in ETFs and other mutual funds incur a layering of expenses, including operating costs and advisory fees that you indirectly

bear as a shareholder in the Fund.

|

PERFORMANCE

The following performance information provides some indication of the risks of investing in the Fund. The bar chart below illustrates how the Fund’s total returns have varied from year to year. The

table below illustrates how the Fund’s average annual total returns for the

1-year

and since inception periods compare with a domestic high yield market index. The Fund’s performance before and after

Rainier High Yield

Fund P / 2

taxes is not necessarily an indication of how the Fund will perform in the future. Updated performance is available on Rainier’s website at www.rainierfunds.com.

RAINIER HIGH YIELD FUND – INSTITUTIONAL SHARES

CALENDAR-YEAR TOTAL RETURNS (%)

The year-to-date total return as of June 30, 2013 for the Rainier High Yield Fund Institutional Shares was 0.86%.

|

|

|

|

|

|

|

|

|

Best Quarter:

|

|

|

+6.82%

|

|

|

(third quarter, 2010)

|

|

Worst Quarter:

|

|

|

-3.89%

|

|

|

(third quarter, 2011)

|

AVERAGE ANNUAL TOTAL RETURNS

as of Dec. 31, 2012

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

Since

Inception

(1)

|

|

|

Rainier High Yield Fund

|

|

|

Return before taxes – Institutional Shares

|

|

|

13.13%

|

|

|

|

15.23%

|

|

|

Return after taxes on distributions – Institutional Shares

|

|

|

10.41%

|

|

|

|

11.95%

|

|

|

Return after taxes on distributions and sale of fund shares – Institutional Shares

|

|

|

8.73%

|

|

|

|

11.23%

|

|

|

Return before taxes – Original Shares

(2)

|

|

|

12.98%

|

|

|

|

14.98%

|

|

|

BofA Merrill Lynch U.S. High Yield Master II Index (reflects no deduction for fees, expenses or taxes)

|

|

|

15.58%

|

|

|

|

21.60%

|

|

|

BofA Merrill Lynch U.S. High Yield BB-B Rated Index (reflects no deduction for fees, expenses or taxes)

|

|

|

14.71%

|

|

|

|

18.67%

|

|

(1)

Institutional Shares

commenced operations on March 31, 2009. Original Shares commenced operations on July 31, 2012.

(2)

Performance of Original Shares for the period prior to the commencement of operations for Original Shares is based on the performance of the Institutional Shares adjusted for

the 12b-1 fee of the Original Shares.

After-tax returns are calculated using the historically highest individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may

differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts.

INVESTMENT ADVISER

Rainier

Investment Management, Inc.

PORTFOLIO MANAGERS

The Fund is team-managed by the Portfolio Managers listed below:

|

|

|

|

|

|

|

Name

|

|

Title

|

|

Managed the

Fund Since

|

|

Matthew R. Kennedy, CFA

|

|

Director of Fixed Income Management

|

|

Inception (2009)

|

|

James H. Hentges, CFA

|

|

Portfolio Manager

|

|

Inception (2009)

|

PURCHASE AND SALE OF FUND SHARES

You may purchase, exchange or redeem Fund shares on any day the New York Stock Exchange (“NYSE”) is open for regular session trading by written request via mail (Rainier Funds,

c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701 for regular mail, or 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202 for overnight service), by telephone at 1-800-248-6314 or through a

financial intermediary. You may also purchase or redeem Fund shares by wire transfer. The minimum initial investment amounts and subsequent minimum investment amounts for the Fund are shown below:

|

|

|

|

|

|

Class and

Type of Account

|

|

Minimum

Initial

Investment

|

|

Subsequent

Minimum

Investment

|

|

Original Shares

|

|

$2,500

|

|

$250

|

|

Institutional Shares

|

|

$100,000

|

|

$1,000

|

TAX INFORMATION

The Fund’s distributions are taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k)

plan or an individual retirement account. Tax-deferred accounts may be taxed later upon withdrawal from those accounts.

PAYMENTS TO BROKER-DEALERS

AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a

bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and shareholder services. These payments may create a conflict of interest by influencing the intermediary or your financial adviser to recommend the Fund

over another investment. Ask your financial adviser or visit your intermediary’s website for more information.

Rainier High Yield

Fund P / 3

RAINIER FUNDS

July 31, 2013

Summary Prospectus

|

|

|

|

|

|

|

|

|

Original

|

|

Institutional

|

|

Rainier High Yield Fund

|

|

RIMYX

|

|

RAIHX

|

As with all mutual funds,

the Securities and Exchange Commission does not approve or disapprove of these shares or determine whether the information in this Prospectus is truthful or complete. It is a criminal offense for anyone to state otherwise.

RA-RIMYX/RAIHX

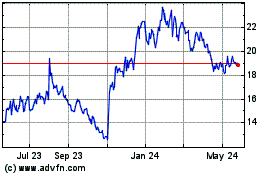

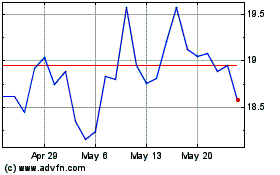

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jun 2024 to Jul 2024

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jul 2023 to Jul 2024